FRC Top Picks

The following table shows last week’s top five performers among our Top Picks, including five junior resource companies. The top performer, World Copper (TSXV: WCU), was up 20%. WCU is advancing multiple copper projects in the Americas.

| Top 5 Weekly Performers |

WoW Returns |

| World Copper Ltd. (WCU.V) |

20.00% |

| Sirios Resources Inc. (SOI.V) |

16.70% |

| Kootenay Silver Inc. (KTN.V) |

15.70% |

| E3 Lithium Limited (ETL.V) |

15.20% |

| Sabre Gold Mines Corp. (SGLD.TO) |

13.30% |

* Past performance is not indicative of future performance (as of Apr 15, 2024)

|

Source: FRC

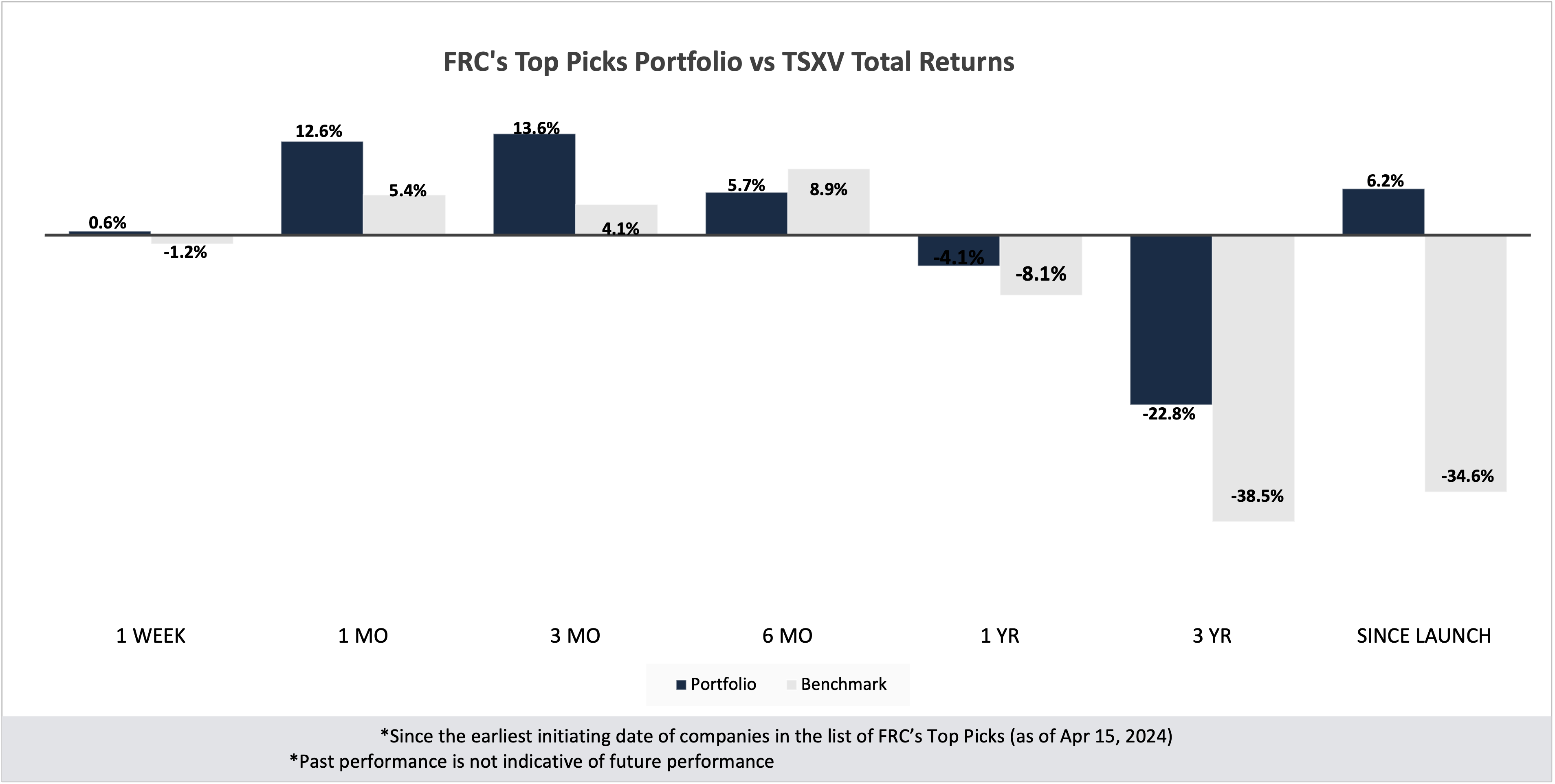

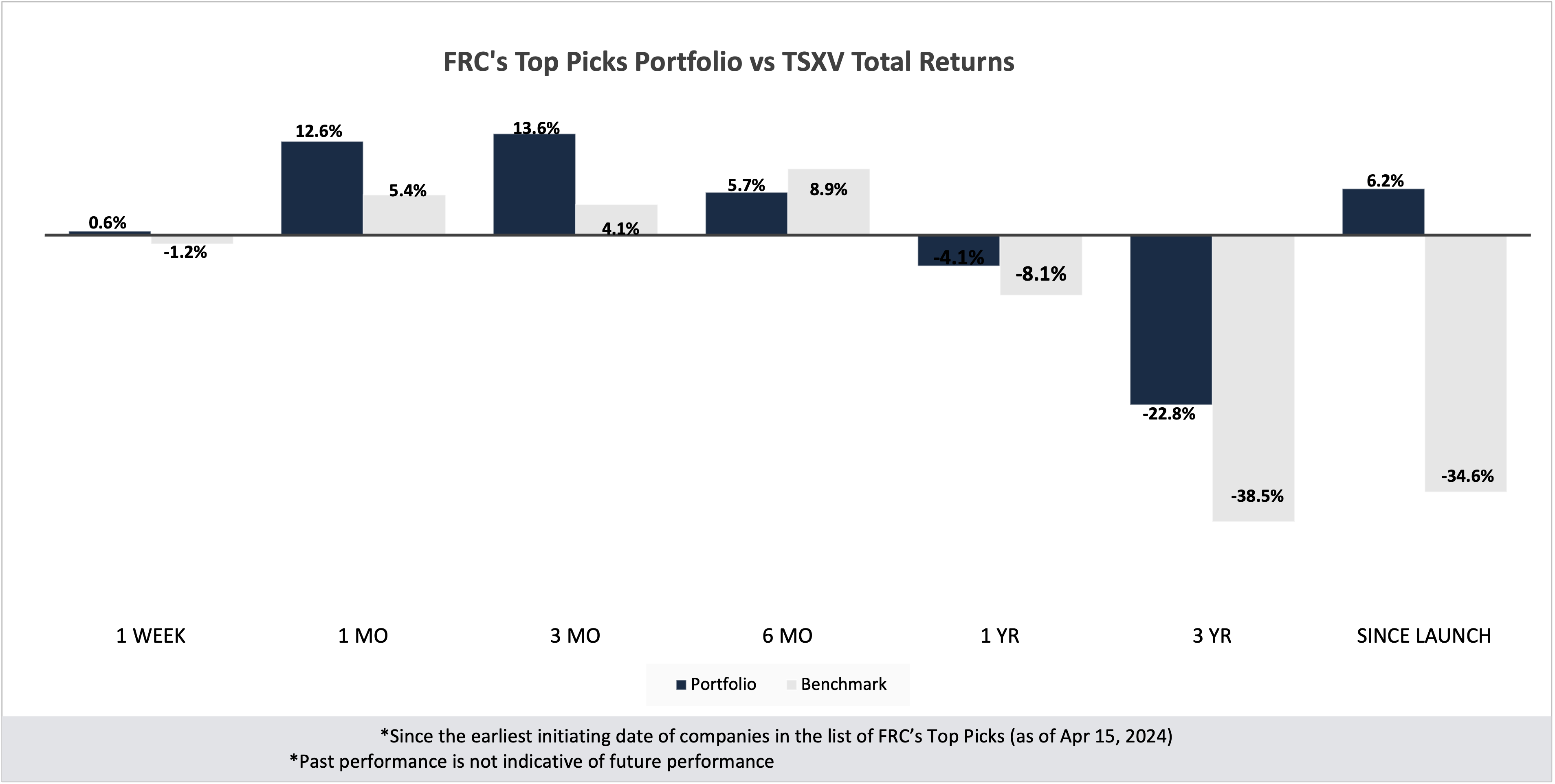

Last month, companies on our Top Picks list were up 13% on average vs 5% for the benchmark (TSXV). Junior resource stocks, comprising 65% of our list of top picks, have exhibited a notable revival, as evidenced by our top picks portfolio outperforming its benchmark in four out of the last five weeks.

