- Federal Immigration Cuts & Market Insulation: We believe federal cuts to international student permits, immigration caps, and tighter work permit rules will put pressure on housing markets across Canada. However, Vancouver is relatively insulated, especially GEC’s student housing, due to a severe shortage of affordable units, with vacancy rates under 1%. We believe GEC’s strategic mix, with 40–50% domestic students, further cushions the impact by reducing reliance on international students.

- Rental Recovery and Persistent Demand: Following a brief cooling in 2025, we expect Vancouver rents to rise through 2026 and 2027, driven by low vacancy rates, and higher construction costs. We believe that rising rental income, combined with lower interest rates, will boost GEC’s property valuations this year.

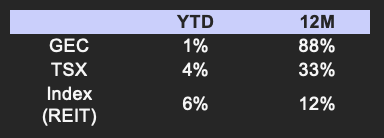

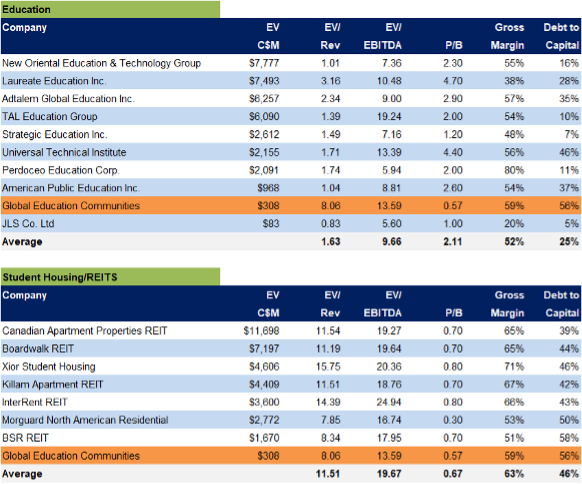

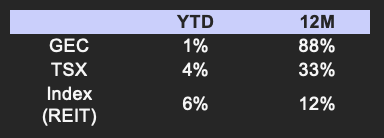

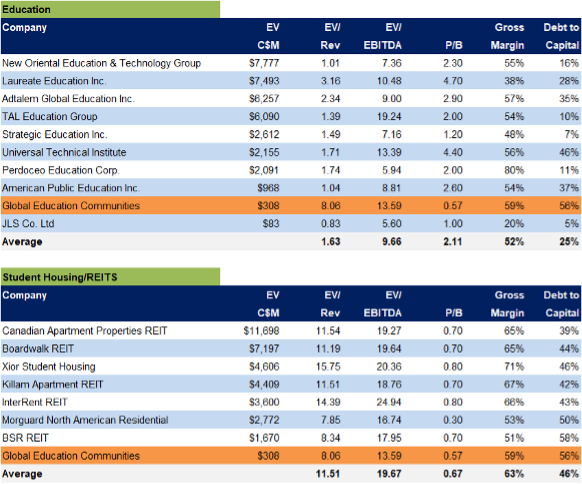

- Relative to REITs, GEC is trading at 8x forward revenue (sector: 12x), and 14x forward EBITDA (sector: 20x), a 31% discount on average.

Price and Volume (1-year)

* Global Education Communities has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions. All figures in C$ unless otherwise specified.

