- Helium is primarily produced as a low-grade by-product of natural gas production, though it can also be sourced directly from dedicated helium wells. Notably, identifying a helium resource is typically faster than traditional metal exploration, like gold or copper.

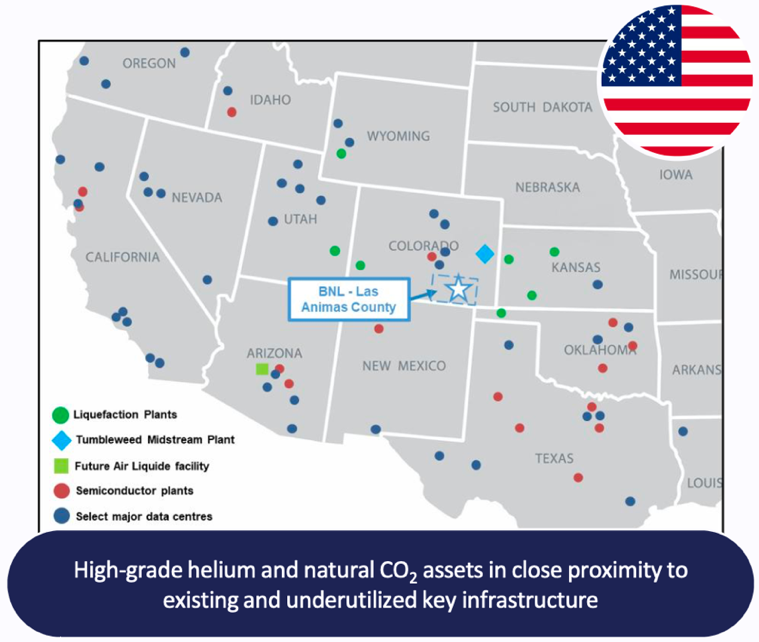

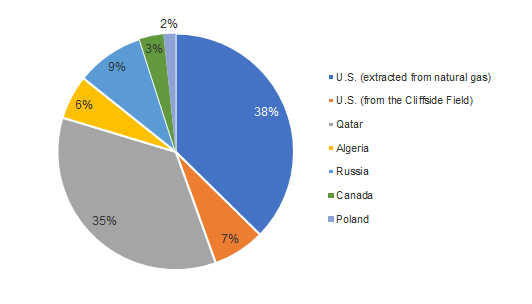

- The U.S. is the world’s leading helium producer, with the second-largest resource base globally. Most helium wells in the U.S. are extracted from natural gas wells located in Texas, Oklahoma, and Kansas.

- BNL’s flagship Galactica and Pegasus projects operate under a 50:50 joint venture with Helium One Global (LSE: HE1; Market Cap: US$58M). Galactica is currently in production, with gas refined at an on-site processing facility. Pegasus is expected to enter production later this year. The gas is not mixed with water or natural gas, supporting lower operating costs.

- These projects could support 15+ years of operations, and accommodate four processing plants serving 30+ wells. At full build-out, we estimate US$82M in revenue, and US$53M in operating profit. BNL trades at 0.25x our operating profit estimate vs >4x for peers, implying the market has yet to recognise its true potential.

- Upcoming catalysts include continued production ramp-up. Compared to traditional commodity markets, the helium market is relatively small and niche, leading to limited investor awareness, and understanding. With a significant supply deficit expected later this decade, we anticipate a surge in investor interest in the helium sector.

Risks

- The value of the company is dependent on helium prices

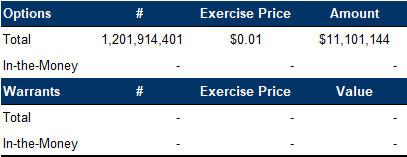

- Access to capital and potential for share dilution

- No assurance that the company will be able to advance all its projects simultaneously

- Exploration and development

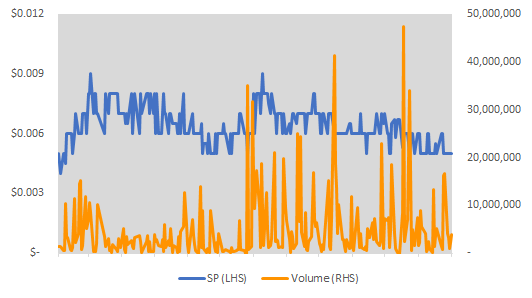

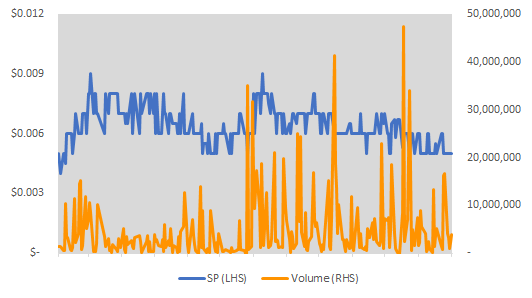

Price and Volume (1-year)

| |

YTD |

12M |

| BNL |

-17% |

11% |

| TSXV |

3% |

6% |

* Subsequent to the 2025 year-end, BNL raised $1.68M. We will start presenting our revenue and EPS estimates once the company starts reporting revenue.

* Blue Star Helium Ltd. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions. All figures in A$ unless otherwise specified.