| Total Return |

1 Week |

1 mo |

3 mo |

6 mo |

1 yr |

3 yr |

| Mining |

2.60% |

17.30% |

17.30% |

5.20% |

-10.30% |

-45.70% |

| Cannabis |

N/A |

N/A |

N/A |

N/A |

N/A |

-43.60% |

| Tech |

-16.70% |

8.10% |

25.00% |

-7.00% |

-16.70% |

-33.50% |

| Special Situations (MIC) |

-4.50% |

-0.30% |

5.50% |

14.10% |

17.30% |

-14.30% |

| Private Companies |

N/A |

N/A |

N/A |

N/A |

6.70% |

20.50% |

| Portfolio (Total) |

0.60% |

12.60% |

13.60% |

5.70% |

-4.10% |

-22.80% |

| Benchmark (Total) |

-1.20% |

5.40% |

4.10% |

8.90% |

-8.10% |

-38.50% |

| Portfolio (Annualized) |

- |

- |

- |

- |

-4.10% |

-8.30% |

| Benchmark (Annualized) |

- |

- |

- |

- |

-8.10% |

-15.00% |

1. Since the earliest initiating date of companies in the list of Top Picks (as of Apr 15, 2024)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

4. Our complete list of top picks (updated weekly) can be viewed here: Top Picks List

Weekly Mining Commentary

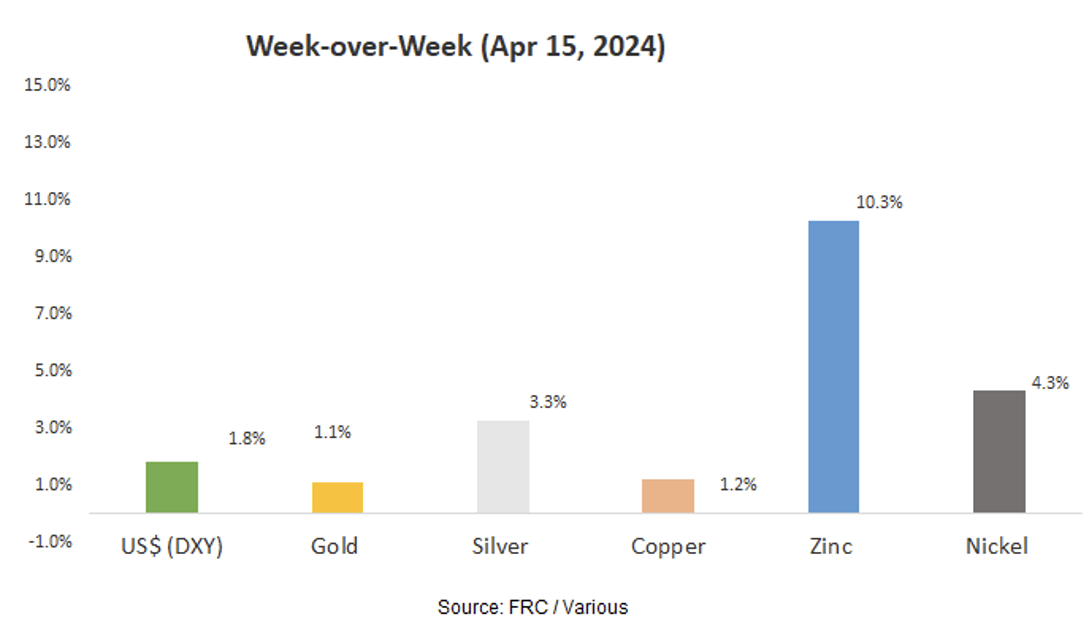

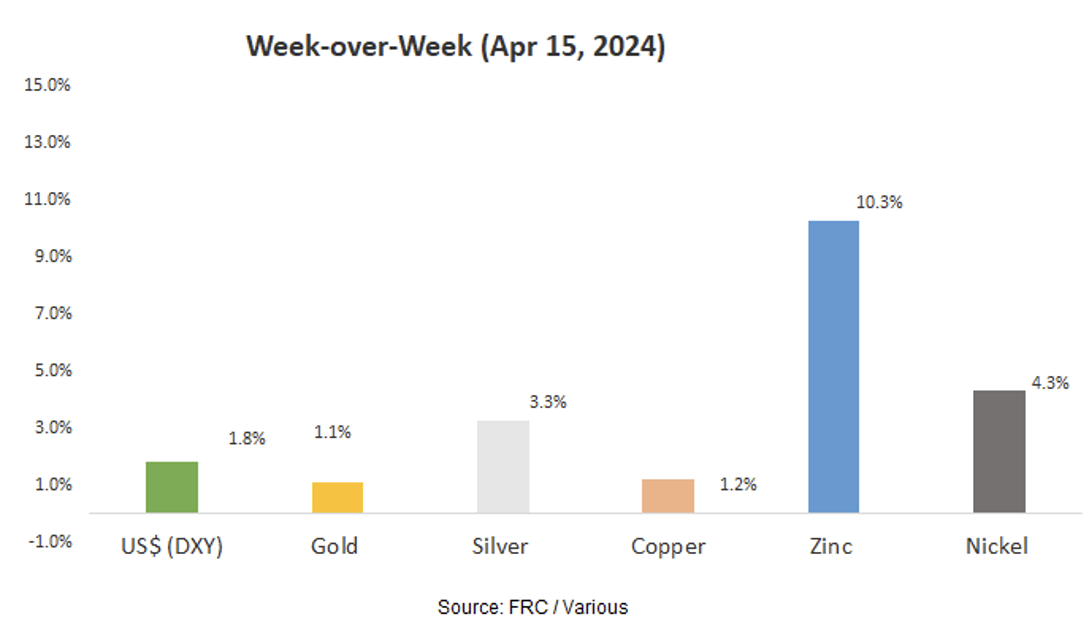

Last week, global equity markets were down 1.0% on average (down 0.3% in the previous week). The US$ and gold/silver strengthened, while equities retreated, amid escalating tensions in the Middle East.

