FRC Top Picks

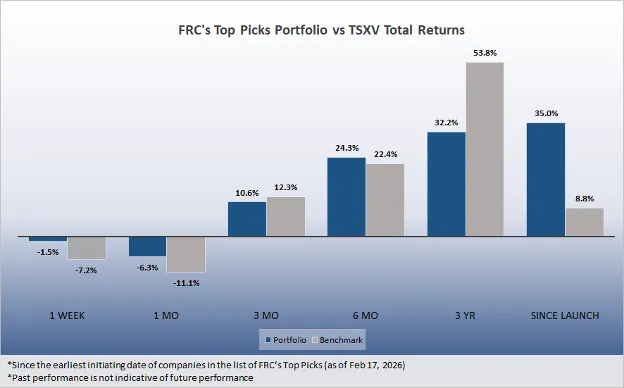

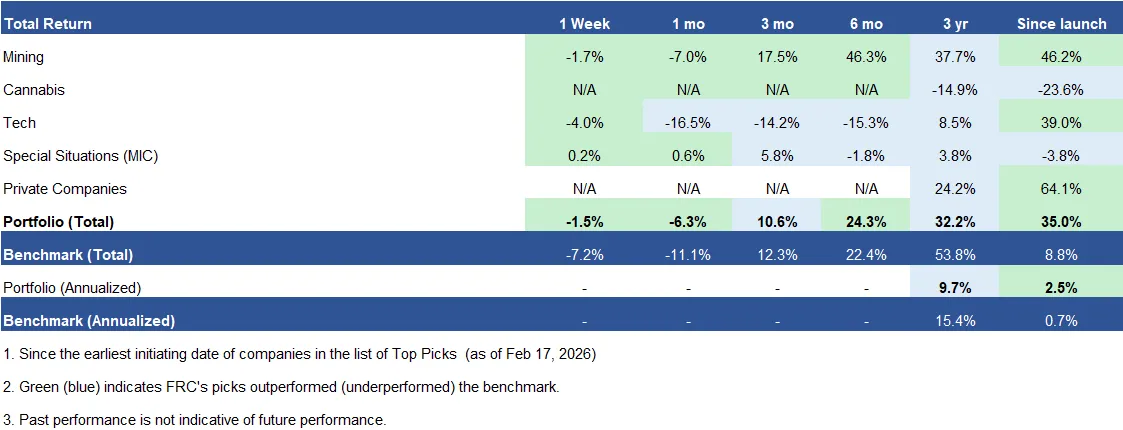

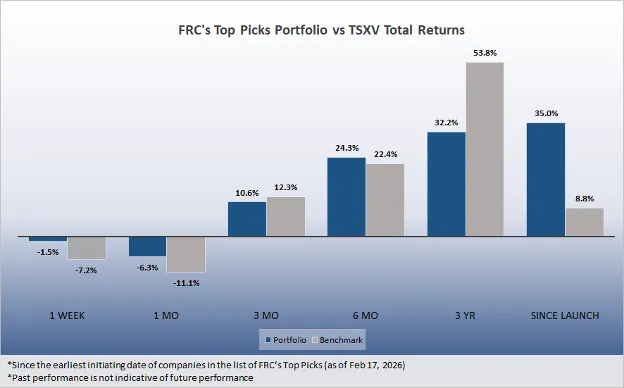

Last week, companies on our Top Picks list were down 1.5% on average vs a 7.2% decline for the benchmark (TSXV). Our top picks have outperformed the benchmark in four out of six time periods listed below. Visit our website to view our full list of Top Picks by sector.

Performance by Sector

Source: FRC

The table below highlights last week’s top five performers, led by

Panoro Minerals, which rose 8%. Panoro owns one of the largest copper-gold deposits held by a junior in the Americas.

* Past performance is not indicative of future performance (as of Feb 17, 2026)

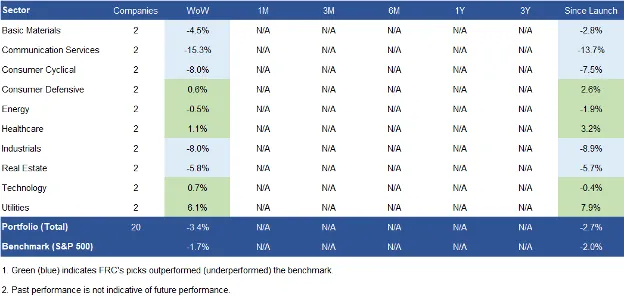

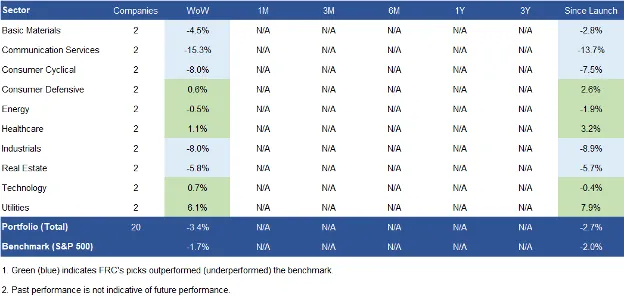

FRC Model Picks

Since we launched the portfolio on February 9, 2026, our picks have declined by an average of 2.7% vs a 2.0% decline for the benchmark (S&P 500). Defensive sectors like Utilities (+7.9%) and Healthcare (+3.2%) provided a buffer, while cyclical and growth-oriented sectors, particularly Communication Services (-13.7%), Industrials (-8.9%), and Consumer Cyclicals (-7.5%), dragged performance. Visit our website to view our full list of Model Picks by sector.

Performance by Sector**

The table below highlights last week’s top five performers, led by Kenon Holdings Ltd., which rose 8%. Kenon is a diversified holding company with investments in global energy and automotive sectors.

* Past performance is not indicative of future performance (as of Feb 17, 2026)

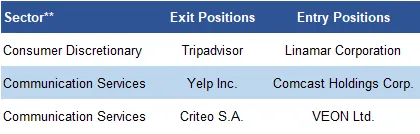

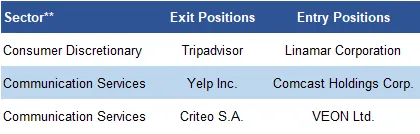

This week, we are rotating out of software and digital ad platforms, focusing on companies with physical infrastructure that are potentially more resilient to AI-driven disruption.

Here is a brief background about each new stock added to the list (AI Generated)**:

- Linamar Corporation – A Canadian diversified manufacturing company specializing in automotive and industrial machinery components.

- Comcast Holdings Corp. – A leading U.S. telecommunications and media conglomerate providing cable, internet, and entertainment services.

- VEON Ltd. – A multinational telecommunications company offering mobile, internet, and digital services primarily in emerging markets.

*Disclaimers - Annual fees ranging from $15,000 to $35,000 have been paid to FRC by Panoro Minerals, Olympia Financial, South Star Battery, Trident Resources, Denarius Metals, Energy Vault Holdings, Kingman Minerals, Tartisan Nickel, Graphite One, and Chilean Cobalt. for research coverage and distribution of reports. FRC or companies with related management, and Analysts, do not hold shares/securities in the companies mentioned in this report.

**We have selected these companies based SOLELY on our screening tool and fair value feature. We have not looked into company or industry specific factors that could affect the stocks. This portfolio and updates are for information, educational, and entertainment purposes only. We want to see how a hypothetical portfolio picked largely using our fair value algorithm would fair against a passive index. Before investing in anything, you should do your own due diligence and speak to a professional advisor. FRC and/or its analysts may hold positions in one or more of the holdings.