Market Uptick: Inflation Cooling / Gold Soaring / Bitcoin Recovering

Published: 8/19/2024

Author: FRC Analysts

Key Highlights

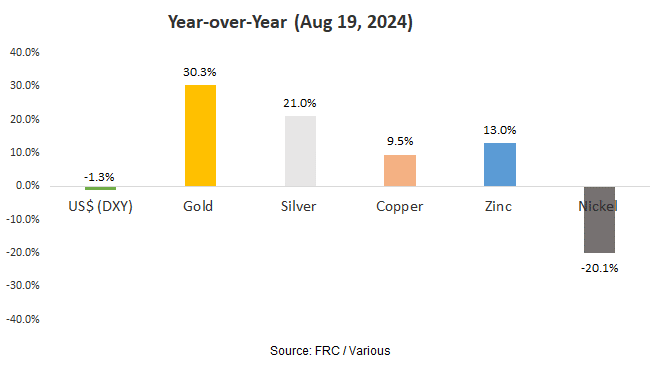

- Last week, the S&P 500 and metal prices rallied amid cooling inflation, which also contributed to a weaker US$ and lower yields.

- Stronger-than-expected retail sales and softer-than-anticipated jobless claims further fueled optimism about a potential 'soft landing' for the U.S. economy.

- The lithium sector witnessed a significant M&A deal, potentially reigniting interest in a sector that has been underperforming for nearly two years.

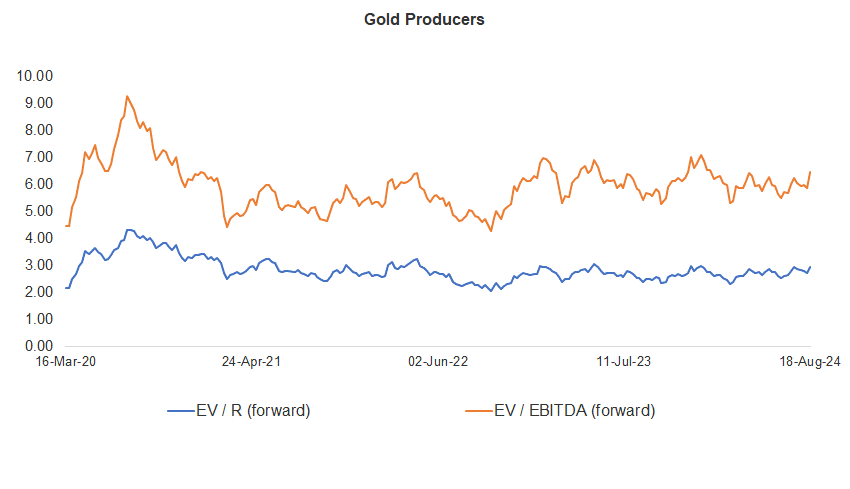

- Gold prices surged to over US$2,500/oz for the first time. However, gold producer valuations are 11% lower than the past three instances when gold surpassed US$2k/oz.

- With four out of five key statistical indicators suggesting potential strength, our near-term outlook for Bitcoin has turned from bearish to bullish.

Contango Ore, Inc. (CTGO)

PR Title: Announces results of the first batch of gold production from the Manh Choh gold mine (Alaska)

Analyst Opinion: Positive – CTGO and partner Kinross Gold (TSX: K) have completed processing the first batch of ore, producing 55 Koz of gold and 11 Koz of silver. CTGO’s share of gold and silver sales totaled $32M. Manh Choh is a medium-sized/ultra-high-grade open-pit mine capable of producing 225 Koz per year (67.5 Koz for CTGO). CTGO will start reporting revenue in the upcoming Q3 financials.

North Peak Resources Ltd. (BTLLF, NPR.V)

PR Title: Reports early holes from the Prospect Mountain North drill program (Nevada)

Analyst Opinion: Positive – Promising results; an ongoing drill program returned high grades over long intervals, including 126.5 m of 1.06 g/t Au, and 21.3 m of 2.03 g/t. Prospect MMC is a historic gold-silver-lead producer, directly bordering i-80 Gold’s (TSX: IAU) Ruby Hill project, which hosts a large gold-silver resource.

