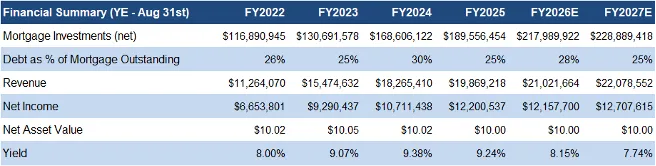

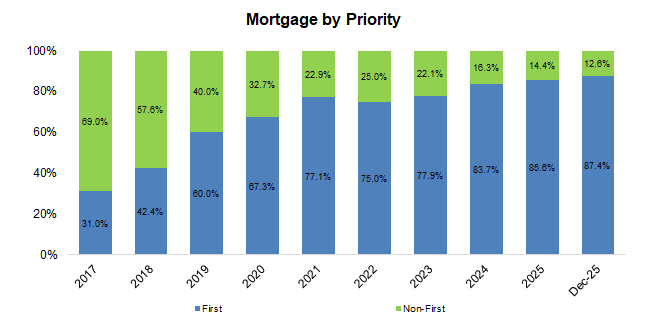

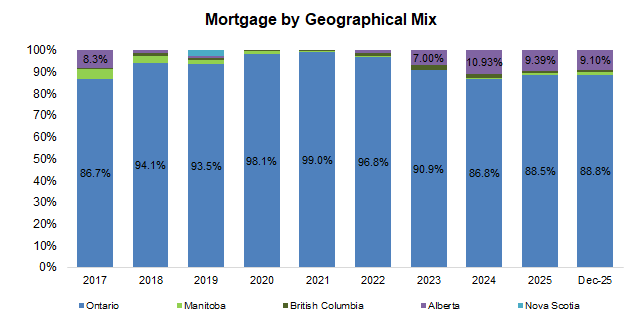

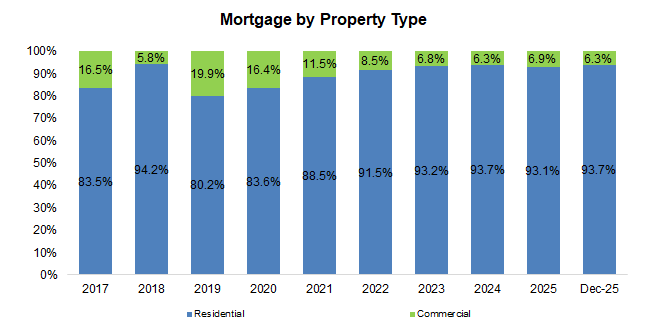

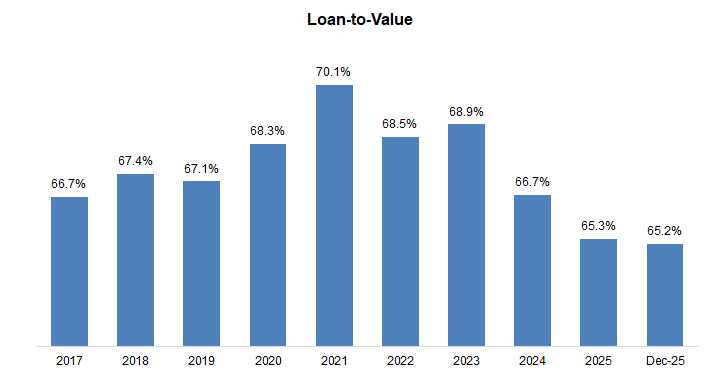

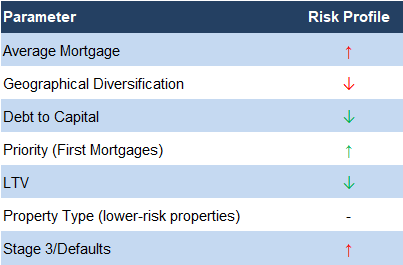

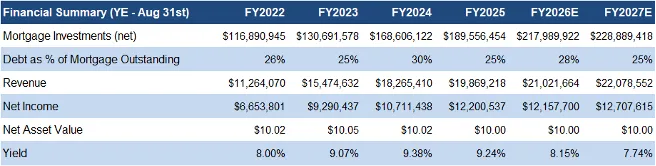

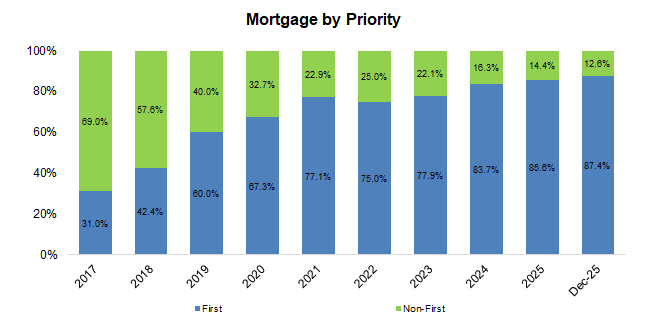

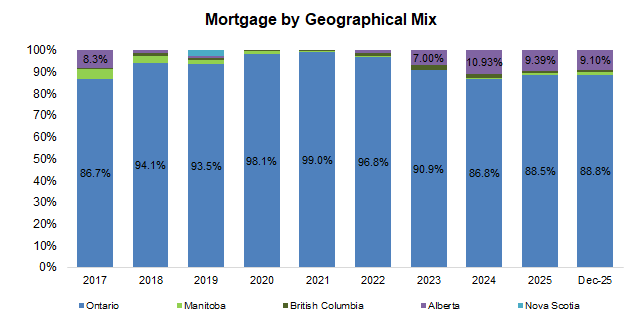

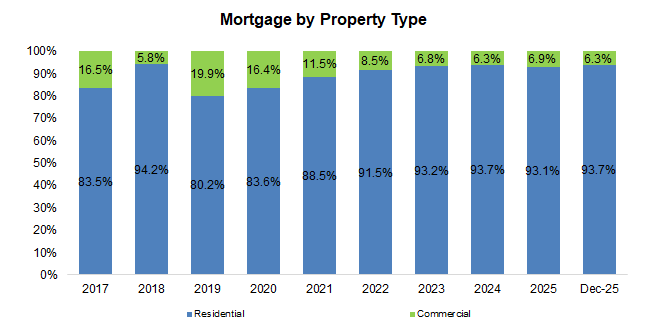

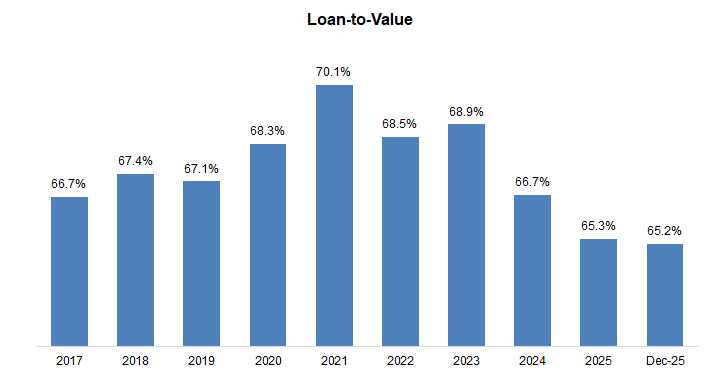

- Portfolio Composition & Risk: As of December 2025, 89% of mortgages were in Ontario (Sector: 49%). The weighted-average loan-to-value was 65% (Sector: 58%). First mortgages comprised 87% of the portfolio (Sector: 75%), reflecting a relatively low risk profile due to high first-mortgage exposure, albeit with limited geographic diversification.

