- The company is also exploring various end-use applications for its high-grade silica, with a focus on building a solar glass manufacturing facility in Brazil. Brazil relies heavily on imports from China, which maintains a dominant position in the global solar glass market. A German turn-key provider has quoted HMR US$165M for equipment required to build a 365 kt/year glass production plant. HMR has secured potential offtake agreements with multiple Brazilian based solar module manufacturers, and plans to complete a feasibility study on the plant this year.

- HMR recently acquired a European R&D company focused on solar and energy storage, and secured an option to acquire 60% of an operating alternative energy distributor, generating US$26M in annual revenue.

- The company’s multi-track approach spreads risk across opportunities, though it may be challenging for investors to follow. We believe it is crucial to assess the potential value of each initiative. Key upcoming catalysts include the receipt of a mining permit, updates on the proposed glass manufacturing plant, and other solar and energy storage end-user initiatives.

- HMR stands out with a vertically integrated model, while most silica peers remain pure-play explorers/developers.

Risks

- Commodity prices

- Permitting and development

- No economic studies

- Access to capital and potential for share dilution

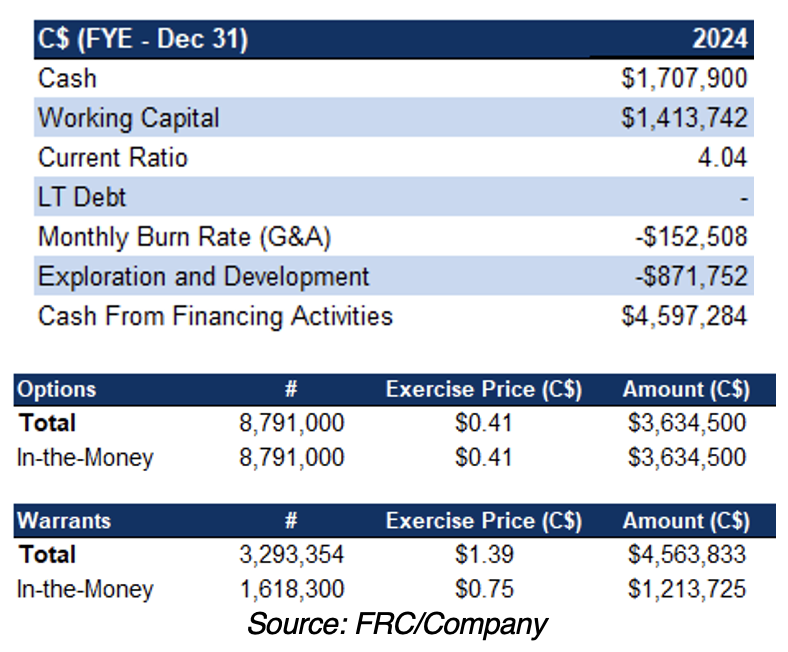

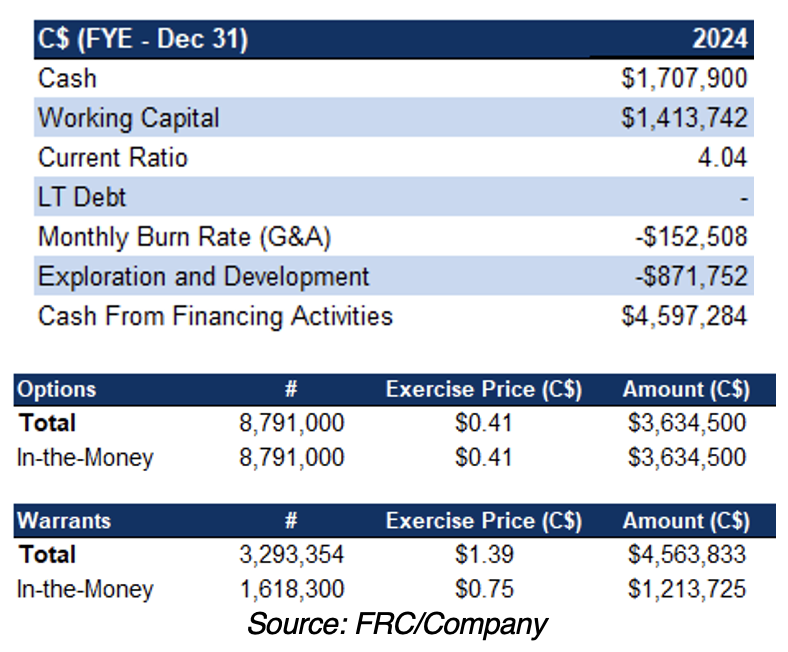

*Can raise up to $4.8M from in-the-money options and warrants; currently pursuing a $3M equity financing

Price Performance (1-year)

| |

YTD |

12M |

| HMR |

-23% |

96% |

| TSXV |

3% |

10% |

A Primer on High Purity Quartz (HPQ)

