Lithium Chile Inc.

Brighter M&A Prospects: Resource Expansion and Anticipated PFS

Published: 4/18/2024

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | CAD $0.85 |

| Fair Value | CAD $1.57 |

| Risk | 5 |

| 52 Week Range | CAD $0.47-.095 |

| Shares O/S (M) | 206 |

| Market Cap. (M) | CAD $175 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 3.1 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

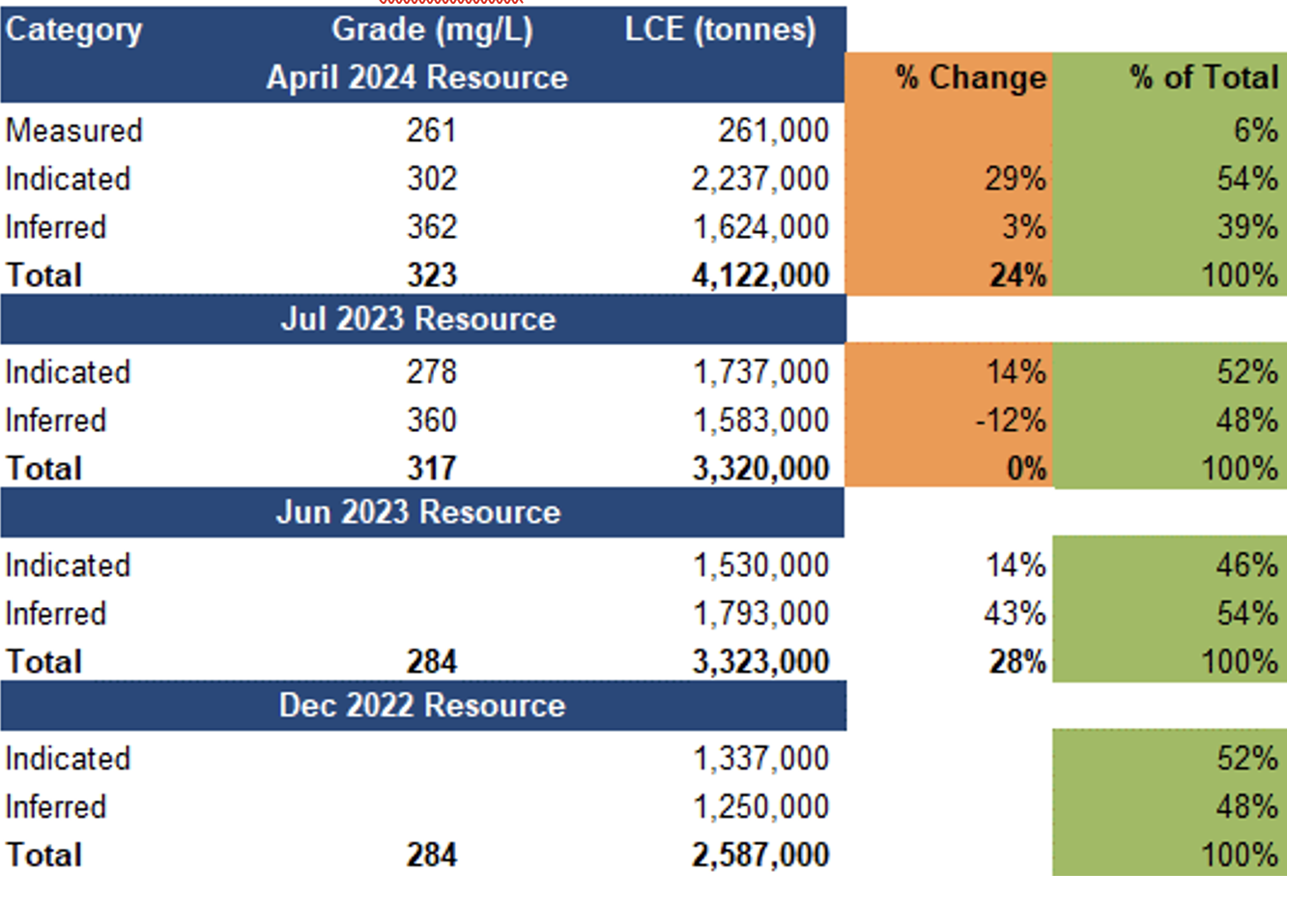

- LITH has completed an updated resource estimate for its flagship Arizaro de Salar project in Argentina. Resources increased by 24% to 4.12 Mt Lithium Carbonate Equivalent (LCE). The average grade increased to 323 mg/L (previously 317 mg/L). M&I resources account for 61% of total resources (previously 52%), implying increased confidence.

- Management is targeting a Pre-Feasibility Study (PFS) by June 2024. A Preliminary Economic Assessment (PEA) had returned an AT-NPV8% of US$1.1B using US$21.4/t LCE, and US$415M using US$15k/t LCE vs the current spot price of US$15.4k/t.

- LITH is spinning out all of its other projects into two new publicly listed entities. Shareholders will get free shares of the new entities. We support this plan as it allows LITH to monetize these assets, while streamlining its corporate structure for potential M&A related to the Arizaro project.

- LITH has attracted ERAMET (LSE: ERA/MCAP: $3.1B), a European miner operating in 15+ countries, as an option partner to advance four lithium properties in Chile.

- Lithium prices are down 37% YoY, but up 24% YTD to US$15.4k/t vs the five-year average of US$21k/t. We believe prices will be under pressure amid slower global GDP, and EV sales growth, and increasing supply. That said, we maintain a positive outlook on juniors focused on EV metals. Battery/EV manufacturers/miners are actively seeking stable/long-term supply sources.

- The company is well funded, with $22M in working capital. LITH is up 20% YoY despite lithium prices being down 37% YoY, as we believe the Arizaro project is turning into an attractive M&A target for larger players.