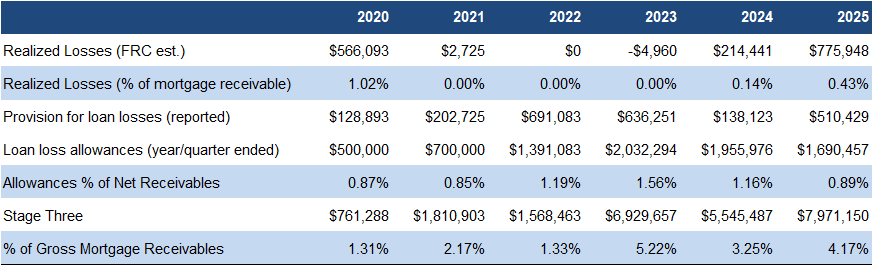

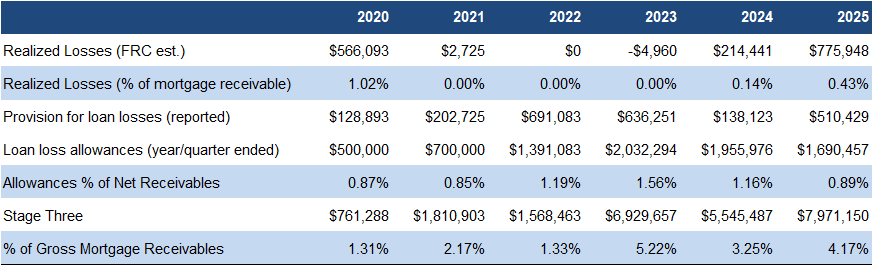

- Credit Quality: As of August 2025, Ginkgo held $8M of stage three (impaired) mortgages, representing 4.2% of the portfolio across 20 of 469 properties, below the sector average of 5.5%, reflecting sound portfolio management.

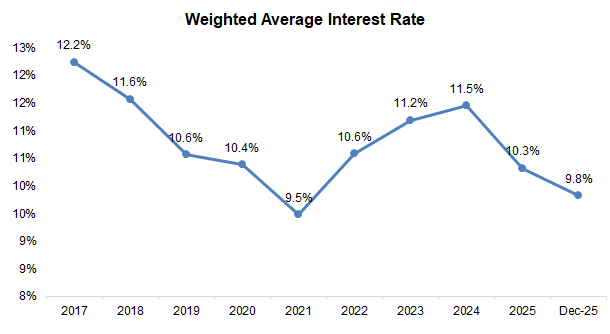

- Macroeconomic Backdrop: Following eight rate cuts totaling 275 bps since June 2024, bringing the policy rate to 2.25%, the Bank of Canada held rates steady at its December 2025 and January 2026 meetings. With declining unemployment and moderating inflation, we expect rates to remain unchanged through 2026. We believe the sector entered 2026 with lower default risk, and improving momentum in mortgage originations.