The U.S., Canada, and EU have classified silicon as a critical mineral

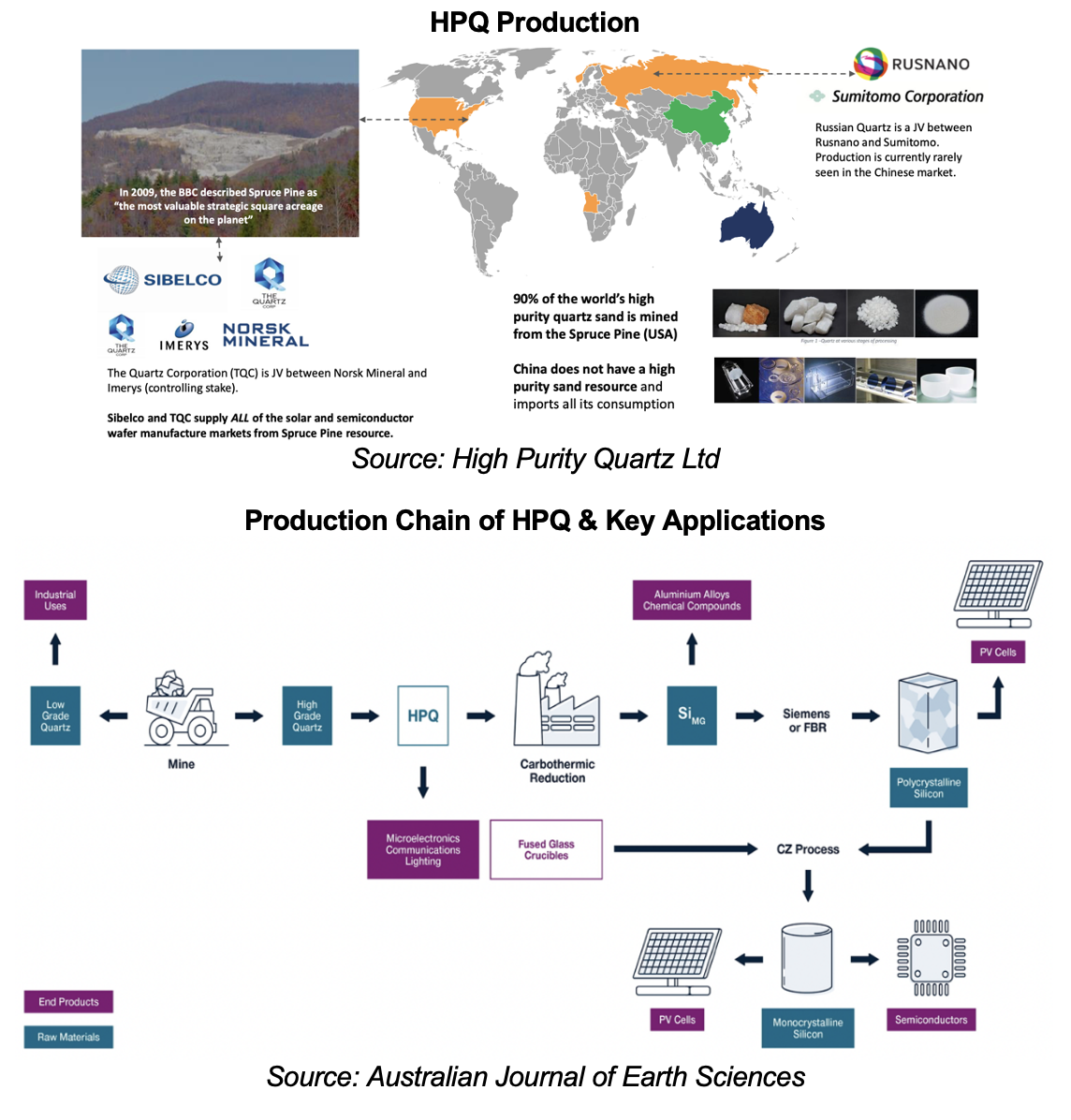

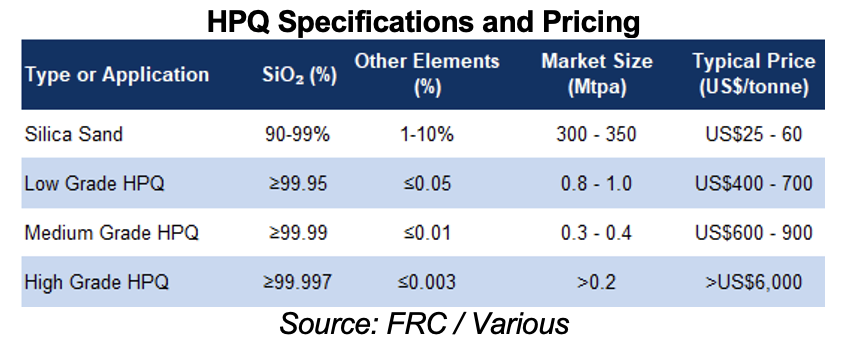

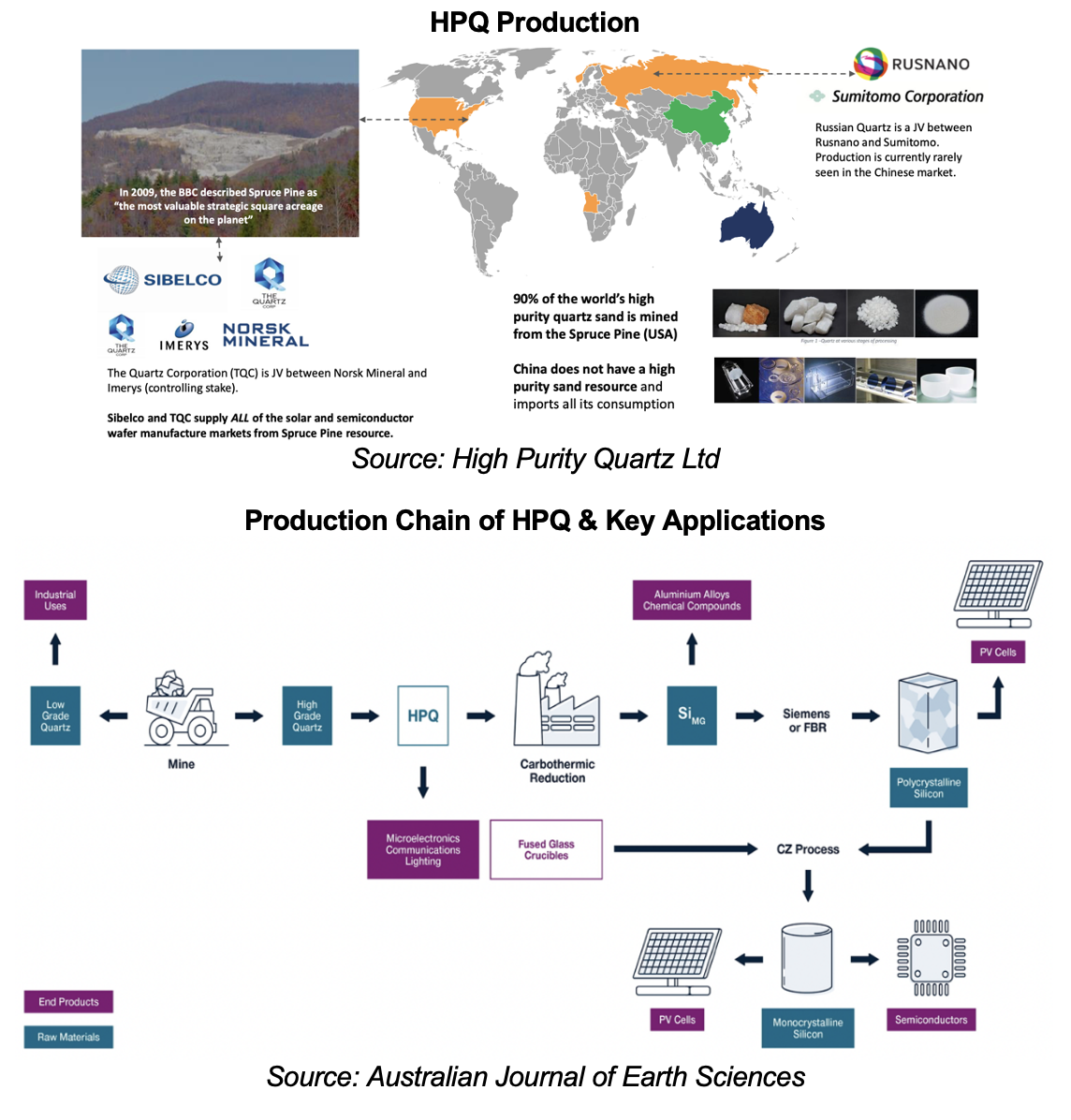

High-purity quartz (HPQ) is a rare, ultra-refined form of quartz with extremely low impurity levels, making it critical for high-tech applications like semiconductors, and solar panels. Quartz, composed of silicon dioxide (SiO₂), is one of the most abundant minerals on Earth, but only a small fraction of deposits meets the stringent purity requirements for HPQ. HPQ production relies on raw materials with naturally low impurities, as the purification process is both expensive and involves multiple chemical and thermal stages. Even with advanced methods, only select silica deposits can be economically upgraded to HPQ.

Major global sources of high-purity silica include the U.S., Russia, Australia, and Brazil.

Global HPQ production exceeds 220 Kt annually, with Spruce Pine (U.S.), accounting for 90% of supply

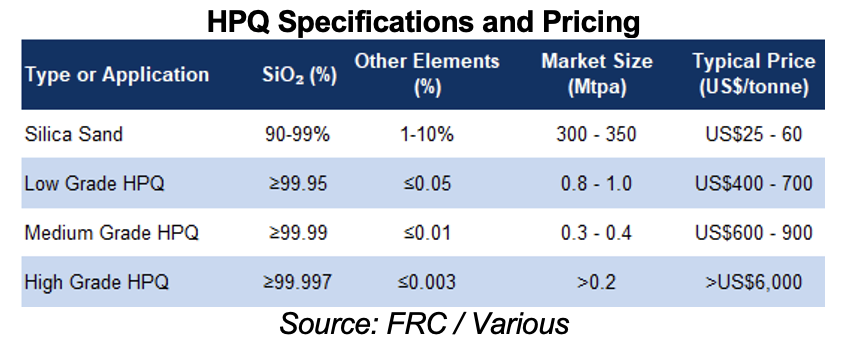

HPQ is a highly purified form of quartz, with SiO2 concentrations exceeding 99.997%, produced through rigorous filtration, and purification processes

The features of high-purity quartz, such as exceptional thermal stability, chemical inertness, and high transparency, make it applicable in a wide range of uses, such as semiconductors, solar panels, and optical fibers.

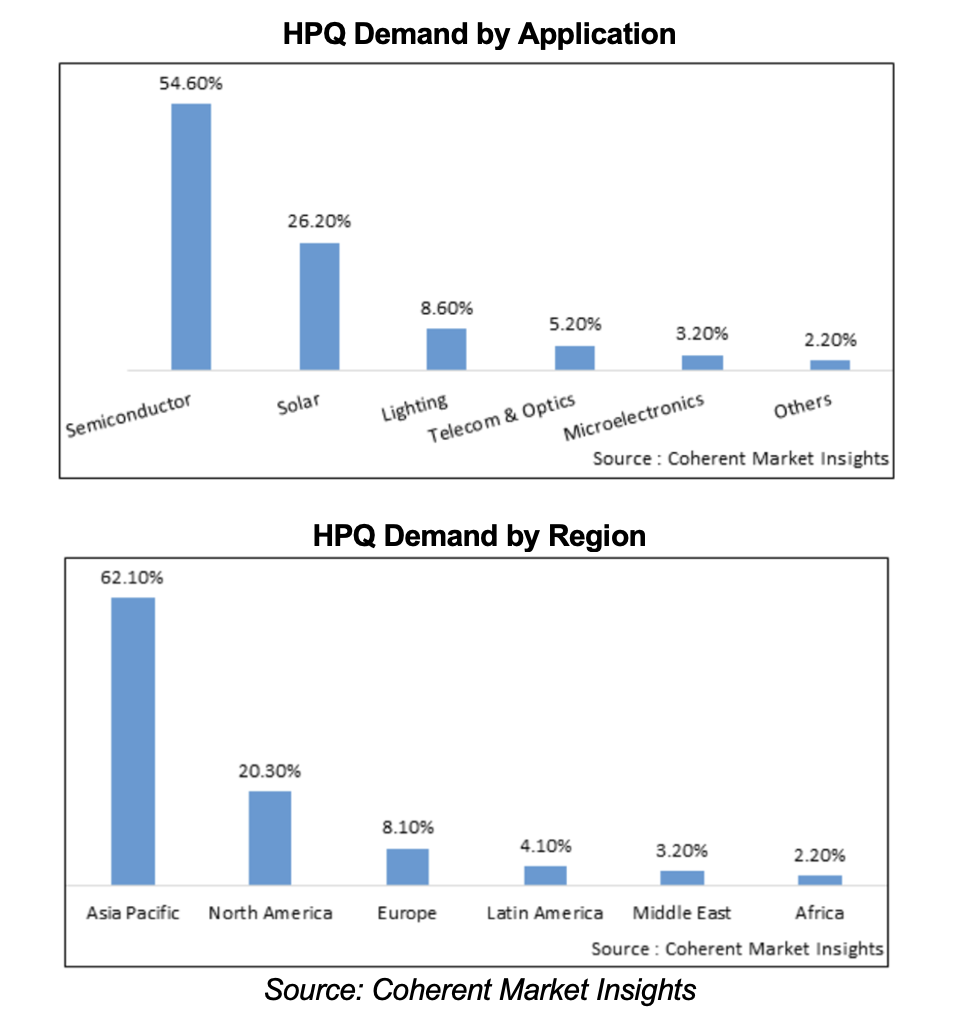

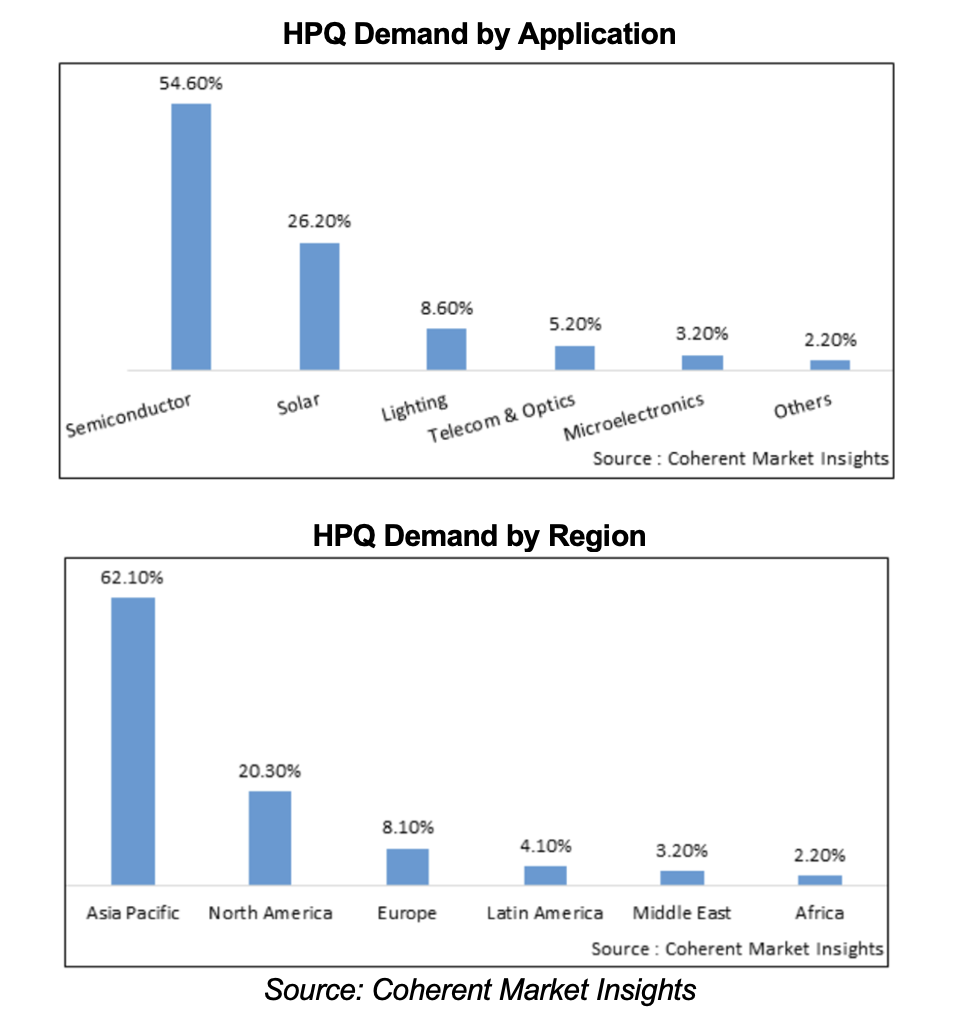

The semiconductor industry, accounting for 55% of market share, is the leading end-user of HPQ, followed by the solar industry

Due to the specialized nature and varying purity requirements of HPQ, it is traded through privately negotiated contracts, rather than on a public exchange.

