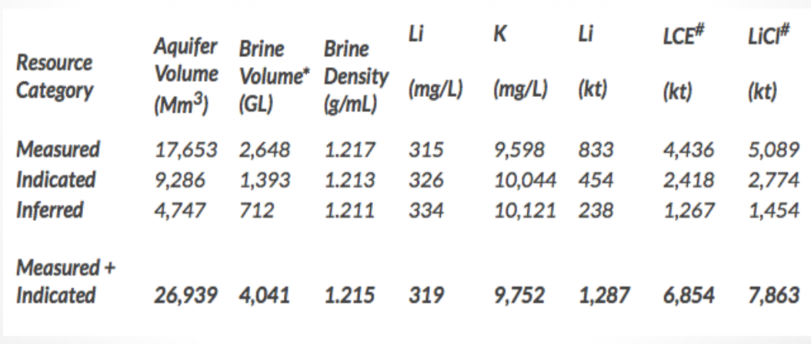

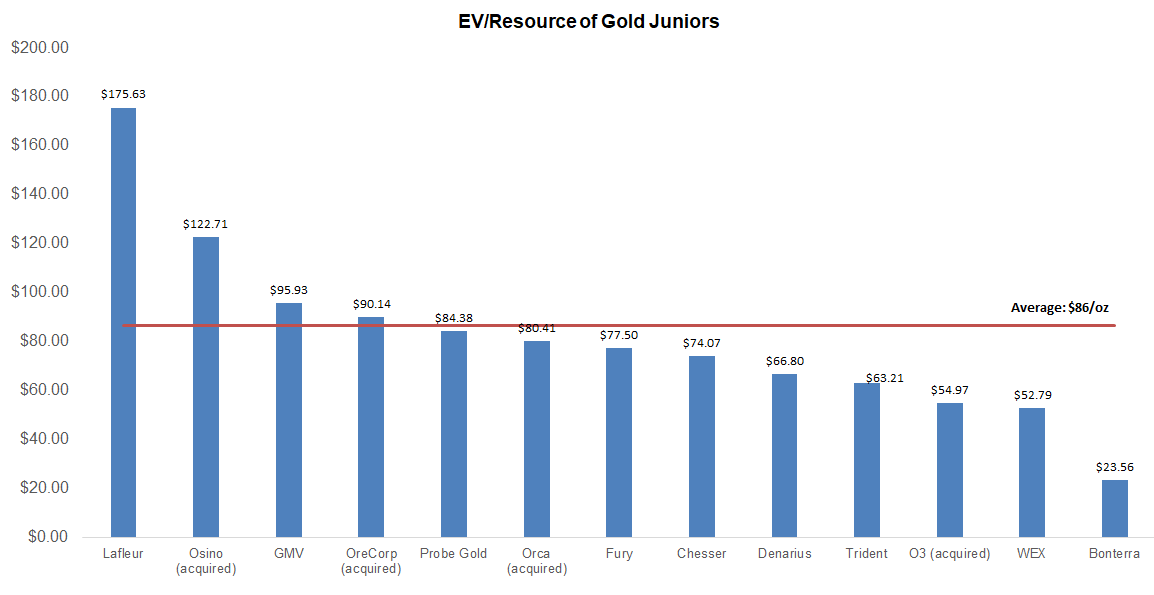

- TNR is awaiting its first royalty payment, expected this quarter, as Ganfeng began production at its Mariana lithium project last year. Based on current spot prices, we estimate TNR could earn US$1.60M annually in royalties. Receiving this first payment will be a major milestone, marking TNR’s transition into a revenue-generating royalty company.

- We believe the timing of these royalties is ideal, as lithium prices are rebounding strongly, up 109% YoY to US$23,000/t, though still below the 2022 peak of US$85,000/t. We expect the lithium rebound to continue as the market shifts from oversupply to deficit this year, with demand led by EVs, energy storage, and rapidly growing sectors like AI data centers, robotics, and automation.

