Analysts' Ideas of the Week

Major Miner Bids $261M for Loncor, 81% of Our Valuation

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

Highlights

*Disseminated on behalf of South Star Battery Metals, Fortune Minerals Limited, Monument Mining Limited, Lake Resources, Denarius Metals, TNR Gold, Geomega Resources, Loncor Gold, and Grid Metals. See the bottom of this report for other important disclosures.

We review the acquisition bid received by Loncor Gold (TSX: LN), a junior we had earlier flagged as a prime M&A candidate. Additionally, we highlight notable developments from our coverage universe, spanning juniors in gold, copper, rare earths, nickel, and lithium.

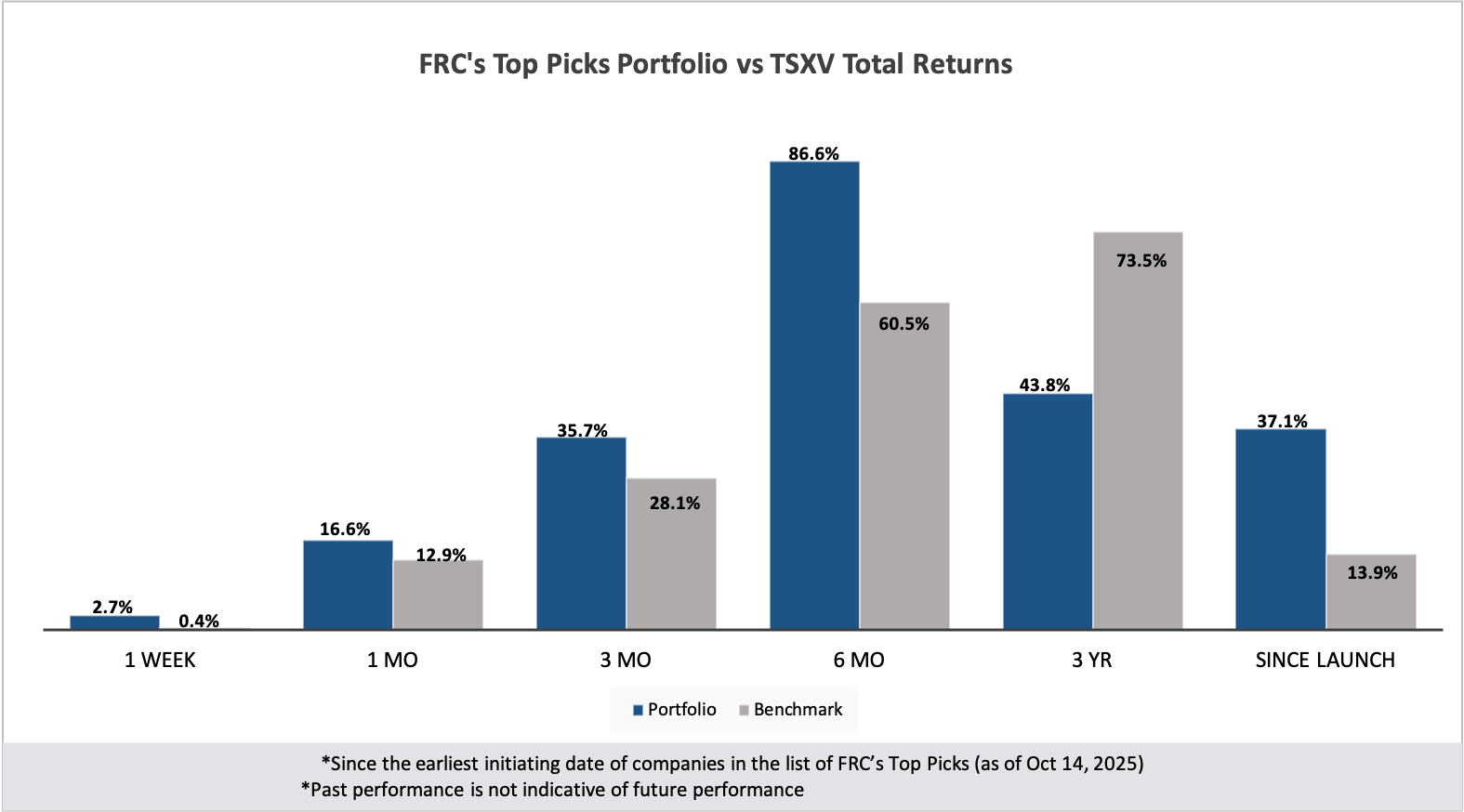

Over the past six months, our Top Picks have delivered an average return of 87%, significantly outperforming the benchmark’s 61% gain. Visit our website to view the full list of Top Picks by sector https://www.researchfrc.com/top-picks. *Past performance is not indicative of future performance.

Updates on Resource Companies Under Coverage

Loncor Gold Inc.

PR Title: Chengtun Mining to acquire Loncor Gold

Analyst Opinion: Positive - Chengtun Mining Group (SHSE: 600711/MCAP: $7B), a Shanghai-listed miner with global operations across copper, cobalt, nickel, and gold, has agreed to acquire LN in an all-cash transaction valued at $261M, offering $1.38/share, a 33% premium to the 30-day volume weighted average trading price. Shareholders holding 38% of LN’s shares have already agreed to support the deal. We view the deal positively. The $1.38/share offer represents 81% of our July 2025 fair value estimate of $1.70/share, when LN traded at just $0.63/share. Pending shareholder, court, and regulatory approvals, the deal is expected to close by Q1-2026.

TNR Gold Corp.

PR Title: McEwen Copper completes a feasibility study (FS) on its Los Azules copper project in Argentina (QP: Jeff Sullivan, FAusIMM, Gordon Zurowski, P.Eng., Steve Pozder and Michael McGlynn, SME, Independent Consultants of McEwen Copper)