Asia Pacific dominates global HPQ demand, with a 62% share. While China is a net exporter of silicon and many critical minerals, and metals, it is a net importer of HPQ

Prices are primarily driven by purity, ranging from US$25/t to over US$6k/t

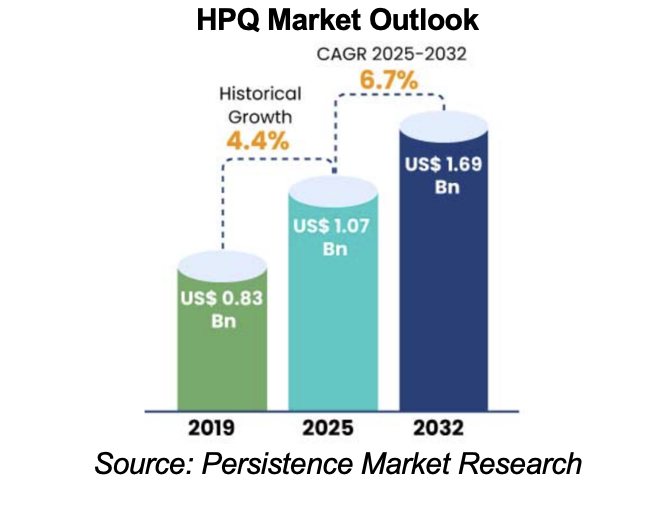

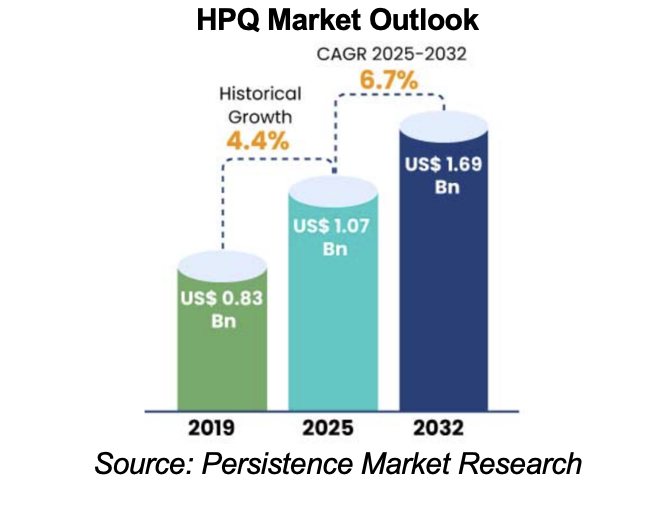

It is estimated that the global HPQ market will grow 7% p.a., from US$1B in 2025, to US$1.7B by 2032, driven by rising demand from the semiconductor, and solar energy sectors

Company Overview

HMR’s business plan is to establish a fully integrated HPQ industrial vertical, managing the entire process from raw material extraction to the final product in solar and energy storage solutions. Solar and energy storage are vital for a clean and reliable energy future, with solar offering renewable power, and storage ensuring consistent availability. We believe this combination is critical in meeting the world's growing demand for electricity.

Formed in 2023. HMR aims to be a leading HPQ materials company through a three-phase business plan

Three Verticals: From Mine to Market

Phase One HPQ Silica Supply

- Identifying and advancing silica resource projects for stable long-term supply

- Targeting Brazil as an untapped region for high-purity silica mining

- Secured a 40-year exclusive mineral extraction lease (with a maiden resource estimate of 64 Mt) near Santa Maria Eterna, granted by the government of Bahia, Brazil

Phase Two Infrastructure & Logistics

- Securing processing, transportation, and storage access for materials extracted in phase one through partnerships, acquisitions, and lease agreements

- In 2024, HMR secured service agreements with local parties: a) a party in the Belmonte Silica District for access to its wash and sort processing facility, and b) other local entities to provide transport and maritime port facility services

Phase Three Revenue & Vertical Integration

- Early cash flows may come from the sale of silica sand in its natural state, though this is a low-margin opportunity; HMR has provided test samples to multiple unsolicited potential customers

- After establishing an on-site processing facility, the company plans to produce processed HPQ silica, and final end-user products

- Key target markets: HPQ silica, advanced materials, solar glass, solar, and energy storage solutions

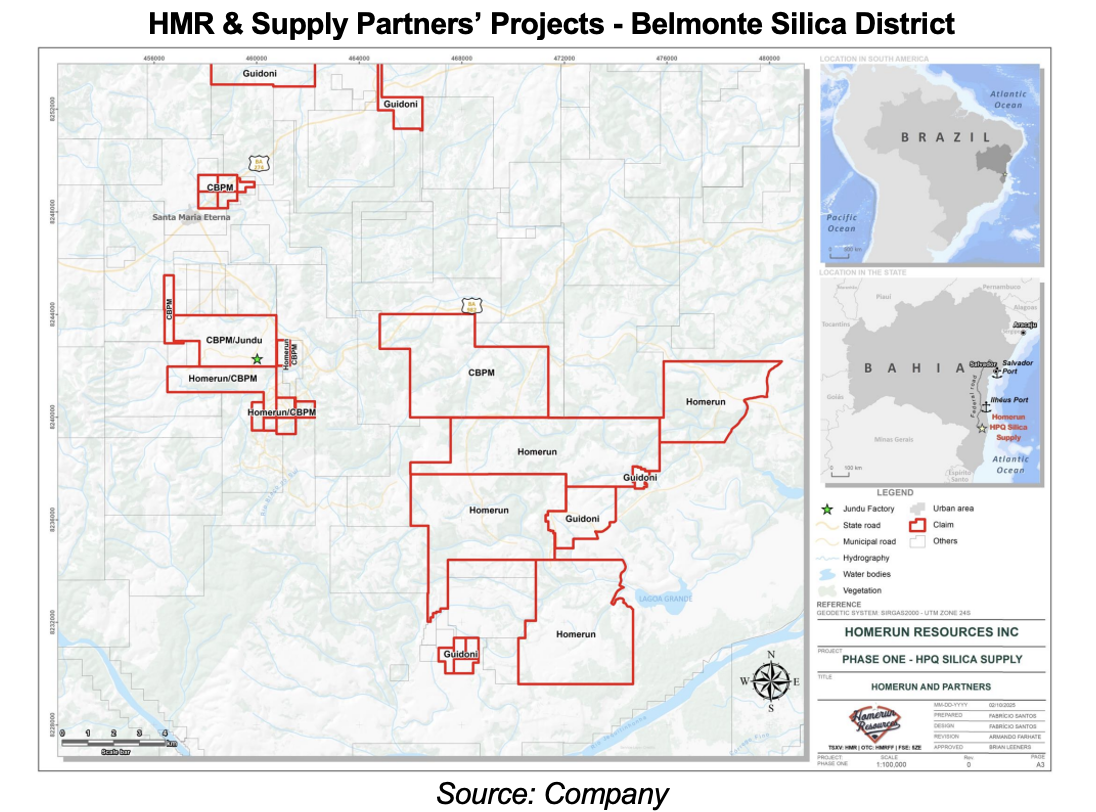

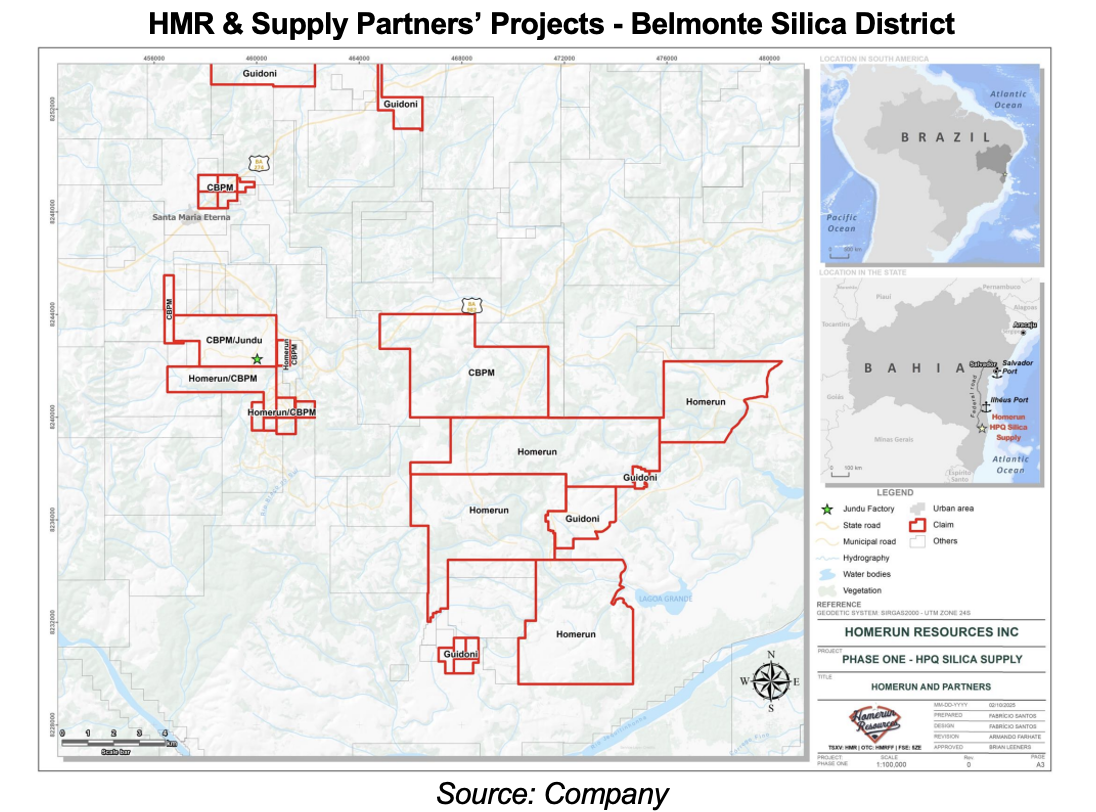

Belmonte Silica District Project, Brazil

HMR gained control of its flagship project through a 40-year exclusive lease with CBPM (a government-owned entity in Bahia, Brazil) for silica extraction; royalties are R$50/ton (US$9/t), plus 5% on international sales

Brazil is the third-largest producer of silicon, trailing only China and Russia, and holds one of the world's largest quartz reserves. HMR’s projects in the Belmonte silica district in Bahia are outlined below. A key advantage of the district is its potential for HPQ silica, which has minimal impurities and contaminants, making it ideal for advanced applications. We believe the recent maiden resource estimate on its flagship project is a testament to this potential.

