Market Intel Weekly

This Week’s Top Movers: AI, Lithium, and Other Critical Minerals

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

*Disseminated on behalf of Noram Lithium, Kidoz Inc., Enterprise Group, Giga Metals Corporation, Sonoro Gold, Skyharbour Resources, Silver X Mining, Trident Resource, Chilean Cobalt, Doubleview Gold, Millennial Potash, Builders Capital, and Rocket Doctor AI.

In this week’s edition we discuss material financings from a mortgage lender, healthcare AI technology company, and a potash junior. In addition, we cover material updates from juniors targeting rare earths, copper, silver, gold, and uranium. All of these have upcoming catalysts, making them worth monitoring or keeping on your radar.

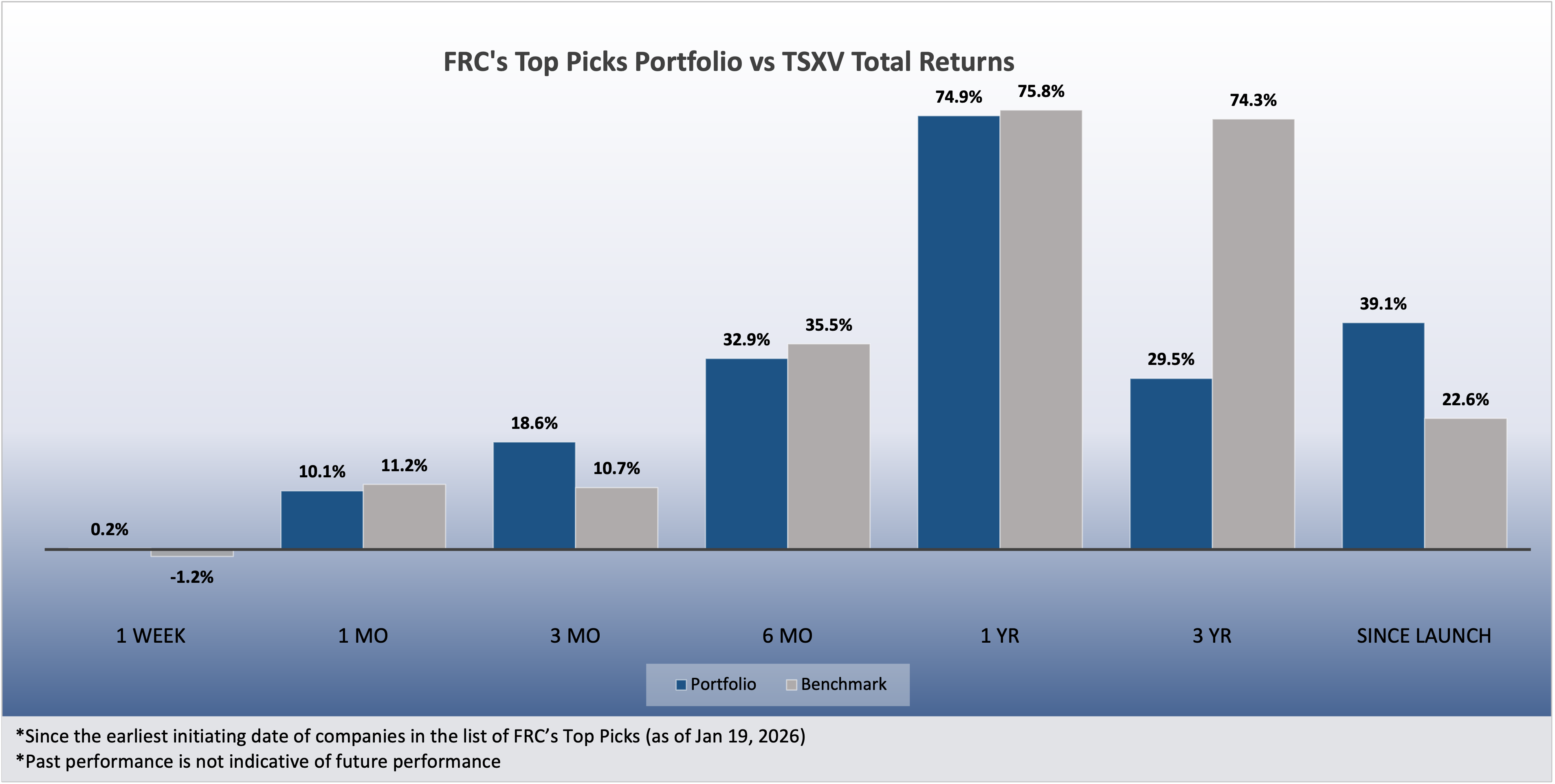

Our Top Picks rose 0.2% on average last week, outperforming the TSXV benchmark, which dropped 1.2%. Lithium junior Noram Lithium Corp. (TSXV: NRM) led the list, up 14% last week. Lithium stocks have surged in recent weeks, with lithium prices up 109% YoY, as we anticipate the market shifting from oversupply to shortage later this year. Visit our website to view our full list of Top Picks by sector.

*Past performance is not indicative of future performance.