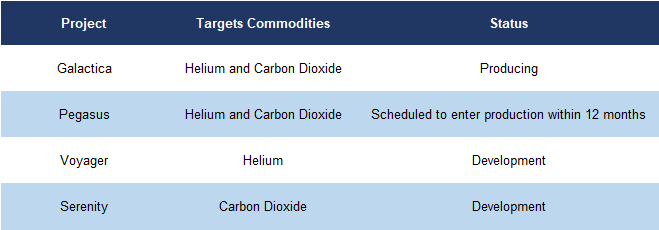

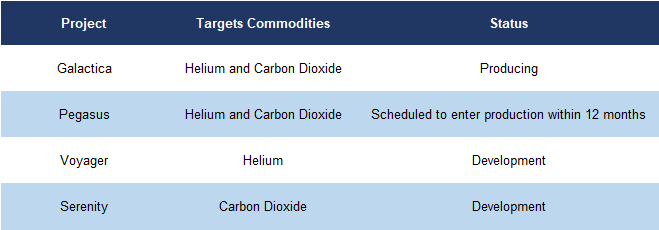

Portfolio Summary

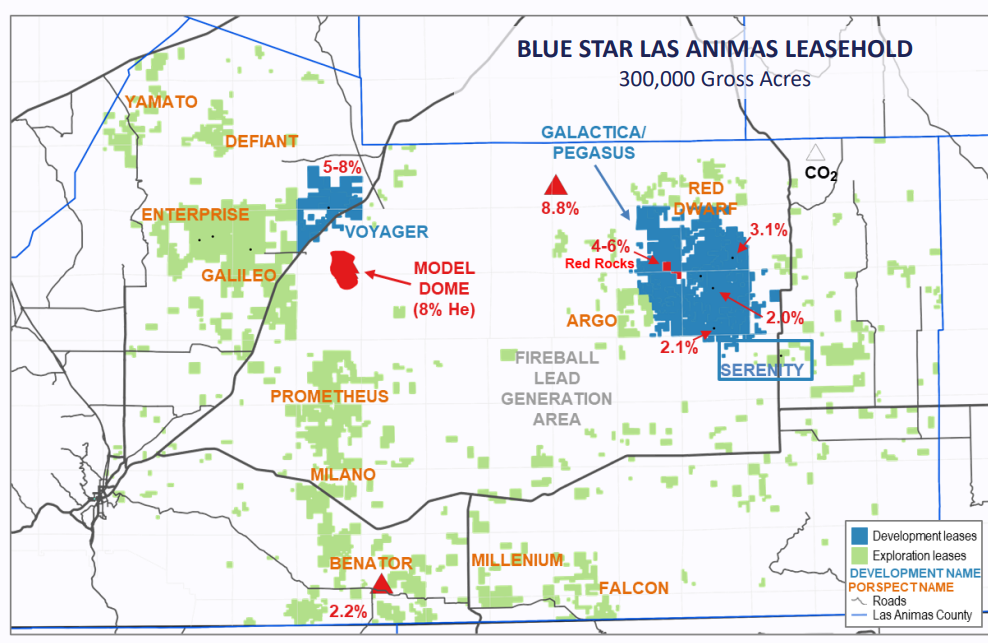

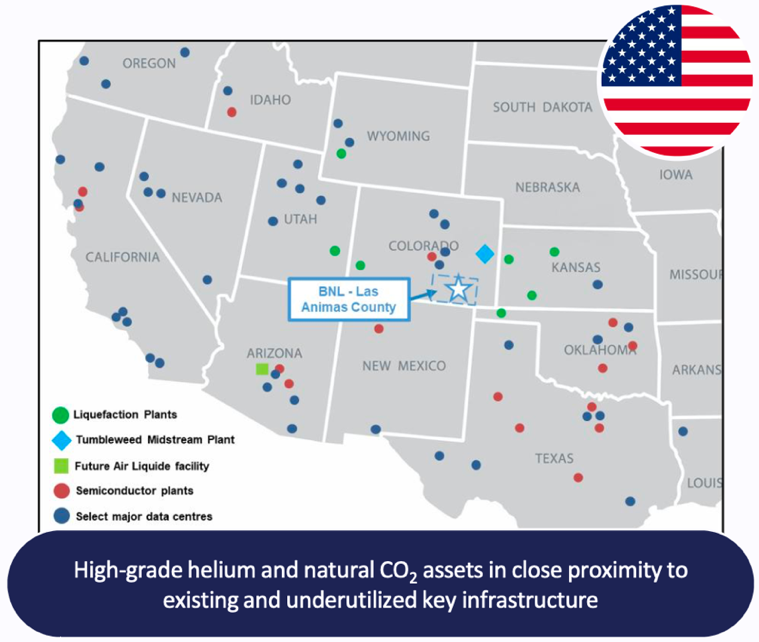

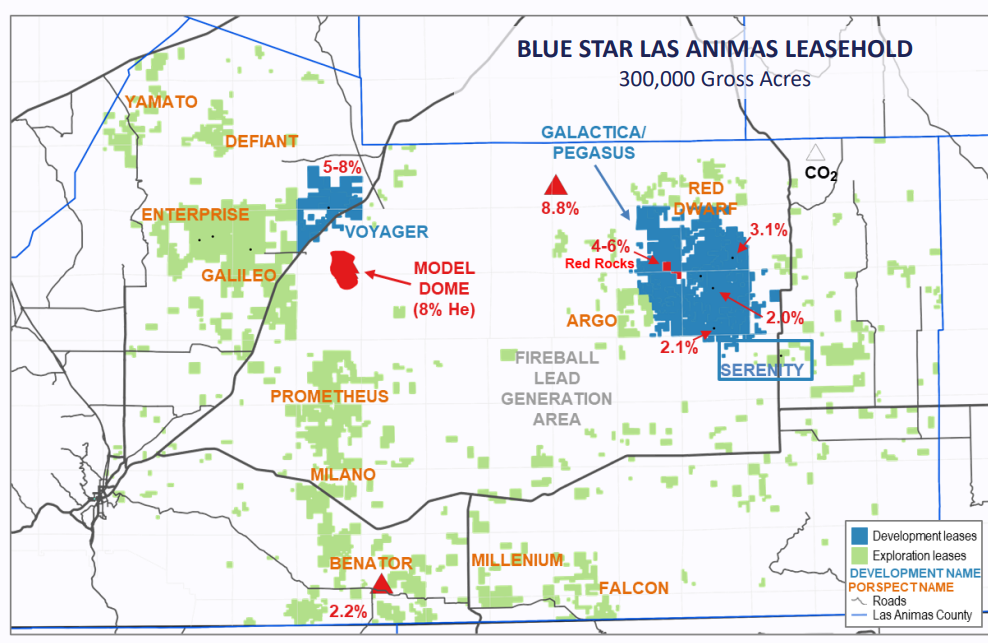

Three primary helium projects, and one CO2 project in Las Animas County, Colorado

Las Animas county is known for its coal mines and natural gas production

Source: Company

Its flagship Galactica-Pegasus project is a 50/50 joint venture with Helium One Global

A major advantage of BNL’s projects is the existing infrastructure for helium operations: highway access, onsite power, and nearby purification facilities within 100-150 miles

Helium: A Primer

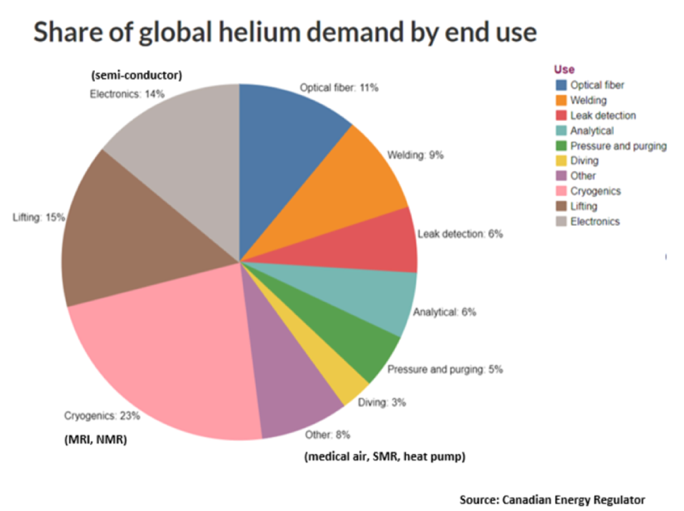

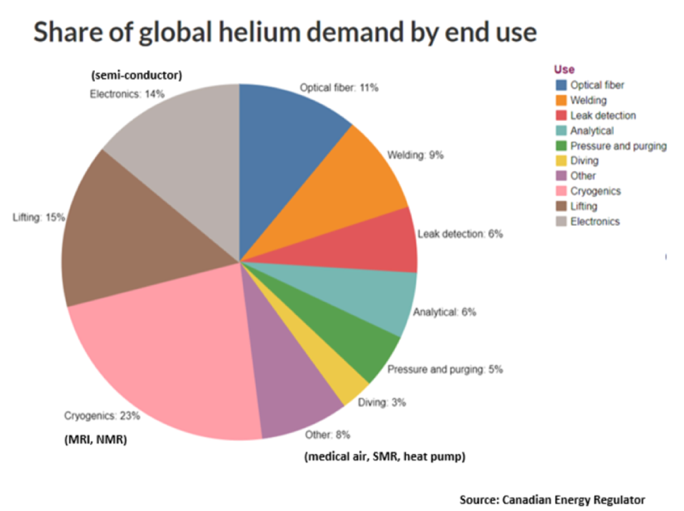

Helium possesses unique properties, including a low boiling point, low density, low solubility, high thermal conductivity, and inertness, making it valuable across a wide range of sectors. These include electronics (fiber optics and semiconductors), energy (nuclear fission and fusion), medical technology (MRI scanners and assisted breathing), aerospace (rocket purging and leak detection), computing (data centers and quantum computing), and industrial applications (welding and leak testing).

