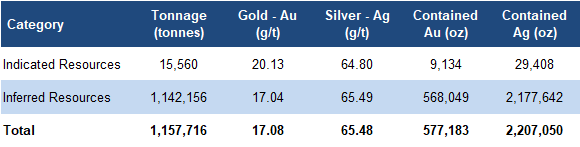

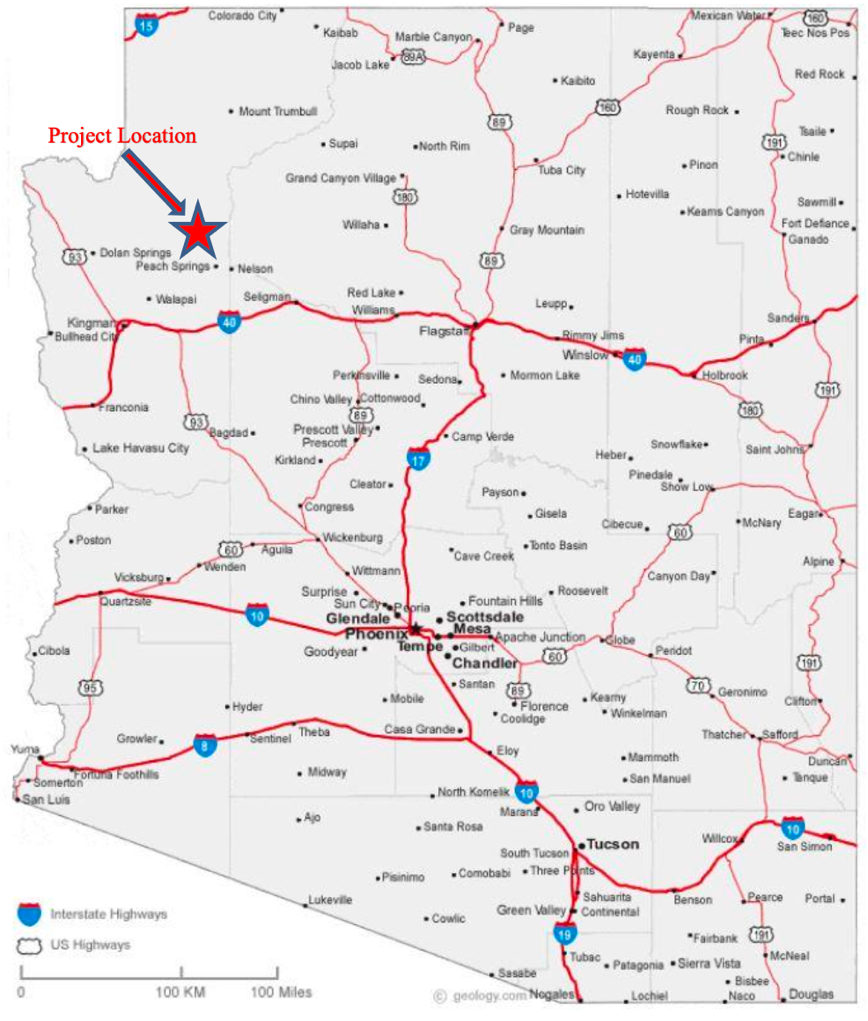

- Based on older records (not recently verified), the project is estimated to host 568 Koz of gold and 2.18 Moz of silver (inferred), and 9 Koz of gold and 29 Koz of silver (indicated, higher confidence). This is a low-to-medium-sized resource for a junior gold project, but the gold grades are very high (17–20 g/t), compared with most mines under 1 g/t, which usually means higher production at lower costs.

- We believe there is room to expand the resource, as drilling has tested less than 20% of the Southwick vein (a major gold and silver bearing vein), leaving most of it unexplored. The company has also identified additional gold-bearing structures and targets, showing further potential beyond the known veins.

- Kingman’s underground sampling and drilling found extremely high-grade veins, including 688 g/t gold and 468 g/t silver over 0.18 m, and 252 g/t gold and 341 g/t silver over 0.46 m. The drill holes hit veins connected to existing tunnels, showing the veins are accessible, which could speed up development and lower exploration risk.

