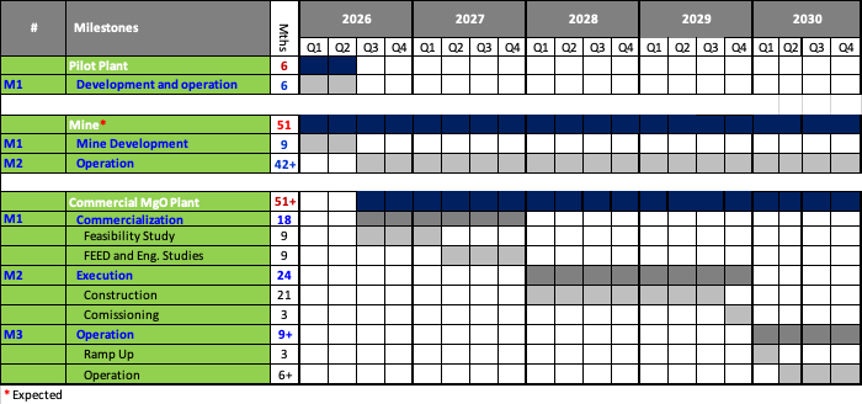

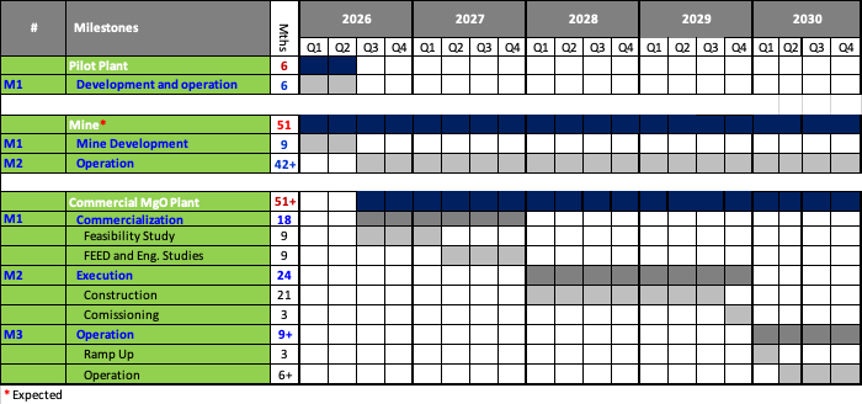

- The company is currently finalizing construction contracts and mobilizing for site preparation, while simultaneously working on project financing. Its goal is to develop a magnesia (MgO) plant by 2030, which we believe is a realistic timeline.

- Magnesium is designated by the U.S., EU, and Canada as a critical mineral, with North America relying heavily on imports. China accounts for 95% of global production, underscoring the strategic importance of developing North American sources like WHY’s Record Ridge project.

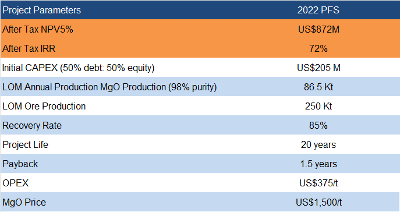

- Record Ridge’s large resource could support a 170+ year mine life, producing high purity MgO products, with a 2022 PFS showing an After Tax-NPV5% of US$872M, and a highly attractive AT-IRR of 72%, at US$1,500/t MgO-98% (in line with spot prices). WHY is trading at just 4% of its NPV.

- WHY also owns two 100% gold projects in B.C., and is exploring joint venture options to advance their development.

- Key upcoming catalysts include the start of ore extraction and shipments to Galaxy Magnesium, along with progress on project financing.

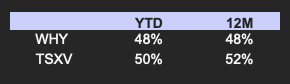

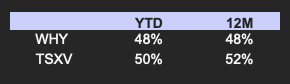

Price and Volume (1-year)

* Subsequent to Q3-2025, the company raised $1.90M from the exercise of warrants

* Qualified Person: Rick Walker B.Sc., M.Sc., P.Geo, Geologist of WHY Resources.

* WHY Resources Ltd. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions.

Magnesium Market Overview

Magnesium is one of the lightest metals and can withstand high temperatures. Its high strength-to-weight ratio, durability, impact resistance, and strong casting characteristics allow it to be used across automotive, aerospace, cement, and agriculture sectors. Magnesium is the third most commonly used metal in construction, after iron and aluminium. Although still in early stages, we note ongoing research into magnesium-ion batteries and their potential viability as a replacement for lithium-ion batteries.

