- Gold is trading near record highs of $4,509/oz, pushing sector multiples up 17% since our November 2025 report. We expect increased M&A activity over the next 12 months. Our outlook on gold remains positive, driven by continued US$ weakness, and robust demand for safe-haven assets amid economic and geopolitical uncertainties.

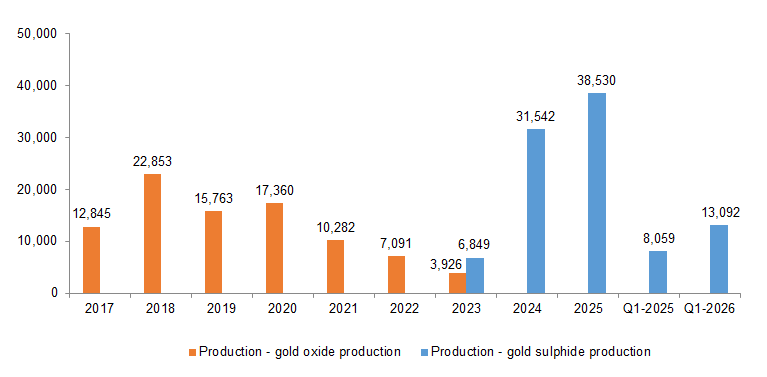

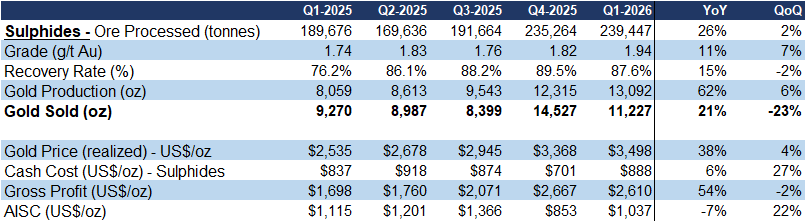

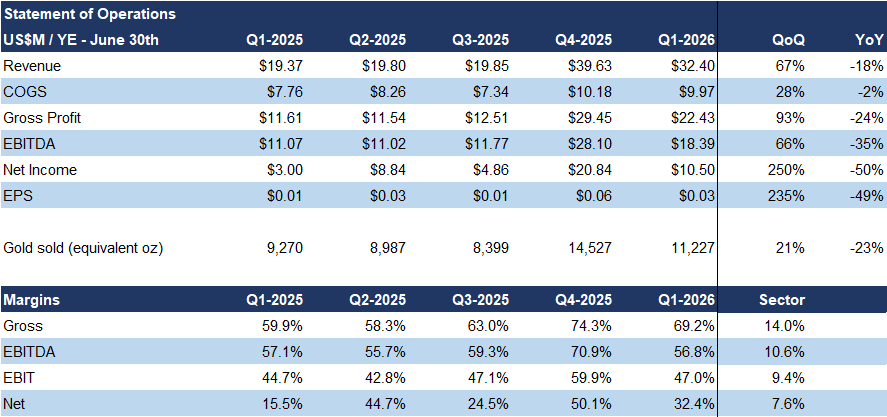

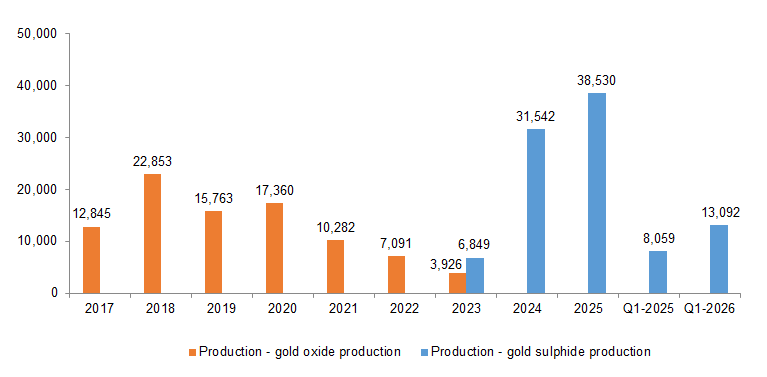

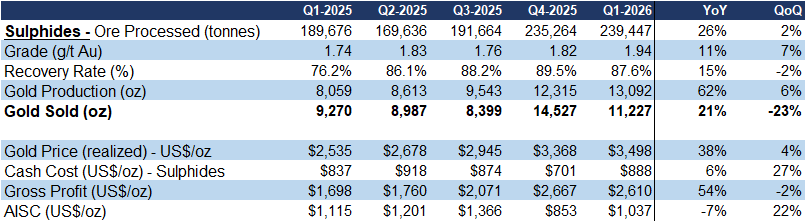

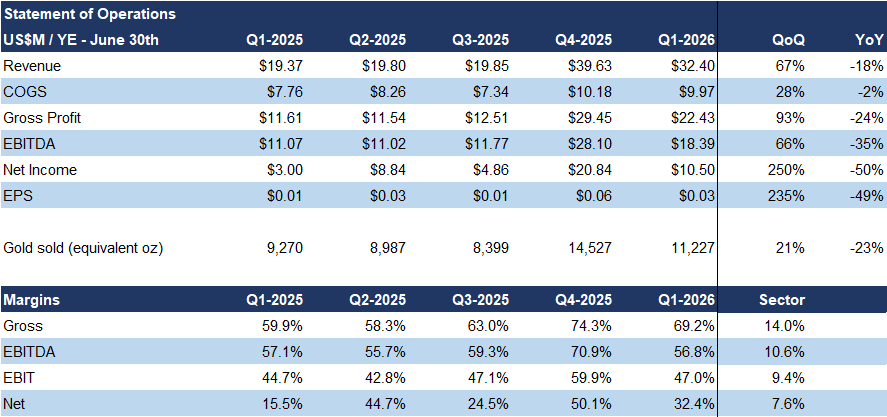

- Q1-FY2026 (ended September 2025) results exceeded expectations. Production at MMY’s 100%-owned Selinsing gold mine in Malaysia rose 62% YoY to 13 Koz, beating our estimate by 12%, due to higher throughput and recoveries. Revenue increased 67% YoY (vs. forecast +10%), and EPS surged 235% (vs. forecast +5%).

