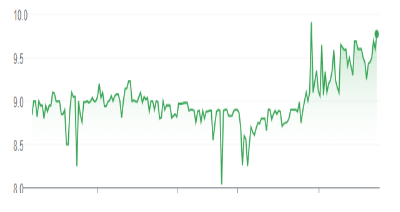

- BCF is up 11% since our previous report. Sector outlook has improved since June, with multiples up 5% (10% YoY). Industry revenue growth is forecast at 4% in 2025 vs 1% in 2024, supported by falling rates, which historically benefit MICs and financials.

- We expect two additional BoC rate cuts over the next six months amid slowing GDP growth, elevated trade tensions, high unemployment, and easing inflation. While mortgage delinquencies remain a concern, falling rates should help mitigate risks. We anticipate a rebound in pre-sales, lower financing costs for developers, and higher transaction volumes for real estate lenders next year.

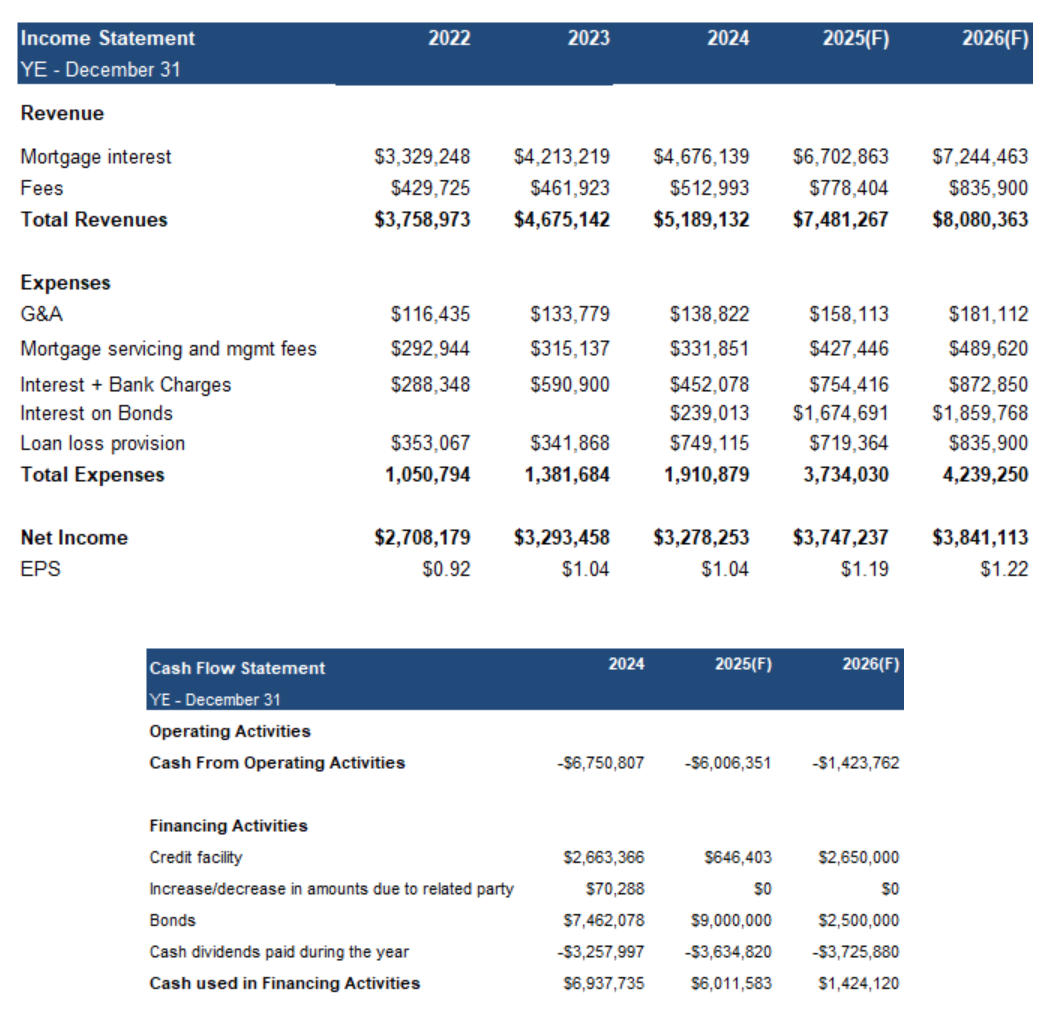

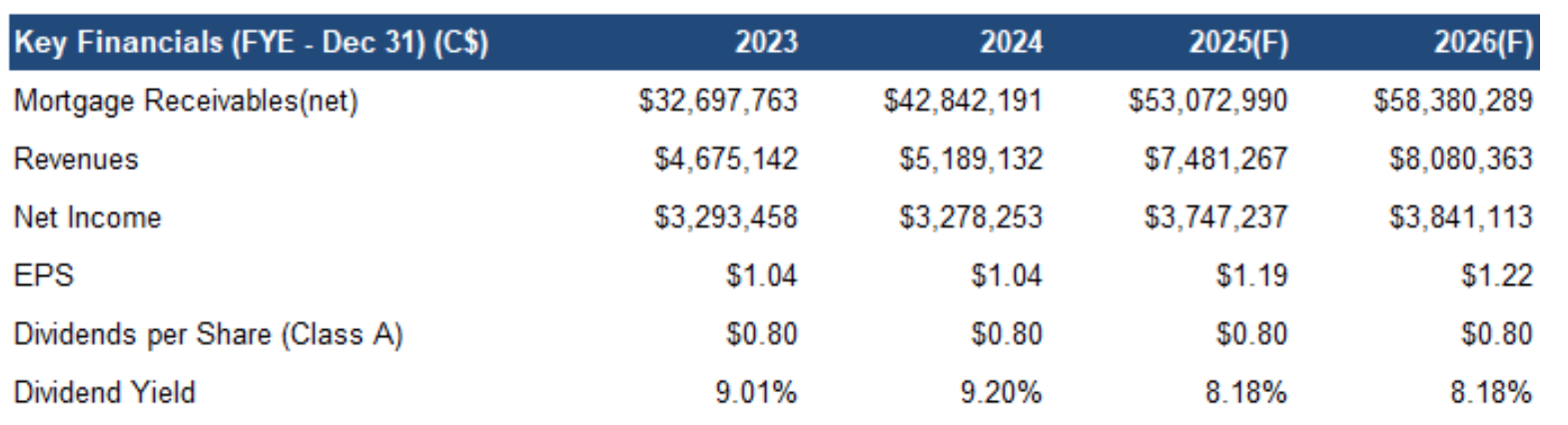

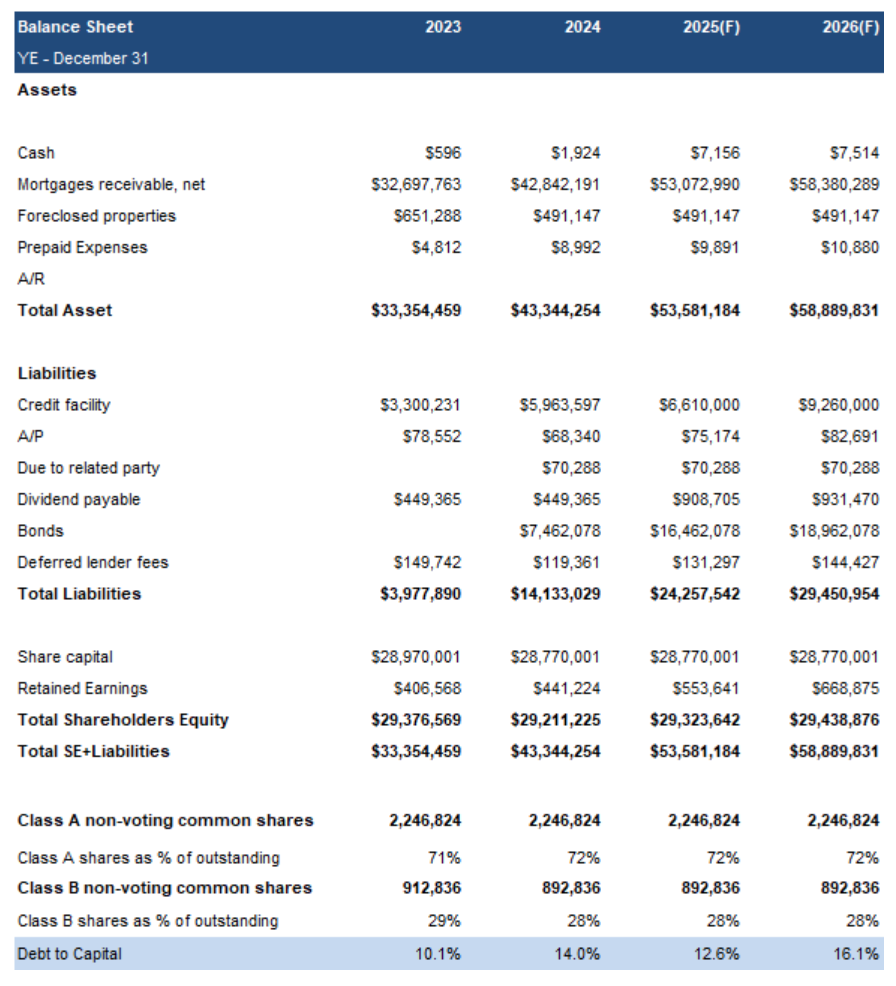

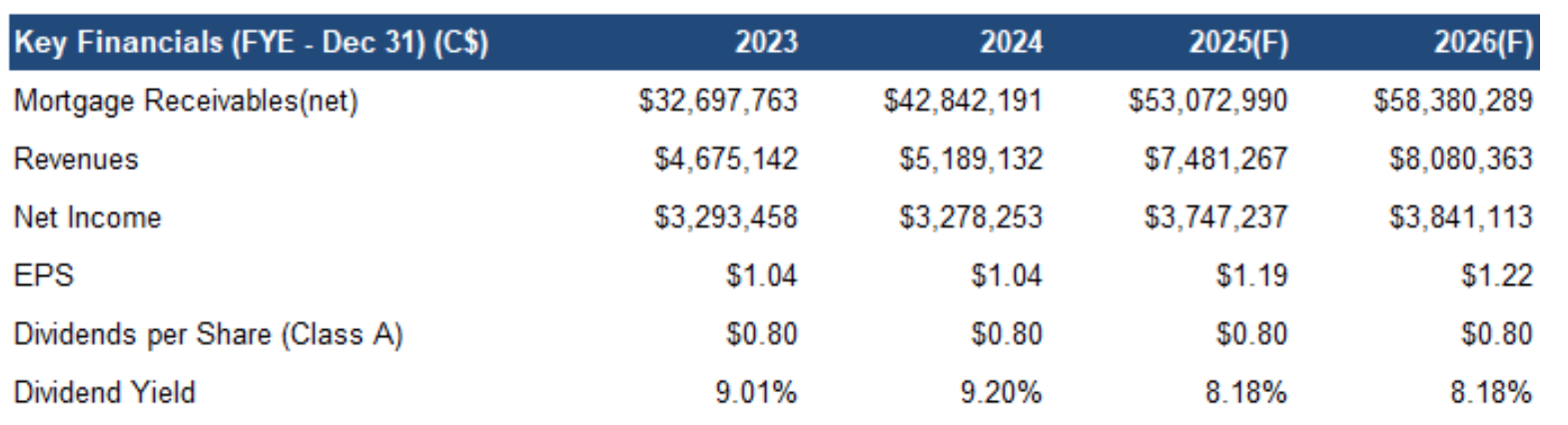

- With Q2 results beating forecasts, we are raising full-year revenue and EPS estimates. Stress tests indicate BCF can comfortably sustain its $0.80/share annual dividend.

Price and Volume (1-year)