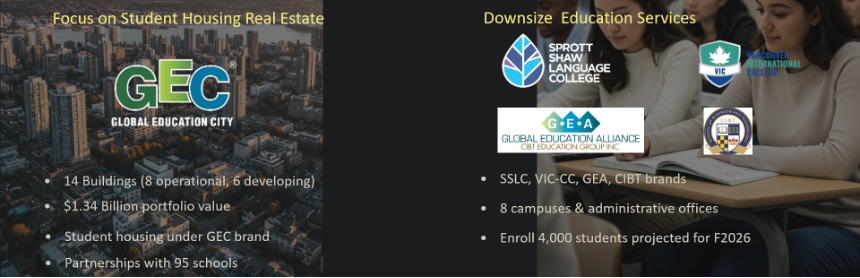

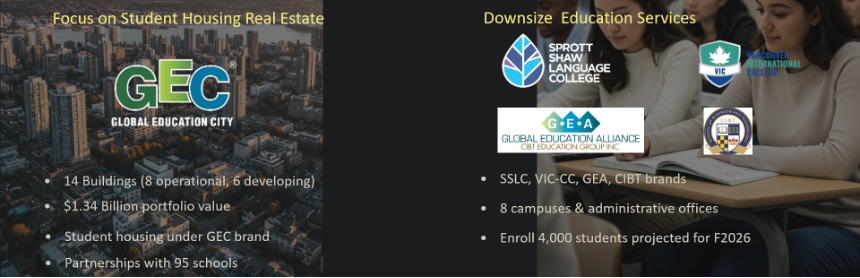

Core Business Strategy

In addition to GEC, the company also owns two language schools: Sprott Shaw Language College (SSLC) and Vancouver International College (VIC).

Source: Company

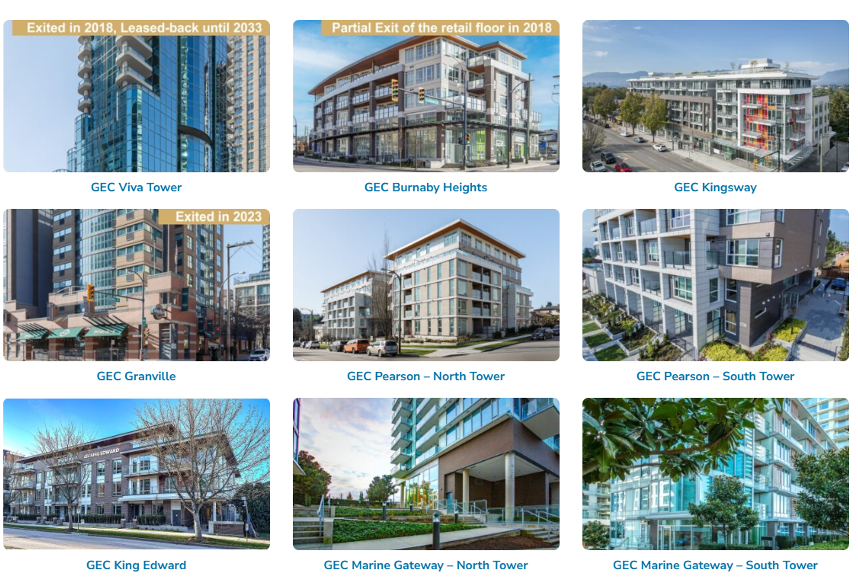

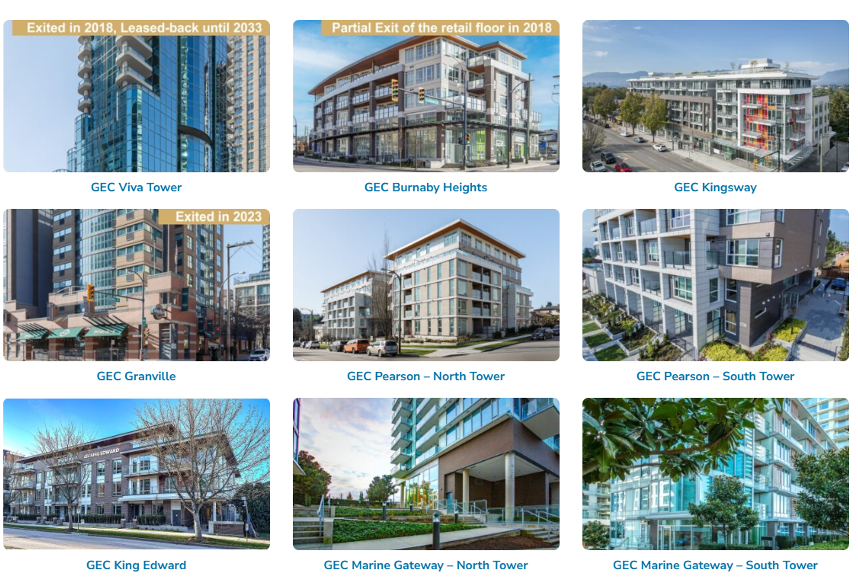

GEC operates B.C.’s largest off campus student housing platform, comprising 14 buildings, eight currently operating and six under development

Rental assets offer inflation-protected income, with low volatility, making them attractive to pension funds and institutions

Several major Canadian REITs have recorded property write-downs over the past 12 months, largely due to softer market rents and valuation pressures. With rents and property values expected to recover modestly in 2026, we believe GEC is well positioned to report valuation gains. These gains should be further supported as ongoing development projects reach completion, providing additional upside to asset values and NAV.

