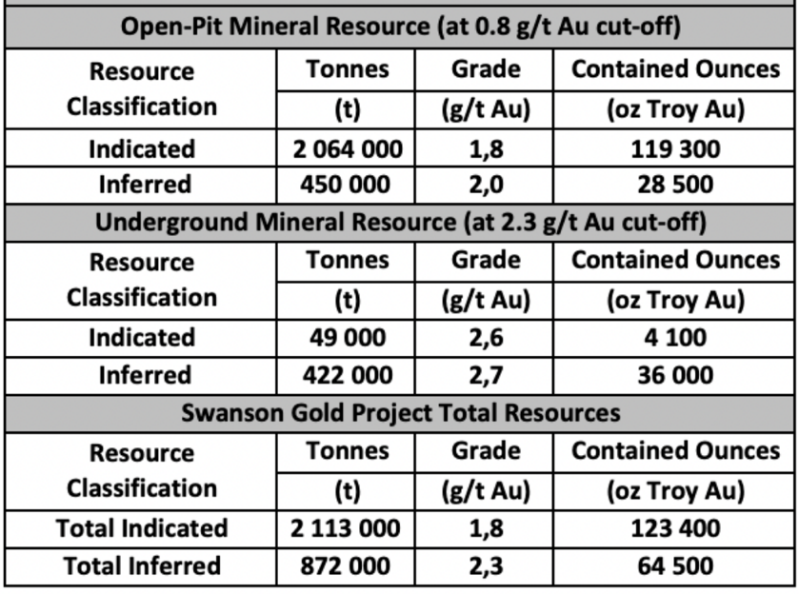

- We believe the current resource at Swanson can support 10+ years of operations, averaging 10-15 Koz of gold annually, with higher production in the initial years from higher-grade ore.

- At 10 Koz/year production, we estimate operating profit of ~US$25 M per year at today’s gold price vs the current MCAP of just US$27M. This implies that shares are trading at 1.1x operating profit (sector: 4.2x), highlighting a significant valuation gap.

- An independent study estimates the mill restart to cost US$4M, and US$52M for full replacement. Given the current MCAP of US$27M, we note the market is not only undervaluing the mill, but also overlooking the Swanson project, capable of 10+ years of production.

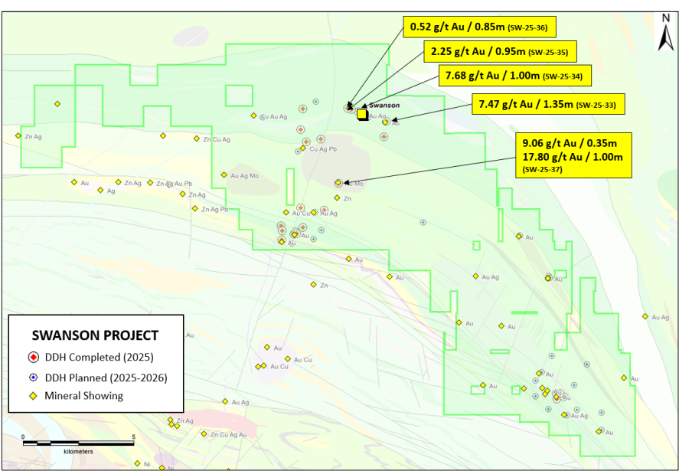

- The company is conducting a 10-hole drill program to potentially validate historical drilling, fill gaps in the resource model, and confirm high-grade continuity.

- With gold near record highs, we anticipate robust M&A activity over the next 12 months as larger companies target juniors. We remain positive on gold prices, supported by US$ weakness, and strong safe-haven demand amid economic and geopolitical uncertainty.

- LFLR is currently pursuing a $6M private placement. Upcoming catalysts include resource expansion/upgrades, a PEA, mill restart, potential custom milling agreements, and project financing.

