Zepp’s Surge Continues, Gold Miner Reports First Revenue, AdTech Eyes Australia Ban

Published: 8/18/2025

Author: FRC Analysts

*Disseminated on behalf of Zepp Health Corporation, Panoro Minerals, Monument Mining, Olympia Financial Group, Millennial Potash, Kidoz Inc., Denarius Metals, East Africa Metals, Pulsar Helium Inc., Trident Resources, and Grid Metals Corp. See the bottom of this report for other important disclosures.

We review the performance of our Top Picks. Zepp Health Corporation (NYSE: ZEPP) once again emerged as the clear standout, up 34% WoW, and a stunning 1,300% YoY. Our Top Picks have gained an average of 86% over the past year, outperforming the benchmark’s 47%. Check out the complete list of our Top Picks by sector on our website. We also provide key updates on companies under coverage, including an AdTech company, and juniors focused on gold, helium, copper, and nickel.

Updates on Resource Companies Under Coverage

Denarius Metals Corp. (DMET.NE, DNRSF)

PR Title: Reports first production and revenue from the Zancudo gold project, Colombia

Analyst Opinion: Positive – In Q2-2025, DMET reported its first revenue of US$49,000 from an initial June shipment, which included 13 oz of gold, and 138 oz of silver. The company realized an average gold price of US$3,303/oz, with cash costs of US$2,260/oz, generating a margin of US$1,043/oz. Q3 revenue and production will be significantly higher. In July, DMET shipped materials containing 74 oz of gold, and 1,913 oz of silver. Both the frequency and volume of shipments are anticipated to increase in the coming months as mining operations continue to ramp up. During the early production phase, running until Q1-2026 when a new 1,000 tpd plant is scheduled to begin operations, materials will be crushed onsite and shipped to port for sale. As production ramps up, we anticipate cash costs will decline toward the 2023 PEA estimate of ~US$1,050/oz. DMET has also begun preparations to restart operations at its Aguablanca project in Spain, the country’s only nickel mine, and an EU-recognized strategic project. Additionally, a Preliminary Economic Assessment (PEA) on its Lomero project in Spain is expected in the near-term.

East Africa Metals Inc. (EAM.V, EFRMF)

PR Title: Attracts a new partner for the development of the Magambazi/Handeni gold project in Tanzania

Analyst Opinion: Positive – EAM’s new investor, Anchises Capital Precious Metal Fund, a San Francisco–based Chinese family trust with mining investments in Africa, has agreed to advance development of the Magambazi/Handeni project. Earlier this year, Anchises invested $5.5M in EAM, acquiring a 19.9% equity stake. The project’s mining license was suspended in 2024 due to non-compliance by the operator, PMM Mining Company, which holds 100% ownership. EAM retains a 30% gold streaming interest. As noted in our June report, the Tanzanian government and EAM had been seeking a replacement partner for PMM. Anchises will pay EAM US$1M upon signing a definitive agreement and assume PMM’s interest, with the goal of bringing the project into production within four years. This is a positive development for EAM. Due to uncertainties and PMM’s performance issues, we had previously assigned no value to EAM’s interest in Magambazi/Handeni. Anchises’ involvement brings the project back on track, enhancing EAM’s potential to monetize this asset.

Pulsar Helium Inc. (PLSR.V, PSRHF)

PR Title: Debt financing and positive flow test results

Analyst Opinion: Positive – PLSR has received a non-binding offer from Michigan-based University Bank to provide debt financing of up to US$12.5M for the construction of a helium processing plant at its flagship Topaz project in Minnesota. University Bank already owns a 5% equity stake in PLSR, and previously extended a US$4M line of credit to the company. PLSR has also achieved a major milestone. The company recently deepened its first well drilled in 2024 from 671 m to 1,550 m. Tests returned triple the flow rates reported in 2024, highlighting strong reservoir performance. Importantly, the well produced clean, dry gas with no formation water, underscoring the reservoir’s quality. Additional compression-assisted testing and gas analyses are underway to determine the well’s full capacity and helium concentrations. The Topaz Project hosts a high-grade helium resource. PLSR is working toward an updated resource estimate, and a Preliminary Economic Assessment. With a significant deficit expected later this decade, we anticipate growing investor interest in the helium sector.

