Junior Resource Financings Surge, Signaling Sector Rebound

Published: 12/2/2024

Author: FRC Analysts

Highlights

In this edition, we analyze the performance of our top picks, including a tech stock under coverage, whose shares rose 21% last week. We also highlight key updates from a silver producer that reported robust Q3 results, along with a series of financings by juniors, indicating growing investor appetite, and a potential turnaround in the junior resource space. Additionally, we present a snapshot of an advanced-stage, low-CAPEX copper junior, on which we will be initiating coverage shortly.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

- Introducing an advanced stage copper junior to our coverage

Commentary on Resource Companies Under Coverage

Silver X Mining Corp. (AGX.V, AGXPF)

PR Title: Announces Q3 results; owns a silver-polymetallic mine in Peru

Analyst Opinion: Positive – Revenue was up 139% YoY, while cash costs were down 32% YoY. As a result, EBITDA improved YoY from negative $1M to negative $0.1M. AGX produced 257 Koz silver equivalent, up 170% YoY. The company’s vision is to expand annual production to over 6 Moz of AgEq within the next few years. We will reinitiate coverage shorty.

PR Title: Ganfeng Lithium’s (SZSE: 002460) Mariana lithium project on track to start production in the coming weeks (Argentina)

Analyst Opinion: Positive – The Mariana lithium project, 100% owned by Ganfeng, hosts a large lithium-potassium brine resource. TNR has a 1.35% net smelter return (NSR) royalty on the project, with payments potentially starting next year. At current spot lithium prices, we project annual royalty revenue of over $1M for TNR.

Tartisan Nickel Corp. (TN.CN, TTSRF)

PR Title: Closes a $1.5M financing

Analyst Opinion: Positive – Proceeds will be used to fund the exploration and development of the company’s flagship Kenbridge nickel project in Ontario. Kenbridge hosts high-grade open-pittable/underground class 1 nickel resources, essential for lithium-ion batteries in electric vehicles (EVs). TN is currently constructing an all-season road for the project, which will significantly reduce exploration costs.

CMC Metals Ltd. (CMB.V, CMCXF)

PR Title: Delivers an updated resource estimate for the Silver Hart project (Yukon)

Analyst Opinion: Positive – Resources increased by 18% to 8.82 Moz AgEq, spread across five zones. Silver Hart hosts high-grade silver-lead-zinc veins, carbonate replacement deposits (CRD), and skarns. We will publish a detailed update shortly.

Southern Silver Exploration Corp. (SSVFF, SSV.V)

PR Title: Announces a $2.2M financing

Analyst Opinion: Positive – Proceeds will be used to fund the development of the Cerro Las Minitas project in Durango, Mexico. Earlier this year, SSV completed an updated PEA which returned an AT-NPV5% of US$501M, and an AT-IRR of 21%, using US$23/oz silver. Drilling is underway to potentially expand the mineralized areas within the three existing deposits.

Churchill Resources Inc. (CRI.V, CRICF)

PR Title: Pursuing a $2M private placement

Analyst Opinion: Positive – Proceeds will be allocated to support exploration activities at two nickel projects: Taylor Brook and Florence Lake, both located in Newfoundland and Labrador. These properties exhibit potential for hosting nickel sulphide deposits, which are a primary source of class 1 nickel used in lithium-ion batteries.

Equity Metals Corporation (EQMEF, EQTY.V)

PR Title: Announces a $2.2M financing

Analyst Opinion: Positive –Proceeds will be directed towards advancing the Silver Queen property, and the recently acquired Arlington gold property, both located in B.C. Silver Queen hosts resources totaling 1.04 Moz AuEq (85 Moz AgEq) at 6.2 g/t AuEq (512 g/t AgEq).

DLP Resources Inc. (DLPRF, DLP)

PR Title: Announces a $2.1M financing

Analyst Opinion: Positive – Proceeds will be used to fund DLP’s two copper-molybdenum properties (Aurora and Esperanza) in Peru. Drilling at its flagship Aurora project has delineated a large mineralized area (1.1 km long x 0.95 km wide x 1 km deep), and we believe the project has potential to host 5+ Blbs CuEq. Management is aiming to complete a maiden resource estimate in Q1-2025.

Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

PR Title: Announces a $25M bought deal financing

Analyst Opinion: Positive - Although Q3 revenue was down 19% YoY, we expect Q4 revenue to recover as clients ramp up operations following earlier delays. We believe the re-election of Trump will provide a major boost for the Oil and Gas Services sector, as his administration is expected to support incresead oil and gas spending in the U.S. While Enterprise lacks direct exposure to the U.S., and is unlikely to see a direct benefit, we expect positive investor sentiment for the broader North American energy services sector.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Kidoz Inc., was up 21%. We published an update report last week. KIDZ’s forward EV/R is 0.9x vs the sector average of 3.03x, a 72% discount. We anticipate EPS will turn positive in 2025, while management expects they may be able to break even this year.

| Top Five Weekly Performers | WoW Returns |

| Kidoz Inc. (KIDZ.V) | 20.8% |

| Zepp Health Corporation (ZEPP) | 12.9% |

| Sabre Gold Mines Corp. (SGLD.TO) | 5.3% |

| Builders Capital Mortgage Corp. (BCF.V) | 4.8% |

| South Star Battery Metals Corp. (STS.V) | 3.7% |

| * Past performance is not indicative of future performance (as of Dec 2, 2024) |

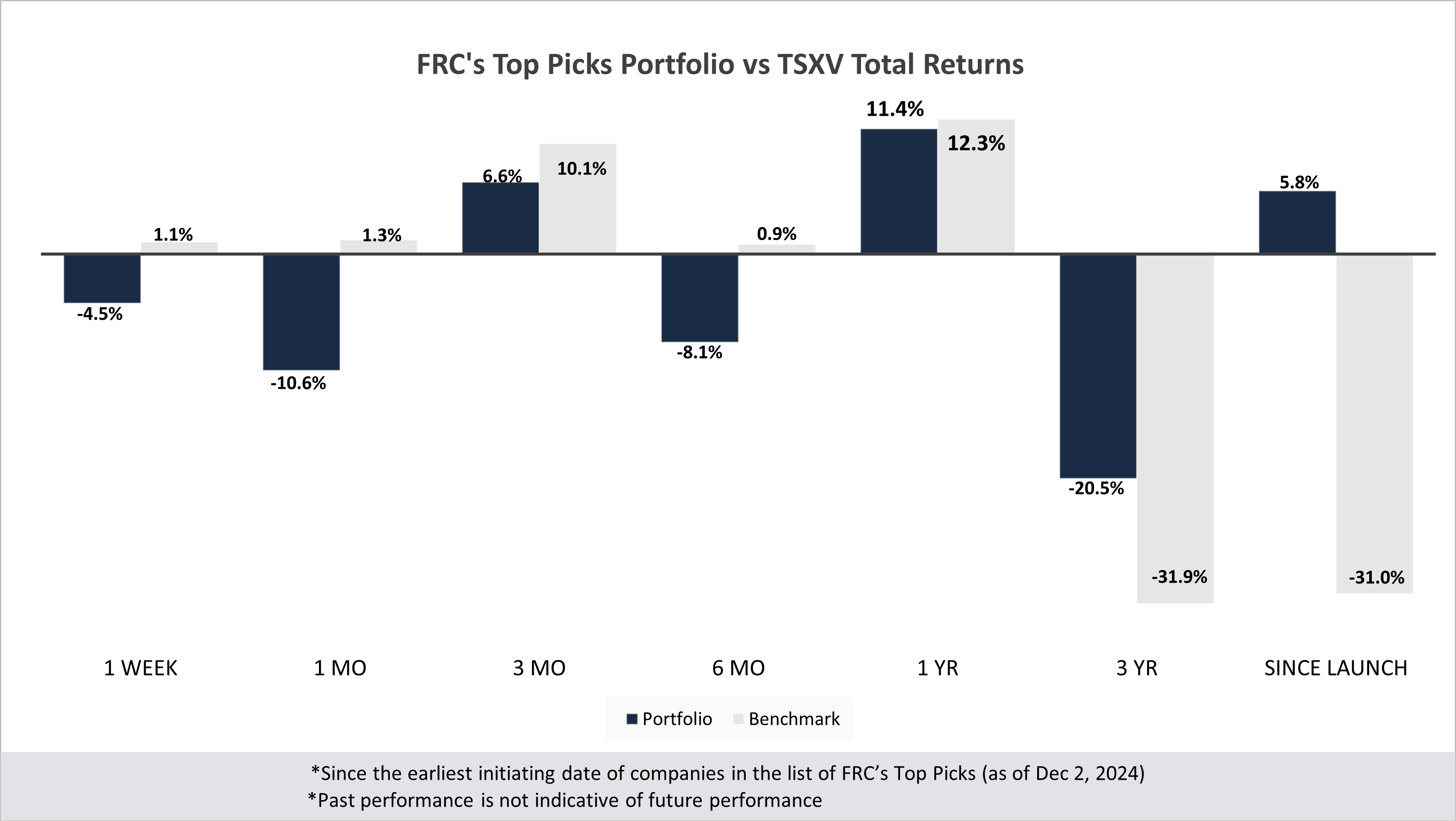

Performance by Sector

| Total Return | 1 Week | 1 mo | 3 mo | 6 mo | 1 yr | 3 yr | Since launch |

| Mining | -6.7% | -13.4% | 6.5% | -13.5% | 7.9% | -38.3% | -4.0% |

