Olympia Financial Group Inc.

Posts Record Revenue & EPS / Poised for Another Strong Year

Published: 3/5/2024

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Financial Services | Industry: Asset Management

| Metrics | Value |

|---|---|

| Current Price | US $102.6 |

| Fair Value | US $125.67 |

| Risk | N/A |

| 52 Week Range | US $65-122 |

| Shares O/S (M) | 2.41 |

| Market Cap. (M) | US $247 |

| Current Yield (%) | 7.0 |

| P/E (forward) | 9.9 |

| P/B | 7.0 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

Highlights

OLY is up 13% since our previous report in November 2023. OLY, through its wholly-owned subsidiary Olympia Trust Company, is Canada's premier trustee/custodian/administrator of self-directed registered investment accounts (such as RRSP/TFSA) for alternative assets.

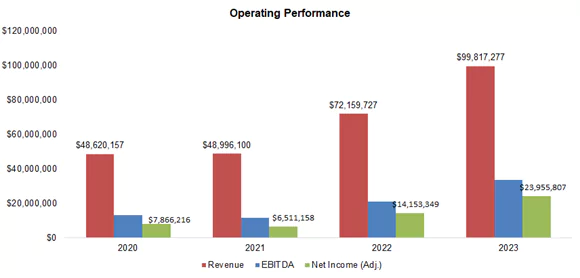

In 2023, revenue was up 38% YoY amid higher interest rates, beating our estimate by 0.2%. EPS was up 69%, beating our estimate by 4.8%. Dividends increased 84% to $5.80/share, exactly in line with our estimate.

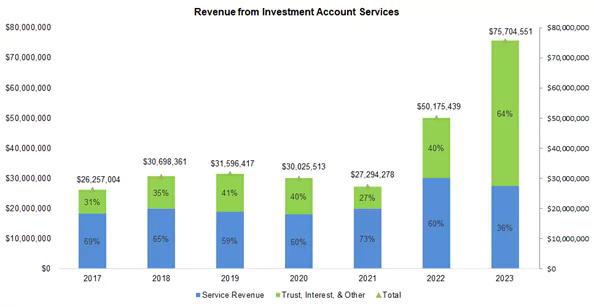

In 2023, 64% of revenue came from interest on unallocated client capital in cash accounts at major Canadian banks, up from 40% in 2022.

Despite the recent uptick in inflation, and downtick in unemployment, we anticipate the Bank of Canada will cut rates by June/July 2024, driven by rising financial instability, and mortgage costs. That said, we anticipate a slower decline in interest rates than previously anticipated, prompting us to increase our 2024 revenue and EPS estimates by 7% on average.

We believe 2024 revenue growth will be driven by a relatively high interest rate environment, and organic demand growth for alternative investments.

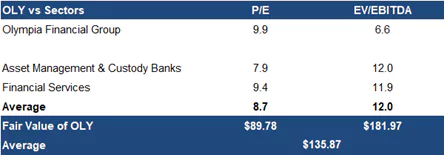

OLY’s EV/EBITDA is 7x vs the sector average of 12x, a 44% discount.

Primary Offerings

- Investment Account Services (IAS): OLY is a trustee/custodian/administrator of self-directed registered investment accounts for alternative investments

- Health Services Plans: Administers health spending accounts for small/mid- sized corporations

- Currency and Global Payments: Facilitates the buying and selling of currencies for corporations and individuals

- Corporate and Shareholder Services: Offers corporate trust, and transferagency services, such as maintenance of security holder registries, organizing annual meetings, and administering dividend reinvestments

- IT services: Provides IT services to exempt market dealers, issuers, and investment advisors

The leading Canadian custodian/ administrator of alternative investments OLY manages 133k accounts

OLY’s platform caters to a comprehensive range of investments not supported by banks, and other traditional trading/investment platforms

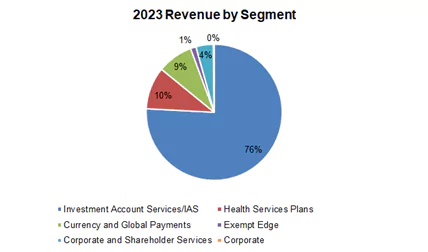

In 2023, 76% of revenue came from IAS, 10% from health service plans, and the remaining 14% from other services

Source: Company/FRC

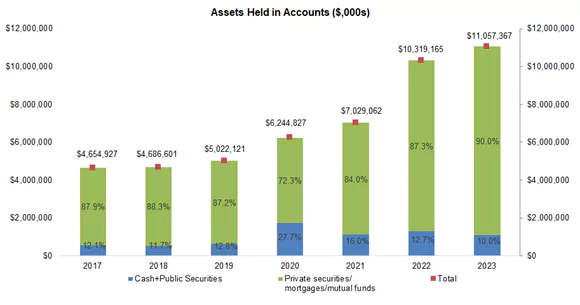

In 2023, client assets held by OLY were up 7% YoY to $11.1B, beating our estimate by 0.2%

Financials (Year-End: Dec 31st)

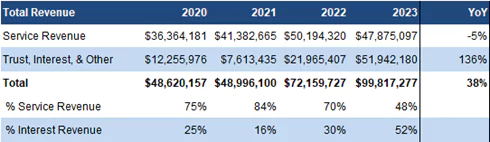

In 2023, revenue was up 38% YoY amid higher interest rates, beating our estimate by 0.2%

Services revenue declined as the company lowered its annual administrative fee from $175 to $150 to enhance its value proposition for customers.