Analyst Opinion: Positive – Los Azules hosts a large, open-pittable copper deposit. The FS returned an after-tax NPV8% of US$2.9B, and an IRR of 20%, based on US$4.35/lb copper. The project is expected to produce 451 Mlbs of copper annually in its first five years, with a life-of-mine (21 years) average of 327 Mlbs. We believe the robust FS results should encourage McEwen Mining to continue advancing the project, in which TNR holds a 0.36% NSR royalty. McEwen plans to begin commercial production by 2029. We project annual royalty revenue of US$6M for TNR, based on a conservative long-term copper price of US$3.75/lb, rising to US$8M at current spot prices. TNR also expects its first royalty payment from Ganfeng Lithium (SZSE: 002460) shortly, following the start of production at the Mariana lithium project, where it holds a 1.35% NSR.

Geomega Resources Inc.

PR Title: Enters into a joint development agreement with Rio Tinto (ASX: RIO

Analyst Opinion: Positive – GMA has signed an agreement with Rio Tinto to advance and license its Bauxite Residue Valorization Technology, which Rio Tinto aims to use to reduce bauxite waste, and recover valuable materials such as iron, rare earths, and titanium from alumina refining. The deal includes up to $4.5M in payments to GMA. We believe the partnership marks a major milestone for GMA as it validates and begins commercializing its proprietary technology with a global industry player, positioning the company for future royalty-based revenue, and broader licensing opportunities.

Grid Metals Corp.

PR Title: Announces a $4M private placement

Analyst Opinion: Positive – The financing will be subscribed by an undisclosed strategic investor, and an existing institutional shareholder, with proceeds directed toward exploration across Grid’s portfolio, primarily at the early-stage Falcon West cesium property. The company’s portfolio in the Bird River area includes four key projects: Makwa (Ni-Cu-PGM-Co, under JV with Teck Resources/TSX: TECK), Mayville (Cu-Ni), Falcon West (Li-Cs), and Donner (Li-Cs), reflecting its strategic focus on advancing critical mineral assets.