The EU and Canada classify helium as a critical mineral

Helium was added to the U.S. critical minerals list in 2018 but removed in 2021, as domestic production now meets national demand

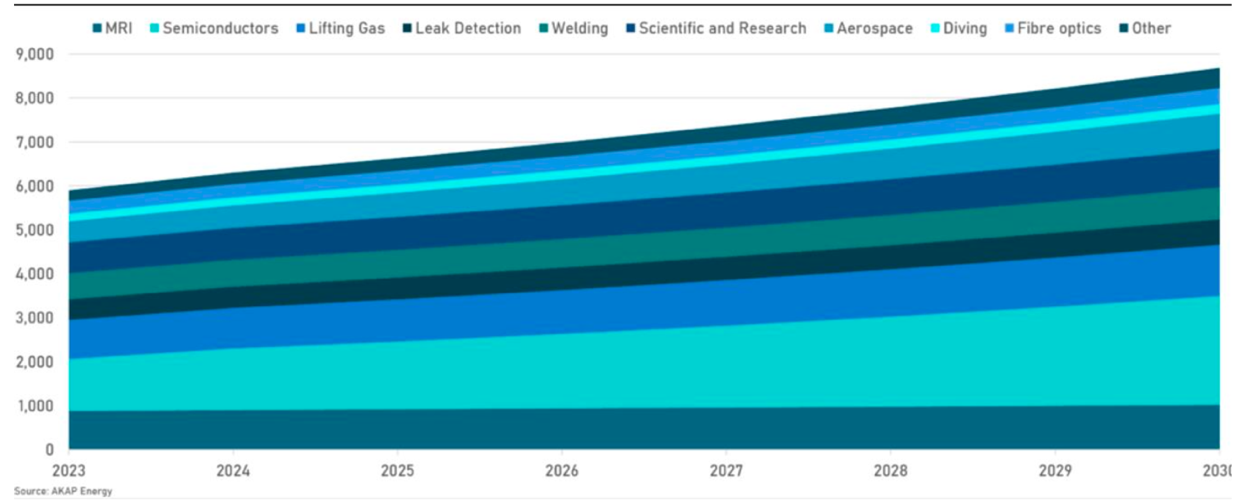

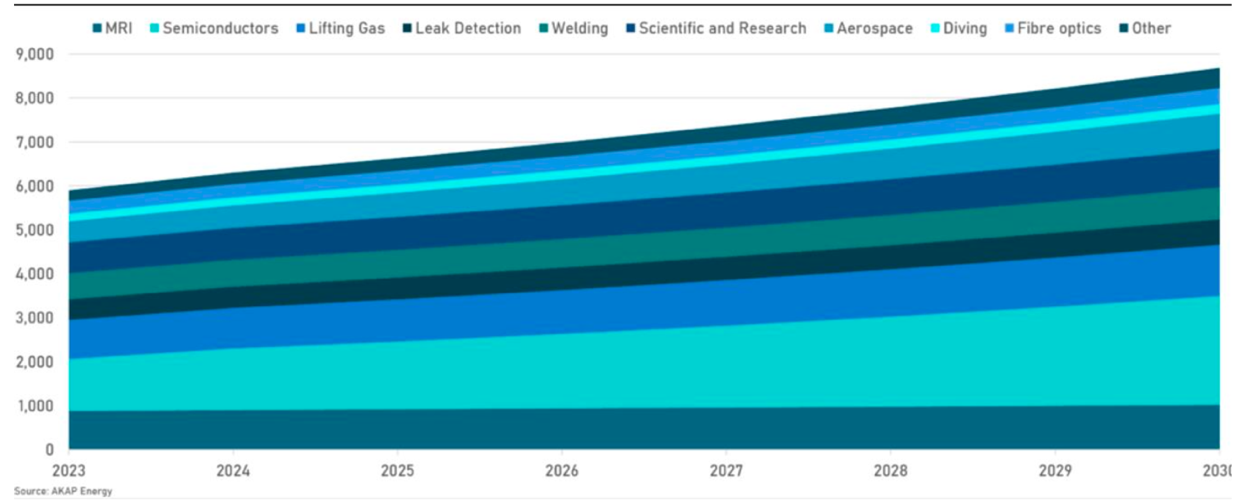

Helium Demand Growth Forecast (mmcf)

It is estimated that global demand will grow from 6.0 Bcf in 2025, to 8.1 Bcf by 2030, reflecting a CAGR of 6.2%, primarily driven by rising demand from the healthcare, semiconductor, and electronics industries

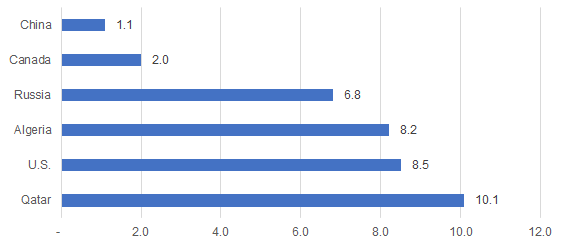

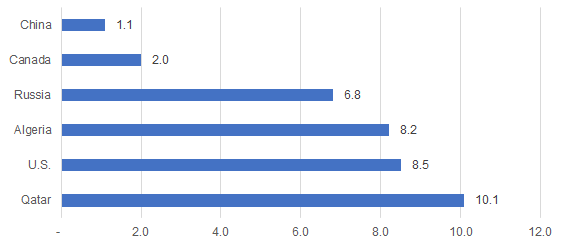

Helium Resources (billion cubic meters)

Source: USGS

Qatar hosts the largest helium resource (28% of global supply), followed by the U.S. (23%)

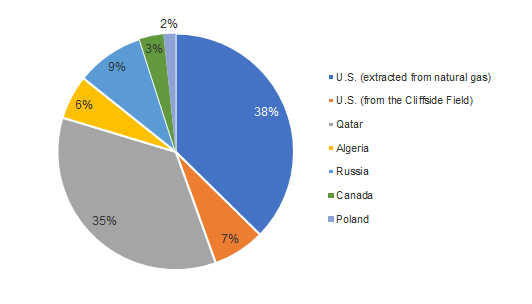

Helium Production – 2024

Source: USGS

Top producers: U.S. 45%, Qatar 35% of global helium supply

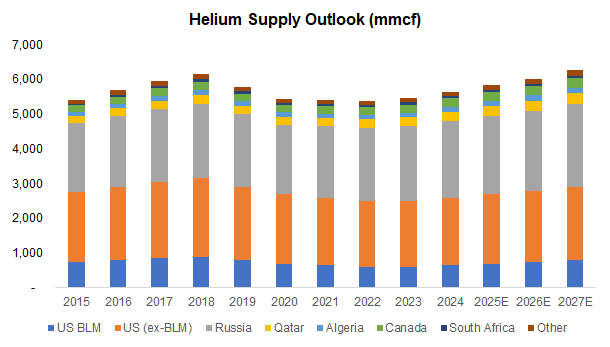

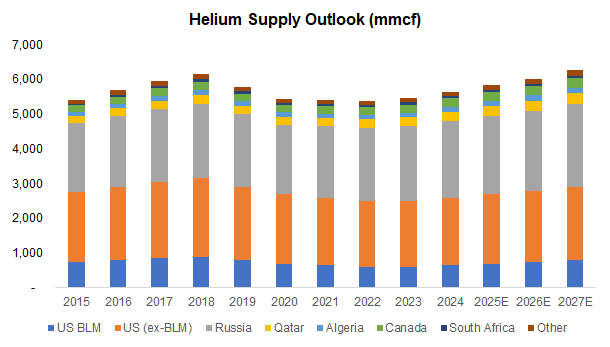

Global production declined from 2018 to 2023, due to depleting gas fields, but has since picked up with new supply coming online, primarily in Russia and Qatar