HMR’s Flagship Project: Santa Maria Eterna Silica Sand Lease

Location, Accessibility and Infrastructure

HMR gained control of the project in 2023. Approximately 600 km from Bahia’s capital city, Salvador

Excellent infrastructure in place, including access to electricity, ports, and railway. Proximity to ports is key, as future production will likely be distributed domestically and exported to global markets

Located adjacent to the Jundu silica project, in a region known for hosting long-life mines

Mineralization and Resources

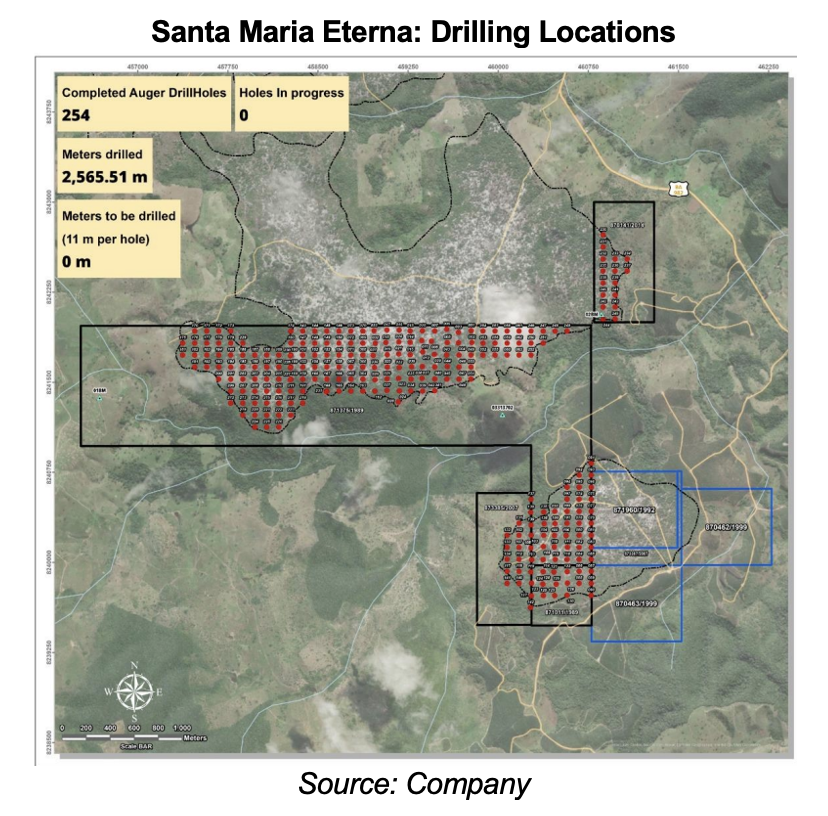

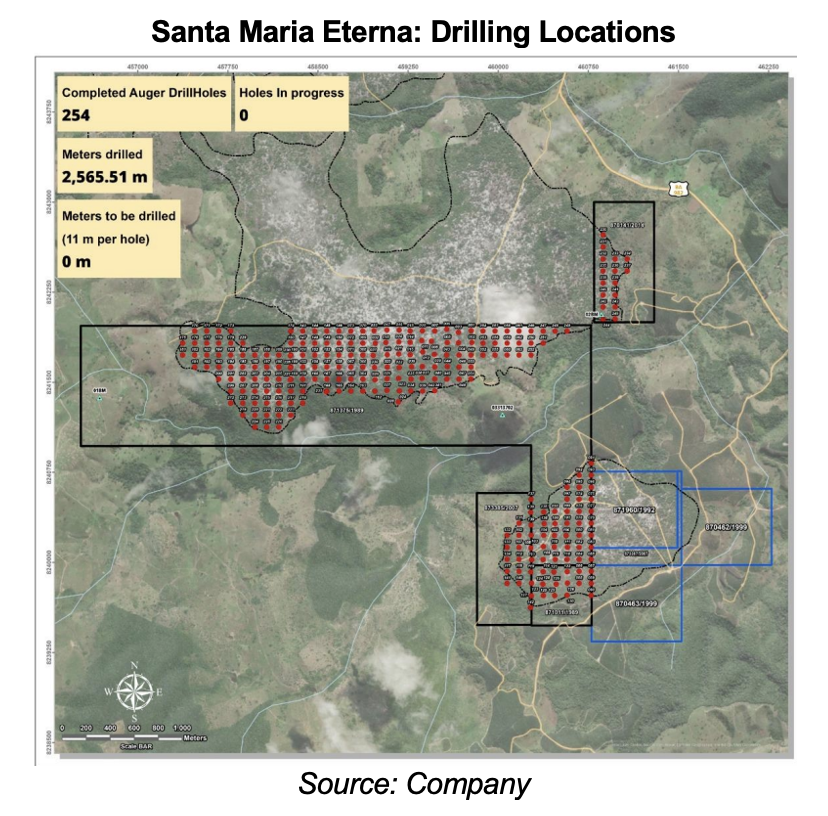

In the 1990s, CBPM drilled 15 holes. HMR followed up with a 254-hole, 2,565 m program from May to September 2024, leading to a recently completed maiden resource estimate

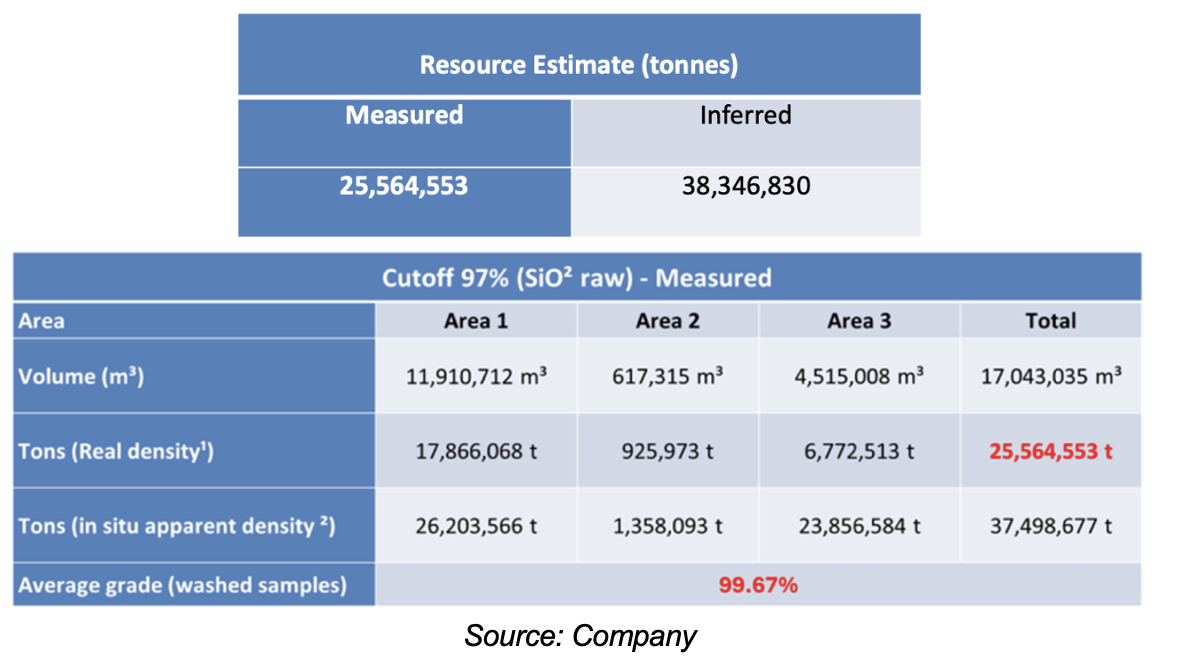

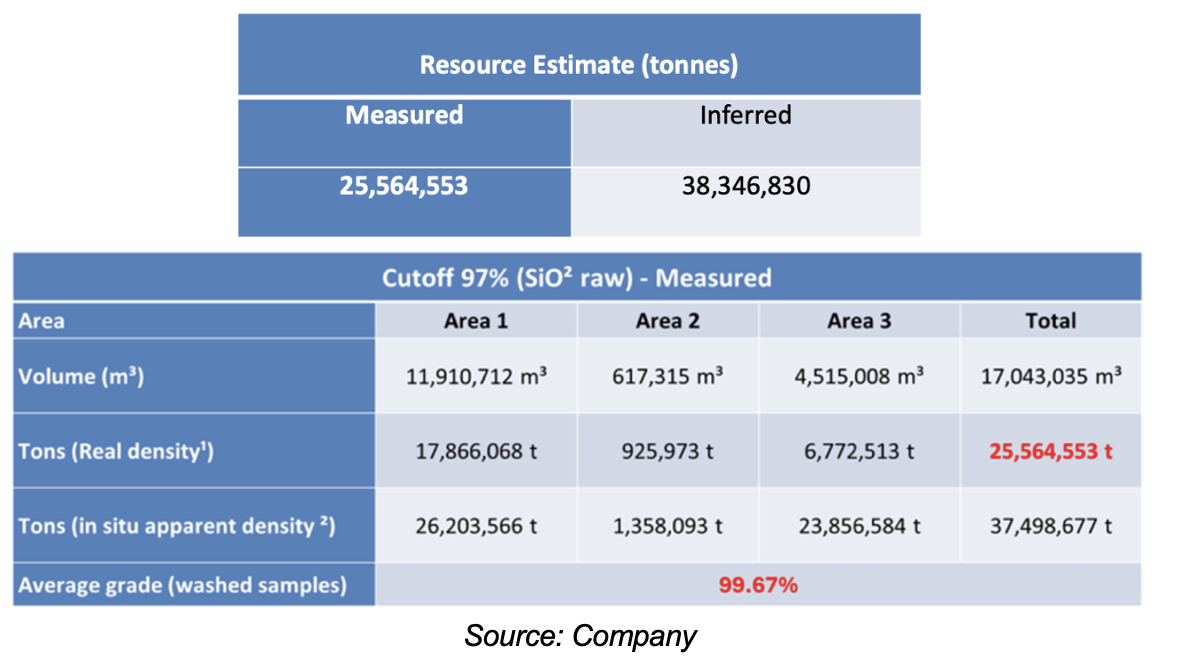

A medium-sized, open-pit resource totaling 64 Mt of high-purity silica sand, grading 99.67% Si02. We believe there is significant resource expansion potential as the deposit remains open at depth, and a new lease remains untested

