Kidoz Inc.

Efficiency Outweighs Revenue Headwinds

Published: 11/22/2024

Author: FRC Analysts

Sector: AdTech | Industry: Advertising

| Metrics | Value |

|---|---|

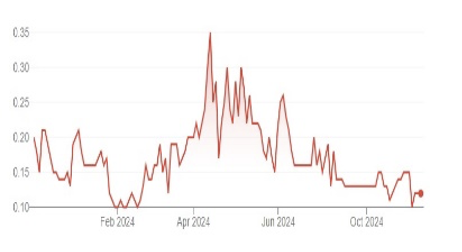

| Current Price | CAD $0.12 |

| Fair Value | CAD $0.58 |

| Risk | 4 |

| 52 Week Range | CAD $0.10-0.36 |

| Shares O/S (M) | 131 |

| Market Cap. (M) | CAD $16 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 2.6 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Q3 revenue fell 19% YoY, missing our estimate by 9% due to lower-than-expected ad sales. Despite lower revenue, EPS improved YoY, driven by higher gross margins, and lower G&A expenses.

- In Q3, major digital ad platforms experienced slower YoY spending growth relative to the first half of the year, primarily driven by economic uncertainty, and stricter data privacy laws. For instance, YouTube (NASDAQ: GOOGL) and Meta (NASDAQ: META) saw their ad revenue growth slow to 12% and 19% YoY, respectively, down from 17% and 23% in H1.

- We anticipate global ad spending growth to rise in the coming quarters amid cooling inflation, and central bank rate cuts.

- We believe KIDZ is poised to benefit from the stricter ad regulations recently introduced by U.S. COPPA 2.0 regulations. By expanding privacy protection to teens, and imposing tighter controls on data handling and targeted ads, we believe COPPA 2.0 creates a more complex landscape for advertisers. As a result, advertisers will likely turn to companies like KIDZ that specialize in kid-friendly advertising.

- In 2025, one of the company's key priorities will be promoting its newly launched ad platform, Prado, aimed at teens and parents, to broaden its target audience.

- Management anticipates a significant revenue rebound in Q4, historically accounting for 45%-50% of annual revenue.