| Cannabis | N/A | N/A | N/A | N/A | N/A | -31.8% | -23.6% |

| Tech | 20.8% | 3.6% | 7.4% | -40.8% | -29.3% | -27.1% | -4.6% |

| Special Situations (MIC) | -3.1% | -5.4% | 8.4% | 20.3% | 50.3% | -26.3% | 7.5% |

| Private Companies | N/A | N/A | N/A | N/A | 6.7% | 20.5% | 30.5% |

| Portfolio (Total) | -4.5% | -10.6% | 6.6% | -8.1% | 11.4% | -20.5% | 5.8% |

| Benchmark (Total) | 1.1% | 1.3% | 10.1% | 0.9% | 12.3% | -31.9% | -31.0% |

| Portfolio (Annualized) | - | - | - | - | 11.4% | -7.3% | 0.5% |

| Benchmark (Annualized) | - | - | - | - | 12.3% | -12.0% | -3.3% |

1. Since the earliest initiating date of companies in the list of Top Picks (as of Dec 2, 2024)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

Introducing an advanced stage copper junior to our coverage: Canadian Critical Minerals Inc. (TSXV: CCMI / OTCQB: RIINF / MCAP: $12M)

We have begun our due diligence on CCMI. We covered the stock from 2020 to 2022, and plan to relaunch coverage in the coming weeks. Below is a brief overview of CCMI’s portfolio and our initial assessment.

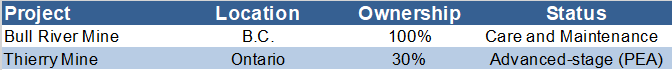

The company owns two advanced-stage copper projects: the Bull River mine in B.C., and the Thierry mine in Ontario. CCMI has received an offer from QC Copper and Gold (TSXV: QCCU) to purchase its 30% interest in the Thierry mine project for $3.5M in shares. We believe this deal will allow CCMI to maintain focus on its flagship Bull River mine, while retaining indirect exposure to QCCU’s projects through equity ownership.