| |

YTD |

12M |

| BCF |

8% |

9% |

| TSXV |

37% |

52% |

Portfolio Update

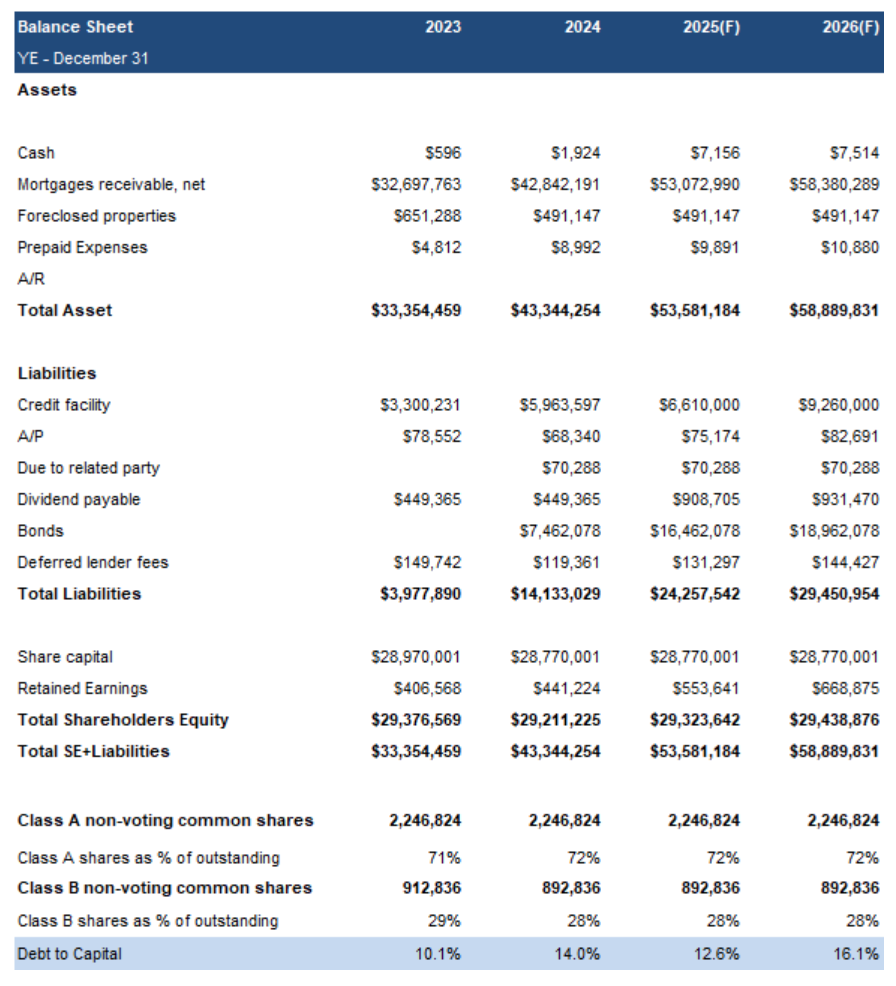

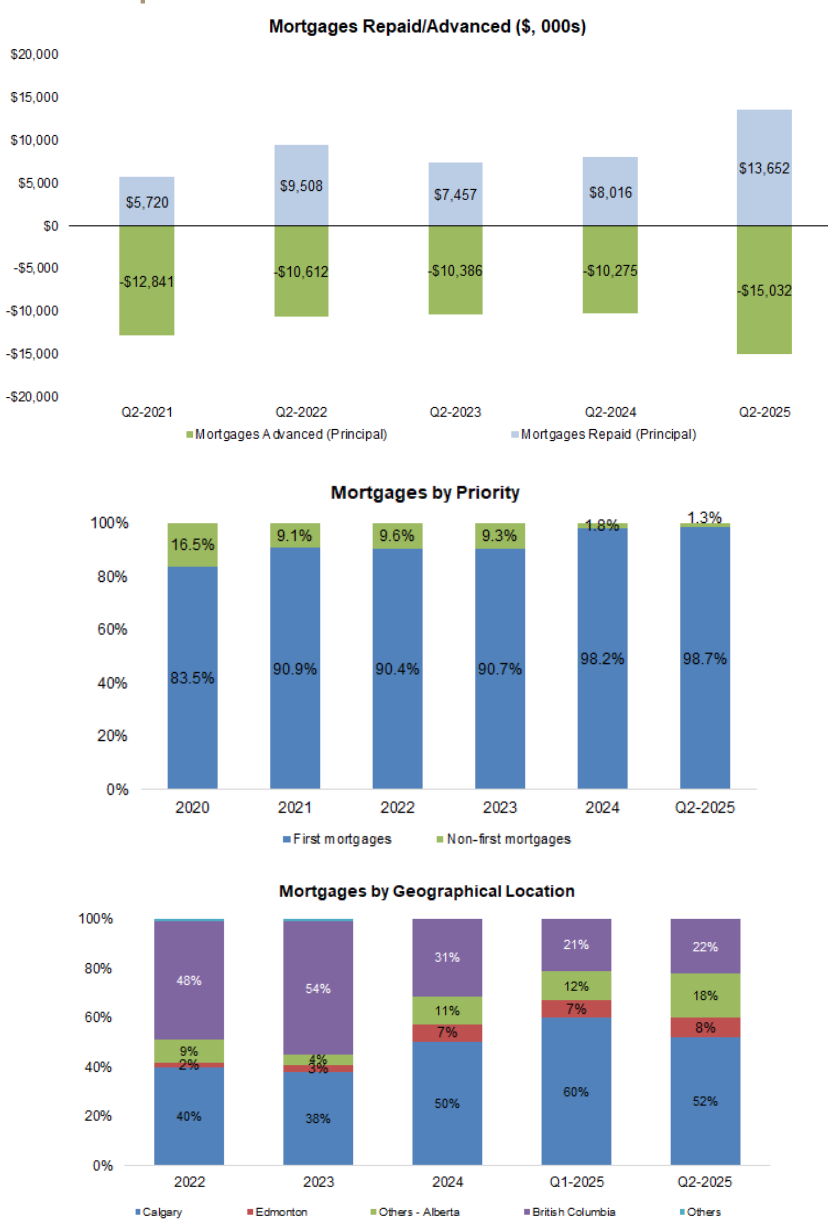