Source: AKAP Energy / FRC

It is estimated that global helium production will grow 3.6% p.a. over the next few years, below the projected 6.2% demand growth, clearly indicating a significant market shortfall later in the decade

In addition, international sanctions on Russia, a major helium producer, create vulnerabilities in the supply chain

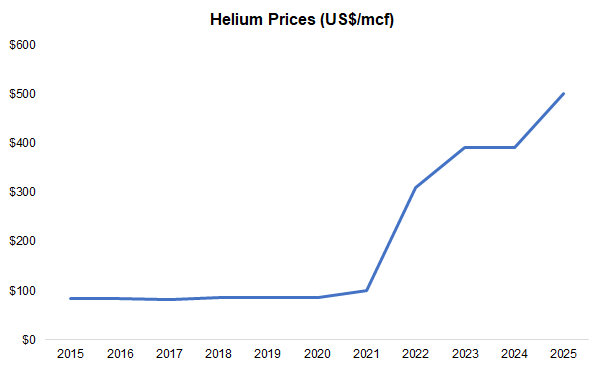

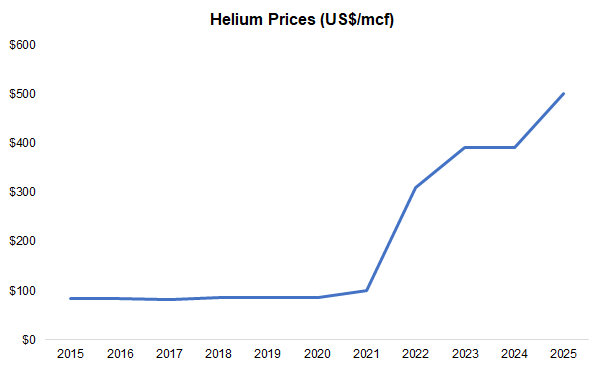

Source: FRC / Various

Helium prices have risen 488% over the past decade, with current contracts priced at US$400-600/mcf

Prices are challenging to track since helium is not publicly traded, with pricing largely set through producer–consumer offtake agreements

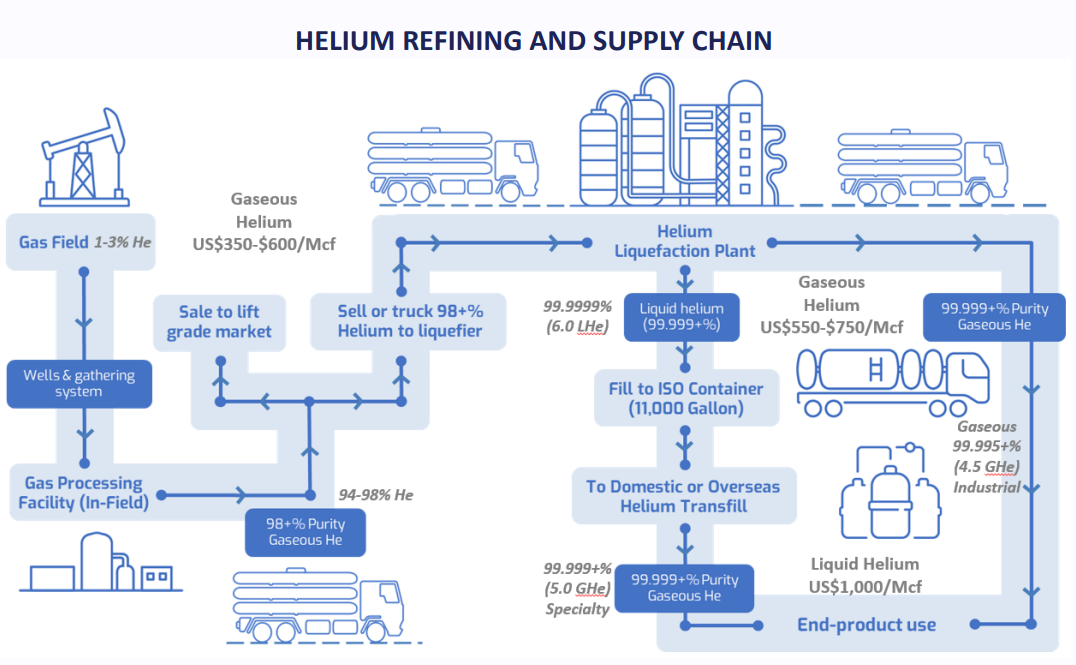

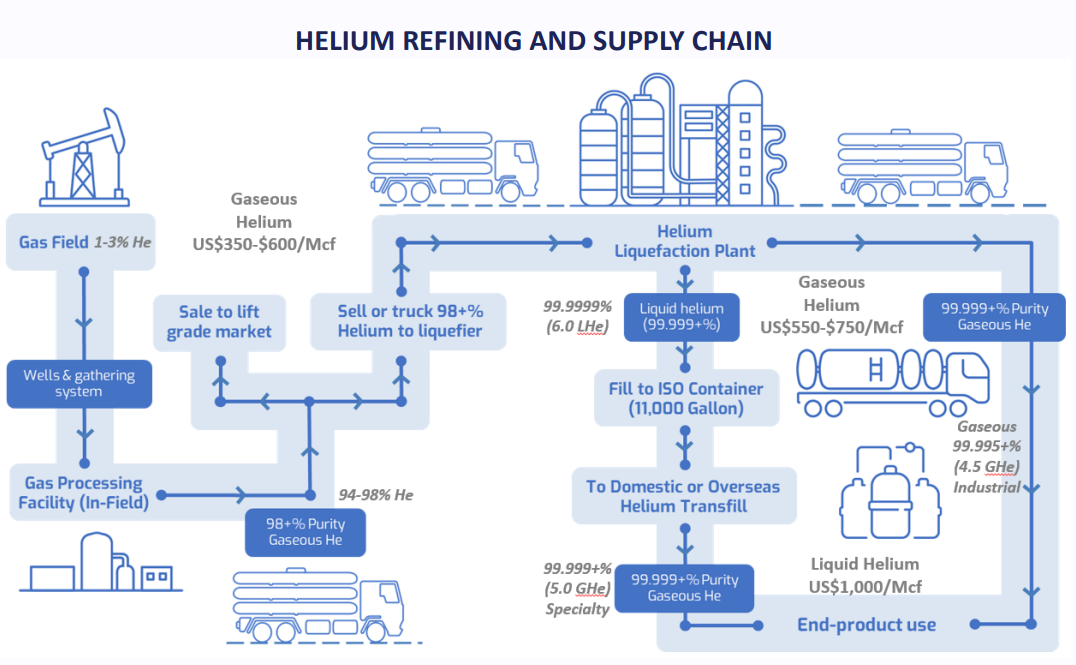

Most helium in the world comes as a byproduct of natural gas production. However, BNL focuses on reservoirs that are rich in helium itself . This approach targets gas that is not linked to oil or natural gas, making production more stable and environmentally friendly.

After extraction, Blue Star uses on site modular processing facilities, like mini plug and play factories, to refine the helium. The final product, 98% pure gaseous helium , is sold either directly to end users, or to liquefiers, who convert it to liquid helium for easier storage and transport.