Fortune Minerals Limited (FT.TO, FTMDF)

PR Title: Completes a new option agreement to acquire the JFSL Alberta refinery site for the NICO project

Analyst Opinion: Positive – Since the option to purchase the site had expired in June 2024, we are pleased to see FT re-engaging with the vendor and renegotiating a deal. The site, located in Alberta, could potentially be used as a refinery to process concentrates from the NICO cobalt-gold-bismuth-copper project in the NWT, and recover bismuth and cobalt from partner Rio Tinto’s (NYSE: RIO) Kennecott operations in Utah.

Churchill Resources Inc. (CRI.V, CRICF)

PR Title: Identifies new nickel targets at the Taylor Brook project, Newfoundland & Labrador

Analyst Opinion: Positive – CRI has identified two large geophysical targets (10 km apart) which will be drill tested in the coming weeks. Taylor Brook exhibits potential for nickel sulphide deposits, a primary source of Class 1 nickel used in lithium-ion batteries.

Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

Metalert Inc./ OTCPK: MLRT

PR Title: Expands distribution; conducting trials in Spain, Portugal, and the Netherlands

Analyst Opinion: Positive - MLRT has partnered with a security solutions distributor, serving over 850 corporate clients, to market its SmartSoles across Latin America. SmartSoles are GPS-enabled devices integrated into shoe insoles, ideal for tracking and monitoring elderly individuals and those at risk of wandering due to cognitive disorders like Alzheimer’s, dementia, and autism. MLRT is also running trials in Spain, Portugal, and the Netherlands.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Kidoz Inc., was up 23%, amid new, stricter regulations on ads targeting kids. We believe these regulations will likely drive advertisers toward companies like Kidoz, which specialize in kid-friendly advertising. For more details, refer to our note on Kidoz from last week.

| Top Five Weekly Performers | WoW Returns |

| Kidoz Inc. (KIDZ.V) | 23.3% |

| E3 Lithium Limited (ETL.V) | 18.9% |

| Zepp Health Corporation (ZEPP) | 17.3% |

| Kootenay Silver Inc. (KTN.V) | 15.8% |

| Panoro Minerals (PML.V) | 13.6% |

| * Past performance is not indicative of future performance (as of Aug 19, 2024) |

