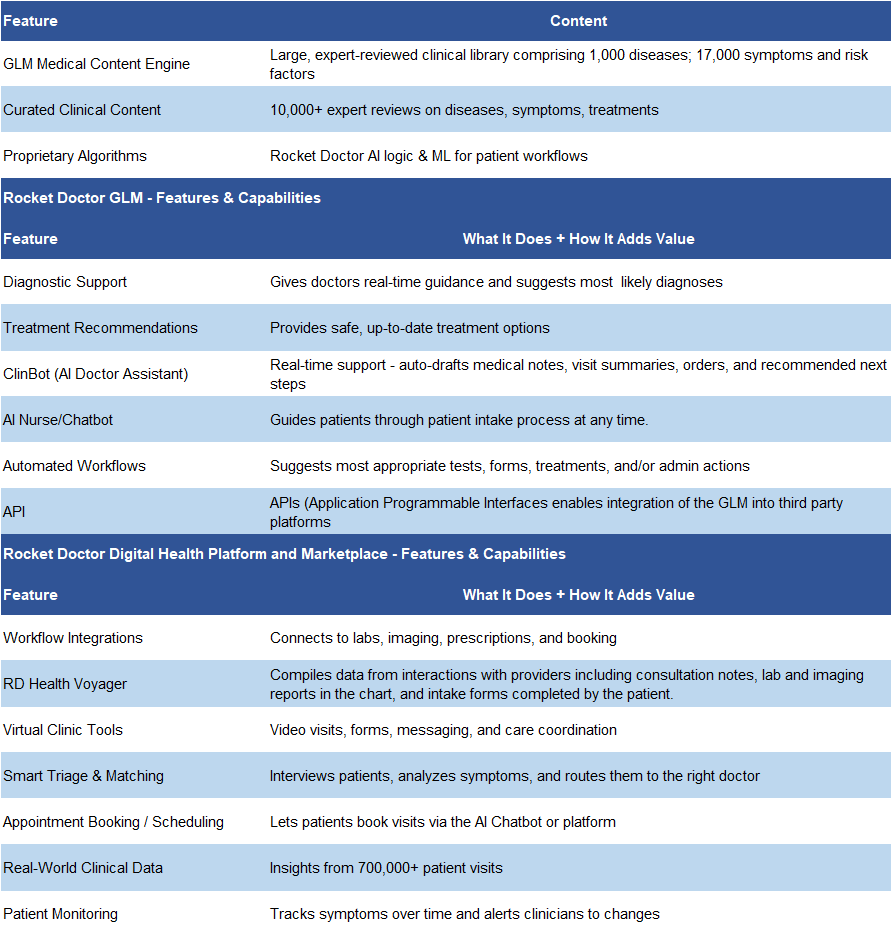

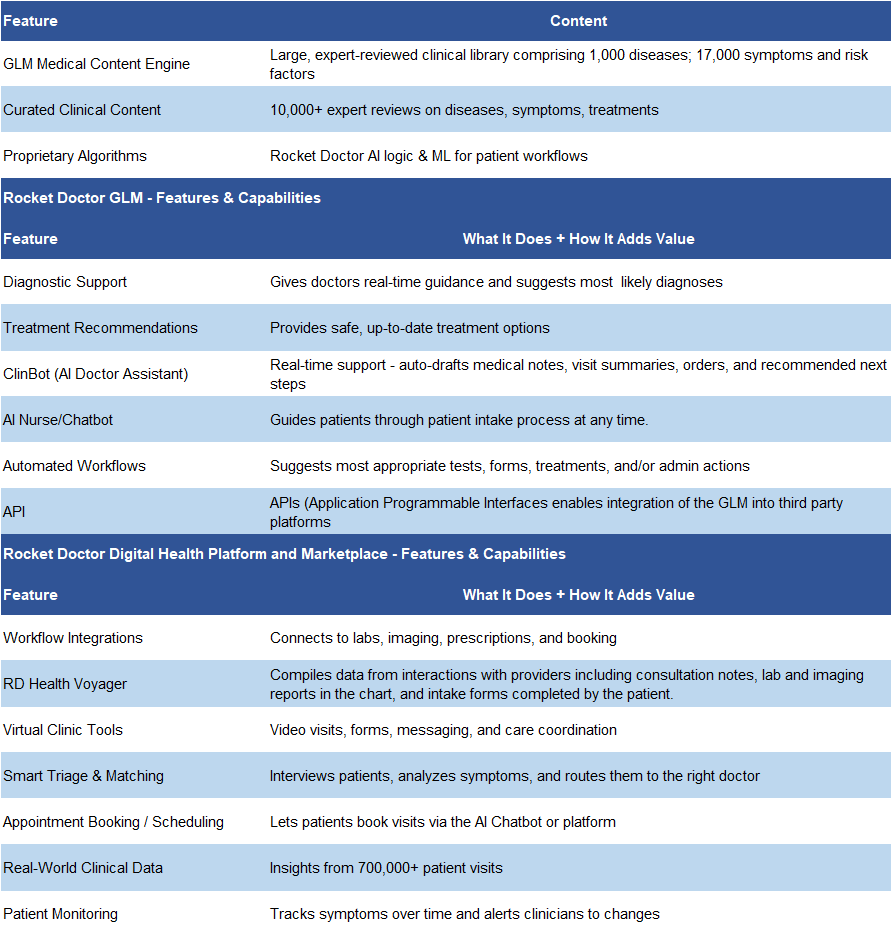

- RD’s AI-powered Global Library of Medicine (GLM) is its core IP, offering real-time diagnostic support for 1,000+ diseases and 17,000+ symptoms. Built on 25,000+ hours of clinician input and verified medical content, RD offers solutions for doctors and healthcare providers for diagnosis, treatment planning, patient care, training, and simulation.

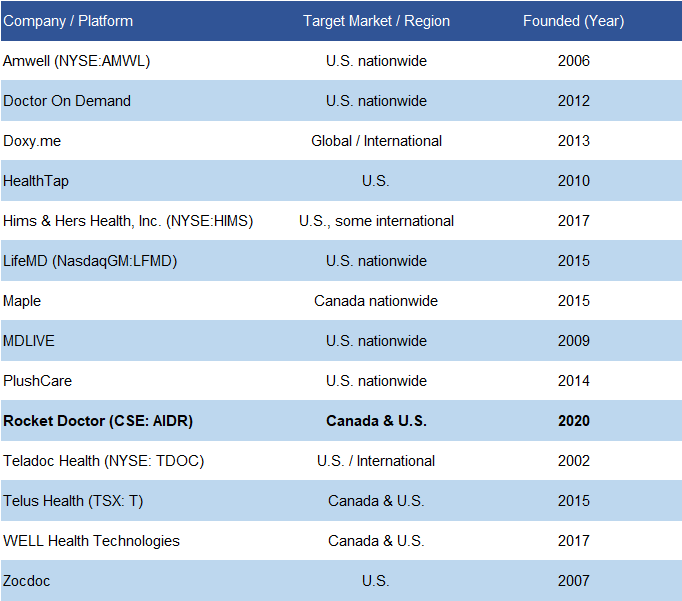

- The virtual healthcare space is highly competitive, with both large and small players. We believe RD stands out by offering a model that supports independent physicians, including a digital practice storefront, full operational support, transparent billing, no long-term contracts, and real-time AI assistance; features many competitors lack, as they often provide only partial support and require physician employment.