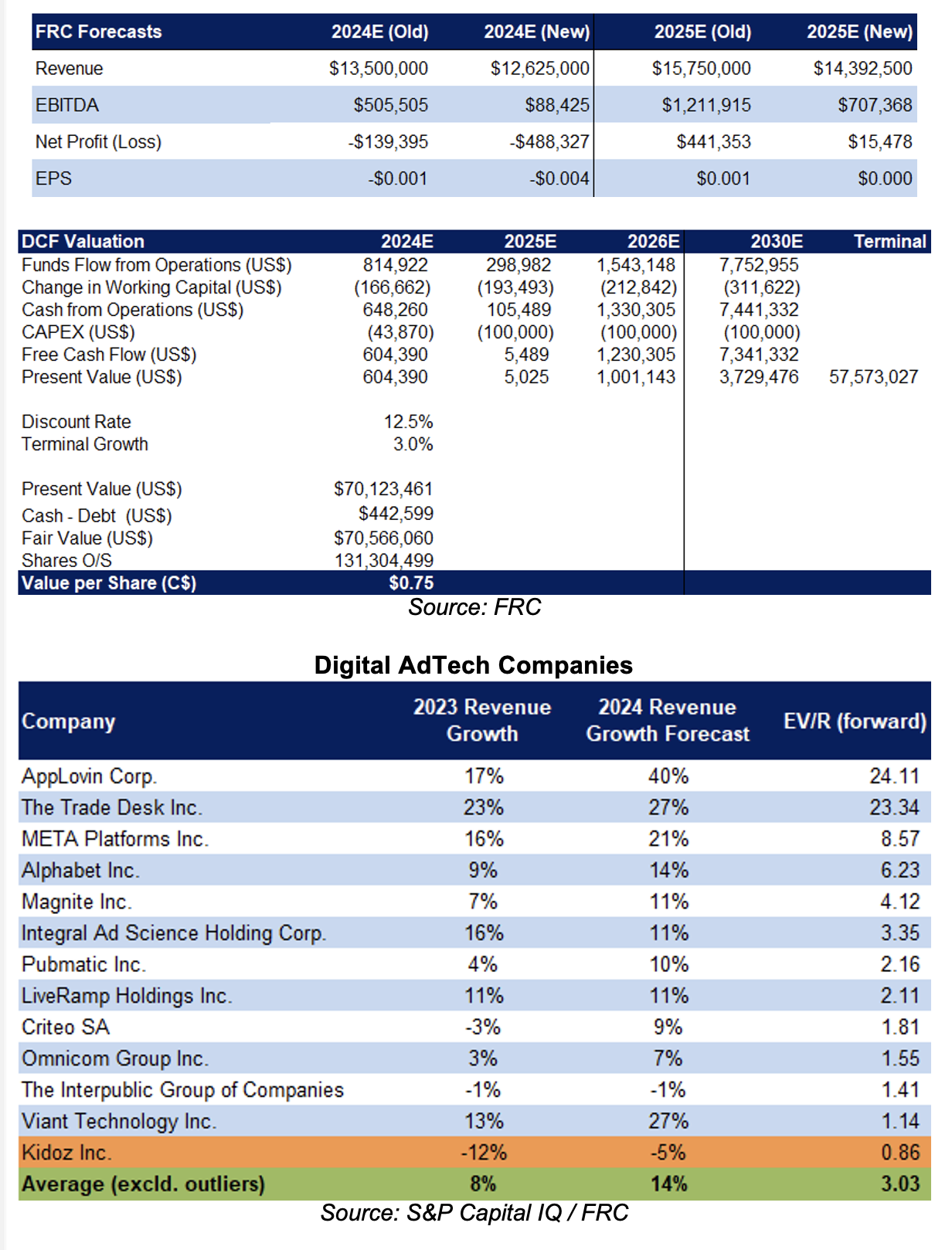

- KIDZ’s forward EV/R is 0.9x vs the sector average of 3.03x, a 72% discount. As Q3 revenue came in below expectations, we are revising our 2024 and 2025 EPS estimates downward. We anticipate EPS will turn positive in 2025, while management expects they may be able to break even this year.

KIDZ Price and Volume (1-year)