Source: FRC

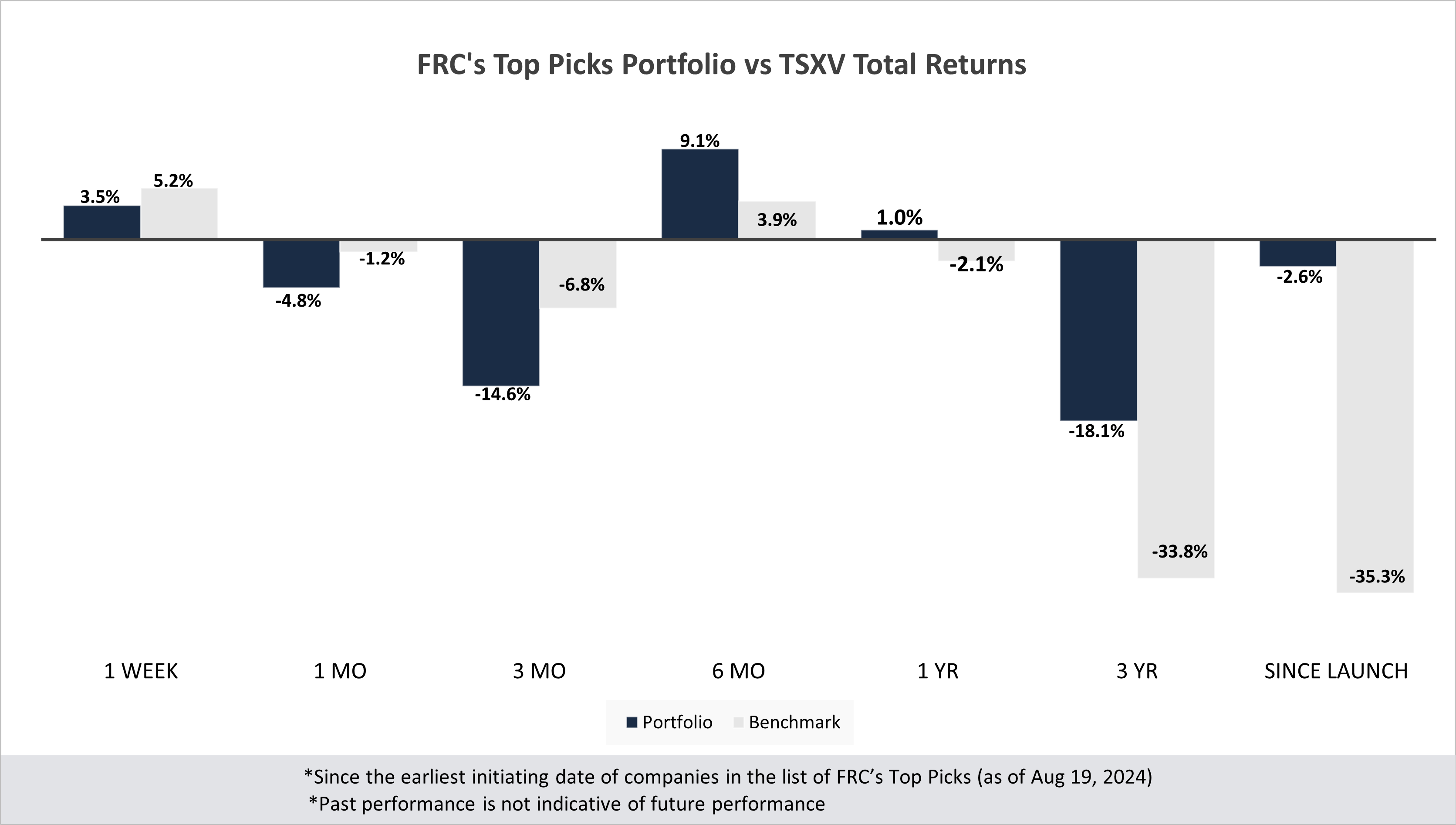

Our top picks have outperformed the benchmark (TSXV) in four out of seven time periods listed below.

Performance by Sector

| Total Return | 1 Week | 1 mo | 3 mo | 6 mo | 1 yr | 3 yr | Since launch |

| Mining | 1.8% | -10.0% | -21.6% | 11.2% | -7.0% | -32.9% | 4.6% |

| Cannabis | N/A | N/A | N/A | N/A | N/A | -46.1% | -23.6% |

| Tech | 23.3% | 19.4% | -9.8% | 42.3% | -11.9% | -31.3% | -4.3% |

| Special Situations (MIC) | 3.7% | 6.2% | 12.5% | 9.6% | 34.6% | -24.6% | -6.3% |

| Private Companies | N/A | N/A | N/A | N/A | 6.7% | 20.5% | 30.5% |

| Portfolio (Total) | 3.5% | -4.8% | -14.6% | 9.1% | 1.0% | -18.1% | -2.6% |

| Benchmark (Total) | 5.2% | -1.2% | -6.8% | 3.9% | -2.1% | -33.8% | -35.3% |

| Portfolio (Annualized) | - | - | - | - | 1.0% | -6.4% | -0.2% |

| Benchmark (Annualized) | - | - | - | - | -2.1% | -12.8% | -4.0% |

1. Since the earliest initiating date of companies in the list of Top Picks (as of August 19, 2024) 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. 3. Past performance is not indicative of future performance. 4. Our complete list of top picks (updated weekly) can be viewed here: Top Picks List

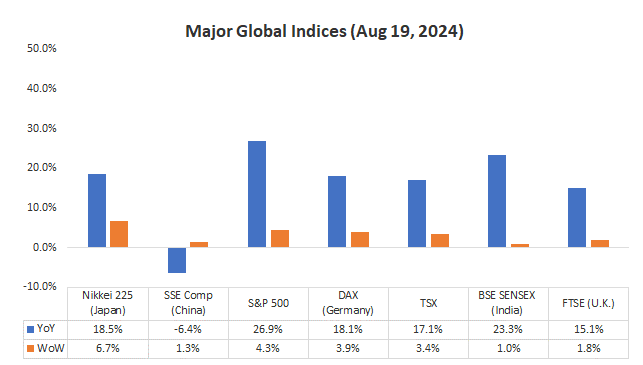

Market Updates and Insights: Mining

Last week, global equity markets were up 3.2% on average (up 1.4% in the previous week). The S&P 500 gained 4.3% amid cooling inflation, which also contributed to a weaker US$ and lower yields. Stronger-than-expected retail sales and softer-than-anticipated jobless claims further fueled optimism about a potential 'soft landing' for the U.S. economy.

