- We now believe Aton hosts 2 Moz AuEq across four targets (up from 1.5 Moz previously), including 0.83 Moz AuEq in NI 43-101 resources (independently verified), with the remainder based on our estimates.

- We believe each individual target has the potential to host small to medium sized resources (typically 200k–500k AuEq/gold equivalent). Together, these targets could form a significant mining camp.

- Management’s long-term plan is a hub-and-spoke model, featuring a central processing plant (the hub), with small nearby mines (the spokes) sending gold-rich rock for processing. This approach can reduce costs, accelerate production, and improve efficiency compared with building separate plants at each site.

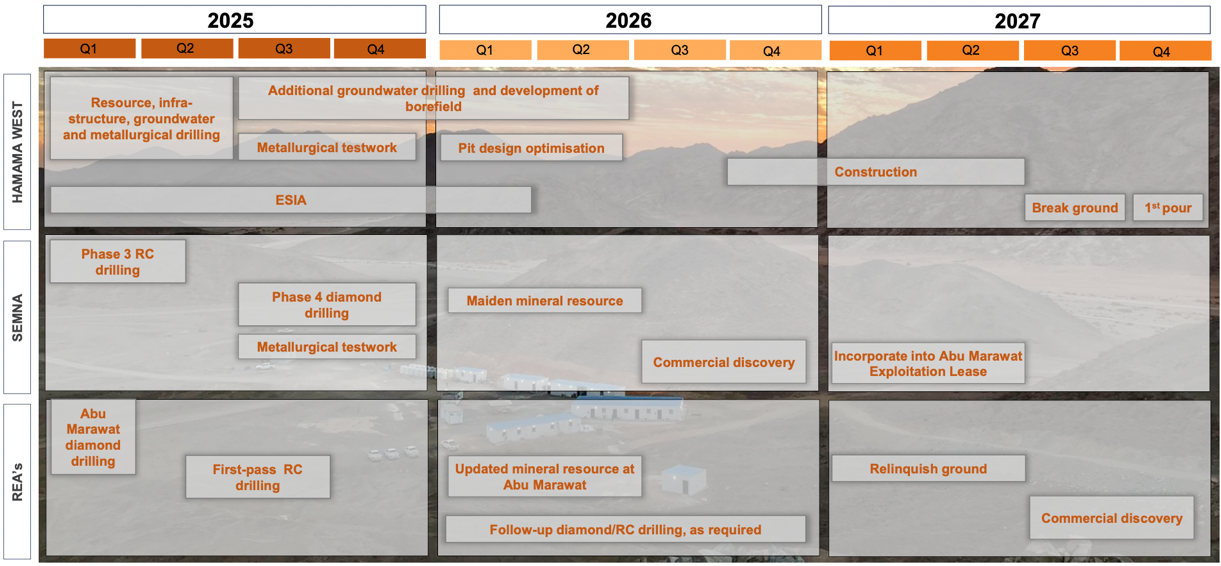

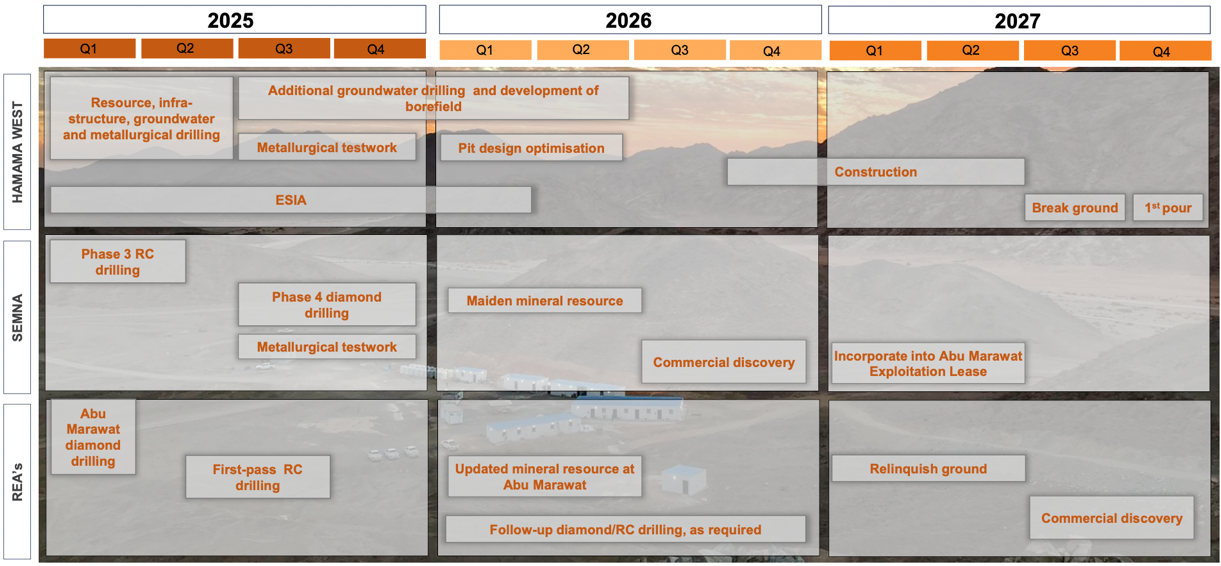

- The company plans to release updated and maiden resource estimates for four targets as a combined report by Q3-2026. These estimates, which quantify the amount of gold and silver likely present at each target, will likely be the next major catalyst for the stock.

- In addition, the company is focused on bringing its first target, Hamama West, into production by late 2027 through a low-CAPEX, low-OPEX open-pit and heap leach operation, expected to produce 13–15 Koz per year over a five to seven year mine life, implying potential net cash flows of approximately US$34M at current prices.

Price and Volume (1-year)

| |

YTD |

12M |

| AAN |

16% |

174% |

| TSXV |

5% |

63% |

| GDXJ |

15% |

159% |

* Qualified Person: Javier Orduña BSc, MSc, MCSM, DIC, MAIG, SEG(M), Chief Geologist of Aton Resources

* Aton Resources Inc. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions. All figures in C$ unless otherwise noted.

