Silver X Mining Corp.

Record Production and Revenue, Narrowed Losses

Published: 4/28/2025

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

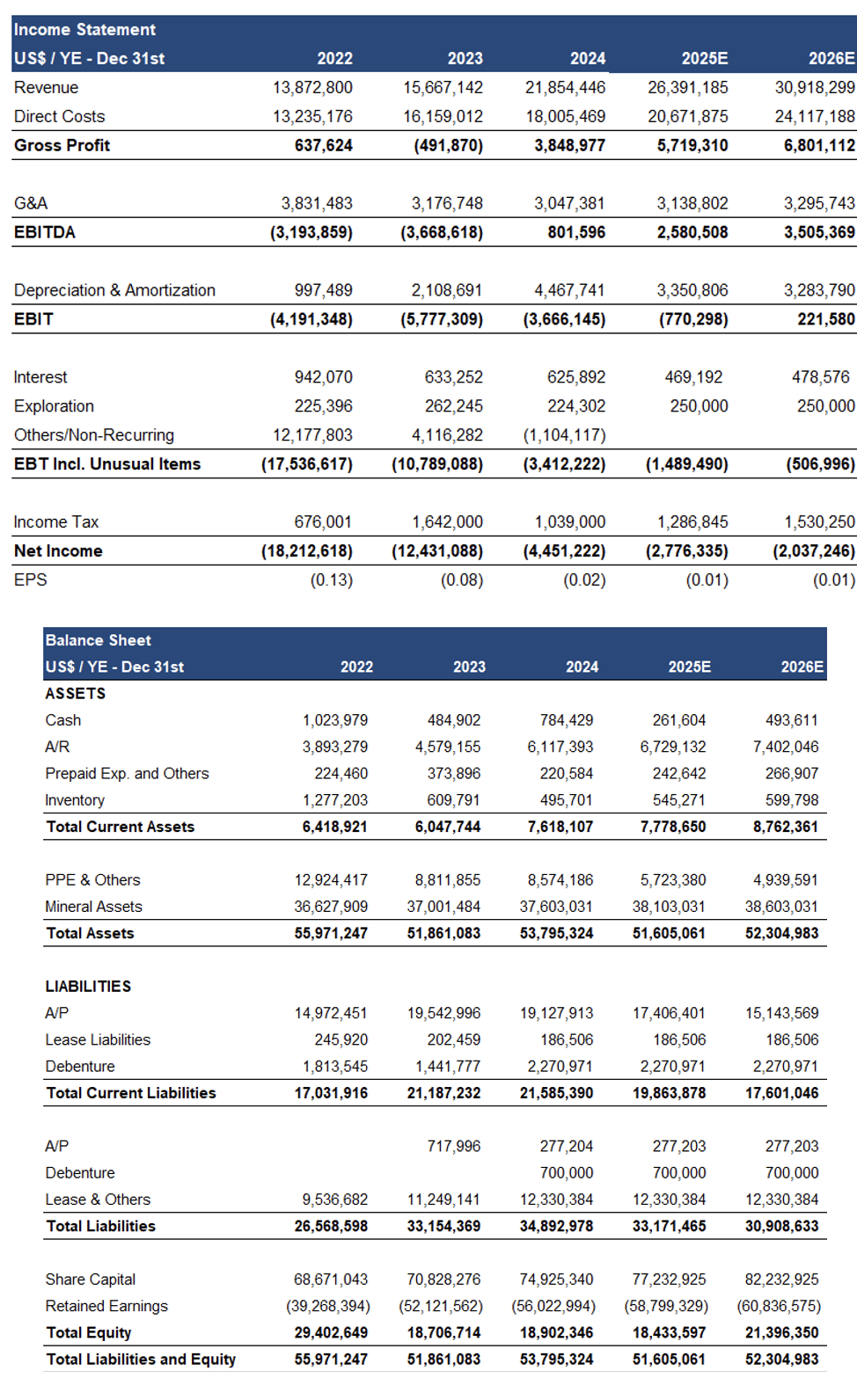

| Metrics | Value |

|---|---|

| Current Price | CAD $0.16 |

| Fair Value | CAD $0.8 |

| Risk | 4 |

| 52 Week Range | CAD $ |

| Shares O/S (M) | 222 |

| Market Cap. (M) | CAD $36 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 1.9 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