Source: FRC / Various

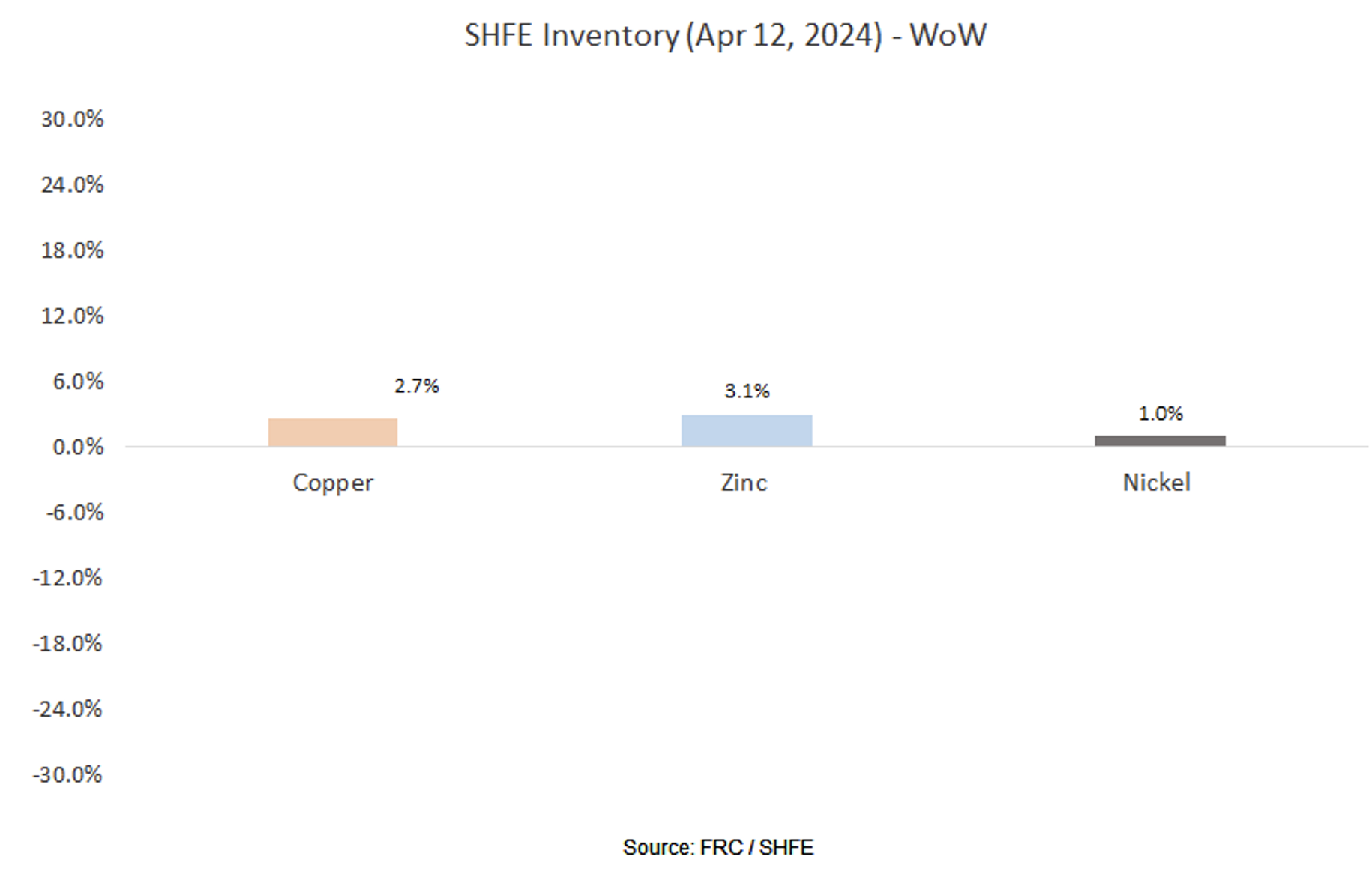

Last week, metal prices were up 4.0% on average (up 6.5% in the previous week).