- While RD’s model is strategically attractive to doctors, we believe patient adoption will depend on marketing effectiveness, platform usability, AI performance, and network size.

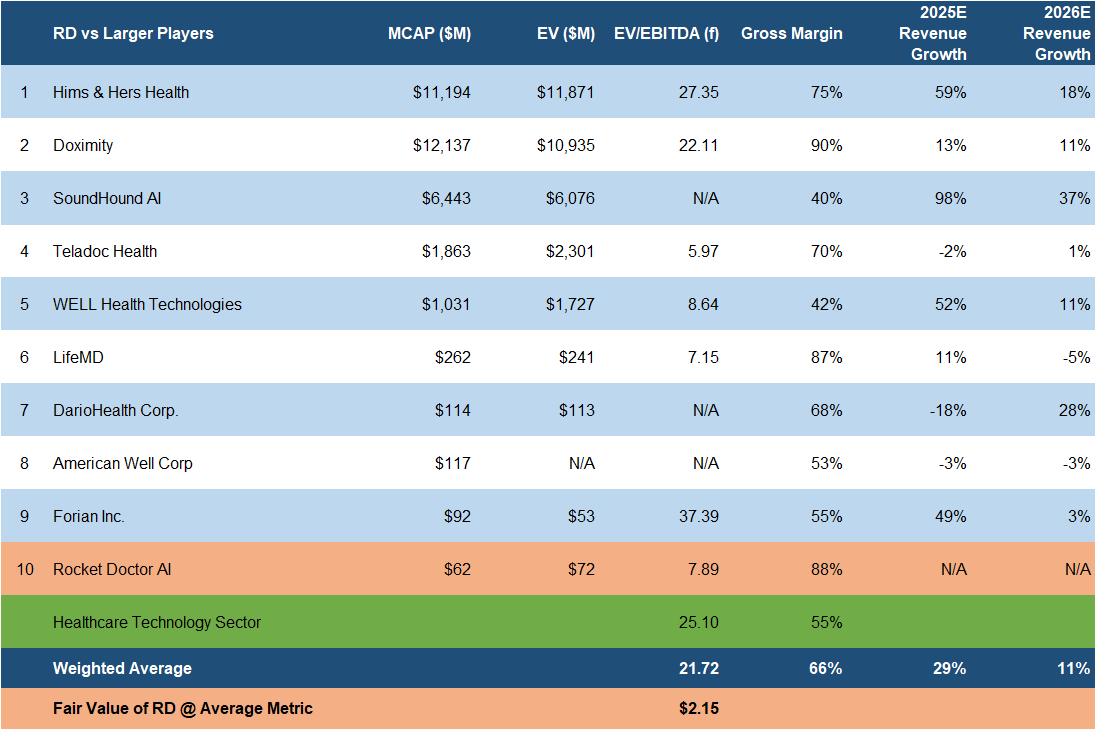

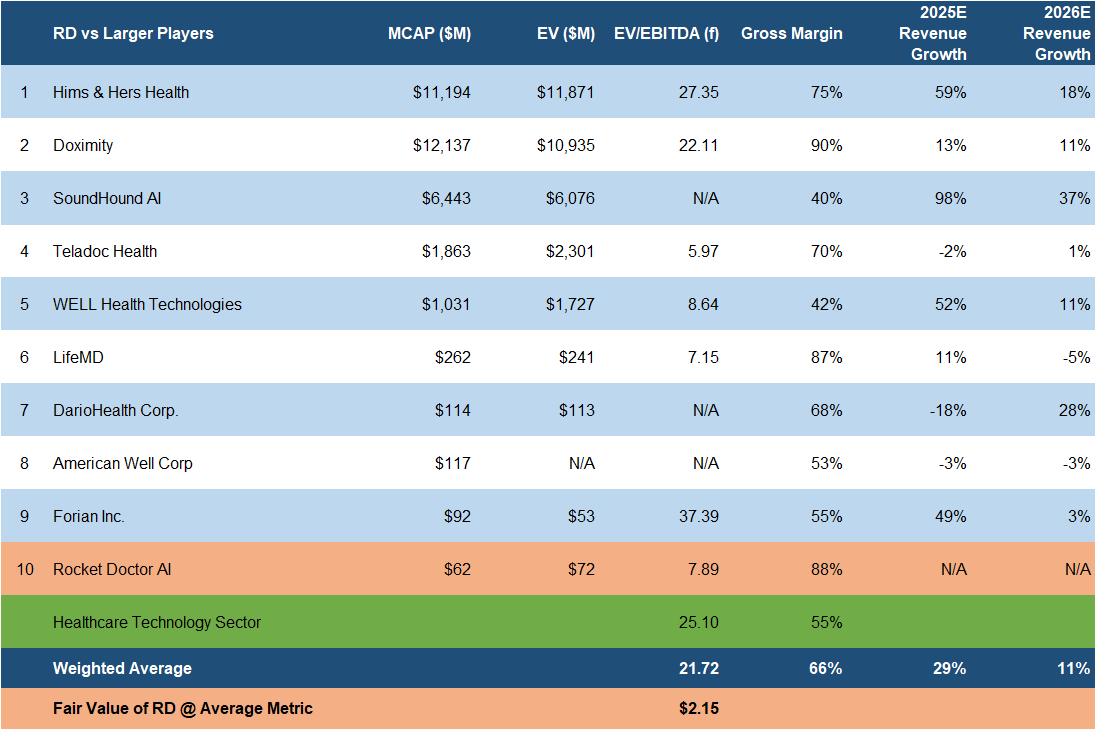

- AIDR is trading at 8x forward EBITDA vs the sector average of 22x, a 64% discount. We believe the company’s marketing campaigns in the U.S. over the next year will be decisive in determining whether it can successfully expand in the U.S. virtual care market, providing investors with early exposure to its potential for success.

- Competition from established telehealth providers

- Early-stage operations; not yet profitable

- New entrant in the U.S.

- Cybersecurity and data privacy risks

- Scaling challenges in building doctor and patient networks

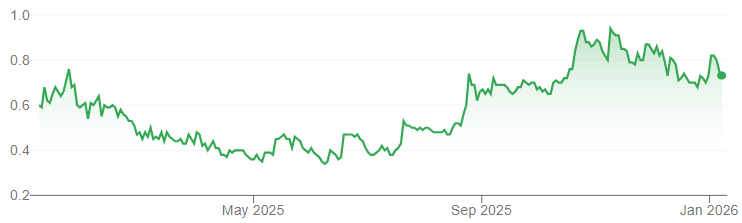

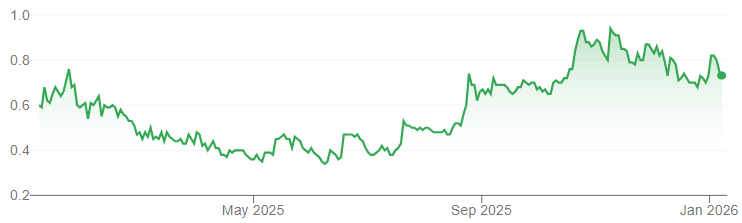

Price and Volume (1-year)