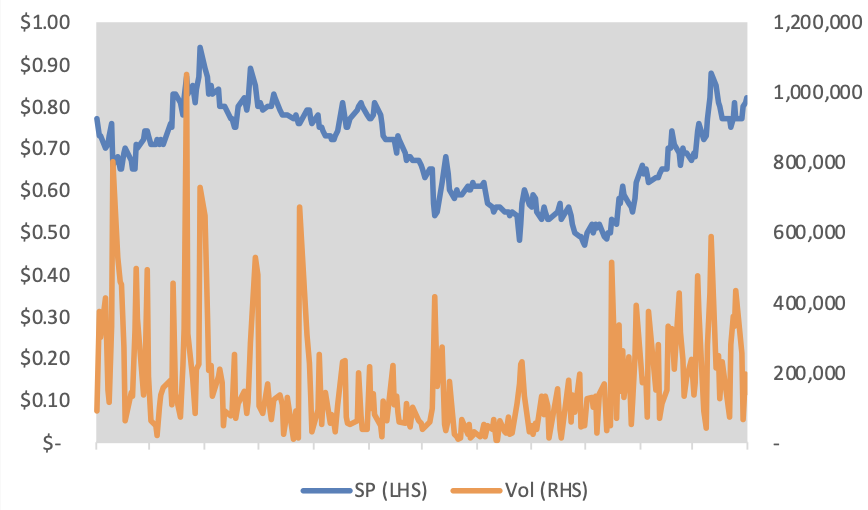

Price Performance (1-year)

*See the bottom of the report for disclosures, ratings, and risk definitions. All figures are in C$ unless otherwise specified.

Resource Update

The updated resource estimate incorporated the results of two additional wells since the previous estimate in July 2023.

Arizaro Resource Estimate

Located in Salta province, northwest Argentina

Resources increased 24% to 4.12 Mt LCE

The average grade increased 2% to 323 mg/L, implying potential for lower OPEX

M&I resources account for 61% of total resources (previously 52%), implying increased confidence

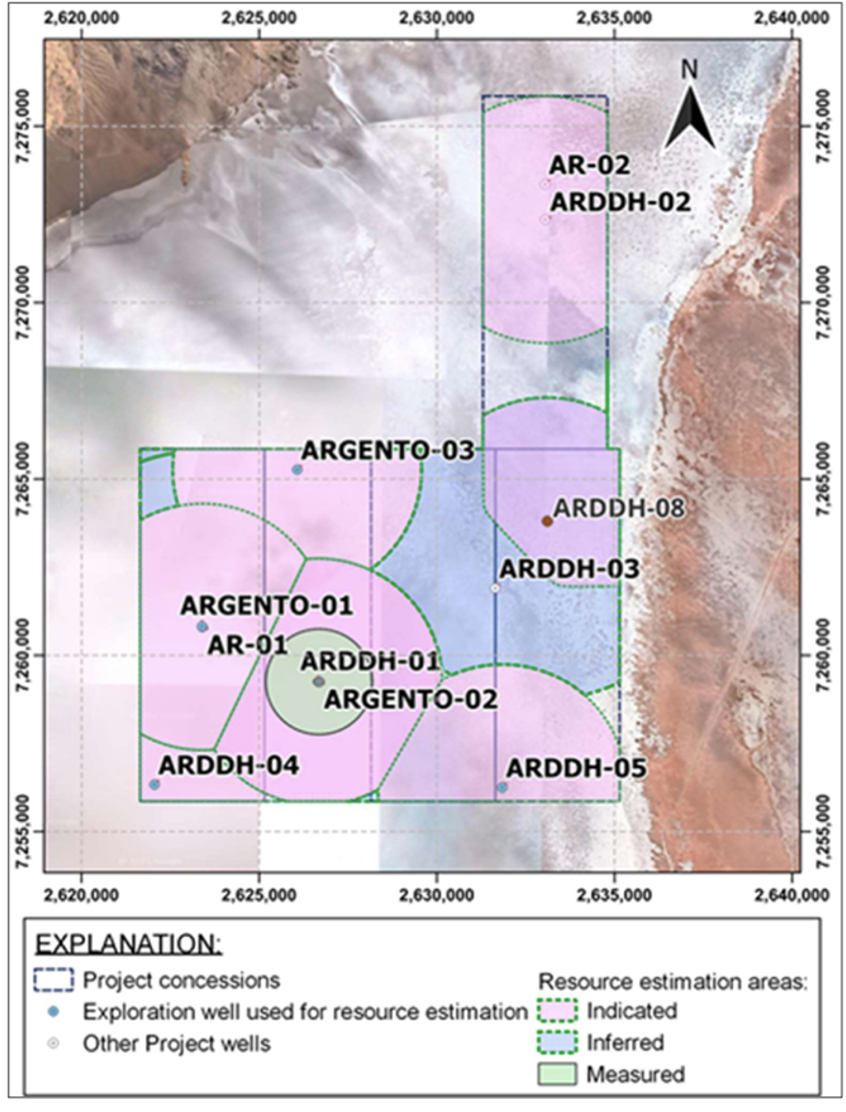

Resource Area

Another resource update is expected upon the availability of results from the area surrounding well ARDDH-08

