S&P Rebounds / Gold M&A / Bitcoin Caution

Published: 8/12/2024

Author: FRC Analysts

Key Highlights

1. While the S&P 500 rebounded last week, we believe sustained optimism depends on the Fed signaling a more aggressive rate-cut trajectory than currently anticipated to prevent a recession

2. Another major gold M&A deal brings additional good news for gold juniors

3. On average, gold producer valuations are 18% lower than the past three instances when gold surpassed US$2k/oz

4. Favorable sector developments for an adtech company under coverage

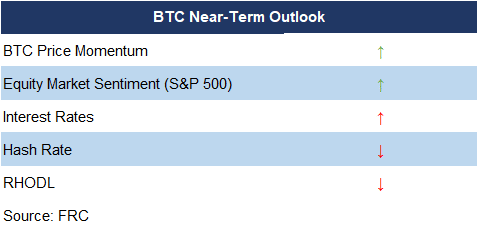

5. Three out of five key statistically significant factors indicate potential weakness in near-term Bitcoin prices

Millennial Potash Corp. (MLP.V)

PR Title: Announces a $1M equity financing

Analyst Opinion: Positive - MLP is advancing its Banio potash project in Gabon, Western Africa. A recent Preliminary Economic Assessment returned an AT-NPV10% of US$1.1B, and a high AT-IRR of 33%, using a 25-year average price of US$387/t of granular Muriate of Potash (gMOP) vs the spot price of US$301/t. MLP is trading at <1% of its AT-NPV.

Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

Kidoz Inc. / TSXV: KIDZ

PR Title: COPPA 2.0: A game-changer for Kidoz and the digital advertising landscape

Analyst Opinion: Positive - We believe Kidz is poised to benefit from the stricter ad regulations imposed by COPPA 2.0. By expanding privacy protections to teens and imposing tighter controls on data handling and targeted ads, we believe COPPA 2.0 creates a more complex landscape for advertisers. As a result, advertisers will likely turn to companies like Kidz that speacialize in kid-friendly advertising.

FRC Top Picks

The following table shows last month’s top five performers among our Top Picks. The top performer, Enterprise Group, was up 16%. Last week, Enterprise reported Q2 results with revenue up 41% YoY, beating our estimate by 9%. EPS turned positive, beating our estimate by 25%.

| Top Five Monthly Performers | MoM Returns |

| Enterprise Group, Inc. (E.TO) | 16.1% |

| Timbercreek Financial Corp (TF.TO) | 5.1% |

| Steppe Gold (STGO.TO) | 4.8% |

| Western Exploration Inc. (WEX.V) | 2.2% |

| Atrium Mortgage Investment Corporation (AI.TO) | 1.7% |

| * Past performance is not indicative of future performance (as of Aug 12, 2024) |