- Management is planning a drill program, which we believe will likely be followed by a NI 43-101 resource estimate, providing official verification of the project’s gold and silver potential.

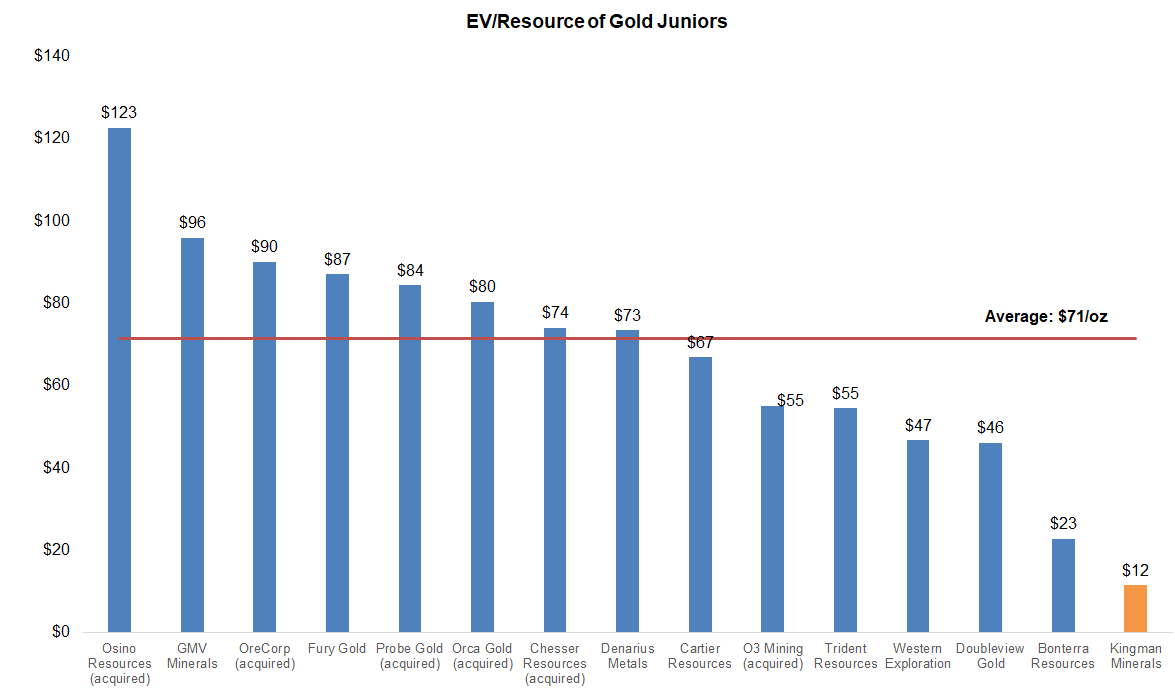

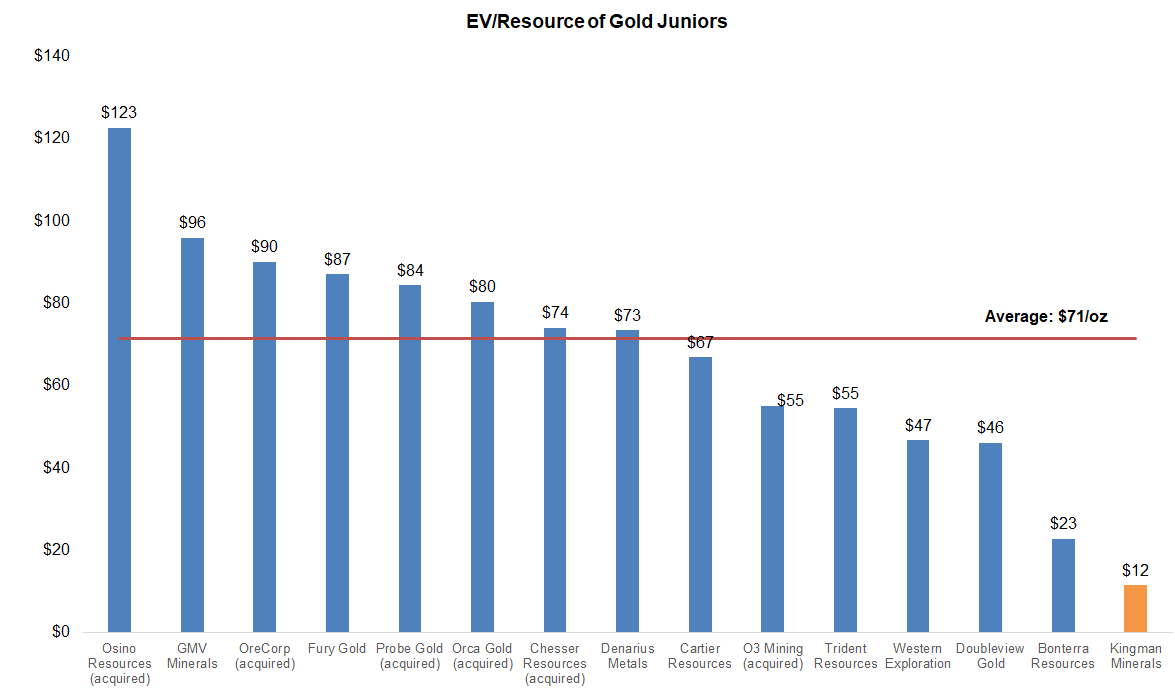

- With gold trading at record highs, we anticipate robust M&A activity over the next 12 months, as larger companies target juniors to expand their portfolios. We remain positive on gold prices, supported by US$ weakness, and strong safe-haven demand amid economic and geopolitical uncertainty.

- We estimate Kingman’s shares trade at just $12/oz compared with the sector average of $71/oz, meaning the market has yet to recognize the company’s potential.

Risk

- The company’s value depends on gold prices

- Access to capital and potential share dilution

- The project lacks a NI 43-101 compliant resource

- Exploration and development

Price and Volume (1-year)

| |

YTD |

12M |

| KGS |

-13% |

-13% |

| TSXV |

15% |

87% |

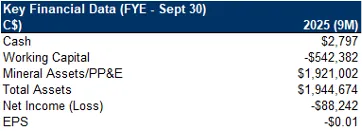

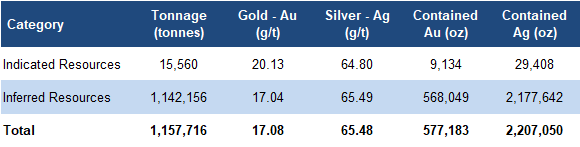

* Subsequent to Q3-FY2025, KGS raised $1.5M through an equity financing

* Qualified Person: Bradley C. Peek, MSc., CPG., Director of Kingman Minerals Ltd.

* Kingman Minerals Ltd. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions.