| |

YTD |

12M |

| KIDZ |

50% |

25% |

| TSXV |

13% |

15% |

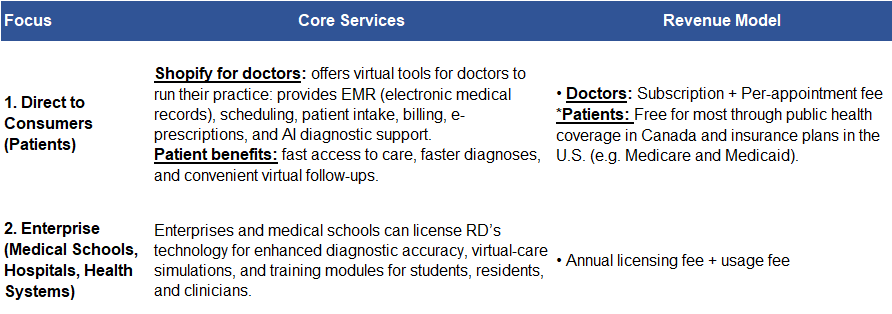

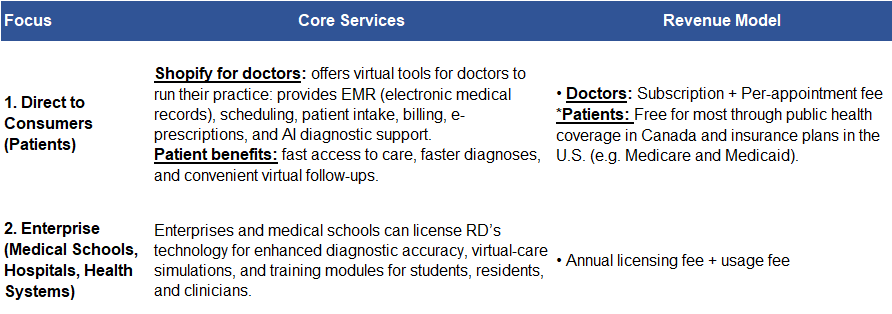

Building an AI-powered healthcare marketplace A two-pronged business model targeting patients (B2C) and healthcare institutions (B2B)B2C: Physician-Funded Model (Primary

Company Overview Evolution Timeline

Source: FRC

The company operates through two core business lines.

Its B2C offering is a digital health platform and marketplace connecting physicians and patients virtually, while enabling physicians to operate their own virtual practices.

On the enterprise side , the company aims to license its technology to medical schools, hospitals, and health systems.

Source: FRC

Revenue Driver)B2B: Institutions license AI tools for training and care RD’s AI-powered engine is its core intellectual property Extensive clinical knowledge base

Global Library of Medicine (GLM) The Global Library of Medicine (GLM) is R D ’s proprietary AI-powered engine designed to help healthcare professionals with diagnosis, treatment, and patient care. It covers over 1,000 diseases , 17,000 symptoms, lab tests, treatments , and provides real-time diagnostic support, and can be integrated into clinics, insurance systems, other patient facing services, or medical schools .

Developed over nearly 10 years with 25,000+ hours of clinician input and verified medical content, RD positions the GLM as reliable, accurate, and carefully designed to reduce bias. GLM and Digital Health Platform – Features, Content, and Capabilities

Below are links to video demonstrations showcasing RD’s diagnostic tools , and how its AI Nurse assesses symptoms : Source: FRC / Company

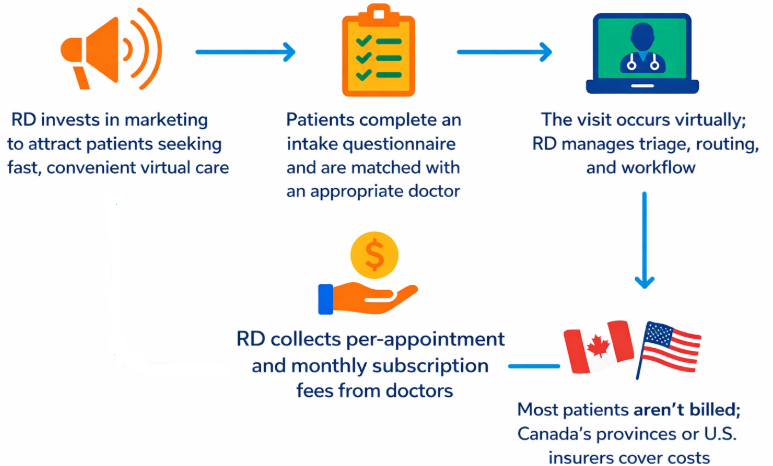

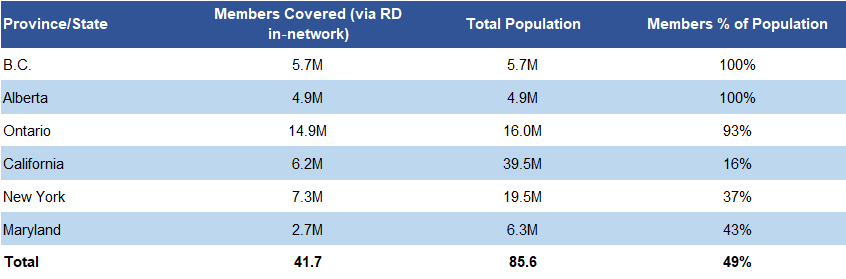

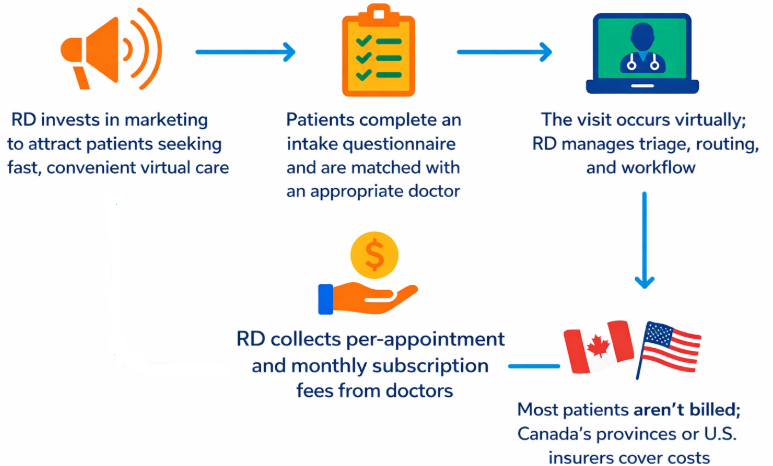

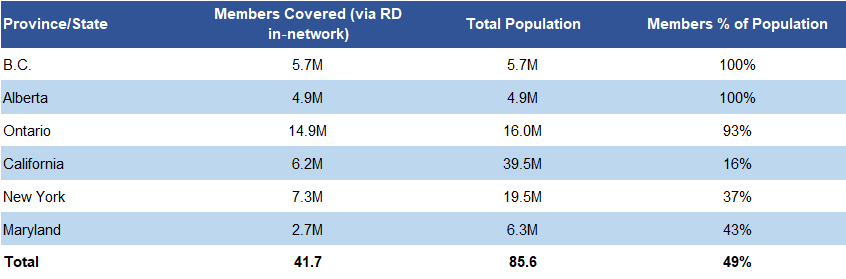

The platform provides end-to-end support, including an AI chatbot handling triage (prioritizing patients based on urgency), patient/provider matching, and appointments, while doctors receive diagnostic and treatment guidance Features include an AI Nurse for symptom checks, a ClinBot that drafts notes and summaries, and automated workflows that streamline tests and administrative tasks Offers a streamlined virtual care experience from patient intake to payment Operating since 2020 in Canada; currently focused on U.S. expansion Canada: Relatively low regulatory hurdles U.S.: Higher barriers due to insurance contracts RD’s target poolincludes 42M people, or 49% of the populationacross its U.S. and Canadian regions Partnerships with over 10 insurers in the U.S.Marketing is key Focusing on family physicians Six out of 14 companies listed are publicly traded Patient networks on virtual care platforms range from several hundred thousand to tens of millions, while doctor networks range from a few hundred to several thousand, reflecting a fragmented market composed of both large and small players