- Sector Trends: We are observing a notable uptick in M&A activity across the sector. Discussions with MIC managers suggest several are actively pursuing acquisitions to scale platforms, drive synergies, and achieve cost savings across administration, operations, and staffing. We believe these efficiencies can support higher investor yields, attract additional capital, and enable increased lending activity.

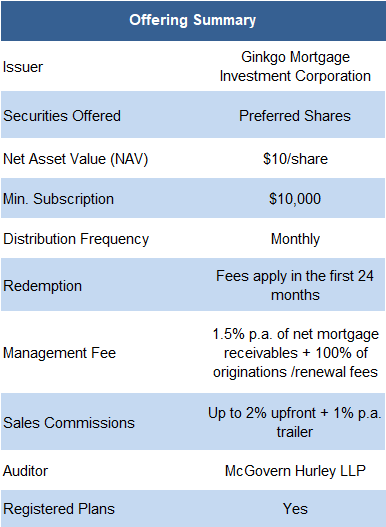

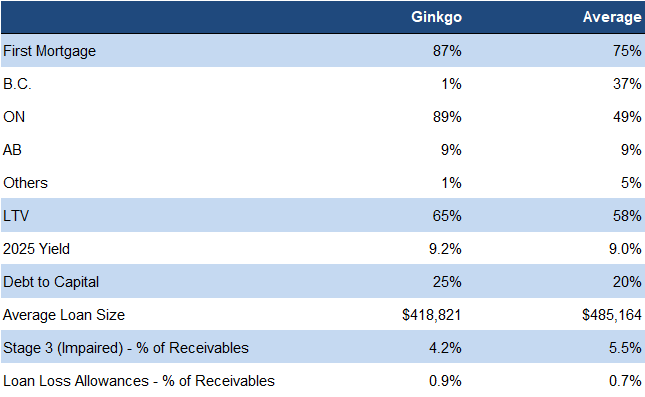

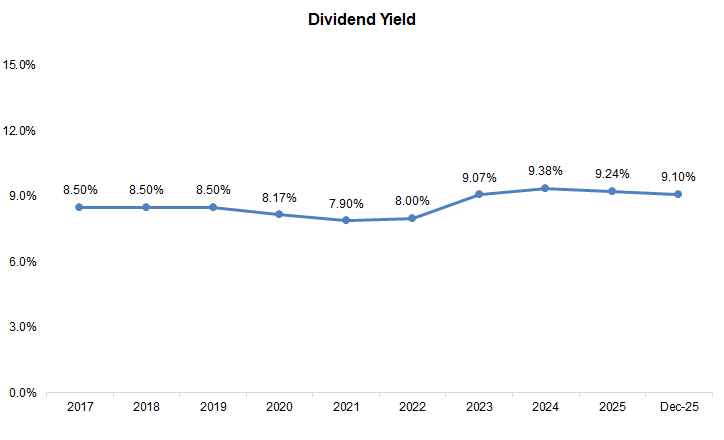

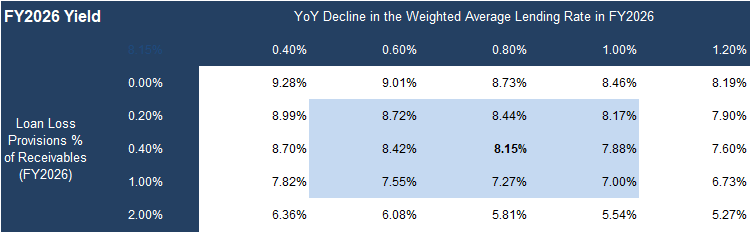

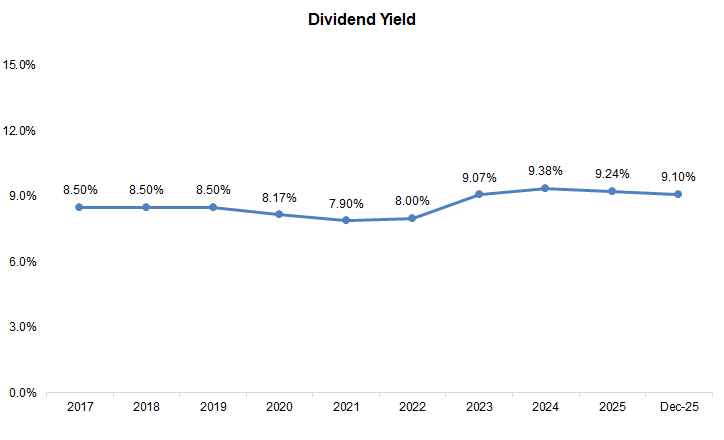

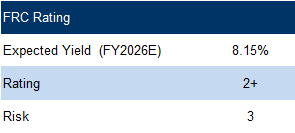

- Outlook: We project an FY2026 yield of 8.15% vs 9.24% in FY2025.