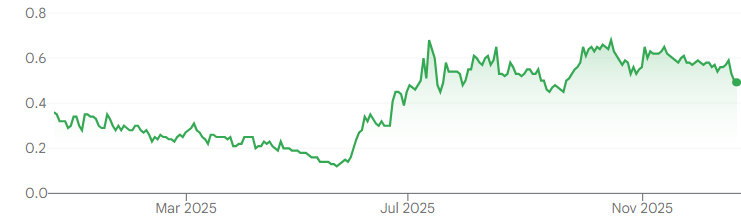

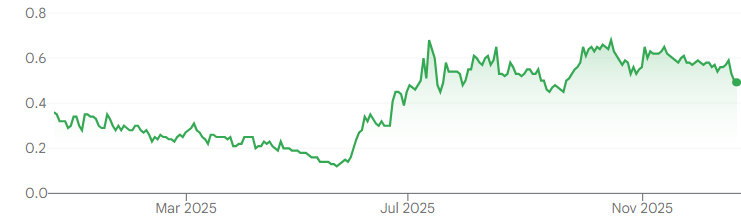

Price and Volume (1-year)

| |

YTD |

12M |

| KIDZ |

50% |

25% |

| TSXV |

13% |

15% |

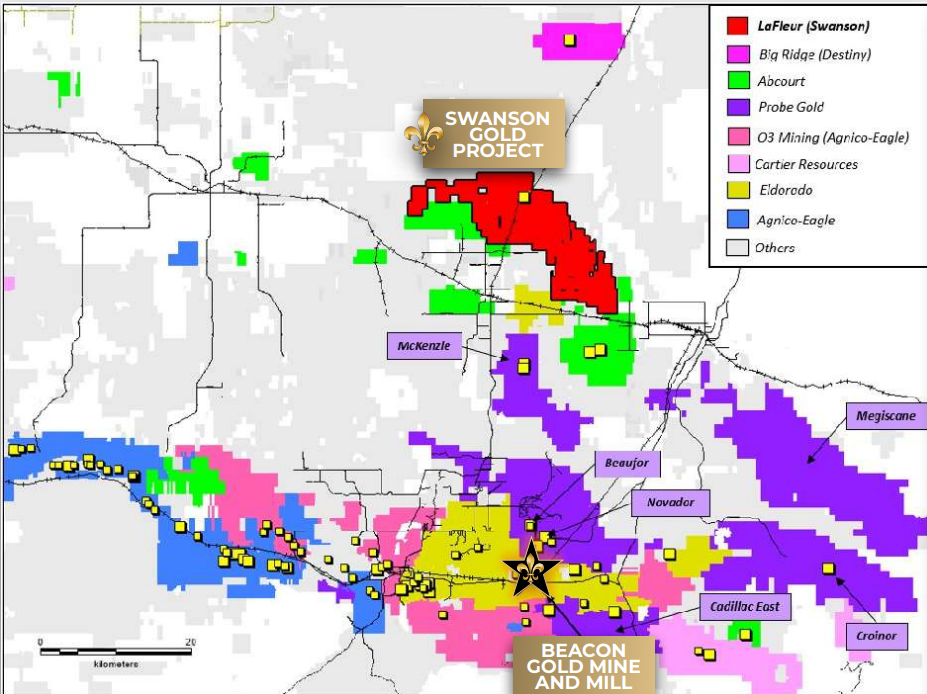

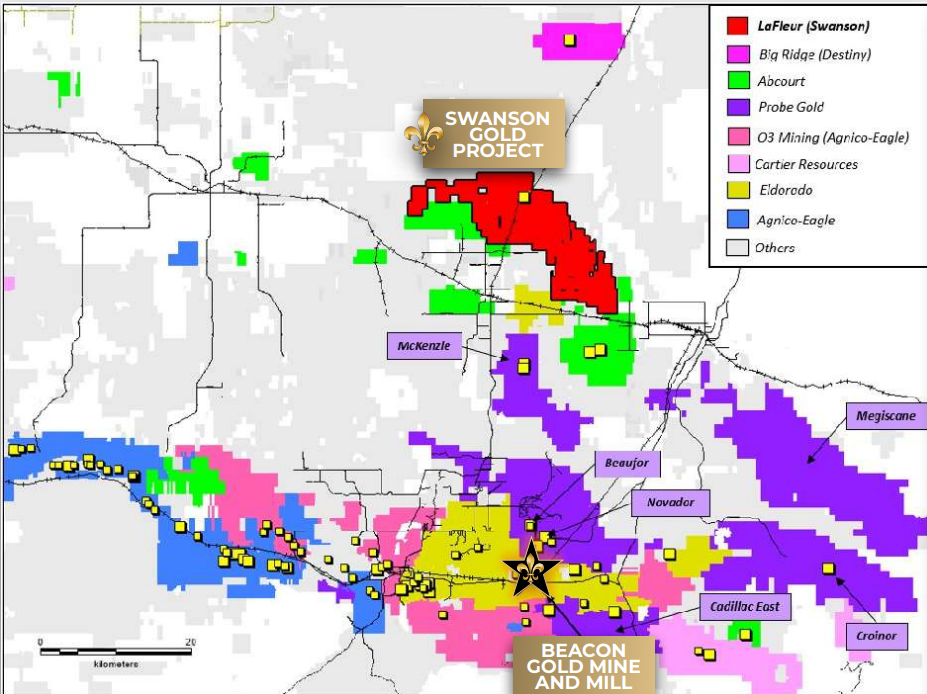

LFLR’s portfolio features the advanced-stage Swanson gold project, and the