Builders Capital Mortgage Corp.

Reports Record Revenue & EPS

Published: 4/24/2024

Author: FRC Analysts

Sector: Financial Services | Industry: Mortgage Finance

| Metrics | Value |

|---|---|

| Current Price | CAD $8.95 |

| Fair Value | CAD $10.18 |

| Risk | 3 |

| 52 Week Range | CAD $8.07-9.20 |

| Shares O/S (M) | 3.16 |

| Market Cap. (M) | CAD $28 |

| Current Yield (%) | 8.9 |

| P/E (forward) | 11.2 |

| P/B | 0.96 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

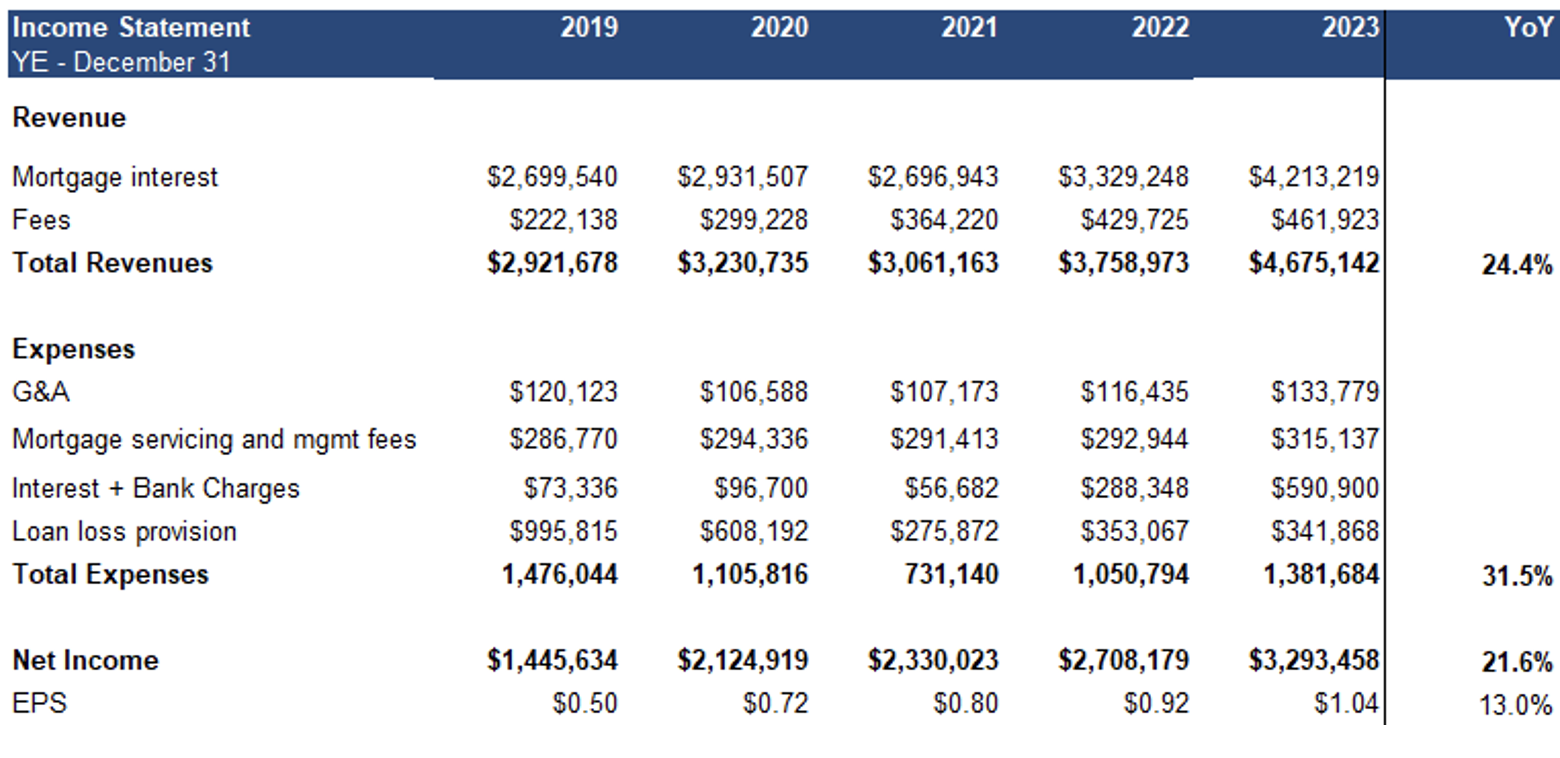

- In 2023, BCF reported record revenue (up 24% YoY), and EPS (up 22% YoY), beating our estimates by 1%, and 5%, respectively, amid higher lending rates.

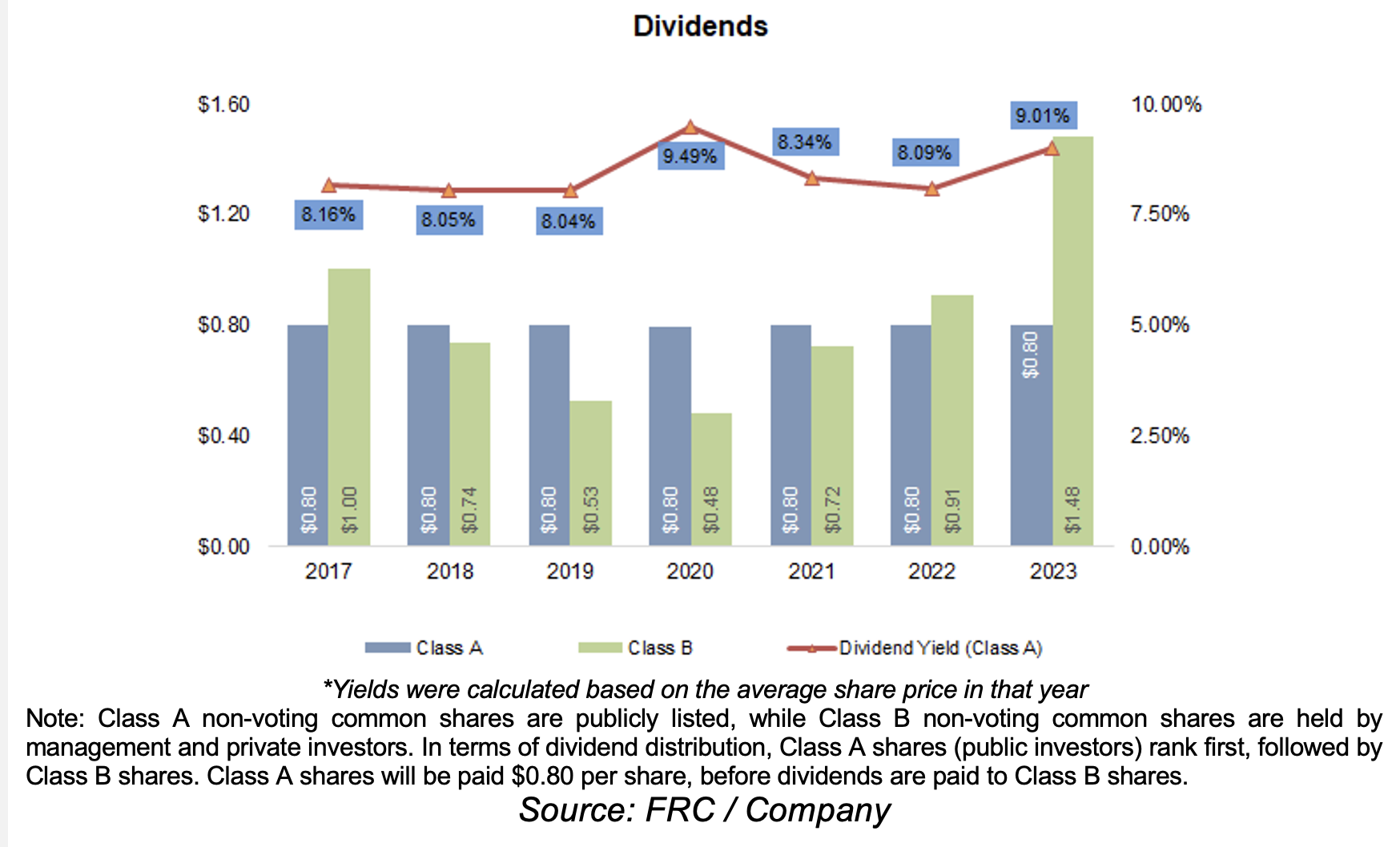

- Dividends remained unchanged at $0.80/share, implying a yield of 8.9%.