Source: FRC / Various

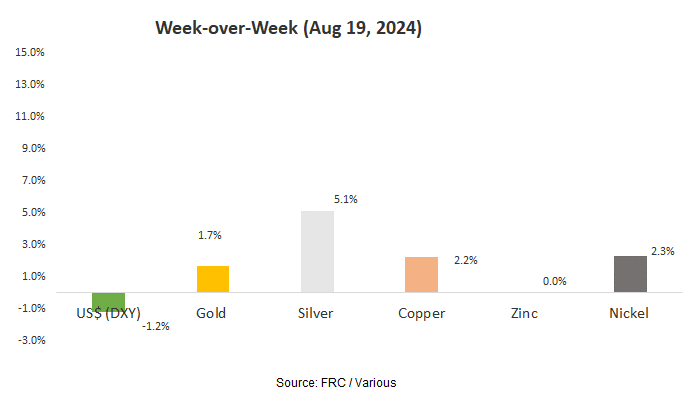

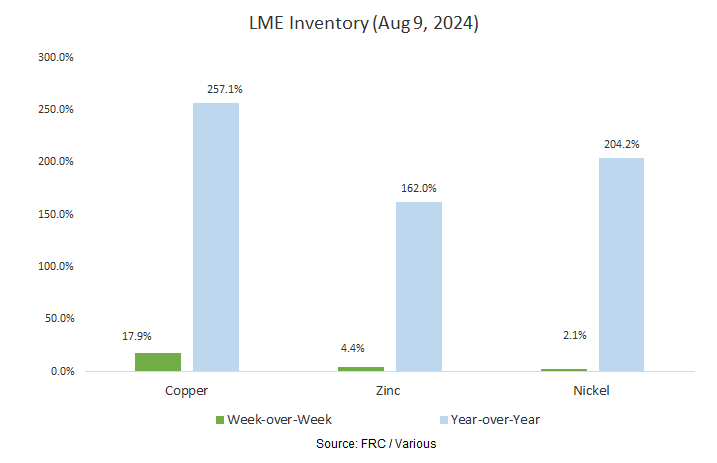

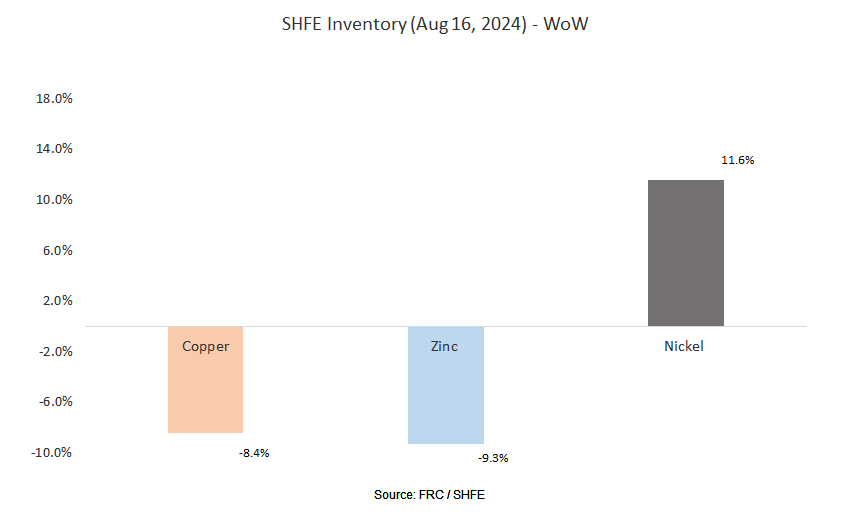

Last week, metal prices were up 2.3% on average (down 2.7% in the previous week).

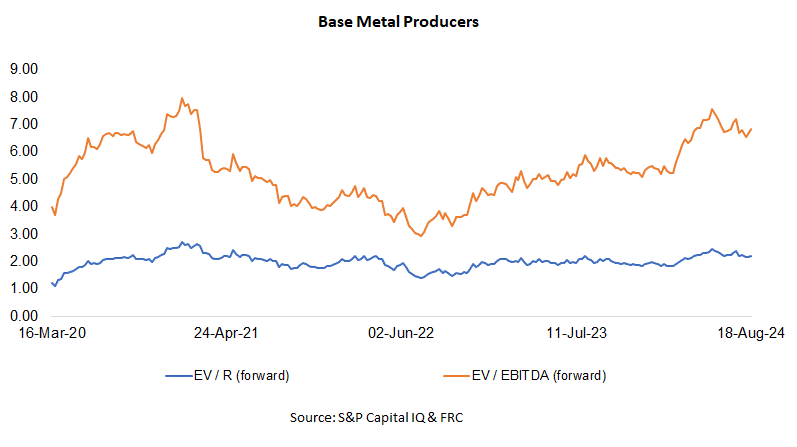

Gold producer valuations were up 9.4% last week (down 2.0% in the prior week); base metal producers were up 2.5% last week (up 0.8% in the prior week). On average, gold producer valuations are 11% lower (previously 18%) than the past three instances when gold surpassed US$2k/oz.