fully permitted 750 tpd Beacon mill Located in the southern part of Quebec’s Abitibi Gold Belt, close to several senior gold producers

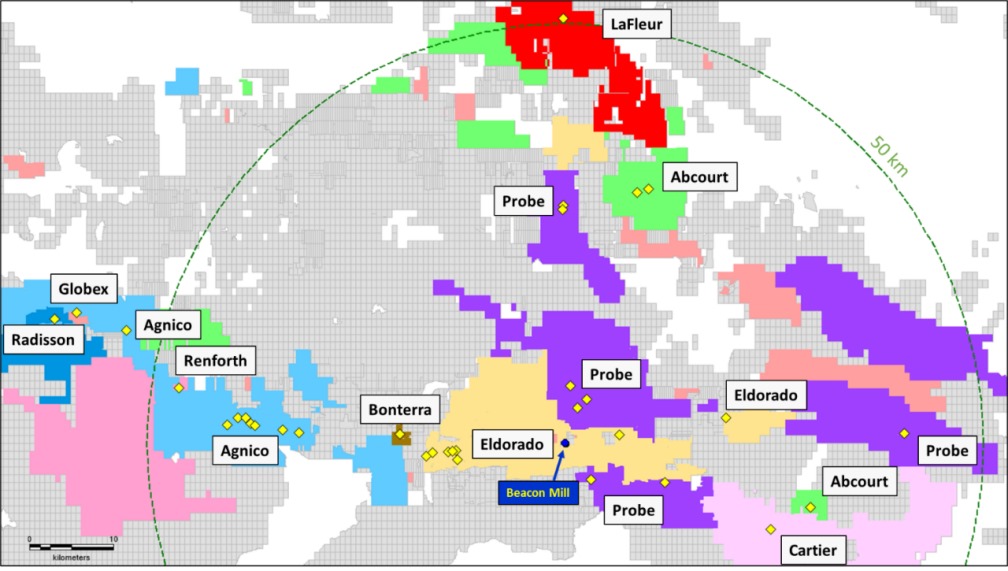

The Swanson property is 66 km north of Val-d’Or, with the Beacon mill 50 km away Well-established infrastructure with roads, rail, power, and nearby gold mills