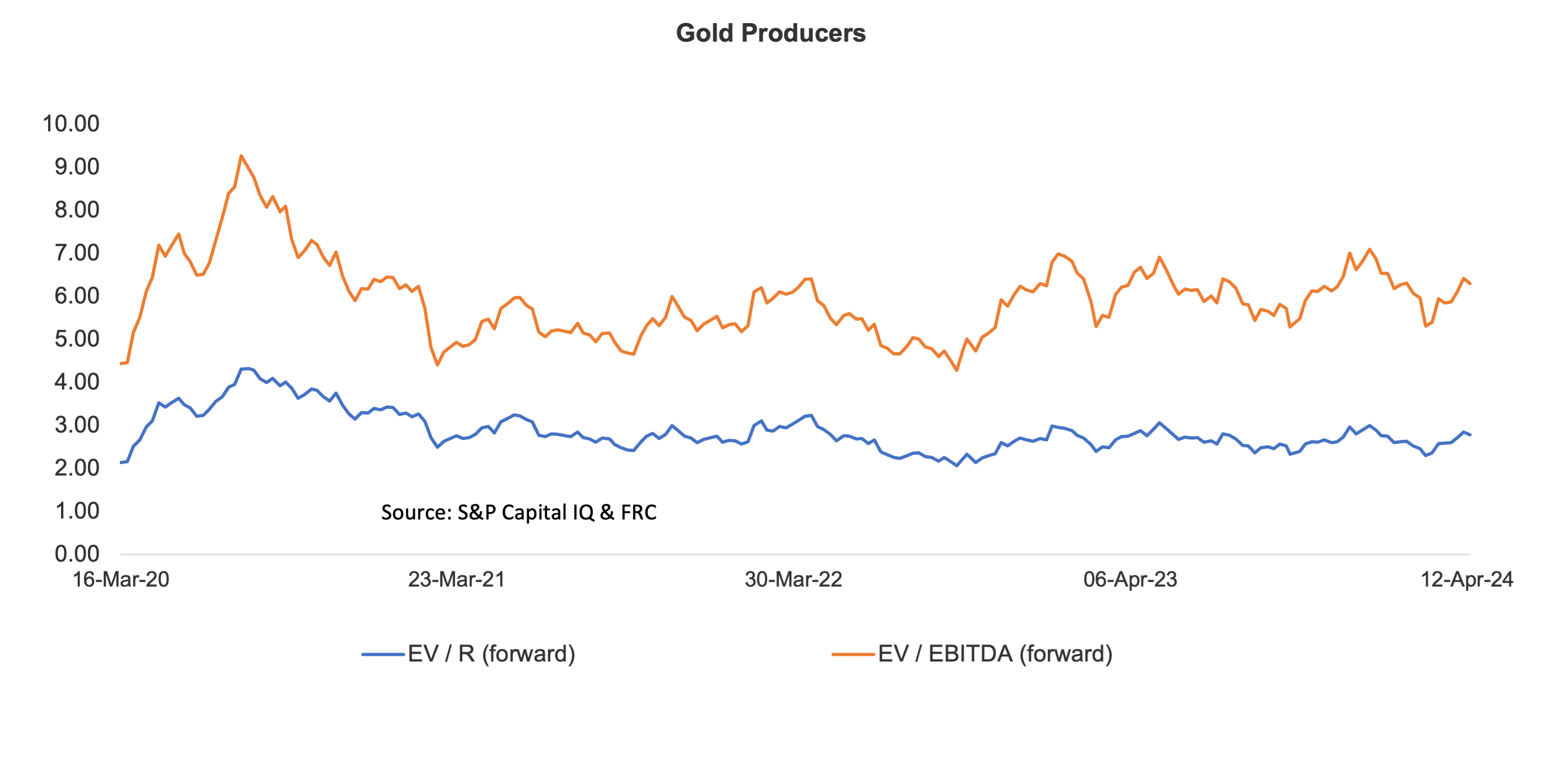

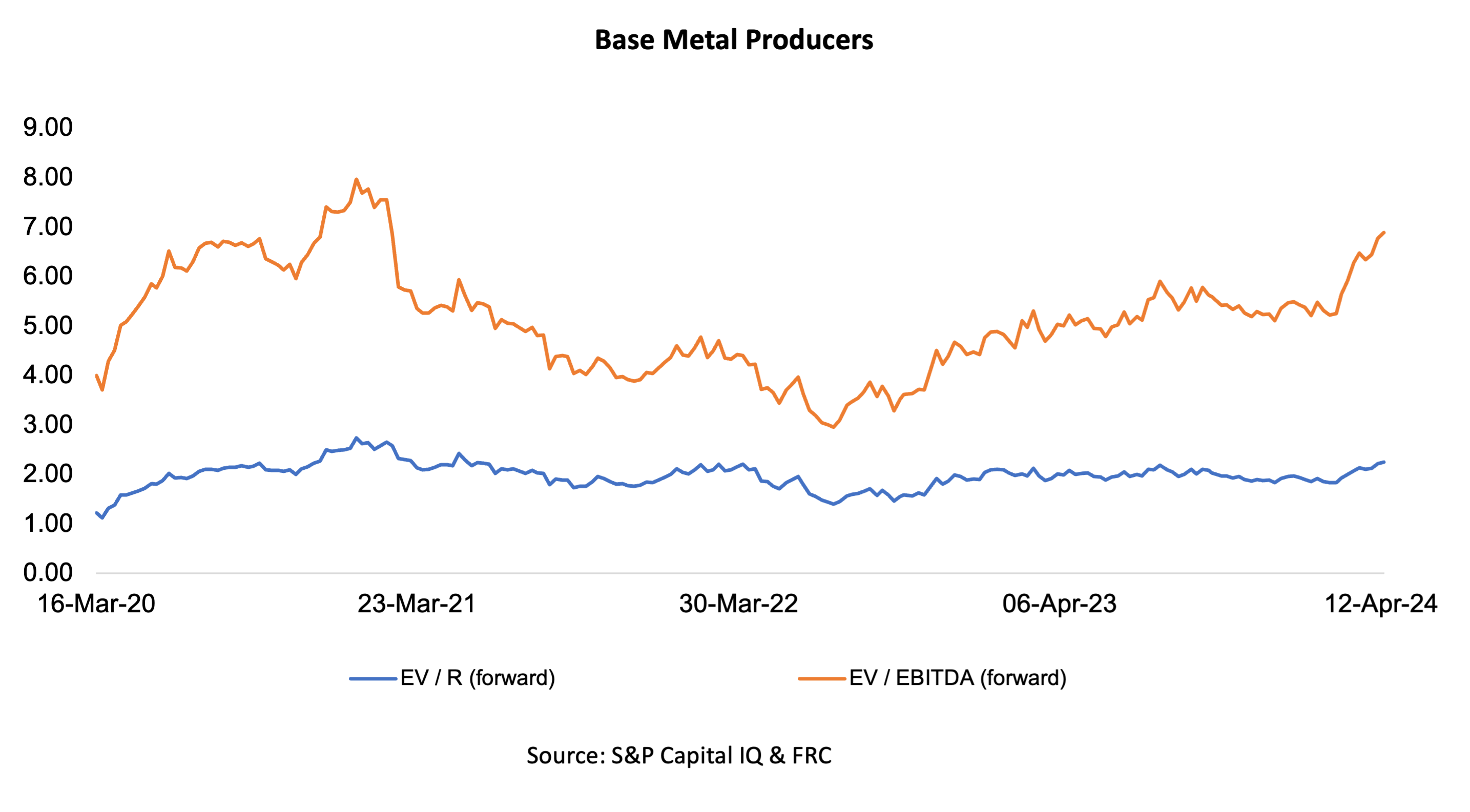

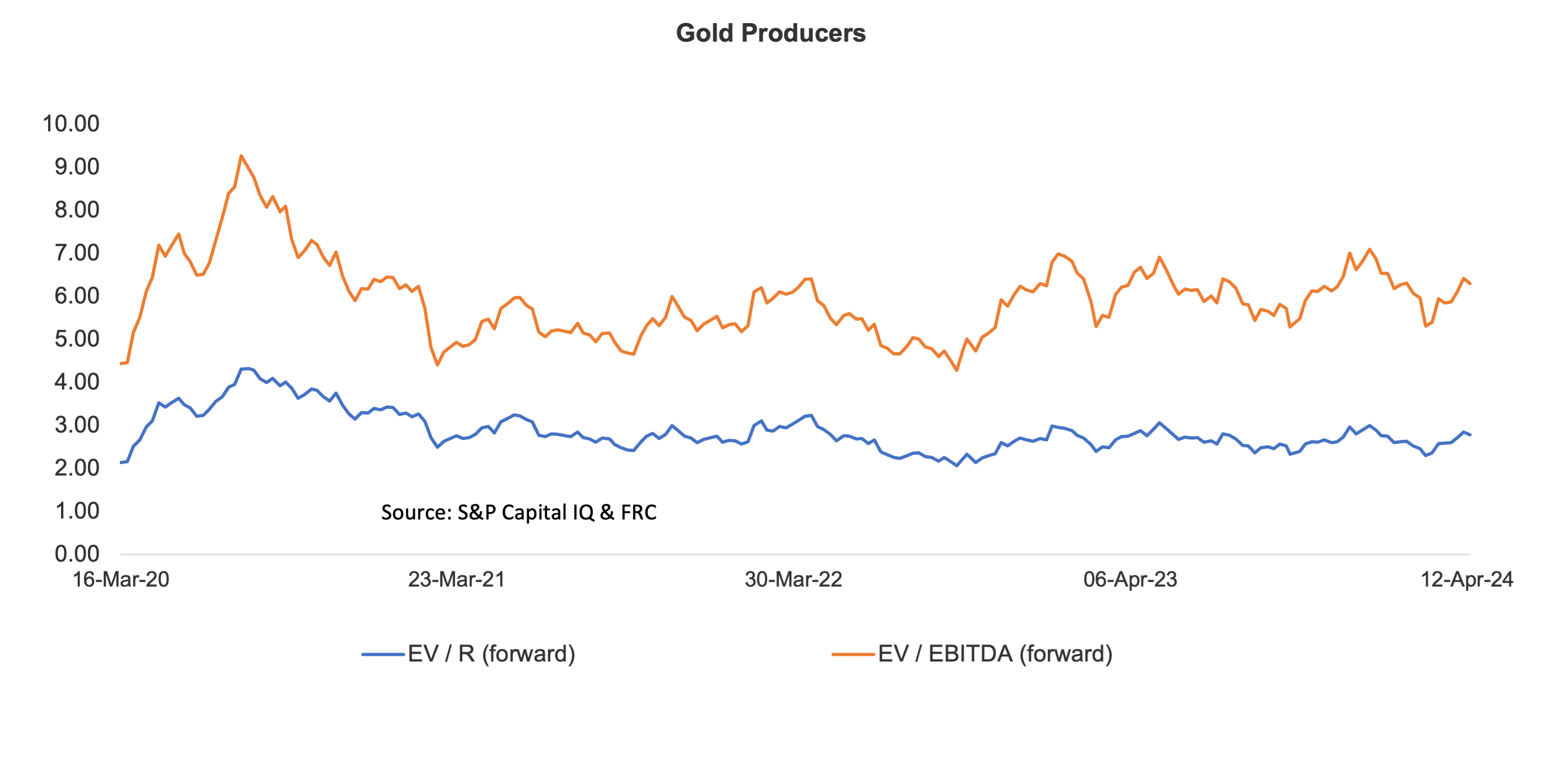

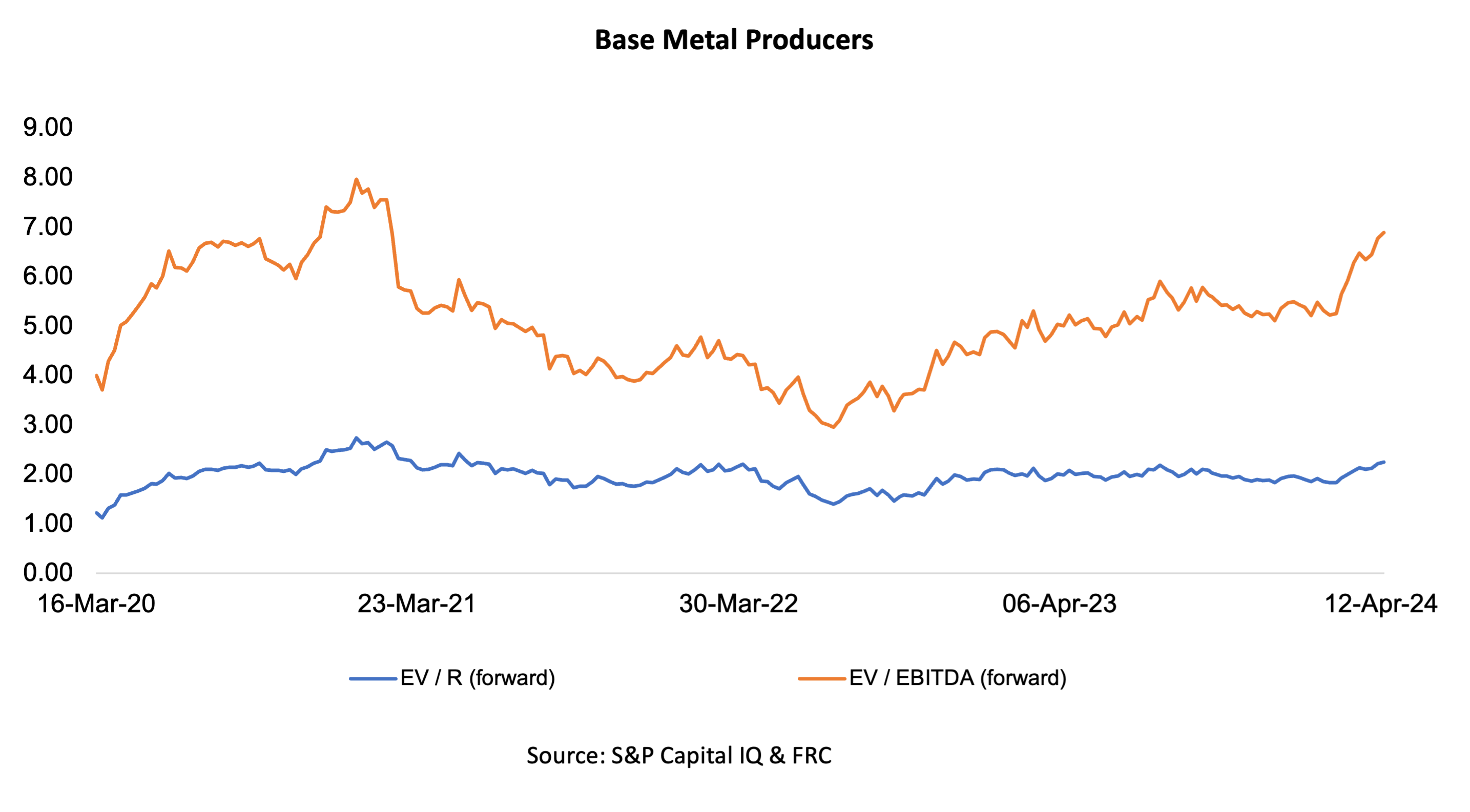

Gold producer valuations were down 2.2% last week (up 4.9% in the prior week); base metal producers were up 1.5% last week (up 4.7% in the prior week). On average, gold producer valuations are 14% lower compared to the past three instances when gold surpassed US$2k/oz.