- Earlier this month, management announced a $50M bond financing. We believe this financing is indicative of the company’s robust pipeline of mortgages. Bondholders will participate on a pari passu (equal) basis with shareholders. As net income will be shared between bondholders and shareholders based on their respective contributions, this financing will not impact shareholder yields. However, we believe shareholders should benefit from the diversification resulting from an expanded mortgage portfolio, especially in default situations.

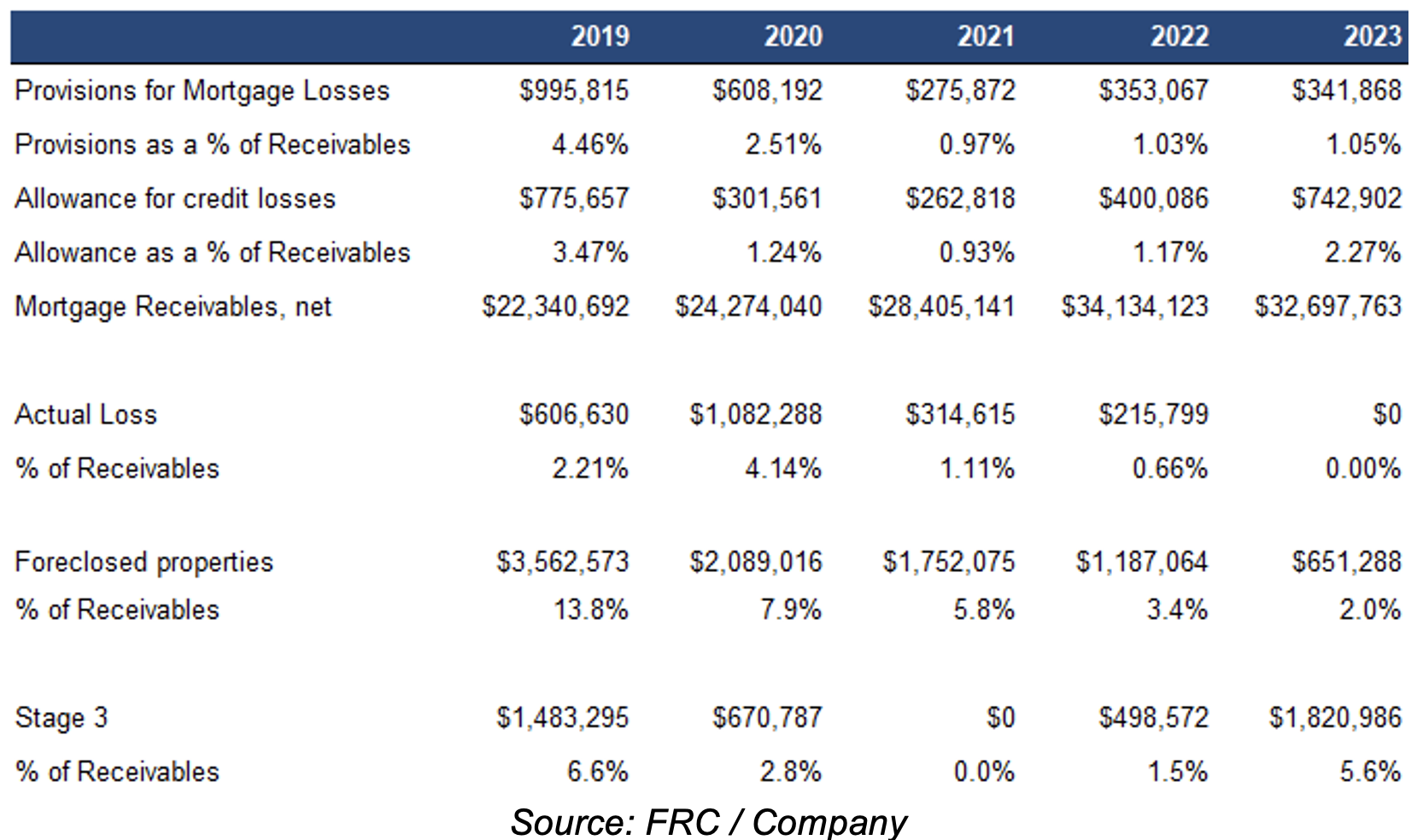

- Stage three mortgages (impaired) increased YoY, from 1.5% to 5.6% of mortgages. On a positive note, foreclosed properties declined 1.4 pp YoY to 2.0% of mortgages. Note that we had anticipated stage three mortgages increasing, as property developers and landlords have been facing challenges stemming from higher borrowing costs, lower pre-sales, and dampened real estate activity.

- We anticipate the Bank of Canada will cut rates by June, or Q3-2024 at the latest, driven by rising financial instability, and mortgage costs. We believe transaction volumes will pick up in H2-2024, driven by lower interest rates.

- Anticipating lower rates, we project higher demand for high-yielding stocks, such as BCF. We believe the current price level presents a narrow window to attain an 8.9% yield.

*See the button of this report for important disclousers, ratings and risks. All figures in C$ unless otherwise specified.