Financials

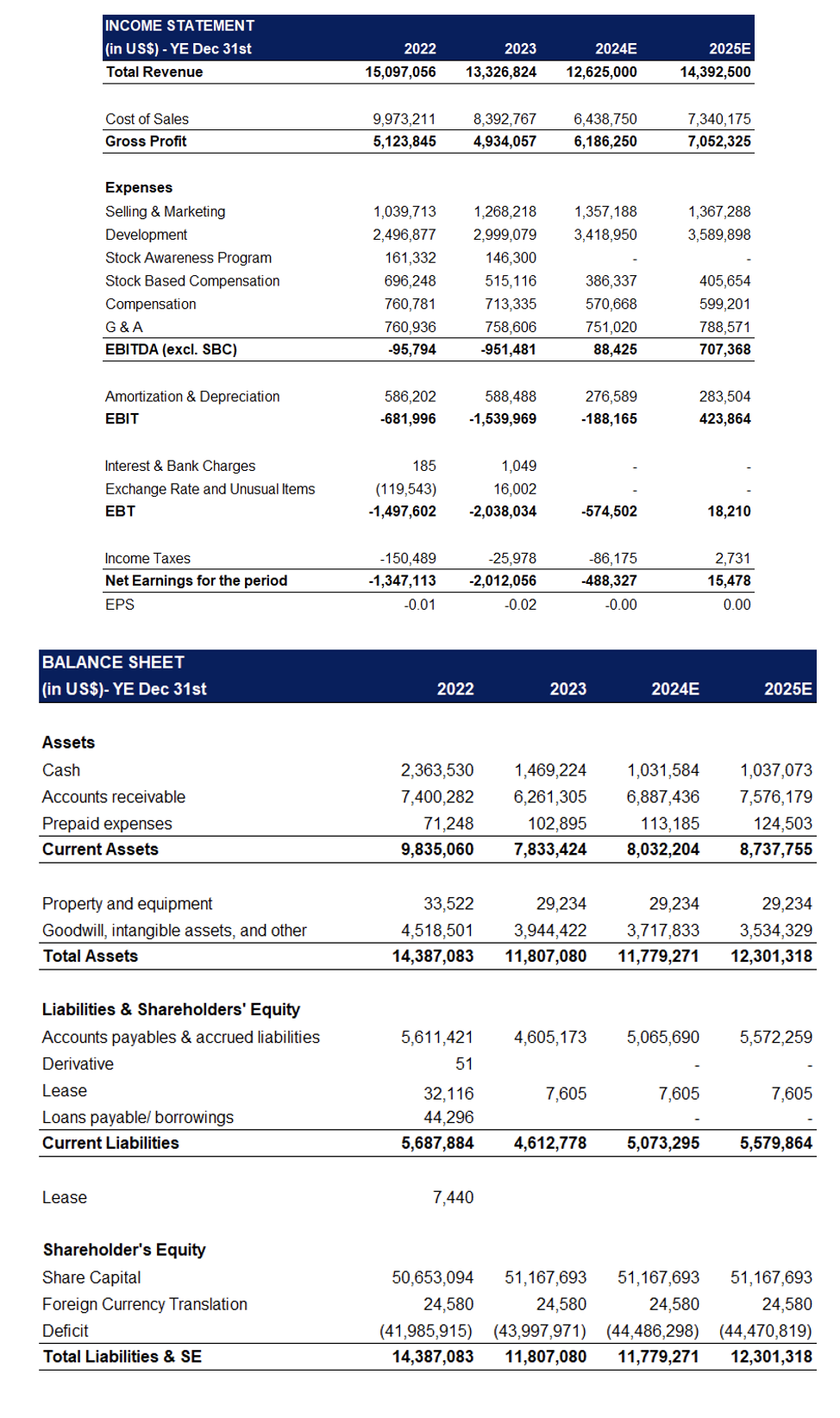

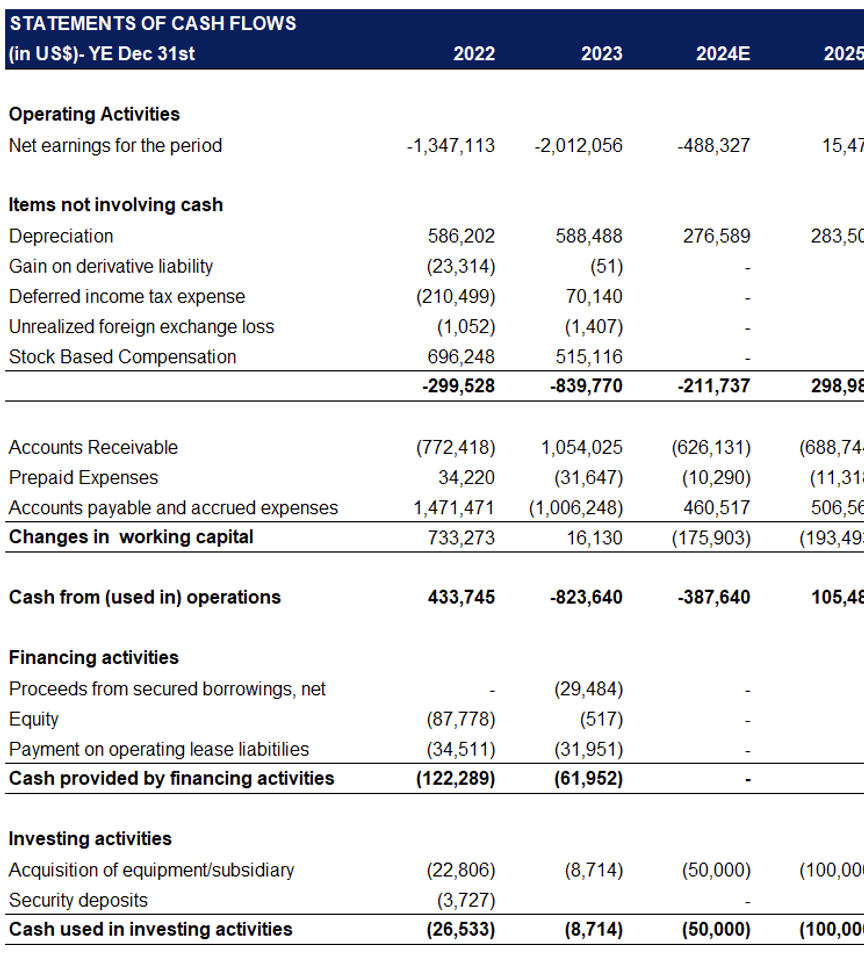

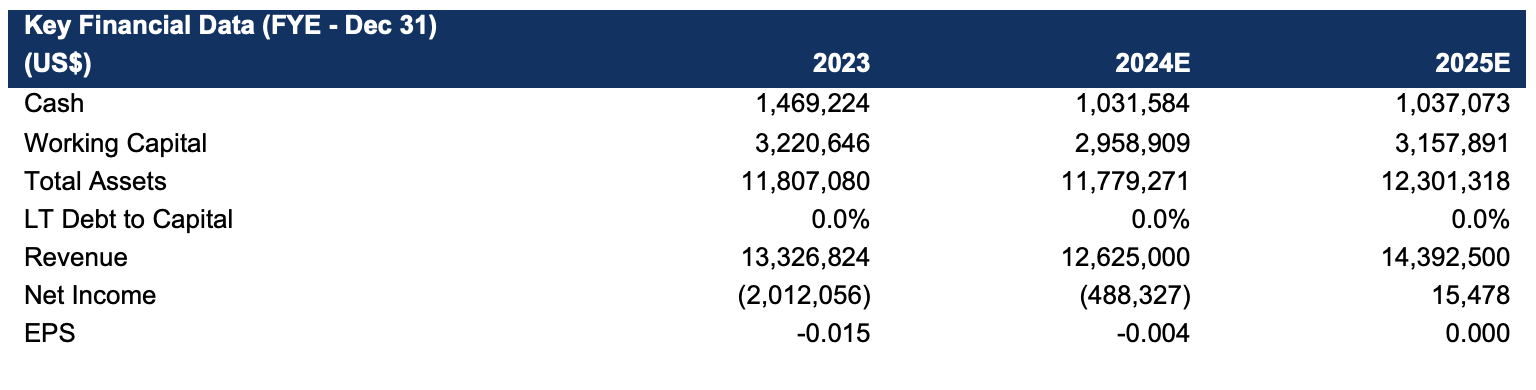

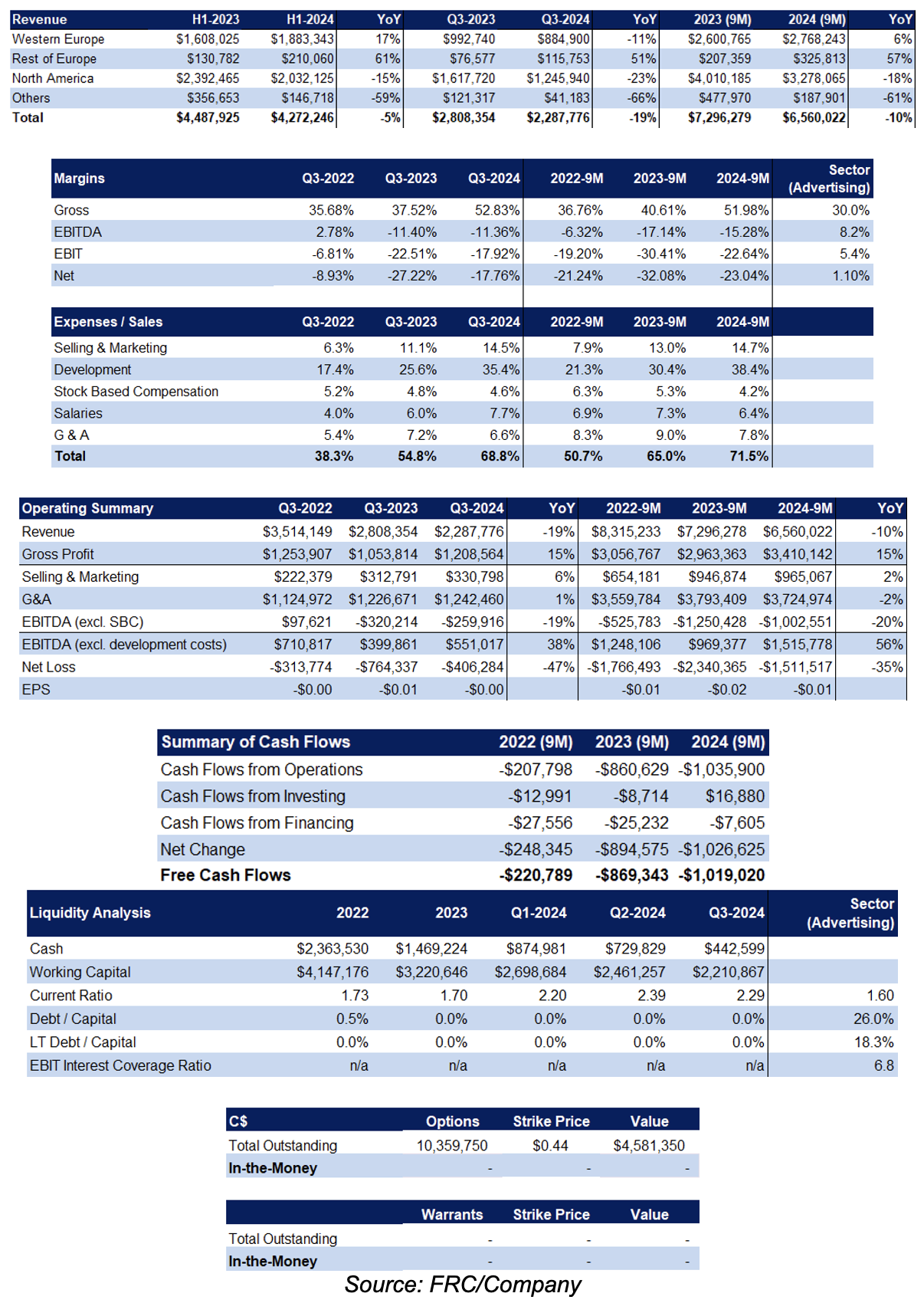

Q3 revenue was down 19% YoY (Q2: down 12% YoY), missing our forecast by 9%. However, gross margins