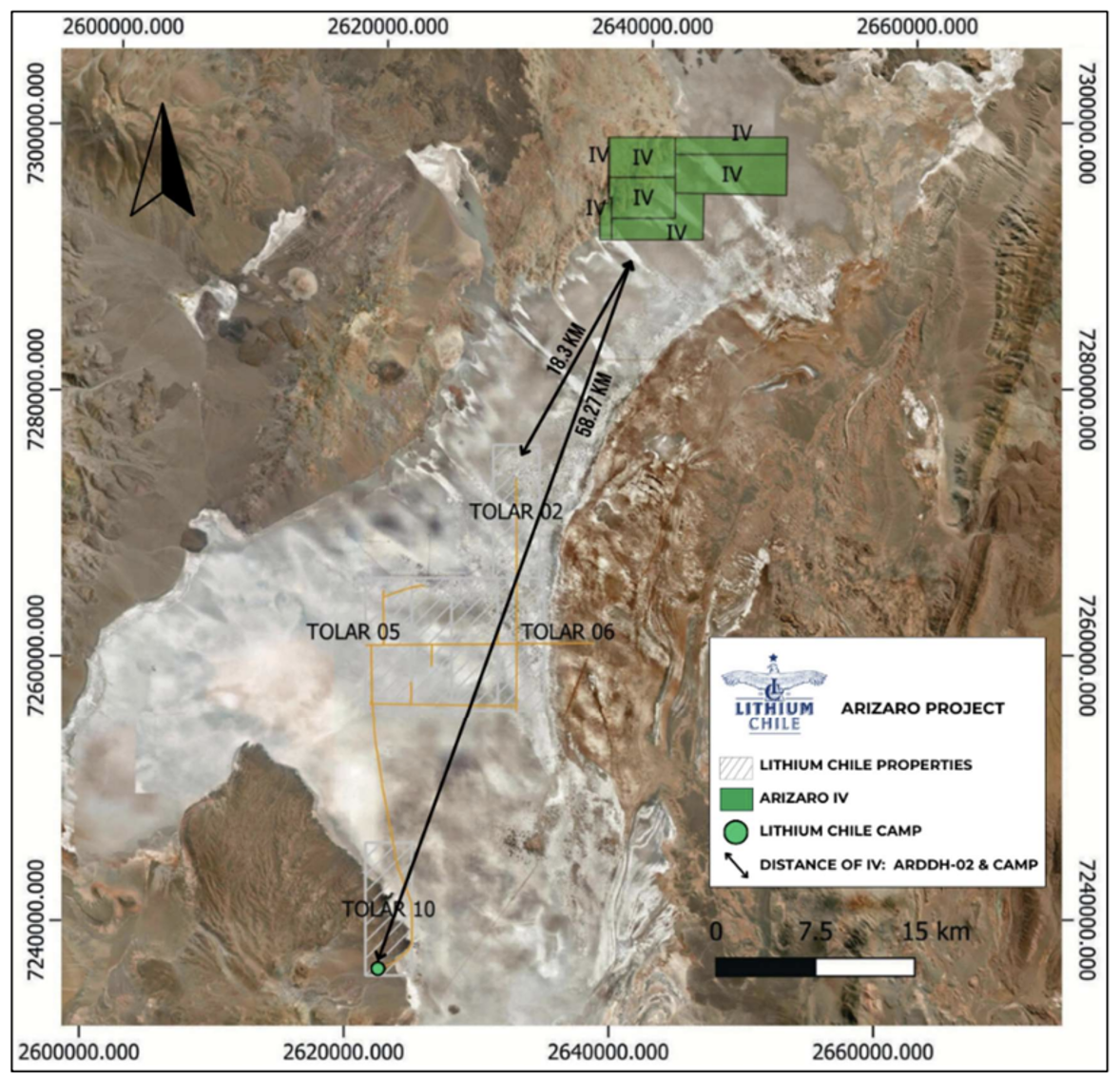

In January 2024, LITH secured access to Block IV (8,445 hectares), a strategically located concession 18 km from the Arizaro project. Based on the results of prior sampling/trenching/geophysical surveys, management believes this concession offers resource expansion potential.

Block IV

LITH has made an initial payment of US$5.74M, with an additional US$11M required to secure a 100% interest