Portfolio Summary Location Map

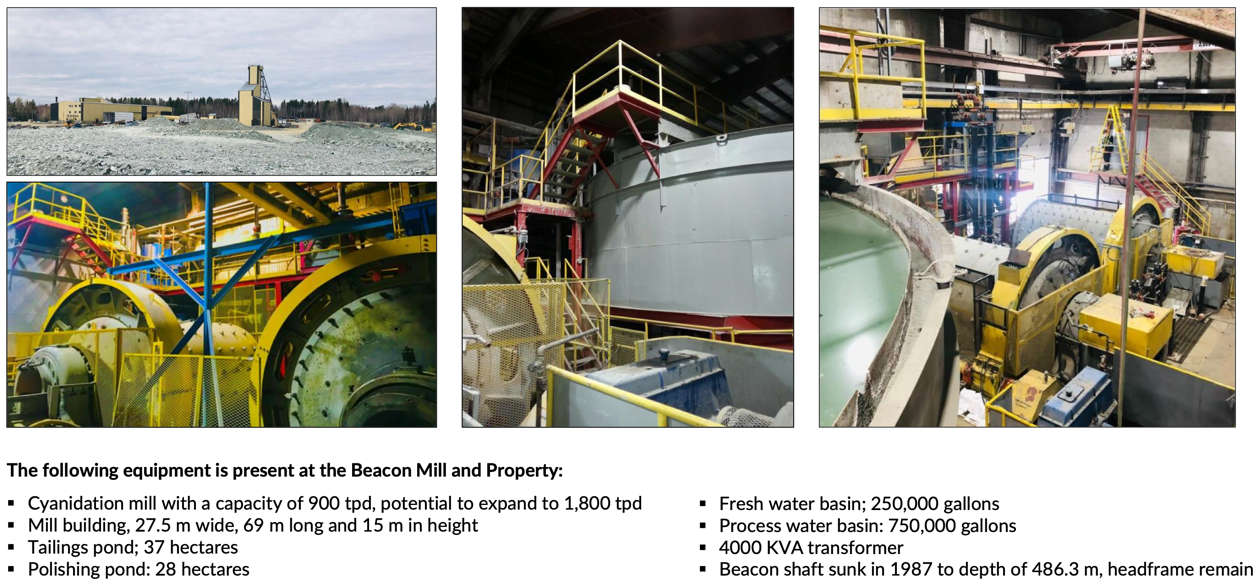

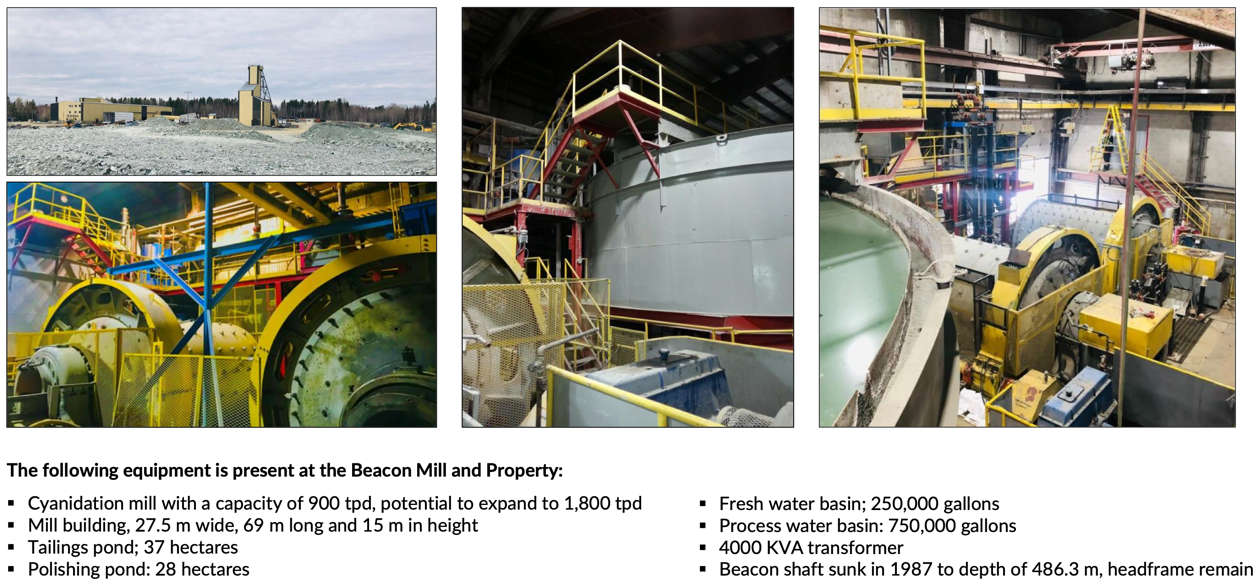

750 tpd Beacon Mill (Merrill Crowe)

Source: Company

The Swanson property includes surface and underground infrastructure, featuring a 500 m ramp to the deposit 80 m below surface

The mill was refurbished in 2022 by the previous owner for $20M, and is currently in good condition, with a permitted tailings facility