Source: FRC

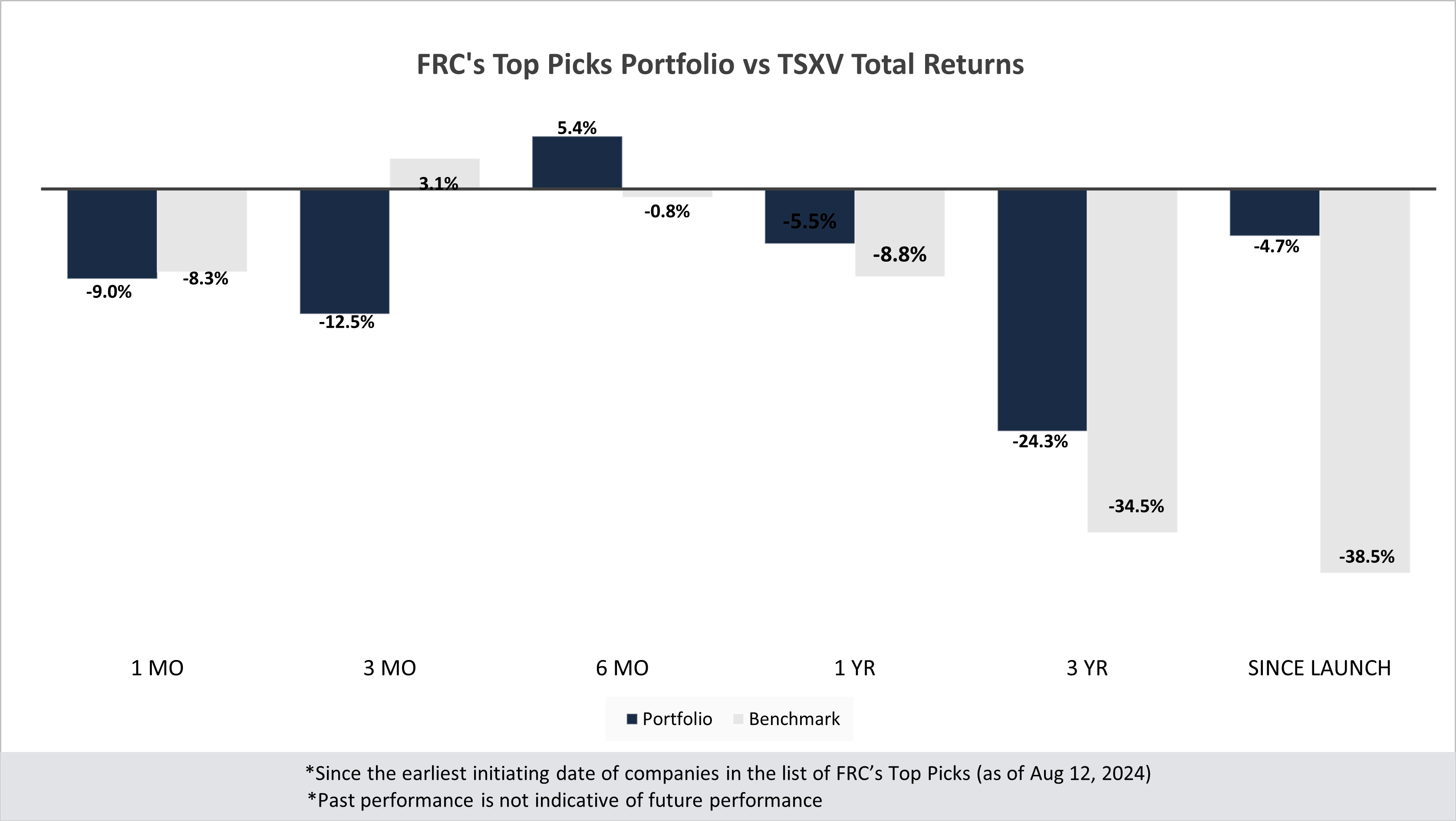

Our top picks have outperformed the benchmark (TSXV) in four out of six time periods listed below.

Performance by Sector

| Total Return | 1 mo | 3 mo | 6 mo | 1 yr | 3 yr | Since launch |

| Mining | -11.9% | -15.7% | 7.8% | -15.1% | -45.7% | -0.4% |

| Cannabis | N/A | N/A | N/A | N/A | -45.2% | -23.6% |

| Tech | -6.3% | -32.0% | 36.4% | -29.0% | -36.5% | -4.6% |

| Special Situations (MIC) | -0.2% | 8.0% | 5.7% | 31.5% | -20.2% | -7.3% |

| Private Companies | N/A | N/A | N/A | 6.7% | 20.5% | 30.5% |

| Portfolio (Total) | -9.0% | -12.5% | 5.4% | -5.5% | -24.3% | -4.7% |

| Benchmark (Total) | -8.3% | 3.1% | -0.8% | -8.8% | -34.5% | -38.5% |

| Portfolio (Annualized) | - | - | - | -5.5% | -8.9% | -0.4% |

| Benchmark (Annualized) | - | - | - | -8.8% | -13.2% | -4.5% |

1. Since the earliest initiating date of companies in the list of Top Picks (as of August 12, 2024) 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. 3. Past performance is not indicative of future performance. 4. Our complete list of top picks (updated weekly) can be viewed here: Top Picks List