| |

|

08-Apr-24 |

15-Apr-24 |

| |

Gold Producers |

EV / R (forward) |

EV / EBITDA (forward) |

EV / R (forward) |

EV / EBITDA (forward) |

| 1 |

Barrick |

3.29 |

7.33 |

3.23 |

7.04 |

| 2 |

Newmont |

3.23 |

7.68 |

3.1 |

7.35 |

| 3 |

Agnico Eagle |

4.52 |

9 |

4.4 |

8.61 |

| 4 |

AngloGold |

2.25 |

5.51 |

2.25 |

5.49 |

| 5 |

Kinross Gold |

2.3 |

5.54 |

2.25 |

5.29 |

| 6 |

Gold Fields |

3.16 |

6.24 |

3.31 |

6.48 |

| 7 |

Sibanye |

0.81 |

3.99 |

0.81 |

4.1 |

| 8 |

Hecla Mining |

4.95 |

17.66 |

4.79 |

18.13 |

| 9 |

B2Gold |

2.09 |

4.31 |

2.08 |

4.28 |

| 10 |

Alamos |

5.32 |

9.69 |

4.76 |

9.28 |

| 11 |

Harmony |

1.77 |

5.55 |

1.83 |

5.77 |

| 12 |

Eldorado Gold |

2.59 |

5.74 |

2.54 |

5.55 |

| |

Average (excl outliers) |

2.85 |

6.42 |

2.78 |

6.29 |

| |

Min |

0.81 |

3.99 |

0.81 |

4.1 |

| |

Max |

5.32 |

17.66 |

4.79 |

18.13 |

| |

|

|

|

|

|

| |

Base Metal Producers |

EV / R (forward) |

EV / EBITDA (forward) |

EV / R (forward) |

EV / EBITDA (forward) |

| 1 |

BHP Group |

2.94 |

5.61 |

2.98 |

5.69 |

| 2 |

Rio Tinto |

2.17 |

4.63 |

2.26 |

4.87 |

| 3 |

South32 |

1.4 |

6.48 |

1.47 |

6.82 |

| 4 |

Glencore |

0.45 |

6.14 |

0.45 |

6.14 |

| 5 |

Anglo American |

1.7 |

5.08 |

1.68 |

5.02 |

| 6 |

Teck Resources |

2.65 |

5.9 |

2.7 |

6.05 |

| 7 |

First Quantum |

4.19 |

13.54 |

4.15 |

13.64 |

| |

Average (excl outliers) |

2.21 |

6.77 |

2.24 |

6.89 |

| |

Min |

0.45 |

4.63 |

0.45 |

4.87 |

| |

Max |

4.19 |

13.54 |

4.15 |

13.64 |

| Source: S&P Capital IQ & FRC |

|

|

|

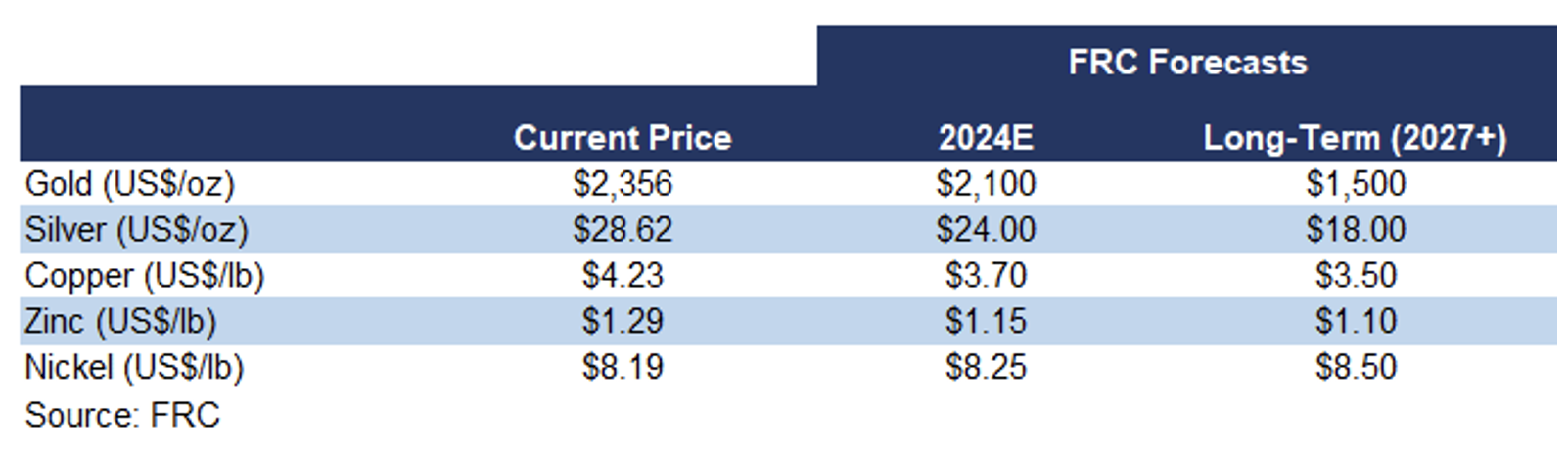

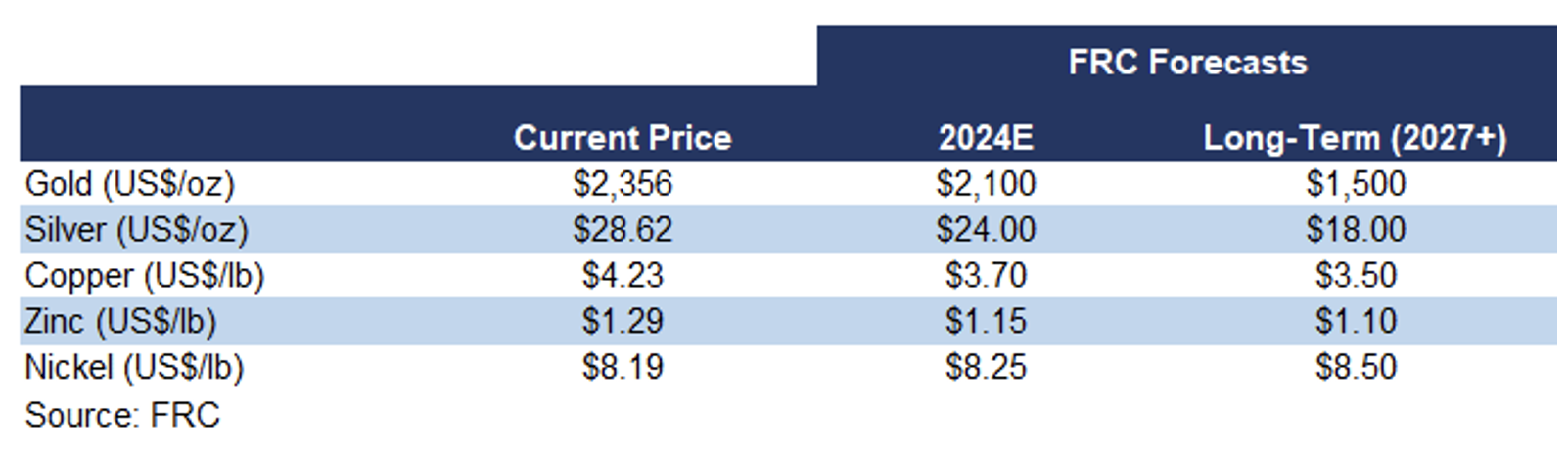

We are maintaining our metal price forecasts.

