- Since our previous report in December 2025, SYH is up 33%. The company closed a $2.1M equity financing, and staked 10 additional early-stage uranium properties, expanding its portfolio to 43 properties covering 662,887 hectares. SYH controls one of the largest portfolios among uranium juniors in the Athabasca Basin.

- SYH is gearing up for its largest annual drill campaign to date, totaling approximately 25,000m at its 100%-owned Moore project, and the new Russell Lake joint venture with Denison Mines Corp. (TSX: DML).

- At the Moore uranium project, management aims to deliver a maiden resource estimate this year, which we believe will provide a clearer view of its potential. This could be a key milestone and catalyst for the company.

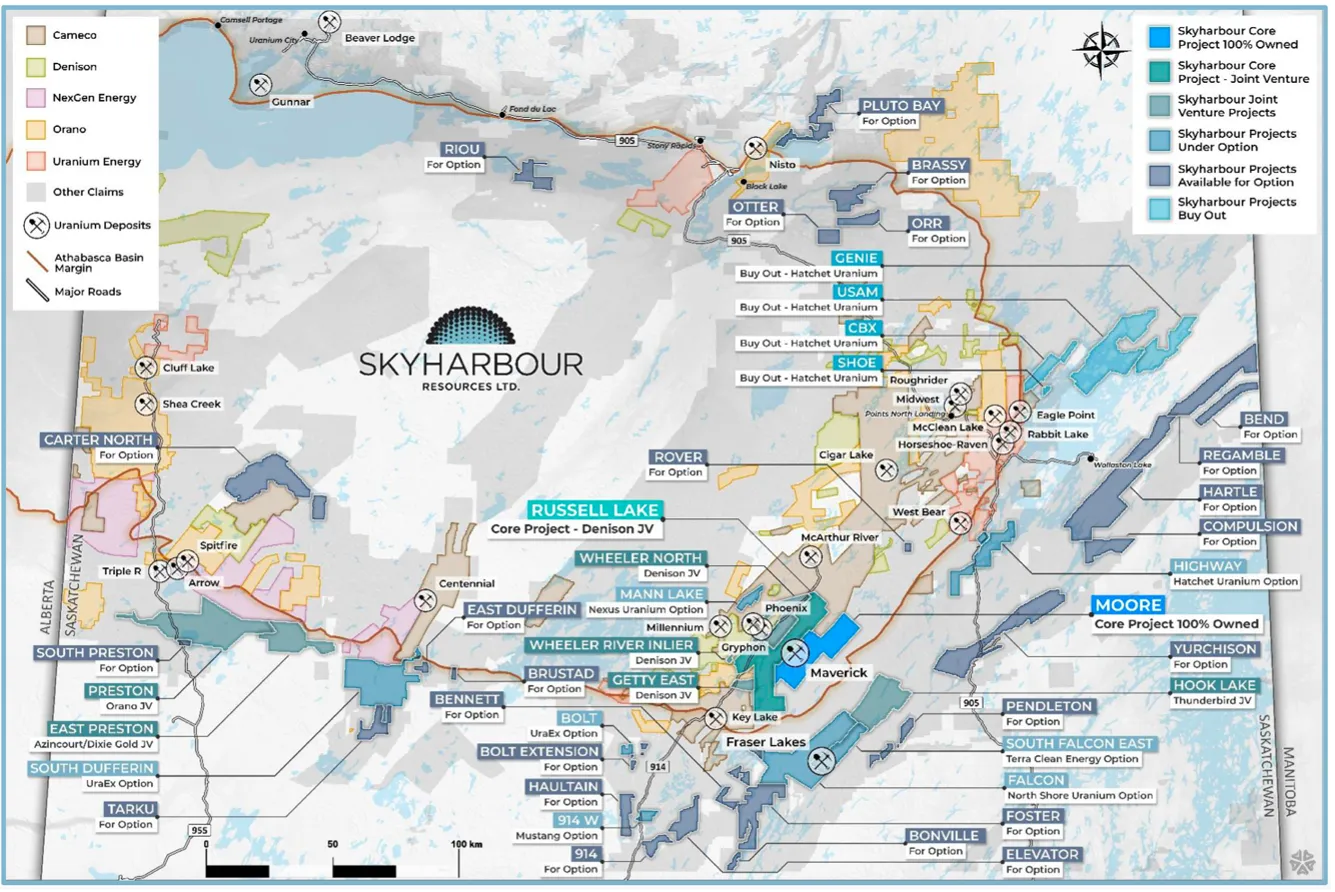

- As for the Russell Lake joint venture, SYH will receive $61.5M from Denison ($21.5M in cash and shares, with $18M paid to date, plus $40M for exploration) to earn a 20%–70% interest across multiple claims over seven years. We view this partnership as a major positive for SYH: it brings in a top-tier operator, and validates the project’s potential.

