Market Intel Weekly

Juniors on the Move as Silver Hits US$85/oz

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

Highlights

*Disseminated on behalf of Fortune Minerals, DLP Resources, Panoro Minerals, South Star Battery Metals, Olympia Financial, Zepp Health, Skyharbour Resources, Silver X Mining, First Phosphate, and Southern Silver. See the bottom of this report for other important disclosures.

Silver juniors dominated headlines last week as silver soared to a fresh record high of US$85/oz, up from just US$26/oz a year ago. Other notable news included a promising product pipeline from a global smartwatch maker, and encouraging updates from phosphate and uranium juniors.

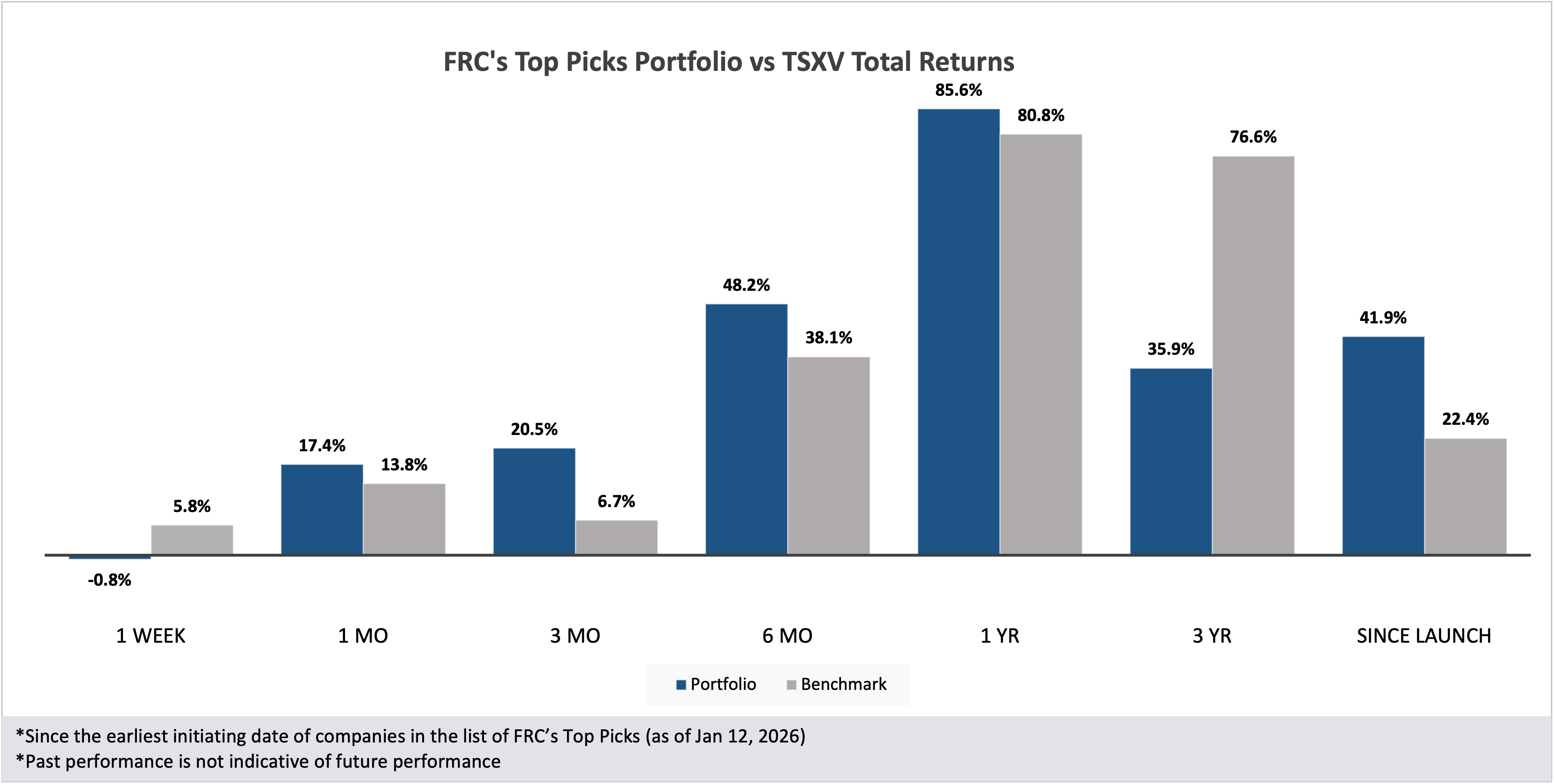

Cobalt-gold junior Fortune Minerals Limited (TSX: FT) led our Top Picks last week, rising 22%. Over the past year, our Top Picks have returned an average of 86%, outperforming the benchmark’s 81% gain. Visit our website to view our full list of Top Picks by sector.

*Past performance is not indicative of future performance.

Updates on Resource Companies Under Coverage

PR Title: Reports production growth at its Nueva Recuperada mine (Peru)

Analyst Opinion: Positive – Q4 production rose 18% QoQ to 197 Koz silver equivalent (AgEq), driven by higher processing rate, bringing full-year production to 812 Koz, almost exactly in line with our estimate of 811 Koz. This was particularly welcome after Q3 production had fallen short of expectations. AGX has surged 423% YoY, outperforming the Junior Silver Miners ETF (+219%), supported by a 204% YoY increase in silver prices. In 2026, the company plans to double its processing rate from 500 tpd to ~1,000 tpd by mid-year, supported by US$5M in CAPEX.

Southern Silver Exploration Corp.

PR Title: Additional drill results from the Cerro Las Minitas (CLM) project in Durango, México (QP: Robert Macdonald, MSc. P.Geo, VP Exploration of Southern Silver)