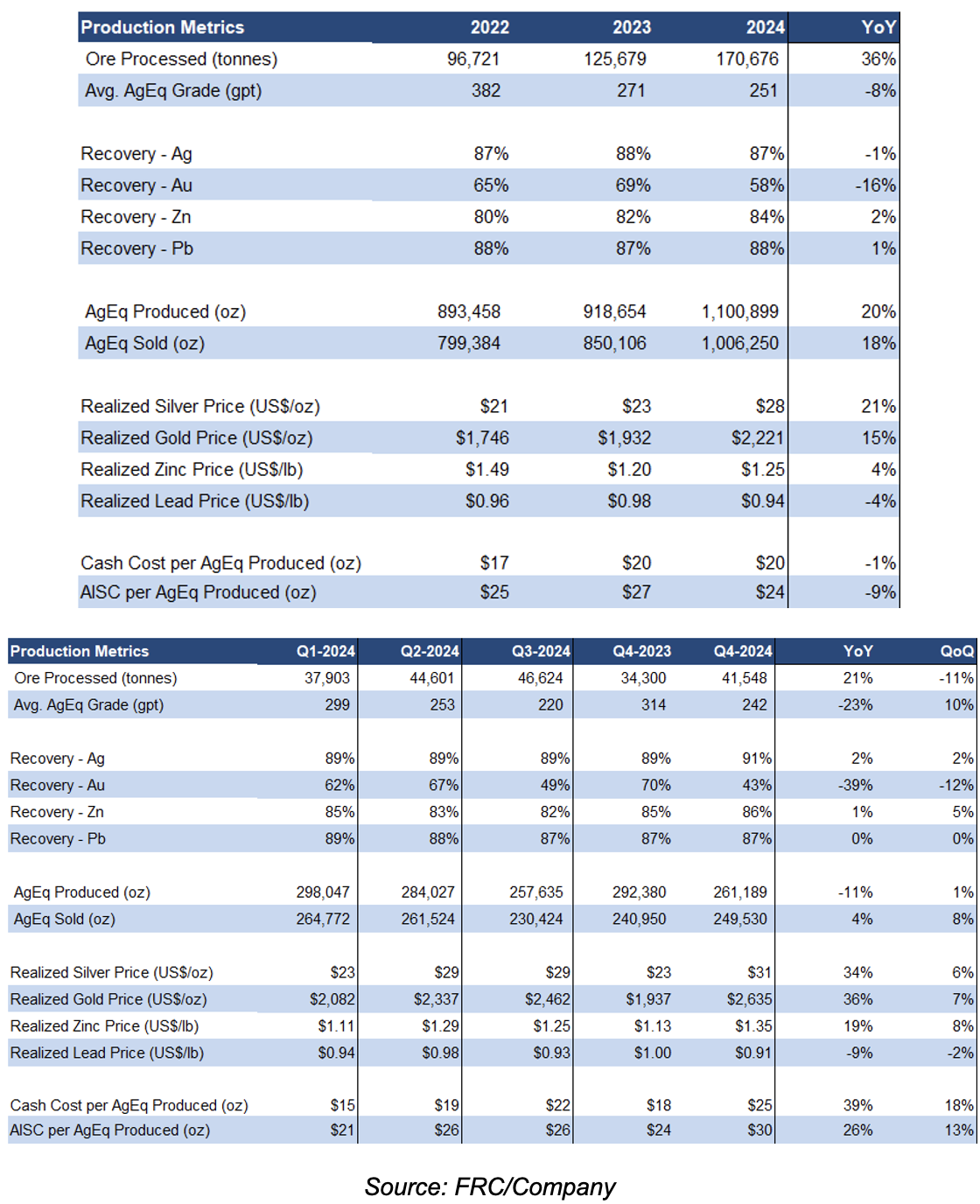

- 2024 production from the Nueva Recuperada silver-polymetallic mine in Peru rose 20% YoY to 1 Moz AgEq, in line with our estimate, driven by higher throughput, partially offset by lower grades. Recovery rates and cash costs remained relatively stable.

- Revenue increased 39% YoY to $21.85M, beating our estimate by 1%, while net losses narrowed 64% YoY to $4.45M, better than our forecast of $4.91M, driven by higher production and metal prices.