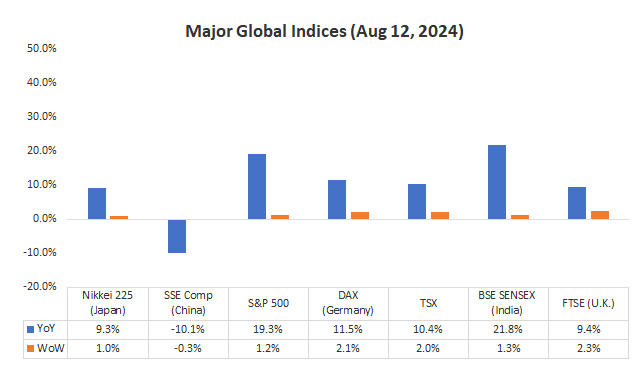

Market Updates and Insights: Mining

Last week, global equity markets were up 1.4% on average (down 4.2% in the previous week). Despite the S&P 500 rebounding by 1.2% last week following a 3.2% drop in the prior week, we believe sustained optimism will depend on the Fed signaling a more aggressive rate-cut trajectory than currently expected to avert a recession.

Source: FRC / Various

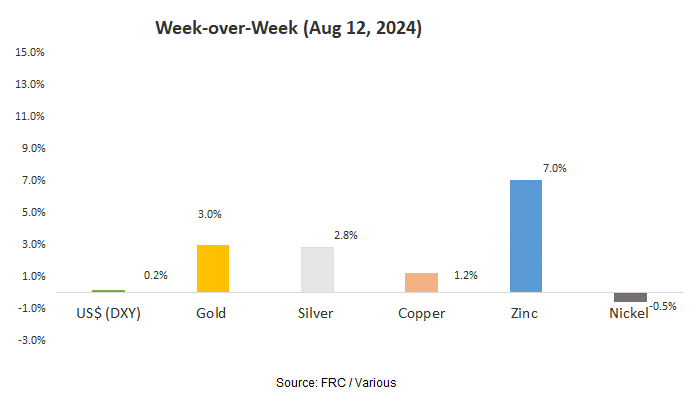

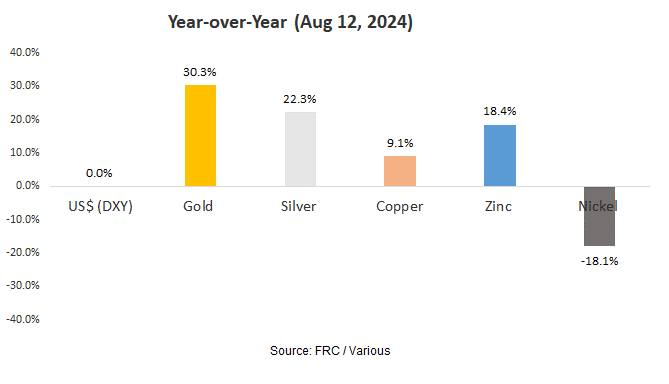