increased 15 pp YoY to 53%, driven by higher direct vs reseller sales, and streamlined campaign execution, beating our estimate by 2 pp

G&A expenses were up 1% YoY, and in line with our estimate. As a result of higher gross margins, and lower G&A expenses, EBITDA and EPS improved, despite remaining negative

Healthy balance sheet, with no debt. No outstanding options are in-the-money

Sector Outlook

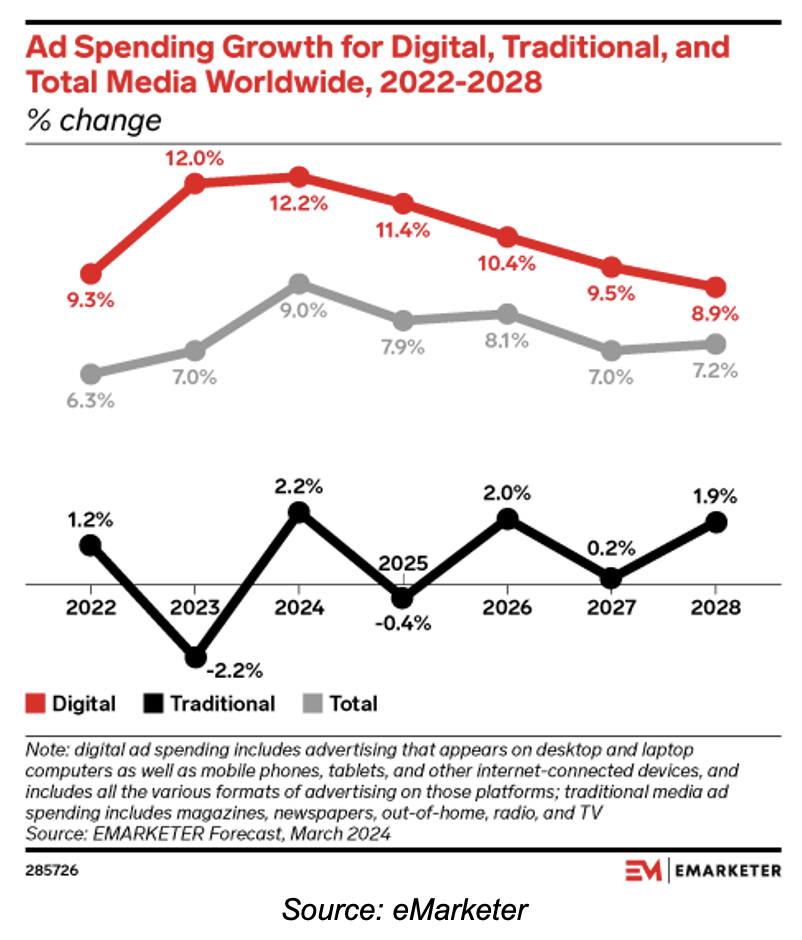

It is estimated that global digital ad spending will grow 12.2% this year, compared to 12.0% in 2023, and 9.3% in 2022