Portfolio Details

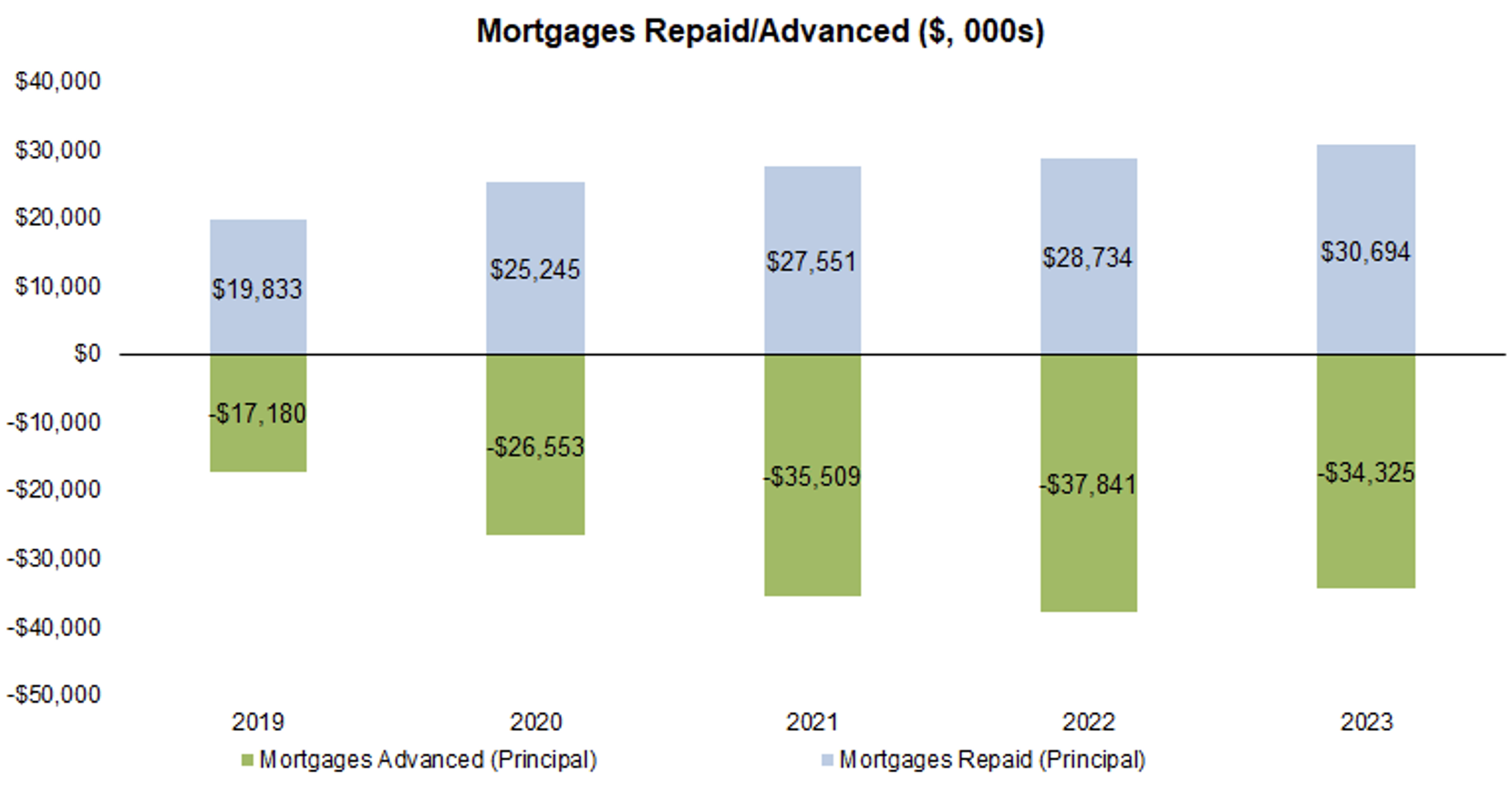

Mortgage advancements were down 9% YoY; repayments were up 7% YoY

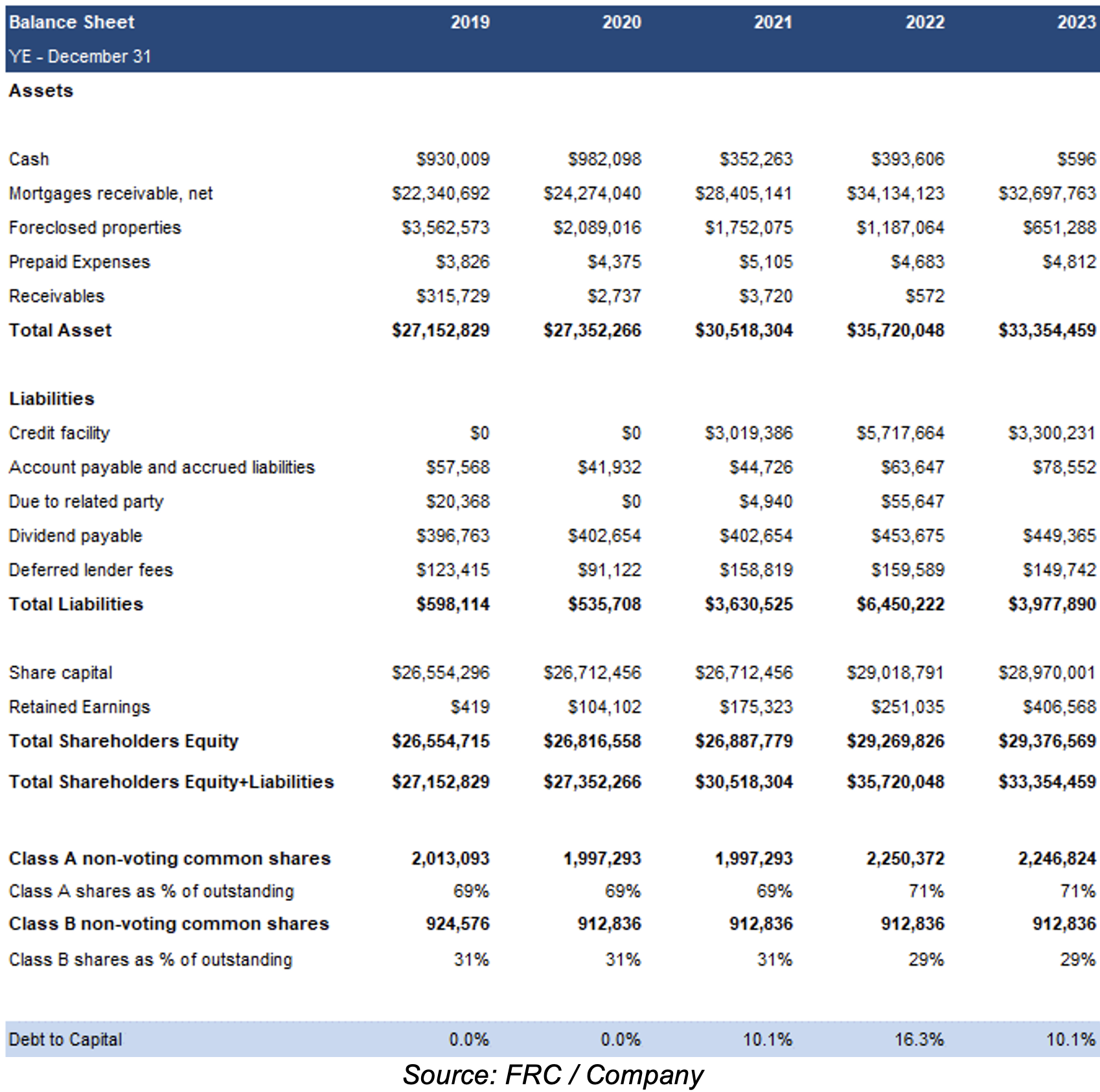

As a result, mortgage receivables declined 0.4% YoY to $33M