Price and Volume (1-year)

* Ginkgo Mortgage Investment Corporation has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions. All figures in C$ unless otherwise specified.

The table below compares Ginkgo ’s portfolio with other MICs (AUM $100M+) focused on already-built single-family residential units.

Source: FRC / Various

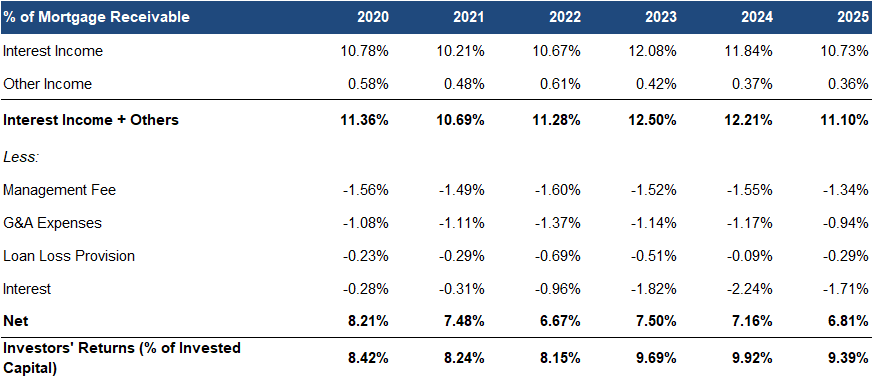

Despite a more conservative first-mortgage mix, Ginkgo’s FY2025 yield exceeded peers, supported by higher LTV lending and greater leverage

A key positive is Ginkgo’s lower Stage 3 (impaired) mortgage ratio versus the sector

We believe the portfolio lacks geographic diversification, with 89% concentrated in Ontario

The sector has seen two material transactions in recent months (listed below). Discussions with MIC managers indicate several are actively pursuing M&A to scale their platforms, drive synergies, and achieve cost savings across administration, operations, and staffing.

We believe t hese efficiencies can support higher investor yields, attract additional capital, and ultimately enable increased lending activity across the sector.

September 2025: Alta West Mortgage Capital Corporation acquired Premiere Home Mortgage for an undisclosed amount.

October 2025: Neighbourhood Holdings acquired Fisgard Asset Management for an undisclosed amount, creating one of Canada’s largest alternative mortgage lenders with over $750M in AUM across 1,550 mortgages .

Portfolio Update (YE: August 31st)

