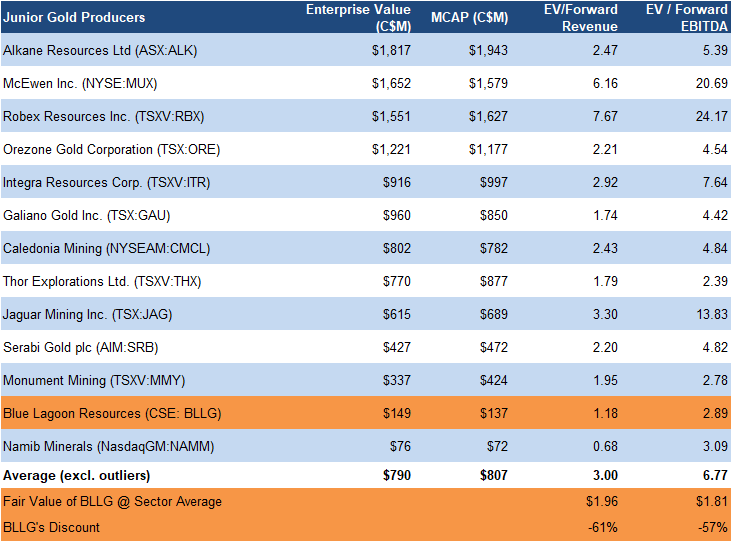

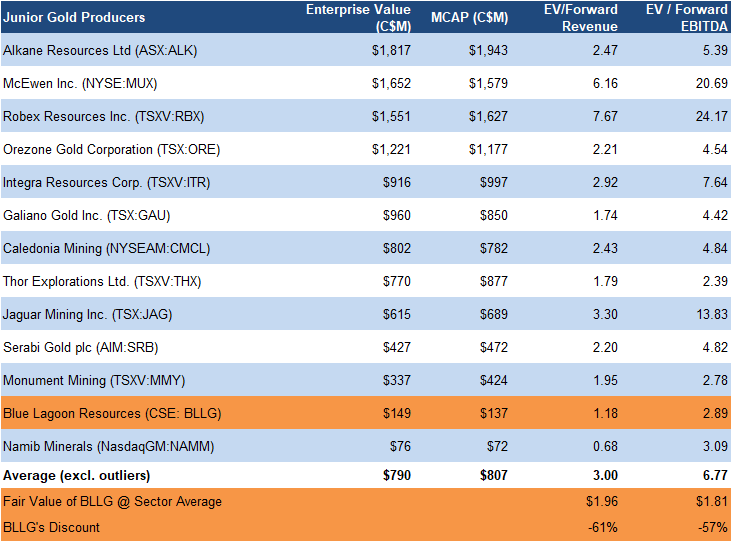

- We believe BLLG could potentially mine and process 40,000–50,000 tonnes in its first year, producing 12–15 Koz of gold. First-year EBITDA is estimated at US$24–$30M. BLLG is trading at 2.89x forward EBITDA vs a sector average of 6.77x, a 57% discount.