FRC Projections and Valuation

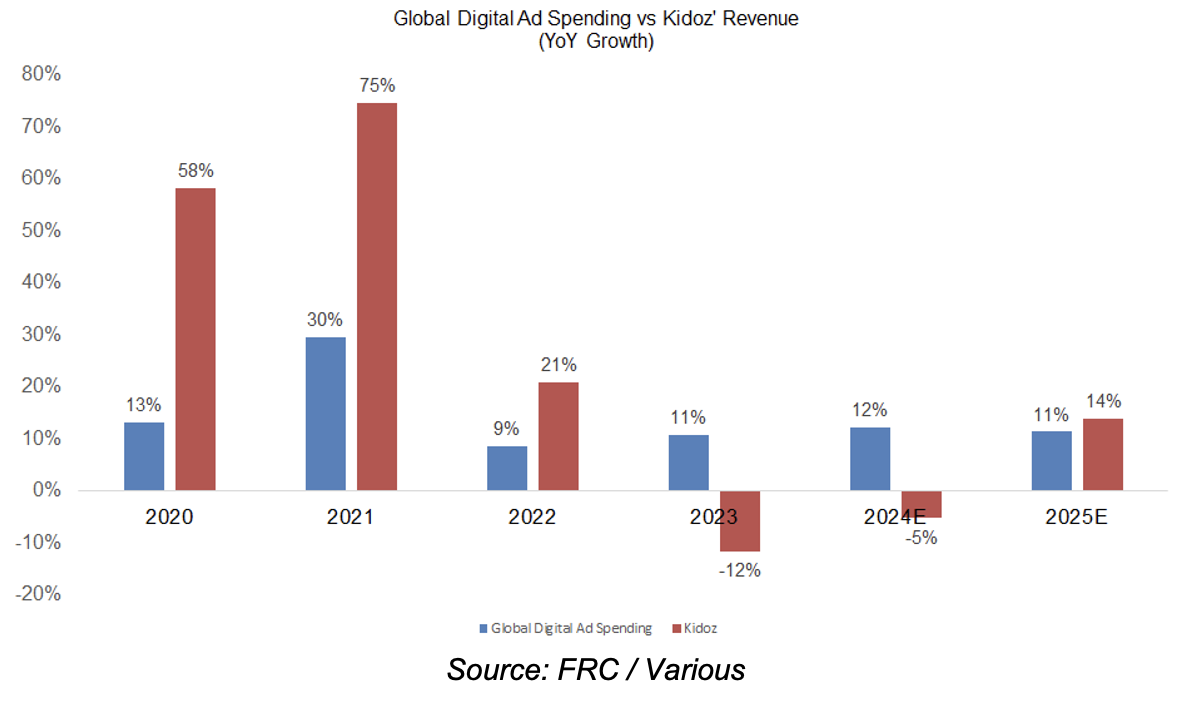

Historically, we estimate that KIDZ's revenue growth outpaced global digital ad spending growth by 1.3x on average

As Q3 revenue was lower than expected, we are lowering our revenue and EPS forecasts. We anticipate profitability next year, with management confident about achieving it this year

As a result, our DCF valuation decreased from C$0.83 to C$0.75/share.

KIDZ is the most undervalued stock on our list of comparables. KIDZ’s forward EV/R of 0.9x (unchanged) is significantly lower than the sector average of 3.0x (previously 3.3x)

Our comparables valuation decreased from C$0.46 to C$0.41/share, driven by our lower revenue estimate

We are maintaining our BUY rating, and adjusting our fair value estimate from C$0.65 to C$0.58/share (the average of our DCF and comparables valuations). While Q3 results were disappointing, prompting us to lower our fair value estimate, KIDZ's strong positioning in the kid-friendly advertising market, management's solid guidance for Q4, the potential benefits of COPPA 2.0, and the anticipated push for Prado lead us to expect multiple near-term catalysts for the stock.

Risks

We believe the company is exposed to the following key risks:

- Operates in a highly competitive space

- Unfavorable changes in regulations

- Ability to attract publishers and brands will be key to long-term growth

- FOREX

Appendix