Trident Resources Corp. (ROCK.V)

PR Title: Expands land package in the La Ronge gold belt; commencing a 5,000 m drill program (Saskatchewan)

Analyst Opinion: Positive – ROCK has expanded its land package by 21% to 91,425 hectares through the acquisition of four blocks bordering its Contact Lake and Greywacke projects, adding new exploration targets with multiple gold showings of up to 45.5 g/t Au. The company’s portfolio includes three projects with historical resources totaling 1.6 Moz AuEq. Management is currently focused on confirming and expanding Contact Lake’s historical resource of 1.05 Moz Au, and is set to commence a 5,000-m drill program this week.

Grid Metals Corp. (GRDM.V, MSMGF)

PR Title: New nickel sulphide surface discovery at the Makwa Ni-Cu-PGE project in Manitoba (QP: Dr. Dave Peck, P.Geo., VP Exploration of Grid Metals)

Analyst Opinion: Positive – Recent exploration has identified nickel-rich mineralization along a 600 m geophysical anomaly, with initial sampling returning grades of up to 1.13% nickel. An exploration program under the joint venture agreement funded by Teck Resources (TSX: TECK), includes prospecting, follow-up geophysical surveys and drilling. GRDM’s portfolio includes a mix of lithium and nickel-copper-PGM projects, two of which have resource estimates: the advanced-stage MM project, which hosts the nickel-dominant Makwa deposit (220 Mlbs NiEq) and the copper-dominant Mayville deposit (660 Mlbs CuEq), and the Donner lithium project (234 Kt LCE).

Updates on Financials, Technology, Energy, and Special Situations Companies Under Coverage

PR Title: Positioned to benefit from Australia’s under-16 social media ban

FRC Opinion: Positive - Australia has expanded its under-16 social media ban to include platforms such as YouTube (NASDAQ: GOOGL), TikTok, Instagram, Facebook (NASDAQ: META), Snapchat, and X, with penalties of up to A$50M for non-compliance. This shift drives demand for safe, age-verified digital advertising solutions. Kidoz, with its COPPA (US) and GDPR-K (EU) compliant mobile gaming network, offers advertisers a privacy-first platform to engage children safely without relying on personal data. We anticipate Q2 results later this month. In Q1, revenue rose 53% YoY to $2.7M, a first quarter record, driven by strong advertiser demand; comparatively, YouTube and Meta grew 10% and 14% YoY, respectively.

FRC Top Picks

The table below highlights last month’s top five performers among our Top Picks. Zepp Health Corporation once again emerged as the clear standout, up 34% WoW, and a stunning 1,300% YoY. We initiated coverage in November 2023, when shares traded at US$4.64; today, the stock hit US$42.87 today. Zepp is the world’s seventh-largest smartwatch maker by unit sales. We will be publishing a detailed update report in the coming days—watch for it to learn the key drivers behind this surge, our take on the latest Q2 results, and our outlook on the stock.