- Option partners on SYH’s other projects are actively advancing their properties, with approximately 6-7,000 m of drilling planned this year. SYH could receive up to $42M in cash and shares if all option agreements are fully executed.

- Upcoming catalysts for SYH include improving uranium market sentiment, partner-funded exploration, and major drilling programs at Moore and Russell Lake.

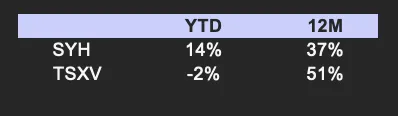

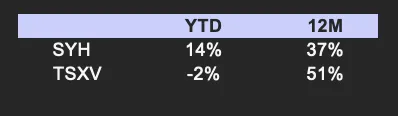

Price and Volume (1-year)

*$11M in cash and marketable securities as of February 2026

*QP: Serdar Donmez, P.Geo., VP Exploration of Skyharbour Resources Ltd.

* Skyharbour Resources has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions.

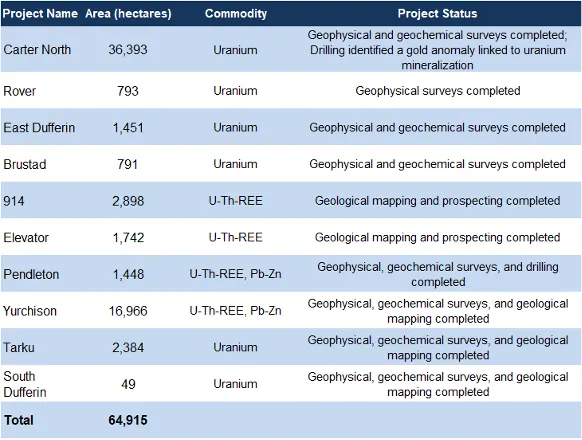

Portfolio Summary

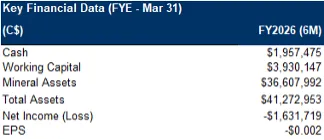

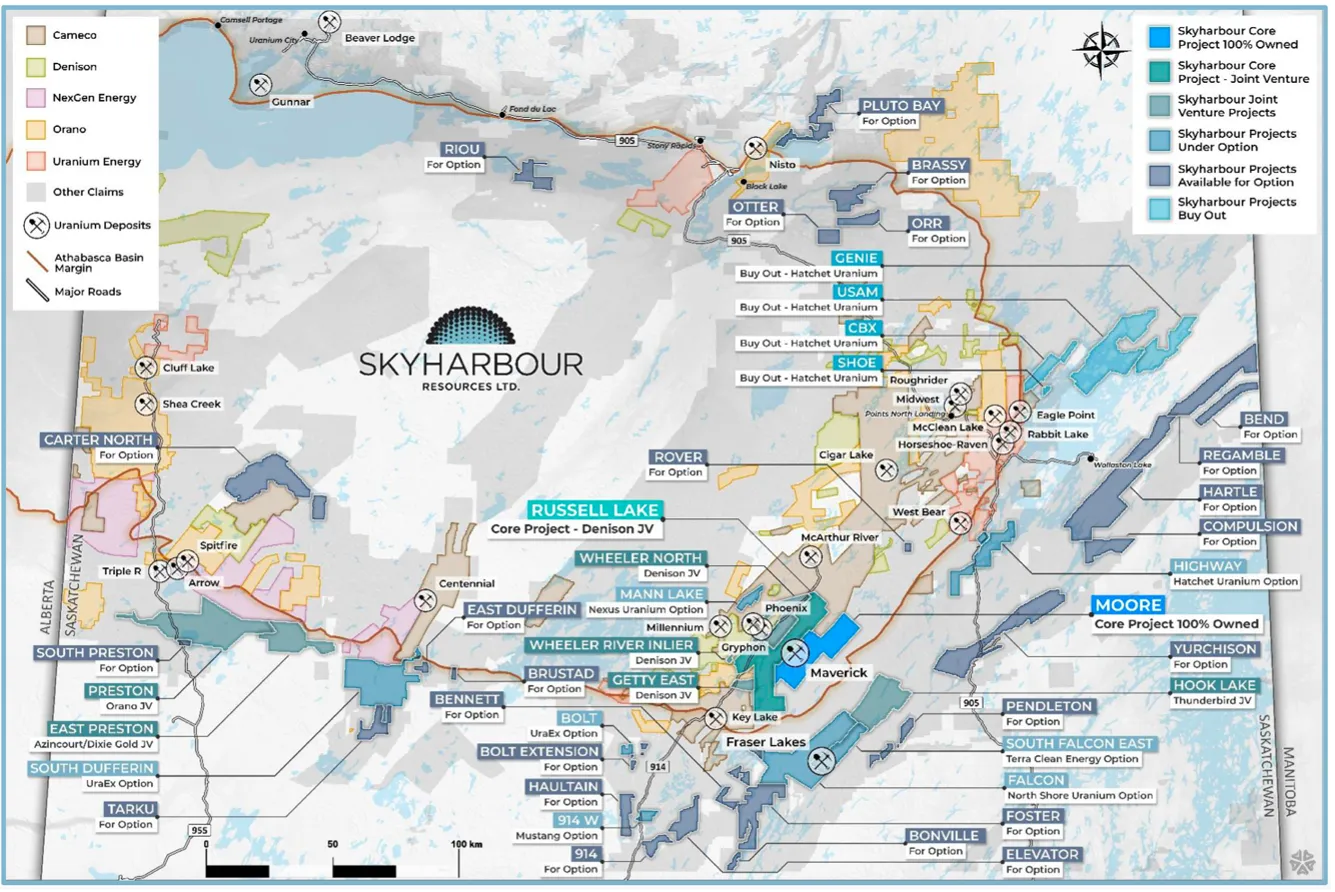

SYH's Portfolio

43 properties, covering 662,887 hectares, in the Athabasca basin

The Athabasca Basin hosts some of the world’s richest uranium deposits and mines, increasing SYH’s likelihood of discovering new uranium deposits than peers operating in other regions