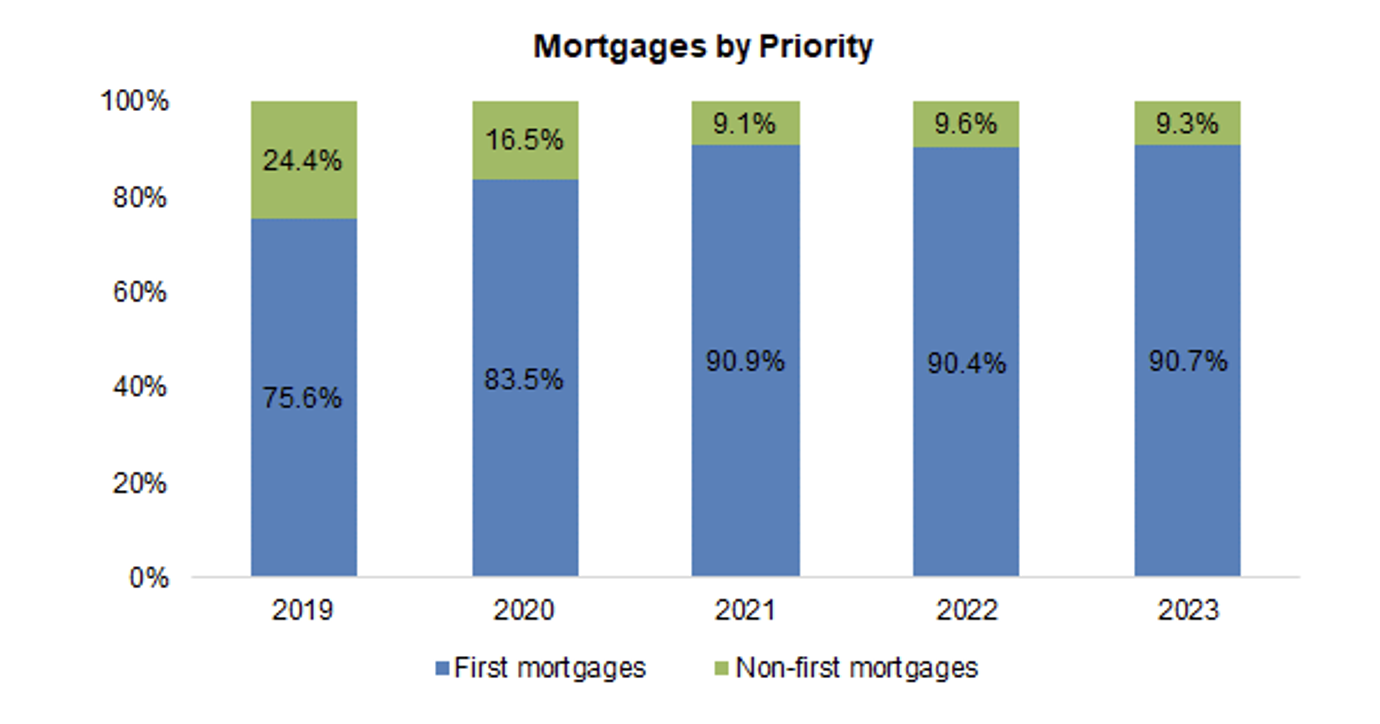

First mortgages remained relatively flat

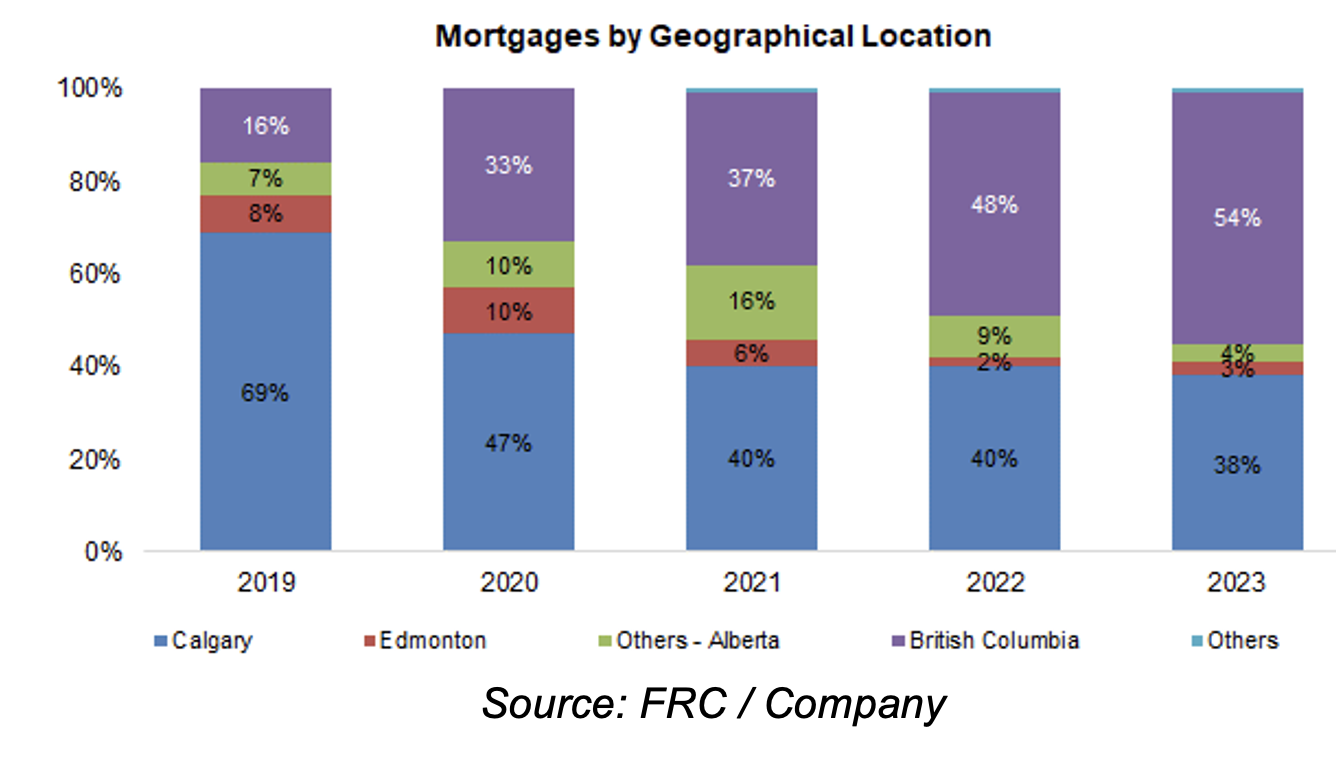

Increased exposure to B.C.

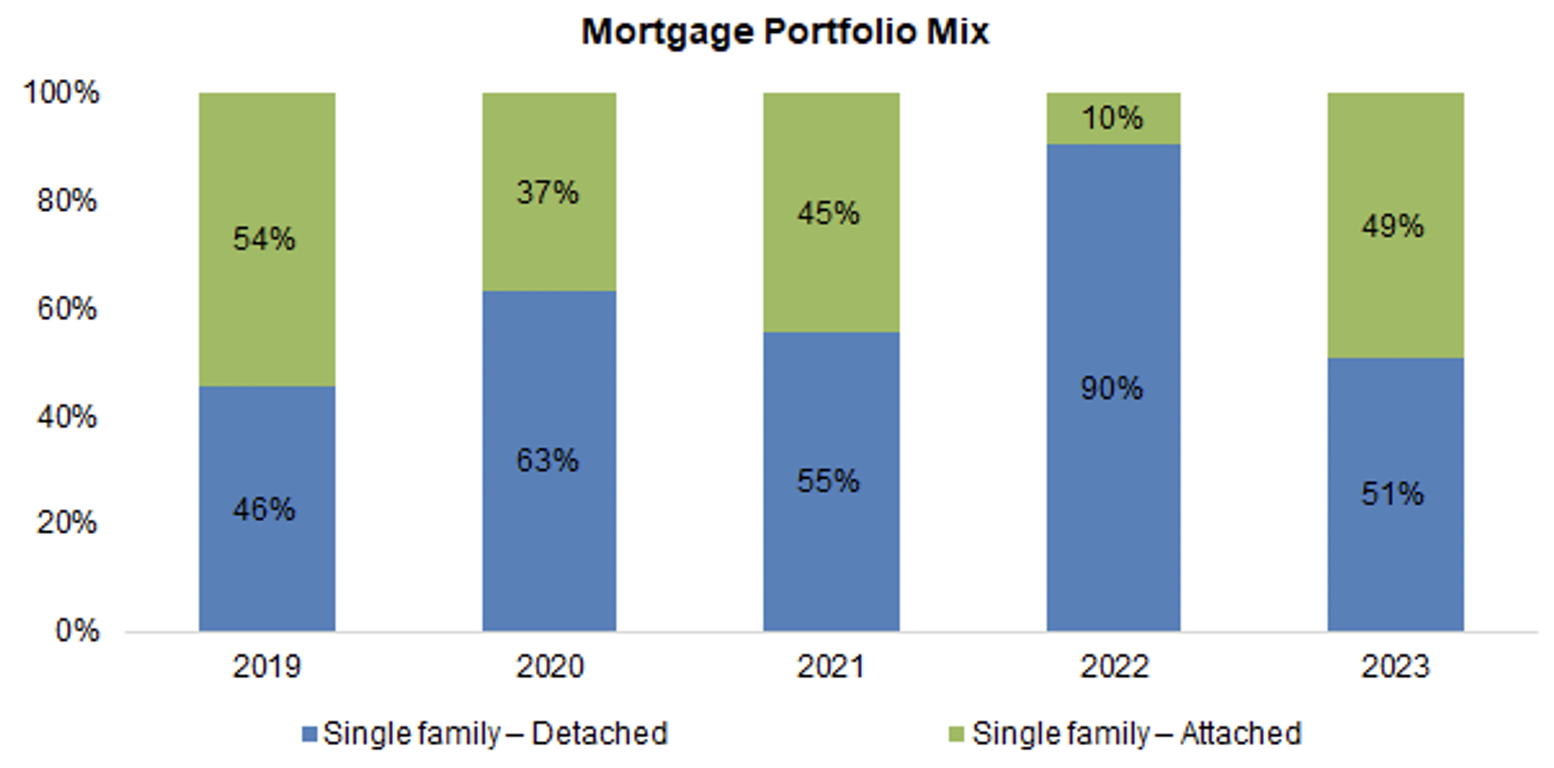

Remains focused on single-family units (construction)