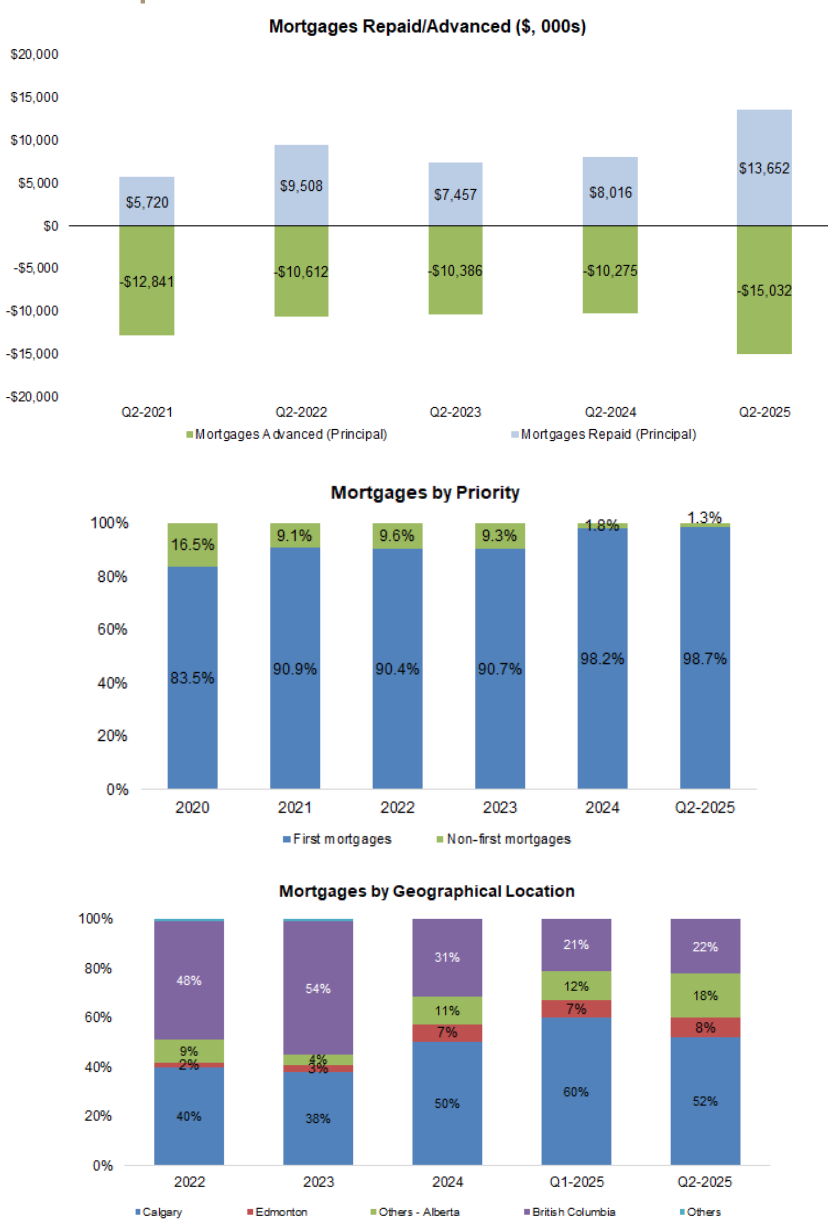

Mortgage advancements increased 46% YoY to $15M, the highest Q2 on record, while repayments rose 70% YoY