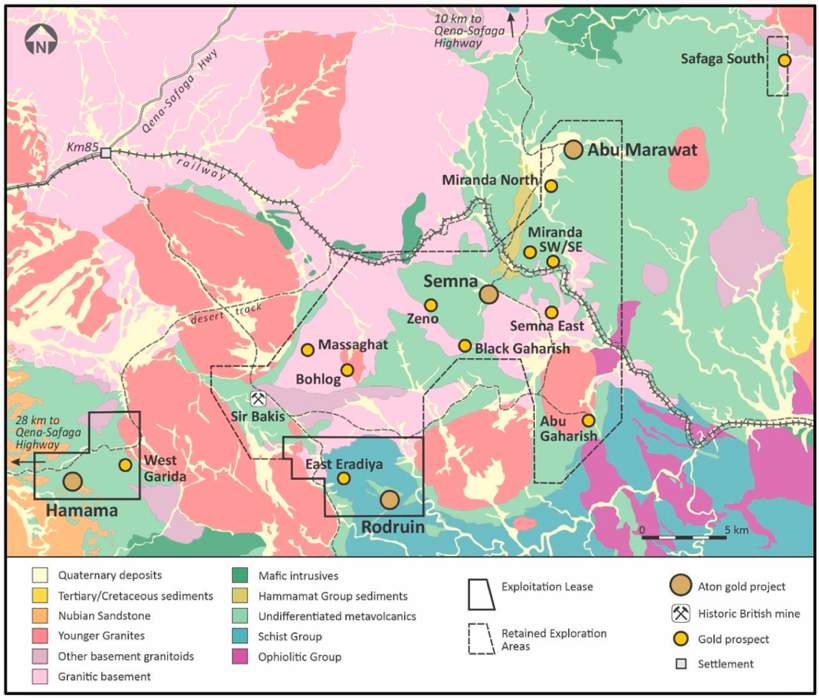

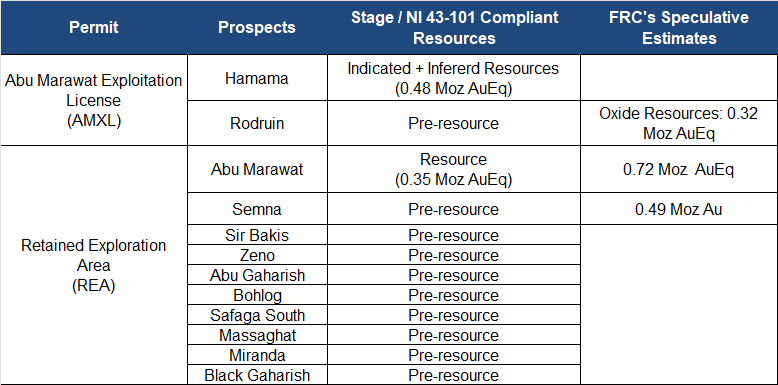

Portfolio Summary

Source: Company

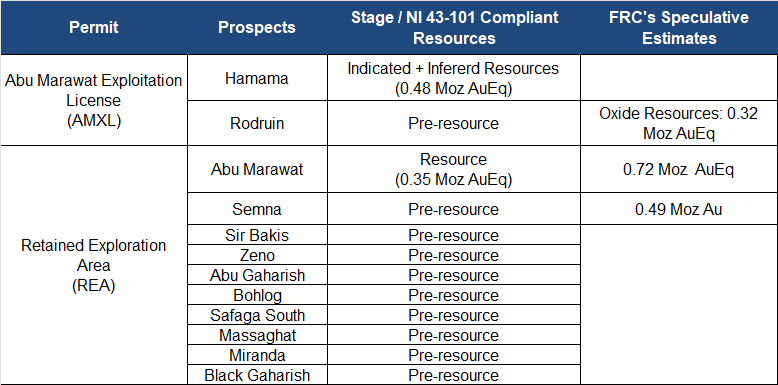

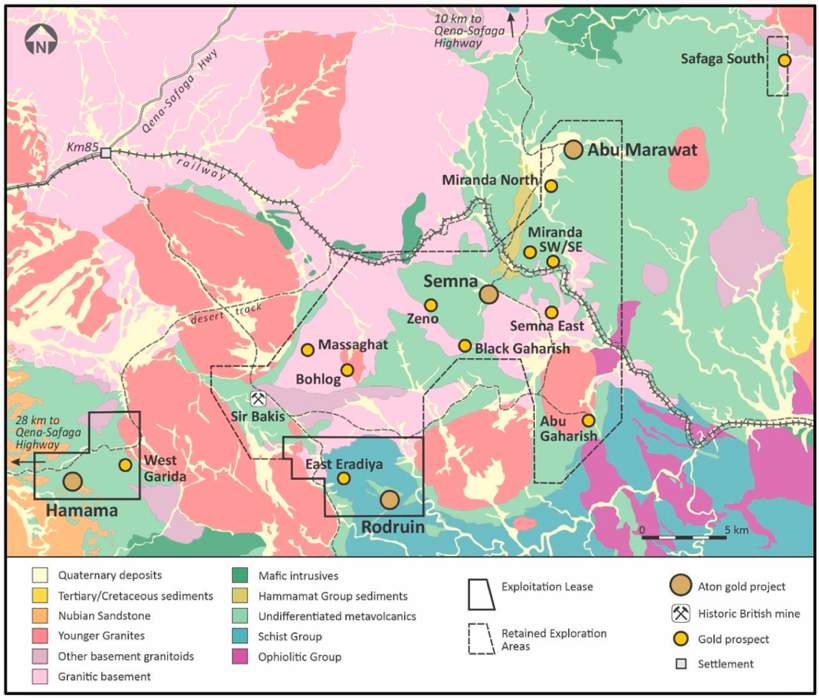

Aton portfolio includes 12 projects at various development stages

Located 200 km north of AngloGold Ashanti’s (NYSE: AU) Sukari Mine, Egypt’s largest gold mine

AU’s US$2.5B acquisition of Sukari’s former owner, Centamin (2024), highlights confidence among majors in Egypt

Aton benefits from nearby infrastructure, power, water, highways, and seaport, essential for mining

Source: Company/ FRC

AMXL operates under a 50:50 production sharing agreement with the Egyptian government

We believe Aton hosts 2 Moz AuEq across four targets (previously 1.5 Moz), including 0.83 Moz AuEq in NI 43-101 resources (independently verified); the rest are our estimates