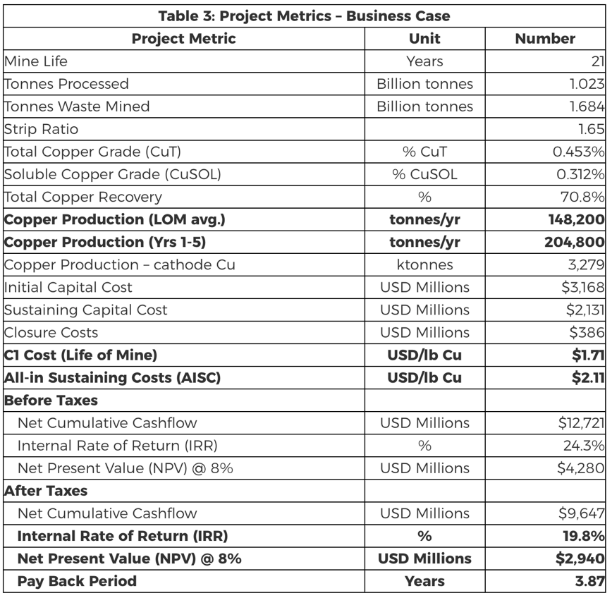

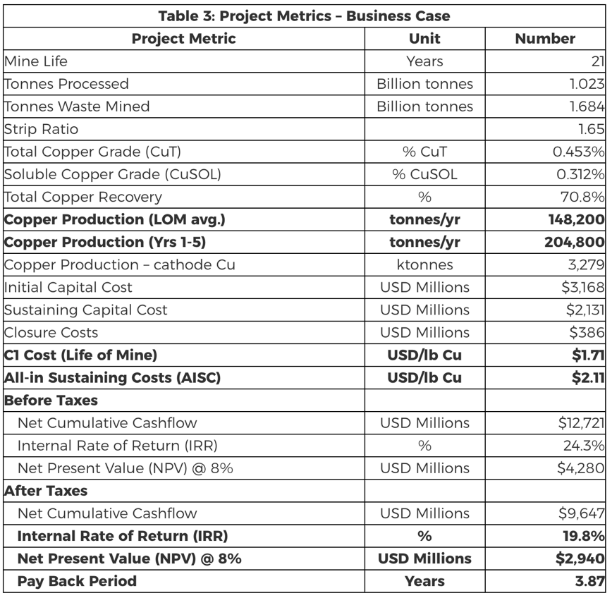

- Regarding TNR’s second royalty, three recent developments increase confidence that McEwen will continue advancing the Los Azules copper-gold project, which is positive for TNR since production delays could affect revenue. First, McEwen completed a robust economic study (feasibility study). Second, the project was included in Argentina’s Large Investment Incentive Regime (RIGI), granting tax and export duty benefits. Third, copper prices are up 34% YoY to $5.82/lb, an all-time high.

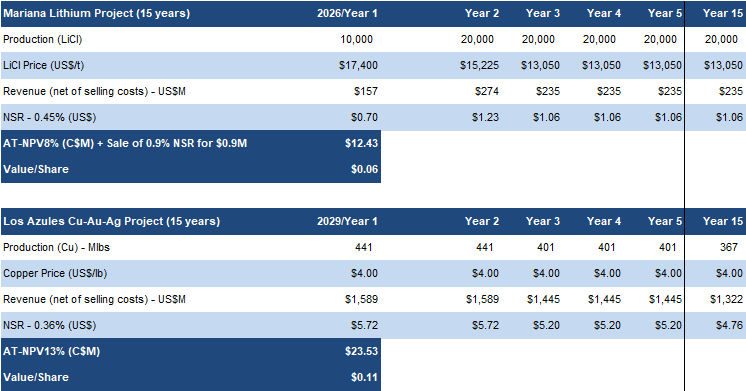

- McEwen plans to begin construction in 2026, and start commercial production by 2029. We estimate TNR could earn US$5M annually in royalties at conservative copper prices, rising to US$8M at current spot prices.

- Upcoming catalysts include Mariana royalty payments, Los Azules construction, and development, and the possibility of a Shotgun JV partner.

Price and Volume (1-year)