Mortgage receivables (net) declined 6% QoQ to $48M, as the MIC sold $6M of mortgages to a related party. Excluding this sale, receivables would have increased 5% QoQ

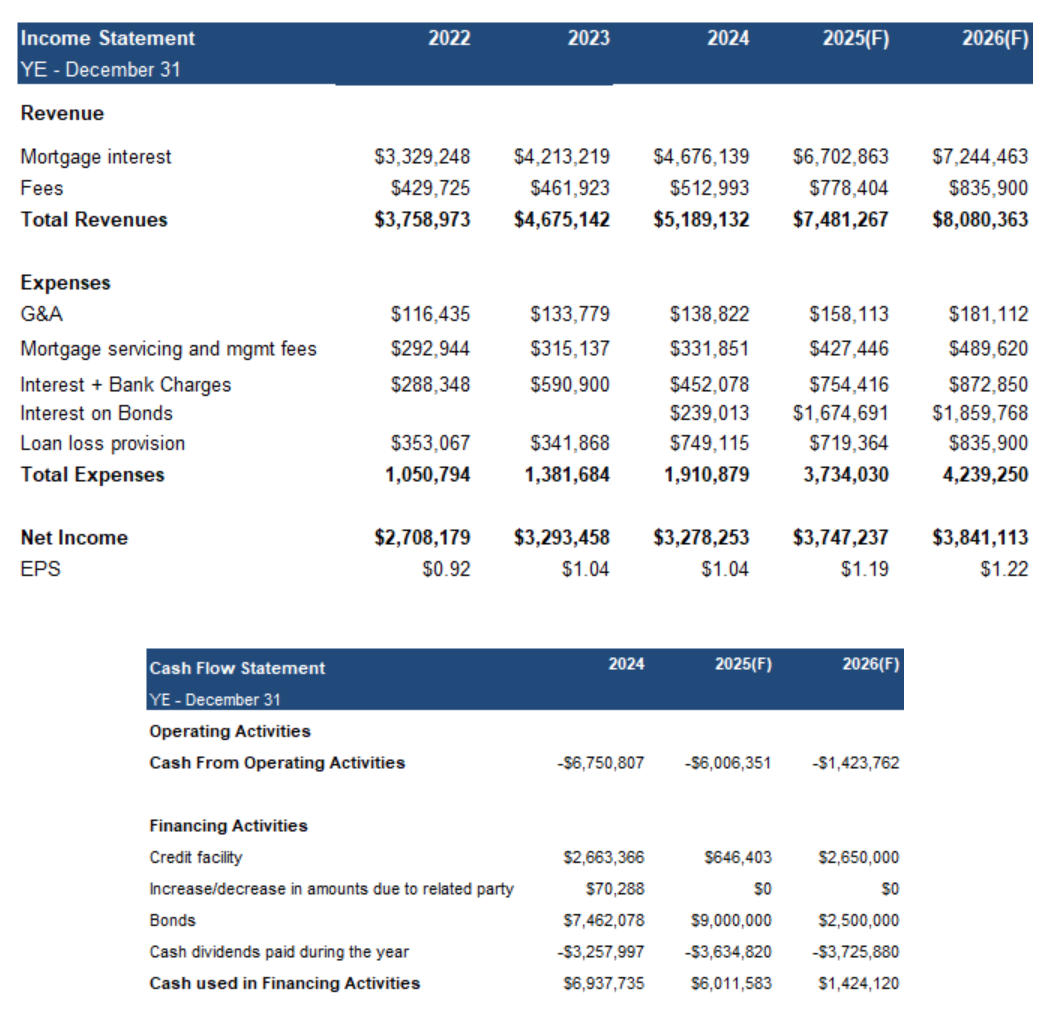

Most of the key portfolio metrics (presented below) remained largely unchanged. First mortgages were 99% vs a five-year average of 91%, with the portfolio remaining focused on AB and B.C

APPENDIX