The project has already received an environmental permit, and HMR expects to receive a mining permit in the coming months.

Development Plans

The company has a near-term path to revenue through a simple quarry operation, including excavation, screening, and washing. The CAPEX for this operation is essentially zero, as the company has formed a partnership (MOU) with a local partner for the extraction, washing, and sorting of silica sand.

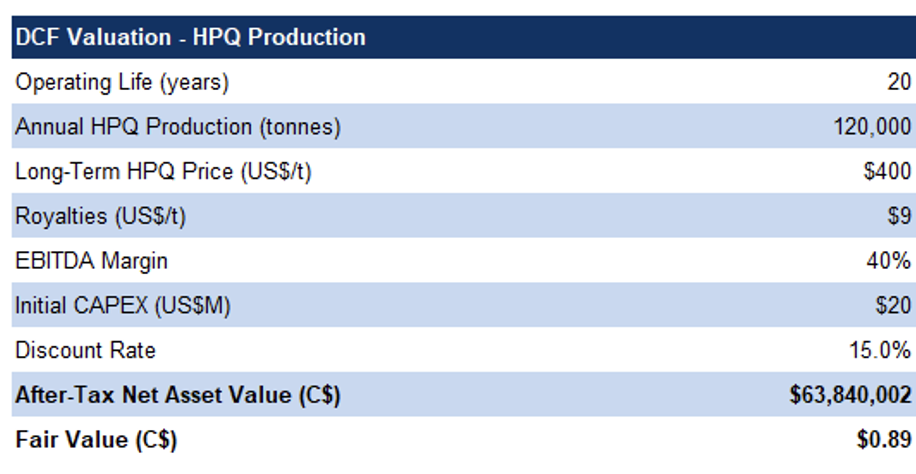

Management is evaluating the potential to develop a 120 ktpa silica sand processing plant on-site, aimed at producing HPQ with <100 ppm impurities. Management's preliminary initial CAPEX estimate is <US$20M, with the final estimate to be determined shortly by the company's engineering contractors. At 120 ktpa, we believe the 64 Mt resource could sustain production for over 500 years. Construction is projected to take 6-12 months, with production targeted to commence in H1-2026.

HMR has partnered with researchers at The University of California, Davis (UC Davis) to develop a single-step thermal processing method to purify HMR’s silica, producing HPQ with a purity of 99.999% SiO2. This process avoids harmful chemicals, and energy-intensive procedures, typically used in traditional HPQ production methods. HMR owns the Intellectual Property/IP developed through this partnership.

Near-term production potential. Evaluating the potential for a 120K tpa HPQ silica sand plant

HMR’s Primary Target Markets & End-User Applications

Solar Market: Brazil

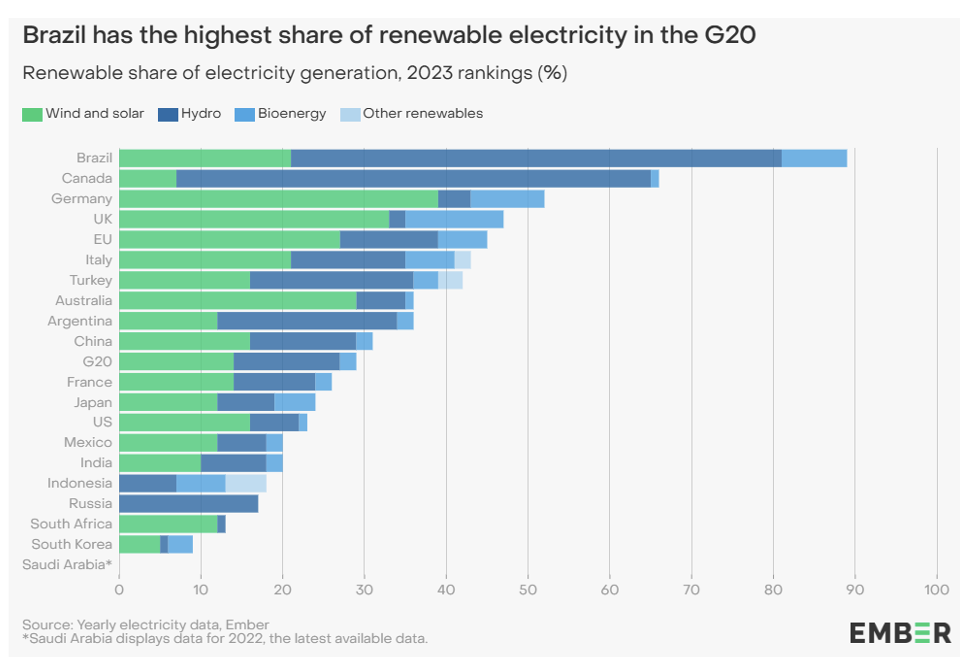

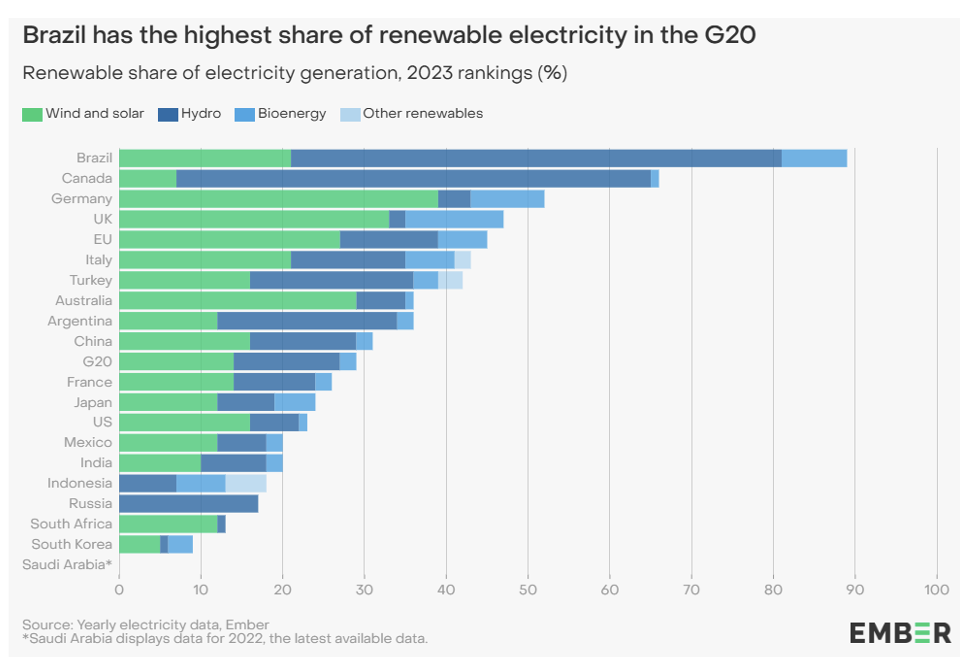

Brazil is a leader in renewable electricity within the G20, with 89% of the country’s electricity generated from renewable sources. Solar power accounts for approximately 7% of Brazil’s total electricity generation, and 22% of Brazil’s total installed electricity capacity, making it the second-largest source of generation, behind hydropower.

Brazil: a G20 leader in renewable energy

Brazil's solar electricity generation is projected to grow at an annual rate of 20.06% from 2025 to 2029 (Source: Statista). The country has seen remarkable growth in its solar PV capacity, expanding nearly sixfold in the past five years. By December 2024, installed capacity is expected to reach close to 55 GW, with projections showing a rise to 97.46 GW by 2028 (Source: Energybiz).

Its is estimated that Brazil’s solar energy market will grow at a rate of 23% during 2025 to 2030

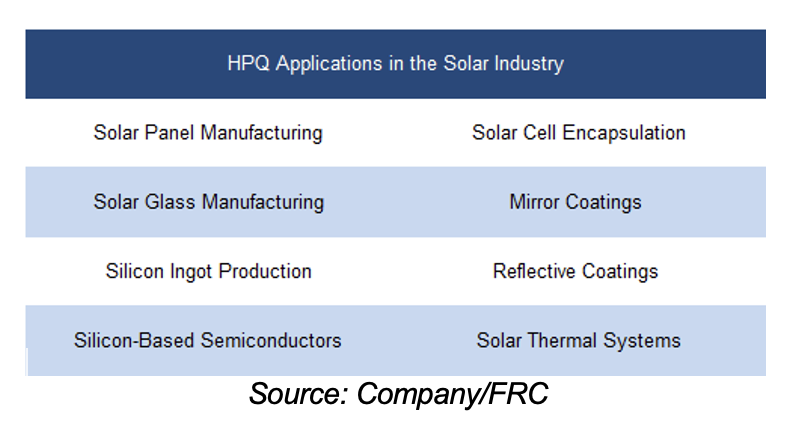

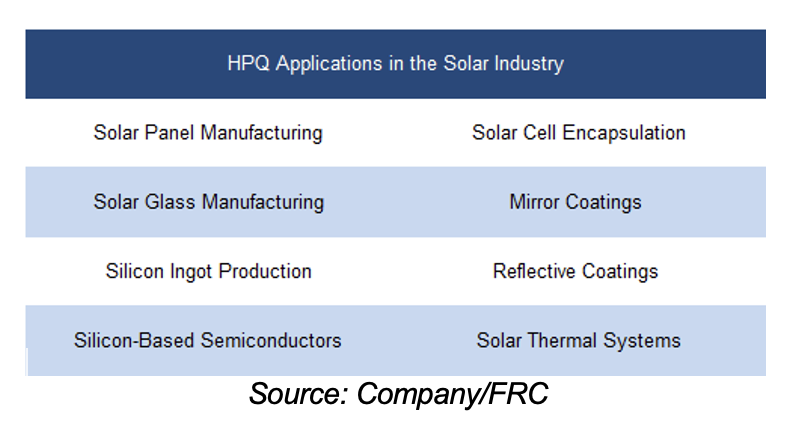

HPQ has diverse applications across the solar industry

Solar Glass Manufacturing

HPQ is an indispensable raw material for the solar industry, playing a crucial role in various stages of solar panel production.