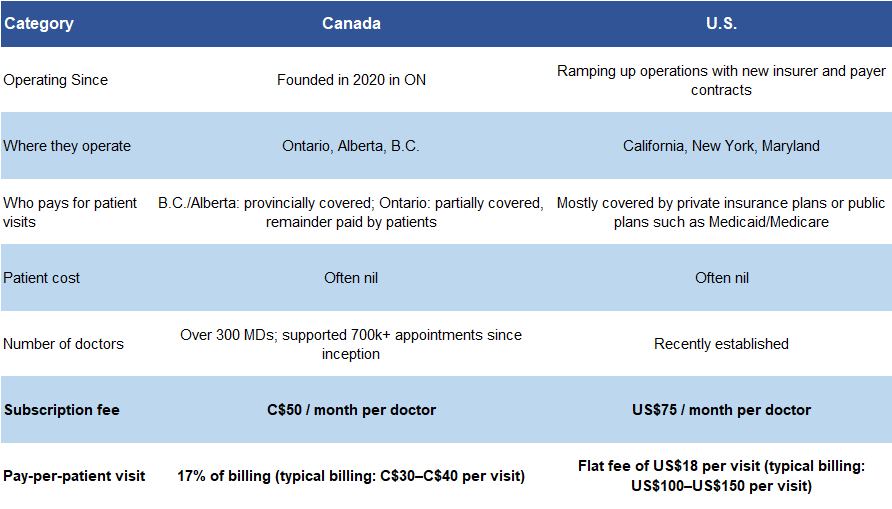

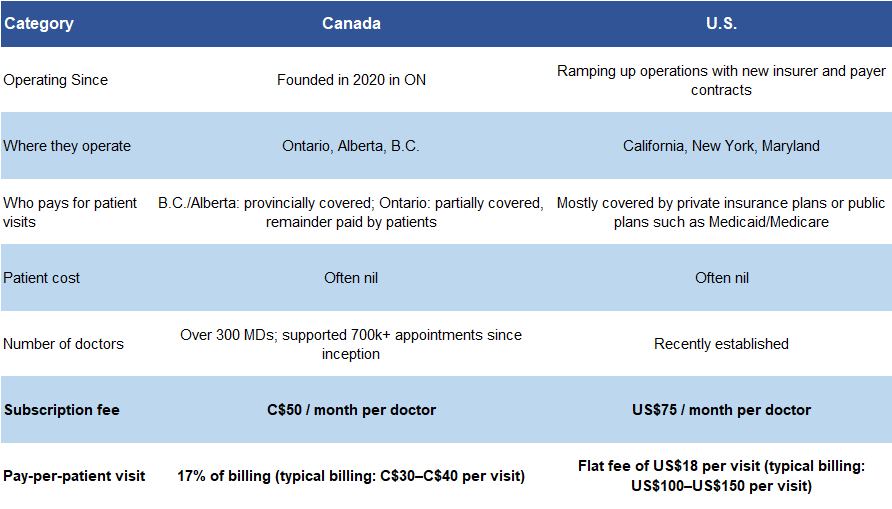

Flagship Revenue Stream ( B 2C) - “Shopify for Doctors” RD operates a digital health platform and marketplace connecting patients with licensed physicians. The platform has been active in Canada since 2020 , and launched in the U.S. in 2024 . Doctors and patients join the RD network and connect via a proprietary platform that matches one another based on clinical needs, preferences, availability, and appropriateness. The company primarily targets patients using government-funded health insurance (provincial in Canada and Medicaid/Medicare in the U.S.). RD generates revenue from doctors through monthly subscriptions and per-appointment platform fees. The Rocket Doctor Process

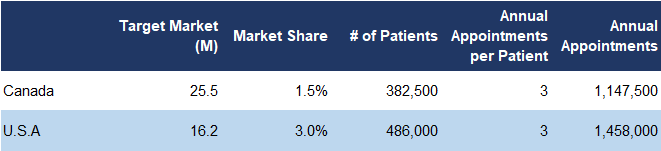

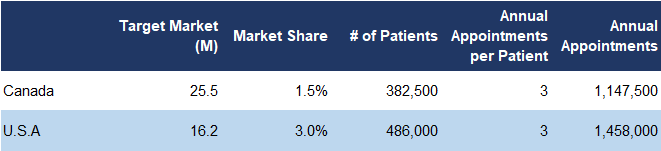

Target Markets

Source: FRC

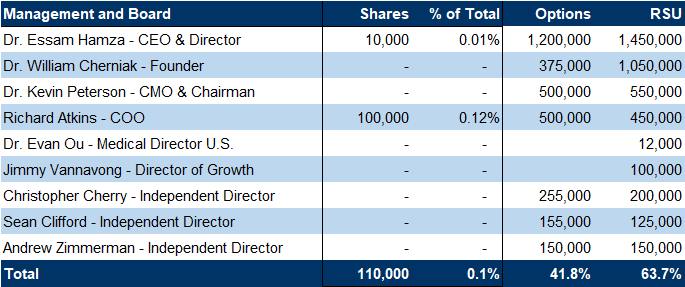

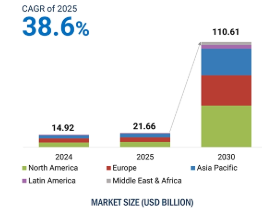

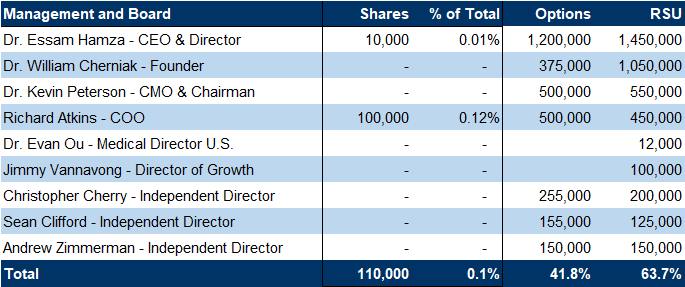

We view these developments as strong testimonials for RD’s technology/platform RD has 18 employees, 27 contractors, and up to 85 call center contractors in the Philippines Management and the board have minimal equity but are incentivized with options and restricted stock units Management blends physicians and technology professionals Three out of five directors are independent North America held the largest share of the virtual care market in 2024, accounting for 28% of the global market

Operating Environment and Barriers to Entry

Source: FRC RD has been active in Ontario, B.C. , and Alberta since 2020. In the U.S., the company recently signed agreements with over 10 insurers , enabling access to all of their insured members in California , New York , and Maryland .

These partnerships allow RD to deliver care to more than 13 M insured patients across these three states.