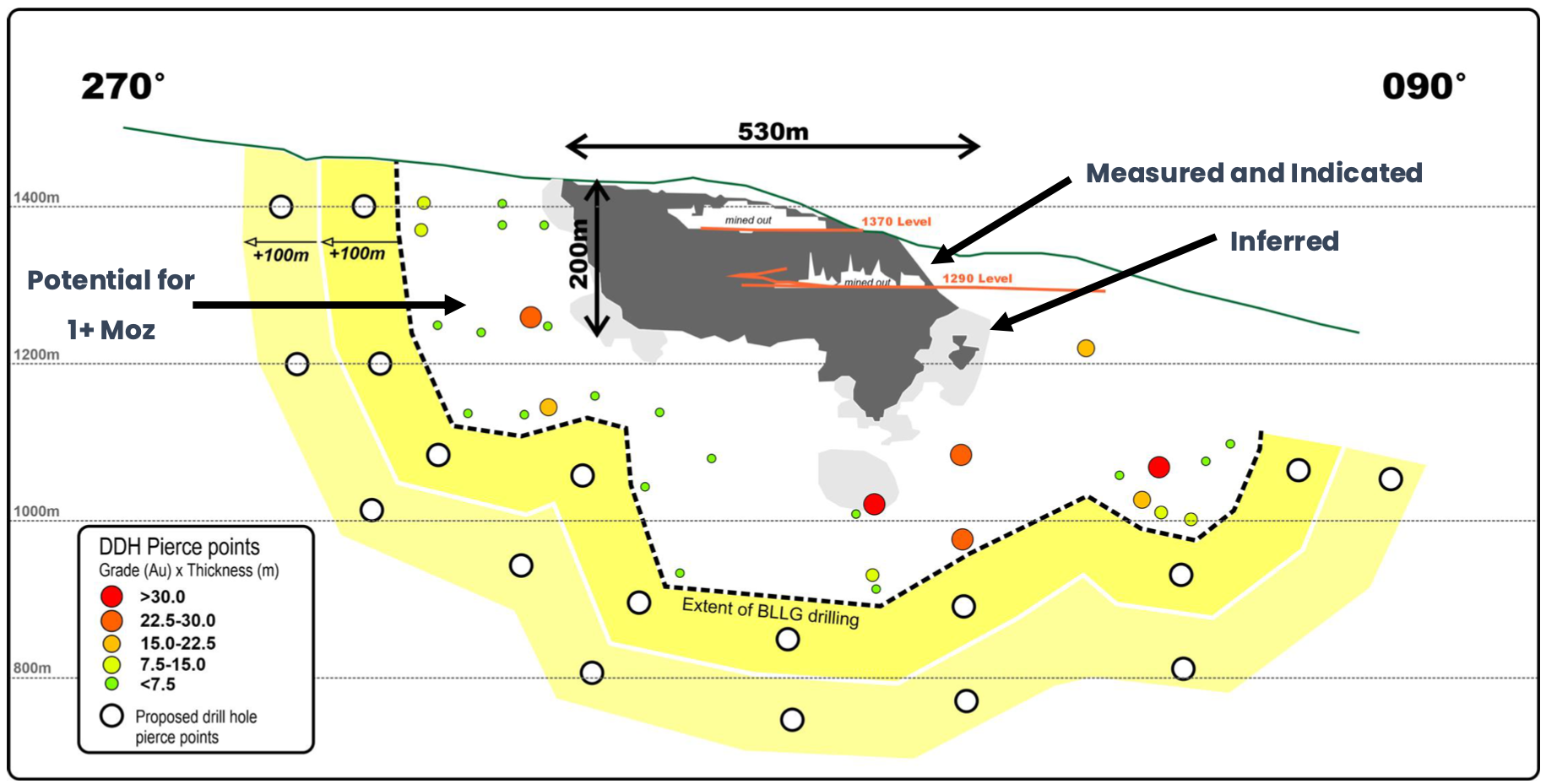

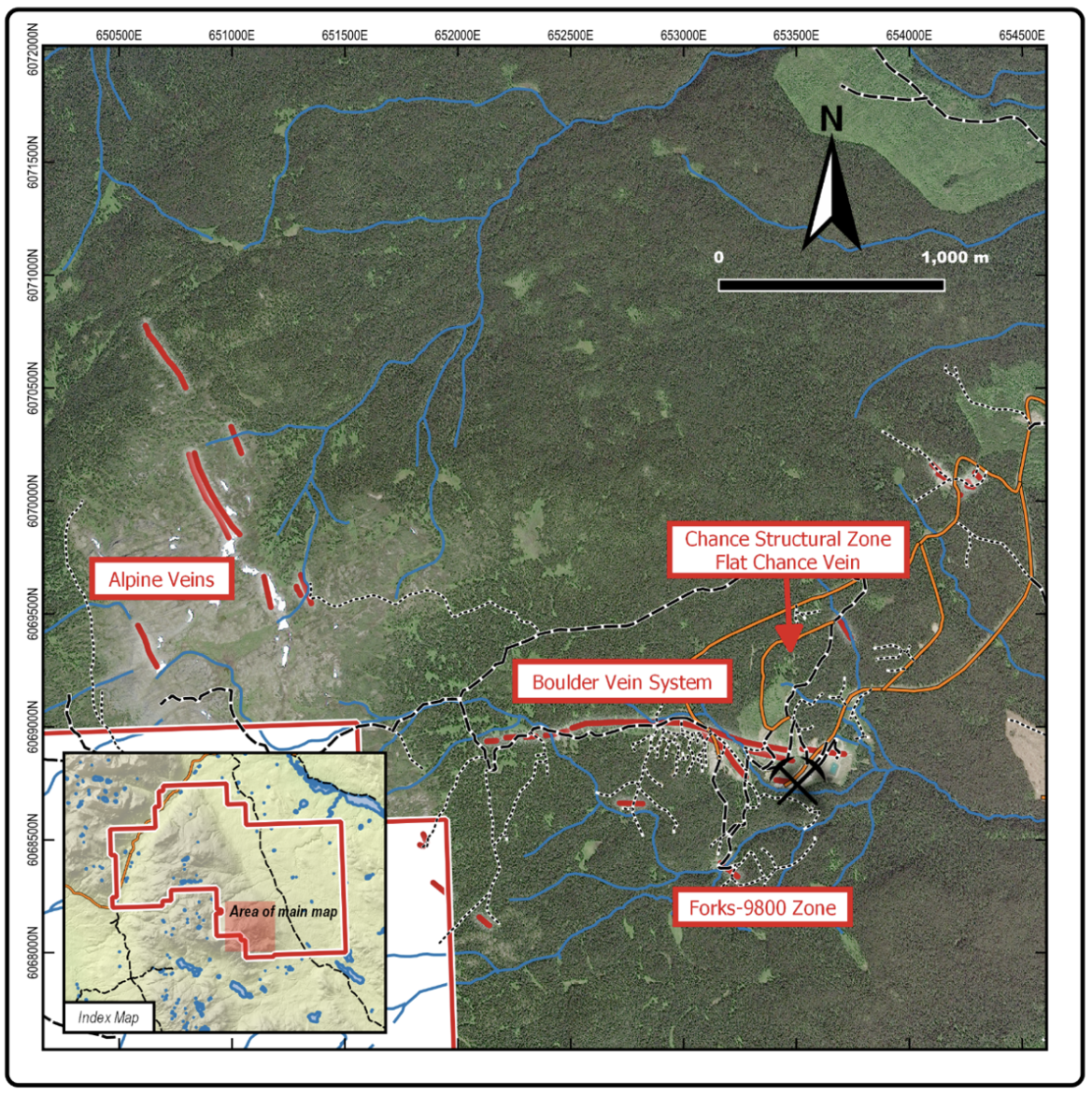

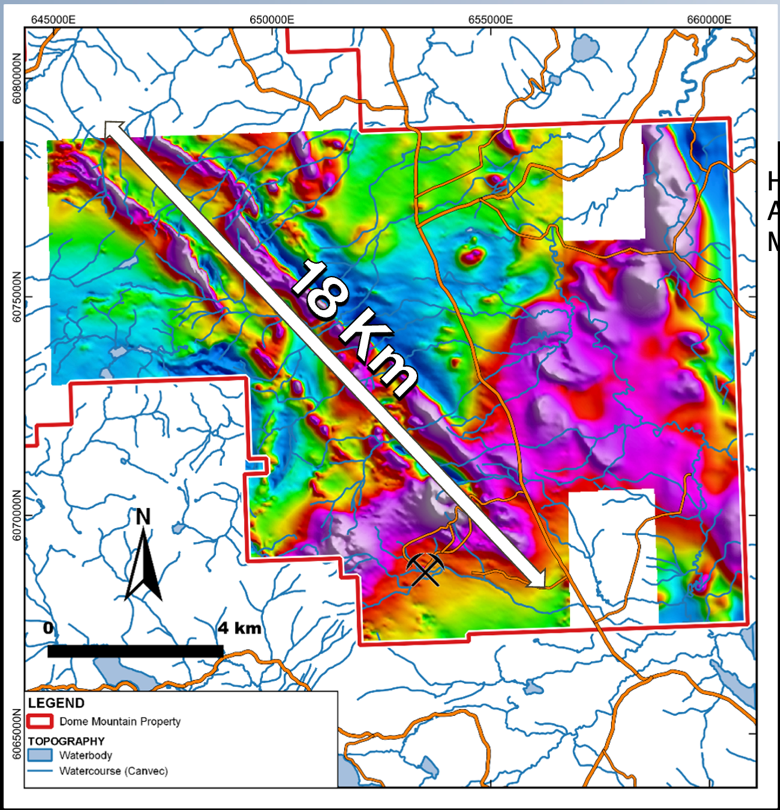

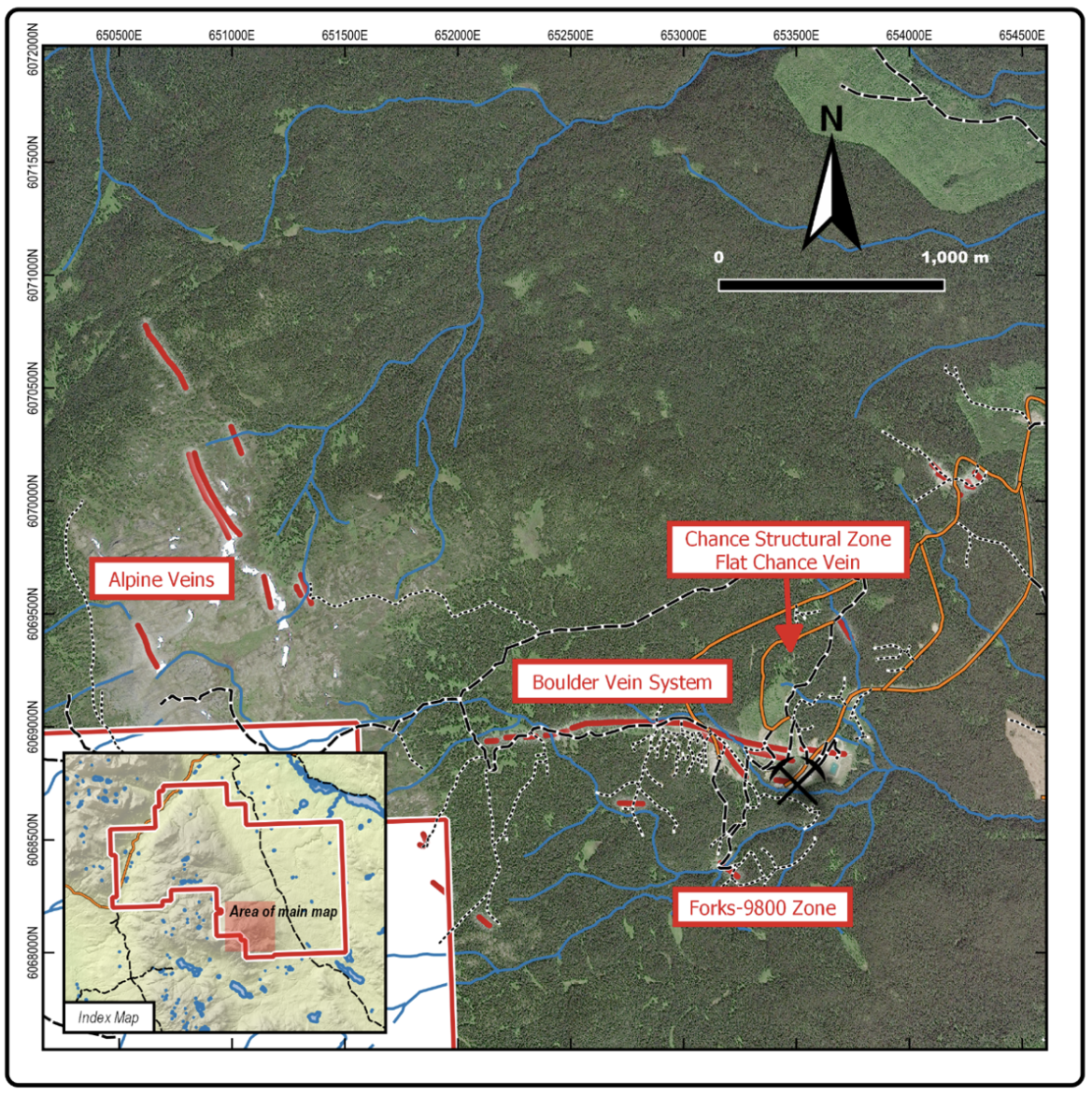

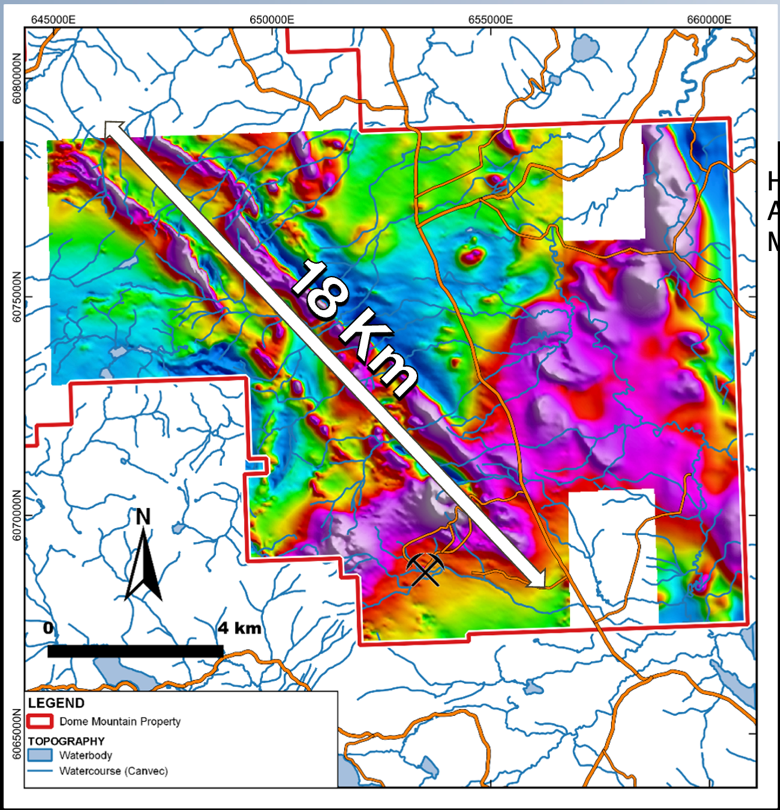

- Dome Mountain hosts a high-grade underground resource that we believe could support up to ~15 years of operations. The company intends to utilize production cash flow to fund a multi-stage exploration program. We believe there is significant resource expansion potential as the deposit remains open in multiple directions (laterally and vertically), and 90% of the project area remains untested along a 18km strike length.

- With gold trading near record highs, we anticipate an increase in M&A activity over the next 12 months as larger companies target juniors. We maintain our outlook on gold, supported by US$ weakness and strong safe-haven asset demand amidst economic and geopolitical uncertainties.