Over 90% of helium is produced as a low-grade by-product of natural gas production

Source: Company

Helium is processed onsite, and delivered as 98% pure gas to end-users or liquefiers

Short-term offtake contracts are in place while long-term deals are negotiated

Galactica -Pegasus Helium Project (50% BNL / 50% Helium Global)

In December 2025, the company began production at its Galactica project, which is currently ramping up, and aims to bring Pegasus into production later this year. Its land package surrounds the privately-owned Red Rocks helium project, which has been producing helium for over two years, providing strong evidence of successful helium operations in the region.

60,000 acres

BNL gained control of the project in 2020,and is the project operator

Background Summary: In 2022, BNL drilled four wells at Galactica, which led to the discovery of a helium system. Helium and other gases flowed naturally to the surface with no water, making processing easier and reducing operating costs.

After the discovery, management planned a transition to production by completing a seven-well development program in 2025 , and building a processing facility, Pinon Canyon, at the Galactica site. This facility acts like a refinery, separating valuable helium from other gases to produce 98 % pure helium. They also built a gas gathering system, an underground network of pipes that carries raw gas from each well to the plant.

The project reached a major milestone in December 2025, starting helium production (with carbon dioxide as a secondary product), and is currently ramping up to full plant capacity.

Pinon Canyon Processing Facility

Source: Company

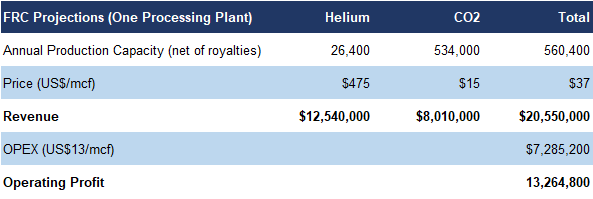

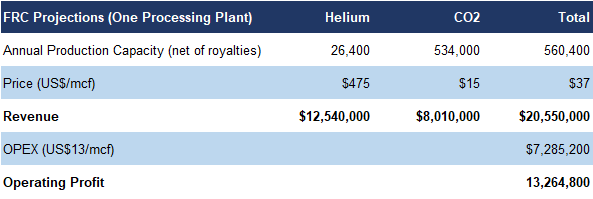

Pinon Canyon can process up to 26,400 mcf of helium, and 534,000 mcf of CO₂ per year, potentially generating US$21M in revenue, and US$14M in operating profit, at current prices