Source: FRC / Various

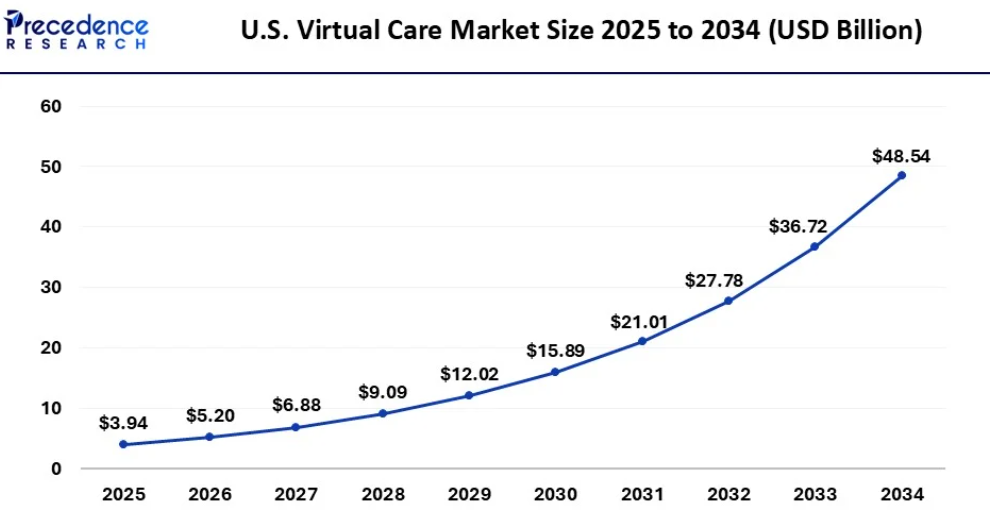

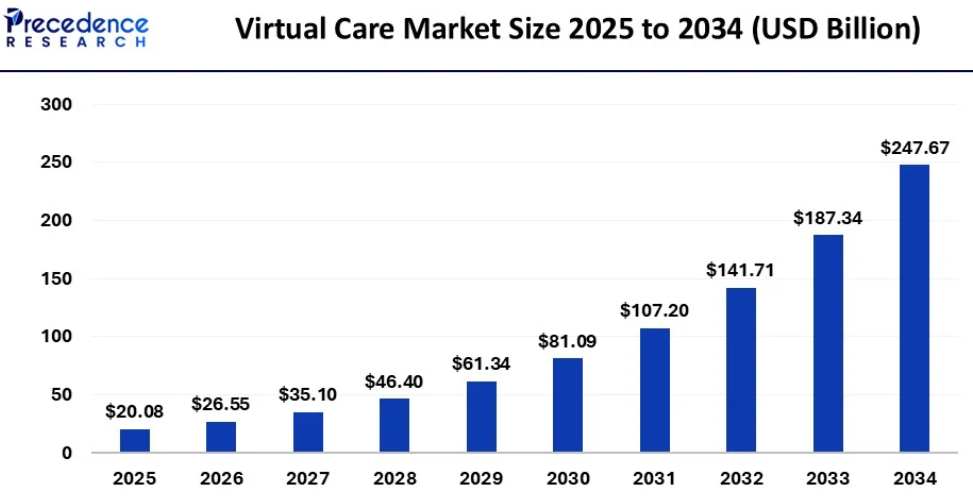

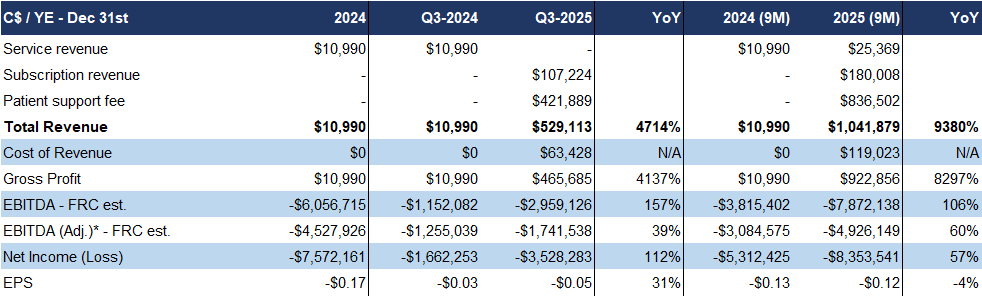

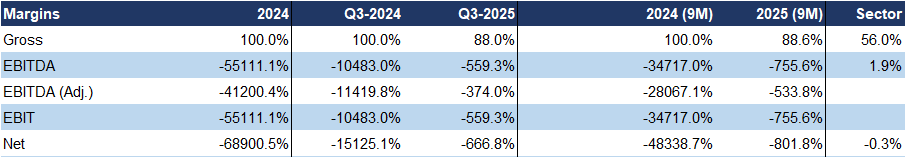

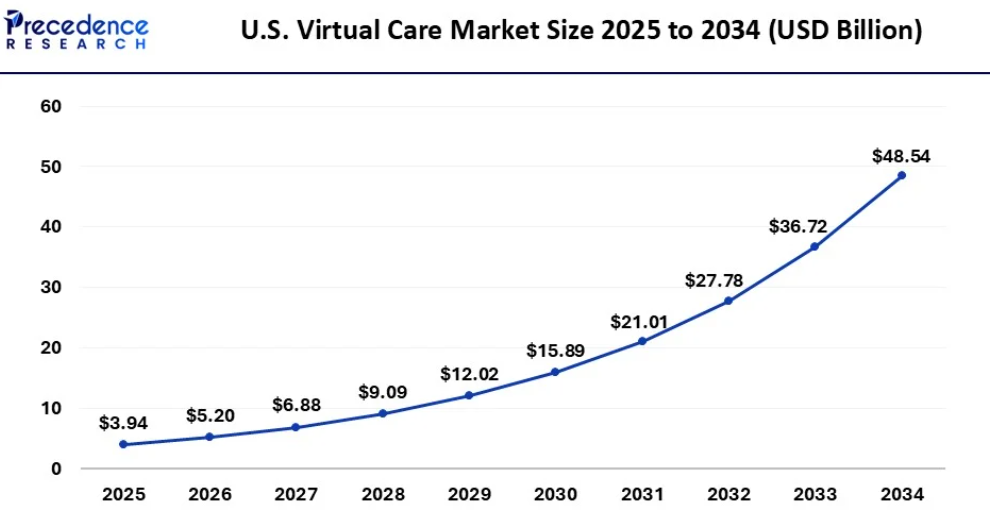

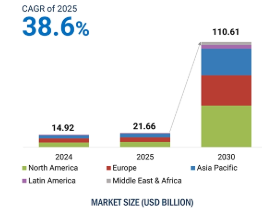

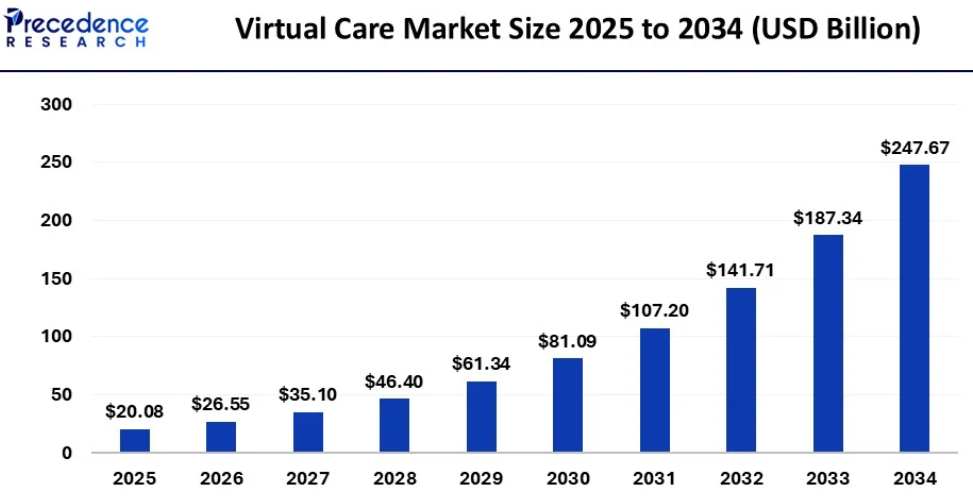

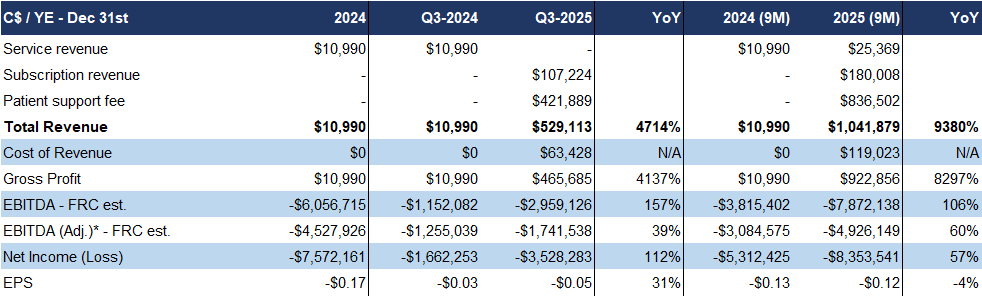

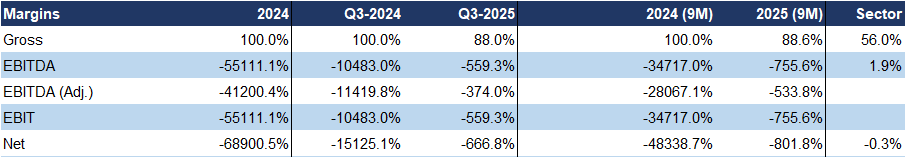

The global AI in healthcare market grew from US$15 B in 2024, to US$22 B in 2025 (estimate), and is projected to reach US$111 B by 2030, growing at a CAGR of 39%The global virtual care market is projected to grow from US$20B in 2025, to US$248b by 2034, at a CAGR of 32%Started generating revenue after acquiring Rocket Doctor in April 2025 Q3 was the first full quarter, with $0.53M in revenue, including $0.11M from subscriptions and $0.42M from patient fees High gross margins (85-90%)

Source:

Company

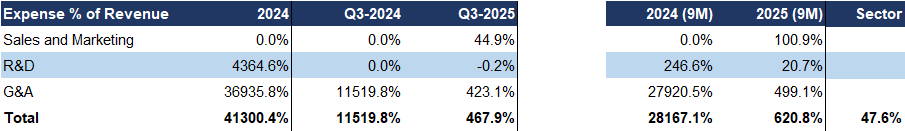

Competitive Landscape and Physician Targeting RD operates in the highly competitive virtual-care market. In both the U.S. and Canada, insurers and provincial healthcare systems work with multiple virtual-care providers to offer residents broad access to services. While RD and other vendors are listed as virtual care partners on provincial or insurer websites, we note that attracting patients requires significant marketing effort .

Physicians can technically join multiple platforms to increase visibility. However, discussions with management indicate that most doctors prioritize convenience and stability, typically joining only one network at a time . RD primarily targets family physicians with a main in-person practice who seek flexible remote work and supplemental income (five to 10 hours weekly).