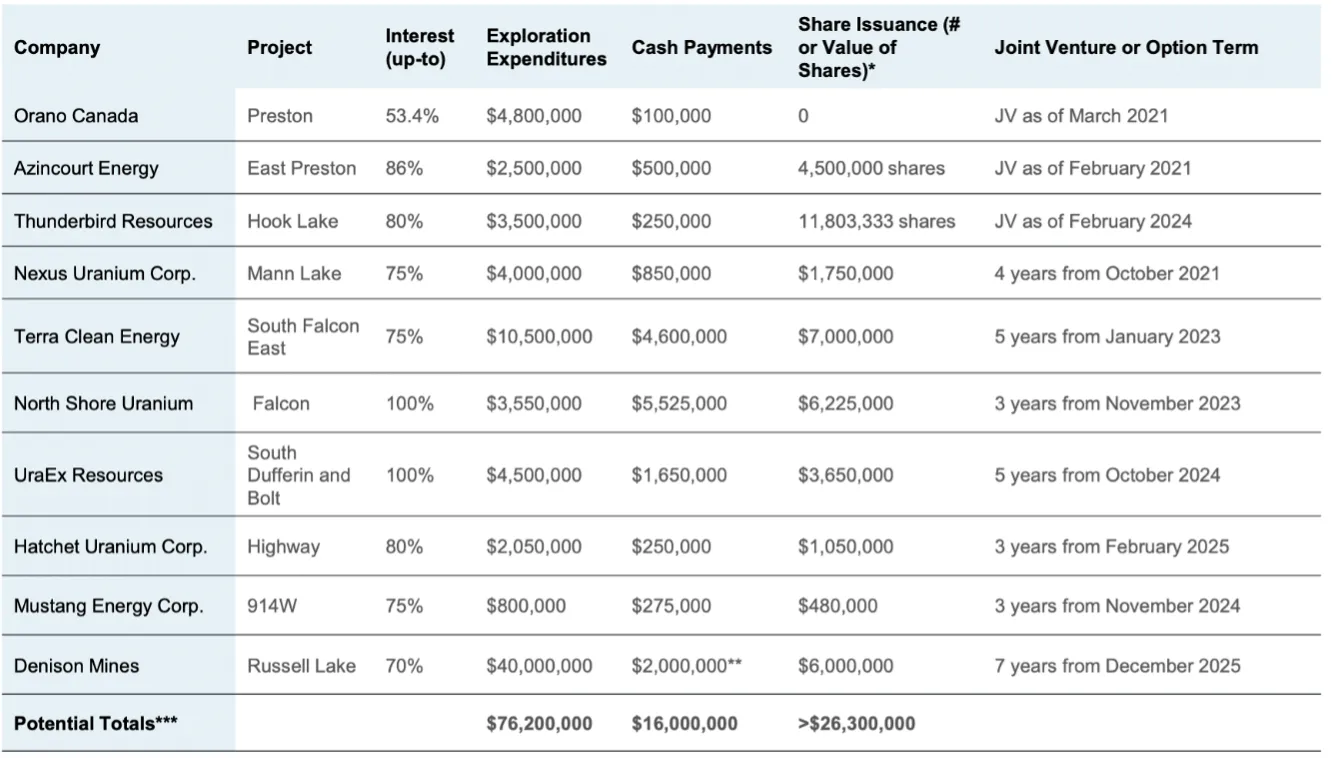

JV/Option Agreements

Source: Company

Fourteen projects under JV/ option agreements with 10 partners

Partners pay for exploration → SYH receives cash and shares from partners, plus exposure to upside potential from discoveries

Partners could commit up to $76M for exploration, and $42M in cash/share payments to SYH

Last month, SYH staked 40 new prospective uranium claims in Northern Saskatchewan, with management now seeking JV partners to advance them.

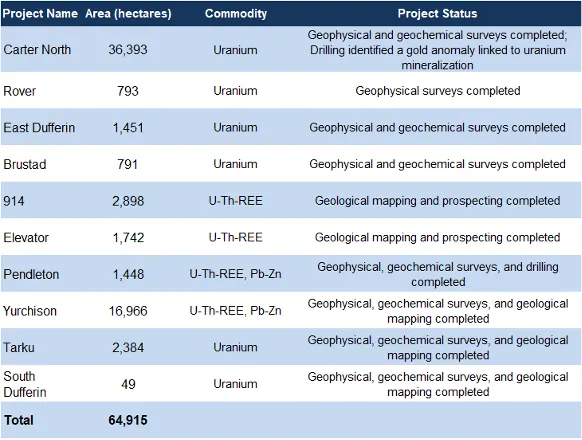

New Claims

Source: FRC / Company

10 prospects covering 64,913 hectares

Carter North is adjacent to Cameco’s (TSX: CCO) North Williams project, and 35 km northeast of NexGen Energy’s (NYSE: NXE) Arrow deposit

Proximity to majors is important, as a successful discovery could make the project an attractive acquisition target

Rover is 40 km east of Cameco’s McArthur River mine, and 31 km southeast of the Cigar Lake Mine