Key Developments:

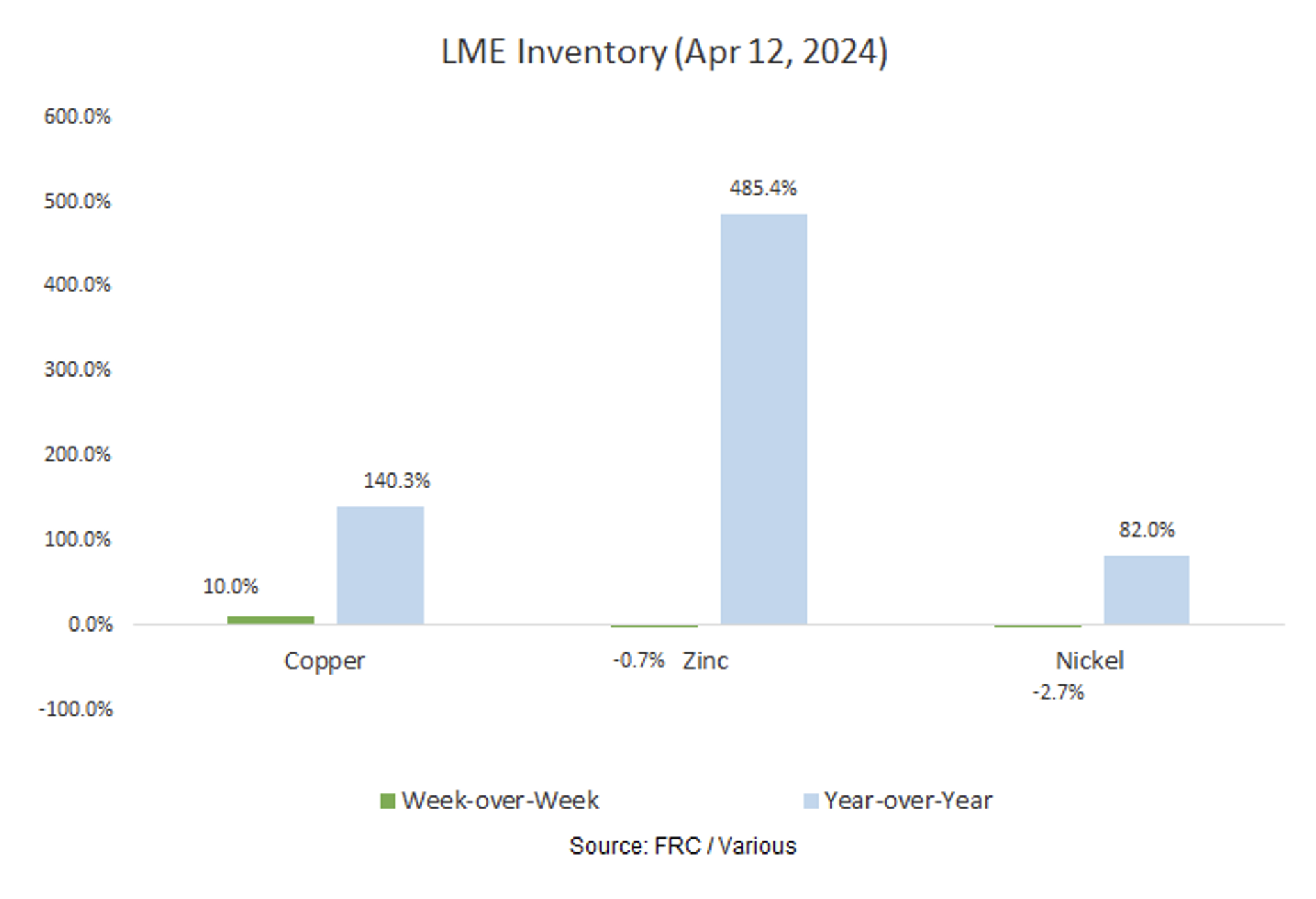

- Last week, the LME (London) and CME (Chicago) halted acceptance of Russian-origin aluminum, copper, and nickel due to new sanctions from the U.S. and the U.K. However, we foresee no notable disruptions in supply or prices. This is because the measure applies solely to transactions on major exchanges, and does not extend to direct deals between companies.

Commentary on Resource Companies Under Coverage

Denarius Metals Corp. / CBOE: DMET.

PR Title - Announces positive Pre-Feasibility Study (PFS) results supporting a restart of mining operations at its 50% owned Aguablanca nickel-copper project in Spain

FRC Opinion: Positive – The study returned an AT-NPV5% of US$83M (100% interest), and a very high AT-IRR of 213%, using US$7.3/lb nickel, and US$3.5/lb copper. Management plans to fast-track Aguablanca to production within the next 12 months. Due to surplus processing capacity at Aguablanca, DSLV can process materials from its flagship Lomero polymetallic project, expediting and reducing the cost of advancing Lomero to production. We will publish a detailed update shortly.

Lithium Chile Inc. / TSXV: LITH

PR Title - Increases lithium resources by 24%, with grades of up to 538 mg/L, at Salar de Arizaro, Argentina

FRC Opinion: Positive – Resources increased by 24% to 4.12 Mt lithium carbonate equivalent. Grades increased by 2% to 323 mg/L. The company will complete another resource update prior to a PFS. LITH is up 20% YoY despite lithium prices being down 36% YoY, as we believe the Arizaro project is turning into an attractive M&A target for larger players. We will publish a detailed update shortly.

Hannan Metals Ltd. / TSXV: HAN

PR Title - Identifies another large porphyry gold-copper target at Valiente, Peru

FRC Opinion: Positive – Pre-drilling exploration has identified a 1.8 km x 0.4 km gold-rich, porphyry-epithermal target. Eight outcropping porphyries have been identified to date.

Power Nickel Inc./ TSXV: PNPN

PR Title - Continues to expand its near surface high-grade copper, platinum, palladium zone

FRC Opinion: Positive – Initial results of a drill program, targeting mineralization 5 km from the main nickel deposit, returned high gold and copper values. Key intercepts included: 6.55 m of 2.59 g Au, 5.33% Cu, 6.35 g Pd, 1.5g Pt and 0.43% Ni, and 15.75 m of 1.6 g Au, 2.52% Cu, 2.73 g Pd, 0.65g Pt, and 0.19% Ni. PNPN is awaiting additional results.

Commentary on Financials, Technology, Energy, and Special Situations Companies Under Coverage

Builders Capital Mortgage Corp. (TSXV: BCF)

PR Title - Planning a $50M bond financing; terms undisclosed

FRC Opinion: Positive – This financing is indicative of the company’s robust pipeline of mortgages. 2023 year-end financials are due by the end of this month. We anticipate record revenue and EPS.

BIGG Digital Assets Inc./ CSE: BIGG

PR Title - Announces preliminary Q1-2024 results

FRC Opinion: Positive – Revenue surged 180% YoY to $3.1M, propelled by a 336% YoY surge in trading volume. Registered users were up 14% YoY. Revenue far exceeded our projected 32% YoY growth for the year, driven by a rebound in crypto prices. We will publish an update when the year-end financial statements are published.

Weekly Crypto Commentary

Prices of mainstream/popular cryptos were down 19% on average last week (up 4% in the previous week).

| April 15, 2024 |

|

|

| Cryptocurrencies |

1-Week |

1-Year |

| Bitcoin |

-11% |

108% |

| Binance Coin |

-9% |

66% |

| Cardano |

-23% |

0% |

| Ethereum |

-13% |

47% |

| Polkadot |

-26% |

-2% |

| XRP |

-20% |

-5% |

| Polygon |

-25% |

-50% |

| Solana |

-23% |

474% |

| |

|

|

| AVERAGE |

-19% |

80% |

| MIN |

-26% |

-50% |

| MAX |

-9% |

474% |

| |

|

|

| Indices |

| Canadian |

1-Week |

1-Year |

| BTCC |

-11% |

107% |

| BTCX |

-10% |

118% |

| EBIT |

-10% |

115% |

| FBTC |

-11% |

35% |

| U.S. |

1-Week |

1-Year |

| BITO |

-10% |

58% |

| BTF |

-12% |

61% |

| IBLC |

-10% |

38% |

| |

|

|

Source: FRC/Yahoo Finance

The global MCAP of cryptos is US$2.42T, down 12% MoM, but up 82%YoY.