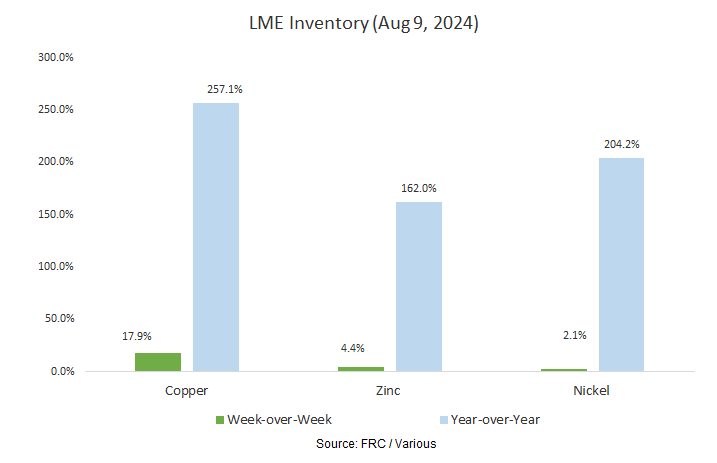

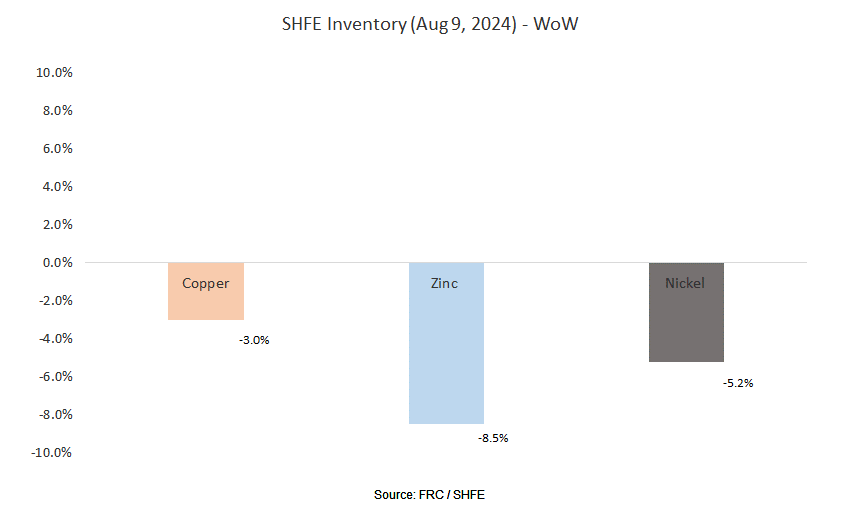

Last week, metal prices were up 2.7% on average (down 0.7% in the previous week).

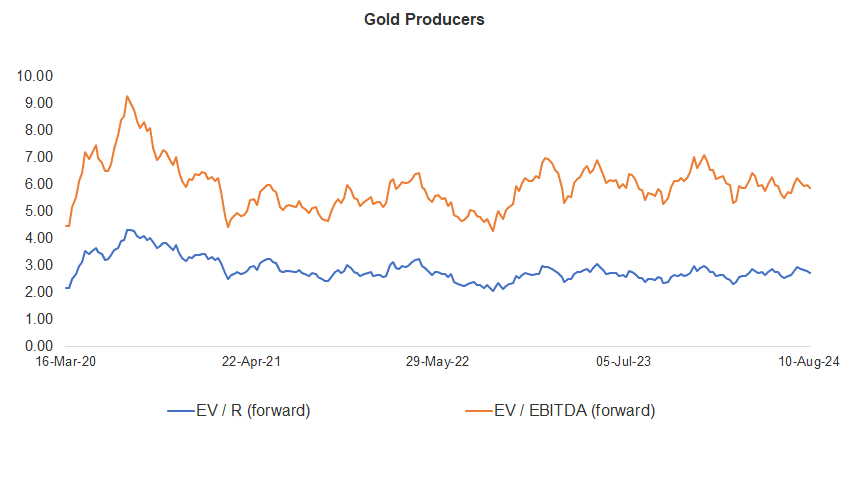

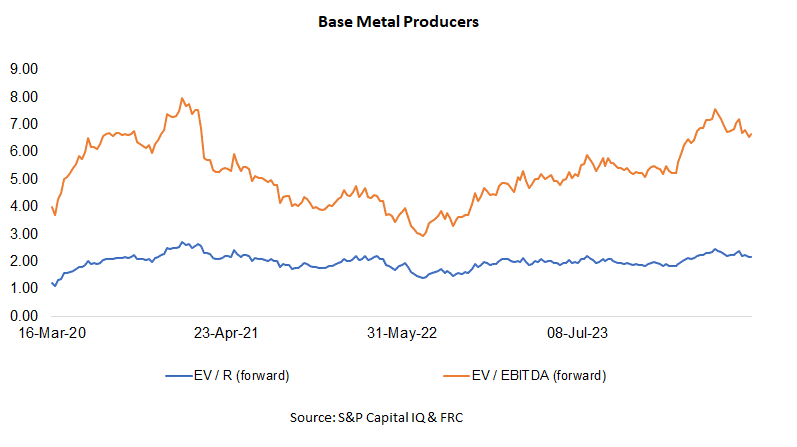

Gold producer valuations were down 2.0% last week (down 0.3% in the prior week); base metal producers were up 0.8% last week (down 3.5% in the prior week). On average, gold producer valuations are 18% lower (previously 17%) than the past three instances when gold surpassed US$2k/oz.