Source: FRC

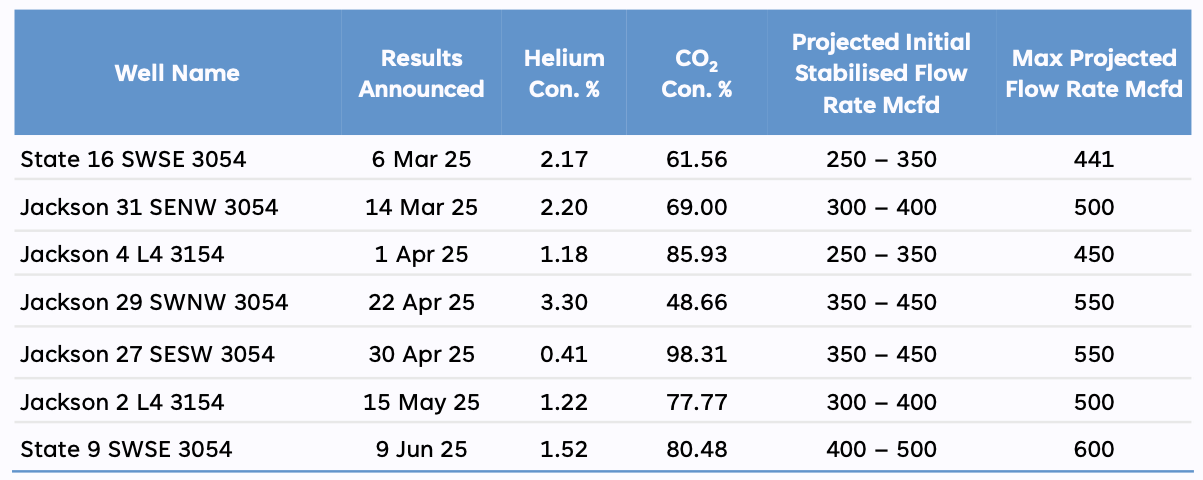

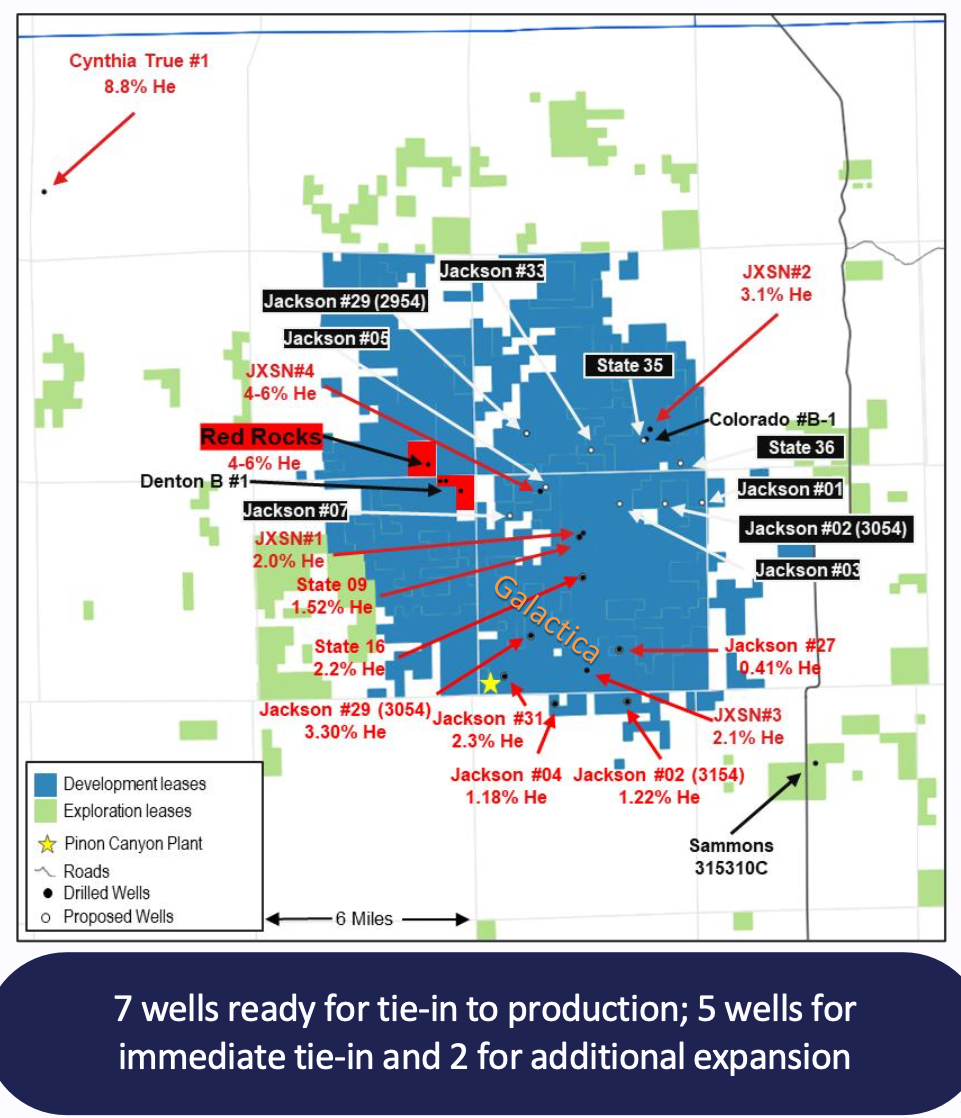

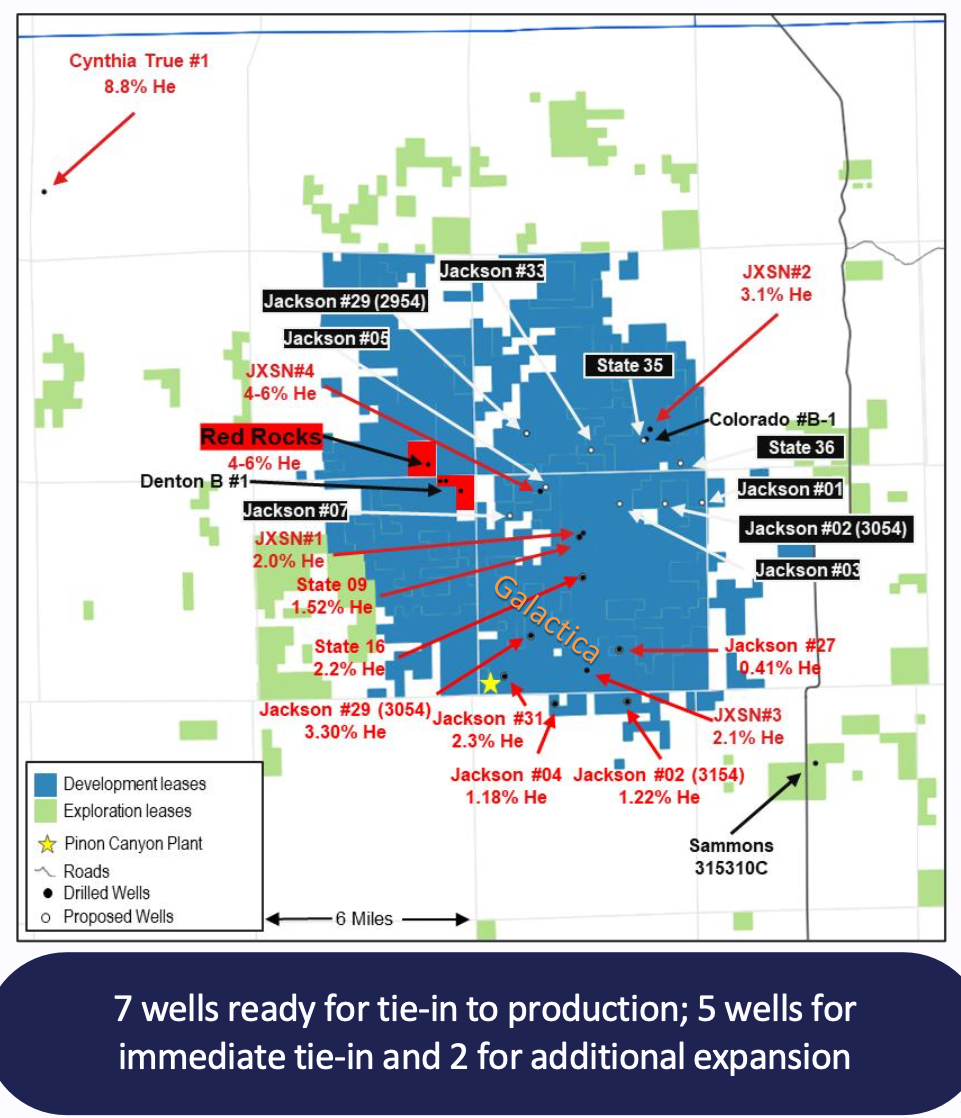

BNL’s immediate plan is to bring seven wells drilled last year into production

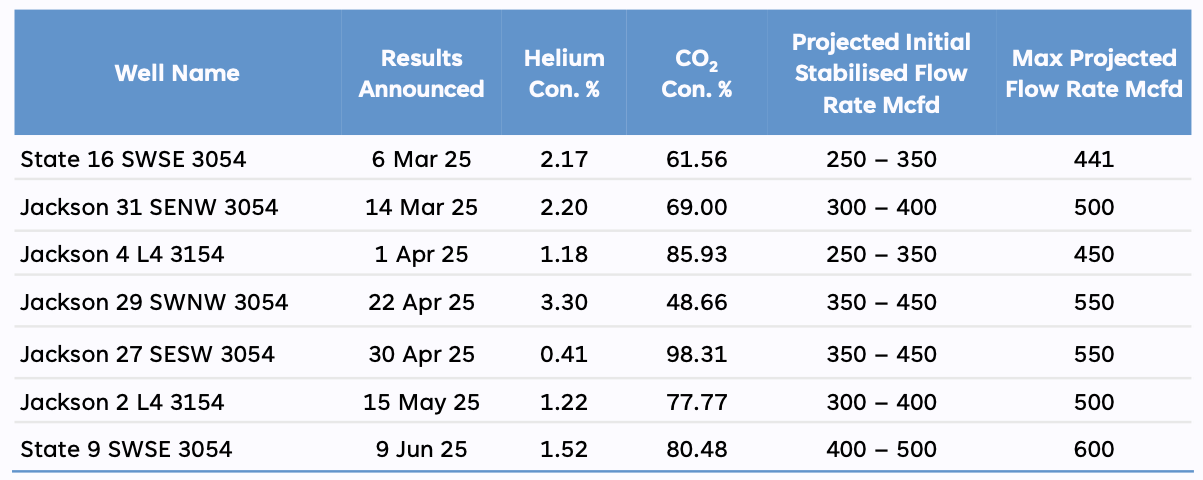

Seven Galactica Wells Ready for Production

Source: Company

Tests show an average helium concentration of 2%, with flow rates of 250–500 mcfd

These are promising values, as concentrations above 0.3% are generally economic

Project Map

Source: Company

While the company ramps up production at Galactica, it aims to bring Pegasus into production later this year

The Pegasus property, adjacent to Galactica, is 8–12 km from the Pinon Canyon processing facility

The map also shows the previously mentioned Red Rocks helium project, owned by another party, which has been producing helium for over two years

Past work indicates that the Galactica and Pegasus projects could host recoverable helium resources of 8 Bcf, supporting 15+ years of operations . The projects may accommodate 30+ wells . Each processing facility, similar in size to Pinon Canyon, can handle gas from 7–8 wells, meaning the full project would require four facilities . Based on the economics of a single plant, we estimate that four plants could potentially generate US$82M in revenue , and US$5 3M in operating profit.

Source: Company

Future development potential:

Galactica and Pegasus represent only 60,000 of the 300,000 acres owned by Blue Star, meaning significant potential exists to develop new projects

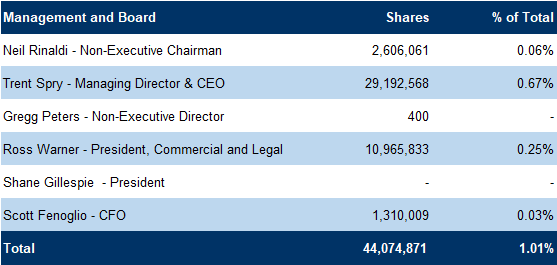

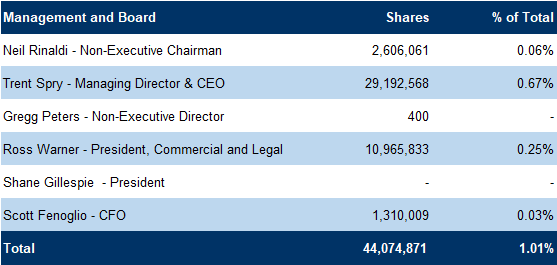

Management and Board

Share Ownership

Source: Company

Management and board own 1% of BNL’s equity

Background: Good mix of capital markets, resource development, and gas/helium expertise