We believe RD offers several advantages that make its platform appealing to physicians: Digital Practice Storefront: Provides a “Shopify-style” virtual practice setup, allowing doctors to run virtual clinics with ease End-to-End Services: RD h andles scheduling, documentation, and billing so doctors can focus on patient care.

Physician Autonomy: Unlike most telehealth models where doctors are employees, RD requires no contracts, giving physicians full flexibility and control over their virtual practices.

EPS have yet to turn positive At the end of

Competitive Economics:

Doctors pay RD ~ 17% of revenue per patient visit, compared with 2 5 –40% typically taken by physical clinics. Most other virtual-care platforms pay doctors a fixed salary or hourly rate instead of per-visit earnings.

Targeted Physician Pool: RD focuses on physicians seeking patients , flexible remote working hours , and supplemental income, rather than those with established practices.

Transparent Billing: Full visibility into payments, including insurer contributions and doctor earnings.

Efficient Billing Cycle: In Canada, doctors bill provinces via RD’s platform, and are paid within a fe w weeks. In the U.S., RD bills insurers on their behalf, with payments taking 1-5 weeks depending on the jurisdiction. In both countries, RD charges its proportional fee to the doctor’s credit card, usually once a month.

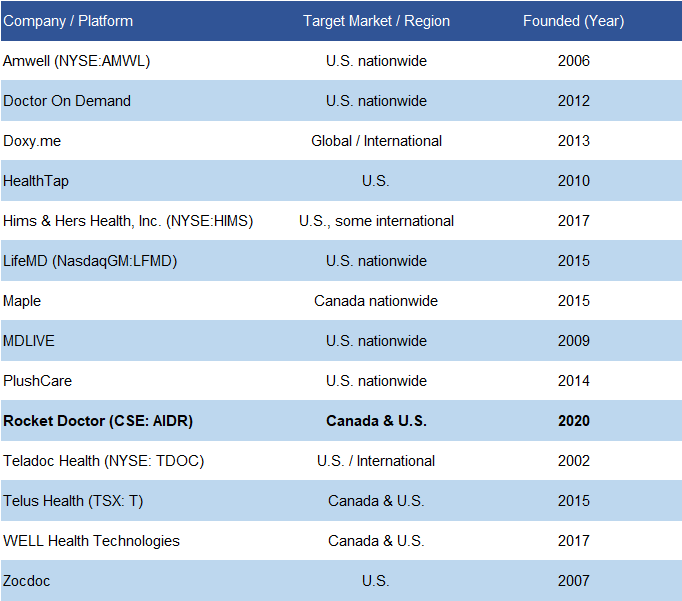

Key Competitors The market features a mix of established players, including the U.S.-focused Teladoc Health /NYSE: TDOC (founded in 2002) and Amwell /NYSE: AMWL (founded in 2006), as well as Canadian competitors like Telus Health /TSX: T, and Maple (both founded in 2015).