| 06-Aug-24 | 12-Aug-24 | ||||

| Gold Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | Barrick | 3.08 | 6.34 | 3.00 | 5.32 |

| 2 | Newmont | 3.36 | 7.59 | 3.41 | 7.68 |

| 3 | Agnico Eagle | 4.67 | 8.43 | 4.73 | 8.58 |

| 4 | AngloGold | 2.34 | 5.39 | 2.45 | 5.44 |

| 5 | Kinross Gold | 2.60 | 5.50 | 2.52 | 5.29 |

| 6 | Gold Fields | 3.05 | 5.65 | 2.75 | 5.13 |

| 7 | Sibanye | 0.62 | 3.47 | 0.60 | 3.67 |

| 8 | Hecla Mining | 4.26 | 11.46 | 4.11 | 12.06 |

| 9 | B2Gold | 1.69 | 3.23 | 1.54 | 3.06 |

| 10 | Alamos | 5.35 | 10.07 | 5.31 | 9.96 |

| 11 | Harmony | 1.71 | 5.21 | 1.74 | 5.19 |

| 12 | Eldorado Gold | 2.68 | 5.16 | 2.56 | 4.92 |

| Average (excl outliers) | 2.77 | 5.98 | 2.72 | 5.86 | |

| Min | 0.62 | 3.23 | 0.60 | 3.06 | |

| Max | 5.35 | 11.46 | 5.31 | 12.06 | |

| Base Metal Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | BHP Group | 2.74 | 5.25 | 2.74 | 5.25 |

| 2 | Rio Tinto | 2.11 | 4.61 | 2.10 | 4.62 |

| 3 | South32 | 1.23 | 5.79 | 1.27 | 5.98 |

| 4 | Glencore | 0.39 | 5.08 | 0.39 | 5.41 |

| 5 | Anglo American | 1.79 | 5.29 | 1.80 | 5.38 |

| 6 | Teck Resources | 3.47 | 8.42 | 3.46 | 8.41 |

| 7 | First Quantum | 3.39 | 11.47 | 3.41 | 11.48 |

| Average (excl outliers) | 2.16 | 6.56 | 2.17 | 6.65 | |

| Min | 0.39 | 4.61 | 0.39 | 4.62 | |

| Max | 3.47 | 11.47 | 3.46 | 11.48 | |

Source: S&P Capital IQ & FRC

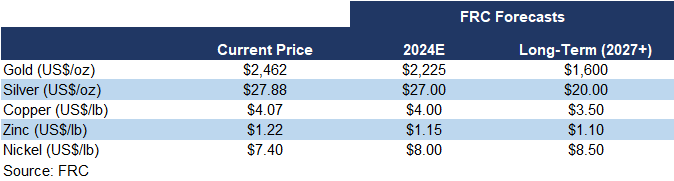

We are maintaining our metal price forecasts.

Key Developments:

- Gold Fields (NYSE: GFI) is acquiring Osisko Mining (TSX: OSK) for $2.16B, or $4.90/share, reflecting a 55% premium over OSK's last closing price. This deal allows GFI to gain full ownership of the Windfall project in Quebec, currently shared equally with OSK. As Windfall hosts 7.4 Moz of gold, we estimate GFI is paying over $375/oz, a significant premium compared to the typical $50-$100/oz range for copper-gold juniors. Earlier this month, BHP (ASX: BHP) and Lundin Mining (TSX: LUN) announced plans to acquire Canadian junior Filo Corp. (TSX: FIL) for $4.1B, or over $200/oz. We believe these deals reflect the eagerness of major players to engage in M&A and consolidate their portfolios, which is excellent news for junior resource companies.

Market Updates and Insights: Cryptos

Prices of mainstream/popular cryptos were up 10% on average last week (down 17% in the previous week).

| August 12, 2024 | ||

| Cryptos | WoW | YoY |

| Bitcoin | 6% | 99% |

| Binance Coin | 8% | 113% |

| Cardano | 4% | 15% |

| Ethereum | 12% | 42% |

| Polkadot | 10% | -10% |

| XRP | 18% | -10% |

| Polygon | 10% | -38% |

| Solana | 10% | 481% |

| Average | 10% | 86% |

| Min | 4% | -38% |

| Max | 18% | 481% |

| Indices | ||

| Canadian | WoW | YoY |

| BTCC | 6% | 96% |

| BTCX | 5% | 104% |

| EBIT | 5% | 102% |

| FBTC | 7% | 26% |

| U.S. | WoW | YoY |

| BITO | 7% | 27% |

| BTF | 7% | 47% |

| IBLC | -2% | 35% |

Source: FRC/Yahoo Finance

The global MCAP of cryptos is US$2.21T, down 4% MoM, but up 83%YoY.