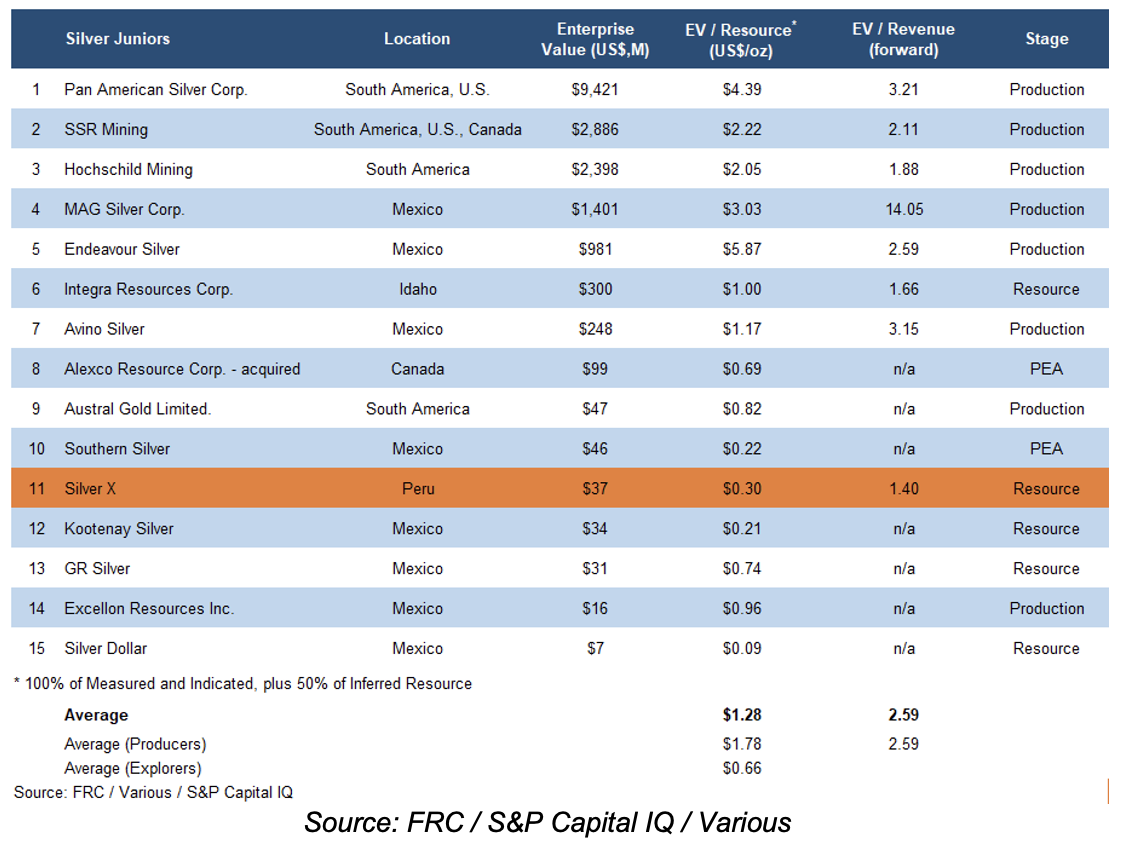

- Junior silver producers are trading at $1.78/oz, while AGX is at just $0.30/oz, an 83% discount. AGX's forward EV/Revenue is 1.4x, compared to the sector average of 2.6x, a 46% discount.

- In Q1-2025, the company released an updated resource estimate of 208 Moz AgEq across the Tangana Mining Unit (TMU), and the Plata Mining Unit (PMU). Production at the PMU is expected to begin in 2026, with management targeting annual production of 6 Moz by 2028. We see significant resource expansion potential, with multiple veins yet to be included in the current resource estimate.

- The mining industry has experienced heightened M&A activity recently, driven by record commodity prices. We expect this trend to continue as larger miners pursue strategic acquisitions to expand their portfolios.

- We believe AGX presents a compelling value proposition, driven by rapid production ramp-up potential, and a significant discount to peer valuations.