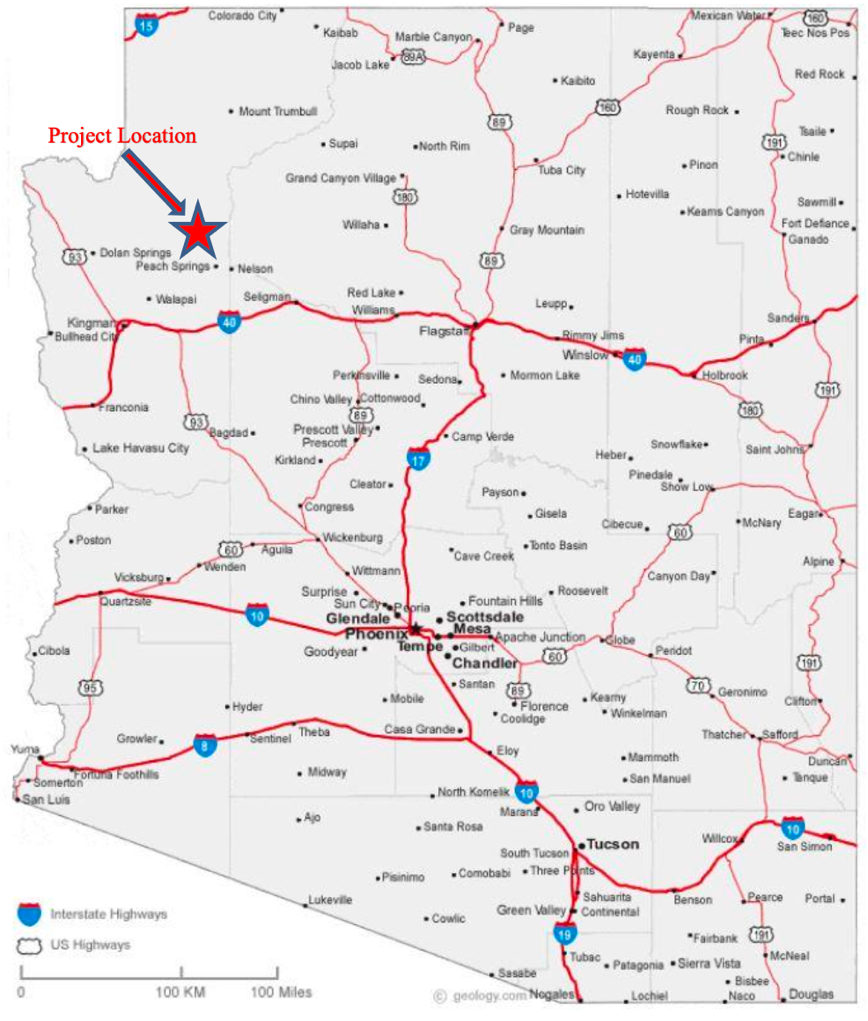

Mohave Project ( 100 % interest)

Ownership and Location

The project covers about 594 hectares , and is located in the Music Mountain district of Mohave County, Arizona ; a historically important gold-producing area. Most deposits in the county are epithermal or mesothermal , which are types of gold deposits known for high grades . These deposits can be mined using open-pit methods, underground methods, or a combination of both.

Mohave county is known for high-grade epithermal deposits

Project Location

Source: Company

Located 51 km northeast of the city of Kingman, with roads, power, and underground mine access already in place

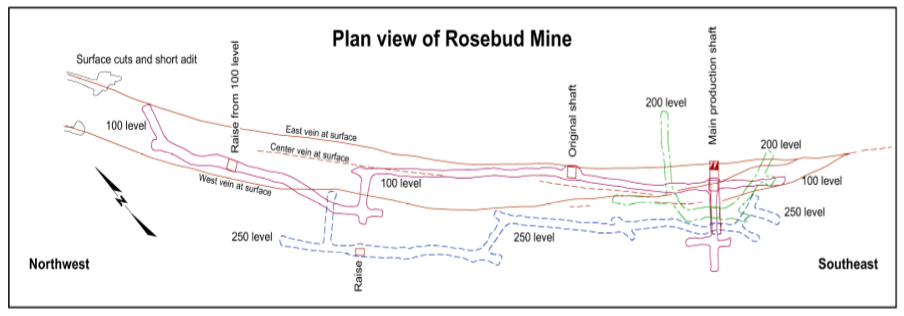

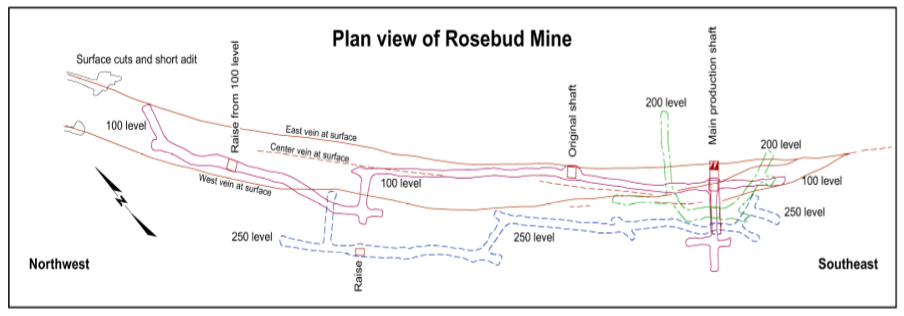

History, Mineralization, and Infrastructure

Gold and silver were first discovered here in 1879 . The property includes the past-producing Rosebud mine , which features the Southwick vein system – a large, double-layered gold and silver vein. It is estimated to stretch about 1,100 m along its length, with widths ranging from 0.3 m to 4.9 m. For context, many gold veins are only a few hundred meters long, and often less than 1 m wide, so the Southwick vein is long and relatively wide , making it a very promising target for mining.

