FRC Top Picks

The table below highlights last week’s top five performers, led by Zepp Health Corporation (NYSE: ZEPP), which rose 22%. We believe the company’s recent announcement, mentioned above, was a contributor to the rally. Additionally, Q4 results are expected shortly, and, like us, the market is anticipating robust performance.

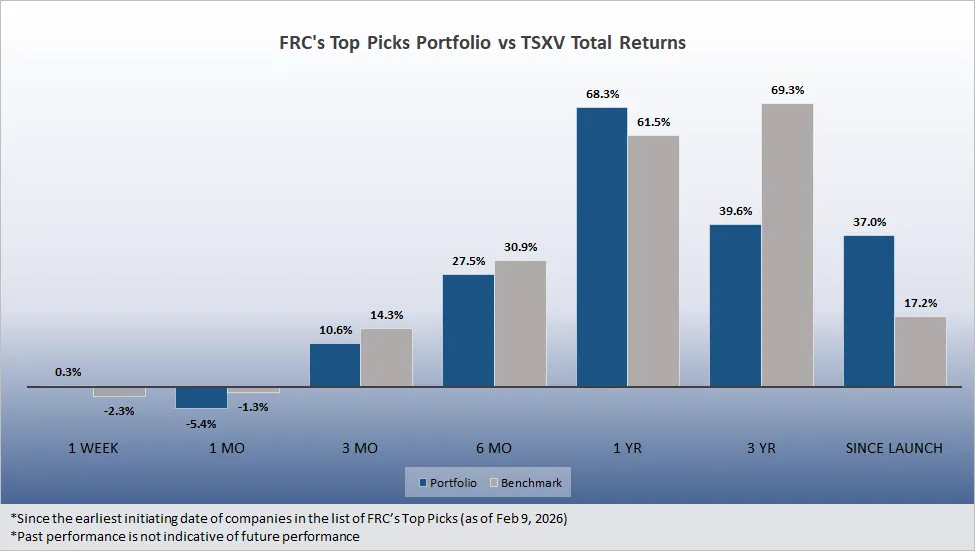

* Past performance is not indicative of future performance (as of Feb 9, 2026)

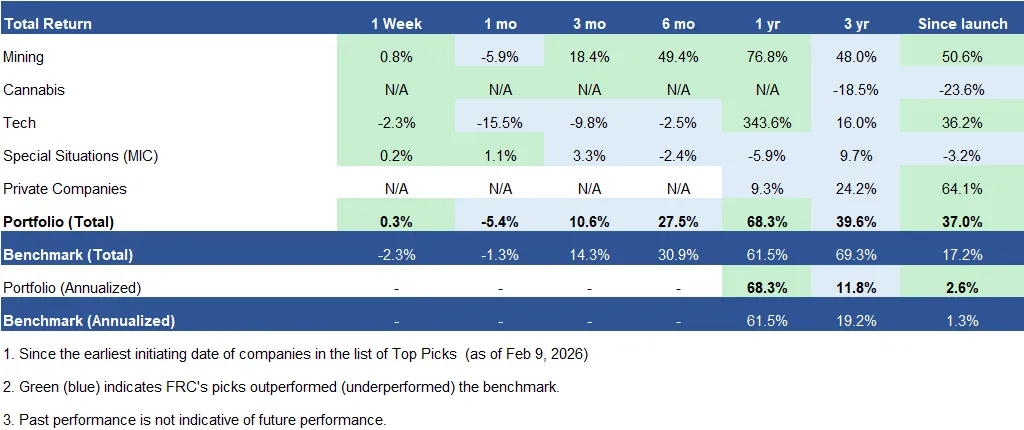

Performance by Sector

Source: FRC

FRC Model Picks

As you may know, we recently launched a new feature on our website that allows you to view our proprietary fair value estimates for most North American stocks. These estimates are generated using our in-house capital allocation model. You can access them easily on our site by searching for any stock of your choice. You can also select the fair value as a filter criterion on our screening tool.