*Service revenue includes annual fees and transaction fees

*Service revenue includes annual fees and transaction fees

*Trust, interest, and other' primarily includes interest revenue

Source: FRC/Company

In 2023, 76% of revenue came from IAS, up from 70% in 2022

IAS revenue was up 51% YoY amid higher interest rates

*Service revenue includes annual fees and transaction fees

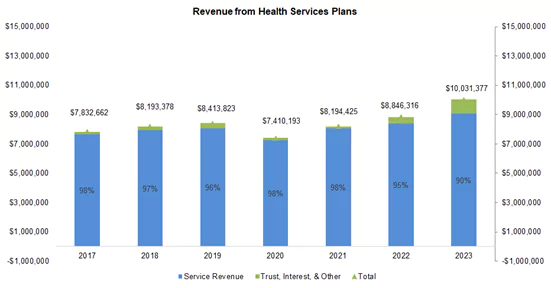

In 2023, 10% of revenue came from Health Services Plans, down from 12% in 2022

Revenue from this division was up 13% YoY driven by an expanded client-base

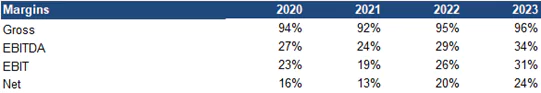

Margins improved across the board due to higher revenue

EBITDA was up 60% YoY, beating our estimate by 1.6%

EPS was up 69%, beating our estimate by 4.8%

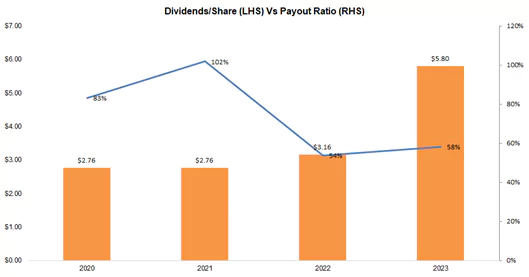

Dividends increased 84% to $5.80, exactly in line with our estimate

In 2023, the payout ratio was 58% vs the historic average of 70%

Source: Company/FRC

Source: Company/FRC

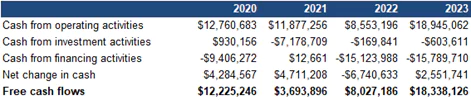

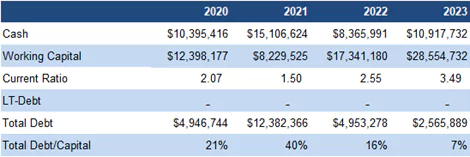

Healthy balance sheet

FRC Projections and Valuation

Source: FRC

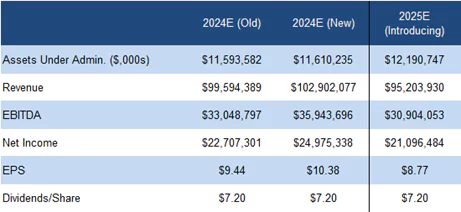

Anticipating a slower decline in interest rates, we are raising our 2024 revenue and EPS forecasts by 7% on average

Source: FRC/S&P Capital IQ

Source: FRC/S&P Capital IQ

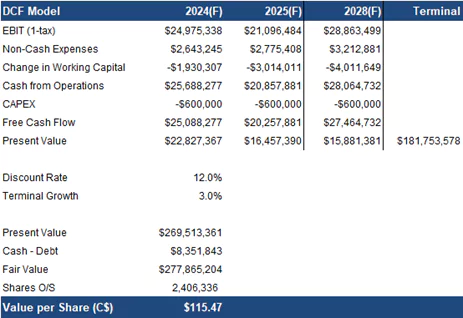

As a result, our DCF valuation increased from $98 to $115/share, and our comparables valuation increased from $115 to $136/share

We are reiterating our BUY rating, and adjusting our fair value estimate from $106.48 to $125.67/share, implying a potential return of 30% (including dividends) in the next 12 months. We anticipate a robust performance in H1- 2024, driven by a relatively high interest rate environment.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Operates in a regulated industry

- The company's target market is niche

- Although OLY dominates the alternative investment market, there is no guarantee that banks and large investment platforms will not enter this space in the future.

- Earnings are significantly affected by fluctuations in interest rates

- Transaction revenue depends on market sentiment for alternative investments