Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

Rocket Doctor AI (CSE: AIDR)

PR Title: Expands U.S. coverage; adds two major insurers covering 6.5M members

FRC Opinion: Positive – We have commenced our due diligence and will publish an initiating coverage report in the coming weeks on Rocket Doctor AI (MCAP: $78M), a digital health company leveraging AI to enhance healthcare delivery. The company operates a digital platform that facilitates virtual doctor visits, provides AI-driven clinical decision support, offers AI-powered medical education tools, and supports patient management. Revenue is generated through subscriptions from healthcare professionals, licensing AI tools to healthcare enterprises and medical educational institutions, and partnerships with health organizations. We are very bullish on the sector, with increasing demand for digital health solutions, and AI integration in healthcare.

According to the company, its platform is designed to support physicians in making faster, more accurate decisions, streamlining workflows, and improving patient care. The company's digital platform supports 300+ physicians, has faciliated 700k+ patient visits, and integrated its AI-powered virtual care platform into 50 pharmacies across Canada. In Q2-2025, Rocket Doctor reported its first significant revenue of $0.5M, achieving a high gross margin of 89%. In August, the company raised $4.23M to accelerate U.S. expansion. Additionally, Rocket Doctor annouced this month that it will receive over US$500k from a US$2M NIH Small Business Innovation Research grant awarded to it and its partner.

The company has signed agreements with several major U.S. insurers, providing potential access to over 13M insured patients, which we believe is a strong testament to the platform’s growing adoption and credibility. Patients covered under these plans can consult doctors via Rocket Doctor’s platform, with the company generating revenue for each visit and service provided.

The company’s management team comprises experienced professionals, including CEO Dr. Essam Hamza, MD, who brings over 20 years of medical and business expertise, including scaling CloudMD from a small Canadian startup to over $100M in revenue.

Our initiating coverage report will include a detailed analysis of the company’s business model, management’s vision, sector outlook, and our revenue/EPS projections, along with a fair value estimate.

FRC Top Picks

The table below highlights last week’s top five performers from our Top Picks. For the first time in several weeks, not a single resource stock made the list, reflecting a sector-wide pullback driven by a stronger US$, declines in gold and silver prices, and easing trade tensions between China and the U.S. The best performer was adtech company Kidoz Inc. (TSXV: KDOZ), which gained 11%. In H1-2025, Kidoz reported record revenue of $5.17M, up 21% YoY. By comparison, major platforms YouTube (NASDAQ: GOOGL) and Meta (NASDAQ: META) posted ad revenue growth of 12% and 19%, respectively. Q3 results are expected next month, and we anticipate record revenue and EPS for 2025.

* Past performance is not indicative of future performance (as of Oct 27, 2025)