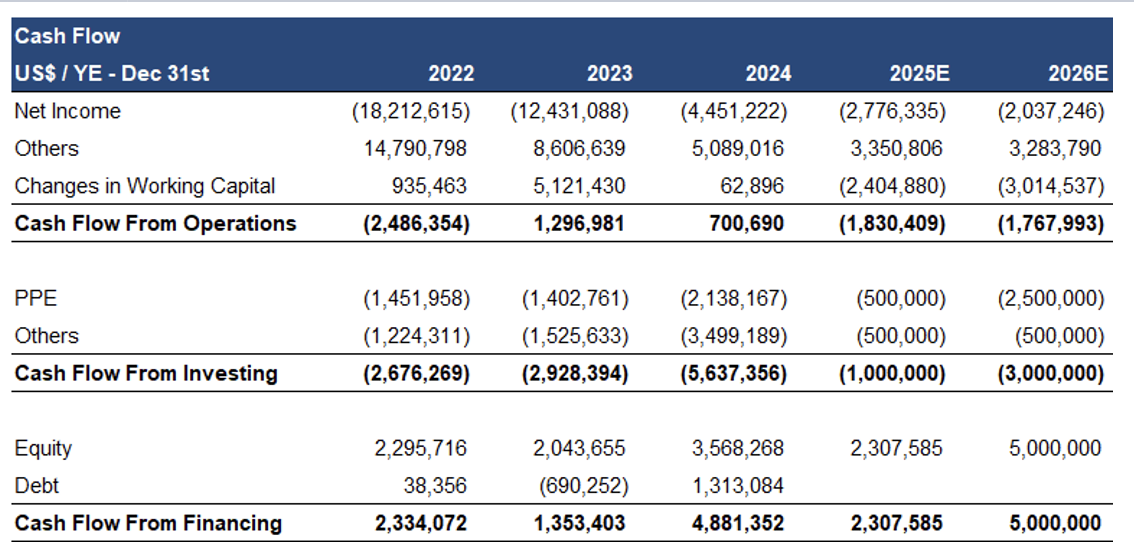

Price Performance (1-year)

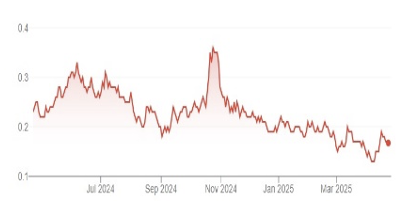

Project Overview

The Nueva Recuperada project is comprised of the producing Tangana mine with a 720 tpd processing plant, and the advanced-stage Plata mining unit, and four exploration projects (Tangana Brownfield, Plata Brownfield, Victoria HS Gold, and Red Silver). Extensive vein fields with 200+ targets, and 500+ outcrop veins