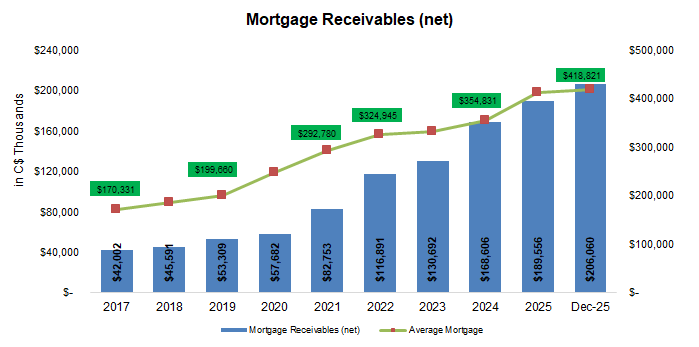

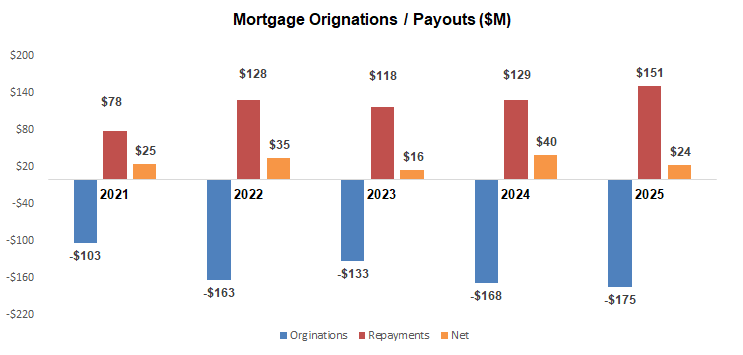

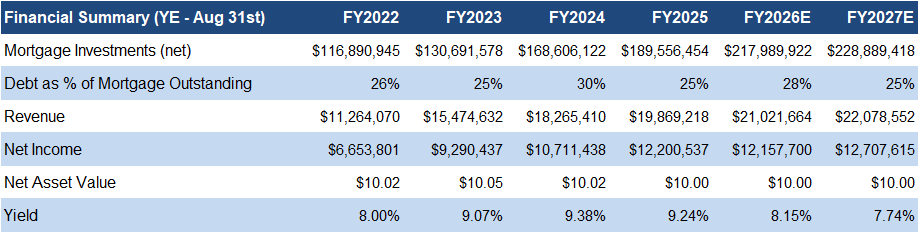

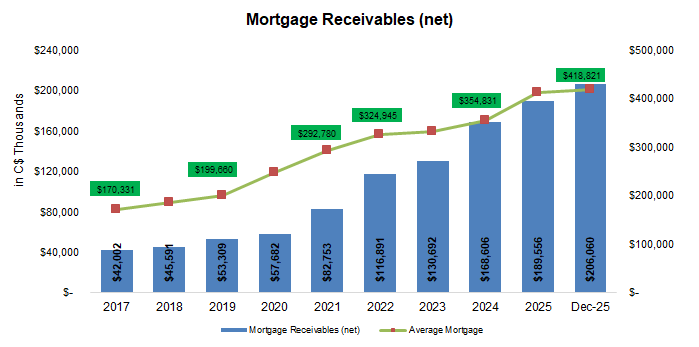

In FY2025, mortgage receivables were up 12% to $190M vs our estimate of $200M

We estimate MIC sector AUM rose 9% during the same period

As of December 2025, receivables reached a historic high of $206M

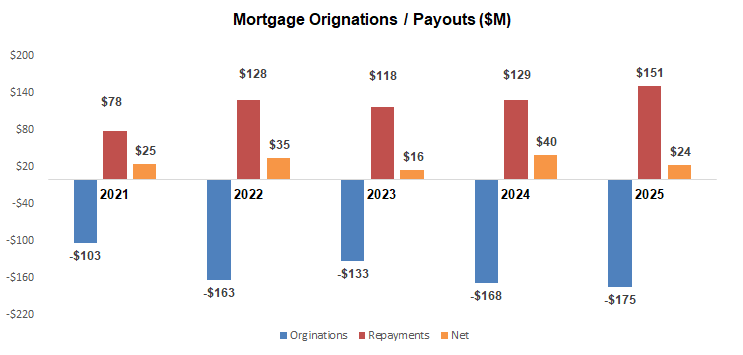

Mortgage advancements grew 4% YoY

Exposure to first mortgages increased, implying lower risk

Key focus areas include the GTA, and second-tier cities such as Cambridge, Kitchener, Oshawa, London, and Hamilton

Remains focused on single-family residential units

LTV declined due to increased exposure to first mortgages

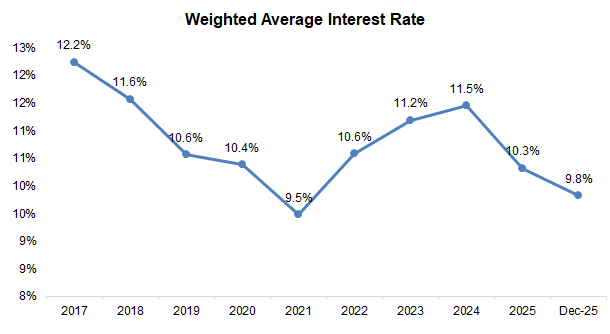

Lending rates have declined alongside broader market rates

Since peaking in 2024, lending rates are down 1.7 pp, while prime rates fell 2.7 pp over the same period, indicating MIC lending rates are less elastic than benchmark rates

Source: Company / FRC

Stage three (impaired) mortgages increased 0.9 pp to 4.2% of portfolio vs the sector average of 5.5%, reflecting prudent portfolio management

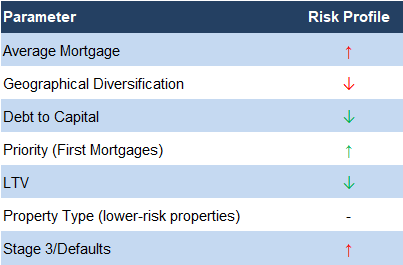

red (green) indicates an increase (decrease) in risk level

Source: FRC

In summary, we believe the portfolio’s risk profile has decreased, driven by higher first mortgages and lower LTVs, partially offset by higher defaults