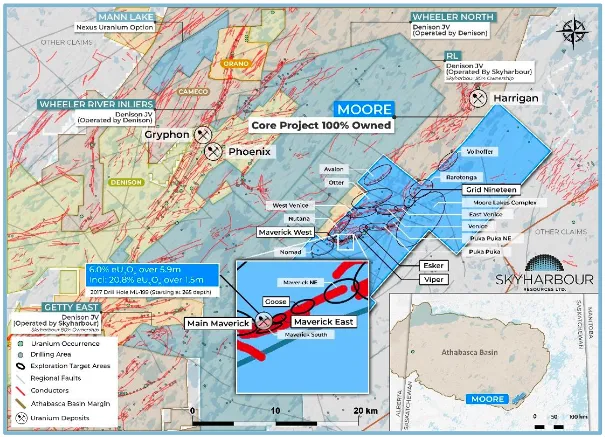

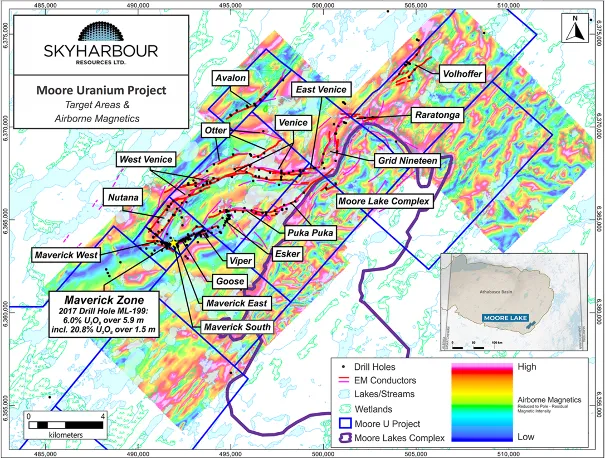

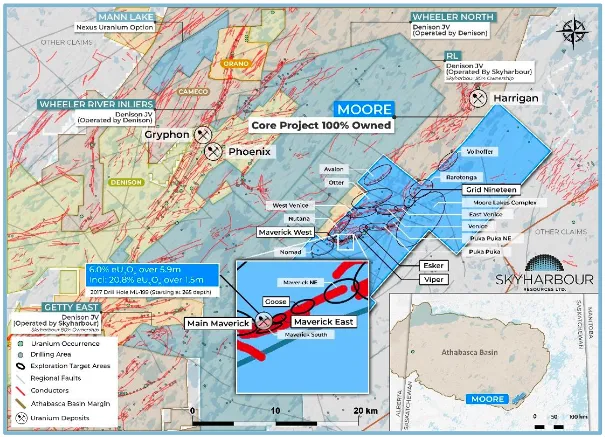

Moore Lake Uranium Project

The 2025 drill program expanded the Main Maverick zone, and discovered the new Nomad zone 1.7 km southwest, highlighting the potential for additional uranium on the project. SYH plans 8,000–10,000 m of drilling (15–25 holes) to follow up on these results and explore other targets.

Location Map

Moore is located 15 km east of Denison’s Wheeler Rover project, and 39 km south of Cameco’s McArthur River mine

The 4.7 km-long Maverick Corridor hosts numerous targets, meaning SYH has multiple opportunities to discover uranium in a highly prospective region

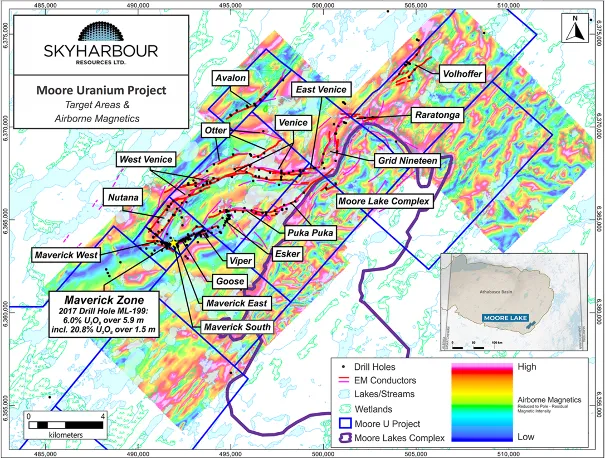

Target Areas

Source: Company

The 2025 drilling at the Main Maverick zone discovered high-grade uranium, including 11.77% U3O8 over 1.6 m, within 4.4 m of 4.84% U3O8, well above typical deposits (<1%); higher grades typically imply higher production, and lower mining costs