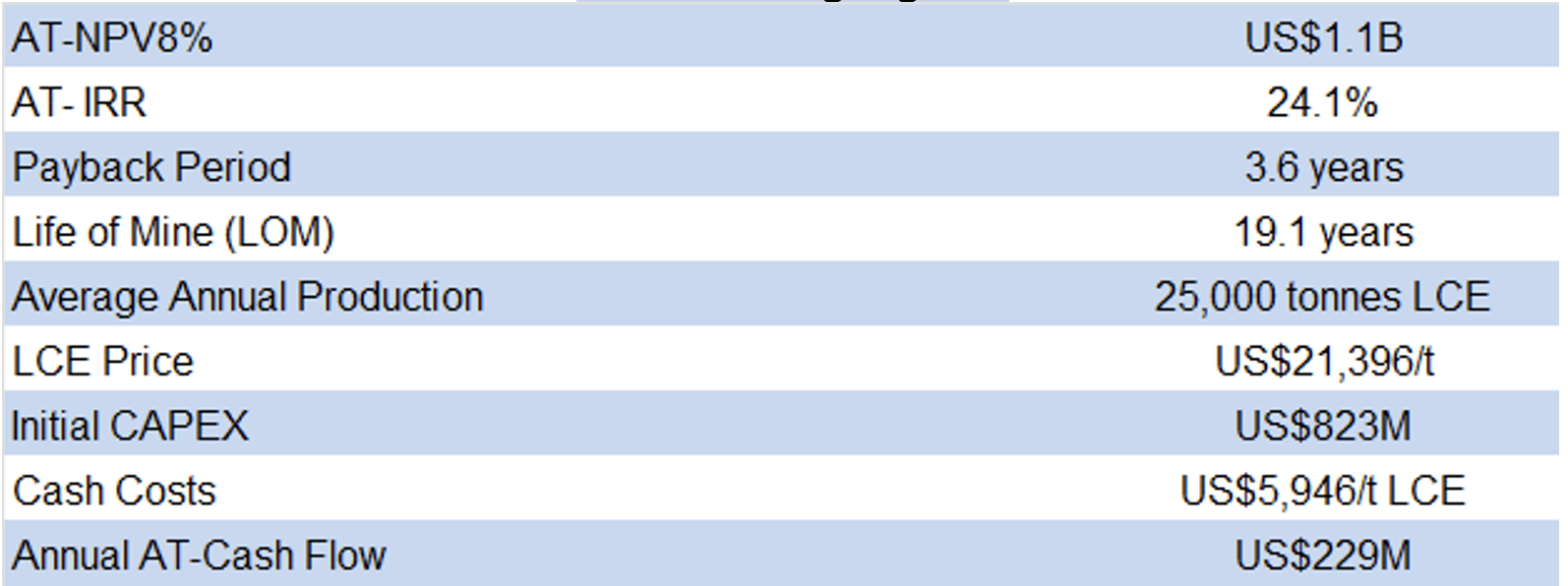

2023 PEA Highlights

Source: Company

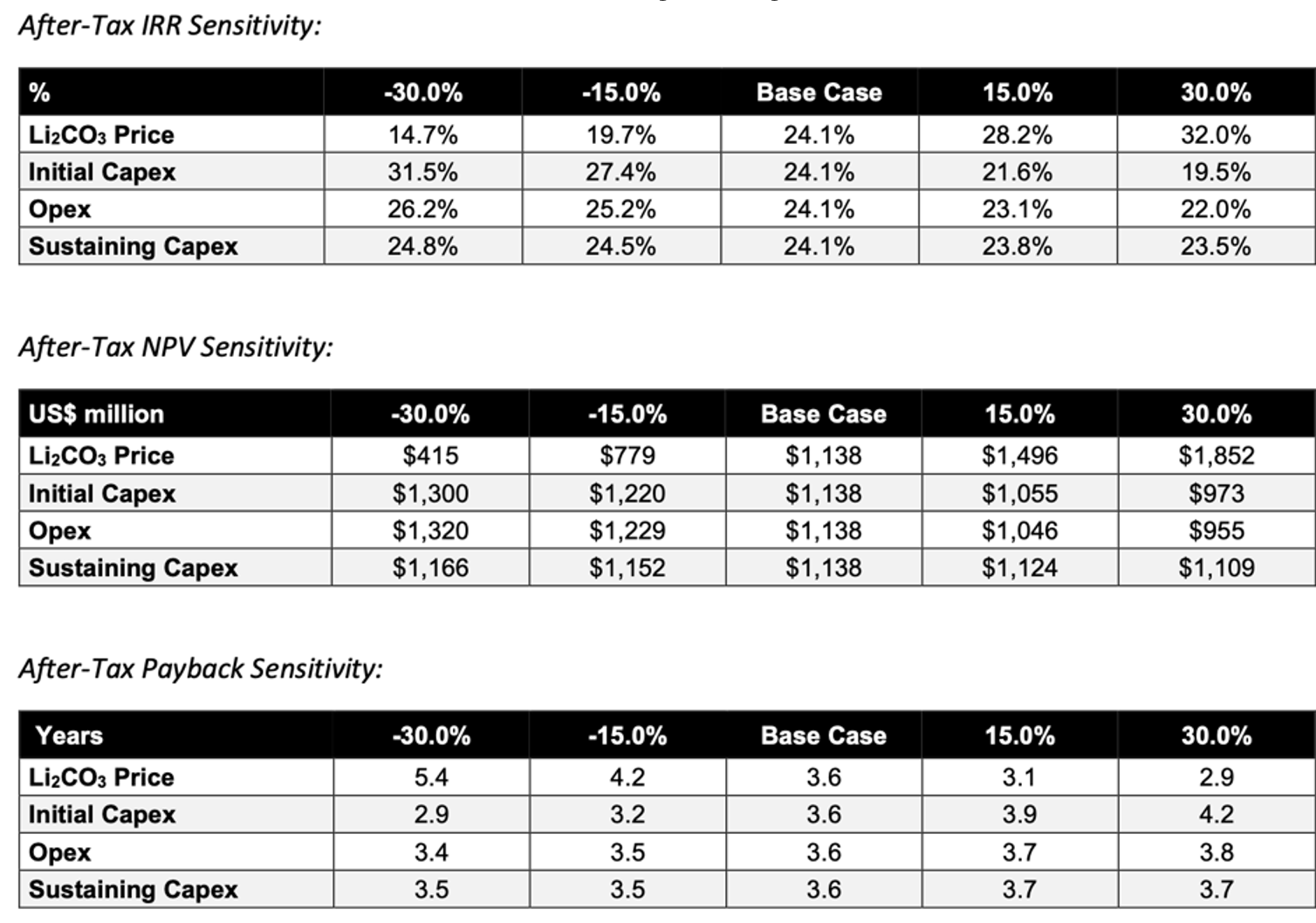

Sensitivity Analysis

Source: Company

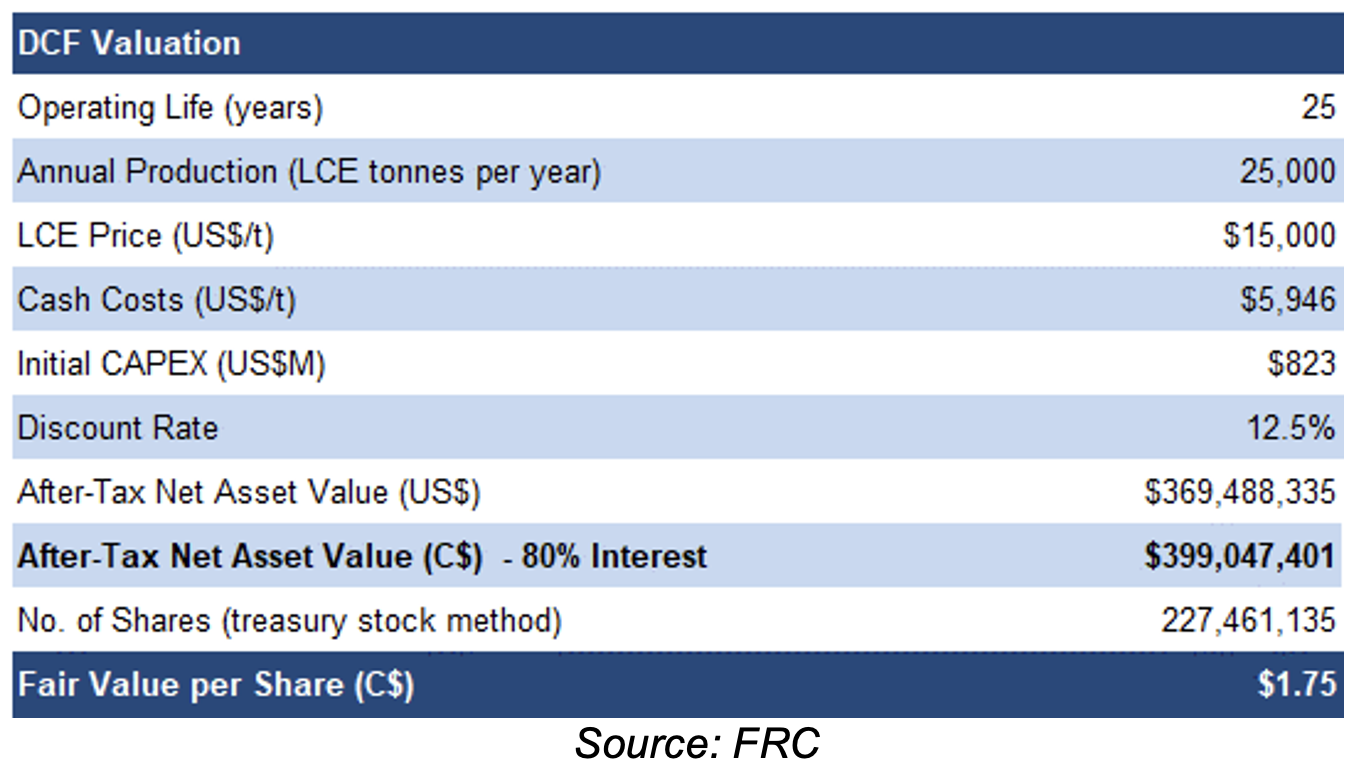