Per Q1 financial statements, these projects were appraised at $307M, up 0.3% QoQ

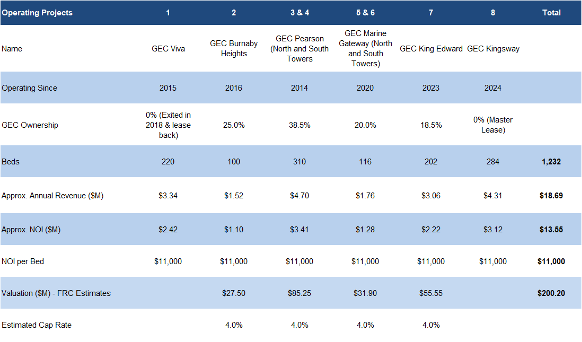

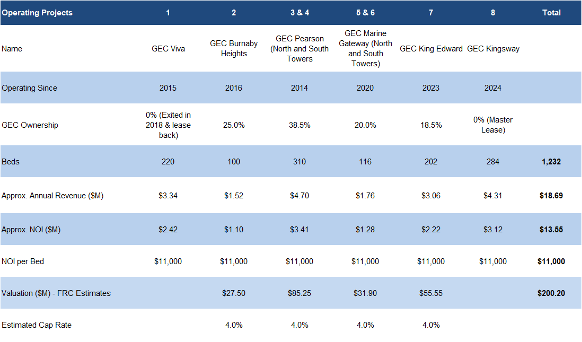

Operating Projects

Source: Company

Eight operating buildings across six projects (1,232 beds)

GEC holds minority interests, and acts as project operator across all properties

Potential to generate $14M in NOI, or $11k/bed in NOI per year

*On January 14, 2025, the company announced that GEC Langara received rezoning approval to redevelop a single-house site into a 26-storey rental tower, allowing the project to move forward with development and building permit applications.