A historic gold site with a major vein system

Historical production figures are not reliably documented , but reports suggest that about 8,400 tonnes of ore were mined, with extremely high gold grades of 15–20 ounces per ton (514–686 g/t Au), equivalent to roughly 150 Koz of gold, worth over US$700M at today’s gold prices.

Historical Resources (Rosebud)

(QP: William Feyerabend, CPG, Consulting Geologist of Kingman Minerals)

Source: Company / FRC

Based on older records (not recently verified or NI 43-101 compliant), the project hosts a medium-sized gold resource, with unusually high grades, plus some silver

Existing Infrastructure

Source: Company

A 400-ft shaft, and 2,500 ft of tunnels, provide underground access, reducing development time and costs

Exploration

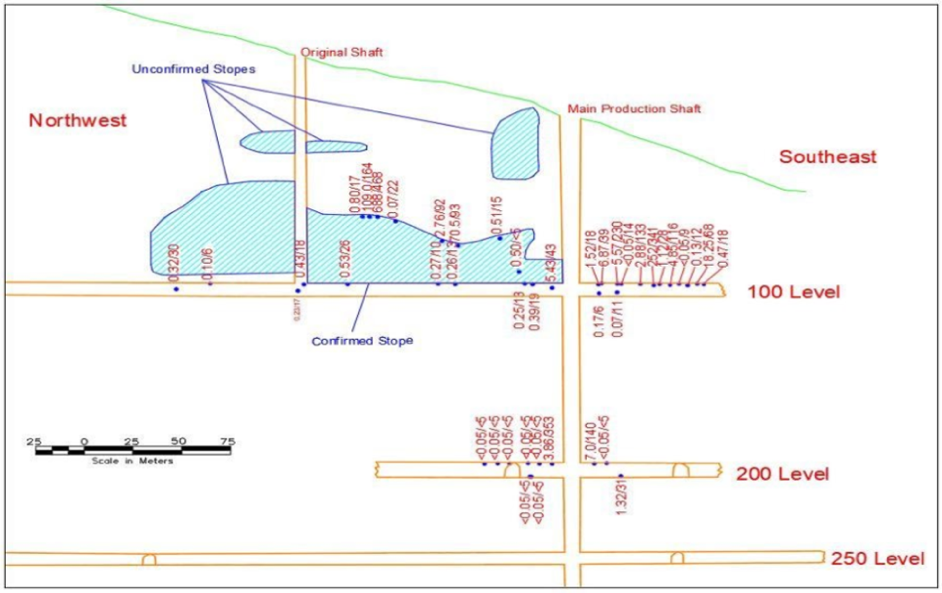

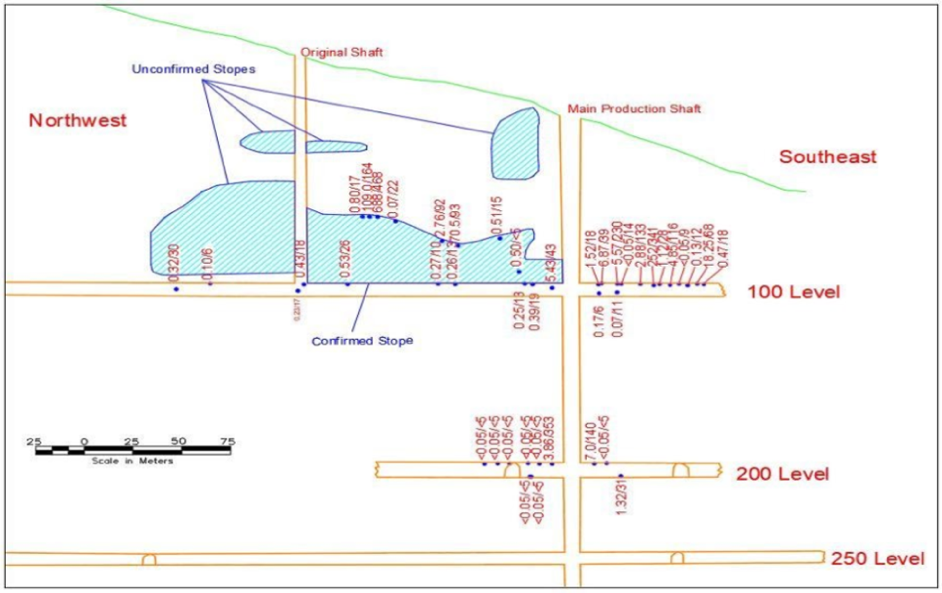

Kingman’s underground sampling , and a two-phase drill program, found extremely high-grade veins, with 688 g/t gold and 468 g/t silver over 0.18 m , and 252 g/t gold and 341 g/t silver over 0.46 m . These grades are far above typical high-grade mines (usually 5–10 g/t gold).

