Power Nickel's Bonanza Grades, Denarius Funding, and Mining Updates

Published: 2/10/2025

Author: FRC Analysts

*Report and research coverage is paid for and commissioned by companies mentioned. See the bottom of this report for other important disclosures.

In this edition, we analyze the performance of our top picks, including a gold-copper junior, whose shares rose 27% last week. We also discuss promising developments by other companies we cover, including a crucial financing by a near-term gold-silver producer, and encouraging results from a junior whose shares are up 589% YoY.

Highlights

1. Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

2. FRC top picks and standout performers from the past week

Power Metallic Mines Inc. (PNPN.V)

PR Title: Additional results from an ongoing drill program from its polymetallic Lion zone discovery (Quebec)

Analyst Opinion: Positive – A recent hole at the high-grade polymetallic Lion zone returned bonanza values of up to 5.35 m of 10.6% CuEq, within 19.4 m of 4.29% CuEq. The market responded highly favorably, with the share price jumping 27% since the press release. Shares are up 589% YoY, driving the MCAP to $326M. Note that the Lion zone is one of the primary zones of mineralization identified on the Nisk project. The other zone is the nickel-rich Nisk Main deposit, which hosts a medium-sized, high-grade resource totaling 178 Mlbs of NiEq. Results from the past few weeks have prompted us to reevaluate our previous estimate for the project, and we will be releasing an updated report shortly. We had previously valued the project based on its potential to host up to 1 Blbs of high-grade CuEq.

Denarius Metals Corp. (DMET.NE, DNRSF)

PR Title: Announces a US$9M prepayment financing with Trafigura for its Zancudo gold-silver project (Colombia)

Analyst Opinion: Positive - Trafigura Pte. Ltd., a leading global commodity supplier, has offered a US$9M prepayment financing to fully fund construction activities at the Zancudo project. DMET and Trafigura had entered into an off-take agreement in 2024. Production is expected to commence in the coming weeks.

Doubleview Gold Corp. (DBLVF, DBG.V)

PR Title: Drilling confirms continuity of mineralization at the Hat polymetallic project (B.C.)

Analyst Opinion: Positive – Drilling demonstrated continuous mineralization, with high-grade intercepts over significant intervals, including 21.5 m of 2.06% CuEq, and 56.6 m of 1.00% CuEq, suggesting the potential to upgrade the current resource. The Hat project hosts an open-pittable polymetallic porphyry deposit, with resources totaling 5 Blbs of CuEq, uniquely enriched with scandium and cobalt. DBG is currently working on an updated resource estimate.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Lumina Gold (TSXV: LUM), was up 27%. LUM is advancing a large gold-copper project in Ecuador.

* Past performance is not indicative of future performance (as of Feb 10, 2025)

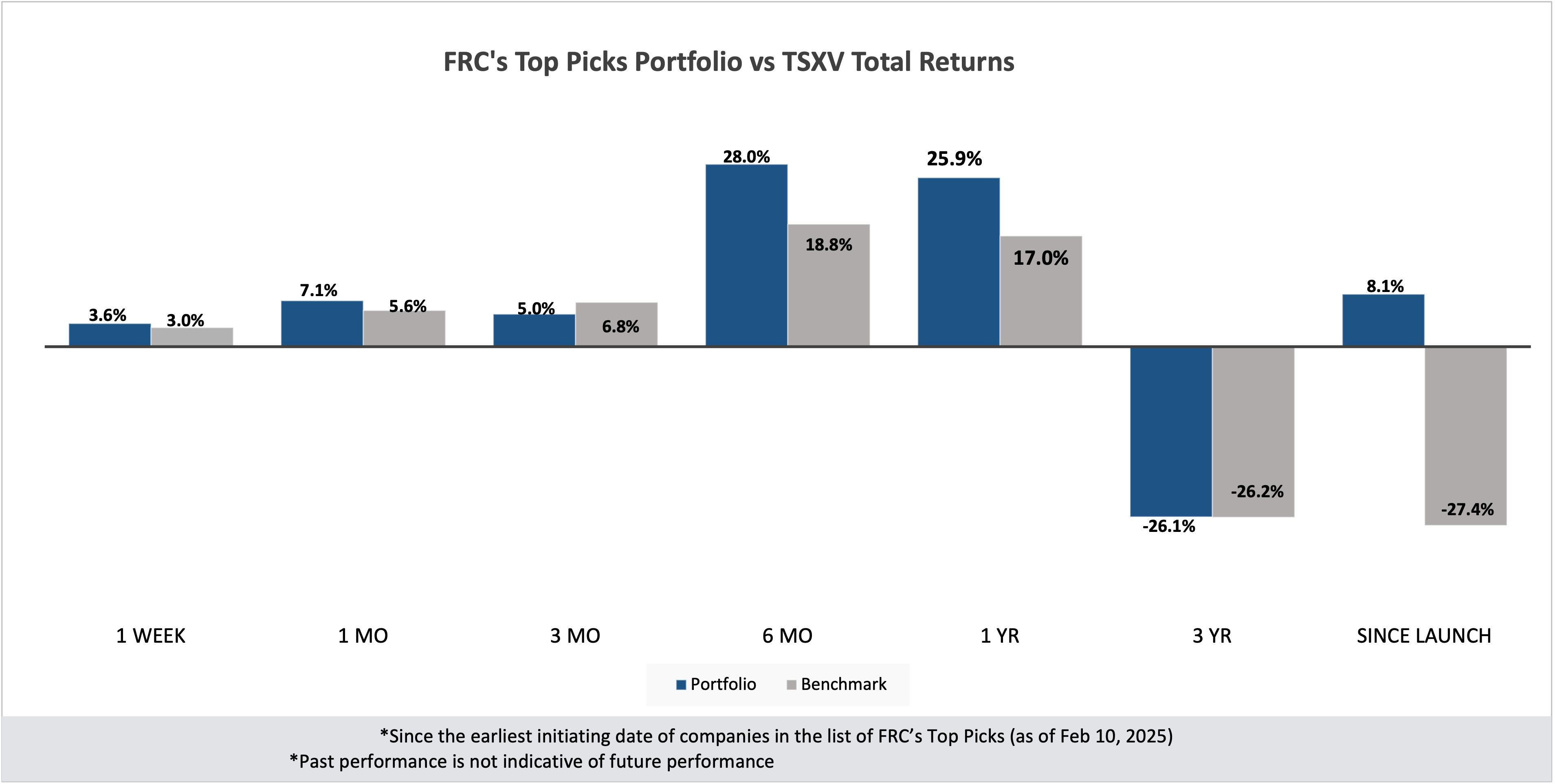

FRC's Top Picks Portfolio vs TSXV Total Returns

Our top picks have outperformed the benchmark (TSXV) in six out of seven time periods listed below.

Performance by Sector

1. Since the earliest initiating date of companies in the list of Top Picks (as of Feb 10, 2025)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.

Our complete list of top picks (updated weekly) can be viewed here.