Market Intel Weekly

This Lithium Stock Is on a Tear: Is an M&A Brewing?

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

Highlights

*Disseminated on behalf of Lake Resources, Panoro Minerals, Giga Metals, Noram Lithium, Kidoz Inc., and Aton Resources. See the bottom of this report for other important disclosures.

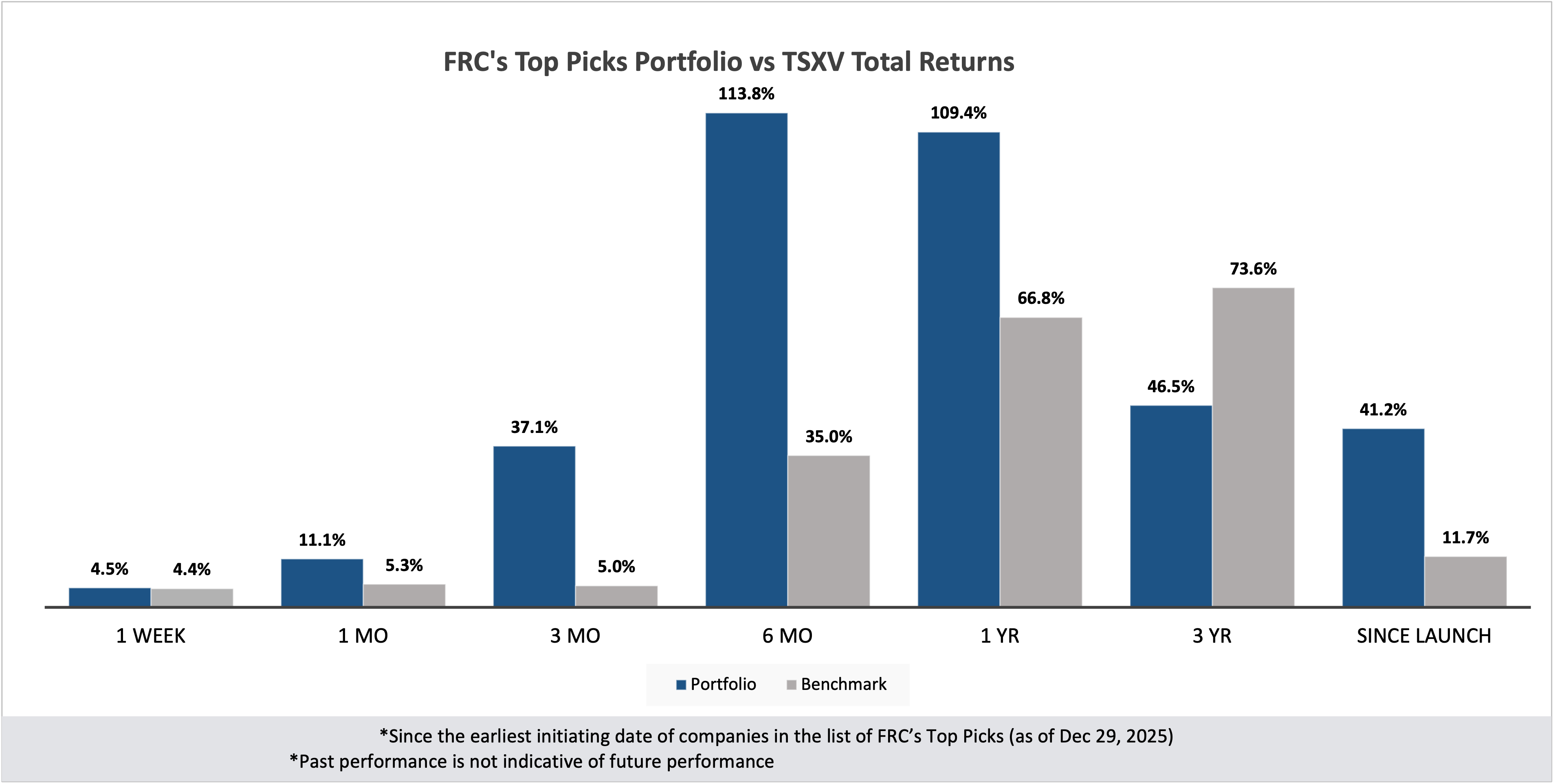

Last week was mostly inactive amid the holiday season, with just one gold explorer in our coverage universe reporting material news. Lithium junior Lake Resources (ASX: LKE), which rose 44% last week, topped our list of top picks. LKE is up 575% over six months vs. 71% for the Global X Lithium & Battery Tech ETF (LIT). We wouldn’t be surprised if some M&A activity is unfolding in the background. Over the past year, our Top Picks have returned an average of 109%, outperforming the benchmark’s 67% gain. Visit our website to view our full list of Top Picks by sector.

*Past performance is not indicative of future performance.

Updates on Resource Companies Under Coverage

Aton Resources Inc.

PR Title: Final results of a drill program at the Semna gold project in Egypt (QP: Javier Orduña BSc, MSc, MCSM, DIC, MAIG, SEG(M), Chief Geologist of Aton Resources)

Analyst Opinion: Positive – The final 29 holes of a 5,257 m / 44-hole drill program returned several high-grade gold intercepts, extending the known mineralization along strike and at depth. We believe the results confirm the Semna project’s potential to host a gold resource. Aton aims to complete a maiden resource estimate next year. Semna is one of several projects in Aton’s portfolio of gold projects in Egypt. In addition to the maiden resource on Semna, the company is advancing a Preliminary Feasibility Study (PFS) on another target, while aiming to bring the Hamama West mine into production in 2027. We believe these catalysts will help Aton gain greater recognition from capital markets next year.