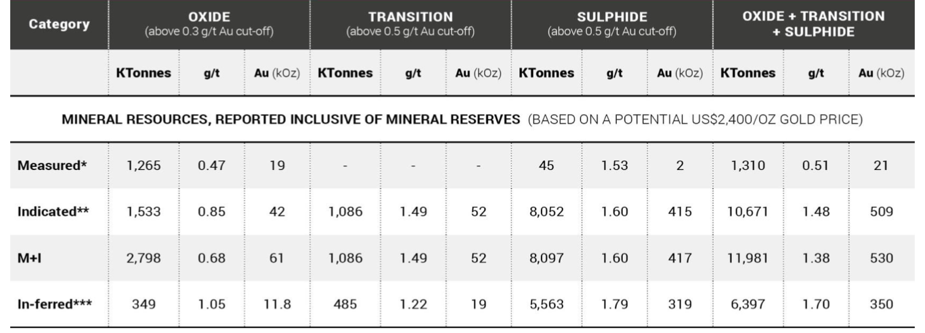

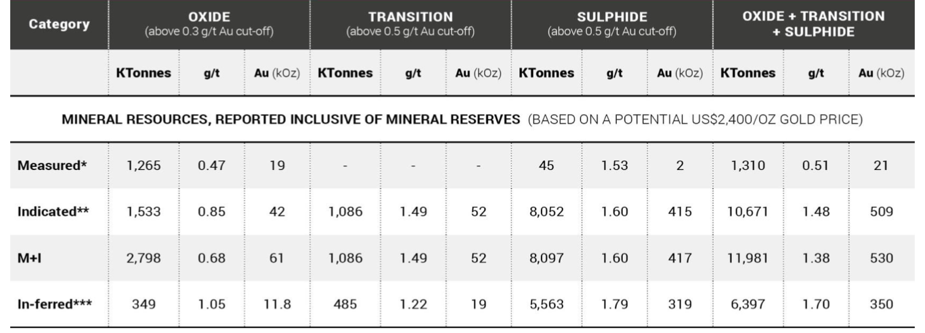

- MMY reported encouraging results from the first 16 drill holes of its resource expansion and upgrade program; a total of 27 holes have been completed to date, totaling 2,952 m. Grades ranged from ~1–5 g/t Au, including several higher-grade intersections above 4 g/t Au, well above the current average grade of 1.5–2.0 g/t Au, and the ~0.3–1.5 g/t range of comparable gold mines. Importantly, these holes were drilled outside the current resource estimate, indicating resource expansion potential. We believe these results support potential mine life extension, and lower cash costs. Management intends to complete an updated resource estimate by late 2026.

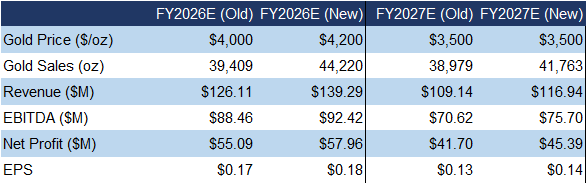

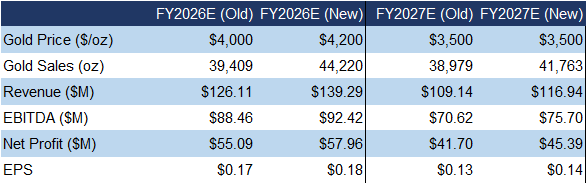

- We are raising our FY2026 EPS estimate from $0.17 to $0.18, reflecting higher gold prices, and stronger-than-expected Q1 production.

Price and Volume (1-year)