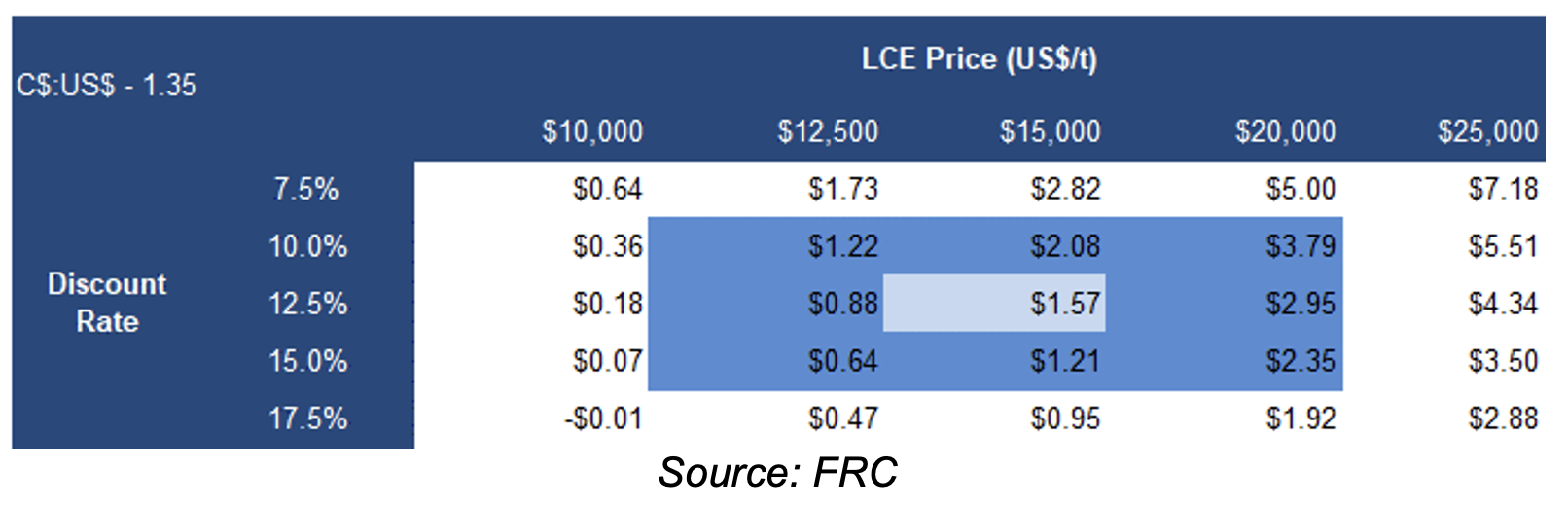

The 2023 PEA had returned an AT-NPV8% of US$415M, and an AT-IRR of 15%, using US$15k/t LCE vs the current spot price of US$15.4k/t