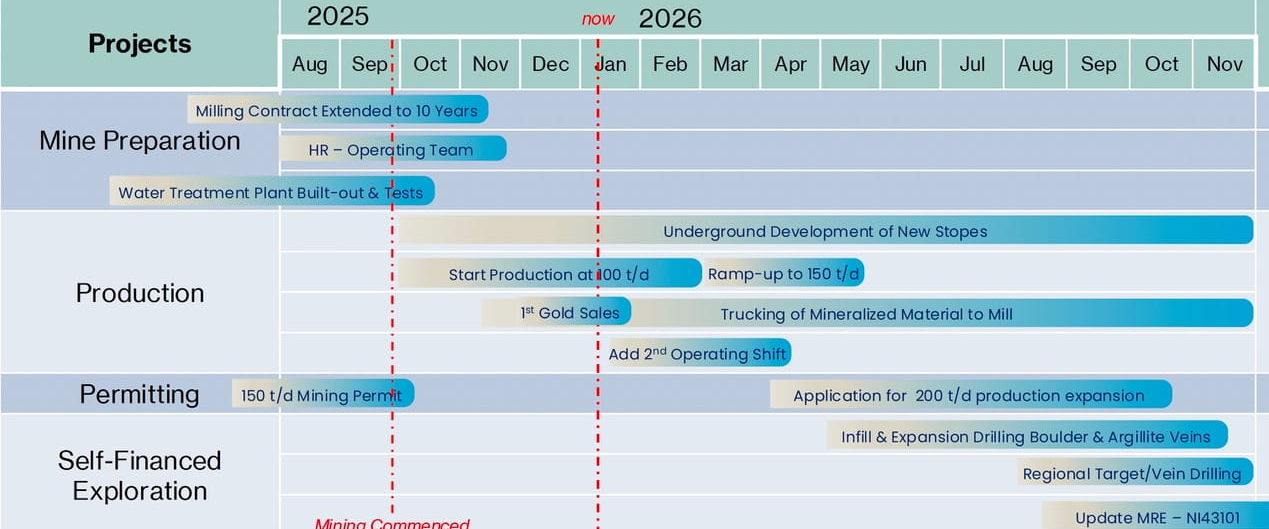

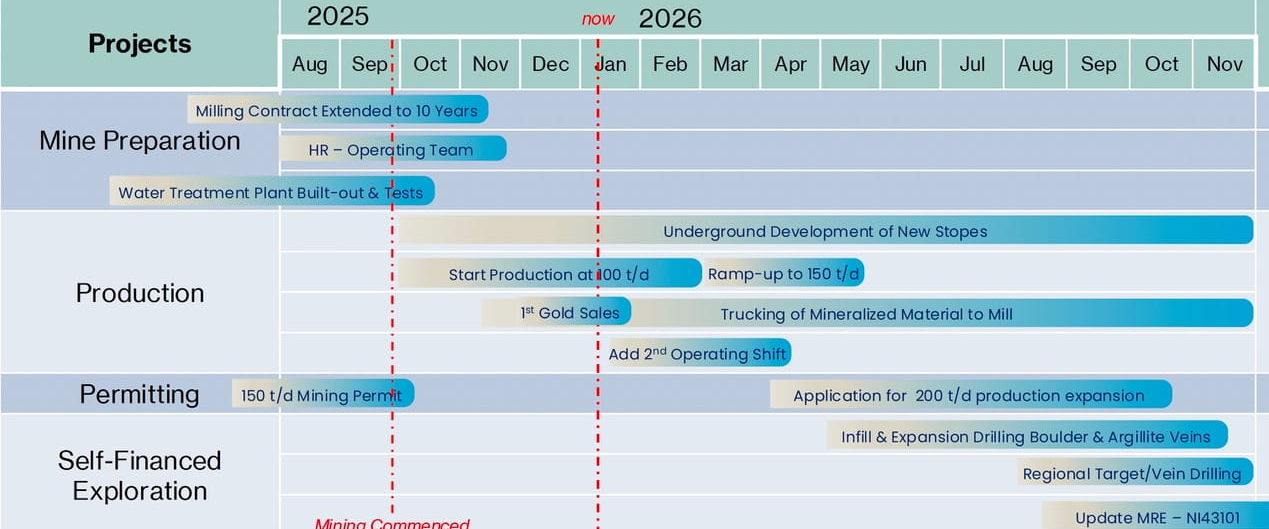

- Upcoming catalysts include production ramp-up, an updated resource estimate, and additional exploration drilling.

Price and Volume (1-year)