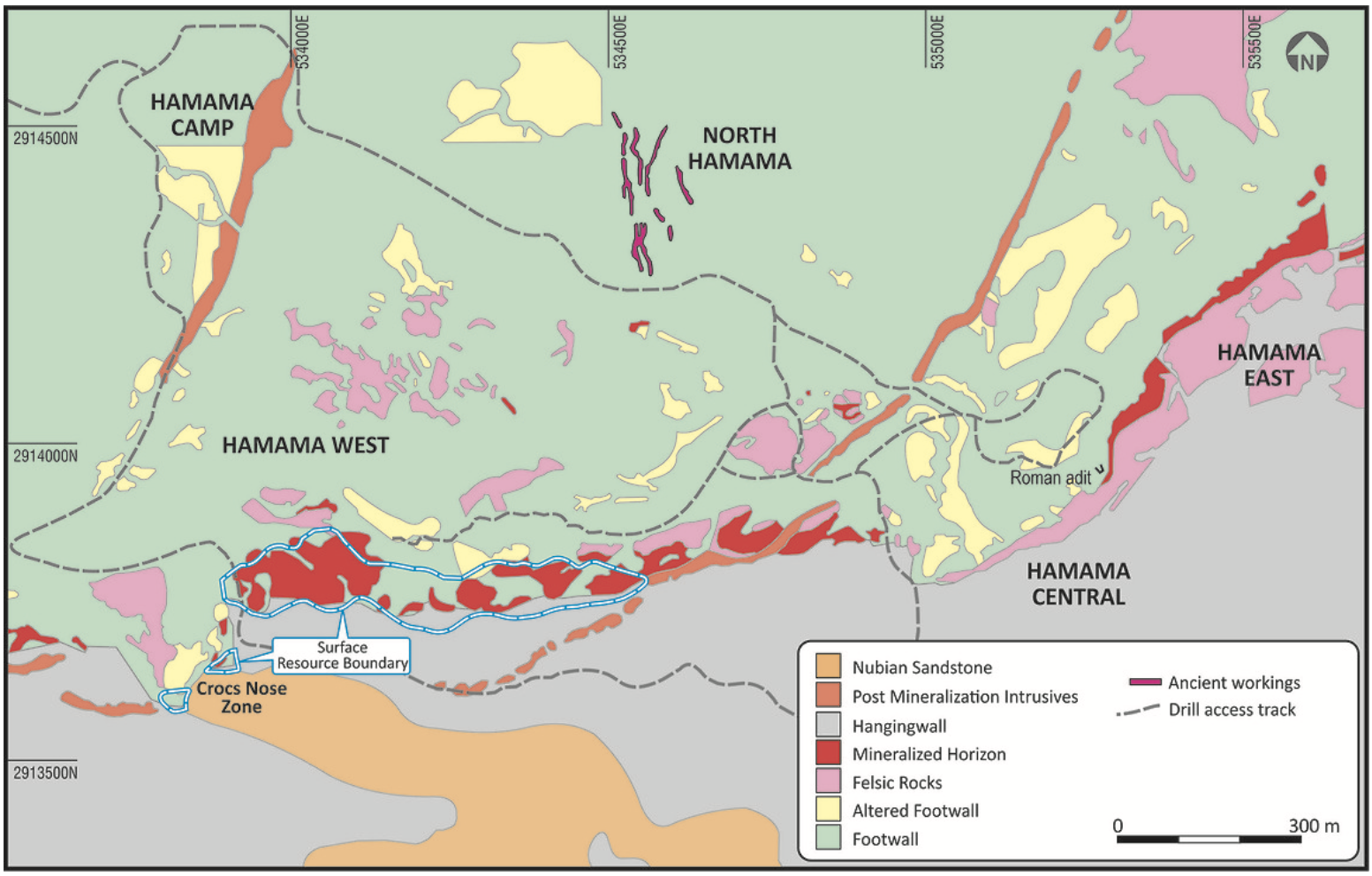

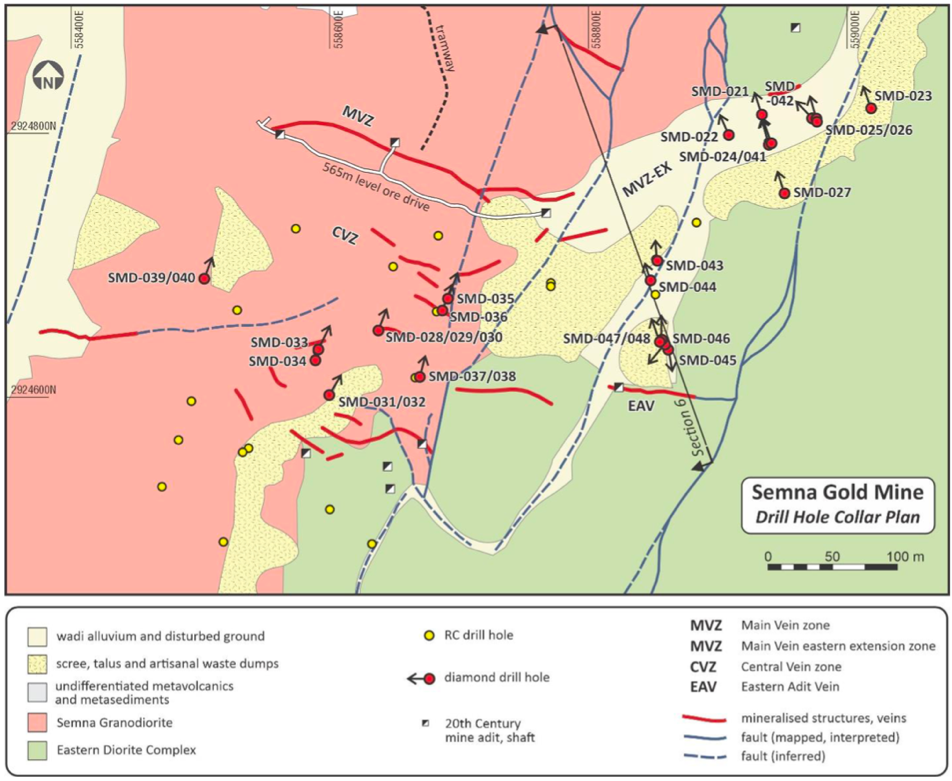

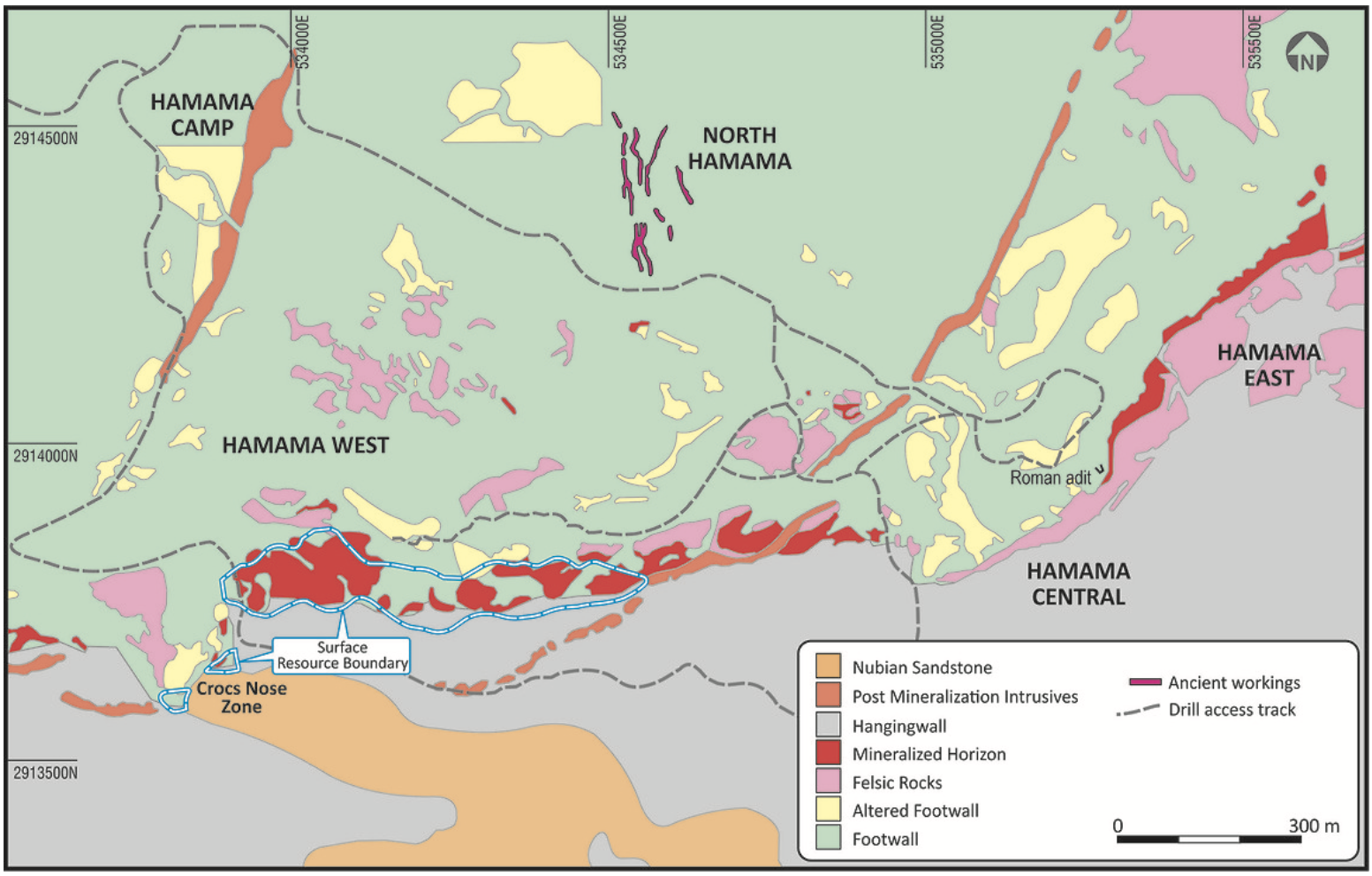

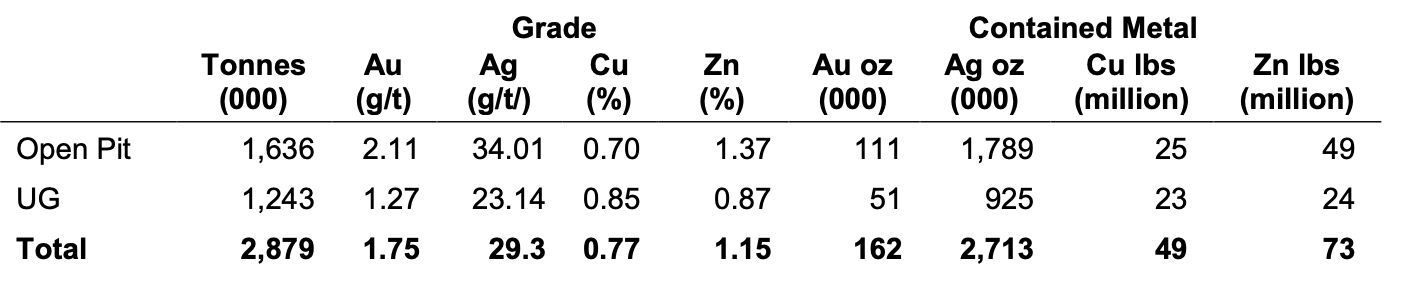

Hamama Gold-Silver-Polymetallic

Project Primary Mineralized Zones

Gold and silver identified across 3 km, divided into Hamama West, Central, and East

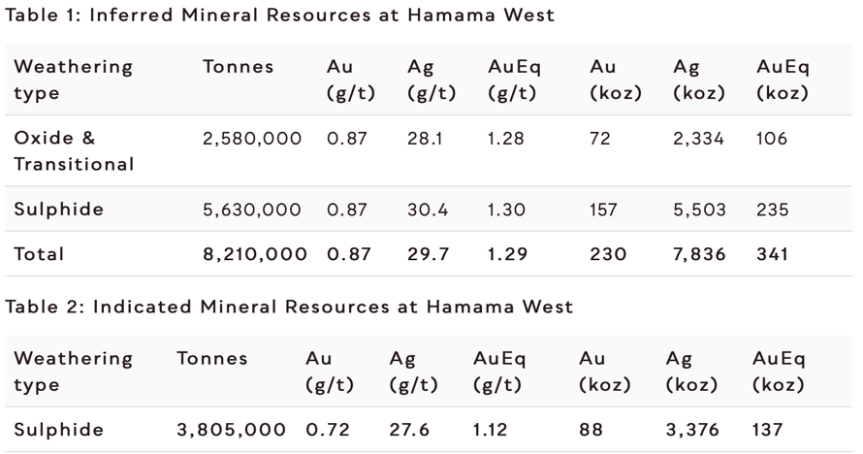

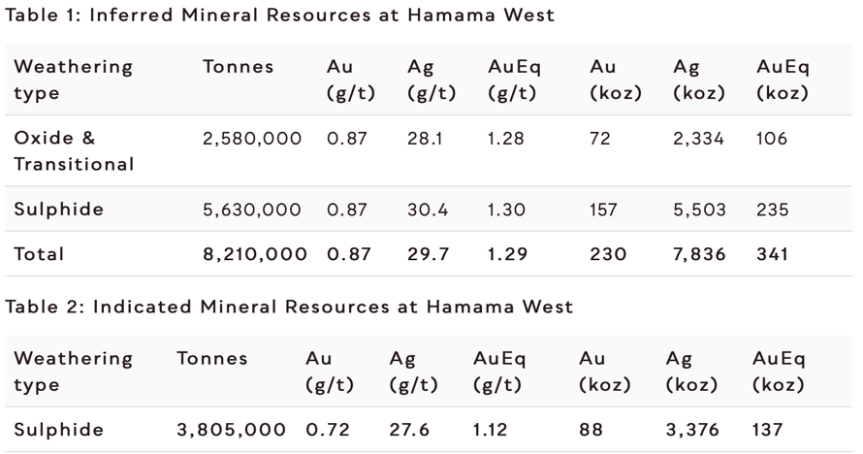

Hamama West Resource Estimate (2017)

(QP: Javier Orduña BSc, MSc, MCSM, DIC, MAIG, SEG(M), Chief Geologist of Aton Resources)

Source: Company

Hamama West hosts a modest gold-silver resource (2017 estimate, dimension: 675 × 60 × 275 m); combined with similar deposits nearby, it could form a significant mining camp

We believe the gold resource could grow, since only one of three targets has been fully tested and several remain un-drilled

A 2023 drill program (1,613 m / 42 holes) confirmed abundant near-surface gold across Hamama West – Crocs Nose Zone (CNZ), Hamama East, and Hamama Central. This indicates the current resource estimate could be expanded.