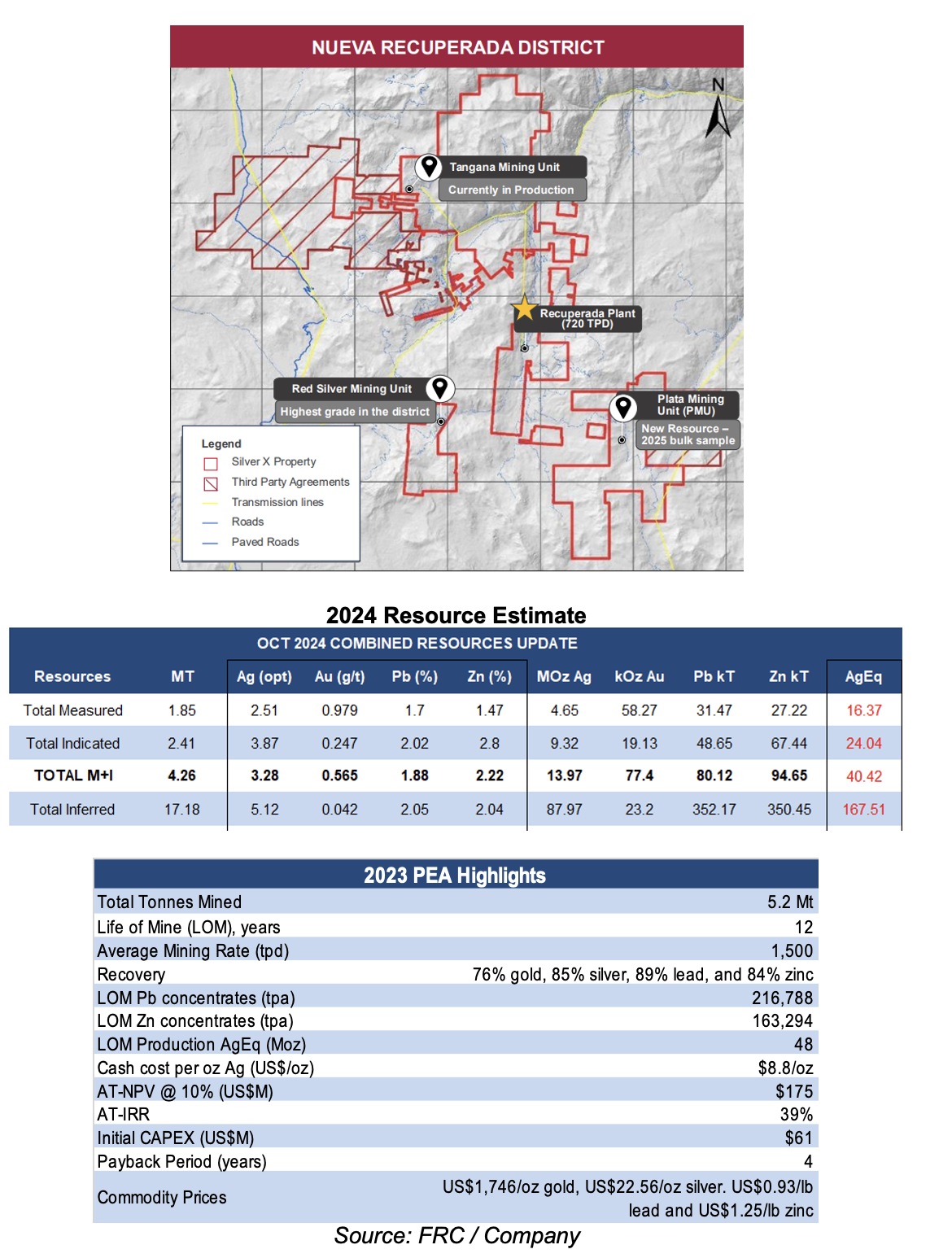

NI 43-101 compliant resources totaling 208 Moz AgEq. A 2023 Preliminary Economic Assessment (PEA) focused solely on the TMU, utilizing <40% of the project’s resources, yielded an AT-NPV10% of $175M, and a high AT-IRR of 39%, using $23/oz silver vs the current spot price of $33/oz