Source: S&P Capital IQ & FRC

| 12-Aug-24 | 19-Aug-24 | ||||

| Gold Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | Barrick | 3.00 | 5.32 | 3.34 | 6.84 |

| 2 | Newmont | 3.41 | 7.68 | 3.57 | 8.04 |

| 3 | Agnico Eagle | 4.73 | 8.58 | 5.10 | 9.14 |

| 4 | AngloGold | 2.45 | 5.44 | 2.58 | 5.72 |

| 5 | Kinross Gold | 2.52 | 5.29 | 2.71 | 5.69 |

| 6 | Gold Fields | 2.75 | 5.13 | 2.98 | 5.63 |

| 7 | Sibanye | 0.60 | 3.67 | 0.64 | 3.89 |

| 8 | Hecla Mining | 4.11 | 12.06 | 4.49 | 13.04 |

| 9 | B2Gold | 1.54 | 3.06 | 1.69 | 3.45 |

| 10 | Alamos | 5.31 | 9.96 | 5.86 | 10.97 |

| 11 | Harmony | 1.74 | 5.19 | 1.92 | 6.25 |

| 12 | Eldorado Gold | 2.56 | 4.92 | 2.81 | 5.41 |

| Average (excl outliers) | 2.72 | 5.86 | 2.95 | 6.46 | |

| Min | 0.60 | 3.06 | 0.64 | 3.45 | |

| Max | 5.31 | 12.06 | 5.86 | 13.04 | |

| Base Metal Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | BHP Group | 2.74 | 5.25 | 2.73 | 5.24 |

| 2 | Rio Tinto | 2.10 | 4.62 | 2.08 | 4.57 |

| 3 | South32 | 1.27 | 5.98 | 1.30 | 6.09 |

| 4 | Glencore | 0.39 | 5.41 | 0.39 | 5.54 |

| 5 | Anglo American | 1.80 | 5.38 | 1.83 | 5.49 |

| 6 | Teck Resources | 3.46 | 8.41 | 3.62 | 8.79 |

| 7 | First Quantum | 3.41 | 11.48 | 3.58 | 12.07 |

| Average (excl outliers) | 2.17 | 6.65 | 2.22 | 6.83 | |

| Min | 0.39 | 4.62 | 0.39 | 4.57 | |

| Max | 3.46 | 11.48 | 3.62 | 12.07 | |

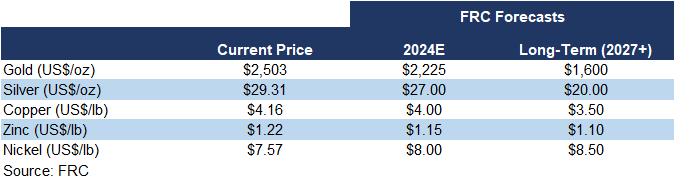

We are maintaining our metal price forecasts.

Key Developments:

- Last week, Pilbara Minerals (ASX: PLS/MCAP: $9B) announced plans to acquire Latin Resources (ASX: LRS) for $560M, reflecting a 67% premium over LRS’s last closing price. LRS owns an advanced stage lithium project in Brazil. We note that PLS is paying $89/t of lithium carbonate vs the sector average of $33/t. Additionally, oil-rich nations like Saudi Arabia are actively diversifying into lithium and other EV metals. We believe these developments suggest positive M&A prospects for lithium juniors.

Market Updates and Insights: Cryptos

Prices of mainstream/popular cryptos were up 2% on average last week (up 10% in the previous week).

| August 19, 2024 | ||

| Cryptos | WoW | YoY |

| Bitcoin | 1% | 127% |

| Binance Coin | 5% | 154% |

| Cardano | 1% | 26% |

| Ethereum | -1% | 55% |

| Polkadot | -1% | -2% |

| XRP | 8% | 17% |

| Polygon | 3% | -26% |

| Solana | 0% | 556% |

| Average | 2% | 113% |

| Min | -1% | -26% |

| Max | 8% | 556% |

| Indices | ||

| Canadian | WoW | YoY |

| BTCC | 0% | 120% |

| BTCX | 0% | 127% |

| EBIT | 0% | 124% |

| FBTC | 0% | 26% |

| U.S. | WoW | YoY |

| BITO | 0% | 43% |

| BTF | -1% | 64% |

| IBLC | 7% | 64% |

Source: FRC/Yahoo Finance

The global MCAP of cryptos is US$2.19T, down 15% MoM, but up 97%YoY.