HPQ plays a crucial role in the production of solar glass, a key component in solar panels that enhances sunlight transmission, and protects photovoltaic cells. Currently, the solar glass market is predominantly controlled by Asian producers, particularly in China, from which Brazil imports a substantial share of its requirements.

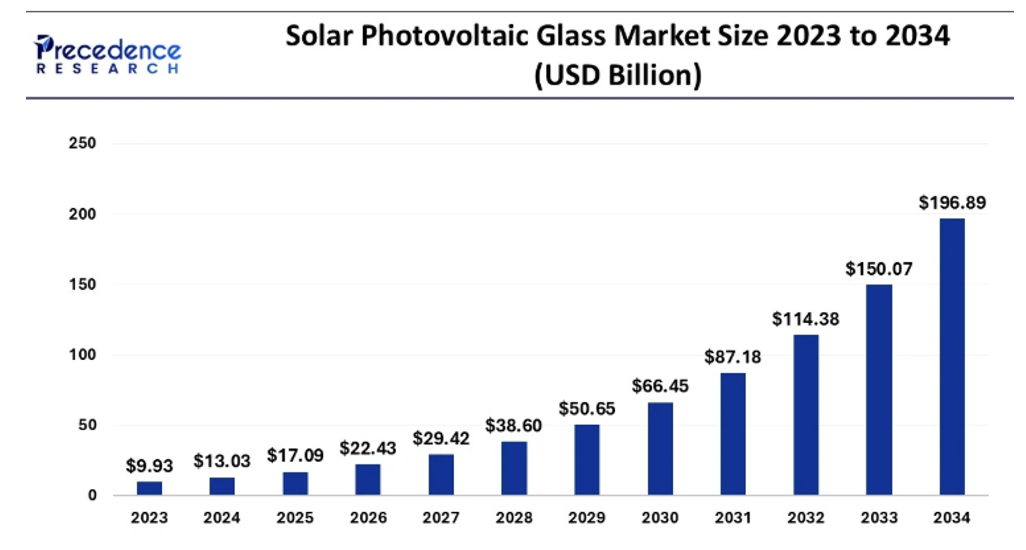

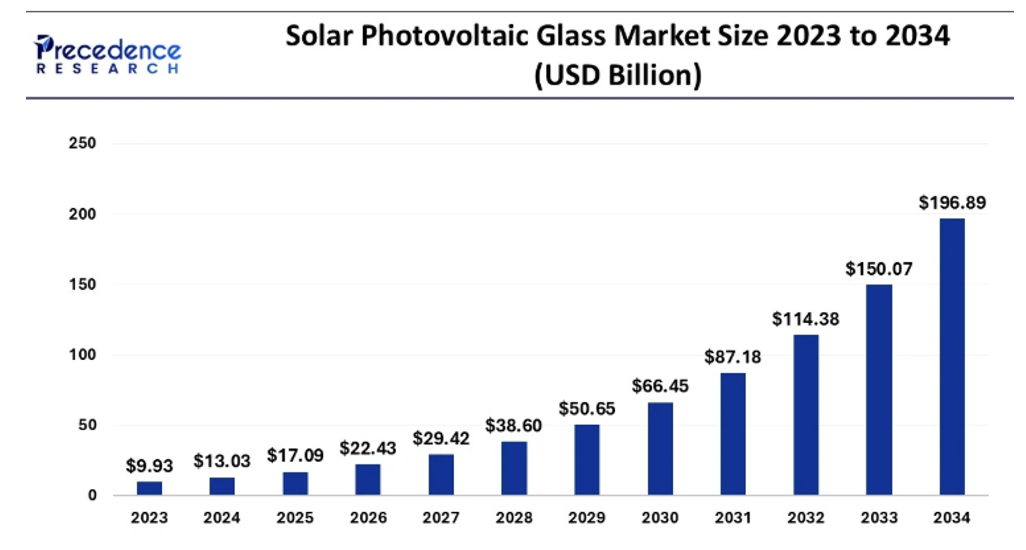

It is estimated that the global solar glass market will grow from $13B in 2024, to US$197B by 2034, reflecting a 31% CAGR

HMR to build Latin America's first solar glass plant. Secures potential offtake agreements. Strong potential with risks ahead

HMR aims to disrupt this import dependency by establishing Latin America's first solar glass manufacturing facility near the port of Aratu, Brazil. The Brazilian government has implemented a 25% tariff on imported Chinese solar components, including glass, while offering tax incentives for domestic production, creating a favorable environment for HMR's initiative. This aligns with Brazil's expanding solar panel market, and its drive for self-sufficiency in the renewable energy sector.

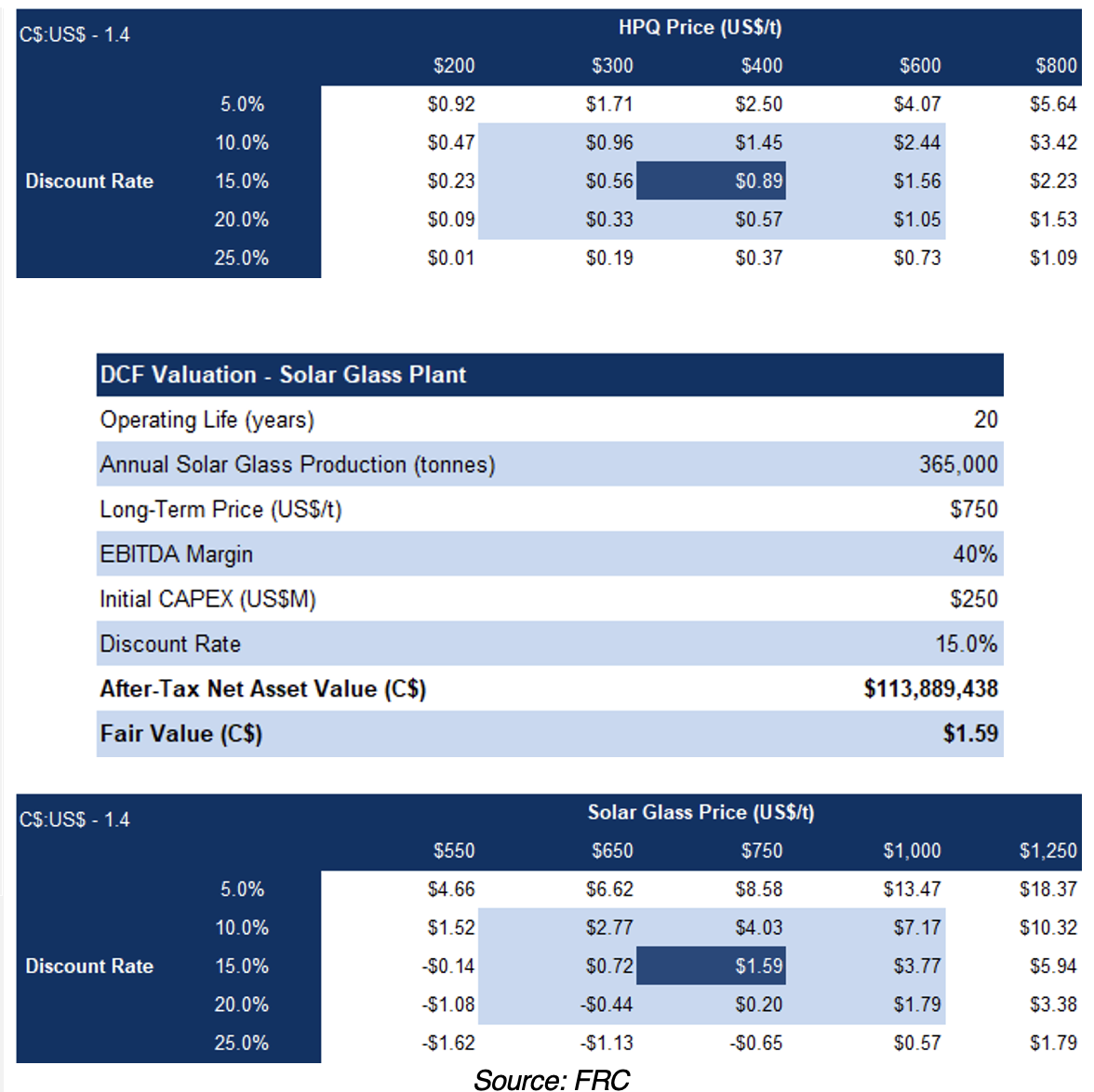

The company has secured significant potential offtake agreements, including multiple Letters of Intent (LOI) with solar panel manufacturers (current and planned) in Brazil. Sengi Solar and Balfar Solar, two leading Brazilian solar panel manufacturers, have committed to a minimum of 120 kt per year at a price of US$750/t, which is in line with current market prices for imported solar glass in Brazil.

To advance the project, HMR has engaged two consultants to complete a feasibility study. A leading German turn-key glass plant provider has quoted US$165M for a 365,000-tonne per year state-of-the-art glass production plant. HMR anticipates completing the feasibility study by the end of the year, followed by project financing. Construction is projected to take 12 months, with production targeted to commence in H1-2027.

Overall, we believe HMR has a solid plan to capitalize on Brazil's growing solar market, and meet the country's demand for domestic solar glass production. However, as a new company in its early stages, it faces all the execution risks typical of such ventures. The upcoming feasibility study will provide much more clarity on the future prospects of this initiative.