Production

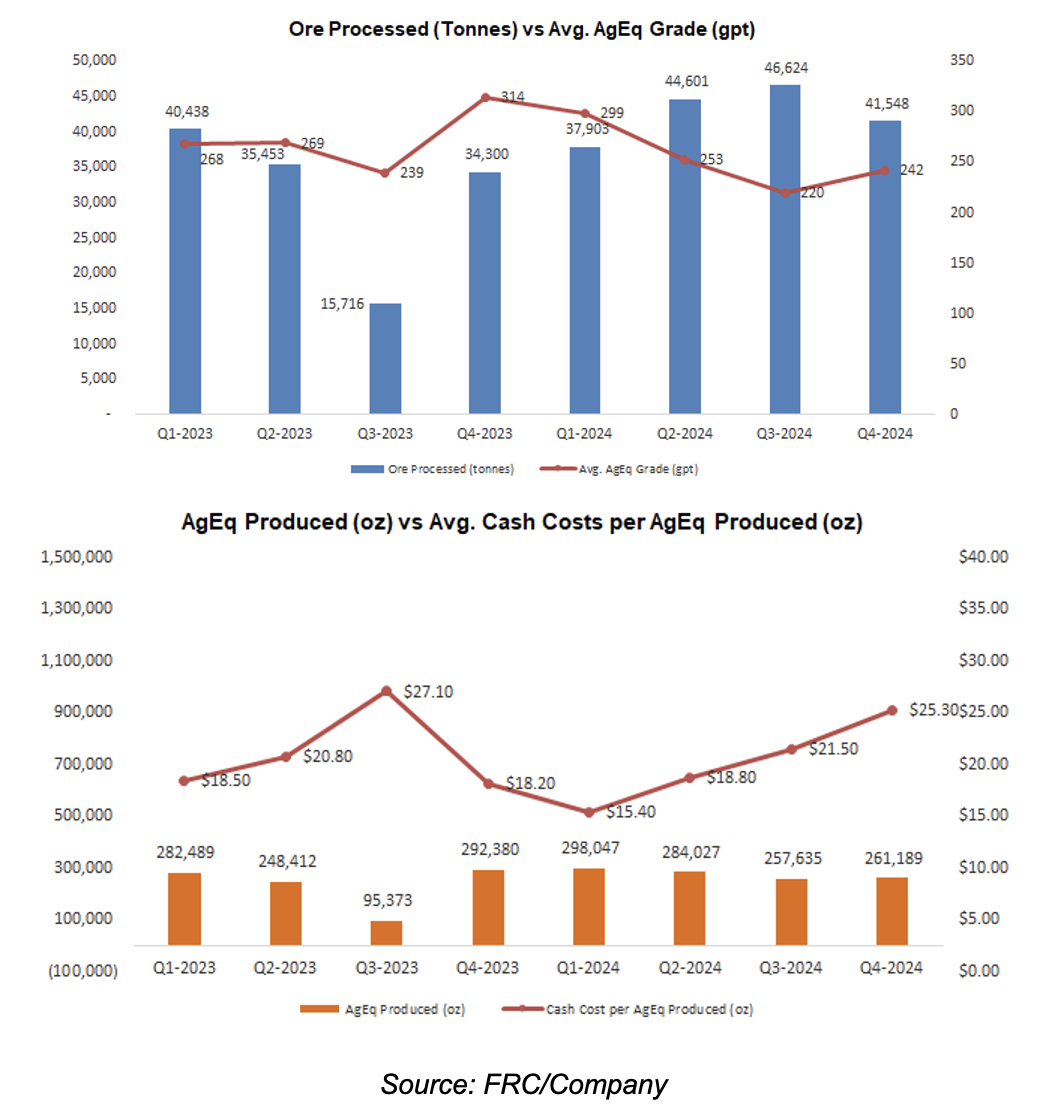

2024 production was up 20% YoY to 1 Moz AgEq, in line with our estimate, driven by higher throughput partially offset by lower grades. Recovery rates and cash costs were relatively stable

Q4-2024 production was relatively flat QoQ, but realized silver prices were up 6% QoQ

Grades improved QoQ in Q4-2024, following three consecutive quarterly declines. However, cash costs continued to trend higher, marking three consecutive quarters of QoQ increases

The company’s vision is to expand annual production to over 6 Moz of AgEq within the next few years. Immediate plans include:

- Complete an updated PEA integrating the Plata and Tangana units this quarter.

- Advance the PMU to production in 2026

- Evaluate the feasibility of expanding the current processing plant from 720 tpd to 1,500 tpd

- Update the Environmental and Social Impact Assessment (ESIA) to support a potential 1,500 tpd operation

- Secure permits to build a new 1,500 tpd processing facility, bringing total production capacity to 3,000 tpd.

