Market Intel Weekly

Bullish Sentiment Dominates Vancouver Resource Investment Conference

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

*Disseminated on behalf of Enterprise Group, Lodestar Metals, Power Metallic Mines, Denarius Metals, Silver X Mining, Fortune Minerals, Trident Resources, Tartisan Nickel, Panoro Minerals, Lake Resources, and Monument Mining.

We attended the Vancouver Resource Investment Conference over the weekend and are pleased to report that it was probably one of the most well-attended events in several years, unsurprising given record metal prices. We had a booth at the event, where we shared our outlook with investors who stopped by.

While robust market sentiment is good for your holdings, it is important to remember that periods of strong enthusiasm are often followed by overexuberance, overvaluation, and sudden corrections. Follow our research regularly to obtain unbiased insights.

Several juniors under coverage released material news last week. In this week’s edition, we provide the implications of those key developments along with actionable takeaways.

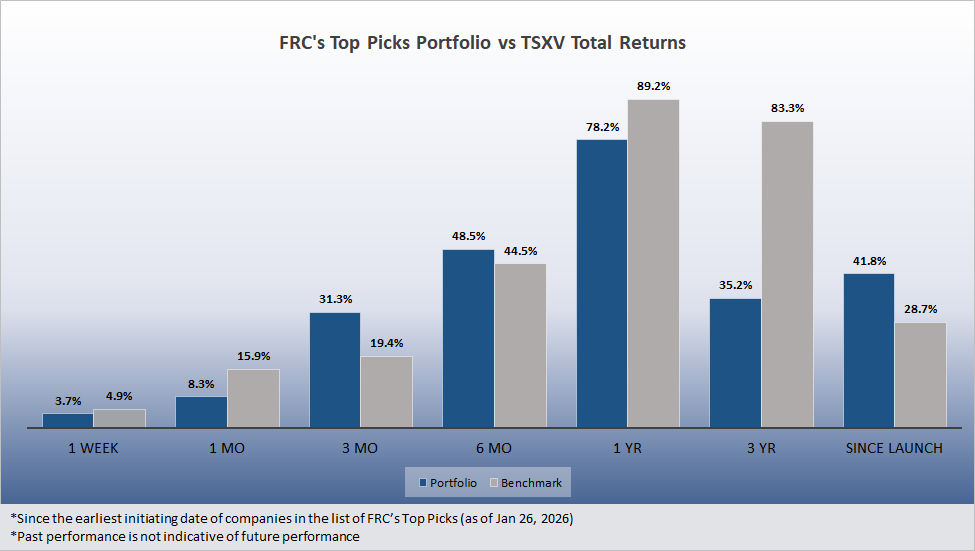

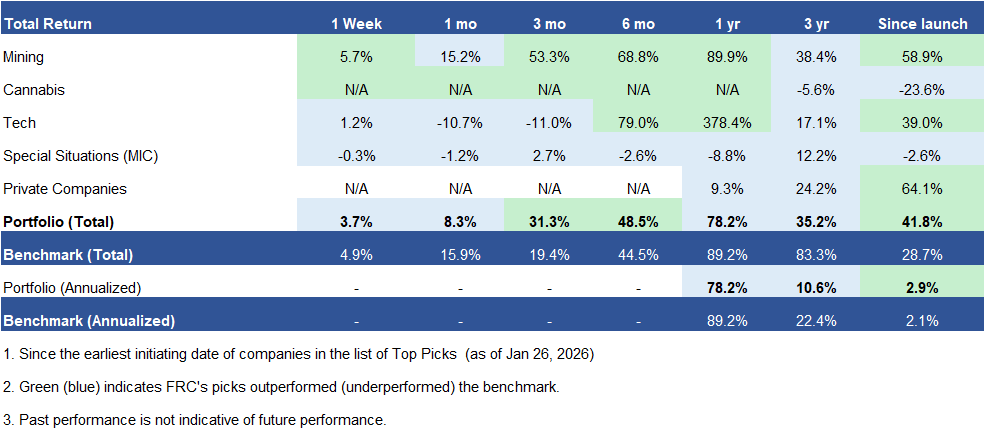

Cobalt junior Fortune Minerals Limited (TSX: FT) led our top picks list, rising 18% last week, driven by material news that we discuss later in this report. Visit our website to view our full list of Top Picks by sector.

*Past performance is not indicative of future performance.