Analyst Opinion: Positive – SSV is up 353% YoY, driven by record silver prices and promising drill results. Ongoing drilling on the recently acquired Puro Corazon claim continues to intersect near-surface, high-grade silver-lead-zinc mineralization, including 10.4 m of 743 g/t AgEq, and 7.3 m of 305 g/t, compared with typical grades of 100-300 g/t for similar projects. SSV plans to incorporate these results into an updated resource estimate, and an updated Preliminary Economic Assessment (PEA). CLM hosts a large silver-rich polymetallic resource totaling 303 Moz AgEq, with relatively high-grade silver. A 2024 PEA reported an after-tax NPV5% of US$931M at US$32/oz silver (current spot: US$86/oz). SSV is trading at just 24% of its NPV based on US$32/oz silver, highlighting substantial upside potential.

First Phosphate Corp

PR Title: Receives initial payment under long-term offtake agreement for phosphate concentrate

Analyst Opinion: Positive - One of PHOS’s offtake partners has made an initial payment of US$0.53M, which we view as a strong vote of confidence in the company. PHOS is completing a 30,000 m drill program, to be followed by an updated resource estimate, and a feasibility study. PHOS is up 127% since we initiated coverage in July 2025, driven by both company-specific advancements, and sector developments. Sector catalysts include the recent addition of phosphate to the U.S. Critical Minerals list, and China’s export controls on cathode active material CAM) for lithium iron phosphate (LFP) batteries.

Skyharbour Resources Ltd.

PR Title: Expands uranium exploration portfolio (Saskatchewan)

Analyst Opinion: Positive – SYH has staked 40 new prospective uranium exploration claims in northern Saskatchewan, increasing its total land position to 662,887 hectares across 43 projects, making it one of the largest portfolios among uranium juniors in the Athabasca Basin. The company recently formed a joint venture with Denison Mines (TSX: DML) to advance its Russell Lake uranium project. Option partners are actively advancing their projects, and could commit up to $76 M for exploration, and $42M in cash/share payments to SYH.