Total Crypto Market Cap Chart

Source: CoinGecko

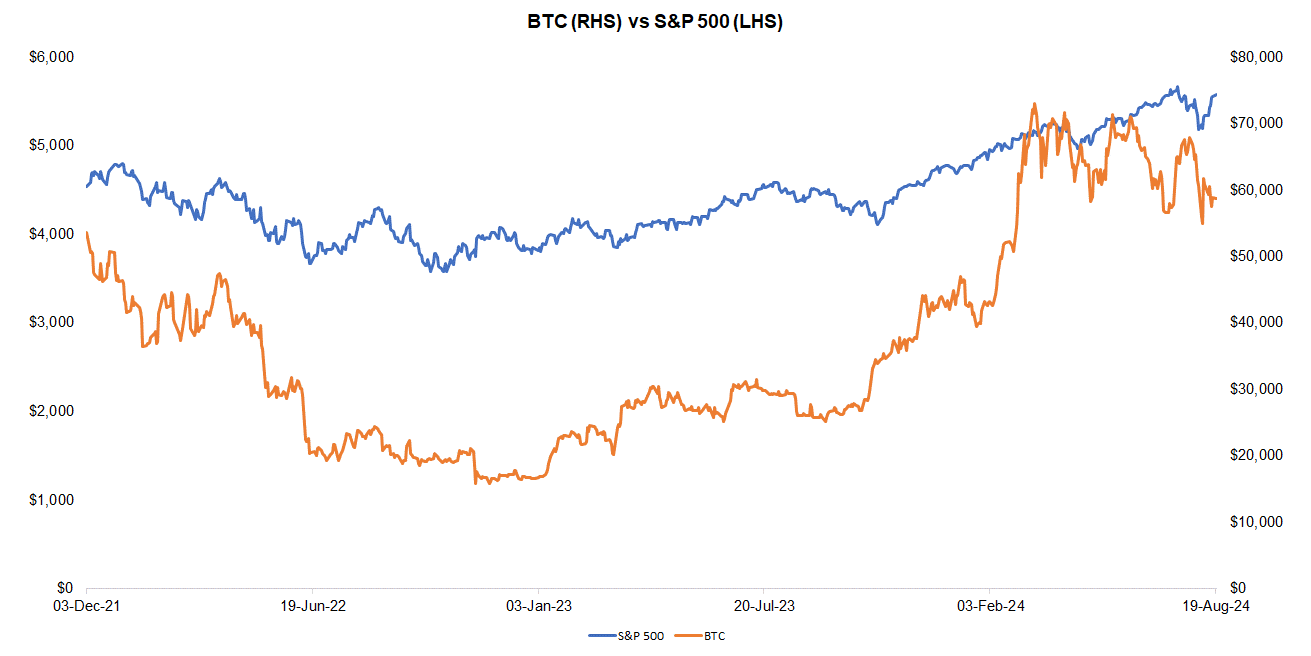

Last week, BTC was up 0.7%, while the S&P 500 was up 4.3%. The U.S. 10-year treasury yield was down slightly by 0.05 pp.

Source: FRC/ Yahoo Finance

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 651 exahashes per second (EH/s), up 7% WoW, and 6% MoM. The increase in hash rates is negative for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