Portfolio Summary

Source: FRC / Company

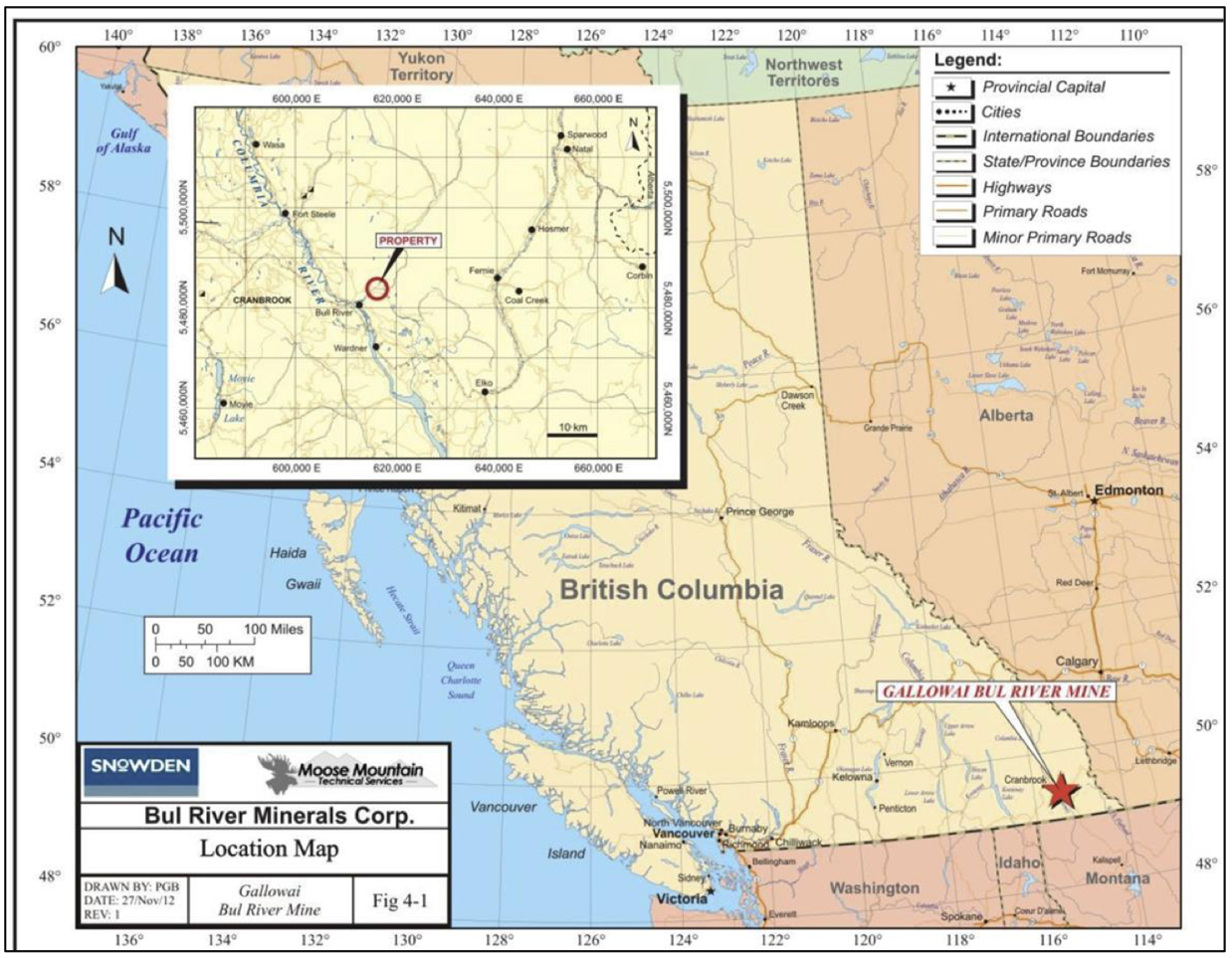

Bull River Mine, B.C.

The Bull River copper-gold-silver mine is a past producer currently in care and maintenance, with significant infrastructure in place. The property features an underground mine, a large surface stockpile, a 700 tpd mill, and 22,000 meters of underground workings.