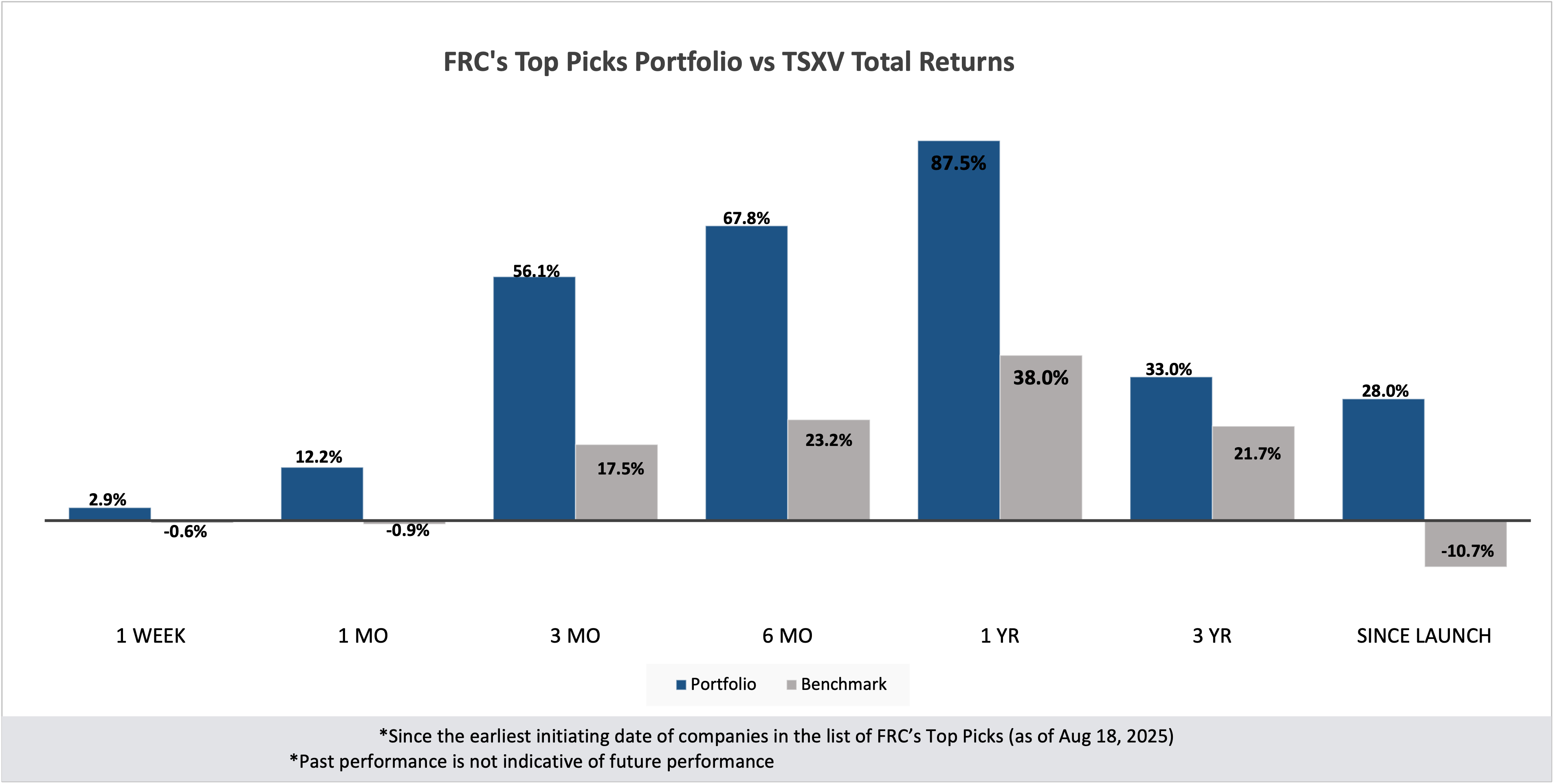

Our top picks have outperformed the benchmark (TSXV) in all seven time periods listed below.

Performance by Sector

Our complete list of top picks (updated weekly) can be viewed here. https://www.researchfrc.com/top-picks

*Disclaimers - Annual fees ranging from $15,000 to $35,000 have been paid to FRC by Zepp Health Corporation, Panoro Minerals, Monument Mining, Olympia Financial Group, Millennial Potash, Kidoz Inc., Denarius Metals, East Africa Metals, Pulsar Helium Inc., Trident Resources, and Grid Metals Corp for research coverage and distribution of reports. FRC or companies with related management, and Analysts, do not hold shares/securities in the companies mentioned in this report.