Cross section of the Rosebud underground mine with sampling locations

Source: Company

Underground sampling confirmed bonanza-grade veins

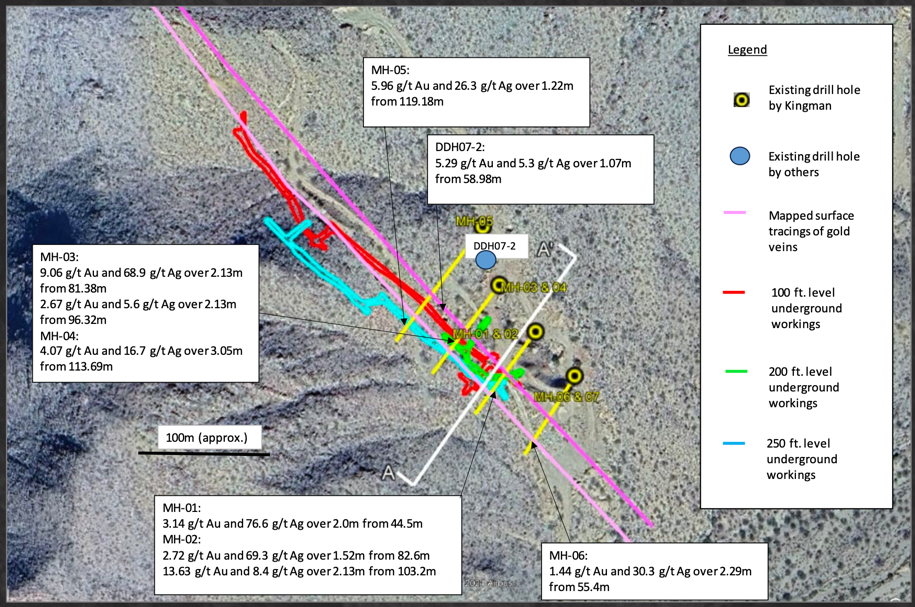

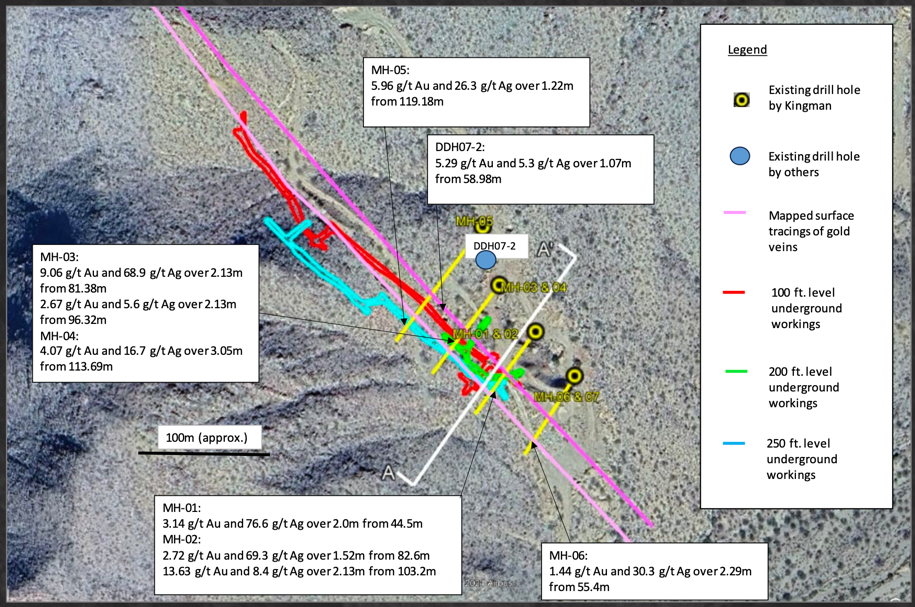

The phase 1 drill program (five holes) focused on areas around the historic Rosebud mine to verify past high-grade gold results. All holes intersected high-grade veins linked to existing underground tunnels, showing the veins are accessible, which could speed up future development and reduce exploration risk. The phase 2 program (three holes) targeted the Southwick vein, confirming that high-grade gold and silver continue near the existing tunnels.

Drilling Highlights

(QP: Bradley C. Peek, MSc., CPG. Director of Kingman Minerals)

Source: Company

Drilling has tested less than 20% of the Southwick vein, leaving most of it unexplored