The table below outlines HMR's two other major initiatives.

Homerun Energy: Formed Through Halocell Europe Acquisition (Closed in March 2025)

- Expanded into solar and energy storage solutions by acquiring Halocell Europe from Halocell Energy (AUS) for 1.1M shares, and A$600k in cash

Halocell's Technology

- Halocell is an Italian company specializing in perovskite solar cell technology

- Perovskite technology uses unique crystal structures for efficient sunlight-to-electricity conversion

- Initial commercial focus is on tandem configurations (perovskite/silicon) to boost solar module efficiency

- The technology is in early stage of commercialization

- Research Funding: US$2M in active grants for research, and commercialization

- Sufficient working capital to self-fund for 18 months

Silica Sand Thermal Energy Storage: HMR and NREL Collaboration

- HMR and the U.S. Department of Energy's National Renewable Energy Laboratory (NREL) are collaborating to develop a novel thermal energy storage system using high-purity silica sand. The system aims to provide energy storage for purification, industrial heat, and electricity arbitrage.

- The project is heading to the commercial pilot phase, involving prototype testing, design optimization, manufacturing, and economic viability assessment.

- Management plans to scale up to full manufacturing of the modular version within 36 months

- Commercialization is dependent on successful demonstration of technical, and economic feasibility

Multiple near-term catalysts

Through its acquisition of Halocell Europe, the company has obtained an option to acquire a 60% interest in SeisSolar Fotovoltaica for US$11M, payable over three years. SeisSolar is a European B2B distributor of solar, battery, inverter and EV charger products. Over 2022–2024, SeisSolar generated US$78M in revenue, averaging US$26M per year, implying HMR’s 60% stake would have equated to US$16M/year. Management has yet to disclose information on this business’s profitability or margins. HMR intends to close this acquisition in the coming months.

Upcoming Catalysts

- Receipt of a mining permit for the Santa Maria Eterna resource, followed by project financing, and the construction of an on-site processing facility to produce purified HPQ silica.

- Advancement of studies for constructing an on-site processing facility to produce HPQ silica.

- Results of an ongoing feasibility study for the proposed glass manufacturing facility.

- Monetization of HaloCell Europe’s existing and pending revenue streams, with a focus on commercializing solar and energy storage solutions.

- Completion of the acquisition of a 60% interest in SeisSolar.

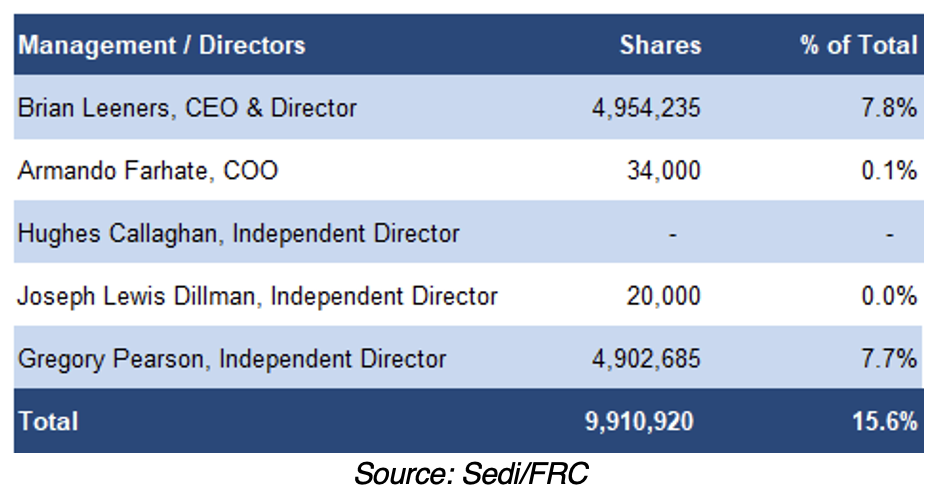

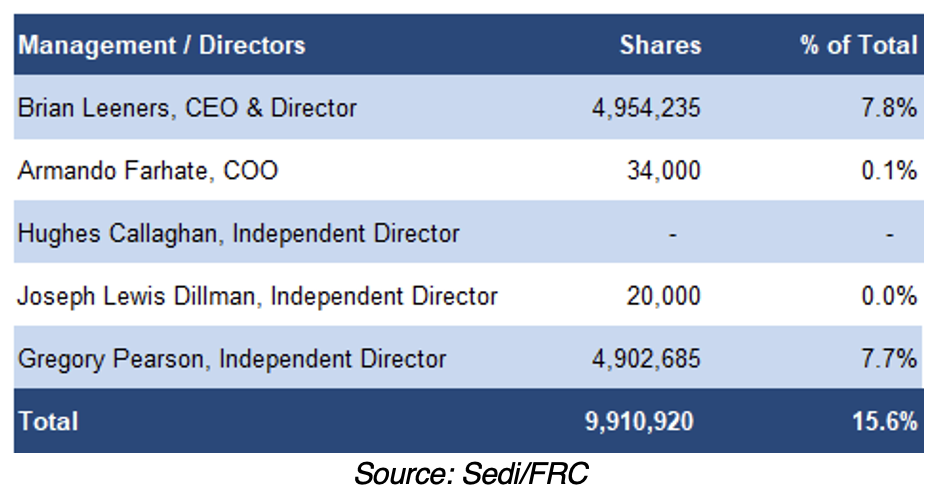

Management and board own 16%. Three out of four directors are independent

Brief biographies of management/board members, as provided by the company, follow:

Brian Leeners, CEO & Director

Brian Leeners received both his B.Comm. and LL.B. degrees from the University of British Columbia in 1992. In 2002, he founded Nexvu Capital Corp. which is a venture capital firm focused on developing companies in the Materials and Technology Sectors. Nexvu has been directly responsible for raising in excess of US$100M in venture capital.

Armando Farhate, COO

36 years of industry experience, with the last 13 years being in the mining sector. He has occupied C-Level and Upper Management positions in mining companies in Brazil, Canada, Namibia and Botswana; special focus on Operations, Sales & Marketing, Engineering and Mineral Resource Development.

Antionio Vitor, Country Manager Brazil

Antionio has experience in project management at large corporations, including Transpetro, PwC, Shell, along with 10 years of experience in mining. He graduated in Business Administration and holds an MBA.

Dr. Mauro Cesar Terence, CTO

Doctorate in Nuclear Engineering from Universidade de São Paulo (2002). Experienced in Material and Metallurgical Engineering, in the following subjects: Advanced Materials, Nano Materials, Biomaterials, Ceramics, Blends and Polymers.

Greg Pearson, Independent Director

Mr. Pearson has over 30 years of experience in the private and public sector capital markets during which time he has been directly responsible for over $100M in financings.

Hugh Callaghan, Independent Director

Hugh Callaghan spent several years with Rio Tinto plc and Xstrata in corporate management roles that included assignments at Escondida, Kennecott Copper, and Mt Isa operations. He subsequently founded or managed a number of junior companies with assets in Latin America, and has built mines in Chile and Mexico. Hugh is currently Chief Operating Officer of ASX listed EV Resources Limited.

J. Lewis Dillman, Independent Director

J. Lewis Dillman has over 20 years experience in managing, financing and operating, public and private oil and gas companies. He has extensive contacts in the oil and gas industry and actively raises funds for energy deals in capital markets. Mr Dillman holds a Masters degree in International Affairs from Columbia University in New York.

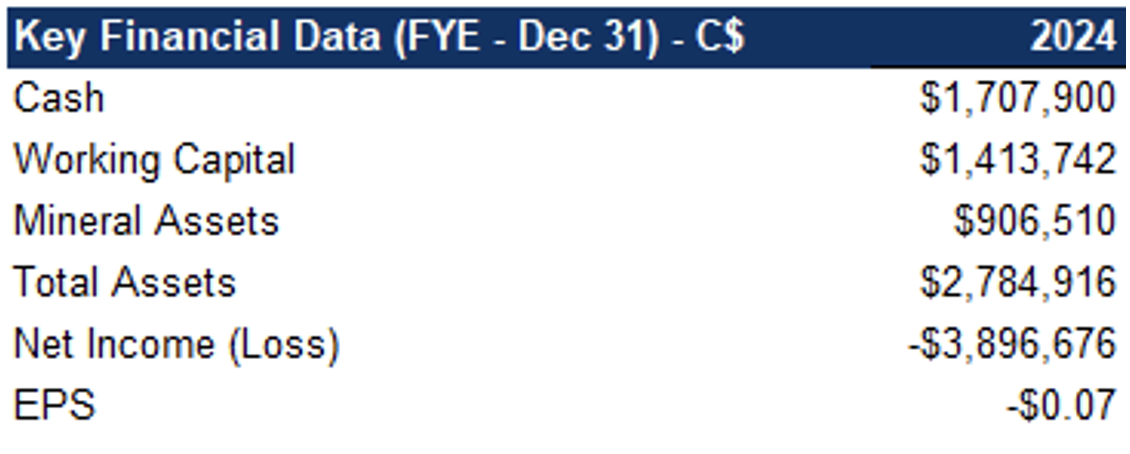

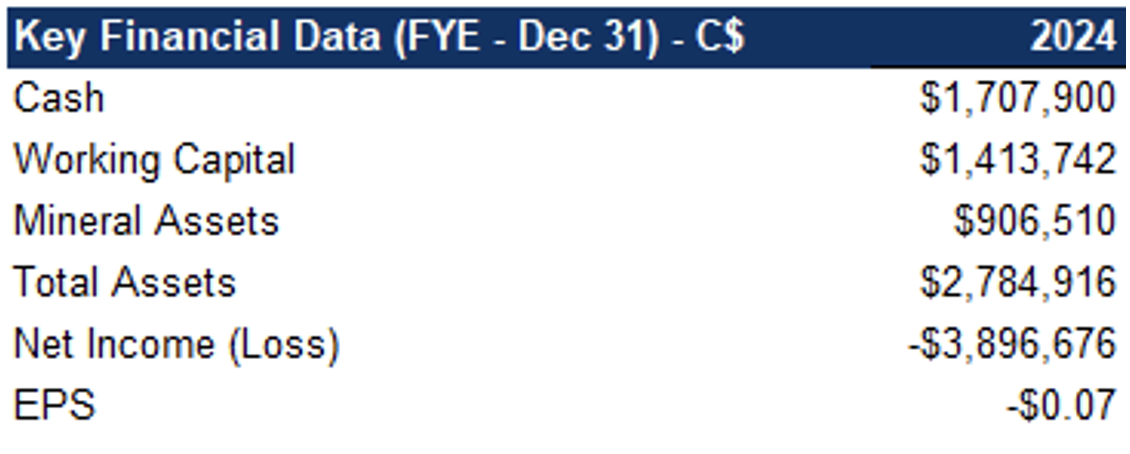

Financials

Healthy balance sheet. Currently pursuing a $3M equity financing. Can raise up to $4.8M from in-the-money options and warrants