Location Map

Source: Company

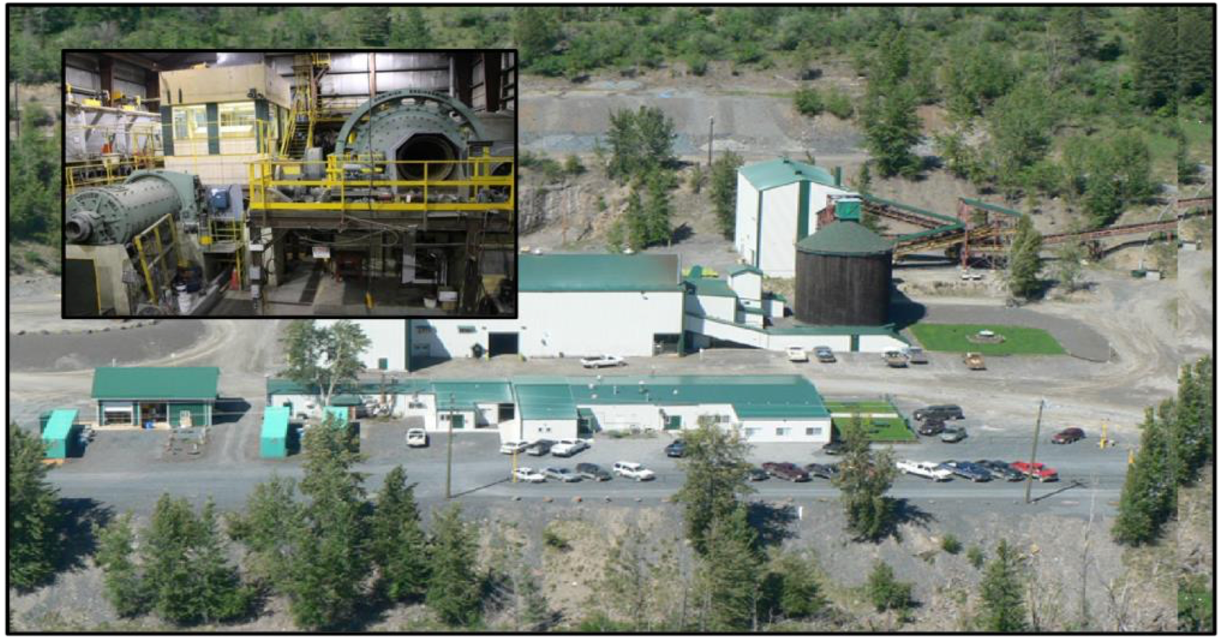

Existing Infrastructure

Source: Company

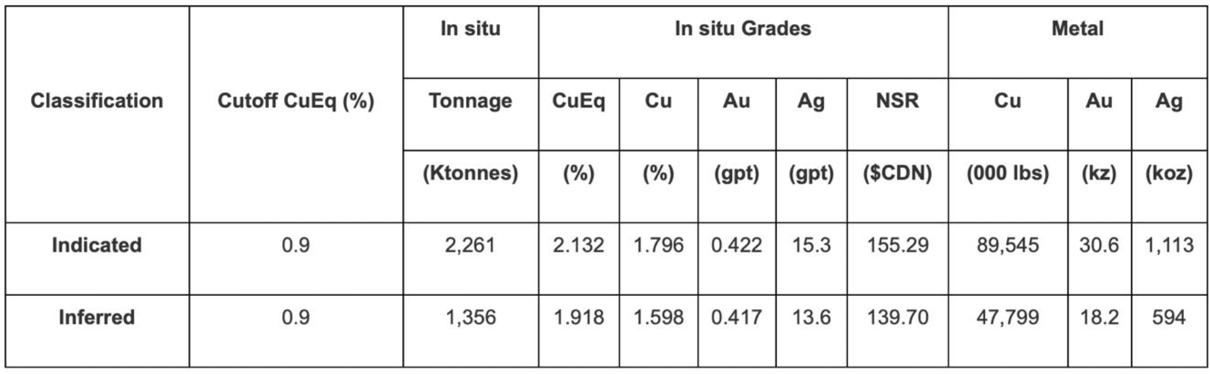

The project hosts a relatively low-tonnage/high-grade copper-gold-silver deposit, with resources totaling 164 Mlbs CuEq. In addition to the underground resource, the project hosts 6.1 Mlbs CuEq (1.7%) in surface stockpiles. Note that these grades are unusually high for stockpiles.

2021 Resource Estimate

Source: Company

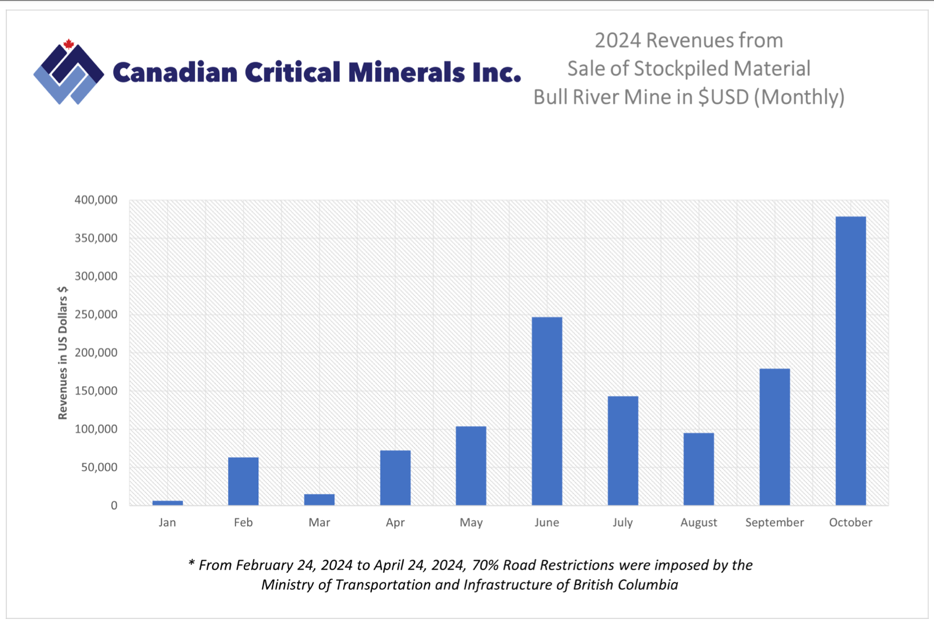

With existing infrastructure in place, the project can be advanced to production with a CAPEX of <US$15M. The company has an ore purchase agreement with New Gold’s (TSX: NGD) New Afton mill facility to supply up to 90 Kt of stockpiled ore over two years. To date, CCMI has shipped approximately 5.3 Kt of mineralized material, generating US$1.3M in revenue.

Surface Stockpile

Source: Company

Management is focused on bringing Bull River back into production. Copper projects are usually capital-intensive, but Bull River’s low CAPEX and swift path to production present a compelling opportunity for CCMI. In our previous report in April 2022, we valued Bull River at $52M, or $0.18/share. CCMI is currently trading at just $0.04/share. As mentioned earlier, we plan to initiate coverage with a detailed report and updated valuation in the coming weeks.