Total Crypto Market Cap Chart

Source: CoinGecko

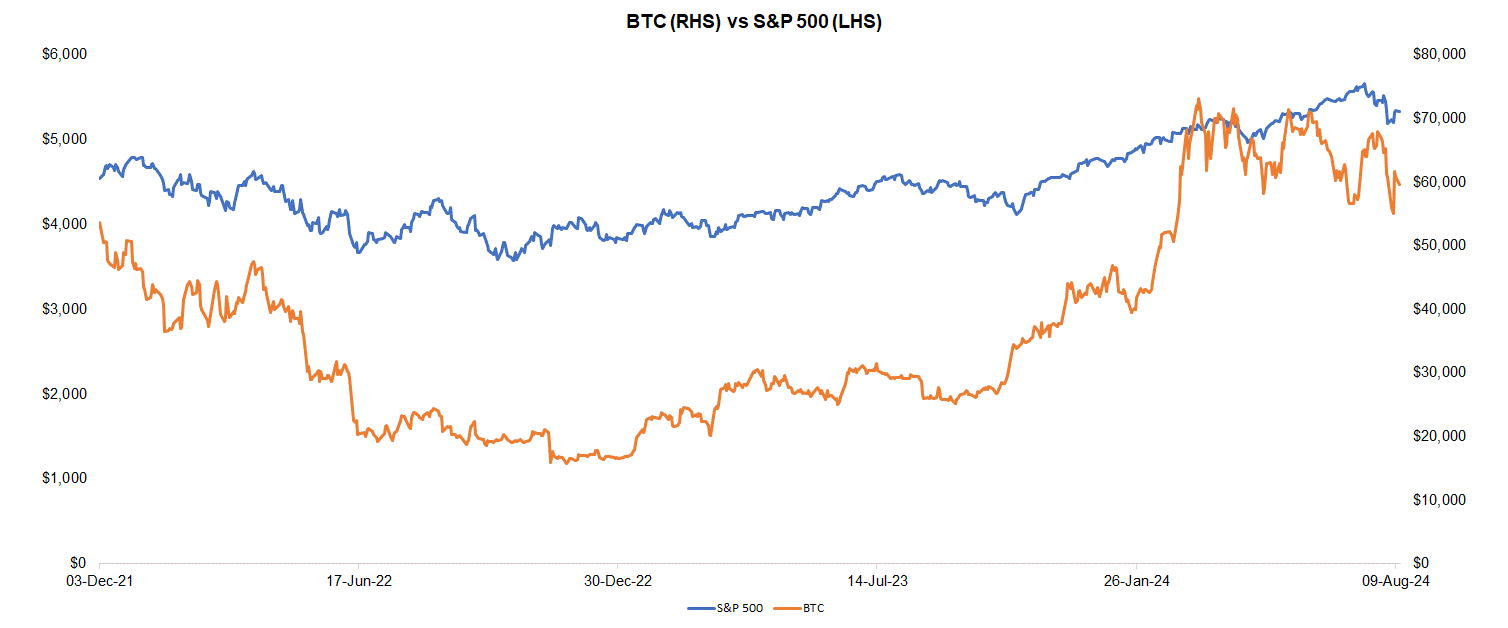

Last week, BTC was up 6.1%, while the S&P 500 was up 1.2%. The U.S. 10-year treasury yield was up slightly by 0.03 pp.

Source: FRC/ Yahoo Finance

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 611 exahashes per second (EH/s), down 3% WoW, but up 6% MoM. The decrease in hash rates is positive for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