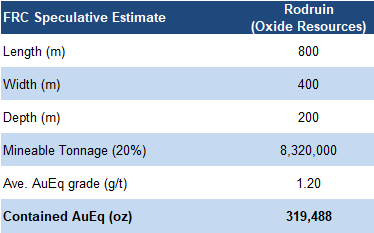

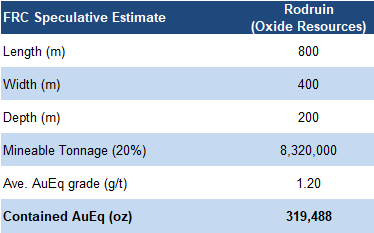

Rodruin Gold-Silver-Polymetallic Project

Through surface sampling and underground drilling, the company has mapped a large mineral zone measuring 800 m long, 400 m wide, and at least 200 m deep.

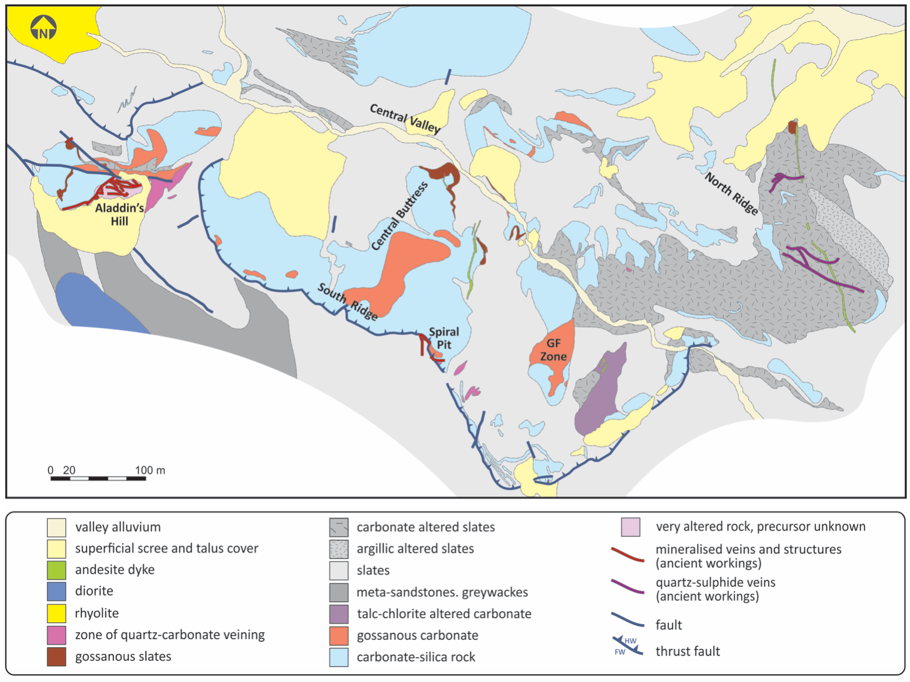

Rodruin Mineralized Zones

Located 18 km east of Hamama, the project has been extensively drilled with 135 holes totaling 13,198 m

Several areas show gold-bearing rock at the surface; this typically indicates high potential for additional discoveries with further drilling

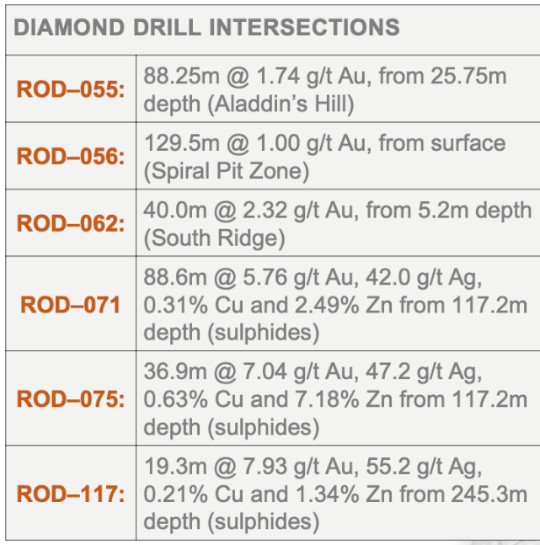

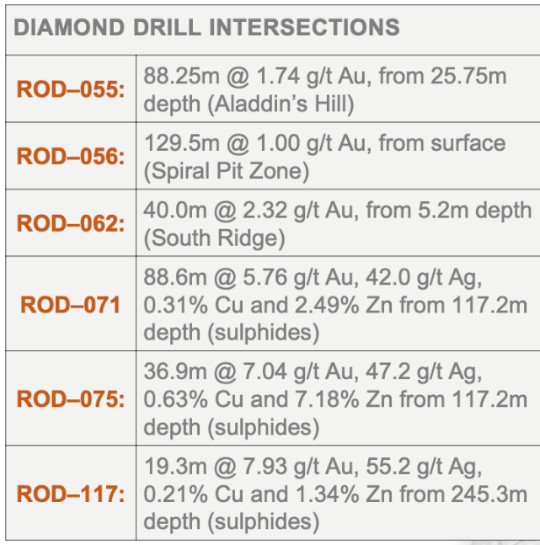

Drilling Highlights

(QP: Javier Orduña BSc, MSc, MCSM, DIC, MAIG, SEG(M), Chief Geologist of Aton Resources)

Source: Company

Deeper drilling has intersected high-grade gold, including 7.93 g/t, well within the typical 2–10 g/t range for underground mining, which requires higher grades to offset higher costs

Source: FRC

Given the higher-grade potential, we are raising our estimate for this target from 0.20 to 0.332 Moz AuEq