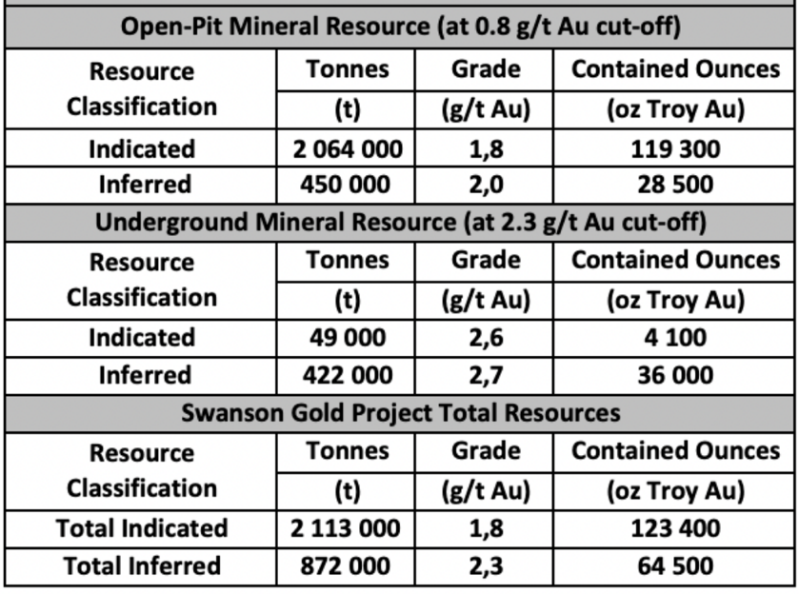

2024 Resource Estimate

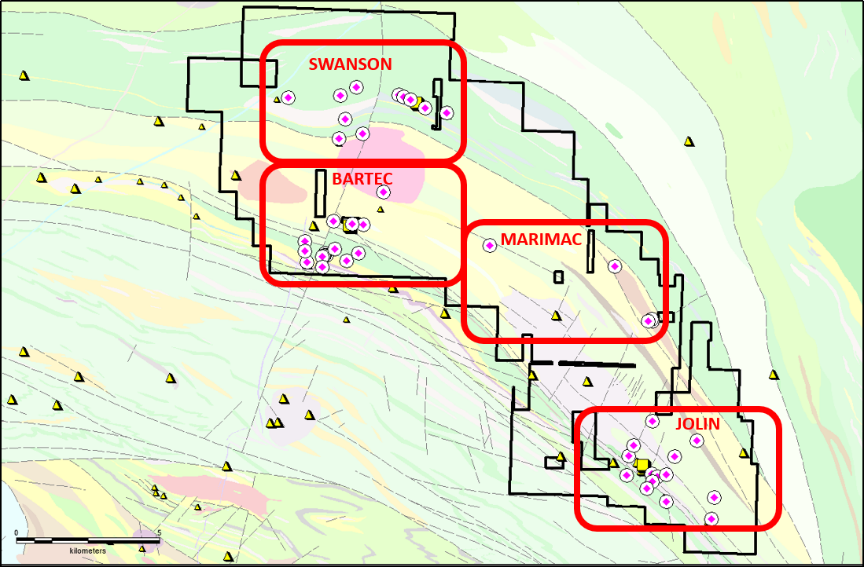

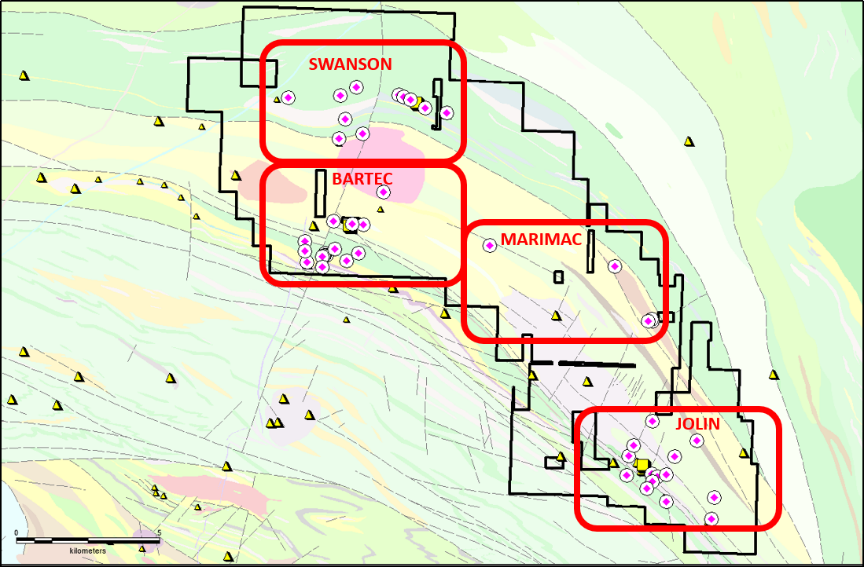

Qualified Person: L ouis Martin, P.Geo . (OGQ), Exploration Manager of LFLR Source: Company LFLR has completed a 5,283 m (24-hole) resource expansion drill program, targeting 50 prospects across Swanson, Jolin, Bartec , and Marimac . Key Targets