Source: Company/FRC

Developing six buildings across four projects (2,988 beds

We are projecting $45M in NOI, or $15k/bed per year

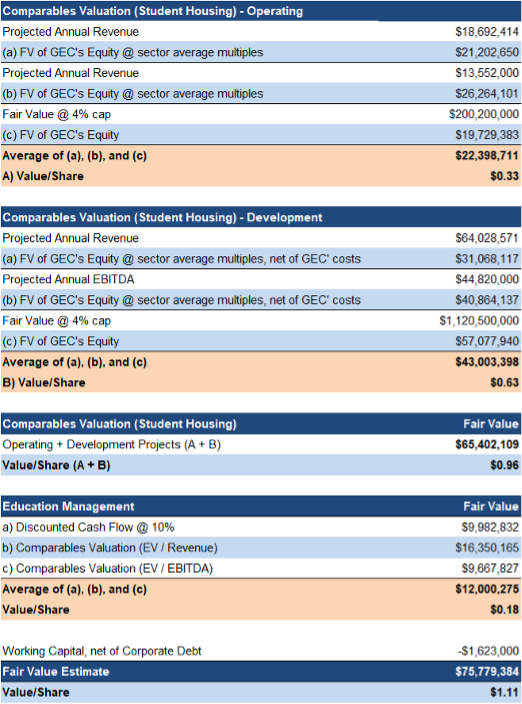

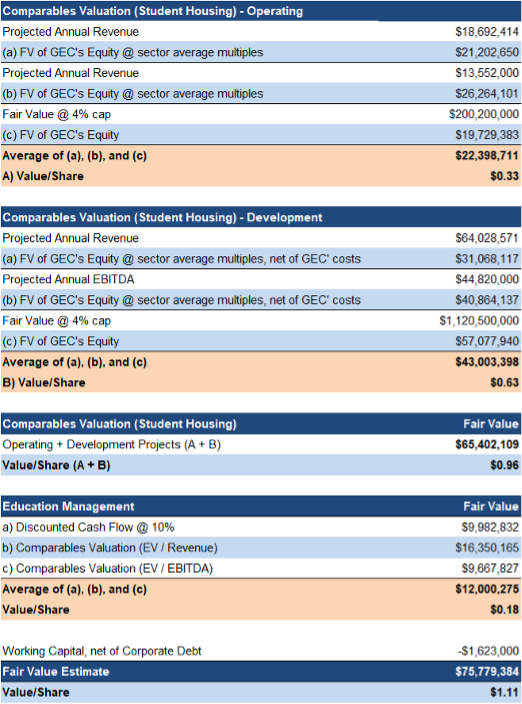

At a 4% cap rate, we value these projects at $1.12B upon completion, unchanged from our report in December 2025

Target completion is 2027–2030; we note that real estate development projects are often subject to permitting/financing delays