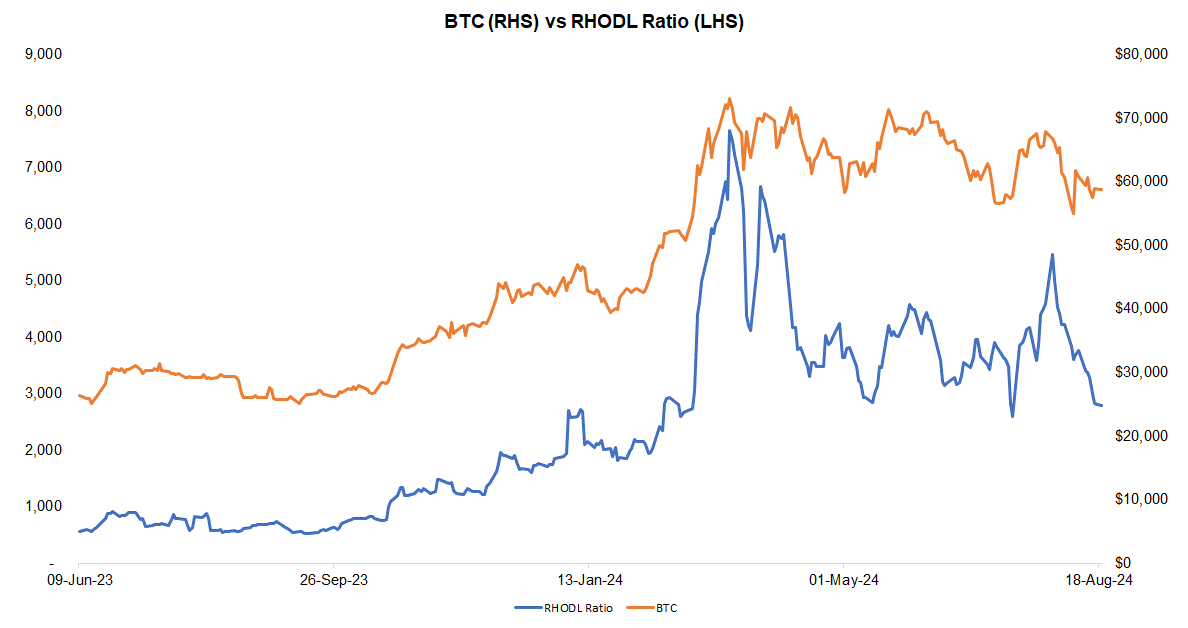

The Realized HODL ratio (RHODL), which gauges the activity of short-term holders relative to long-term holders, was down 18% WoW, but up 567% YoY. We interpret the decrease in RHODL as a sign of weakening demand, suggesting potential for a downtick in near-term prices. Historically, BTC prices have moved in tandem with this ratio. By tracking RHODL, we believe we can identify potential turning points in BTC prices.

Source: FRC/ Various

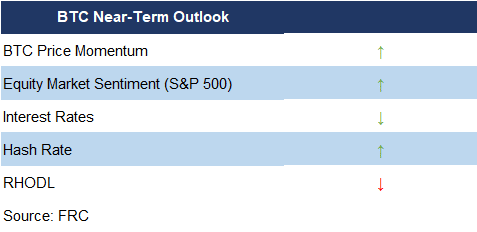

The table below highlights key statistically significant factors influencing BTC prices. With four positive signals and one negative (compared to two positive and three negative in the previous week), the near-term outlook for BTC prices has turned from bearish to bullish.

* “↑” and “↓” indicate whether a parameter has increased or decreased

* “↑” and “↓” indicate whether a parameter has increased or decreased

* Red (green) denotes a negative (positive) signal for BTC prices; black implies neutral.