Source: Company

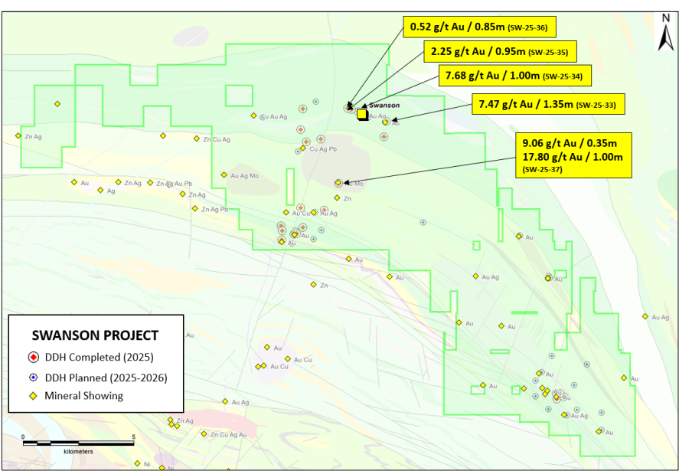

The program returned high-grade, near-surface gold assays, including 7.47 g/t Au over 1.35 m and 7.68 g/t Au over 1 m , confirming continuity and expansion potential. Step-out drilling extended mineralization southeast and northwest.

Previous owners delineated a high-grade, small-tonnage open-pit resource

The current resource envelope measures 475 m long x 425 m wide x 500 m deep; 84% of resources are open-pittable

Significant Assays from the Swanson and Bartec Targets

Source: Company

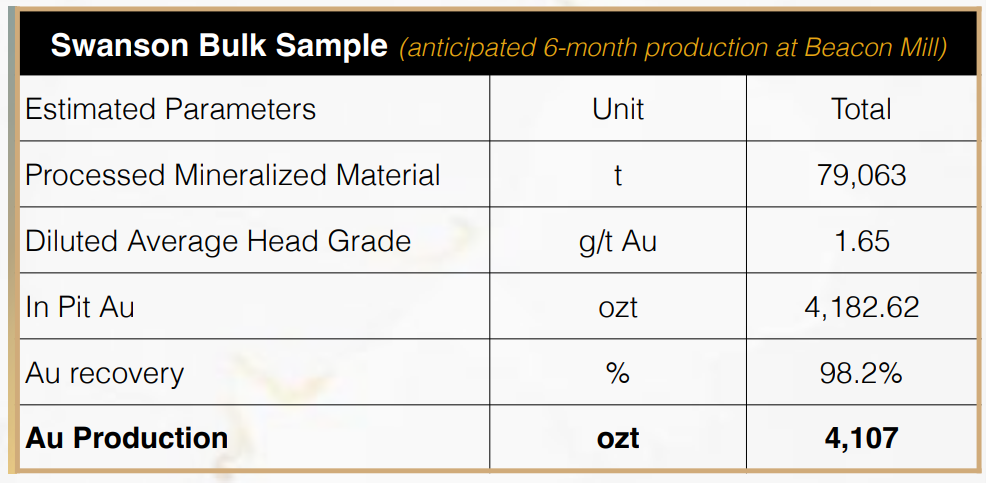

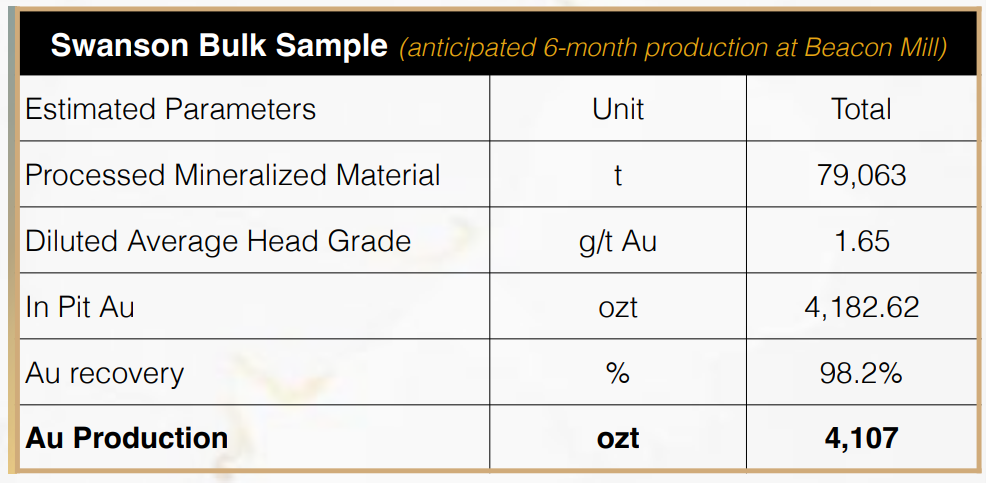

The company is currently conducting a 10-hole program to validate historical drilling, infill gaps in the resource model, and confirm high-grade continuity. LFLR is also conducting geological and engineering planning for an 80,000 tonne bulk sampling program at Swanson, with processing planned at the Beacon m ill. Data from this program will support the upcoming PEA .