Source: FRC / Various

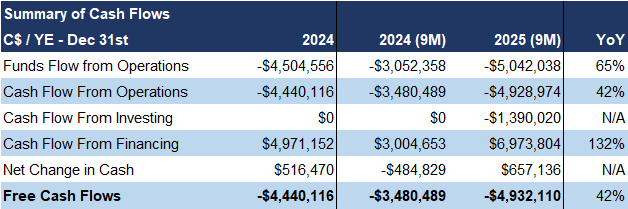

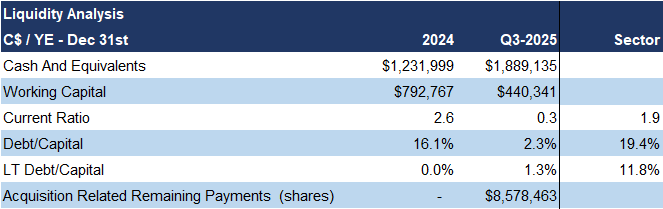

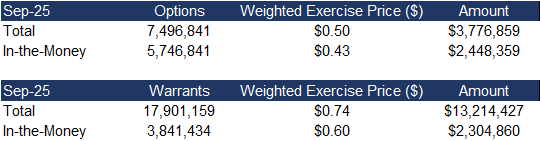

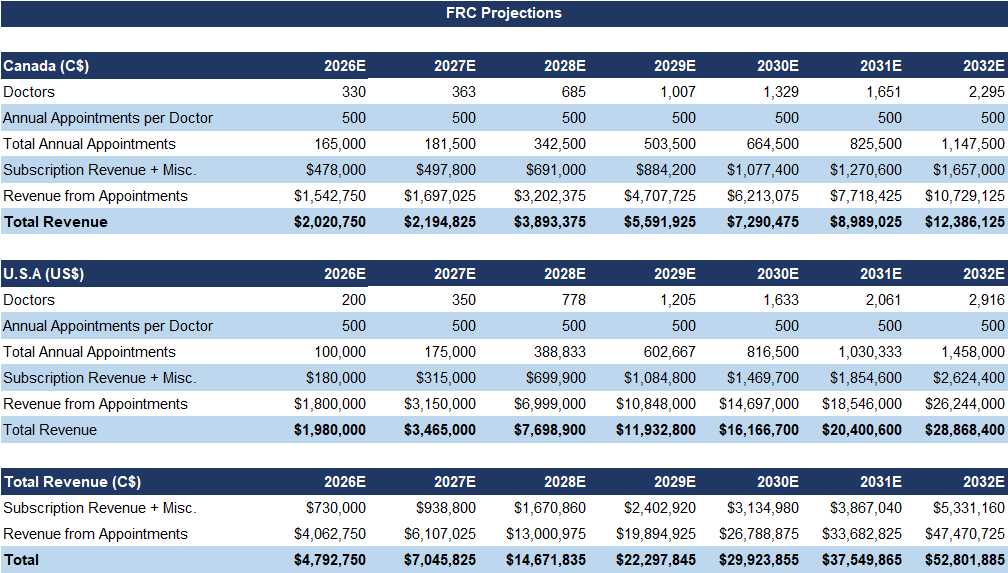

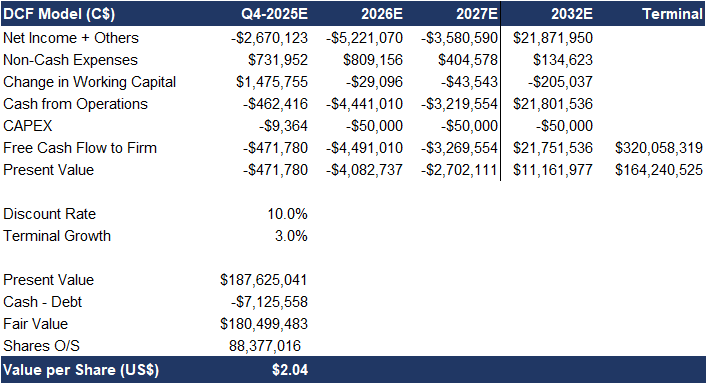

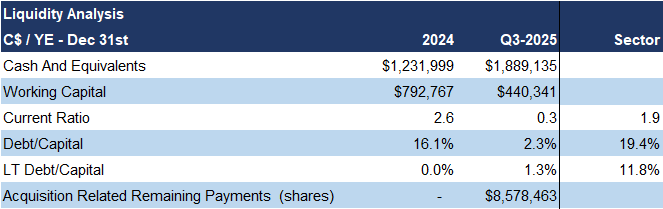

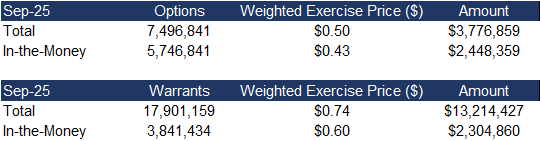

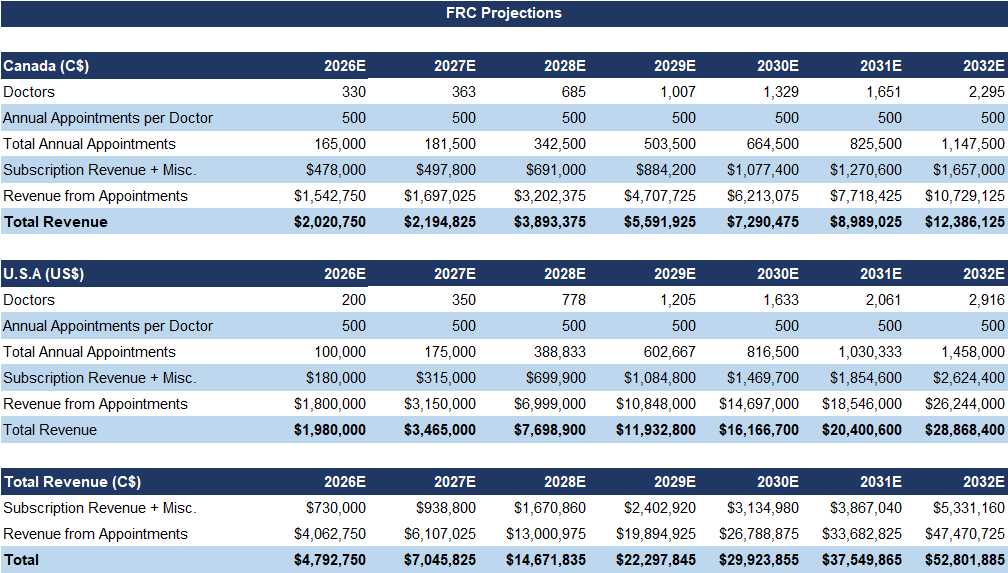

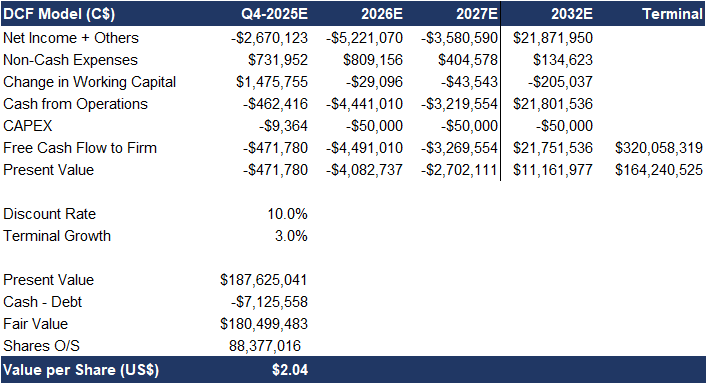

Q3, the company had $1.89 M in cash, and minimal debt In-the-money optionscan bring in $5 M We are conservatively valuing RD based on the assumption that its network will capture 1.5% of its target market in Canada, and 3% in the U.S. by 2032 Our DCF model returned a fair value estimate of $2.04/share AIDR is trading at 8x forward

As mentioned earlier, the

virtual healthcare and telehealth space is highly competitive , with several large providers connecting patients and doctors across the U.S., Canada, and even globally.

On the patient side, RD claims its AI-driven features , including triage, remote consultations, and diagnostic tools , are superior, though we have not independently verified this.