Management aims to complete a maiden resource estimate this year

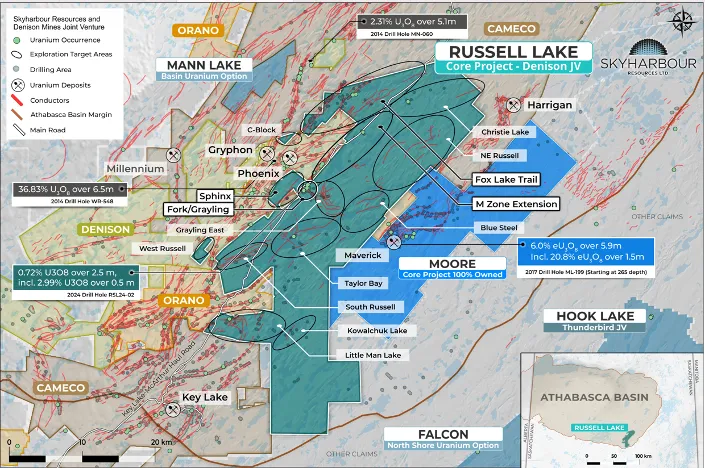

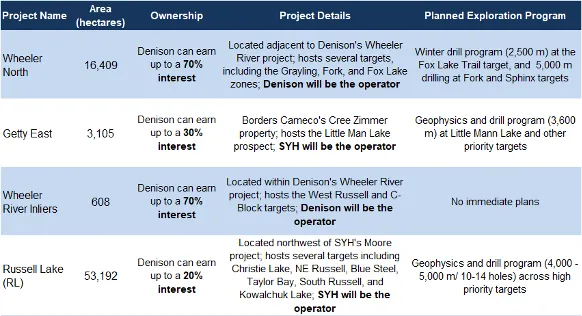

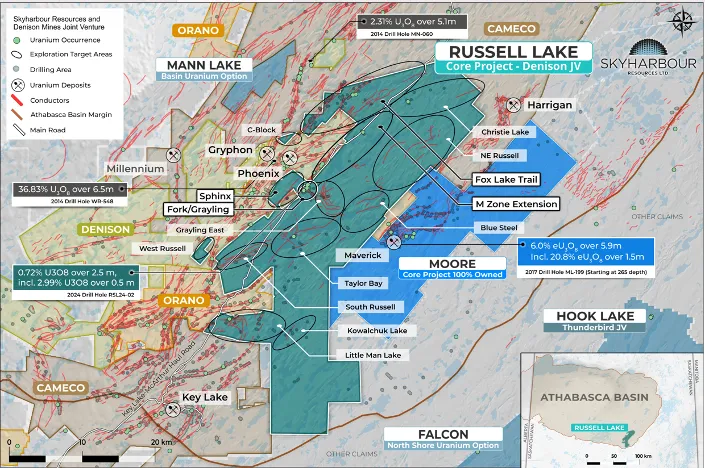

Russell Lake Uranium Project – JV with Denison Mines

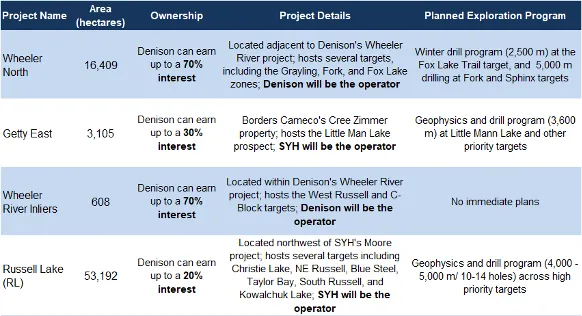

The 73,314-ha Russell Lake property is divided into four JV projects – Russell Lake (RL), Getty East, Wheeler North, and Wheeler River Inlier. SYH and Denison plan an extensive exploration program this year, including geophysics and over 15,000 m of drilling. This program will build on key targets identified through a 19-hole (9,844 m) drill campaign, and electromagnetic surveys, conducted by SYH in 2025.

Location Map

Source: Company

SYH recently formed a joint venture with Denison Mines allowing Denison to acquire 20–70% of the Russell Lake claims for up to $61.5M, including $21.5M in cash/shares ($18M received to date), and $40M in exploration over seven years

Russell Lake is strategically located between SYH’s Moore uranium project, and Denison’s Wheeler River project, and close to Cameco’s Key Lake mill, and MacArthur River mines

2026 Exploration Programs

Source: FRC / Company

35+ km of untested targets

Denison and SYH plan to spend $8–$9M this year, including $5.5–$6M from Denison, with the remainder from SYH

Four targets returned significant radioactivity

Updates on Other Projects

- At the Falcon uranium project, partner North Shore Uranium (TSXV: NSU, MCAP: $24M) has detected significant radioactivity, indicating potential uranium mineralization, and has identified 36 uranium targets to date