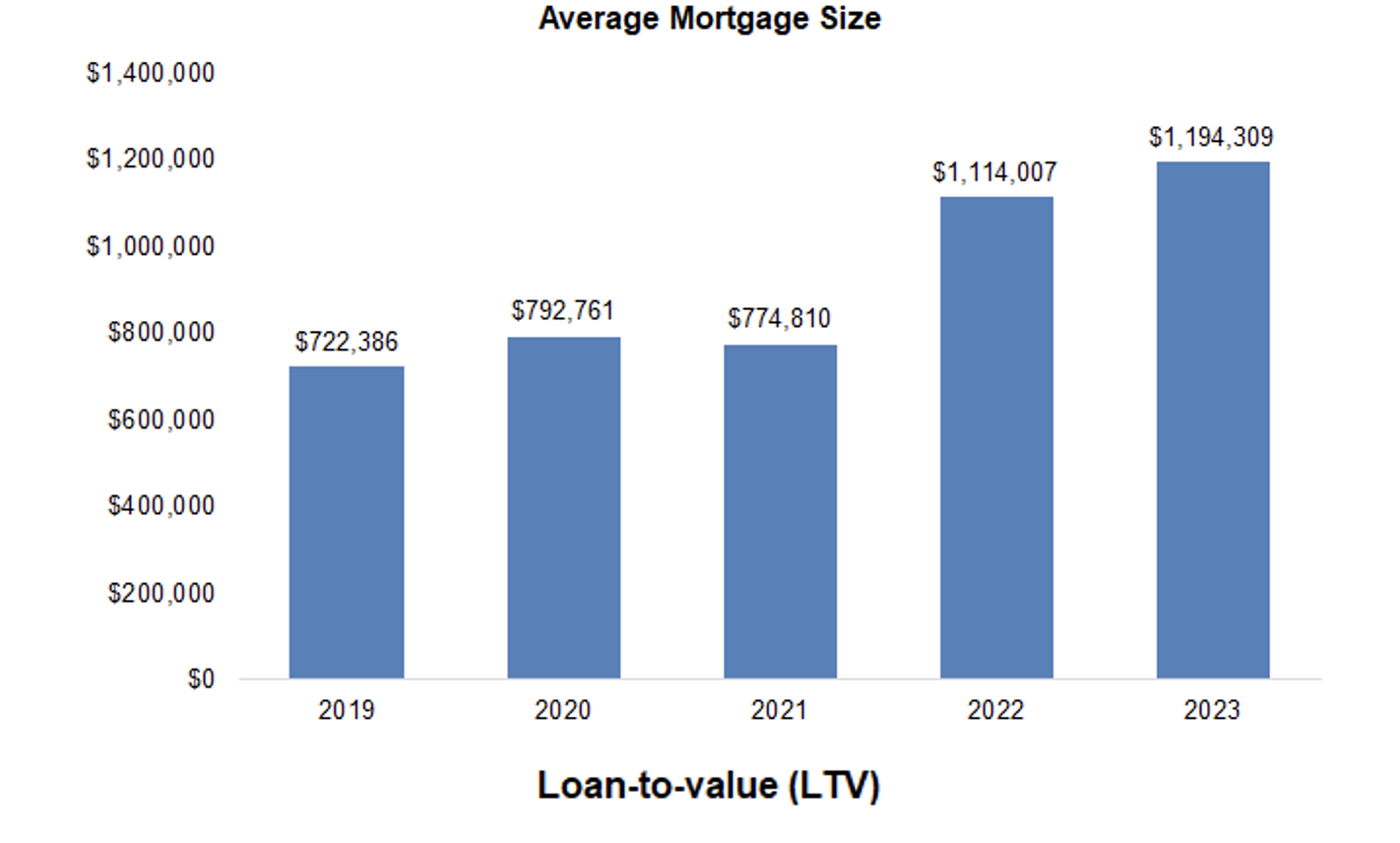

The average mortgage size was up 7% YoY

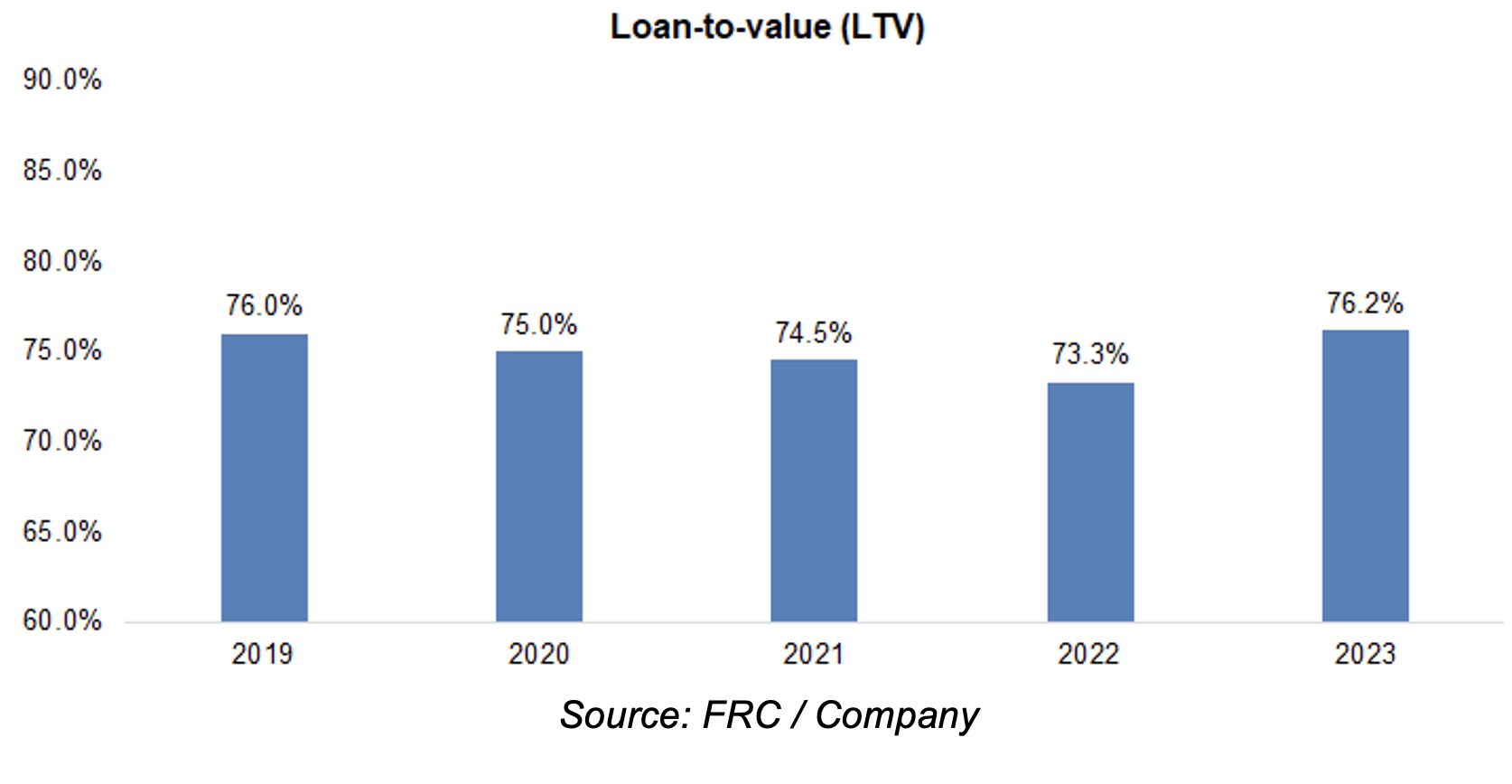

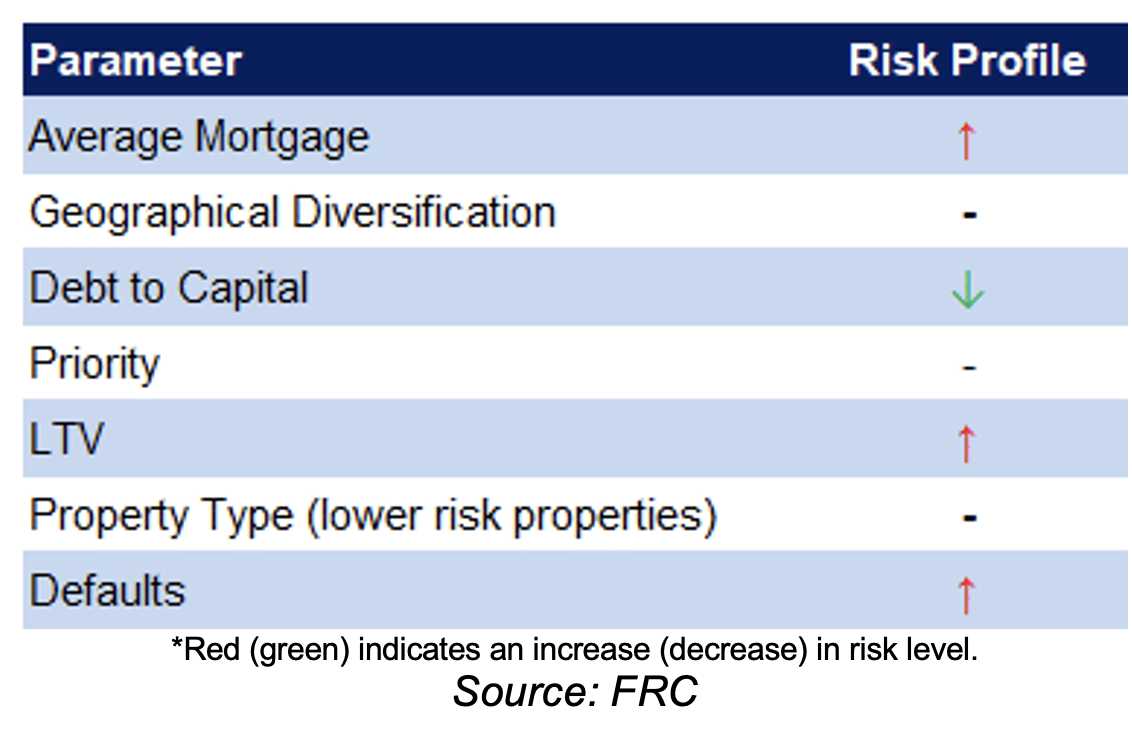

LTV was up 2.9 pp YoY, implying higher risk profile

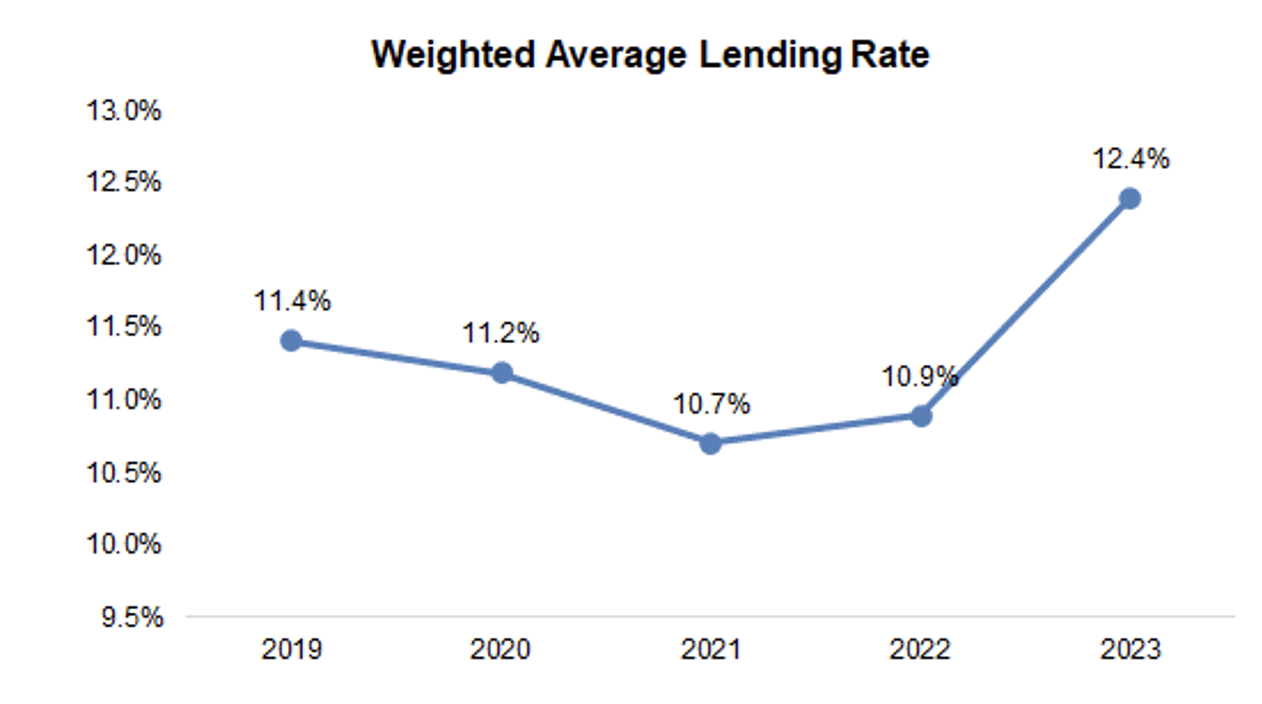

Raised lending rates

In 2023, loan loss provisions were 15% lower than our estimate

Stage three mortgages (impaired) increased YoY, from 1.5% to 5.6% of mortgages, which we note is slightly higher than the sector average of 5%

As a result, loan loss allowances were raised by 1.1 pp YoY to 2.3% of mortgages

In summary, we believe the portfolio’s risk profile has increased due to higher stage three mortgages