Source: Company

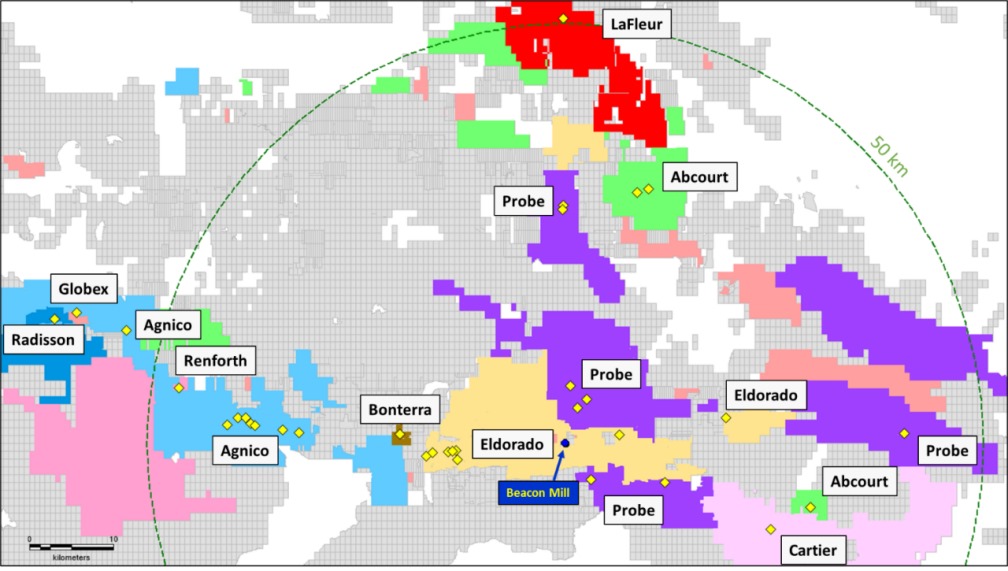

Management is currently completing Beacon mill restart work , with six months of repairs and maintenance anticipated. LFLR is also pursuing toll milling opportunities from nearby advanced-stage gold projects to generate additional

We believe the project has resource expansion potential as the deposit remains open at depth, and along strike Additional assay results pending, expected

Q1-2026 Bulk sampling could recover over 4koz of gold; program expected to start mid-2026, pending permits

cash flow from the mill . Potentially compatible deposits are shown on the map below.

Gold deposits and mines within a 50 km radius of the Beacon Mill

Source: Company

Near-Term Plans Updated resource estimate and PEA (January 2026) Resource upgrade and expansion drilling Project financing Commence bulk sampling (mid-2026)