Source: CoinGecko

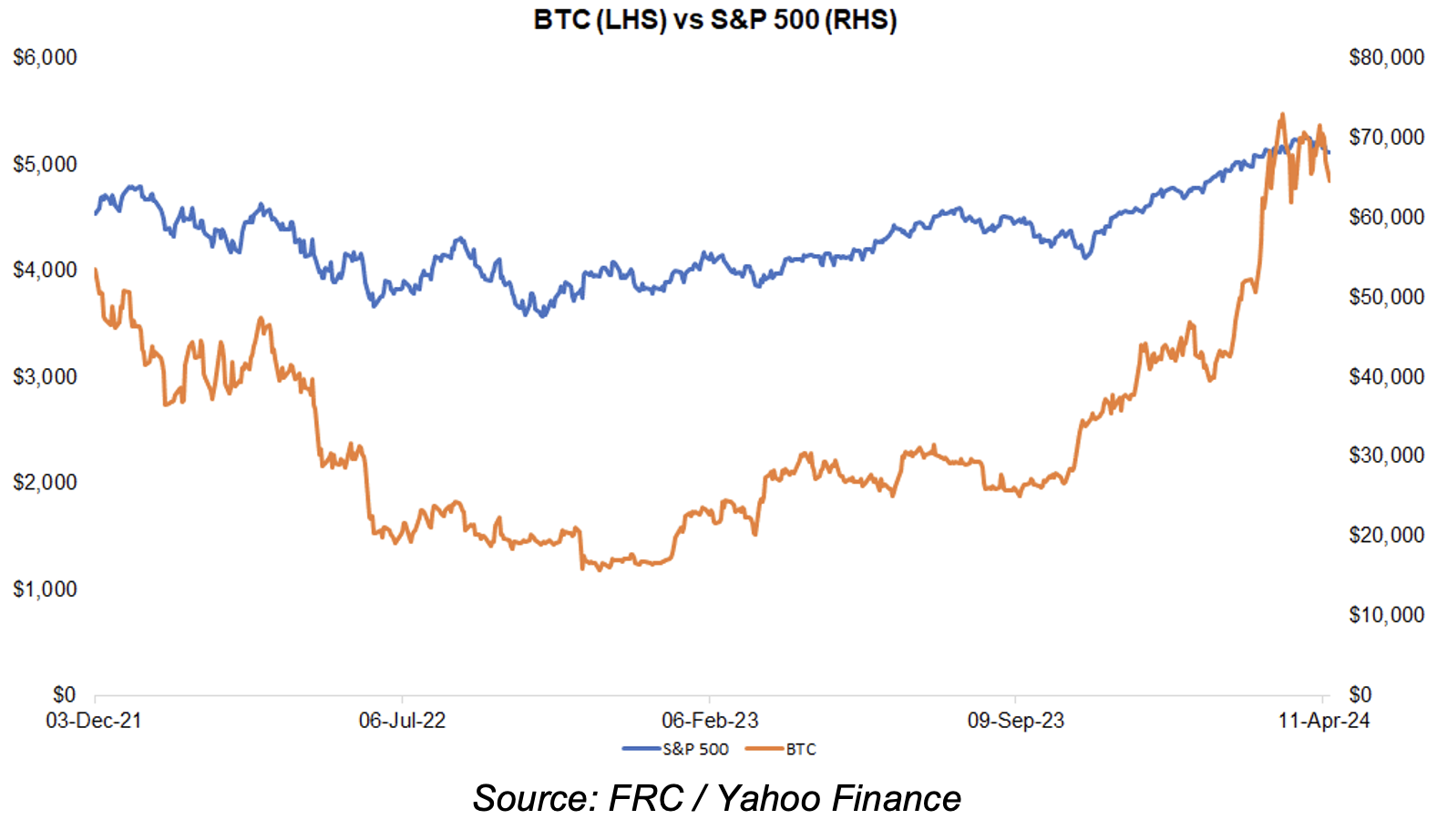

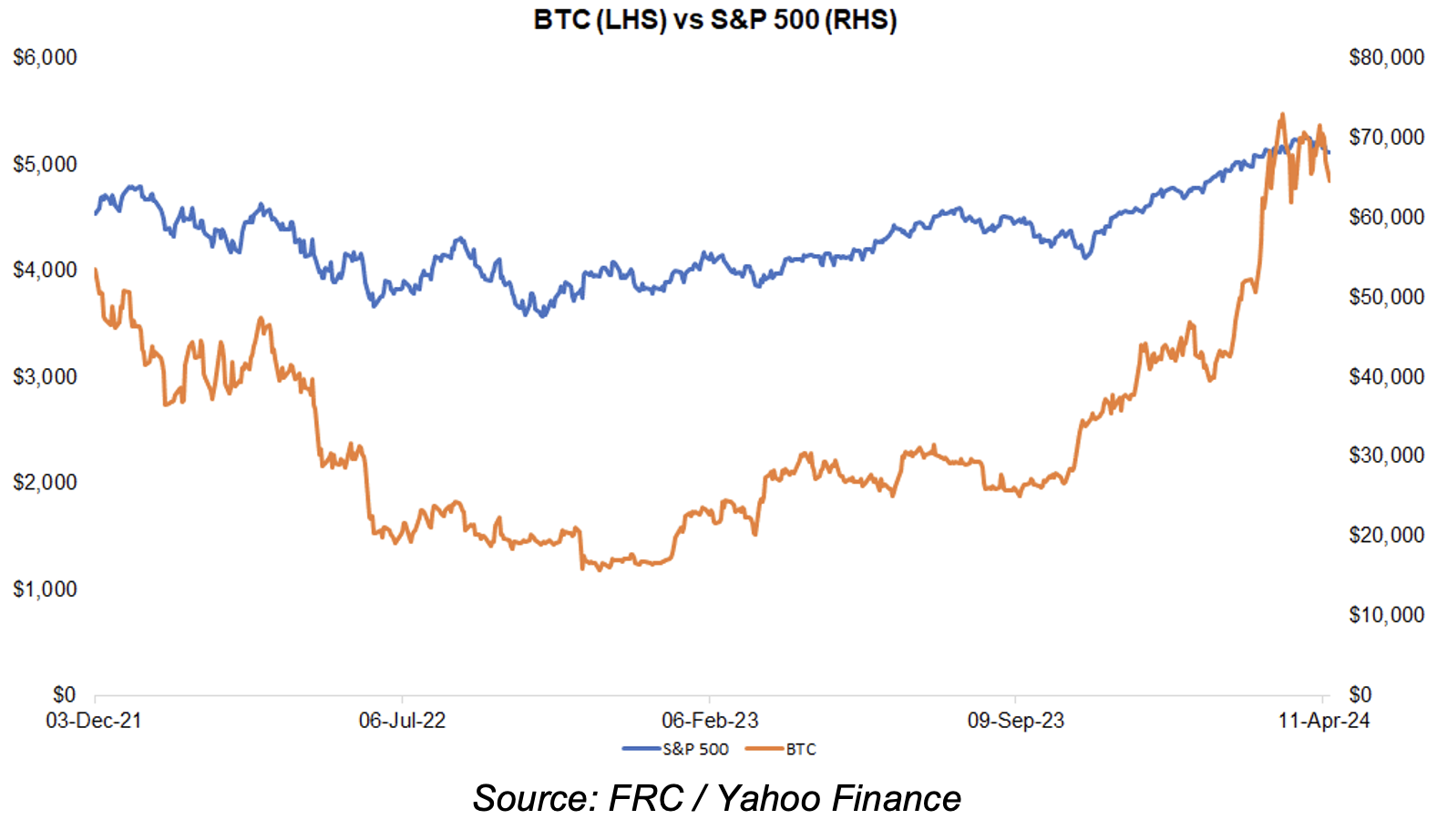

Last week, BTC was down 11%, while the S&P 500 was down 2%.