| |

YTD |

12M |

| KIDZ |

50% |

25% |

| TSXV |

13% |

15% |

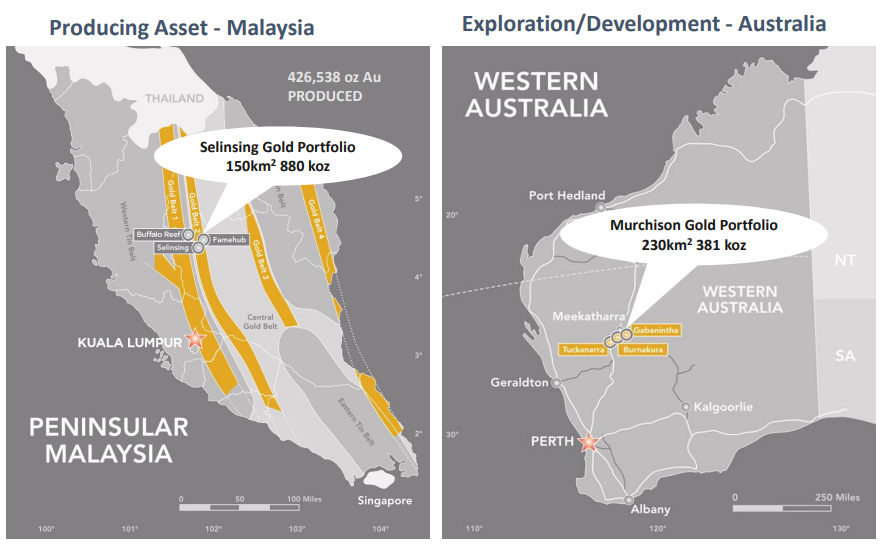

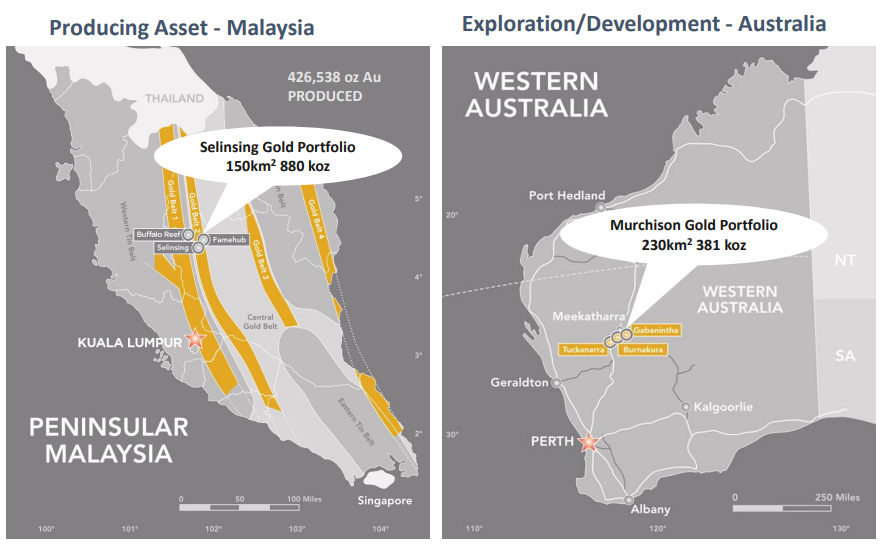

Owns a producing gold mine in Malaysia, and exploration projects in Western Australia Total compliant resources of over 1.2 Moz Au MMY has been processing sulphide materials since December 2022, producing a total of 90 Koz by September 2025 Q1-FY2026 production was up 62% YoY, and 6% QoQ, beating our estimate by 12%, driven by higher throughput and grades

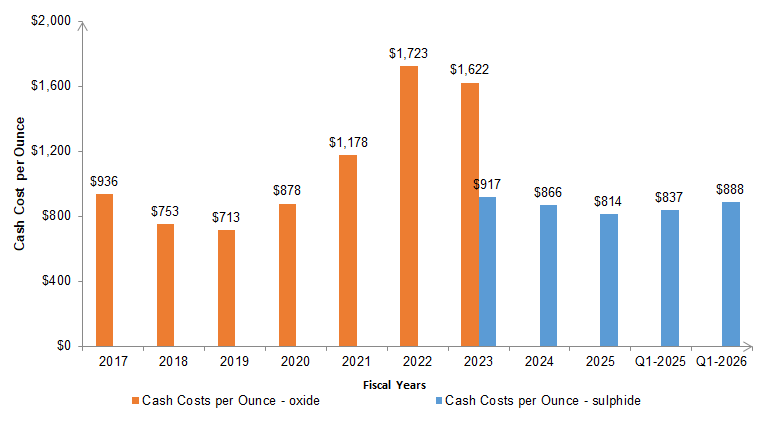

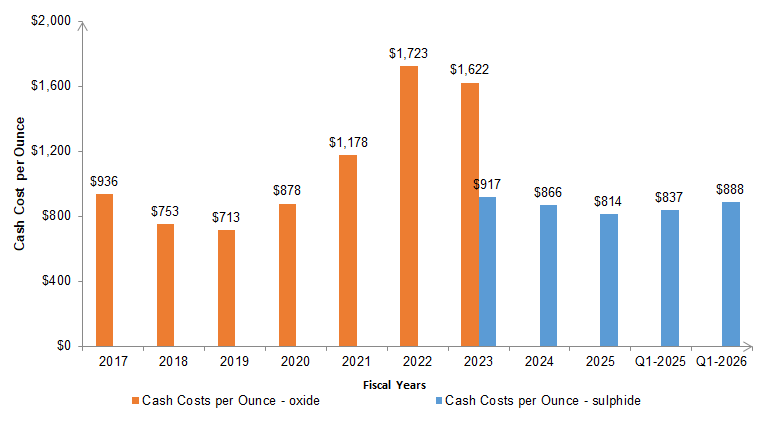

Cash costs were up 6% YoYto $888/oz, vs our estimate of $875/oz, mainly due to higher gold-price-linked royalty payments