Financials

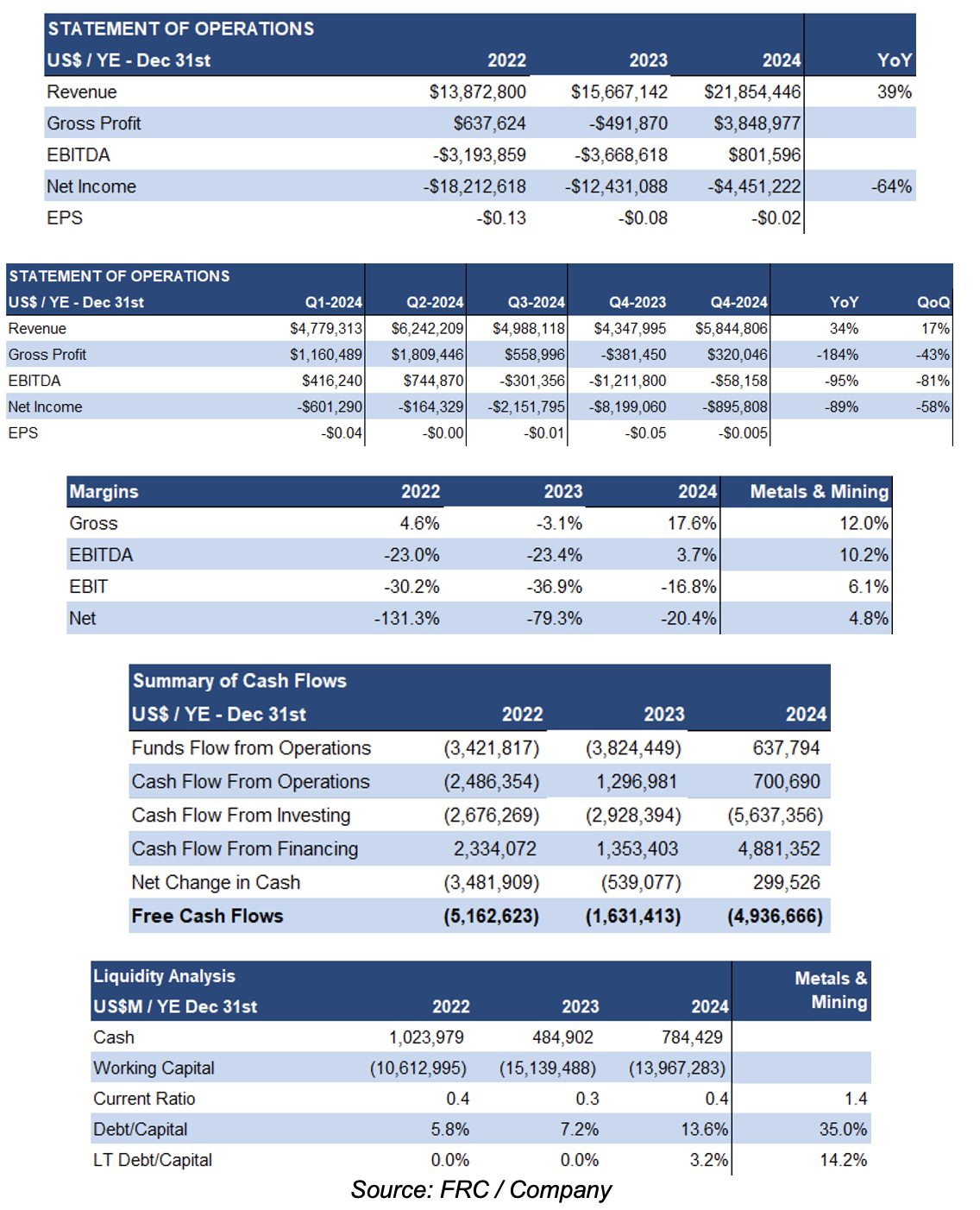

2024 revenue was up 39% YoY to $21.85M, beating our estimate by 1%, while net losses were down 64% YoY to $4.45M vs our forecast of $4.91M, driven by higher production, and metal prices. Q4 revenue was up 17% QoQ, and net losses were down 58% QoQ

Margins improved across the board. Although funds flow from operations increased, free cash flows declined primarily due to increased investment in mining equipment to support higher production

While the company has limited debt, working capital was negative at the end of 2024, primarily due to $19M in payables. In Q1-2025, AGX completed a $2.4M equity financing

Although AGX’s negative working capital is a concern, we believe it should be able to extend payables, and/or secure debt financing this year, given its strong production growth plan.

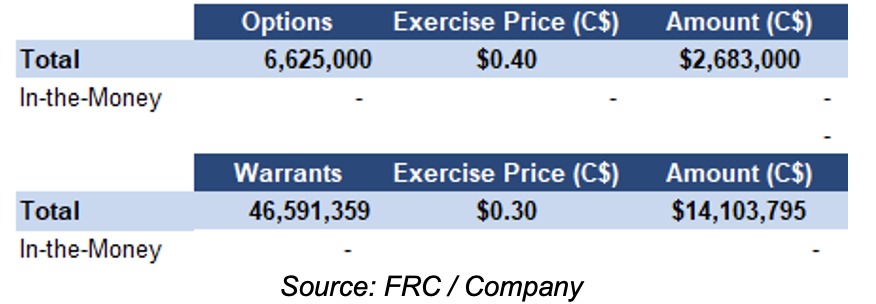

No outstanding options/warrants are currently in-the-money

Comparables Valuation

Junior silver producers are trading at $1.78/oz (previously $1.50/oz), while AGX is trading at just $0.30/oz (unchanged), an 83% discount. Applying the sector average multiple of $1.78/oz, we arrived at a fair value estimate of C$1.31/share (previously C$1.21/share)

We are introducing a new valuation metric in this report; the forward EV/Revenue of AGX is 1.4x vs the sector average of 2.6x, a 46% discount. Applying the sector average EV/Revenue, we arrived at a fair value estimate of C$0.38/share

