Lumina Gold Attracts $1.27/Share Offer, Closely Aligning with Our $1.22/Share Valuation

Published: 4/21/2025

Author: FRC Analysts

We review the performance of our Top Picks. On average, companies on our list were up 2.0% WoW, outperforming the TSXV, which gained 0.4%. Notably, one of our Top Picks, Lumina Gold (TSXV: LUM), surged 28% today following a $581M takeover bid at $1.27/share, closely aligning with our valuation of $1.22/share. We also highlight key updates from other juniors under coverage.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Denarius Metals Corp. (DMET.NE, DNRSF)

PR Title: Final drill results from an infill drill program at the Zancudo gold-silver project in Colombia

Analyst Opinion: Positive – Results from 13 drill holes, targeting one of two primary zones, confirmed high-grade mineralization across multiple veins, and uncovered a new vein, indicating resource expansion potential. Notable intercepts include 0.5 m of 12.12 g/t Au & 93 g/t Ag, 0.70 m of 14 g/t Au & 96 g/t Ag, and 0.40 m of 23.11 g/t Au & 1,653 g/t Ag. DMET plans to complete an updated resource estimate by Q3-2025. The project achieved production last month. First ore deliveries are expected by the end of this month. This project has the potential to produce approximately 50–60 Koz of gold annually for at least 10 years, at an estimated cash cost of US$1,100–$1,300/oz.

Silver Dollar Resources Inc. (SLVDF, SLV.CN)

PR Title: Phase one drilling extends mineralized vein strike at the recently acquired Ranger-Page project (Idaho)

Analyst Opinion: Positive – Geologic modeling based on recently completed phase one drilling has identified multiple promising targets for follow-up drilling. This project hosts six historic mines, which have produced over 1.1 Blbs of zinc and lead, and 14.6 Moz of silver. Additionally, the company’ s La Joya project in Mexico hosts a large, shallow, historical inferred resource totaling 160 Moz AgEq (silver equivalent).

Churchill Resources Inc. (CRI.V, CRICF)

PR Title: Enters into a LOI to acquire the Black Raven antimony-gold property in Newfoundland and Labrador

Analyst Opinion: Positive – The project, which hosts two small-scale past-producing gold mines, contains multiple showings of gold, antimony, silver, copper, zinc, and lead. Located 100 km north of the Beaver Brook antimony mine (owned by a Chinese state-owned entity), the property is in the early stages of exploration. CRI can acquire the project for 12M shares (currently valued at $0.24M), and by committing to $1.2M in exploration spending. Management is proceeding with due diligence, and is planning preliminary exploration work, including re-sampling of surface showings, and electromagnetic surveys.

Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Lumina Gold Corp. (TSXV: LUM), was up 33%. Earlier today, LUM announced it has received a takeover offer from Chinese mining major CMOC Group Limited (SEHK: 3993/MCAP: $26B) for $581M, or $1.27 per share. LUM owns an advanced-stage gold-copper project in Ecuador. While we do not currently cover LUM, our last report in June 2023 assigned a fair value estimate of $1.22/share, closely aligning with the offer price. This transaction not only validates our valuation, but also reinforces our outlook for heightened M&A activity in the mining sector, as major players pursue high-quality junior assets to expand their portfolios.

* Past performance is not indicative of future performance (as of Apr 21, 2025)

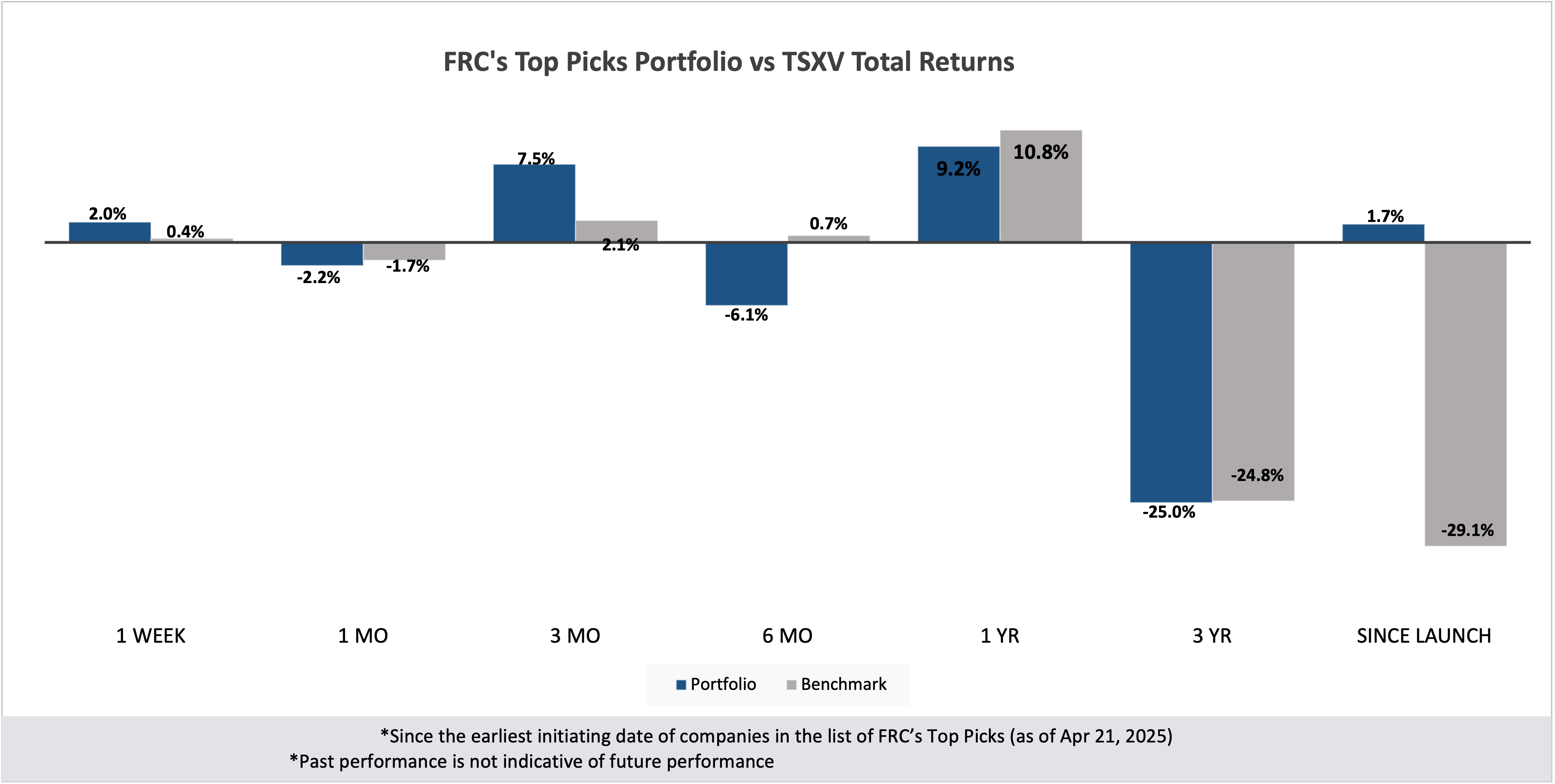

Last week, companies on our Top Picks list were up 2.0% on average vs 0.4% for the benchmark (TSXV).

FRC's Top Picks Portfolio vs TSXV Total Returns

Performance by Sector

1. Since the earliest initiating date of companies in the list of Top Picks (as of Apr 21, 2025)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.