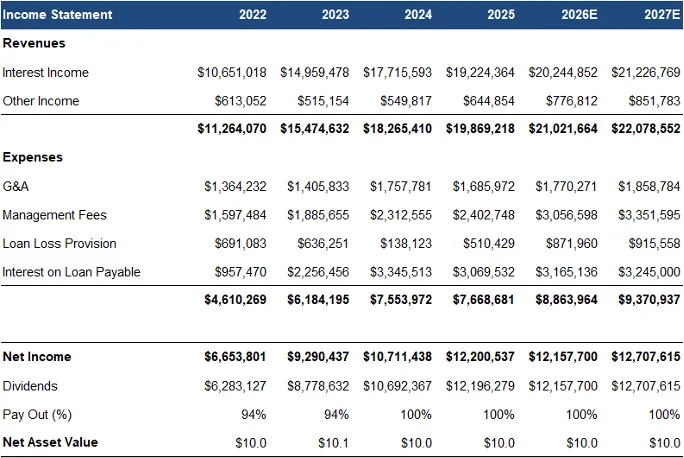

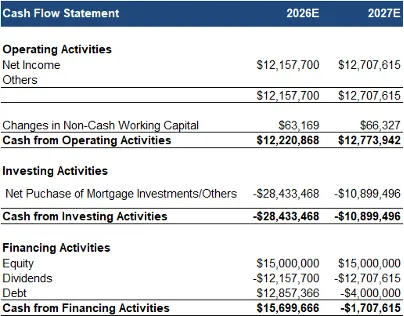

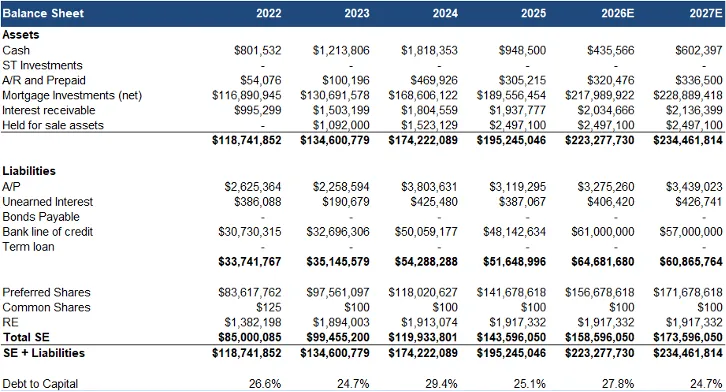

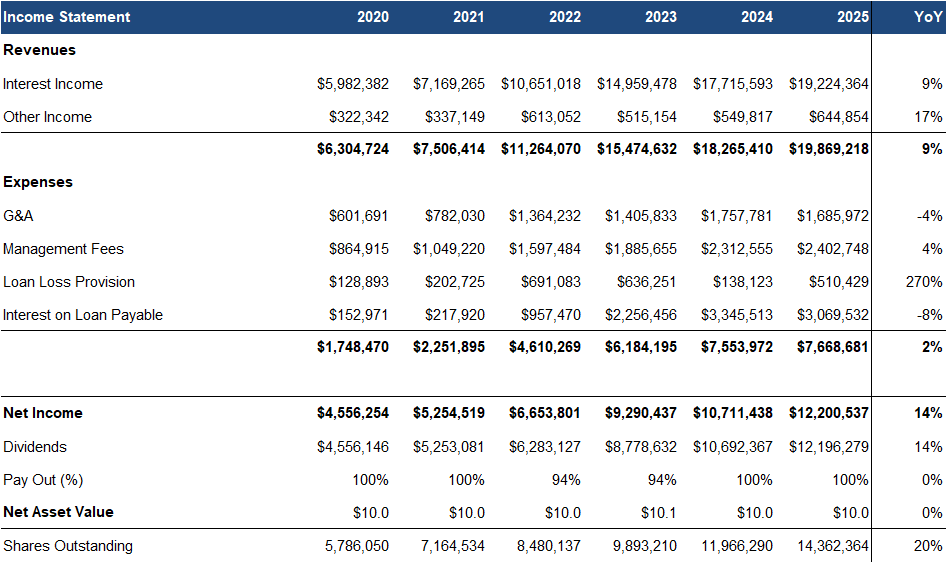

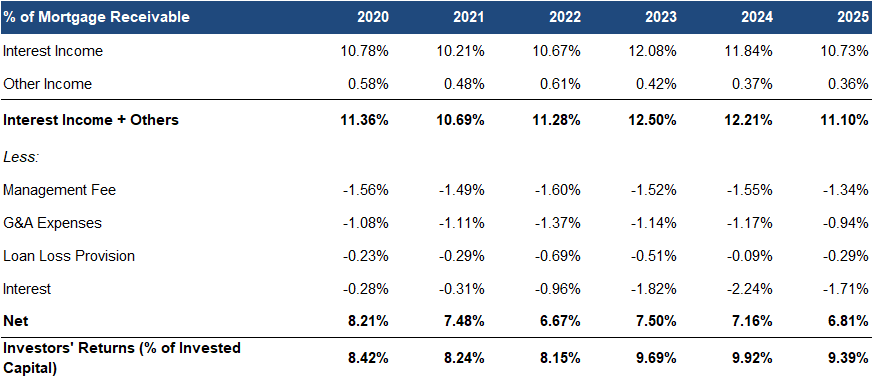

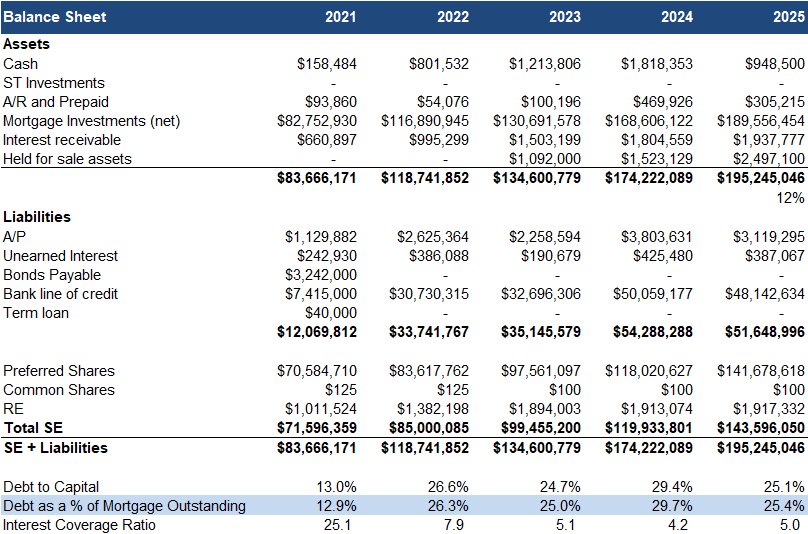

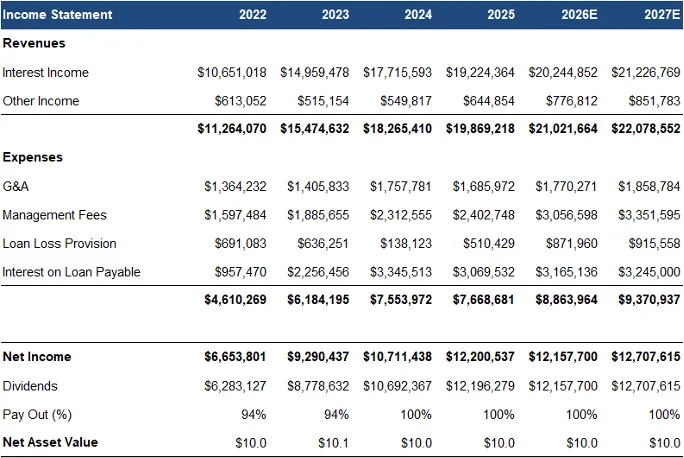

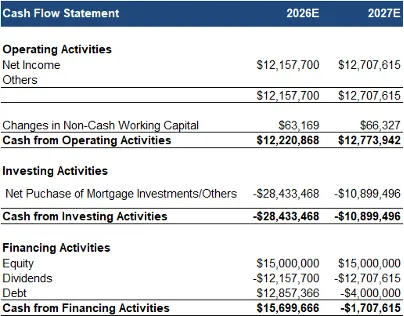

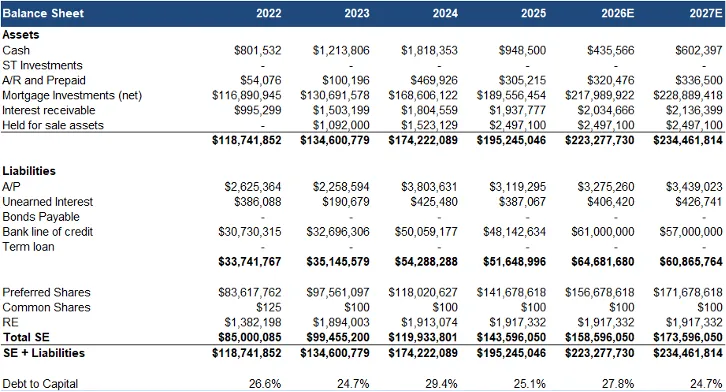

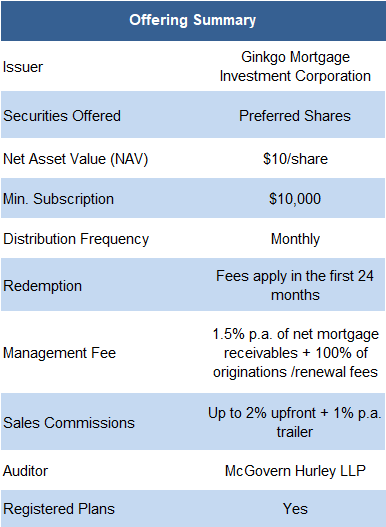

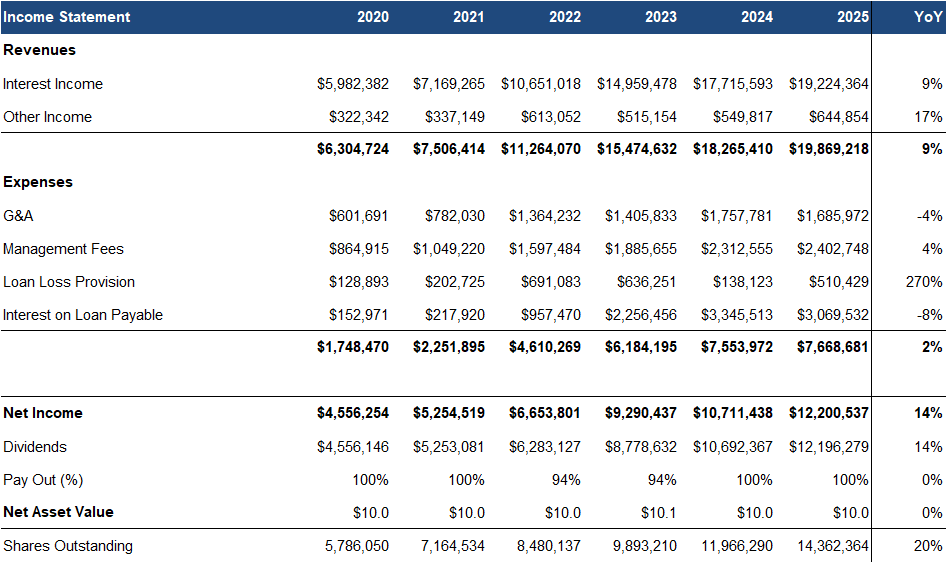

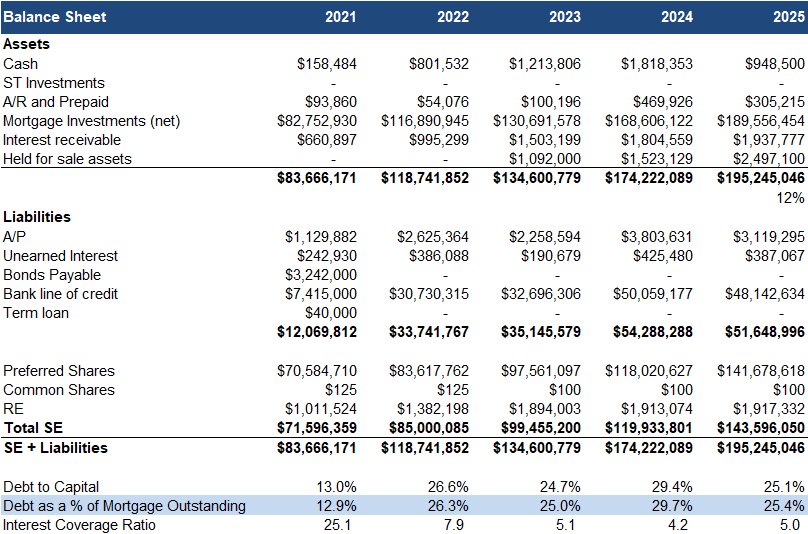

Financials (YE: August 31st)

FY2025 revenue rose 9% YoY, missing our estimate by 4% due to lower-than-expected mortgage receivables

Note that the above figures may be slightly different from the figures reported by Ginkgo due to a difference in the method of calculation.

Source: Company / FRC