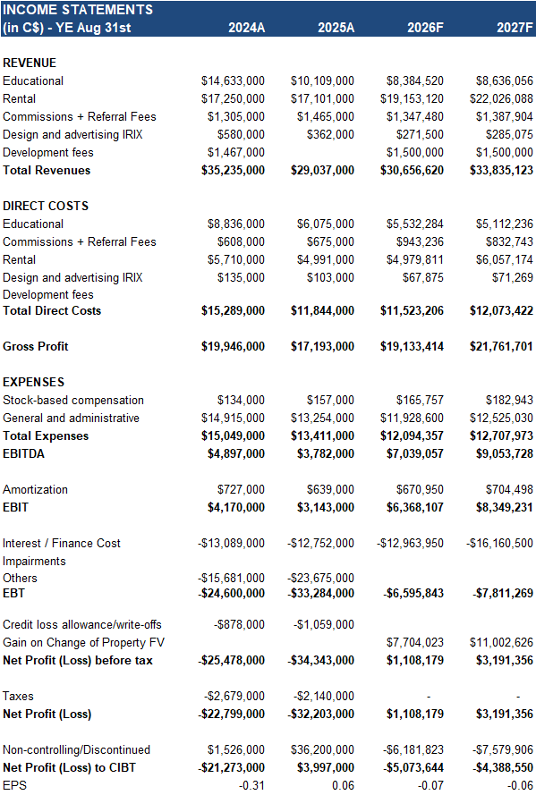

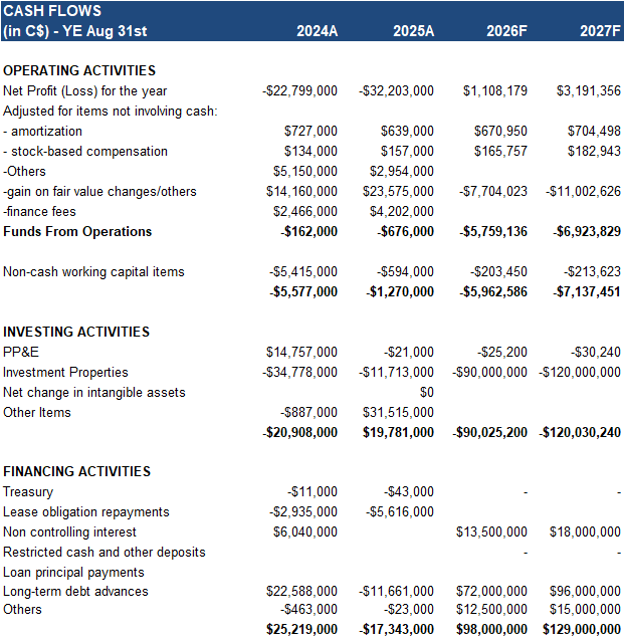

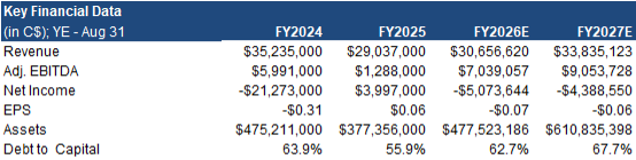

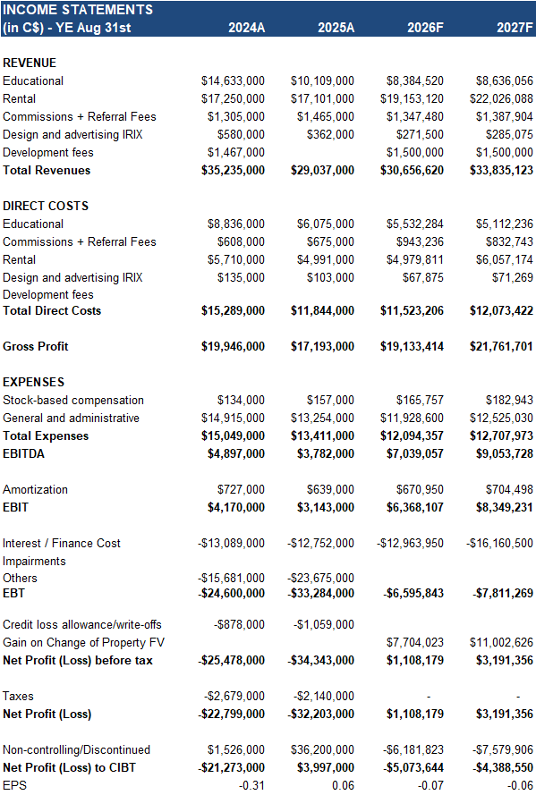

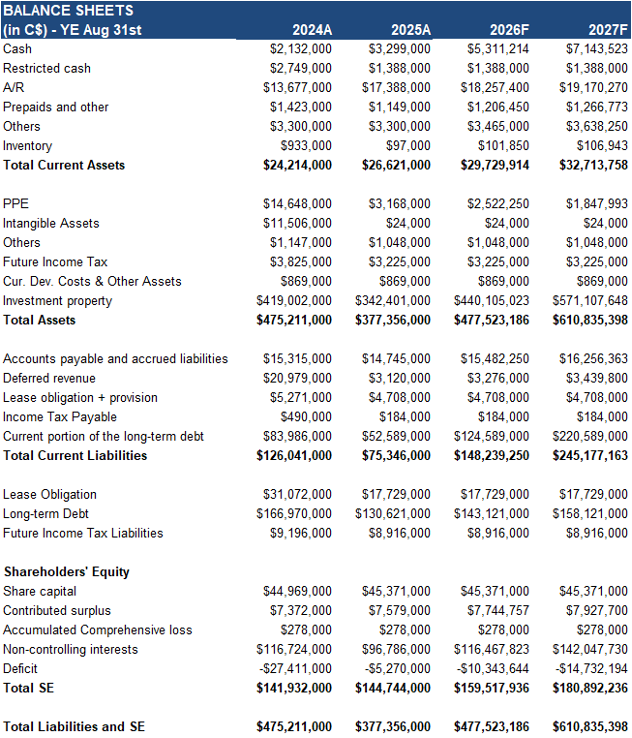

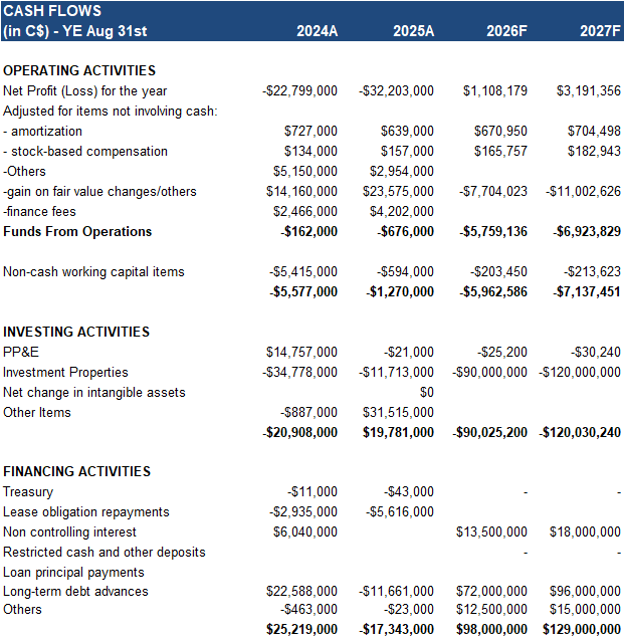

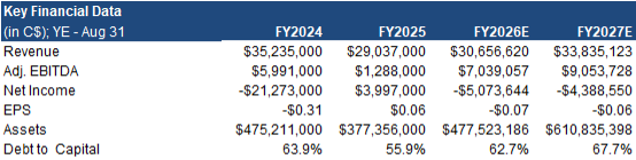

Financial

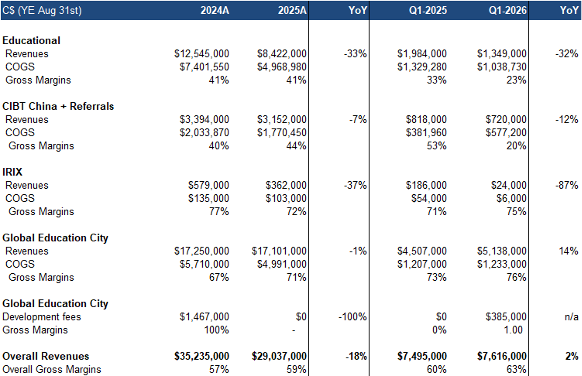

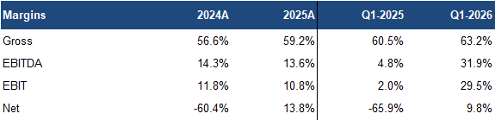

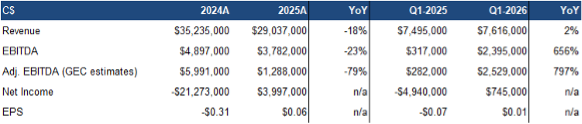

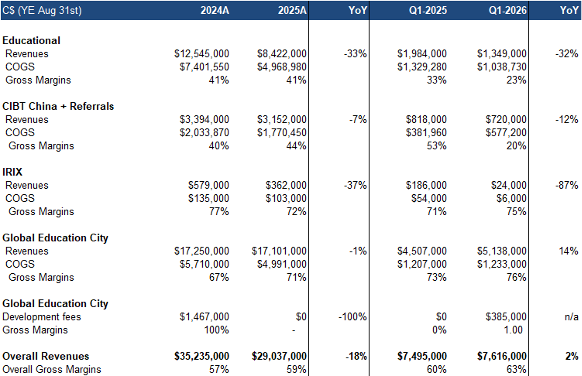

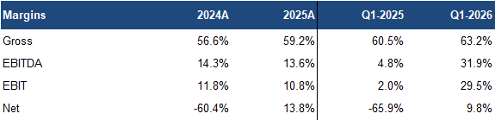

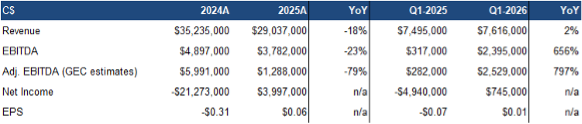

Q1 revenue rose 2% YoY, missing our estimate by 3%, driven by 14% growth in the flagship rental business, and partially offset by weaker education revenue due to lower international enrollments

Rental revenue, which made up 67% of total revenue (Q1 2025: 60%), grew with contributions from recently completed projects

Gross margins rose 2.7 pp to 63%, beating our estimate by 1.5 pp, driven by higher rental business margins

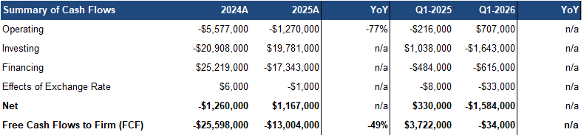

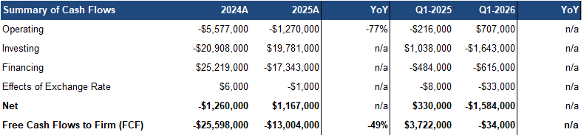

G&A expenses fell sharply YoY following the SSC sale last year, resulting in higher EBITDA, EPS, and operating cash flow