We have used these tools to launch a new model portfolio in addition to our popular Top Picks Portfolio. This new portfolio includes our top two picks from each major sector of the market, selected based on high upside potential, with most holdings having a market cap above $1B. As a result, the portfolio is more large-cap focused and potentially less risky/volatile than out micro- and small-cap focused Top Picks Portfolio. In general, combining a predominantly larger cap portfolio with a small weighting to a smaller cap names can be a good way to enhance returns while lowering over portfolio volatility though you should speak to an investment advisor who understands your specific situation.

The portfolio is equally weighted, consisting of 20 stocks in total. For illustration, a $1,000 investment would be split into 20 equal positions of $50 each. We will report the portfolio’s performance weekly and highlight any changes we make, so you can track its progress over time.

FRC Model Picks

Here is a brief sentence for each stock featured on this list (AI Generated)**:

Information Technology

Adobe Inc.: A global leader in creative software known for its ubiquitous Creative Cloud suite.

United Microelectronics Corp: A major Taiwanese semiconductor foundry that produces integrated circuits for various electronic applications.

Health Care

Collegium Pharmaceutical: A specialty pharmaceutical company focused on developing and commercializing products for pain management.

Lantheus Holdings: A provider of innovative diagnostic and therapeutic agents used to identify and treat cardiovascular and other diseases.

Consumer Discretionary

Nike Inc.: The world's largest supplier of athletic shoes and apparel, recognized globally for its "Swoosh" logo.

Tripadvisor: An online travel platform that provides user-generated reviews and booking services for hotels, restaurants, and experiences.

Communication Services

Criteo S.A.: A French commerce media company that specializes in digital performance marketing and personalized retargeting.

Yelp Inc.: A platform that connects people with local businesses through crowdsourced reviews and professional photography.

Industrials

TriNet Group: A provider of comprehensive human resources solutions, including payroll and benefits, for small and medium-sized businesses.

Star Bulk Carriers: A global shipping company that specializes in the ocean transportation of dry bulk cargoes.

Consumer Staples

Fresh Del Monte Produce: One of the world's leading vertically integrated producers and marketers of high-quality fresh and fresh-cut fruit and vegetables.

Archer-Daniels-Midland Company: A major food processing and commodities trading corporation that operates a massive global nutrition network.

Energy

Chord Energy Corporation: An independent exploration and production company focused on unconventional oil and gas resources in the Williston Basin.

Precision Drilling Corporation: A leading provider of safe and environmentally responsible services to the energy industry, specializing in land drilling.

Materials

SSR Mining Inc.: A precious metals producer with a focus on gold and silver operations across the Americas and Turkey.

Fortuna Mining Corp.: A Canadian-based precious metals producer with operating mines in Latin America and West Africa.

Utilities

Kenon Holdings Ltd: A holding company that operates businesses in the global energy and automotive industries.

Genie Energy Ltd.: A retail energy provider and renewable energy solutions company serving residential and small business customers.

Real Estate

DigitalBridge Group: A leading global asset manager dedicated to investing in digital infrastructure, including cell towers and data centers.

eXp World Holdings: The parent company of a cloud-based real estate brokerage that operates globally using virtual technology.

*Disclaimers - Annual fees ranging from $15,000 to $35,000 have been paid to FRC by Zepp Health, Panoro Minerals, South Star Battery, Fortune Minerals, Denarius Metals, Energy Vault Holdings, Zepp Health, Cupani Metals, Noram Lithium, Kingman Minerals, West High Yield Resources, Tartisan Nickel, OBY Critical Minerals, White Cliff Minerals, and Bayhorse Silver Inc. for research coverage and distribution of reports. FRC or companies with related management, and Analysts, do not hold shares/securities in the companies mentioned in this report.

**We have selected these companies based SOLELY on our screening tool and fair value feature. We have not looked into company or industry specific factors that could affect the stock. This portfolio and updates are for information, educational, and entertainment purposes only. We want to see how a hypothetical portfolio picked largely using our fair value algorithm would fair against a passive index. Before investing in anything, you should do your own due diligence and speak to a professional advisor.