| |

YTD |

12M |

| KIDZ |

50% |

25% |

| TSXV |

13% |

15% |

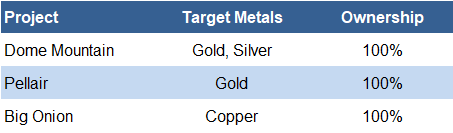

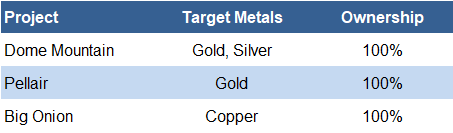

Two gold and one copper project in B.C.Records first gold & silver sale

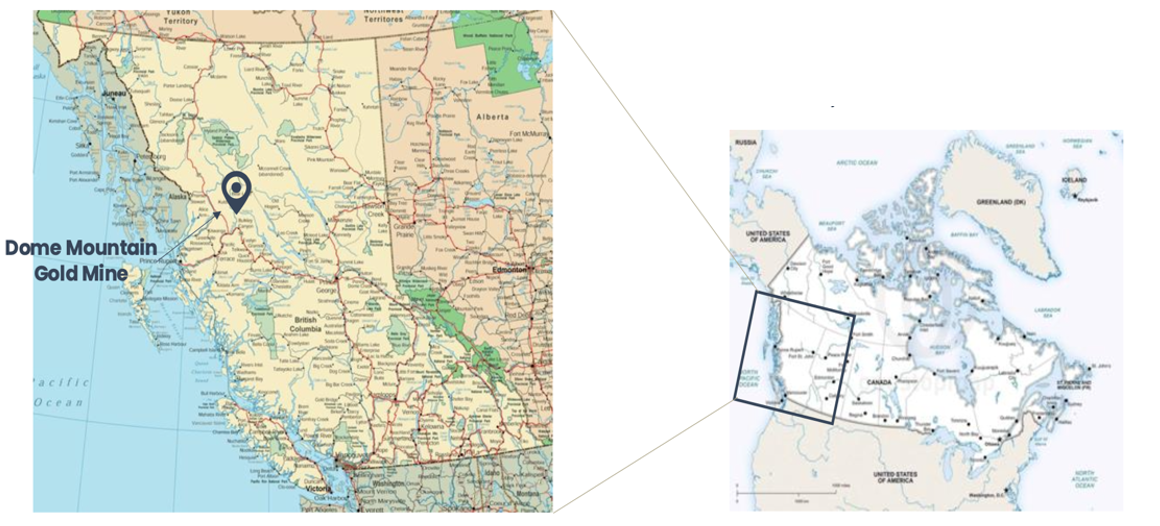

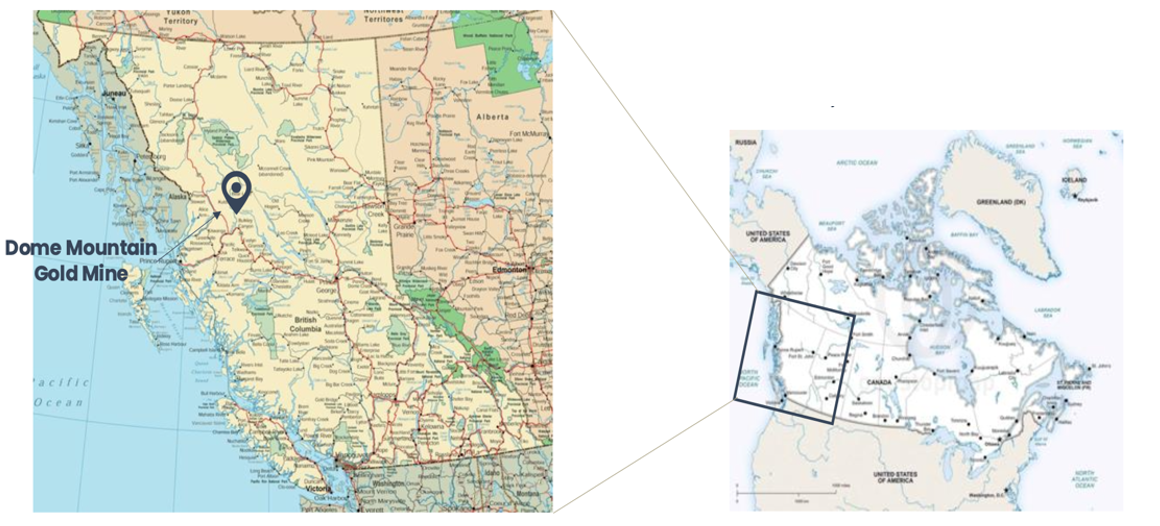

The mine is well connected, just a 50-minute drive from Smithers, B.C.Hosts high-grade veins averaging ~9 g/t, well above typical underground mine grades of 3–5 g/t A 2022 study identified a high-grade resource that we believe can support ~15 years of operations A key advantage of the project is its pre-existing underground development, and an active toll milling arrangement with Nicola Nicola’s mill is approximately 900 km from Dome Mountain. While long-distance trucking is challenging and cost-prohibitive for large operations, Dome Mountain’s relatively small-scale operation, and high-grade material, make it feasible BLLG has a 10-year milling profit share agreement with Nicola Mining for up to 75,000 tonnes per year (200 tpd)

Portfolio Summary

Source: Company

Dome Mountain Gold Project (100% interest) After commencing underground mining in September 2025, BLLG achieved a major milestone in late December 2025 , with its first gold and silver sale, generating $1 M in revenue from 1,000 tonnes of mineralized material delivered to its milling partner, Nicola Mining, for processing. This milestone marks the company’s official transition to a gold producer .

Location Map

Source: Company

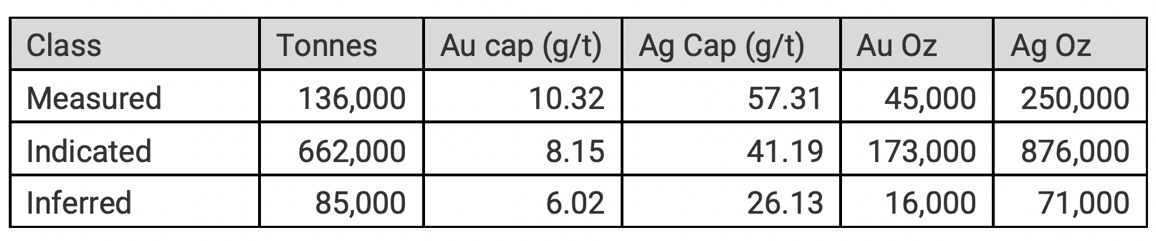

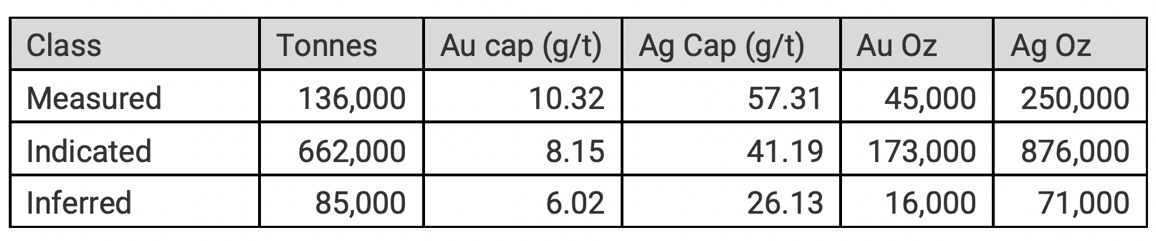

2022 NI 43-101 Resource Estimate

(Q P : Dr. Gilles Arseneau, P. Geo., ARSENEAU Consulting Services Inc.) Source: Company

The mill is capable of processing 250 tpd through crushing, grinding, gravity separation, and flotation; permitting is underway to increase capacity to 500 tpd