Two out of three directors are independent

Brief biographies of the management team and board members, as provided by the company, follow:

Neil Rinaldi – Non- Executive Chairman

Mr. Rinaldi’s career in the finance sector spans more than two decades, starting as an Investment Advisor at one of Australia’s premier investment firms. He was the founding Managing Director of Truestone Capital Limited, a London based Corporate Advisory firm. Mr. Rinaldi was appointed CEO at ASX listed Aziana Limited, a multi commodity, exploration company focused on assets in Madagascar and Louisiana, and was instrumental in recommending and completing the reverse takeover of Aziana Limited by Brainchip Limited (ASX: BRN)

Trent Spry – Managing Director & CEO

Mr. Spry brings significant ASX corporate experience, expertise in geoscience, exploration and project development as well as significant recent experience in the US. He has over twenty years of experience in the upstream oil and gas industry in exploration, appraisal and development. Mr. Spry holds a Bachelor of Science (Hons) (National Centre for Petroleum Geology & Geophysics, University of Adelaide). He has originated numerous projects from concept or acquisition through to discovery, appraisal, successful development and exit in Australia, SE Asia, the Gulf of Mexico and the US onshore.

Shane Gillespie – President

Mr. Gillespie has extensive experience in the natural resources sector, with a specific emphasis on acquisitions and divestitures (A&D), asset management, and the development of grassroots oil, gas, and helium projects. He has held foundational roles in several energy start-ups, overseeing the transition of assets from exploration through to commercial transaction.

Ross Warner – Executive President, Commercial and Legal

Mr. Warner is an experienced natural resources executive and has held executive and non-executive director roles in several public companies listed on AIM and the ASX and a number of private companies. He has been involved in ventures with interests in operated and non-operated oil and gas assets in Texas, Louisiana , and Oklahoma and upstream and gas to power projects in Indonesia. Mr. Warner practiced as a corporate finance lawyer with Mallesons Stephen Jaques in Perth and Melbourne and Clifford Chance in London.

Scott Fenoglio – CFO

Mr. Fenoglio is a seasoned executive with industry professional with 20+ years in the oil and gas and financial services industries through disciplined leadership.

Gregg Peters – Non-Executive Director

Mr. Peters brings a proven track record of commercial leadership in the industrial gas sector with over 30 years of direct market experience. Most recently he was Helium Director, North America for Linde PLC (Praxair Inc.). Currently , he is COO for the Edelgas Group and Managing Director for Disruptive Resources, LLC. Mr. Peters h olds a Bachelor's degree in marketing from Valparaiso University and an MBA in operations from Loyola University.

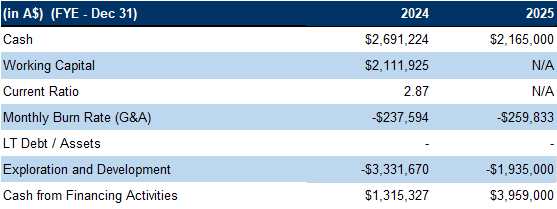

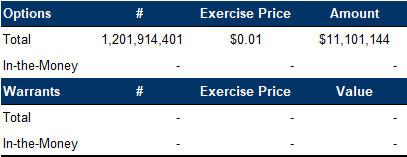

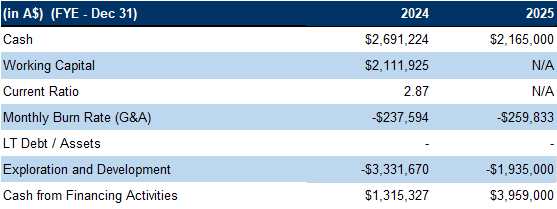

Financials

Healthy cash position of $2.17M as of December 2025, with $1.68M raised afterward, and no debt

Source: FRC / Company

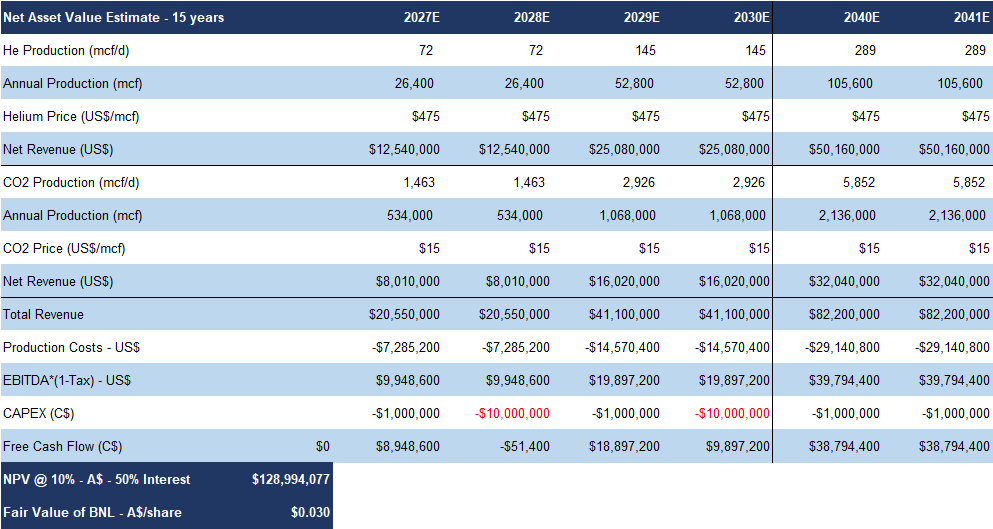

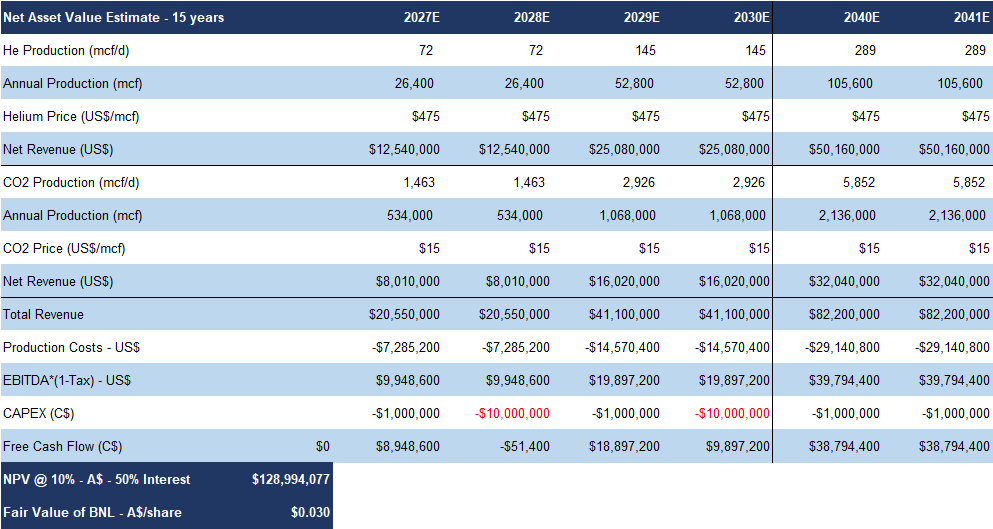

FRC DCF Valuation Key Assumptions:

- Projects included: Galactica and Pegasus only, for conservatism; no value attributed to other projects

- Processing facilities: Four facilities serving 30 wells

- Facility rollout: Start with existing facility; add one every two years (CAPEX $10 M each)