| |

YTD |

12M |

| TNR |

6% |

240% |

| TSXV |

10% |

77% |

| ETF* |

5% |

17% |

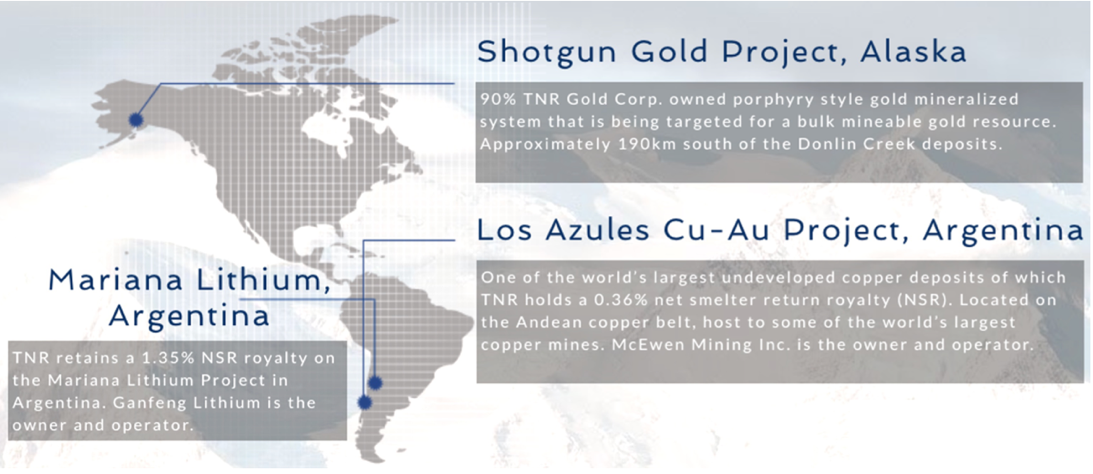

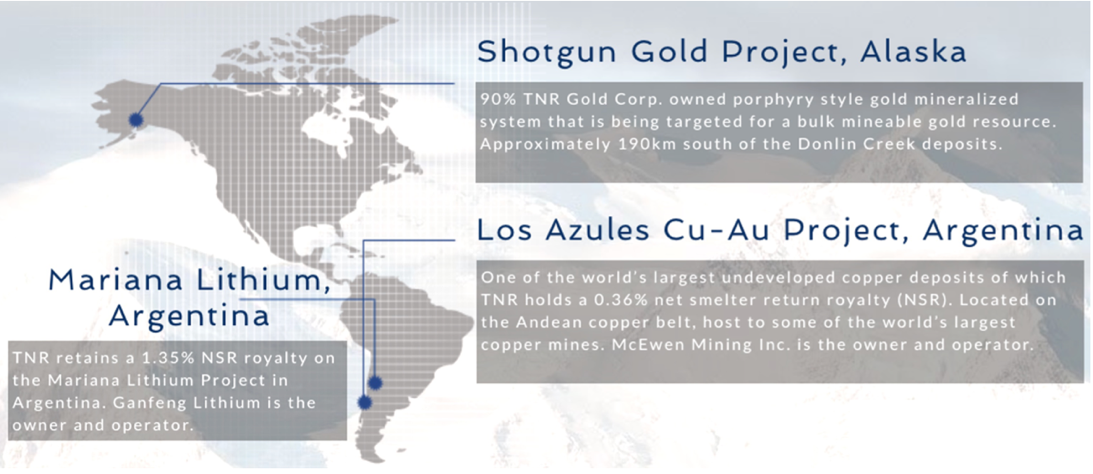

Royalties in two advanced-stageprojects in Argentina+90% interest in the Shotgun gold project in Alaska100% owned by McEwen Inc.Located in the prolific Andes copper belt, 90 km north of Glencore’s (LSE: GLEN) El Pachon copper-molybdenum project Los Azuleshosts one of the largest undeveloped copper resources in the world