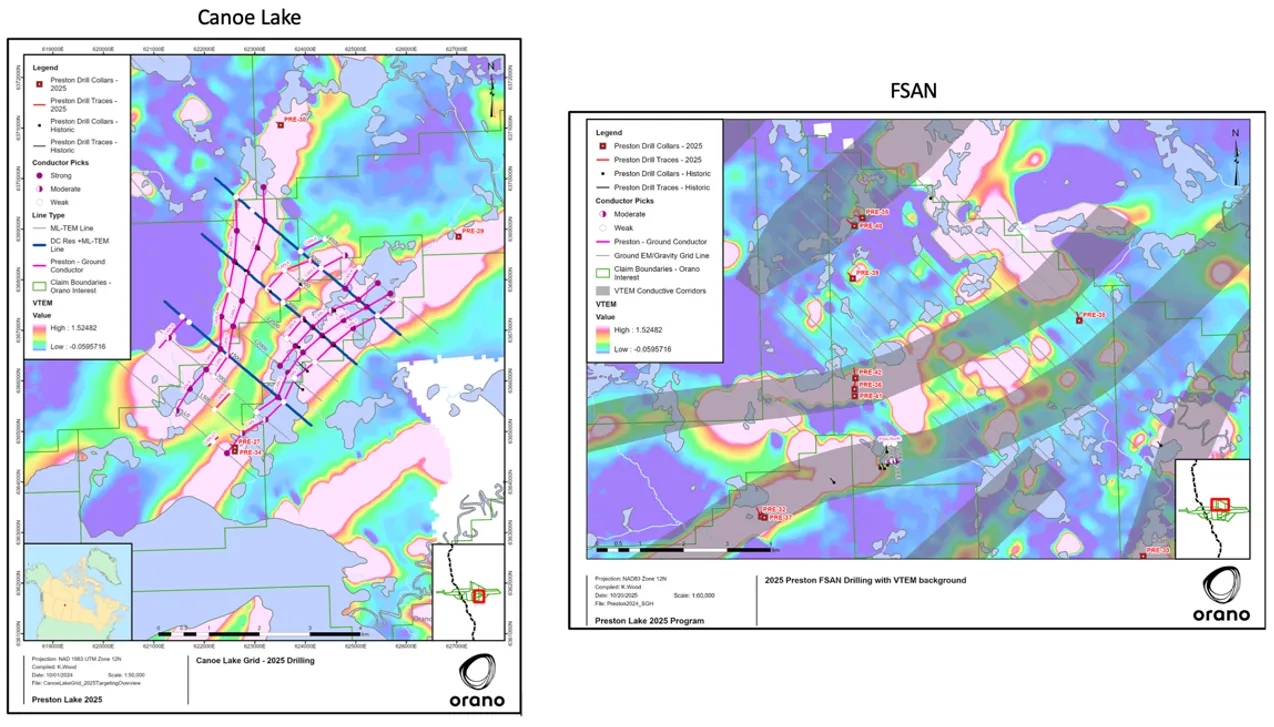

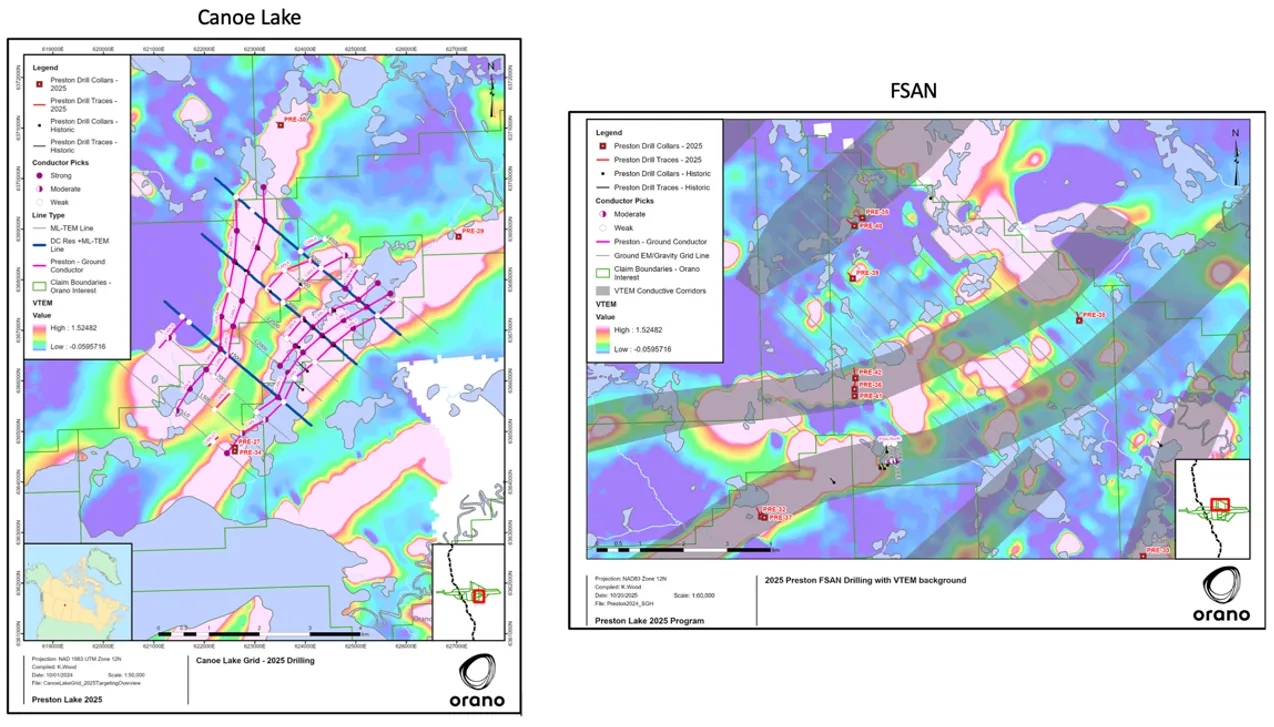

- At the Preston uranium project, JV partner Orano Canada is launching an exploration program with geophysics and drilling to build on encouraging 2025 results.

Preston Uranium Project - Canoe Lake and FSAN Zones

*Brighter colors may indicate potential mineralization

Source: Orano Canada / Company

3,500 m drilling planned at the FSAN area

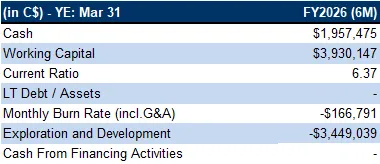

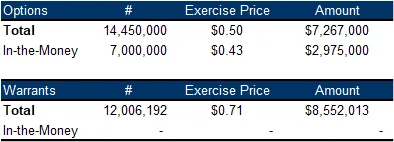

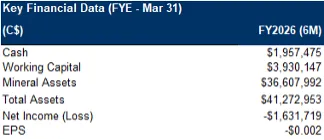

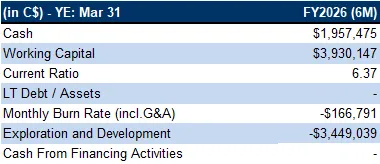

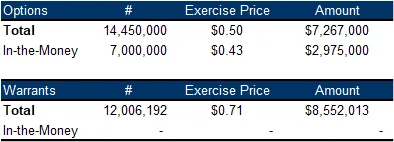

Financials

Strong balance sheet, with over $11M in cash and marketable securities, as of February 2026

In-the-money options can bring in $3M

Source: FRC / Company

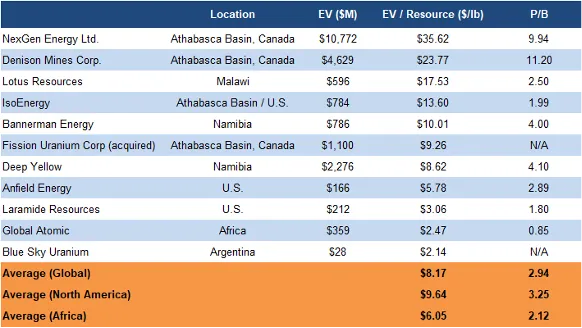

FRC Valuations

Source: FRC / Various / S&P Capital IQ

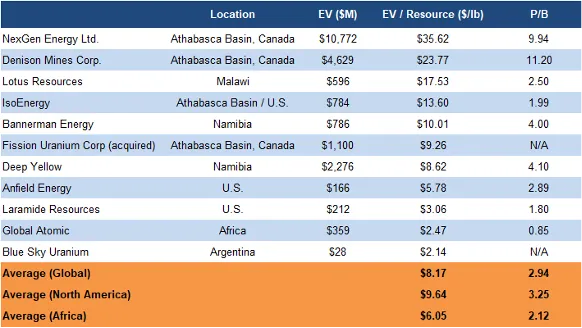

North American uranium juniors are trading at $9.64/lb (previously $8.92/lb), and 3.3x book value (previously 2.9x)

Source: FRC

Applying sector multiples to SYH’s flagship assets, we arrived at a revised fair value estimate of $1.16/share (previously $1.12/share)

We are reiterating our BUY rating, while adjusting our fair value estimate from $1.12 to $1.16/share. With an expanded portfolio, partner-funded exploration, and key drilling programs at Moore and Russell Lake, we believe SYH is well positioned to benefit from a potential upswing in sector sentiment.

Risks

We believe the company is exposed to the following key risks:

- The value of the company is dependent on uranium prices

- Exploration and development

- None of its flagship projects have a NI 43-101 compliant resource estimate

- Access to capital and share dilution

- No guarantee that option partners will follow through with their proposed programs

We are maintaining our risk rating of 5 (Highly Speculative)