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 634 exahashes per second (EH/s), up 5% WoW, and 6% MoM. The increase in hash rates is negative for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

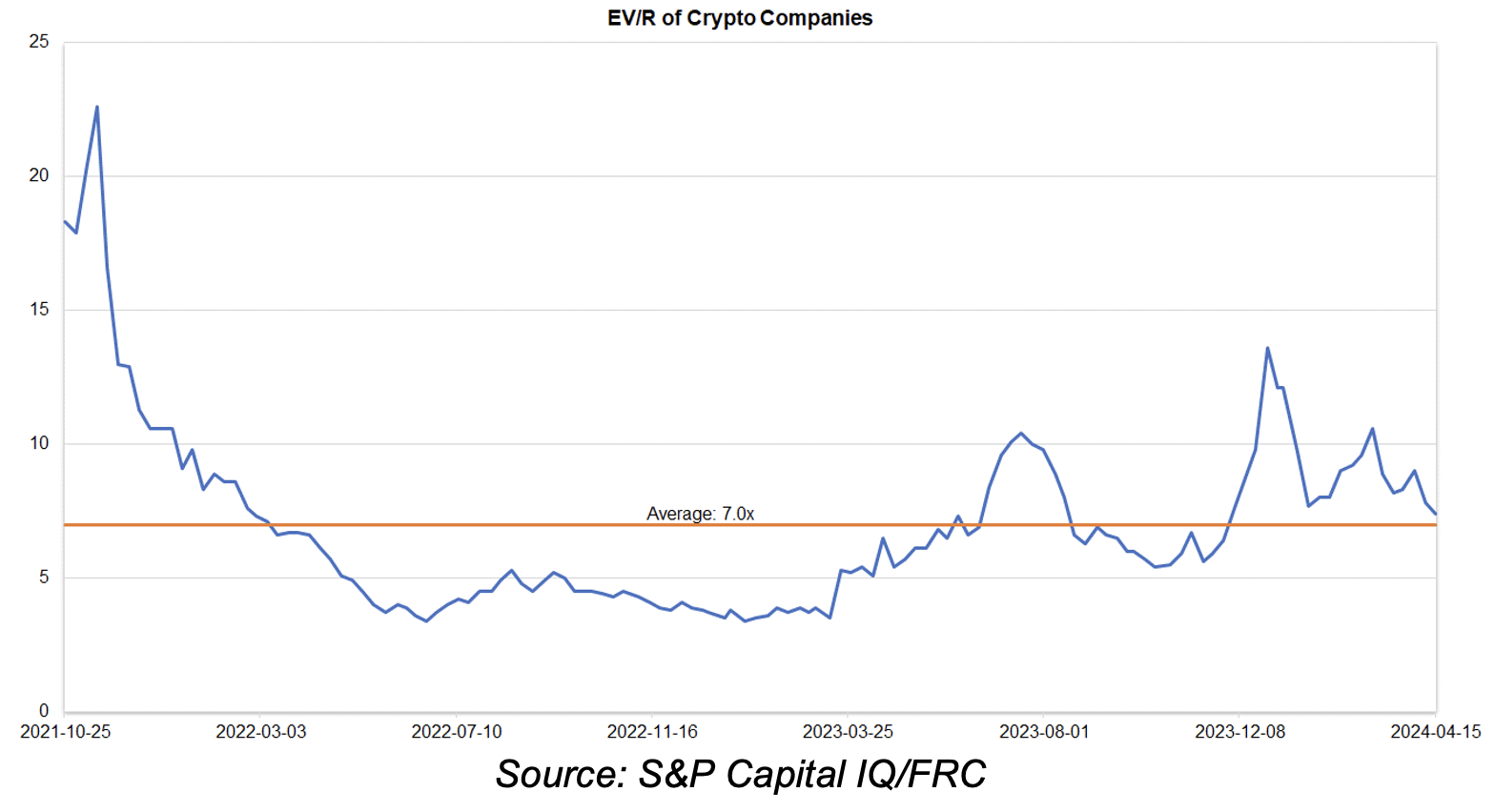

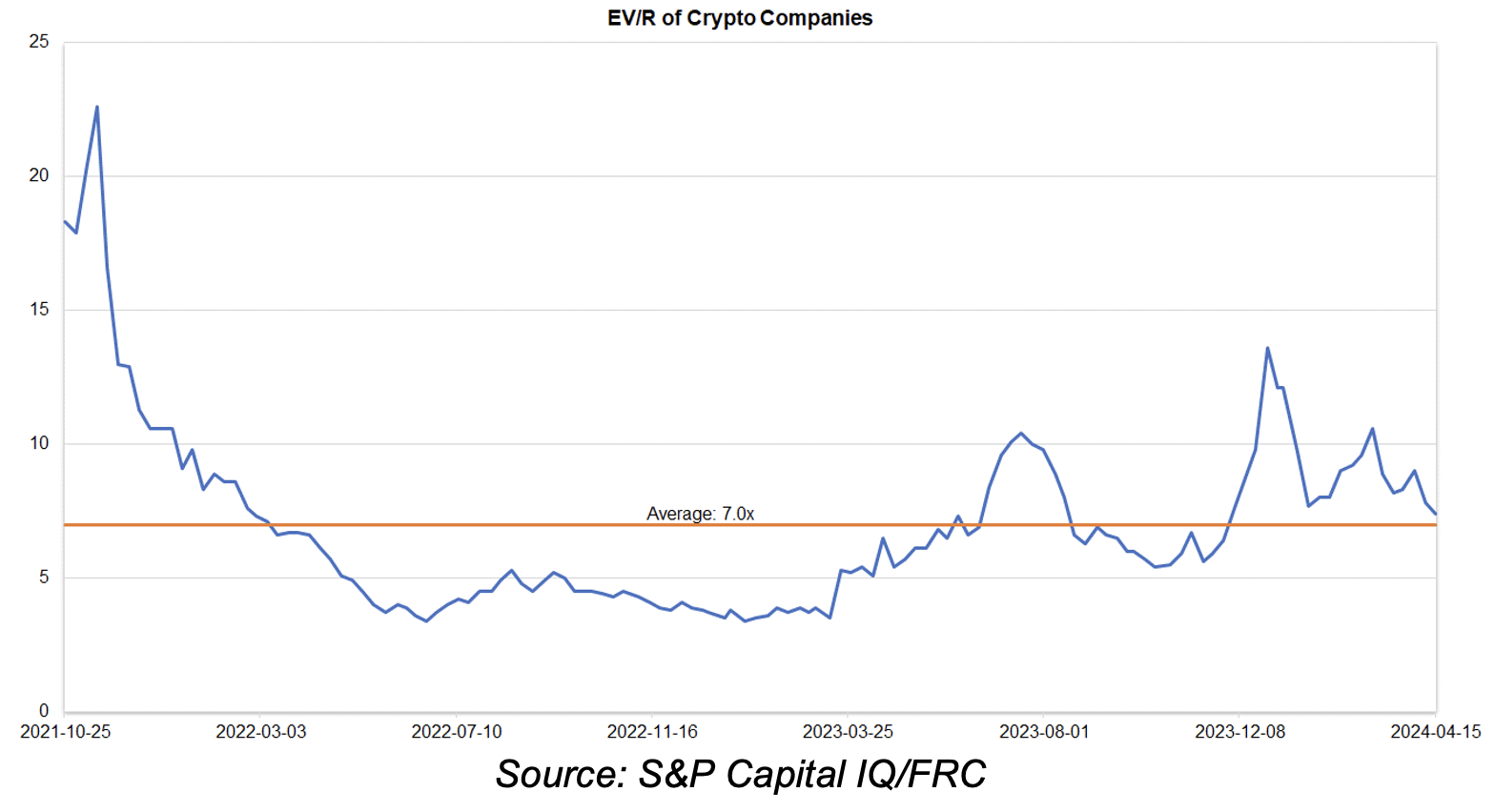

Companies operating in the crypto space are trading at an average EV/R of 7.4x (previously 7.8x).

| April 15, 2024 |

|

|

| Crypto Companies |

Ticker |

TEV/Revenue |

| Argo Blockchain |

LSE: ARB |

3.3 |

| BIGG Digital |

CSE: BIGG |

10.6 |

| Bitcoin Well |

TSXV: BTCW |

0.8 |

| Canaan Inc. |

NASDAQ: CAN |

0.9 |

| CleanSpark Inc. |

NasdaqCM:CLSK |

15.5 |

| Coinbase Global |

NASDAQ: COIN |

19.6 |

| Galaxy Digital Holdings |

TSX: GLXY |

N/A |

| HIVE Digital |

TSXV:HIVE |

3.3 |

| Hut 8 Mining Corp. |

TSX: HUT |

8.2 |

| Marathon Digital Holdings |

NASDAQ: MARA |

11.1 |

| Riot Platforms |

NASDAQ: RIOT |

6.2 |

| SATO Technologies |

TSXV: SATO |

2.4 |

| AVERAGE |

|

7.4 |

| MEDIAN |

|

6.2 |

| MINIMUM |

|

0.8 |

| MAXIMUM |

|

19.6 |

Source: S&P Capital IQ/FRC