Deposit size: ~4 km × 2.2 km × 1 km

Portfolio S ummary

Source: Company

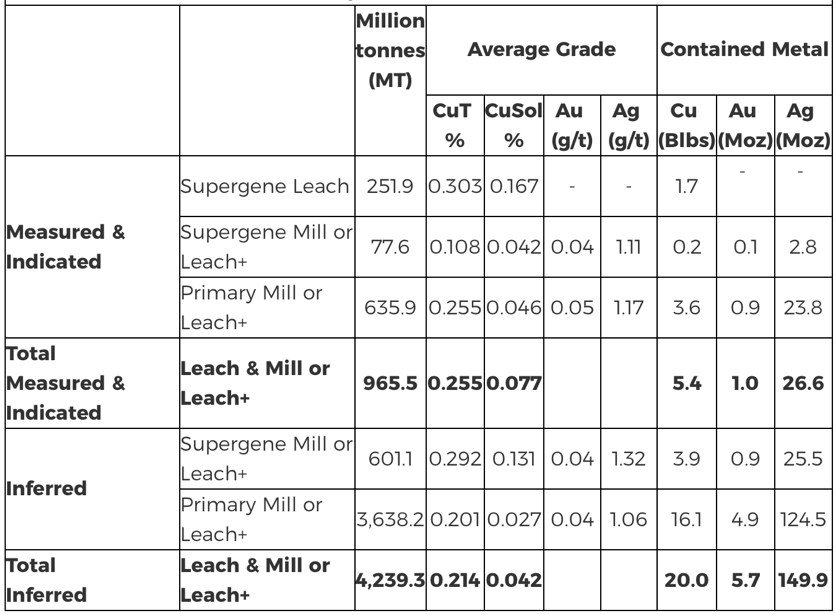

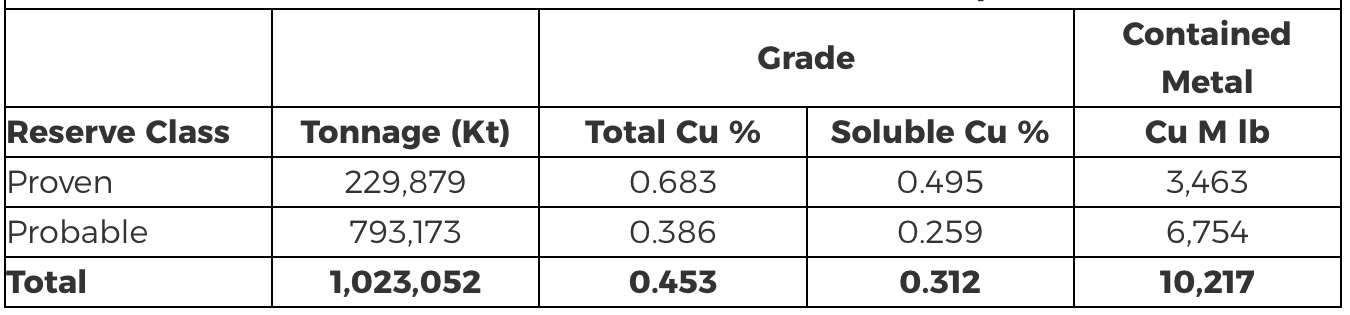

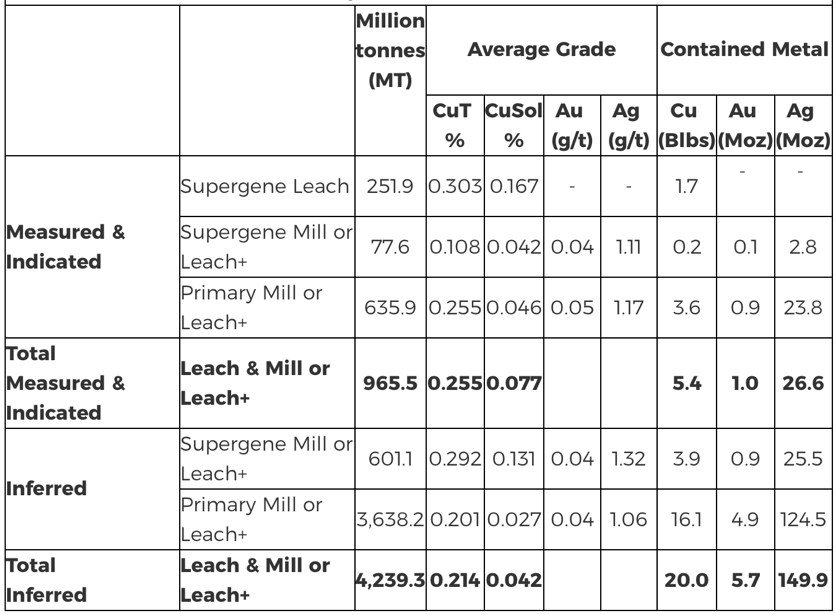

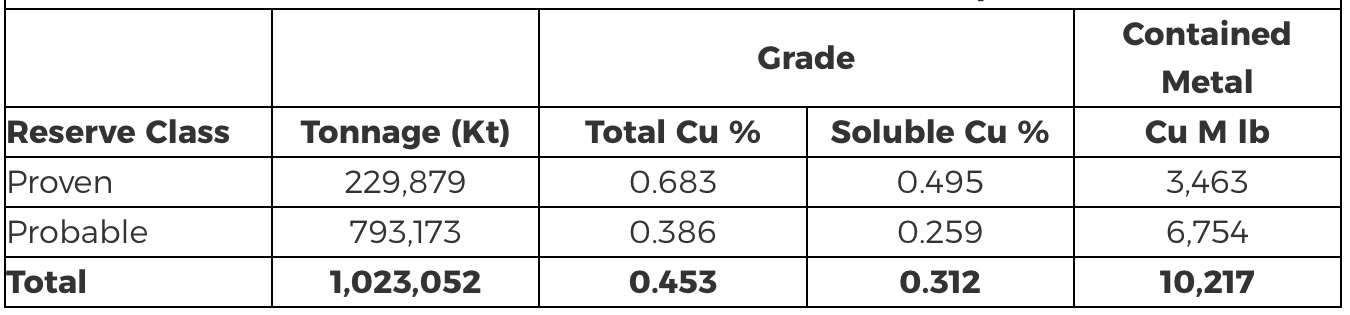

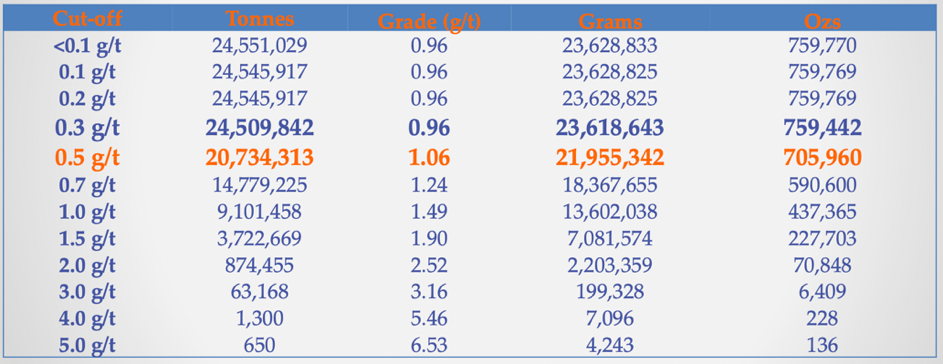

Los Azules Copper-Gold-Silver Project, Argentina ( TNR: 0.36% NSR) 2025 Resource Estimate (Exclusive of Mineral Reserves)

(QP: Jeff Sullivan FAusIMM , CRM-SA, LLC Employee ) 2025 Reserve Estimate

(QP: Gordon Zurowski, P.Eng., AGP Mining Consultants Employee Source: McEwen Inc.