Source: FRC

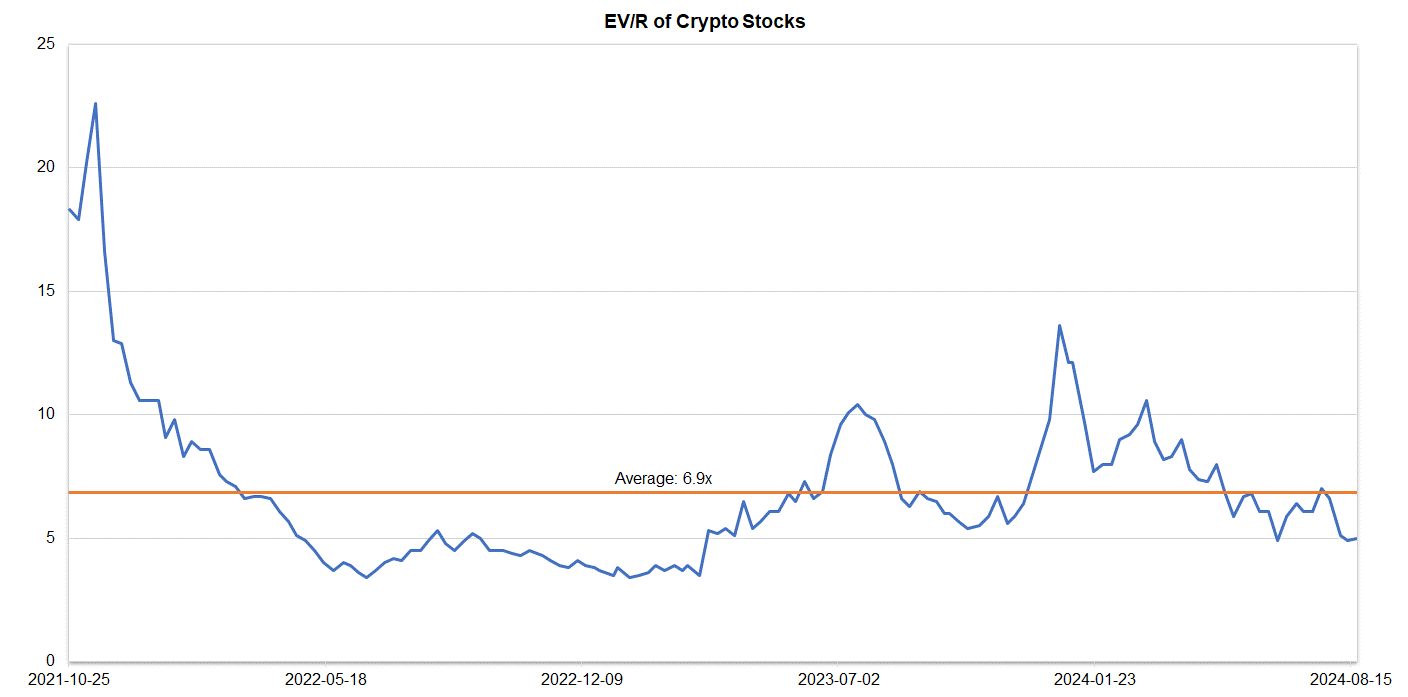

Companies operating in the crypto space are trading at an average EV/R of 5.0x (previously 4.9x).

Source: S&P Capital IQ/FRC

| August 19, 2024 | |

| Crypto Stocks | EV/Revenue |

| Argo Blockchain | 2.1 |

| BIGG Digital | 4.3 |

| Bitcoin Well | 0.7 |

| Canaan Inc. | 1.0 |

| CleanSpark Inc. | 8.2 |

| Coinbase Global | 10.7 |

| Galaxy Digital Holdings | N/A |

| HIVE Digital | 2.8 |

| Hut 8 Mining Corp. | 8.2 |

| Marathon Digital Holdings | 8.6 |

| Riot Platforms | 6.5 |

| SATO Technologies | 1.5 |

| Average | 5.0 |

| Median | 4.3 |

| Min | 0.7 |

| Max | 10.7 |

Source: S&P Capital IQ/FRC

Market Updates and Insights: Artificial Intelligence/AI

Major AI indices are up 5% WoW on average (up 2% in the previous week), and 17% YoY.

| August 19, 2024 | ||

| AI Indices | WoW | YoY |

| First Trust Nasdaq AI and Robotics ETF | 6% | 2% |

| Global X Robotics & AI ETF | 5% | 21% |

| Global X AI & Technology ETF | 6% | 32% |

| iShares Robotics and AI Multisector ETF | 1% | 0% |

| Roundhill Generative AI & Technology ETF | 6% | 30% |

| Average | 5% | 17% |

| Min | 1% | 0% |

| Max | 6% | 32% |

Source: FRC/Various

The following table highlights some of the most popular large-cap AI stocks. Shares of these companies are up 8% WoW on average (down 2% in the previous week), and 96% YoY. Their average P/E is 32.6x (previously 29.8x) vs the NASDAQ-100 Index’s average of 31.0x (previously 29.6).

| AI Stocks | WoW | YoY | P/E |

| Arista Networks | 3% | 89% | 16.6 |

| Dell Technologies | 15% | 99% | 22.8 |

| Microsoft Corporation | 2% | 30% | 35.5 |

| NVIDIA Corp | 15% | 175% | 72.8 |

| Micron Technology | 11% | 68% | n/a |

| Palantir Technologies | 9% | 123% | n/a |

| Qualcomm | 5% | 56% | 22.0 |

| Super Micro Computer (SMCI) | 10% | 147% | 31.3 |

| Taiwan Semiconductor Manufacturing | 3% | 81% | 27.2 |

| Average | 8% | 96% | 32.6 |

| Median | 9% | 89% | 27.2 |

| Min | 2% | 30% | 16.6 |

| Max | 15% | 175% | 72.8 |

Source: FRC/Various