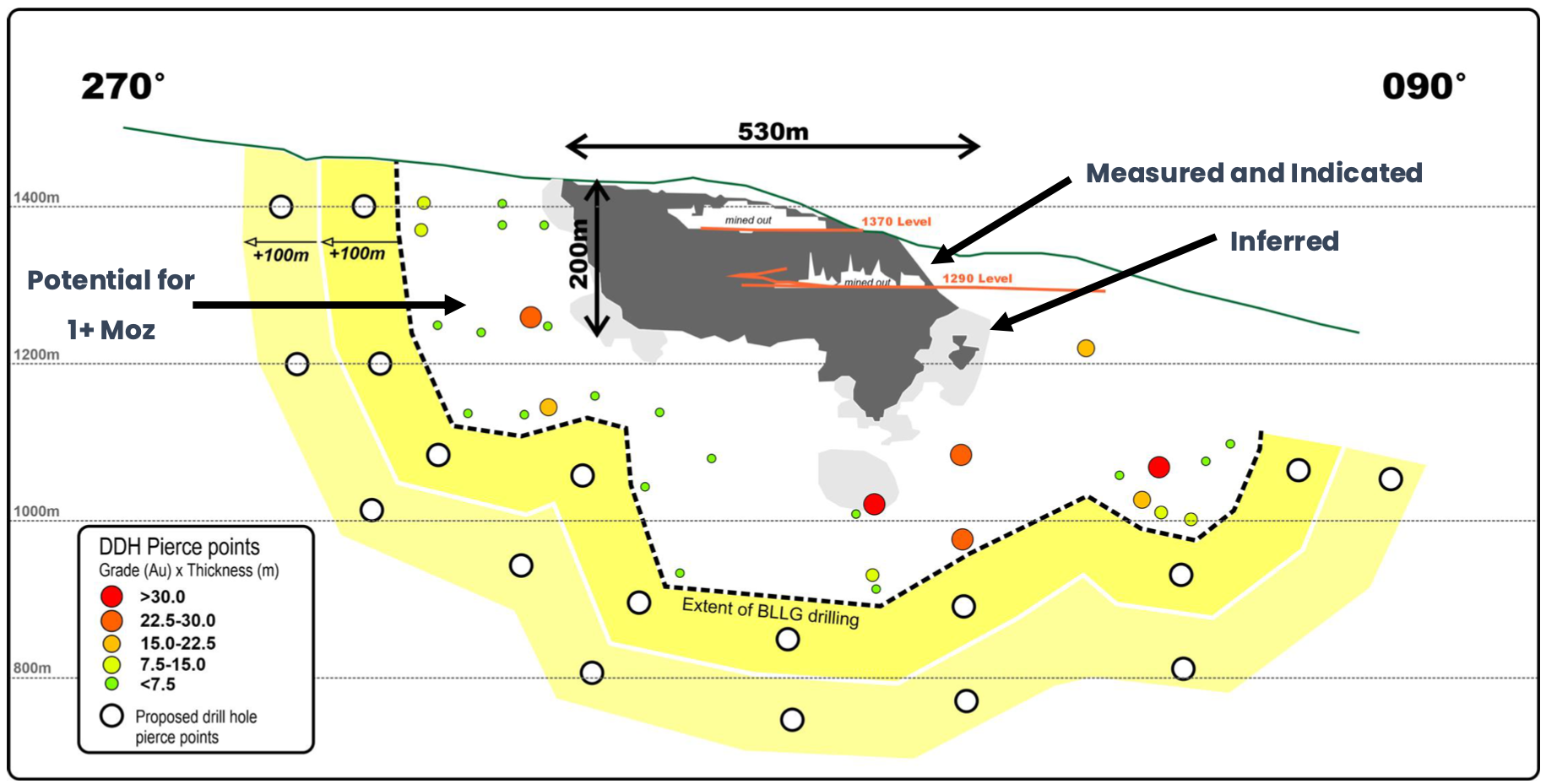

The current resource envelope, limited to the Boulder Main vein, measures 530 m long by 200 m deep and does not include drilling from 2022–2023 campaigns

Dome Mountain Existing Infrastructure

Merritt Mill and Tailings Facility

Source: Company

We believe there is significant potential for resource expansion, as the deposit remains open in multiple directions In addition to the Boulder Vein System, the property hosts 15 other identified veins90% of the land package is untested, with only six out of 15 known gold veins tested by BLLG Multiple high-grade veins within an 18 km structural corridor are not included in the current resource estimate

The Argillite vein, parallel to Boulder, has the potential to host ~25% higher grades Local community support is often key to a project's success, with many resource-rich projects stalled globally due to its absence Applying for a permit to increase production from 150 to 200 tpd Planning resource expansion drilling, followed by a resource update later in the year Healthy balance sheet Subsequent to

Nicola now operates exclusively as the processing facility for Dome Mountain material,

following the end of its arrangement with Talisker Resources (TSX: TSK).

We believe this reduces risk for BLLG by providing assurance that all of its material will be processed promptly and consistently . Resource Expansion Potential The property’s principal mineralized zone is the Boulder Vein System, which includes the Boulder, Boulder East, and Argillite veins. The current resource estimate is limited to the Boulder Main vein.

Resource Expansion Potential

Major Veins

Source: Company

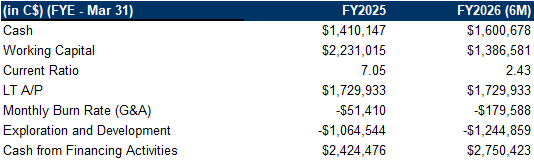

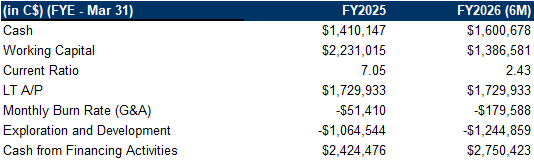

Q2-FY2026, BLLG raised $2M through warrant exercises

Exploring an 18 km Prospective Vein Trend

Source: Company

The company will reinvest operating cash to advance gold exploration . In H1 - 2026, it will drill more around the Boulder vein to see if the gold deposit can be extended, test a nearby target called the Argillite vein, and explore other areas across its large land package of about 22,000 hectares.