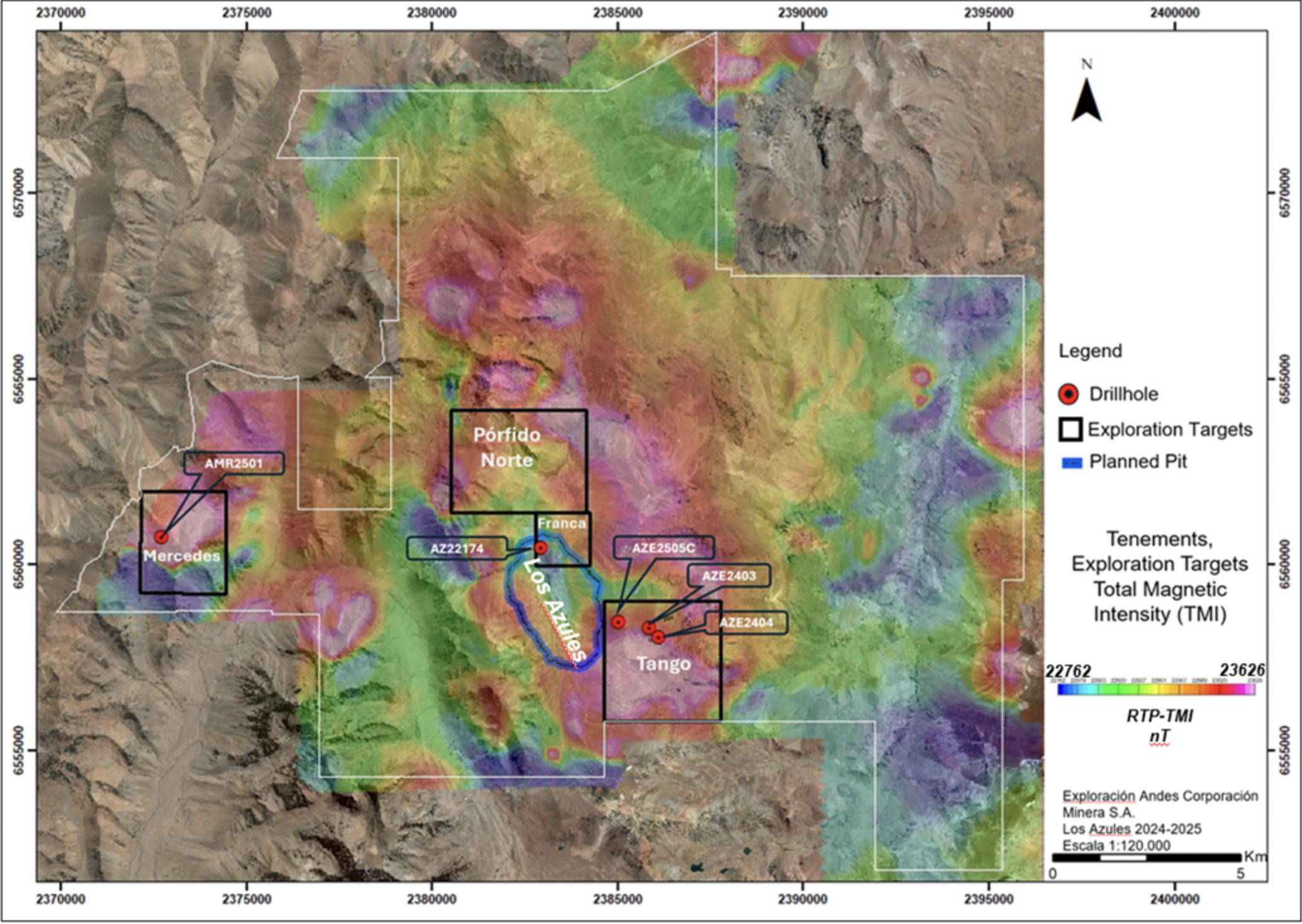

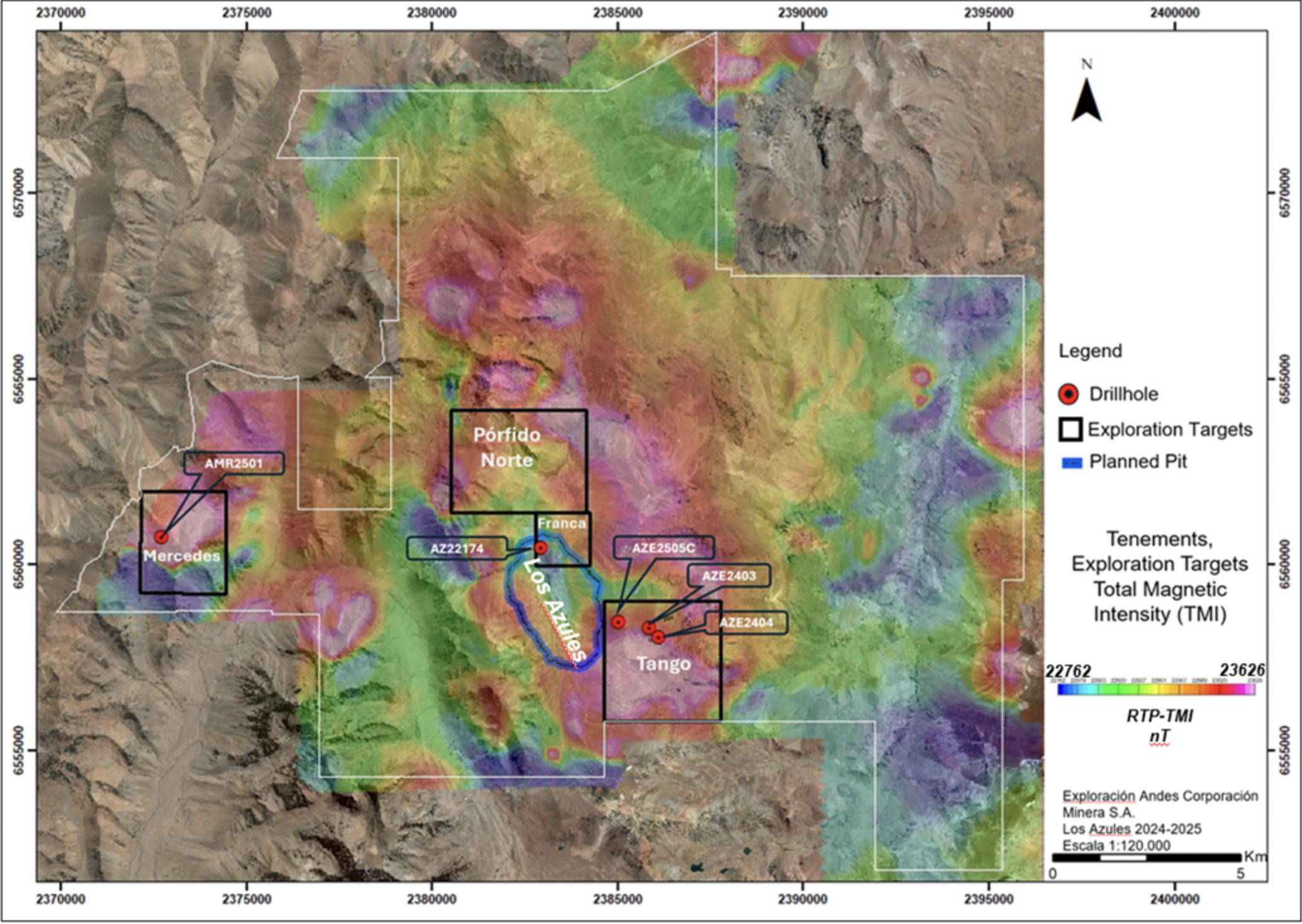

We note the deposit could be larger than currently known, with gold extending beyond the current area, and deeper underground Additionally, several high-priority exploration targets could increase resources and extend mine life, potentially extending TNR’s royalty income AT-NPV8% of US$2.9B, using US$4.35/lb copper (current spot: US$5.35/lb)McEwen plans to start construction this year, and begin commercial production