Portfolio Summary

Production (Year-End: June 30th) - Oz

Source: FRC

Source: FRC

/ Company

Gross profit was up 54% YoY to $2,610/oz With 550-600 Koz of sulfide resources remaining, we believe the mine could produce forapproximately 12 more years Driven by higher production and gold prices, Q1revenue rose 67% YoY, EBITDA +66%, and

Cash Costs Per Oz

Source: FRC / Company

Reserves and Resources (Snowden NI 43-101 Technical Report: 2019)

* Qualified Person - Frank Blanchfield, an employee of Snowden Source: Company

EPS +235%Revenue topped our forecast by 10%, with

Financials (Year-End: June 30th)

Source: FRC / Company

Source: FRC / Company

Source: FRC / Company

Source: FRC / Company

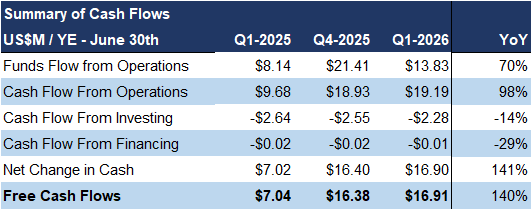

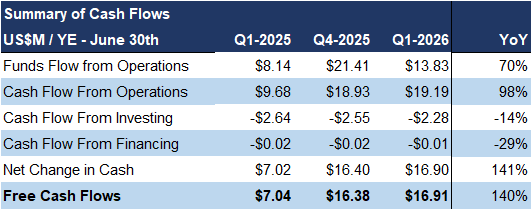

EPS ahead by 5%Margins improved across the board and remained well above sector averages FCF surged 140% YoY