However, net income was up 14% YoY, beating our estimate by 8%, driven by lower-than-expected operating expenses

The FY2025 yield was 9.24% vs our forecast of 9.01%

Source: Company / FRC

Debt-to-capital declined due to higher use of equity, but remained within the 20%-40% range typical of comparables

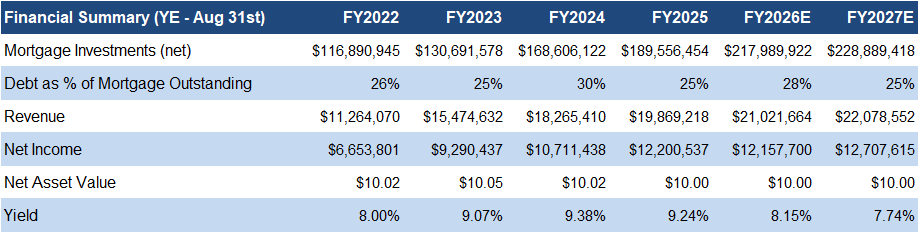

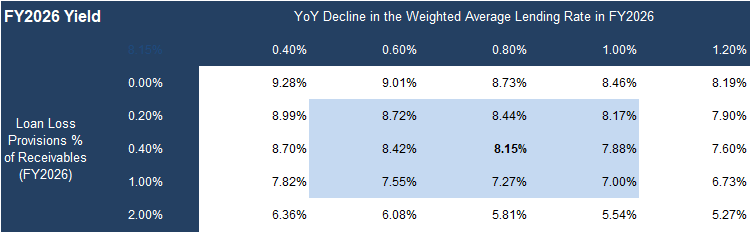

FRC Projections & Rating

With rates peaking last year, we expect yields to decline in FY2026

We are projecting a yield of 8.15% in FY2026

Source: FRC

Our FY2026 yield estimate varies between 7.00% and 8.72%, as loan loss provisions and lending rates vary

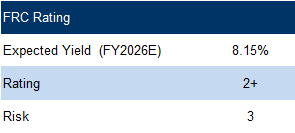

Overall, FY2025 results reflect a more defensively positioned portfolio , with higher first-mortgage exposure, lower LTVs, and impaired loans below the sector average. While yields are expected to moderate in FY2026 as rates stabilize, earnings resilience has been supported by disciplined cost management and sound credit quality. We believe the MIC offers a lower-risk profile with stable dividend potential, albeit with concentration risk tied to Ontario exposure. We are reaffirming our overall rating of 2+ and risk rating of 3 .

Risks

We believe the MIC is exposed to the following key risks (not exhaustive) :

- Concentration risk – the bulk of mortgages are in Ontario

- Operates in a highly competitive sector

- Lower housing prices will result in higher LTVs

- Shareholders’ principal is not guaranteed

- Timely deployment of capital is critical

- Default rates can rise during recession

- Loans are short term and must be sourced and replaced quickly

- The MIC employs leverage, which increases exposure to adverse events

APPENDIX