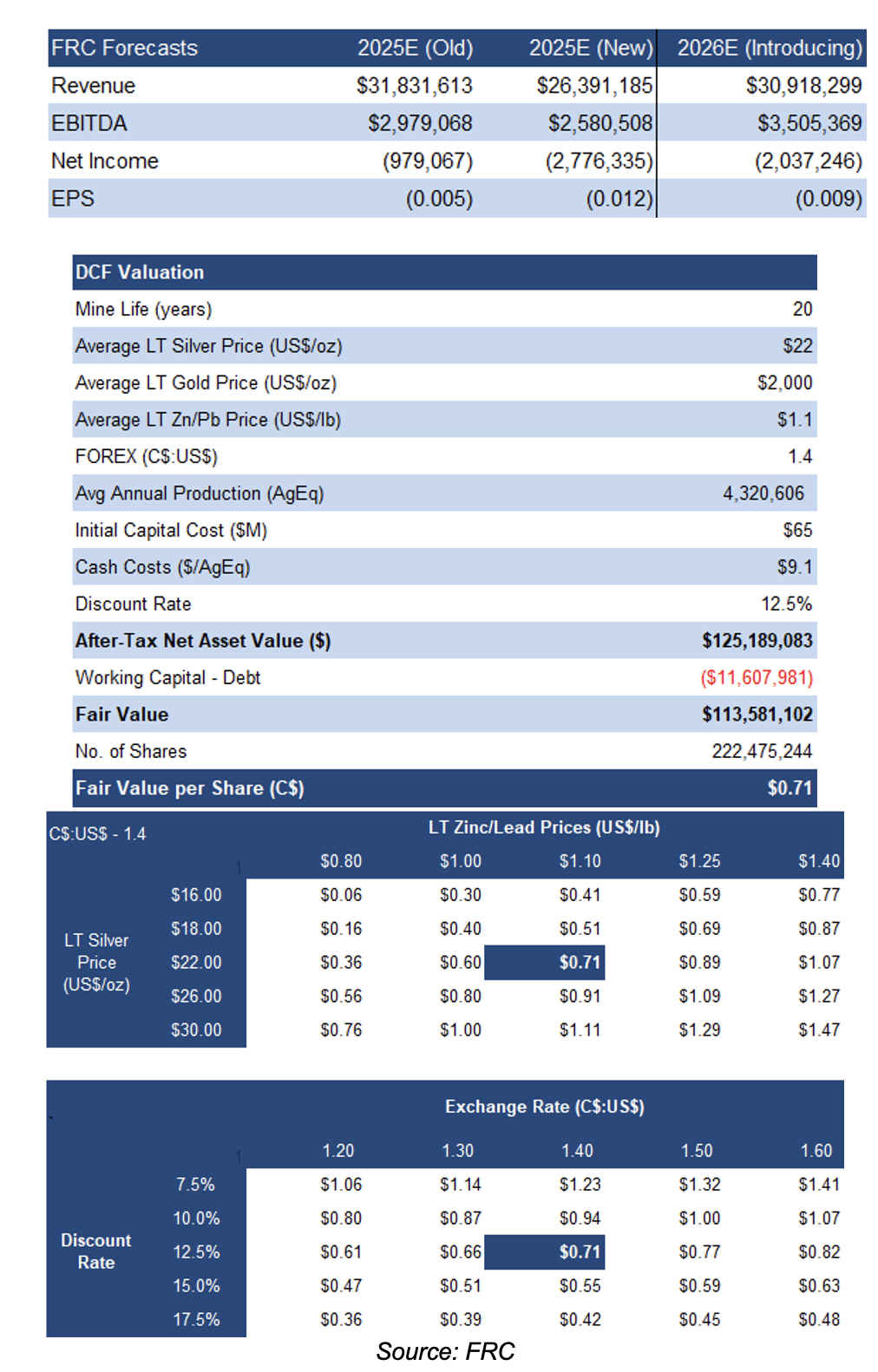

DCF Valuation

We are lowering our 2025 production and revenue forecasts, recognizing that our earlier projections may have been too aggressive. As a result, our DCF valuation declined to C$0.71/share (previously C$0.75/share)

Our valuation was also impacted by share dilution from the recent financing, and a weaker US$. Our valuation is highly sensitive to metal prices

We are reiterating our BUY rating, and adjusting our fair value estimate from C$0.98 to C$0.80/share (the average of our DCF and comparables valuations). We anticipate a significant boost in revenue and EPS in 2025.

We maintain a positive outlook on silver prices, anticipating continued US$ weakness, and strong demand for safe-haven assets amidst economic and geopolitical uncertainties, and the potential for a global GDP slowdown. Additionally, the silver market is anticipated to remain in deficit for a fifth consecutive year in 2025, according to the Silver Institute.

We believe the significant discount in AGX's valuation compared to its peers, combined with the anticipated production from the PMU, and the potential for M&A activity in the sector, present an attractive entry point.

Risks

We believe the company is exposed to the following key risks:

- Metal prices

- Exploration and development

- FOREX

- Negative working capital

- The upcoming PEA might not be promising

APPENDIX