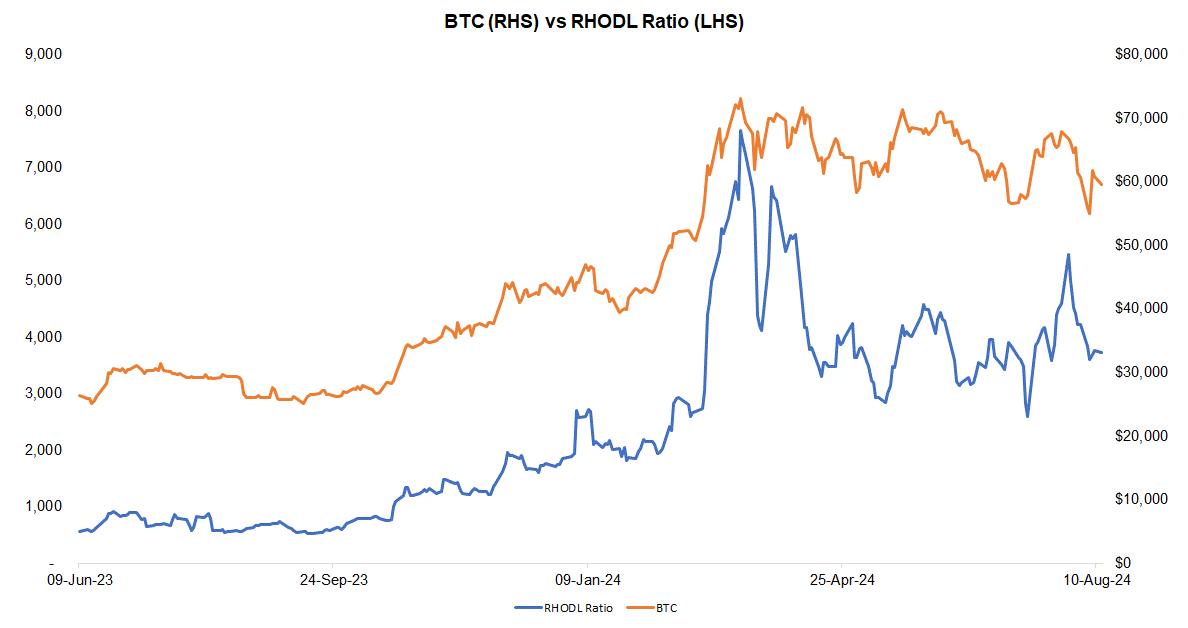

The Realized HODL ratio (RHODL), which gauges the activity of short-term holders relative to long-term holders, was down 3% WoW, but up 561% YoY. We interpret the decrease in RHODL as a sign of weakening demand, suggesting potential for a downtick in near-term prices. Historically, BTC prices have moved in tandem with this ratio. By tracking RHODL, we believe we can identify potential turning points in BTC prices.

Source: FRC/ Various

The table below highlights key statistically significant factors influencing BTC prices. With three negative signals and two positive, the near-term outlook for BTC prices appears weak.

* “↑” and “↓” indicate whether a parameter has increased or decreased

* “↑” and “↓” indicate whether a parameter has increased or decreased

* Red (green) denotes a negative (positive) signal for BTC prices; black implies neutral.