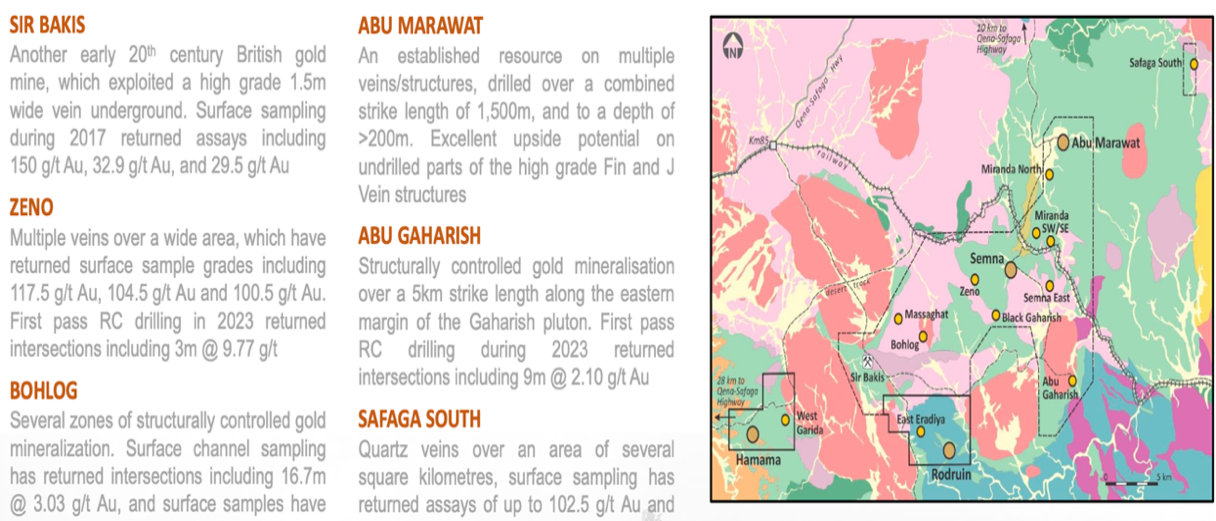

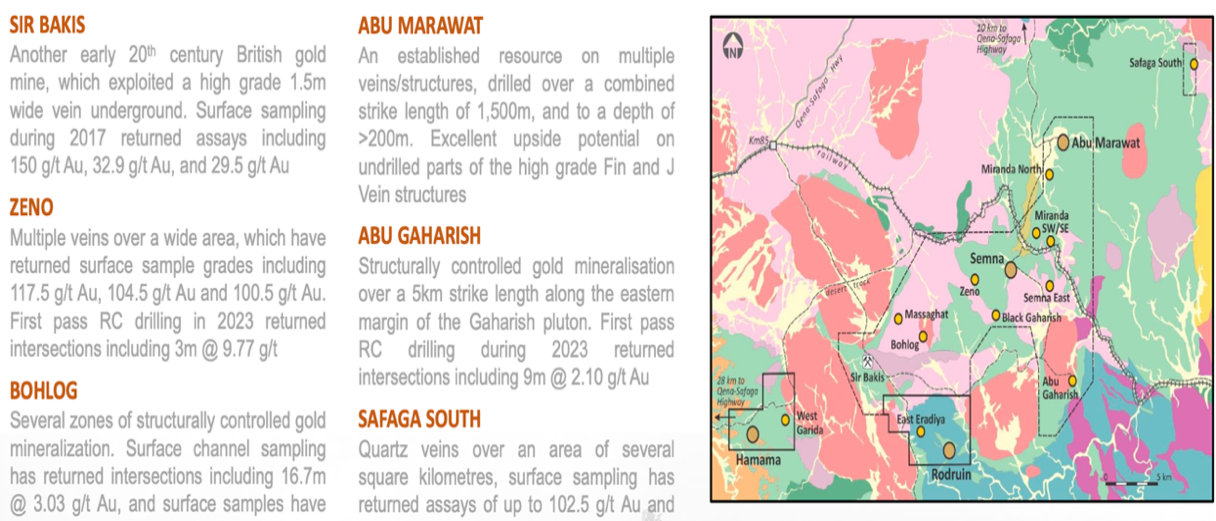

Retained Exploration Areas (REA)

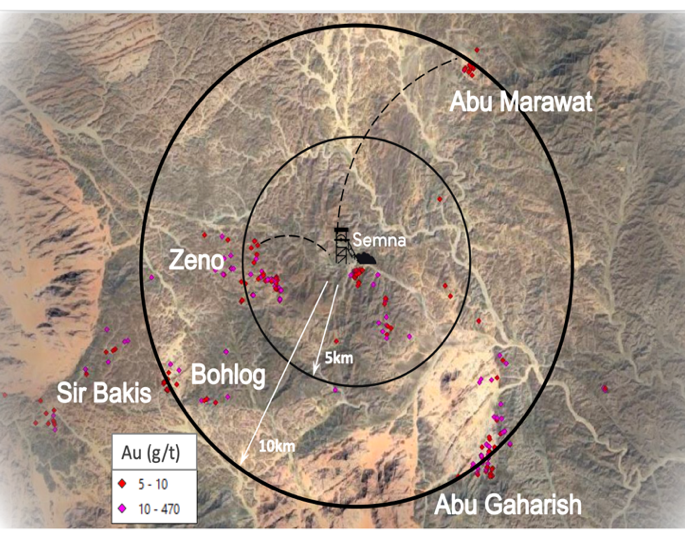

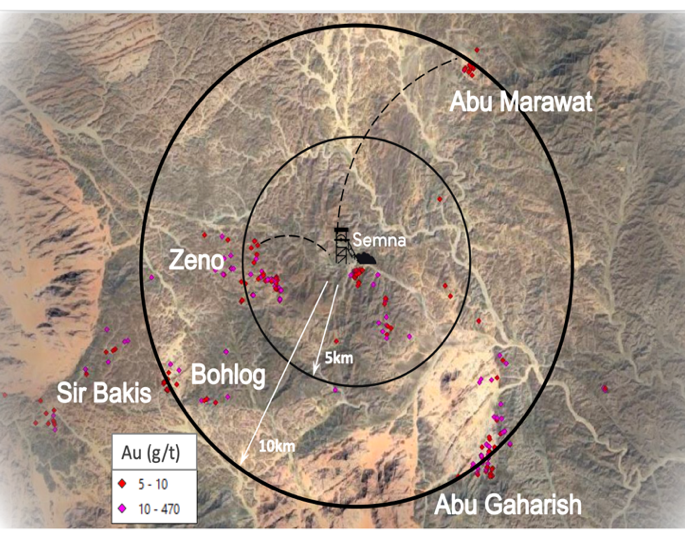

Aton controls an additional 255 km² of exploration land, including the Abu Marawat polymetallic deposit, the high-grade Semna discovery, and several other targets.

Targets

Aton has identified 15+ zones/targets along a 20 km long corridor

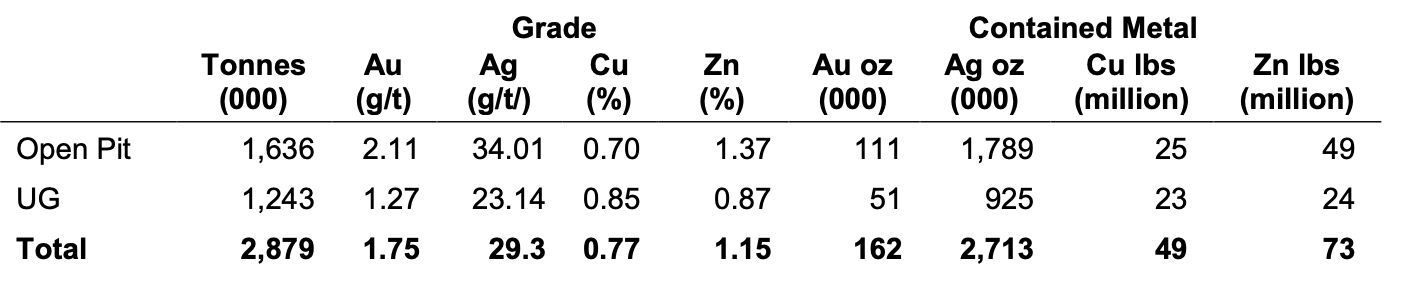

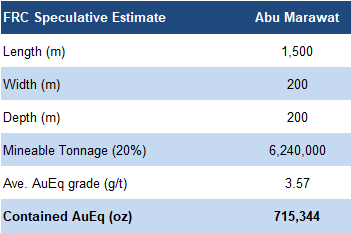

Abu Marawat Inferred Resources (2012)