by 2029 Located in Salta province, Argentina Argentina is the fourth largest lithium producer in the world

Los Azules D eposit and Exploration Targets

Source: McEwen

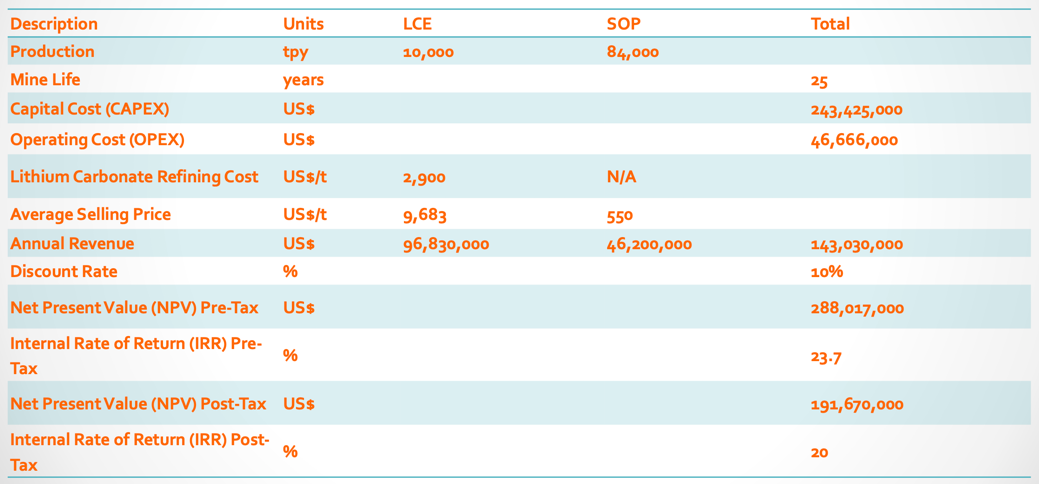

Inc. In October 2025, McEwen completed a feasibility study confirming the project is economically attractive, giving management confidence to keep advancing it to production. 2025 FS

QP: Steve Pozder, P.E, Samuel Engineering & David Tyler, SME, Project Director Source: McEwen Inc.