EPS improved YoY from ($0.07) to $0.01, beating our estimate by 7%

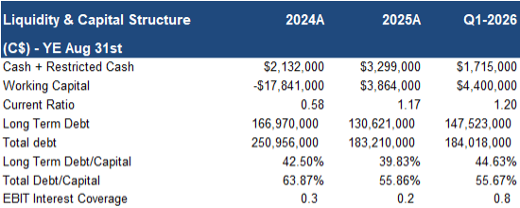

Source: FRC / Company

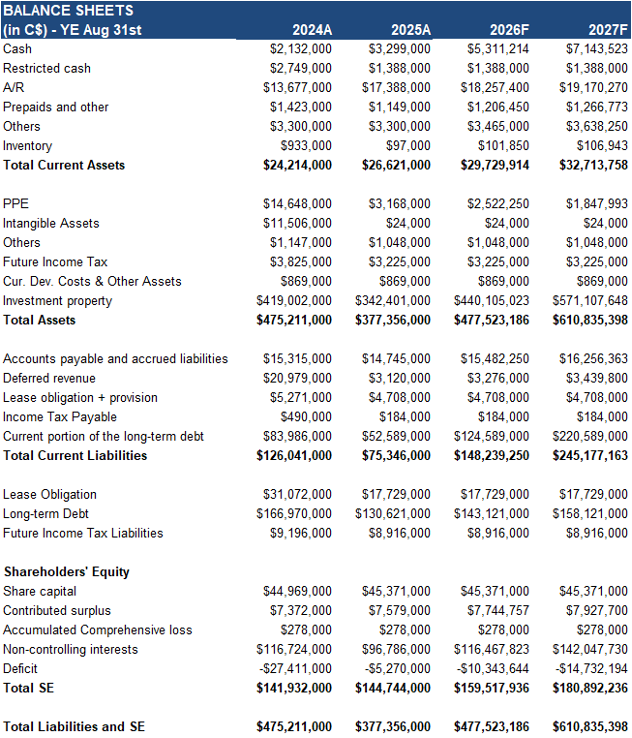

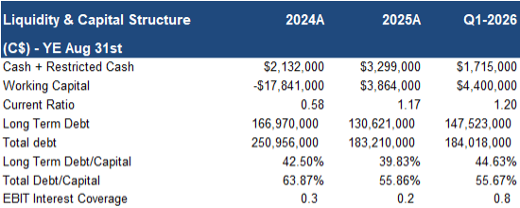

Debt-to-capital remained above the sector average (56% vs. 46%), but this is expected to improve once development projects are completed

FRC Projections and Valuation

Sector Multiples and Ratios

Source: S&P Capital IQ, FRC

GEC’s EV/R and EV/EBITDA multiples remain higher than those of education management peers but lower than real estate peers

Relative to REITs, GEC is trading at 8x forward revenue (sector: 12x) and 14x forward EBITDA (sector: 20x), a 31% discount on average

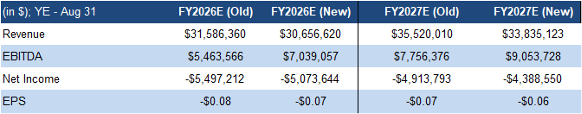

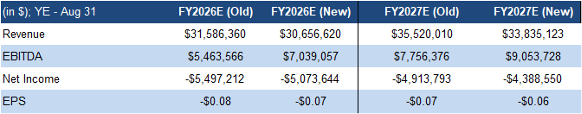

Although Q1 revenue missed, we are raising our EBITDA and EPS estimates on stronger gross margins, and lower G&A expenses

Source: FRC

As a result, our fair value estimate increased from $1.09 to $1.11/share

We are reiterating our BUY rating, and adjusting our fair value estimate from $1.09 to $1.11/share. GEC delivered a solid Q1, with strength in student housing, margin expansion, and lower G&A expenses driving EPS above our estimate despite modest revenue softness. We believe GEC’s diverse mix of domestic and international students, in Vancouver’s tight rental market, positions the company to weather immigration-related challenges.

Risks

We believe the company is exposed to the following risks:

- Real estate development and financing

- Potential for delays in project development and construction

- Cost overruns

- Permitting

- Profitability is highly dependent on the health of the rental market in Vancouver

- Vacancy and rental rate fluctuations

- Leveraged balance sheet

Maintaining our risk rating of 3 (Average)

APPENDIX