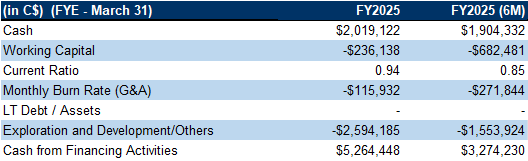

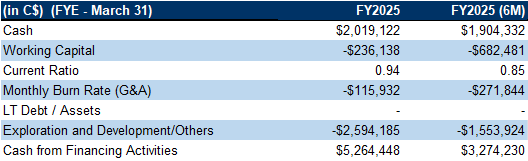

Financials

Source: FRC / Company

Options foradditional cash flows through toll milling

Multiple upcoming catalysts

Source: FRC / Company

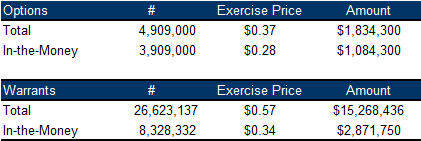

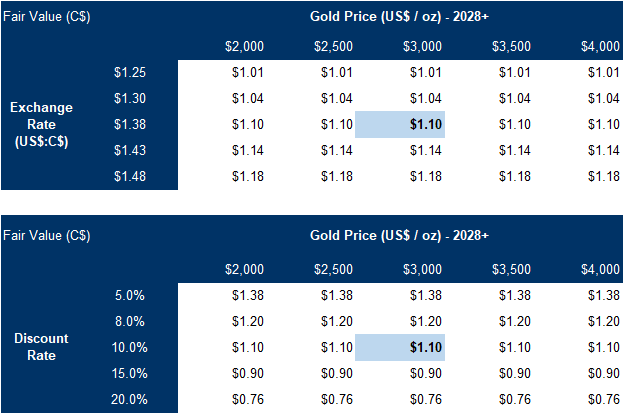

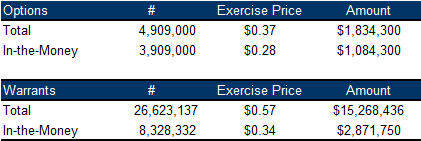

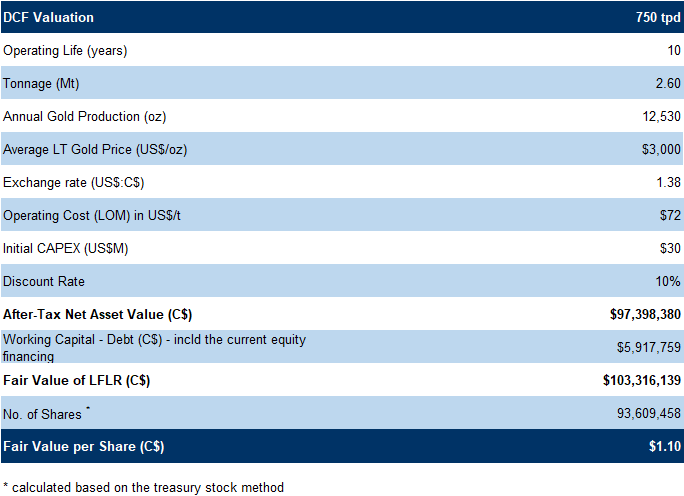

FRC Valuation

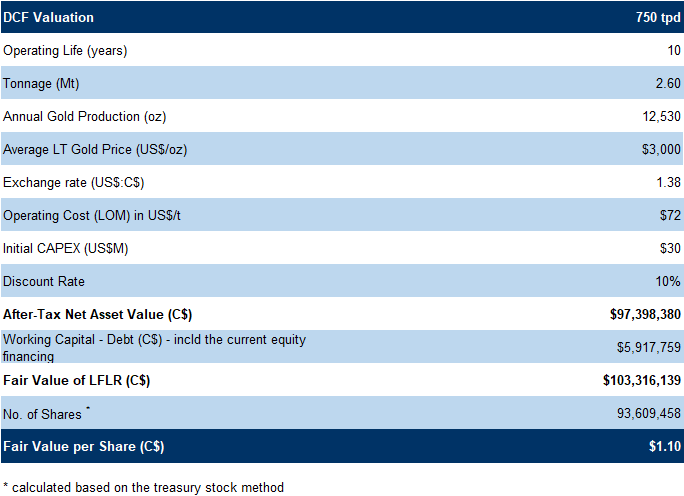

Strengthening balance sheet$1.90 M in cash at the end of September 2025 Subsequently, LFLR completed a $1.66M equity financing, and is currently pursuing an additional $6 M raise In-the-money options and warrants can bring in up to $4 M Our DCF model returned a fair value estimate of $1.10/share (previously $1.04/share), driven by higher gold prices, partially offset by share dilution since our previous report in August 2025 As with any mining project, our valuation is highly sensitiveto gold prices

Source: FRC

- We are reiterating our BUY rating, and raising our fair value estimate from $ 1.04 to $ 1.10 /share .

- We base our valuation solely on our DCF model, as few projects offer a similar low-CAPEX, quick-to-production profile.

- We believe the market significantly undervalues the Beacon m ill , and the Swanson resource, highlighting a clear valuation gap . Upcoming catalysts such as the PEA, drill results, potential custom milling agreements, and project financing could unlock substantial value.

- Risks We believe the company is exposed to the following key risks (not exhaustive): The value of the company is highly dependent on gold prices Exploration and development Permitting Access to capital and potential for share dilution CAPEX and OPEX could exceed our estimates

Maintaining a risk rating of 4 (Speculative)