We believe t he capabilities of its GLM engine, particularly in knowledge and diagnostic support, represent a major potential advantage .

On the doctor side , RD ’s model helps physicians establish a digital practice storefront while handling all operational tasks. Many competitors either require doctors to manage these tasks themselves or provide only partial support. Additionally, RD does not tie doctors into long-term employment contracts and offers transparent billing, providing physicians with greater flexibility in how they practice.

We believe t he GLM’s real-time physician support is another significant benefit, allowing doctors to leverage AI assistance for knowledge and diagnostic purposes.

Barriers to entry in this space are high due to the need for insurer partnerships, infrastructure setup, and building a robust doctor network, which management estimates takes two-three years for new entrants . RD believes new entrants would need two - three years to replicate its platform

Source: Company

That said, RD currently has a significantly smaller network of doctors and patients than established players. The success of its model depends on the company’s ability to scale both its doctor network and patient base .

While RD’s model is strategically attractive to doctors, we believe patient adoption will depend on marketing effectiveness, platform usability, AI performance, and network size.

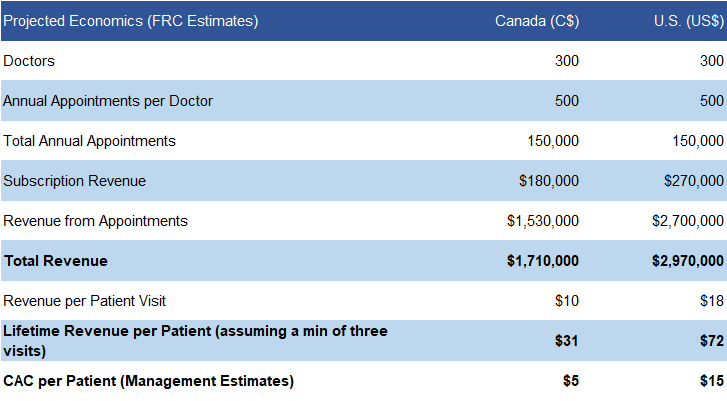

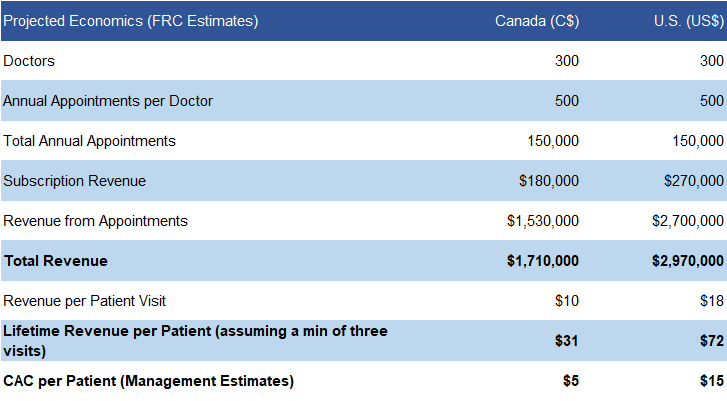

Economics The table shows Canada’s revenue run rate and our projected U.S. revenue once its physician network matches Canada’s .

EBITDA vs the sector average of 22x; applying the sector multiple yields a comparables valuation of $2.15/share

Source: FRC

RD targets chronic patients (e.g., diabetes, hypertension, asthma, and depression/anxiety ), focusing on recurring care that generates stable, long-term revenue , as these patients typically require multiple visits per year .

Customer acquisition cost (CAC) is a key driver of the business’s economics. Historically, RD’s CAC in Canada was C$5 per patient, compared with lifetime revenue of C$31 per patient, implying robust margins. In the U.S., normalized CAC is expected to be around US$15 per patient vs lifetime revenue of US$72 per patient.

Enterprise Business RD’s B2C platform currently operates without GLM components.

The company plans to offer physicians access to GLM modules, or the full suite, for diagnostic and real-time clinical support, for a monthly or usage-based fee.

The GLM is currently used primarily for enterprise sales, with one institution licensed to date ( University of Minnesota ). RD has yet to start generating meaningful revenue from enterprise sales.

Its pricing structure includes an undisclosed upfront implementation fee, ongoing hosting fee s , a per-user monthly platform access fee, and a percentage of billings processed through the platform.

Recent Developments: NIH Grant – Treatment.com Inc.: RD has received a US$0.5M grant (over two years) from the National Institutes of Health (NIH) to develop an AI-powered medical history tool to improve early diagnosis and preventive care.

We are assigning a risk rating of 4 (Speculative)

TMU Partnership:

Partnered with Toronto Metropolitan University (TMU) to accelerate physician recruitment , and provide medical students and trainees with hands-on experience by connecting them to physicians across Canada through its clinician network.

Alea Health Acquisition: Acquired UAE-based Alea Health, an AI-driven mental health platform, to expand GLM mental health capabilities, integrate AI therapy with primary care, and create an opportunity to enter the Middle East. Total consideration: US$350 k in cash and shares.

Management and Directors Share Ownership

Source:

Edgar / FRC

Source: Company

Market Overview

Virtual health appointments have surged from 1% of total visits in early 2020 , to over 20% today , driven by patient demand for convenience, while in-person visits remain essential for hands-on exams and comprehensive diagnostics in a hybrid care model.

AI in Healthcare

Source: MarketsandMarkets

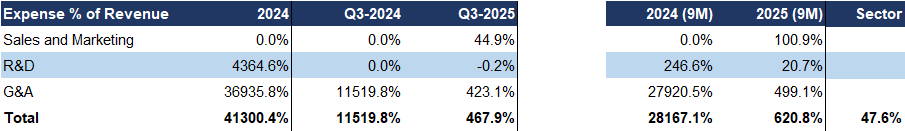

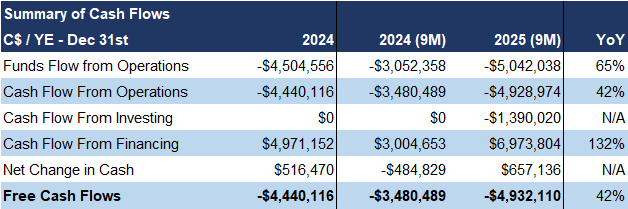

Financials

* In FY2024 and FY2025 ( 12 months end ed March), the acquired entity generated $1.20M and $1.83M in revenue, respectively .

Source: FRC / Company

Source: FRC / Company

Source: FRC / Company

Source: FRC / Company

Source: FRC / Company

FRC Valuation and Rating

Source: FRC

Source: FRC

Source: FRC

*We use the present value of our 20 30 EBITDA estimate for RD in this calculation.

Source: FRC / S&P Capital IQ We are initiating coverage with a BUY rating, and a fair value estimate of $ 2. 10 /share (the average of our DCF and comparables valuations).

We believe RD is well-positioned in the rapidly growing virtual healthcare market, offering a scalable , AI-powered platform with strong margins , and a model that supports independent physicians, differentiating it from competitors.

With recent U.S. expansion and potential access to 13M insured patients, its growth trajectory could accelerate if marketing and platform adoption succeed.

Risks We believe the company is exposed to the following key risks (not exhaustive): Competition from established telehealth providers Regulatory changes Early-stage operations; not yet profitable New entrant in the U.S.; high customer acquisition costs and uncertain adoption Cybersecurity and data privacy risks , including patient data breaches Scaling challenges in building doctor and patient networks Need to raise equity to fund marketing and growth, with potential for share dilution