FRC Projections and Valuation

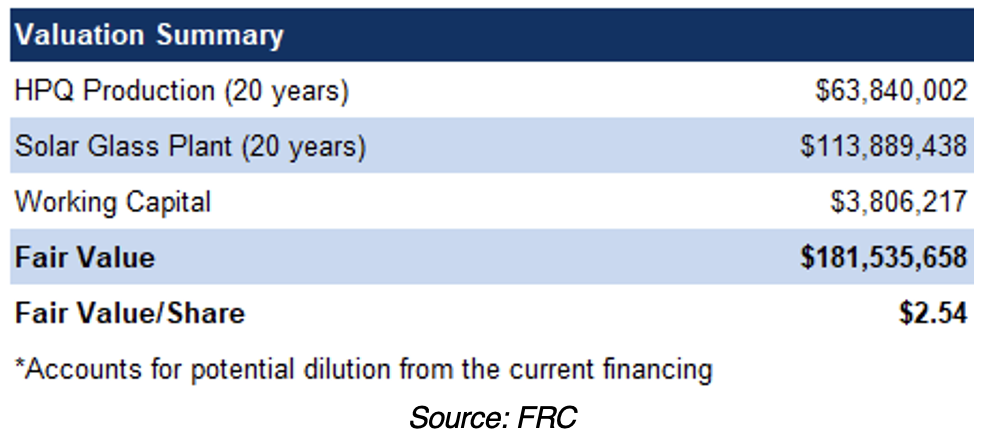

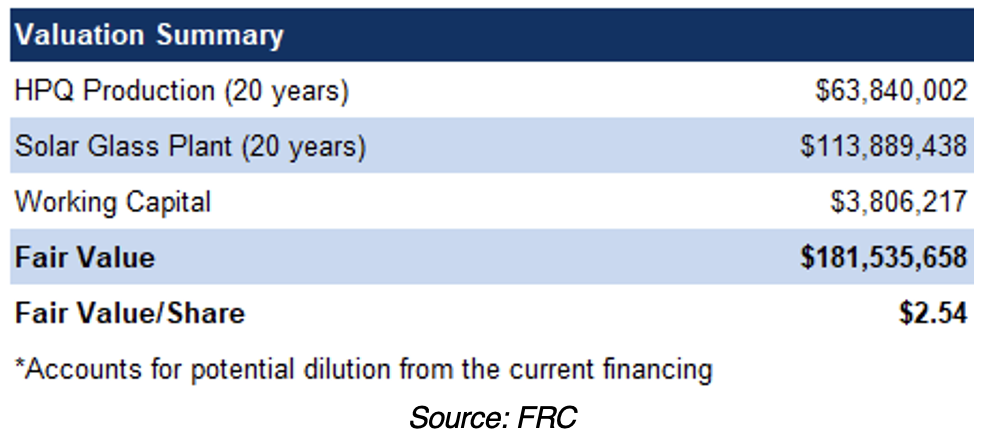

There are several publicly traded silica juniors with advanced-stage assets, but they are not directly comparable to HMR. Most are pure explorers/developers with no vertical integration plans, and many have higher impurity levels, making their processes more capital-intensive. As a result, we are valuing HMR based on our Discounted Cash Flow models on the two main flagship initiatives: a) HPQ silica production from a potential 120 ktpa operation at the Santa Maria Eterna silica project, and b) the proposed 365 ktpa solar glass manufacturing plant. For the sake of conservatism, we are not assigning any value to the company's other initiatives.

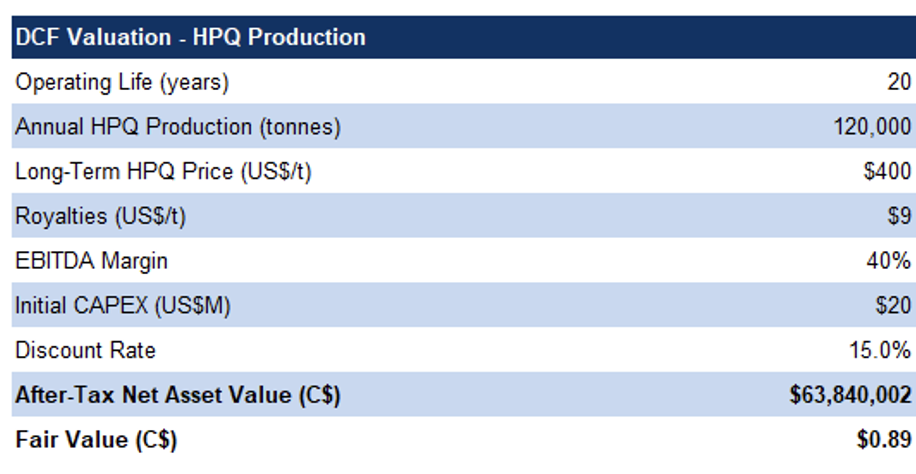

Based on a conservative 20-year mine life, we are valuing the company’s HPQ project at $0.89/share

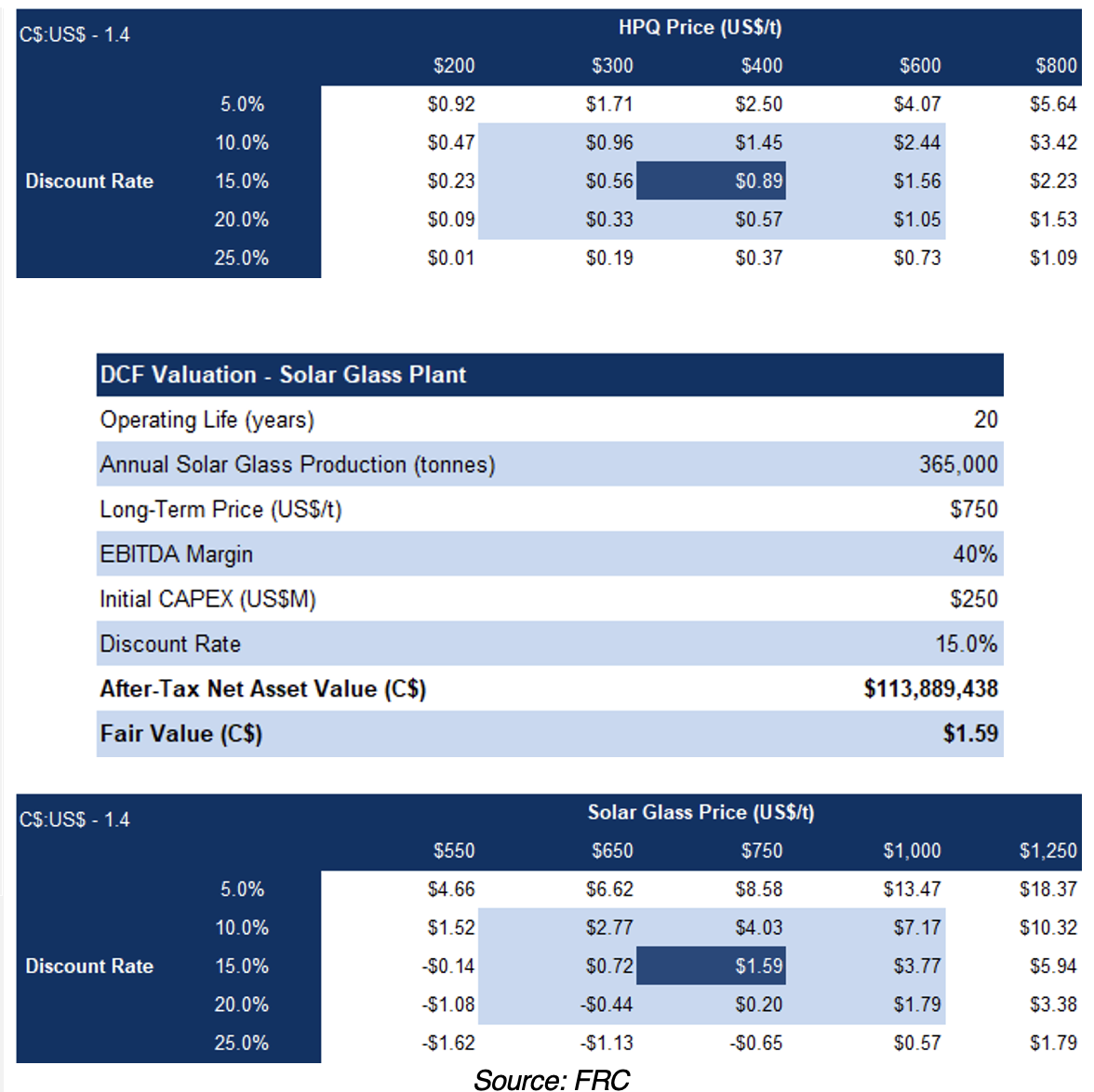

Below is a summary of our valuation models, including assumptions, key inputs, and sensitivity analysis.

Based on a conservative 20-year mine life, we are valuing the company’s proposed solar glass plant at $1.59/share

Assigning a risk rating of 5 (Highly Speculative)

Based on our review of the company’s projects, and management initiatives, we are initiating coverage with a BUY rating, and a fair value estimate of $2.54/share. We believe HMR presents a notable yet complex opportunity through its ambition to establish a vertically integrated HPQ operation, capitalizing on Brazil's import reliance, and the growing solar and energy storage sectors. Monitoring upcoming milestones, particularly the mining permit, and updates on the proposed glass manufacturing plant, and other solar and energy storage end-user initiatives, will be crucial in assessing HMR's execution viability.

Risks

We believe the company is exposed to the following risks (list is non-exhaustive):

- Commodity prices

- Permitting and development

- No economic studies

- Access to capital and potential for share dilution

- FOREX

- The company’s multi-track approach may be harder for investors to follow, but it also spreads risk across multiple opportunities