FRC Projections and Valuation

Source: FRC

Source: FRC/S&P Capital IQ

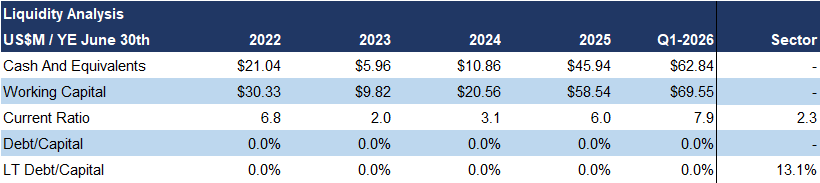

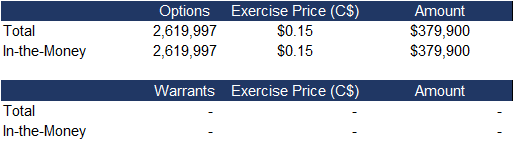

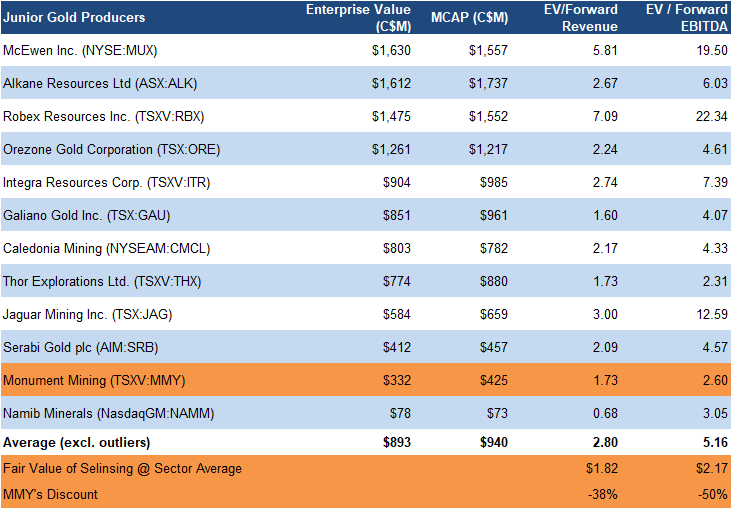

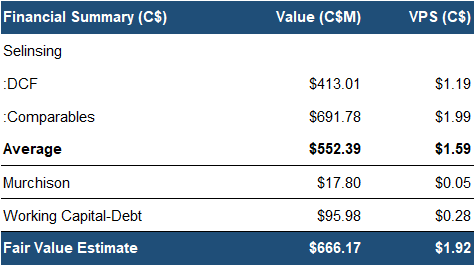

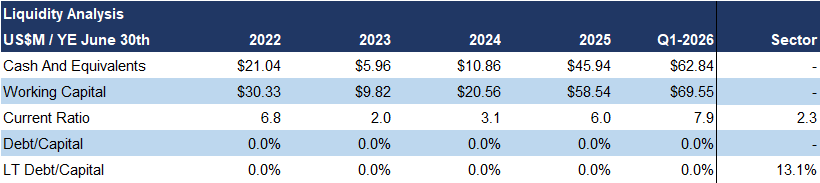

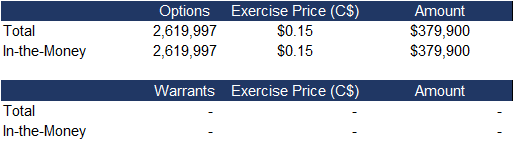

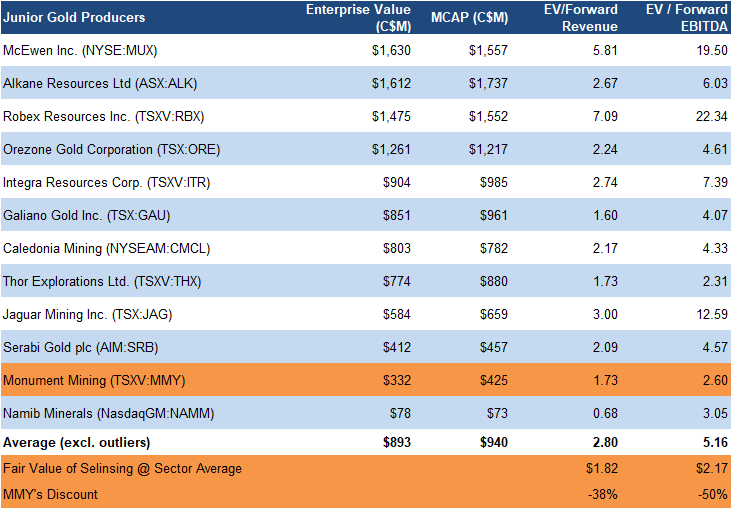

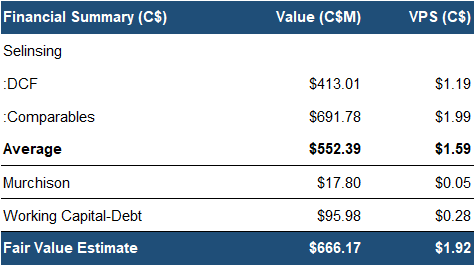

As a result, the balance sheet strengthened, with $70 M in working capital and no debt With production exceeding our forecasts and gold prices trending higher, we are raising our estimates across the board Sector multiples have risen17% since our November 2025 report, driven by higher gold prices MMY is trading at a 44% discount (previously 50%) to comparablejunior gold miners Applying sector multiples, we arrived at a fair value estimate of C$1.99/share (previously C$1.64/share) on the Selinsing mine Using a sum-of-parts valuation, we arrived at a fair value estimate of C$1.92/share (previously C$1.50/share)

Source: FRC

We are reiterating our BUY rating, and raising our fair value estimate from C$ 1.50 to C$ 1.92 /share. MMY’s strong operational performance, robust balance sheet, and special dividend reflect its financial strength. The company remains undervalued relative to peers despite a 251 % YoY share price surge , and promising drill results suggest potential mine life extension, and lower cash costs.

Risks We believe the company is exposed to the following key risks: The value of the company is dependent on gold prices FOREX Operational Exploration and development

We are maintaining our risk rating of 3 (Average)