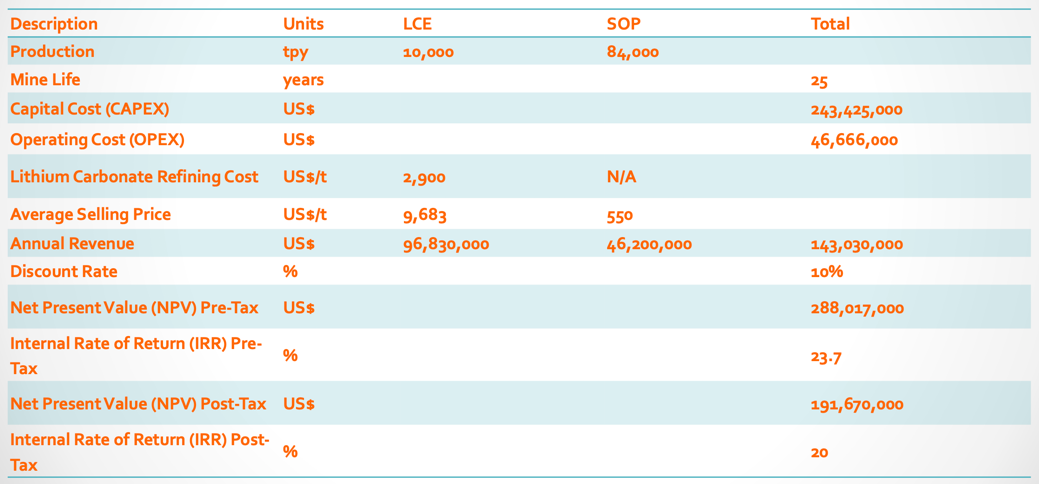

The project hosts a large lithium resource A 2018 independent study (PEA) supported a 25-year mine life, averaging 10,000 tonnes of lithium carbonate per year, meaning TNR could receive royalties for about 25 years Located 190 km from NovaGold(TSX: NG) and Barrick’s (TSX: ABX) Donlin gold project, which is one of the largest undeveloped gold deposits in the world; Donlin has experienced delays due to strong opposition from local groups

We estimate that TNR could earn

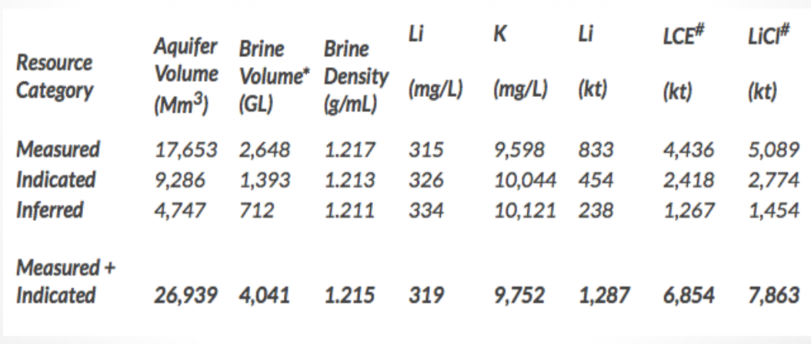

US$ 5 M per year in royalties from this project using a long-term copper price of US$ 4 /lb, rising to US$ 8 M at current spot prices . Mariana Lithium-Potassium Brine Project, Argentina ( TNR: 1.35% NSR) Ganfeng began production in early 2025 , and is currently ramping up to 20,000 tpa of lithium chloride. We estimate that TNR should receive its first royalty payment this quarter, which will be a major milestone. 2021 Resource

2018 PEA Highlights

Source:

Ganfeng Lithium TNR owns a 1.35% NSR in the project.

Ganfeng has an option to buy 0.90% for C$0.9M, which we believe they will exercise, reducing TNR’s interest to 0.45% .

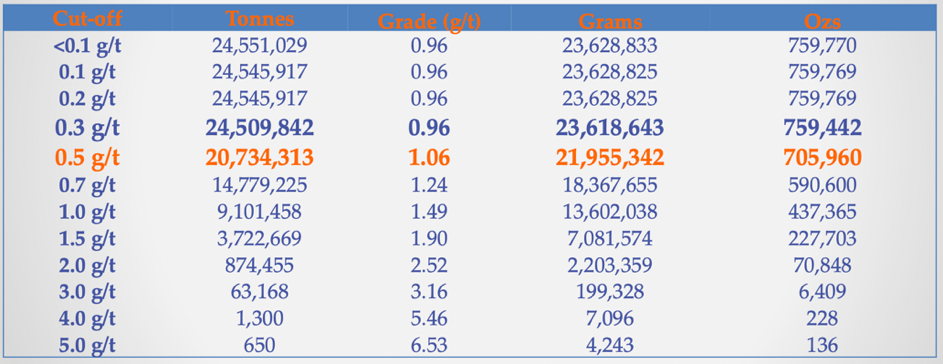

We estimate that TNR could earn US$1.6 0 M per year in royalties at current lithium prices. Shotgun Gold Project, A laska ( 90 % interest ) Th is property hosts a medium-sized/ relatively high-grade/shallow deposit on one of five identified targets.