- Project life: 15 years

- Facility capacity: Each processing facility handles seven wells, producing 7 2 m cfd of helium , and 1,4 60 m cfd of CO ₂ annually

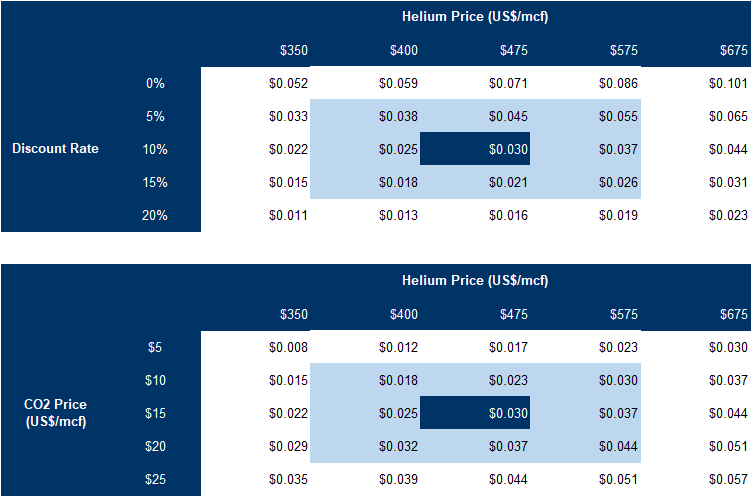

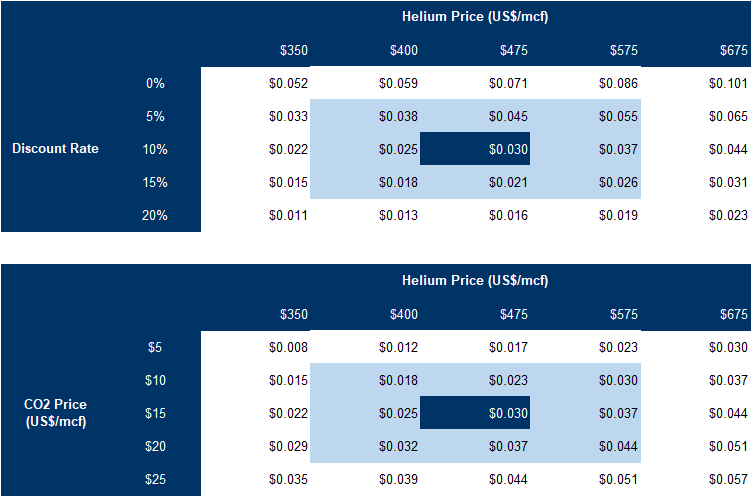

Our DCF model returned a fair value of $0.03/share

Source: FRC

Our model is highly sensitive to commodity prices

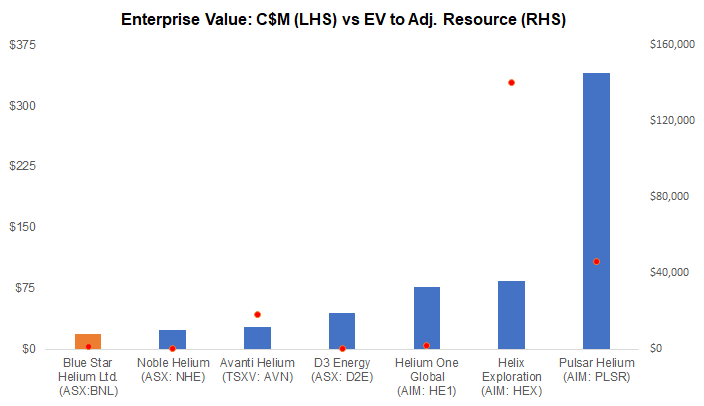

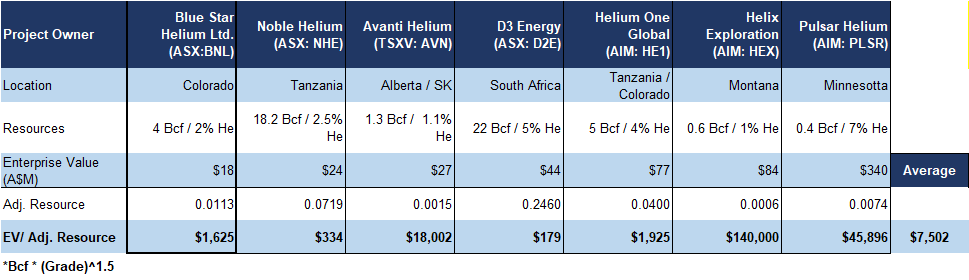

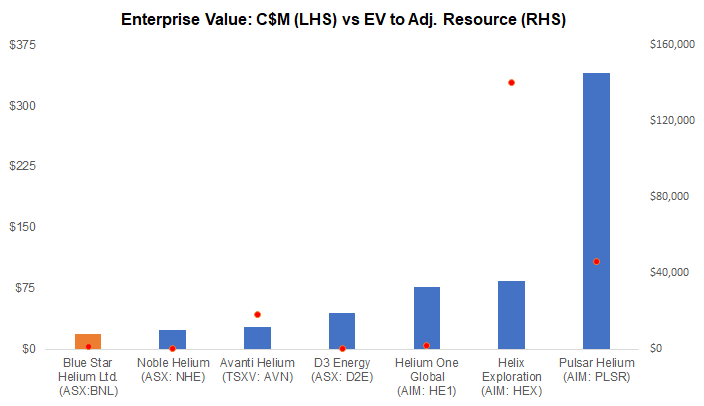

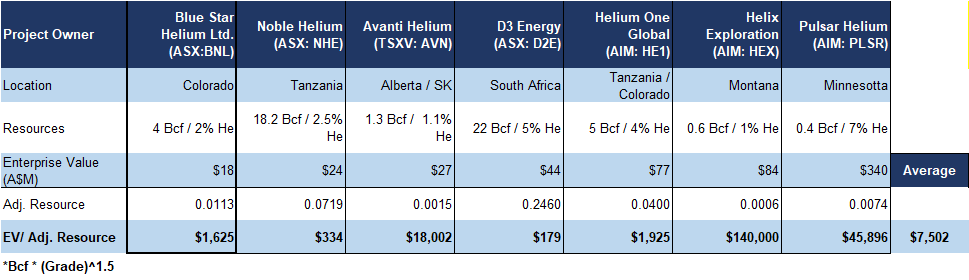

FRC Comparables Valuation

In our review of comparable helium juniors, we observed that MCAP is more closely tied to grade than to resource size. Therefore, instead of our standard E nterprise Value (EV) to resource metric, we use an adjusted EV to resource ratio that weights helium grade more heavily (exponent 1.5) alongside resource volume, creating a single metric for directly comparing project valuations.

BNL is trading at just $1,625 vs an average EV to adjusted resource of $7,502 for comparable helium juniors

Source: FRC / Various

Applying the comparables average, we estimate a valuation of $0.02/share on BNL

We are initiating coverage with a BUY rating, and a fair value estimate of $0.025/share (the average of our DCF and comparables valuations). BNL combines near-term production growth, long-life assets, and exposure to a tightening helium market. At 0. 2 5x our operating profit estimate vs peers at over 4x, we believe the market has yet to recognize its true potential. As production scales and market awareness increases, we anticipate the share price will move closer to our fair value estimate.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is primarily dependent on helium prices.

- Access to capital and potential for share dilution

- No assurance that the company will be able to advance all its projects simultaneously

- Exploration and development

We are assigning a risk rating of 4 (Speculative)