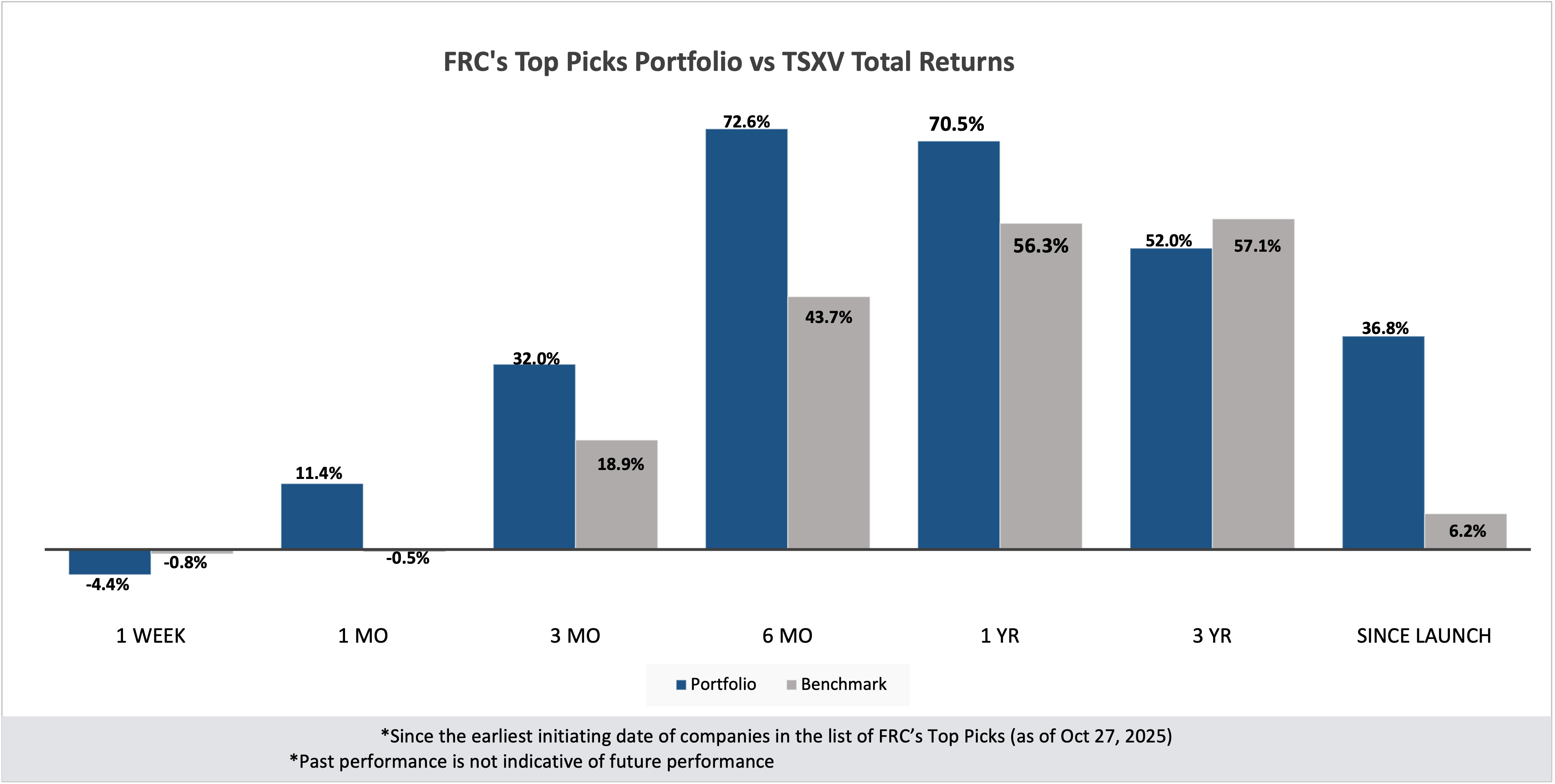

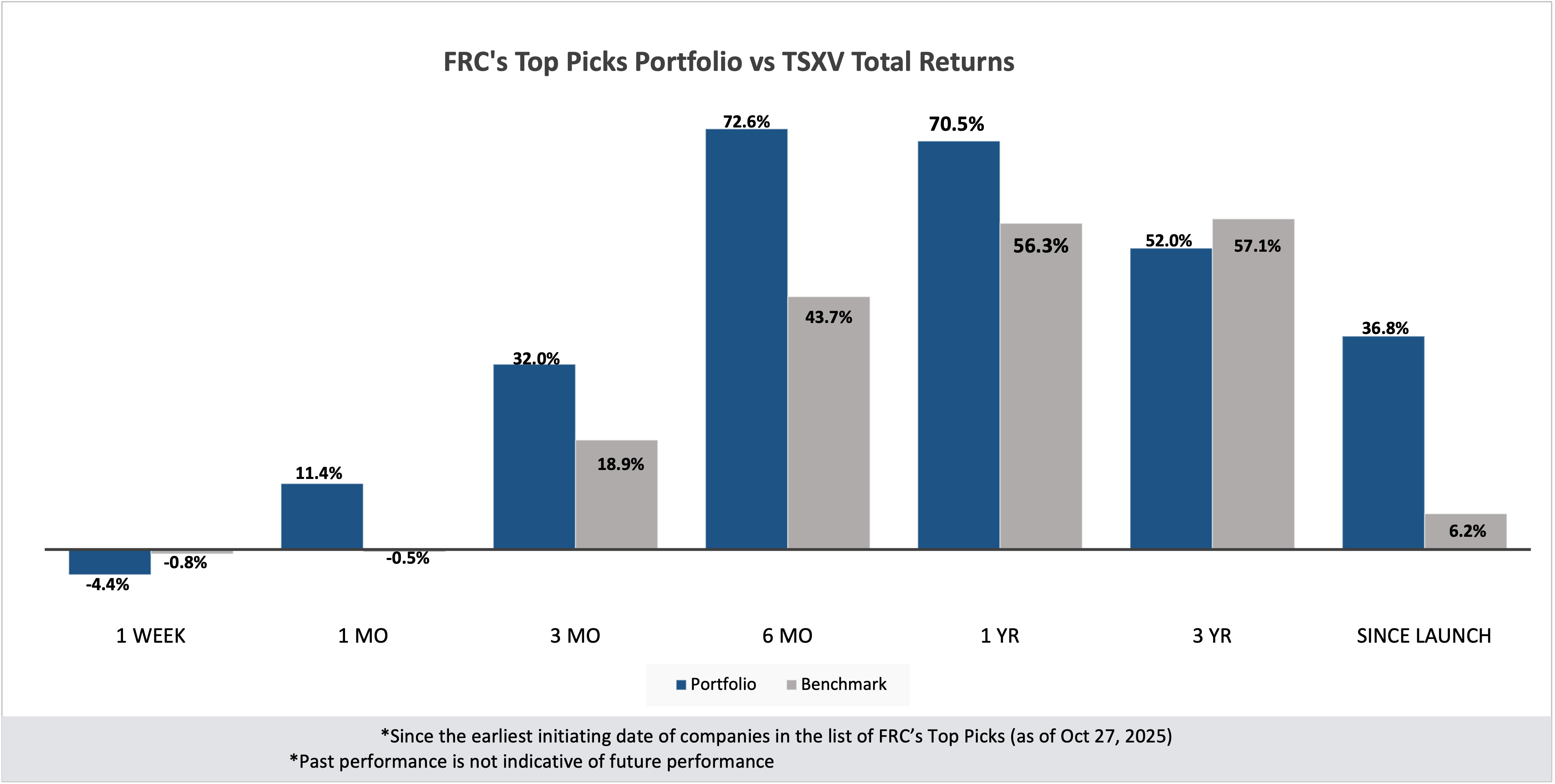

Our top picks have outperformed the benchmark (TSXV) in five out of seven time periods listed below.

Performance by Sector

| Total Return |

1 Week |

1 mo |

3 mo |

6 mo |

1 yr |

3 yr |

Since launch |

| Mining |

-8.00% |

17.30% |

23.40% |

32.00% |

49.10% |

70.20% |

38.60% |

| Cannabis |

N/A |

N/A |

N/A |

N/A |

N/A |

-34.60% |

-23.60% |

| Tech |

-0.30% |

14.20% |

146.20% |

796.50% |

674.60% |

11.70% |

86.40% |

| Special Situations (MIC) |

1.70% |

-3.30% |

-5.90% |

14.20% |

3.10% |

6.80% |

-3.00% |

| Private Companies |

N/A |

N/A |

N/A |

N/A |

9.30% |

24.20% |

64.10% |

| Portfolio (Total) |

-4.40% |

11.40% |

32.00% |

72.60% |

70.50% |

52.00% |

36.80% |

| Benchmark (Total) |

-0.80% |

-0.50% |

18.90% |

43.70% |

56.30% |

57.10% |

6.20% |

| Portfolio (Annualized) |

- |

- |

- |

- |

70.50% |

15.00% |

2.70% |

| Benchmark (Annualized) |

- |

- |

- |

- |

56.30% |

16.20% |

0.50% |

1. Since the earliest initiating date of companies in the list of Top Picks (as of Oct 27, 2025)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

Our complete list of top picks (updated weekly) can be viewed https://www.researchfrc.com/top-picks

*Disclaimers - Annual fees ranging from $15,000 to $35,000 have been paid to FRC by Kidoz Inc., Olympia Financial Group, Builders Capital Mortgage, Atrium Mortgage Investment, Enterprise Group, Canadian Critical Minerals, Churchill Resources, DLP Resources, Loncor Gold, Rocket Doctor AI, and West High Yield (WHY) Resources for research coverage and distribution of reports. FRC or companies with related management, and Analysts, do not hold shares/securities in the companies mentioned in this report.