Source: FRC

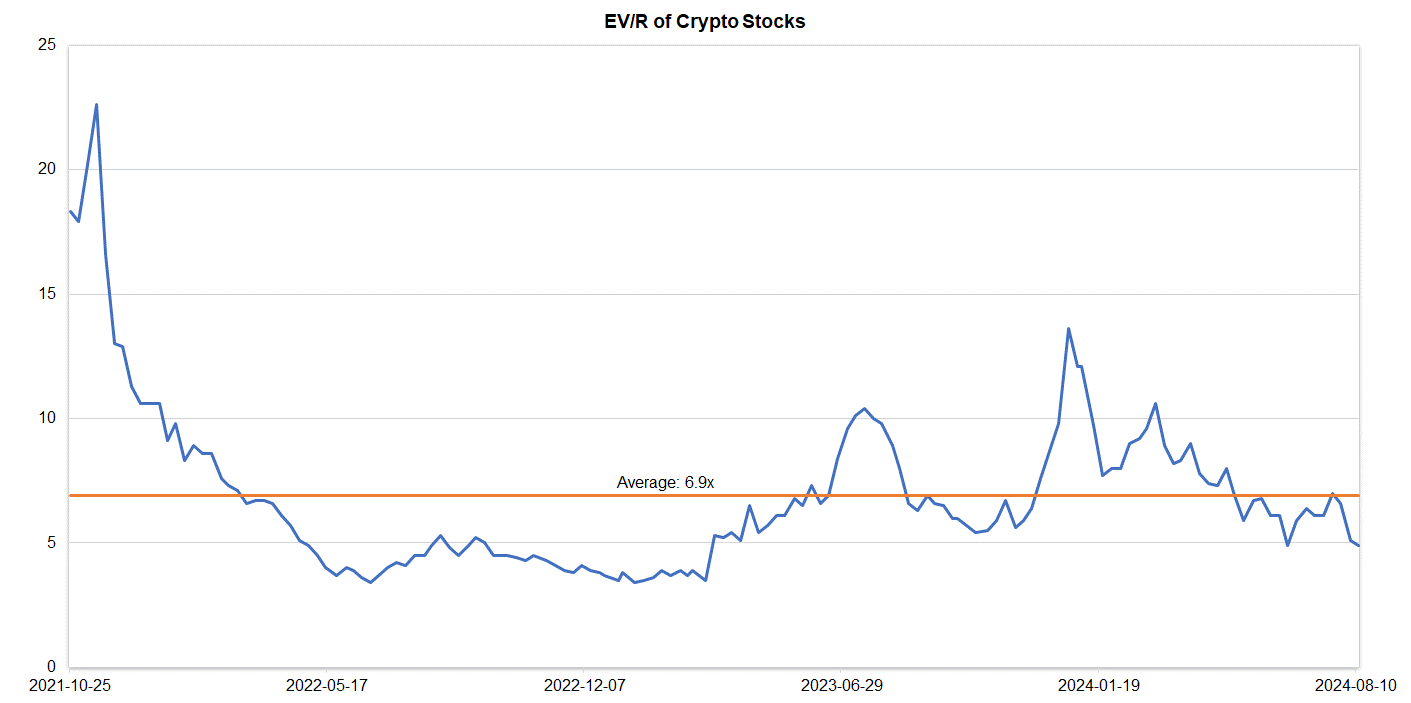

Companies operating in the crypto space are trading at an average EV/R of 4.9x (previously 5.1x).

Source: S&P Capital IQ/FRC

| August 12, 2024 | |

| Crypto Stocks | EV/Revenue |

| Argo Blockchain | 2.0 |

| BIGG Digital | 4.3 |

| Bitcoin Well | 0.8 |

| Canaan Inc. | 1.1 |

| CleanSpark Inc. | 7.6 |

| Coinbase Global | 10.2 |

| Galaxy Digital Holdings | N/A |

| HIVE Digital | 3.1 |

| Hut 8 Mining Corp. | 8.2 |

| Marathon Digital Holdings | 9.0 |

| Riot Platforms | 6.5 |

| SATO Technologies | 1.6 |

| Average | 4.9 |

| Median | 4.3 |

| Min | 0.8 |

| Max | 10.2 |

Source: S&P Capital IQ/FRC

Market Updates and Insights: Artificial Intelligence/AI

Major AI indices are up 2% WoW on average (down 8% in the previous week), and up 10% YoY.

| August 12, 2024 | ||

| AI Indices | WoW | YoY |

| First Trust Nasdaq AI and Robotics ETF | 3% | -8% |

| Global X Robotics & AI ETF | 4% | 10% |

| Global X AI & Technology ETF | -7% | 13% |

| iShares Robotics and AI Multisector ETF | 4% | 20% |

| Roundhill Generative AI & Technology ETF | 4% | 17% |

| Average | 2% | 10% |

| Min | -7% | -8% |

| Max | 4% | 20% |

Source: FRC/Various

The following table highlights some of the most popular large-cap AI stocks. Shares of these companies are down 2% WoW on average (down 9% in the previous week), but up 75% YoY. Their average P/E is 29.8x (previously 32.9x) vs the NASDAQ-100 Index’s average of 29.6x (previously 28.7).

| AI Stocks | WoW | YoY | P/E |

| Arista Networks | 5% | 89% | 43.6 |

| Dell Technologies | -4% | 68% | 18.9 |

| Microsoft Corporation | 1% | 25% | 12.4 |

| NVIDIA Corp | 5% | 149% | 61.2 |

| Micron Technology | -6% | 38% | n/a |

| Palantir Technologies | -9% | 87% | n/a |

| Qualcomm | -3% | 43% | 21.0 |

| Super Micro Computer (SMCI) | -12% | 101% | 25.3 |

| Taiwan Semiconductor Manufacturing | 8% | 74% | 26.2 |

| Average | -2% | 75% | 29.8 |

| Median | -3% | 74% | 25.3 |

| Min | -12% | 25% | 12.4 |

| Max | 8% | 149% | 61.2 |

Source: FRC/Various