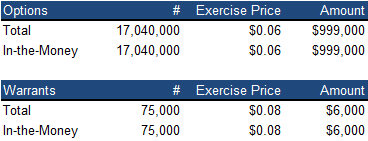

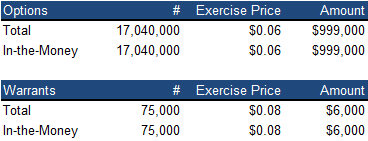

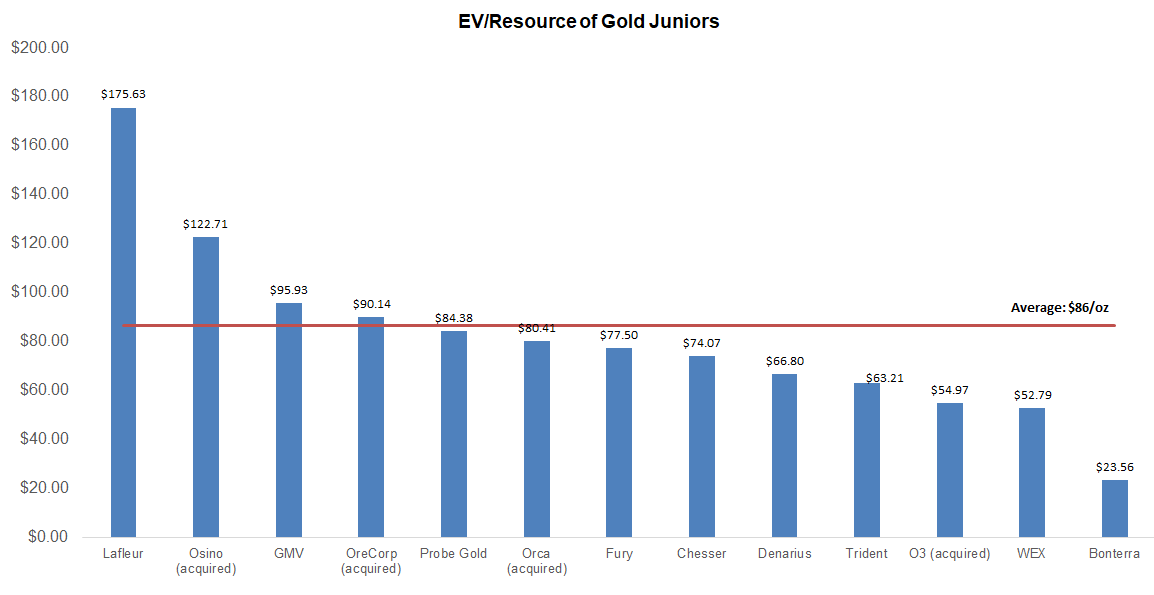

As Shotgun is much smaller, we anticipate a smoother permitting process TNR maintains a lowburn rate In-the-money options can bring in $1 M Based on an average EV/Resource of $86/oz (previously $66/oz) for gold juniors, we estimate a fair value of $0.18/share (previously $0.15/share) on the Shotgun project

2013 Resource Estimate

QP: Jonathan Findlay, P. Geo, Geological Consultant of TNR Source: Company TNR is seeking an option or JV partner to advance the project. As the company is not pursuing any activity, no additional capital is needed, limiting shareholder dilution. The downside is there’s no guarantee a JV partner will be found, and the project could remain idle.

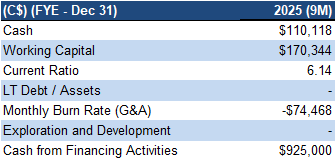

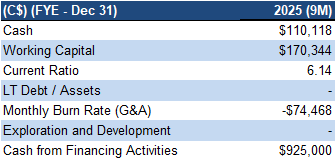

Financials

Source:

Source:

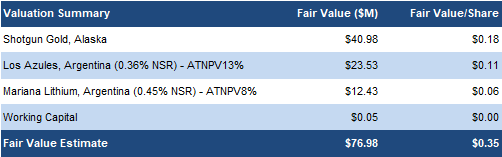

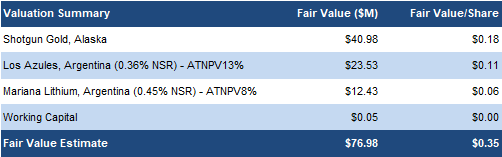

FRC / Company

We are raising our fair value estimate on its royalties by 12% to $0.17/share, driven by higher metal prices Using a sum-of-parts model, we now estimate a fair value of $0.35/share on TNR (previously $0.30/share)

FRC Projections and Valuation

Source: FRC/S&P Capital IQ/Various

Source: FRC

Source: FRC

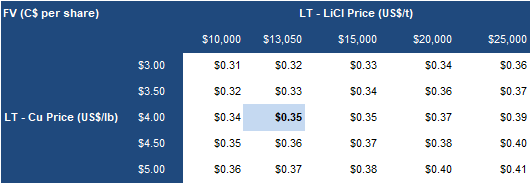

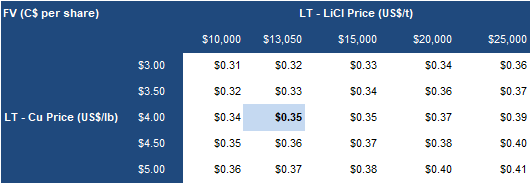

Our valuation remains sensitive to metal prices

Source: FRC

We are reiterating our BUY rating, and adjusting our fair value estimate from $0.30 to $0.3 5 /share. TNR offers exposure to gold, lithium, and copper through projects in Alaska and Argentina, and is on the verge of earning its first royalty revenue.

We believe high metal prices, combined with project milestones, position TNR for significant revenue potential.

Risks We believe the company is exposed to the following key risks (not exhaustive) : C ommodity prices Operator performance Potential for delays in attracting a partner for Shotgun Project delays Regulatory/political

We are maintainingour risk rating of 5 (Highly Speculative)