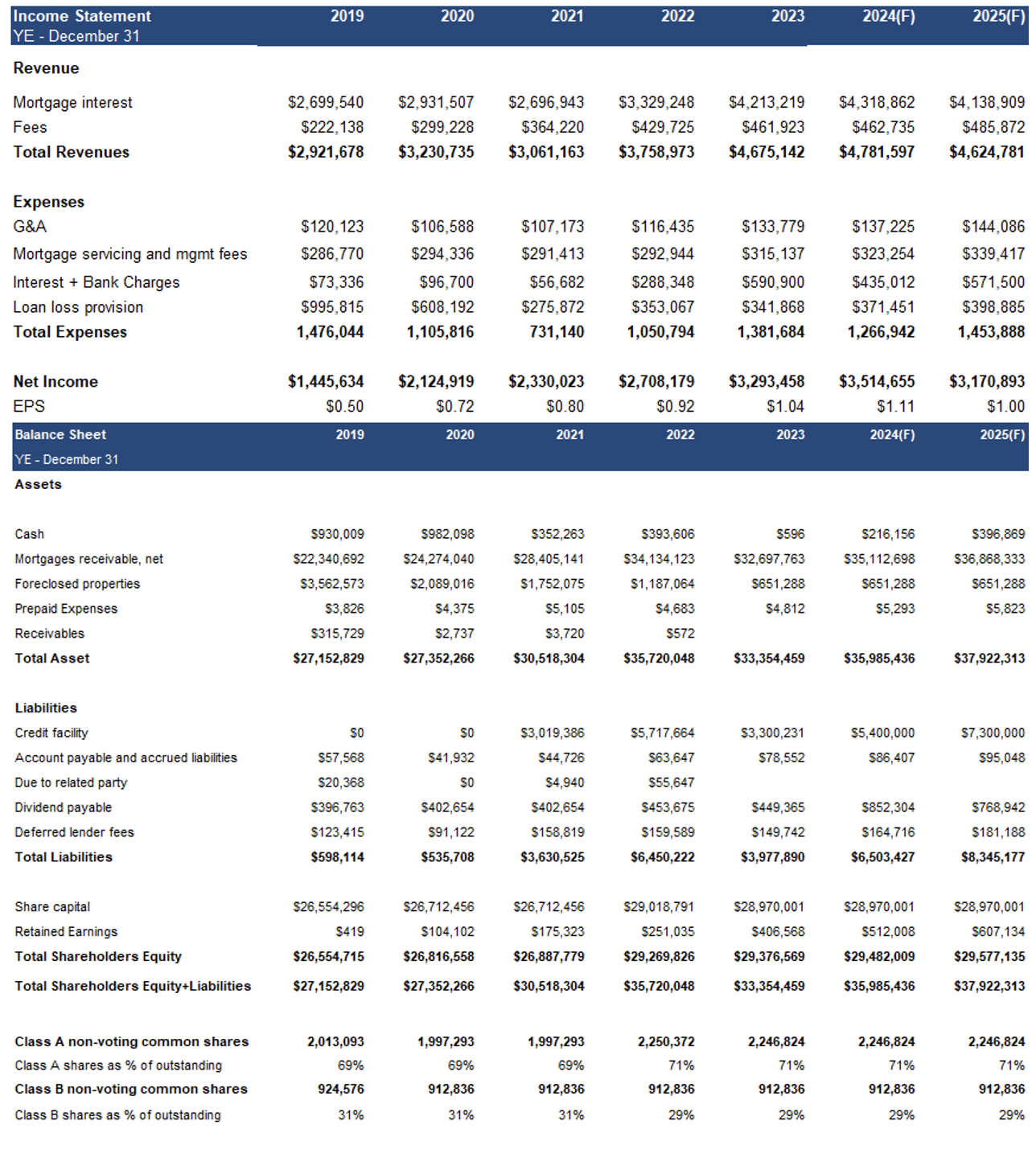

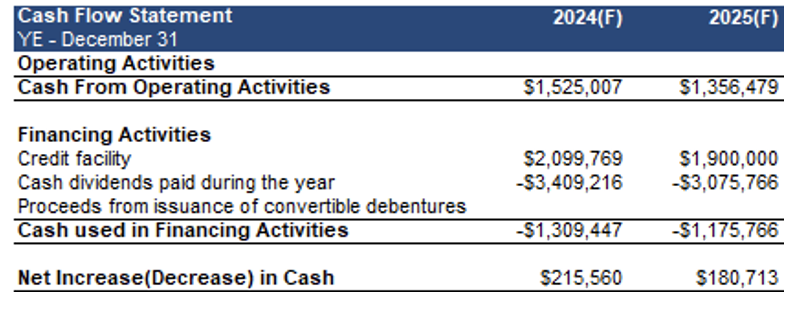

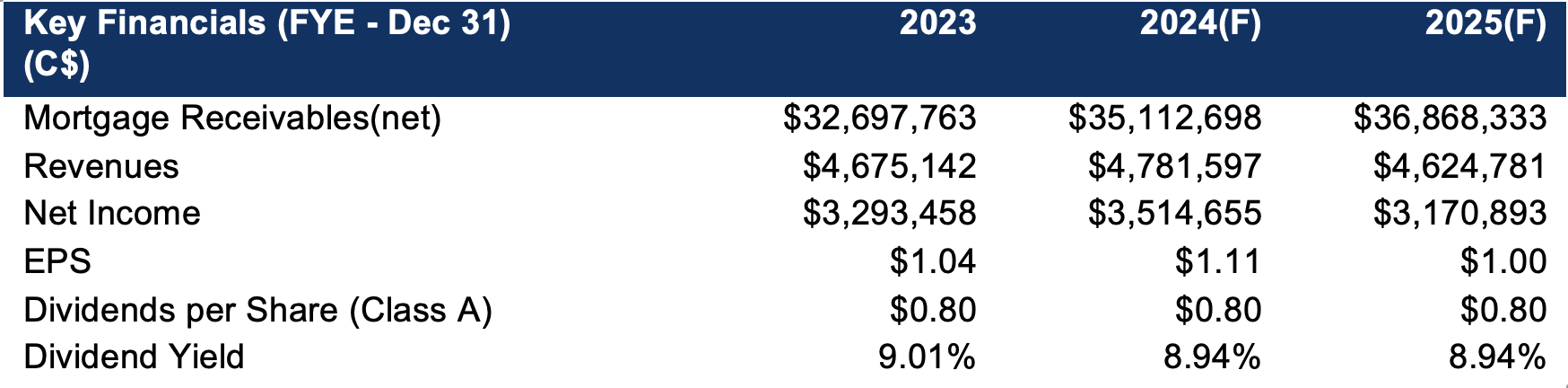

Financials

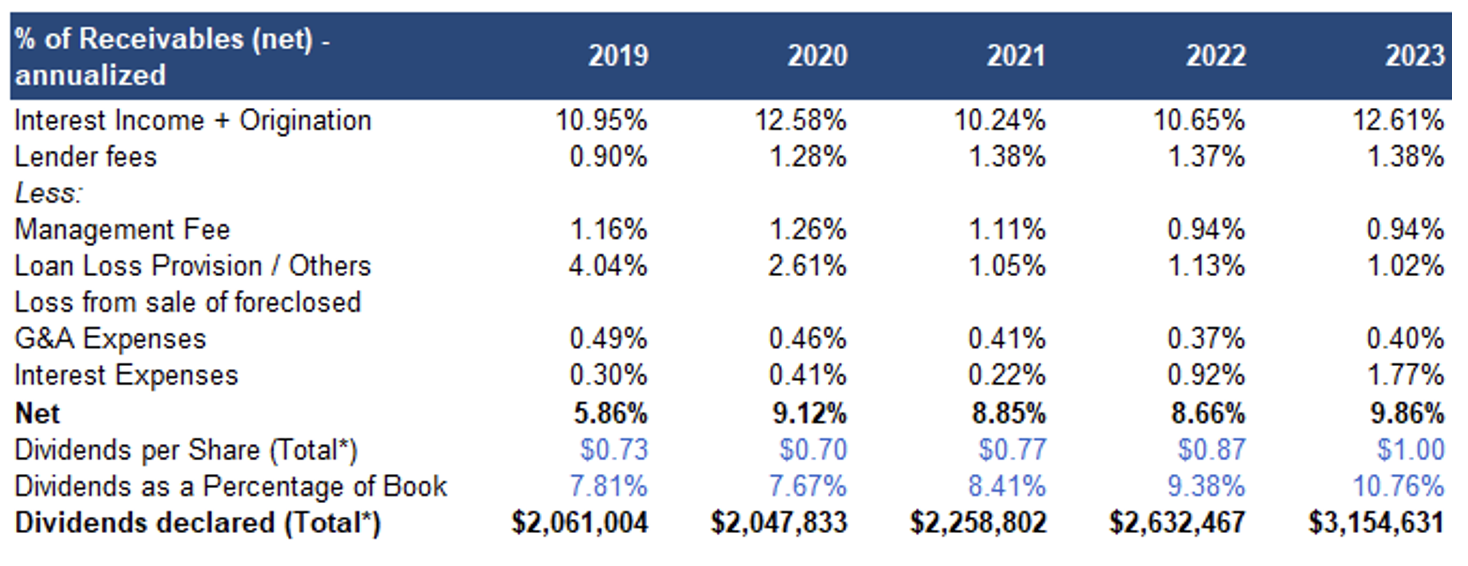

Revenue was up 24% YoY, beating our estimate by 1%, due to higher than expected lending rates

EPS was up 22% YoY, beating our estimate by 5%, due to lower than expected loan loss provisions, and interest expenses

Dividends for Class A investors remained unchanged at $0.80/share, implying a yield of 8.9%

Debt/capital declined due to softer originations, and higher repayments

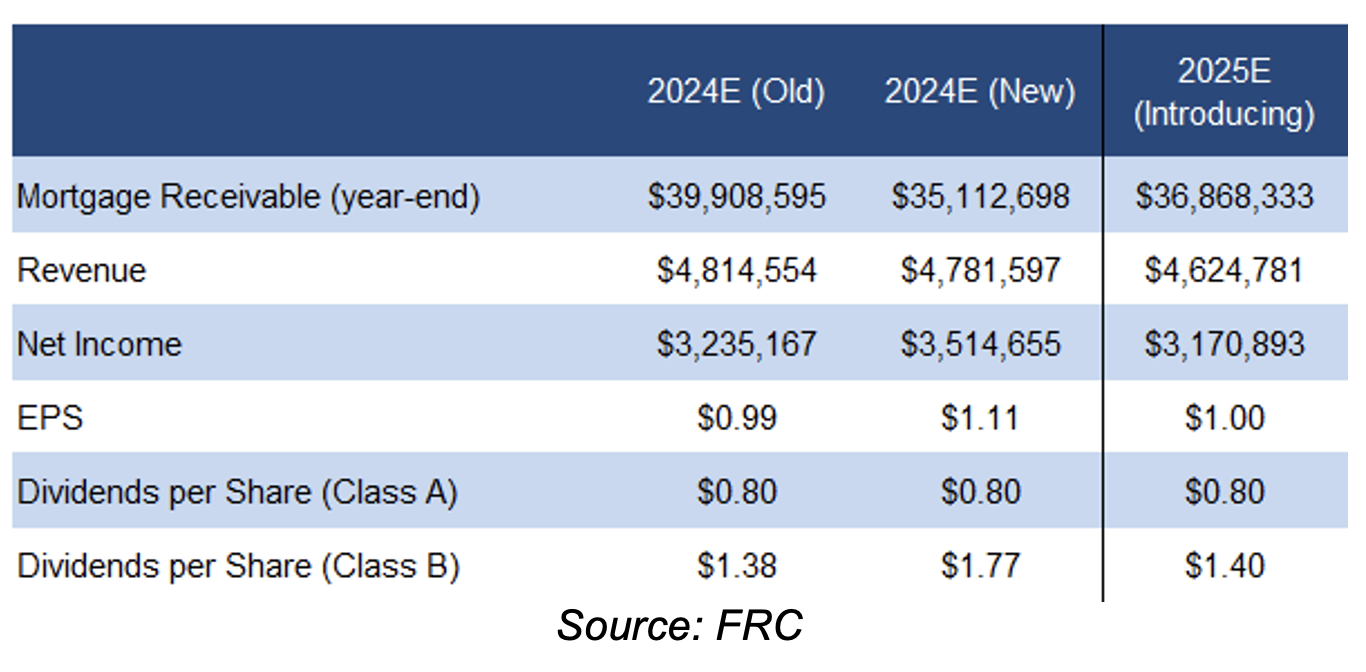

FRC’s Projections and Valuation

As interest rates have been higher than expected YTD, we are raising our 2024 EPS estimate