As with all large projects, the NPV and IRR are highly sensitive to LCE prices

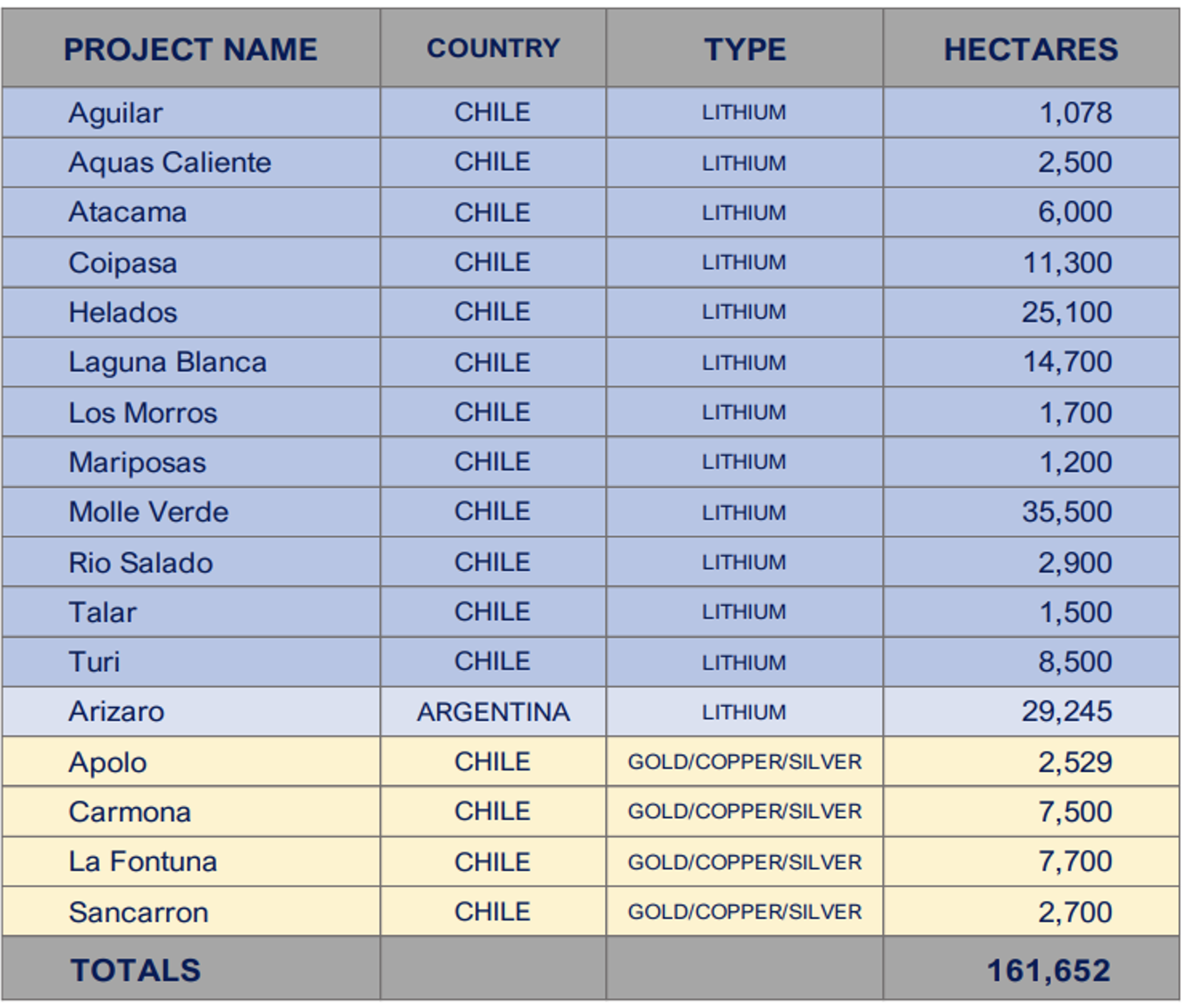

Other Projects

Source: Company

In March 2024, LITH entered into a farm-in agreement with ERAMET, wherein ERAMET can acquire a 70% interest in its four Chilean properties by spending US$20M on exploration

LITH plans to spin out these projects into two new publicly listed entities:

Lithium Projects: 12 properties, spanning 111,978 hectares, will be transferred to Lithium Chile 2.0 Inc. Shareholders will get one share of this new entity for every four shares of LITH.

Gold Projects: Five properties, spanning 22,629 hectares, will be transferred to Kairos Gold Inc. Shareholders will get one share of this new entity for every 10 shares of LITH.

We support this plan as it allows LITH to monetize these assets, while streamlining its corporate structure for potential M&A related to the Arizaro project