A major advantage is that no additional financing is required , limiting potential dilution. Management intends to allocate internally generated cash flow to both near-mine and regional exploration.

Receives 2026 PDAC Award for Indigenous Collaboration BLLG has strong support from the Lake Babine First Nation, a partnership that has been crucial to the development and restart of the Dome Mountain project. We observed this during our site visit in July 2026 for the mine’s official reopening, where we met with management, local stakeholders, Lake Babine First Nation representatives, and key contractors overseeing operations and logistics .

This collaboration was recognized when BLLG received the 2026 PDAC Sustainability Award , highlighting its genuine Indigenous engagement and commitment to environmental responsibility. We believe this positions the c ompany favorably as it pursues permitting for expanded mining operations and exploration .

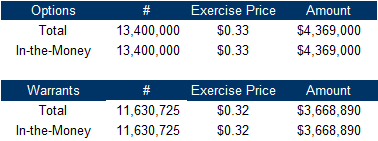

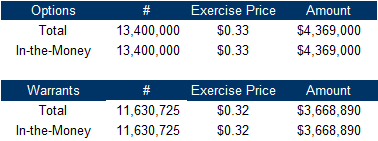

Can raise up to $6 M from in-the-money options and warrants

Upcoming Catalysts Project Timeline

Source: Company

Financials

Source: FRC / Company

Source: FRC / Company

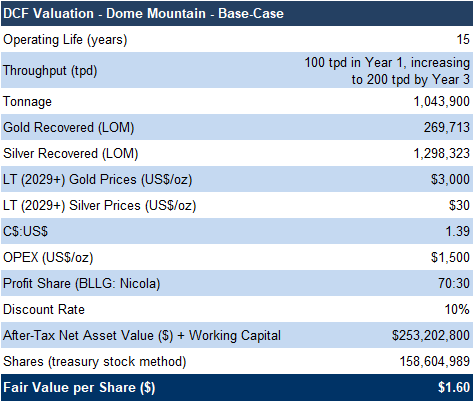

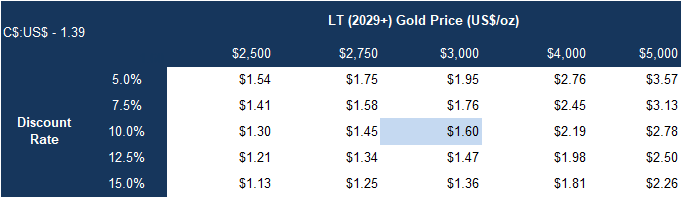

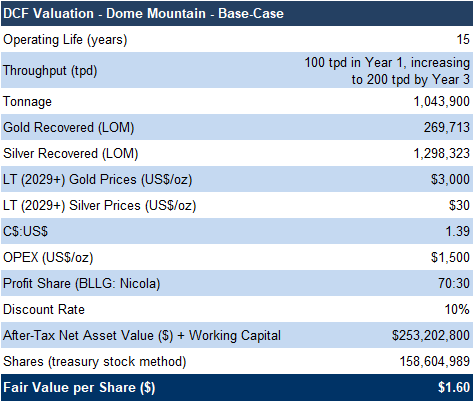

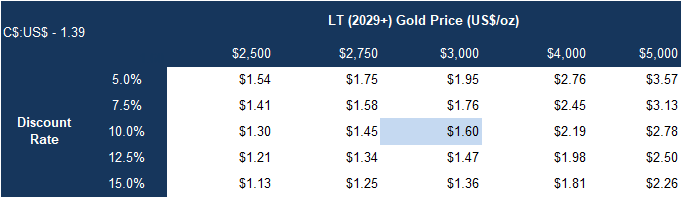

Our DCF valuation increased from $0.99 to $1.60/share, driven by higher gold prices, and increased production assumptions supported by a dedicated toll-milling facility Base-case gold price forecasts: US$4,250/oz in 2026, declining to US$3,000/oz by 2029+ (prior estimate for 2029+: US$2,500/oz)

FRC Valuation and Rating

Source: FRC / S&P Capital IQ

Source: FRC / S&P Capital IQ

Our valuation increases to $2.23/share using the current spot price as the long-term average BLLG is trading at a 59% discount (previously 70%) to comparable junior gold miners Applying sector multiples, we arrived at a fair value estimate of $1.88/shareon BLLG (previously $1.24/share)

Comparables Valuation

Source: FRC / S&P Capital IQ

We are reiterating our BUY rating , and adjusting our fair value estimate from $1.11 to $1. 74 /share (the average of our DCF and comparables valuations). BLLG’s transition to producer status, first gold sale, and secured toll-milling , position the company for near-term revenue and cash flow growth .

Trading at a significant discount to peers, we believe BLLG offers an attractive opportunity ahead of upcoming catalysts, including production ramp-up , and an updated resource estimate .

Risks We believe the company is exposed to the following key risks (not exhaustive): The value of the company is dependent on gold prices Dome Mountain does not have a feasibility study Exploration and development Permit upgrades are needed to expand mine capacity Operations and execution

Maintaining our risk rating of 4 (Speculative)