We will incorporate the ongoing bond financing into our models upon its completion

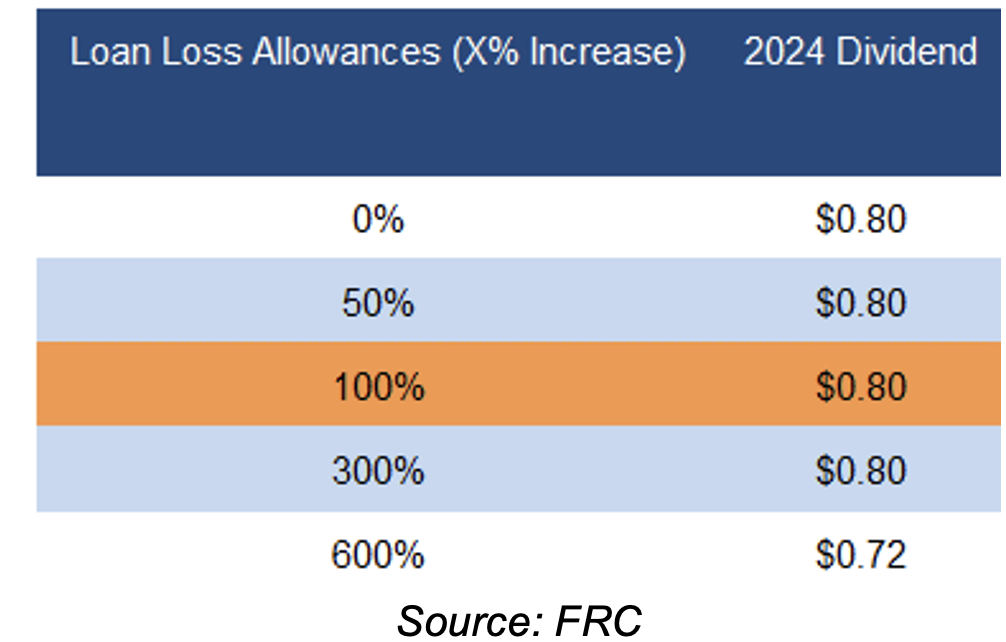

We note that the MIC should be able to distribute declared dividends ($0.80/share) even if loan loss allowances are raised by 500%

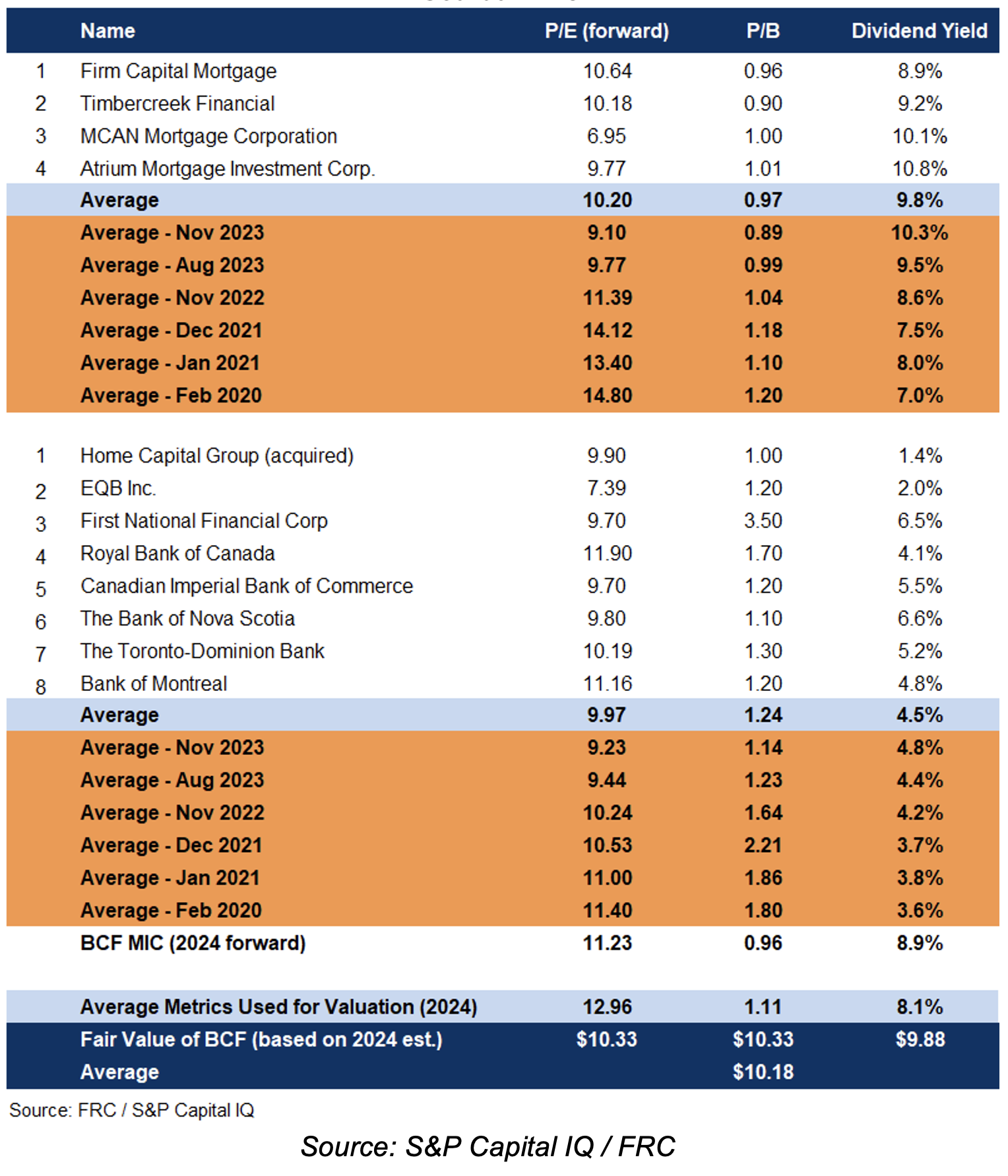

Sector multiples are up 9% since our previous report in November 2023, but 26% below pre-pandemic levels

Our fair value estimate increased from $10.01 to $10.18/share, driven by higher sector multiples, and our upgraded 2024 EPS estimate

We are reiterating our BUY rating, and adjusting our fair value estimate from $10.01 to $10.18/share, implying an expected return of 23% (including dividends) in the next 12 months. As we expect rates will start declining in H2-2024, we anticipate an increase in appetite for high-yielding stocks, such as BCF. Key risks include a softer mortgage origination market, and higher default rates.

Risks

The following, we believe, are the key risks of the company:

- Market concentration: BCF’s primary market is residential construction

- Allows borrowers to defer interest payments till maturity

- Credit and collateral

- Timely deployment of capital is critical

- Distributions are not guaranteed

- Investments in mortgages are typically affected by macroeconomic conditions, and local real estate markets

- The company uses leverage, increasing the fund’s exposure to negative events

- Default rates can rise during recession.

Maintaining our risk rating of 3

APPENDIX