(QP: Javier Orduña BSc, MSc, MCSM, DIC, MAIG, SEG(M), Chief Geologist of Aton Resources)

Source: Company

Hosts a modest gold-rich polymetallic resource (calculated in 2012), spanning 1,500 m long and over 200 m deep, based on 98 drill holes totaling 19,573 m

Aton’s 2024–2025 drill program (113 holes / 9,642 m) was highly successful, with 88% of holes intersecting polymetallic mineralization. Recent metallurgical tests show the minerals can be efficiently separated using conventional methods.

Source: FRC

Drilling returned high gold grades in several holes, including 28 m of 4.15 g/t AuEq, and 17 m of 5.29 g/t AuEq, compared with benchmark grades of <2 g/t for similar projects

Based on these results, we believe the project could host 0.72 Moz AuEq, up from the 2012 estimate of 0.35 Moz

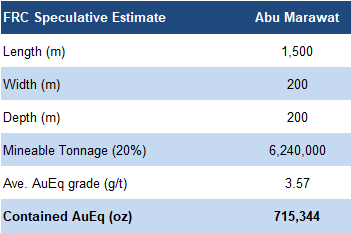

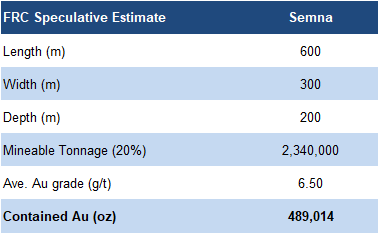

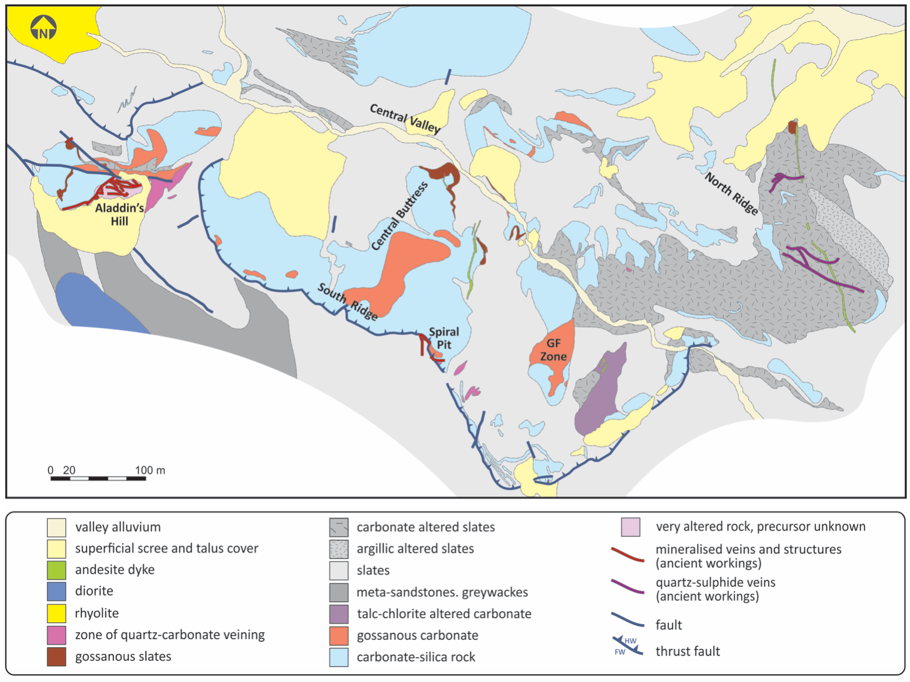

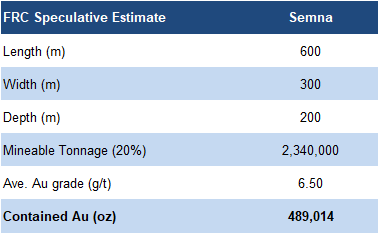

Semna High-Grade Gold Project

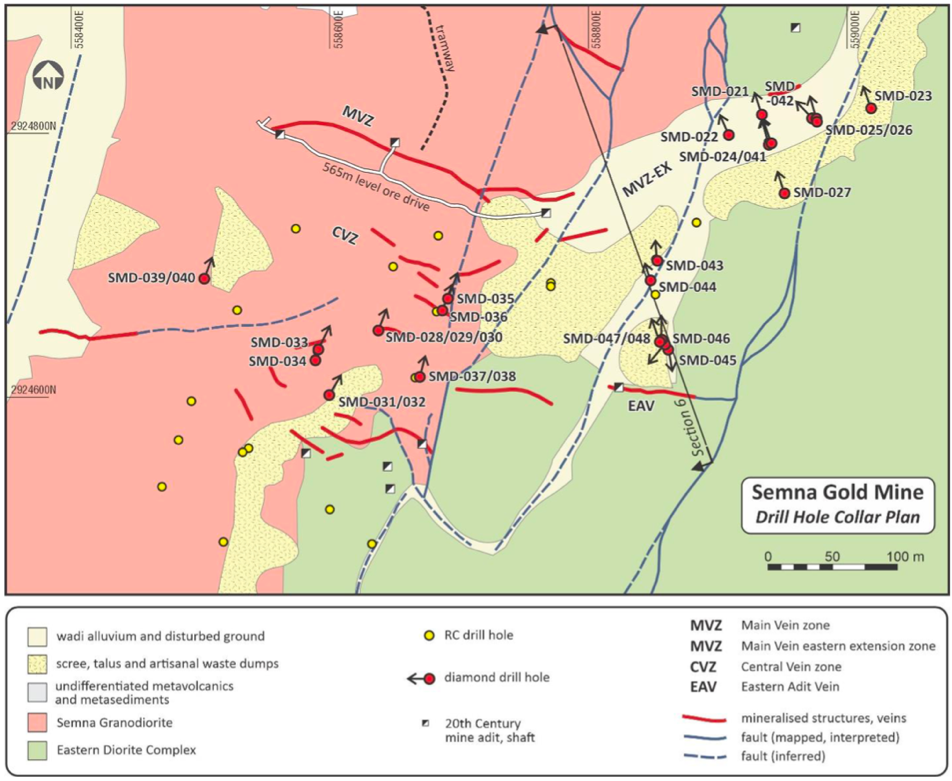

Semna Gold Mine: Vein Zones

Source: Company

Located 27 km northeast of Hamama West and 13 km northeast of Rodruin

Four major areas (veins) have been tested across 600 m long x 300 m wide x 200+ m deep

Between 2023 and 2025, Aton completed 93 drill holes totaling 13,620 m, hitting gold-bearing rock 91% of the time . These results suggest the area could host a gold deposit.