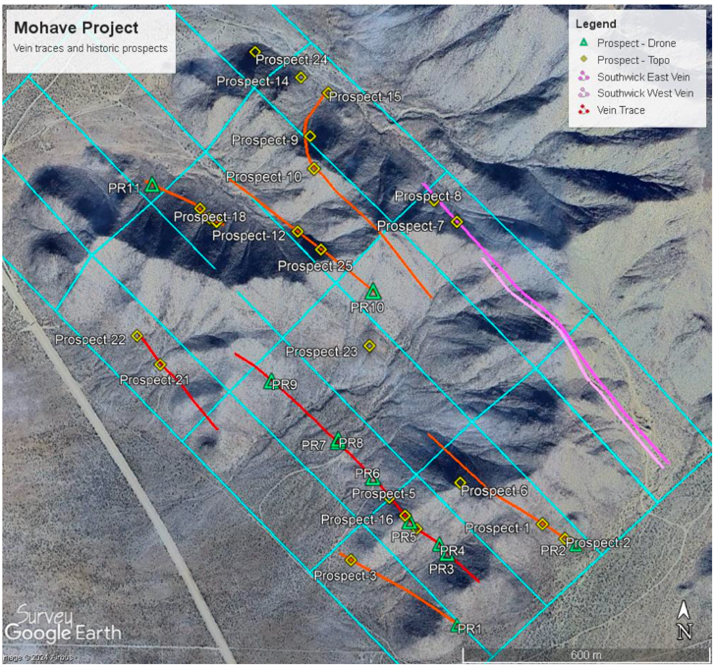

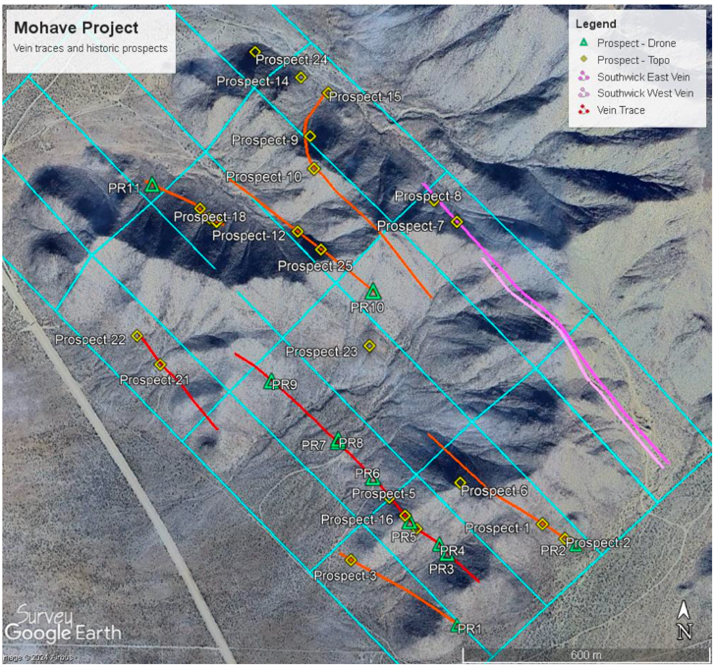

A drone survey mapped multiple gold-bearing structures, and identified new targets, meaning the project has unexplored potential beyond the known veins.

Mohave Veins and Prospects

Source: Company

Seven sub-parallel veins west of Southwick have been identified as high-priority targets

Management is planning an initial five-hole drill program after integrating drone-based magnetic results, mapping, and sampling to create a 3D model of the site. This approach allows targeted drilling in the most promising areas.

Drone surveys underway

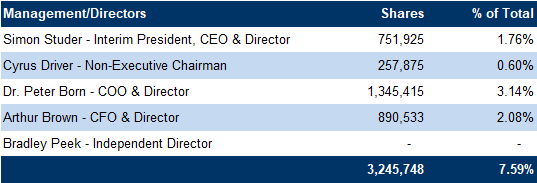

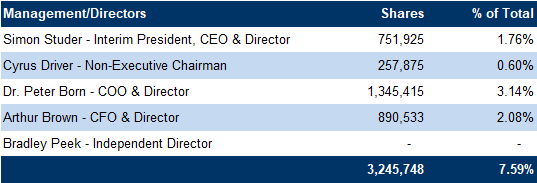

Management and Board

Share Ownership

Source: Sedi/FRC

Management and the board own 8% of the shares outstanding, which we view as positive; we believe >5% ownership signals alignment with investors

However, only two of five directors are independent, so board independence is limited

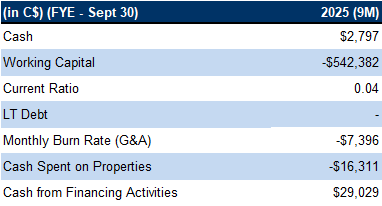

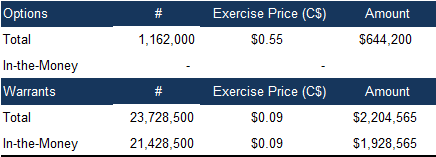

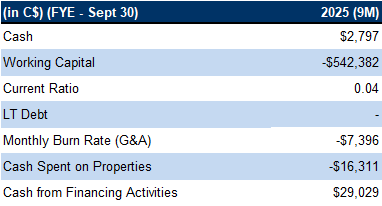

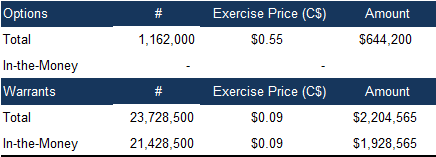

Financials

Subsequent to Q3-2025, KGS raised $1.5M through an equity financing

Cash on hand as of December 2025: $1.4M

Source: FRC / Compan

In-the-money warrants could generate an additional $1.9M

FRC Projections and Valuation

Source: FRC / Various / S&P Capital IQ

KGS is trading at $12/oz gold equivalent (AuEq) resources vs a comparables average of $71/oz

Applying the sector multiple to KGS’s resources, we arrived at a fair value estimate of $0.44/share

We are resuming coverage with a BUY rating, and a fair value estimate of $0.44/share. We believe the market has yet to recognize the value of the Mohave project, which hosts high-grade gold with room to expand and accessible veins. An upcoming drill program could produce a NI 43-101 resource estimate, and with gold at record highs and shares trading below the sector average, we see material upside potential.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on gold prices

- Access to capital and potential for share dilution

- No NI 43-101 compliant resource estimate

- Exploration and development

We are assigning a risk rating of 5 (Highly Speculative)