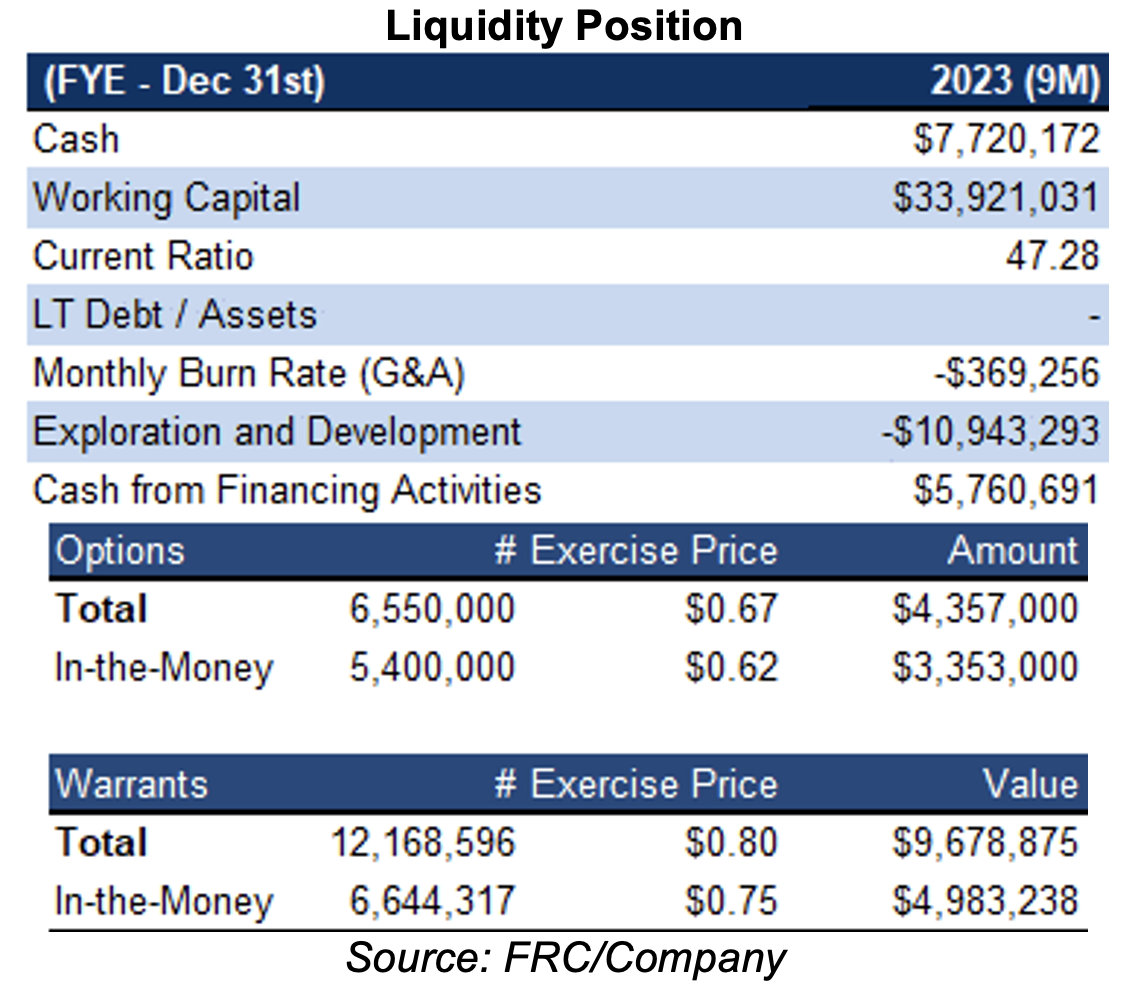

Financials & Valuation

Strong balance sheet

In-the-money options can bring in $8.34M

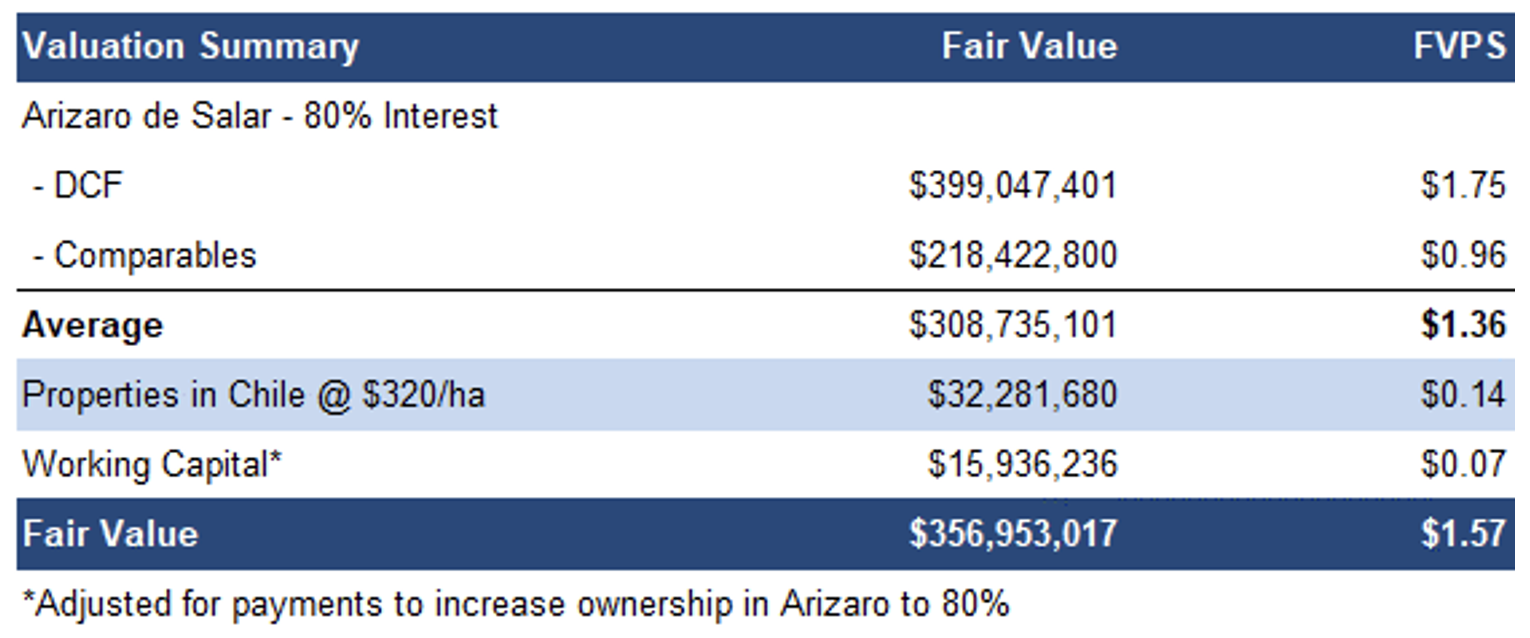

Our DCF valuation increased from $1.55 to $1.75/share, driven by higher resources, and a corresponding increase in mine life from 19 to 25 years