Source: FRC

Drilling returned high gold grades in several holes

Based on these results, we are raising our prior estimate on the target from 0.45 to 0.49 Moz Au

Hub and Spoke Model

Source: Company

Management’s long-term plan is a hub-and-spoke model, with a central processing plant at Semna (the hub) and smaller nearby mines (the spokes) sending gold-rich rock for processing into gold

This approach can reduce costs, speed up production, and improve efficiency compared with building separate plants at each site

The company plans to release updated and maiden resource estimates for four targets (Hamama, Rodruin , Abu Marawat, and Semna ) as a combined report by Q3 2026 . In the short term, the focus is on bringing near-surface resources at Hamama West into production using open-pit mining and heap leach processing ; a conventional, low-CAPEX (13–15 Koz per year , with the current oxide resource lasting five to seven years.

Management’s Projected Timeline

Source: Company

Near-term focus: Hamama West, 13–15 Koz/year, low-cost, fast production

Aiming to complete a comprehensive resource report on four targets by Q3 2026

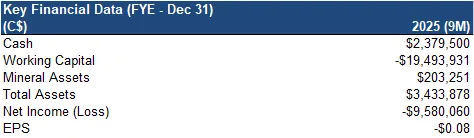

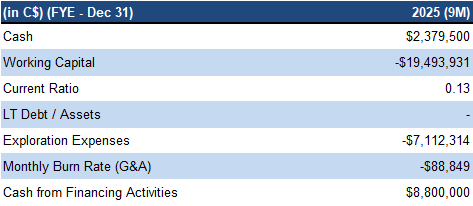

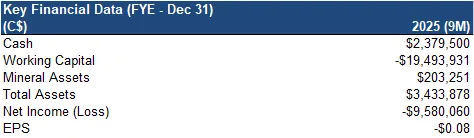

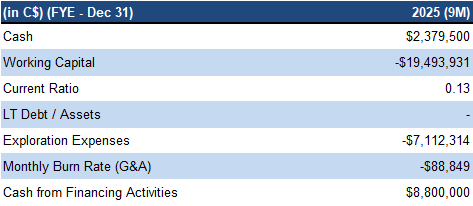

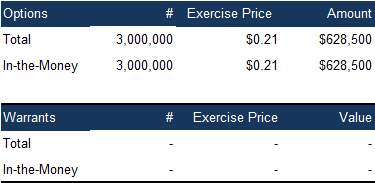

Financials

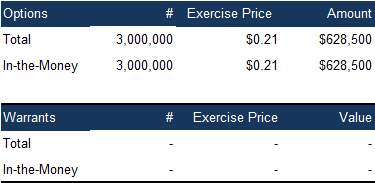

At the end of Q3-2025, the company had $2M in cash, and $20M in debt due to major shareholders

Source: FRC / Company

In-the-money options can bring in $0.63M

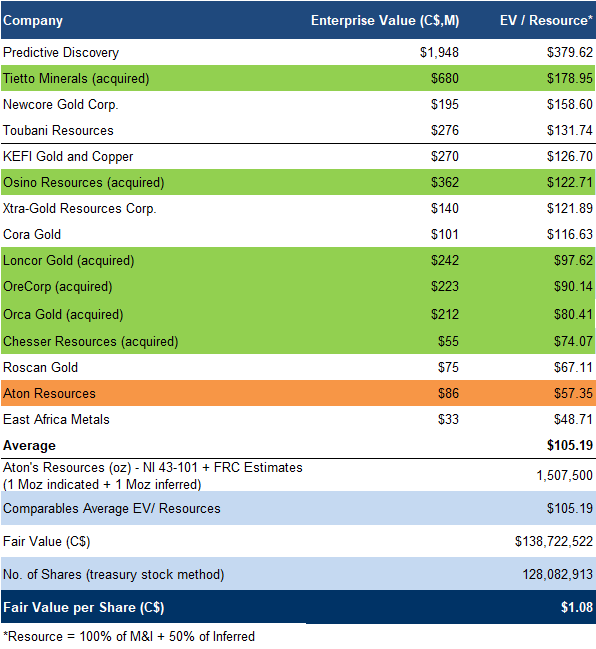

FRC Projections and Valuation

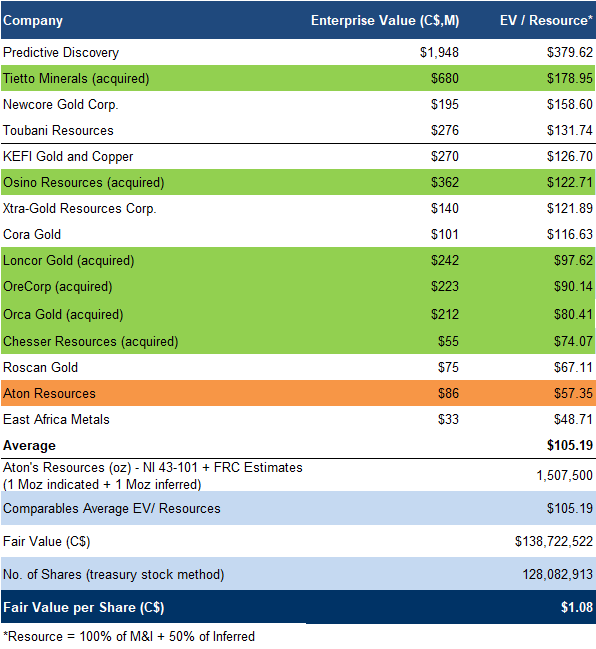

Source: FRC / S&P Capital IQ / Various

African gold juniors are trading at $105/oz (previously $56/oz)

Aton is trading at $57/oz (previously $29/oz), a 45% discount

Applying $105/oz to EAM’s resources, we arrived at a comparables valuation of $1.08/share (previously $0.63/share)

We are reiterating our BUY rating, while raising our fair value estimate from $0.63 to $1.08 per share. Gold and silver remain well above historical levels despite recent pullbacks, supported by safe-haven demand amid ongoing geopolitical uncertainty. Aton’s promising drill results, and strategic hub-and-spoke approach , position it to potentially capitalize on both near-term production and long-term resource expansion.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on gold prices

- Access to capital and share dilution

- Exploration and development

- Geopolitical and FOREX

- No assurance that the company will be able to advance all of its projects simultaneously

We are maintaining our risk rating of 5 (Highly Speculative)