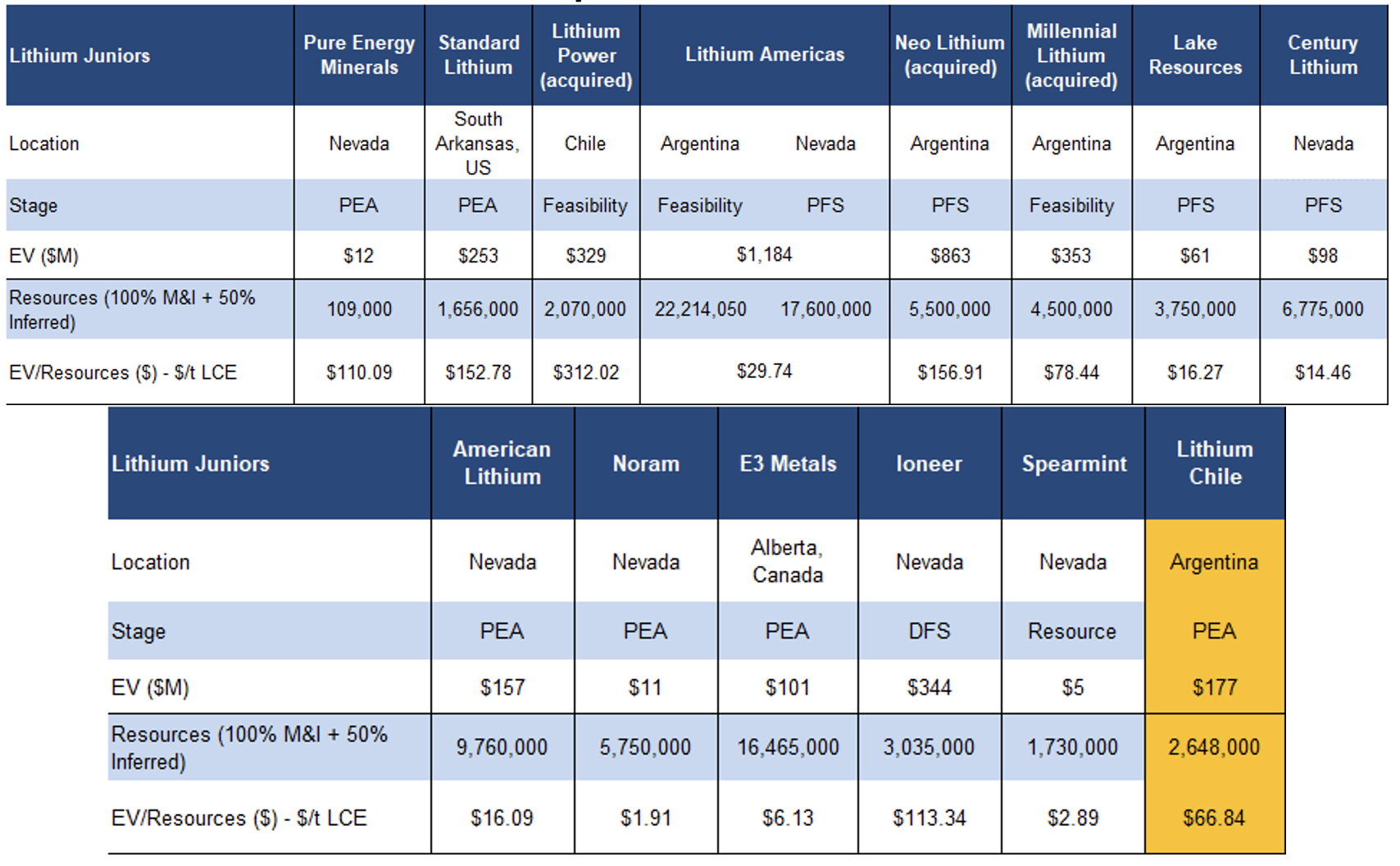

Comparables Valuation

LITH is trading at $67/t (previously $59/t) vs the sector average of $83/t (previously $100/t)

By applying $83/t to Arizaro’s resources, we arrived at a revised comparables valuation of $0.96/share (previously $0.89/share

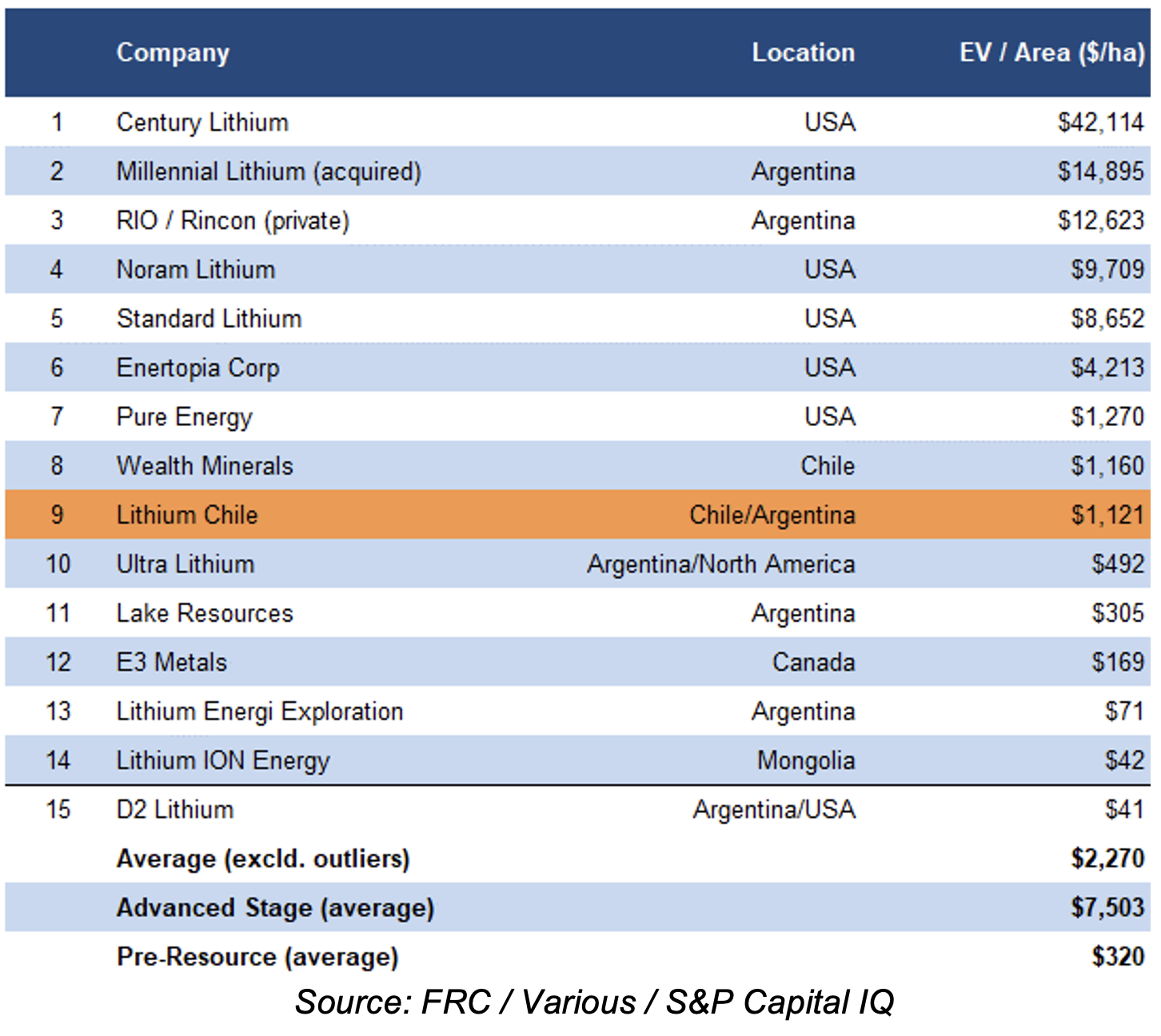

Pre-resource lithium juniors are trading at $320/ha (previously $433/ha)

By applying $320/ha to LITH's Chilean properties, we arrived at a revised valuation of $0.14/share (previously $0.19/share

Under the proposed spin-out terms mentioned above, we believe management values these assets at $0.30/share

Using a sum-of-parts model, we arrived at a revised fair value estimate of $1.57 (previously $1.55/share)

Valuation increased due to higher resources, partially offset by the impact of lower sector valuations

We are reiterating our BUY rating, and adjusting our fair value estimate from $1.55 to $1.57/share. We believe the company's M&A prospects have improved significantly due to the significant increase in resources, and the upcoming PFS.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Volatility in lithium prices

- Development

- Permitting

- Access to capital and share dilution

- Might not be able to advance all of its projects simultaneously

Maintaining our risk rating of 5 (Highly Speculative