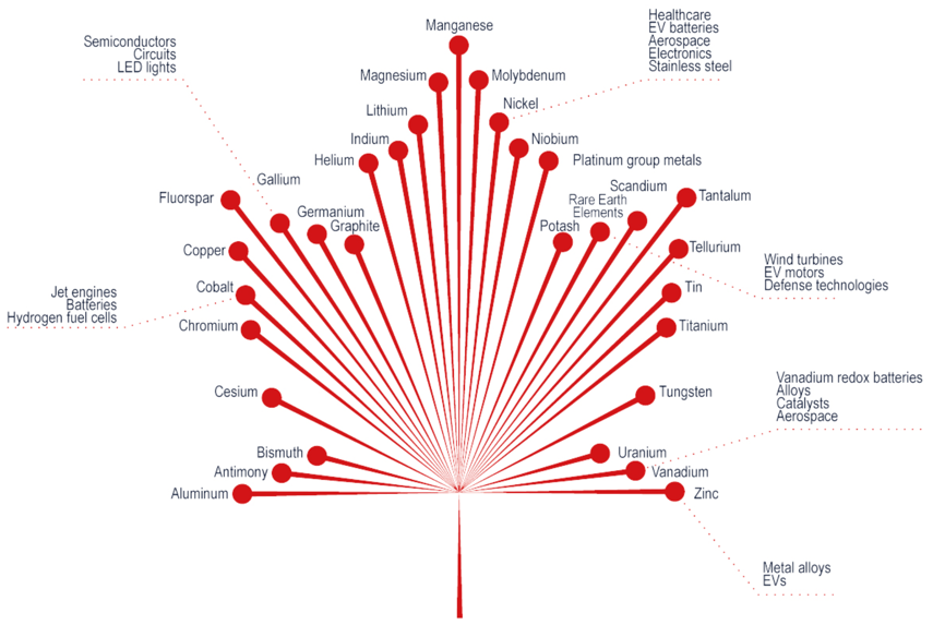

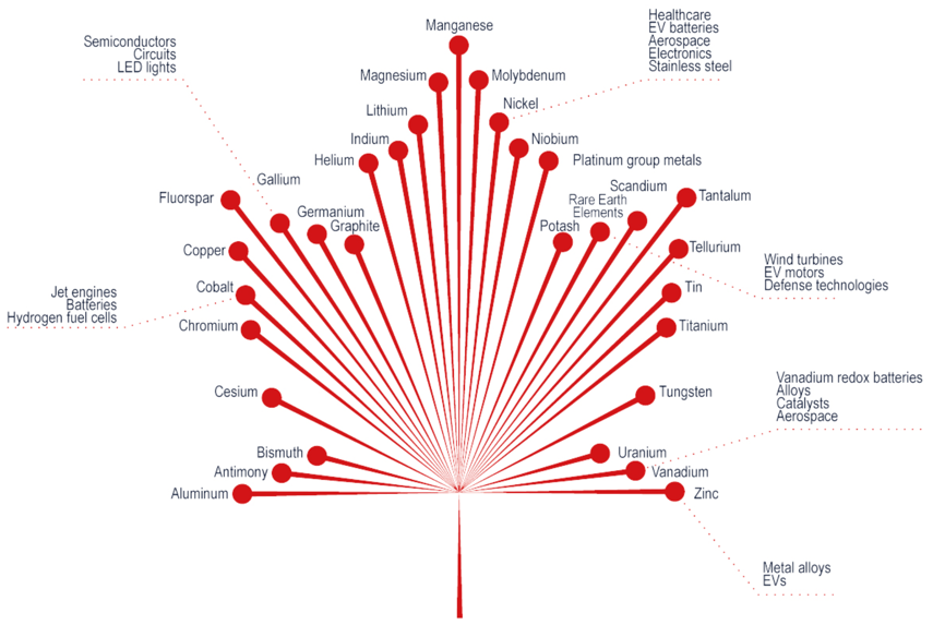

Magnesium is designated as a critical mineral by the U.S., EU, and Canada

The Western world is making a strong push to increase domestic production of critical minerals to reduce reliance on China, which dominates the supply of most critical minerals

Canada’s Critical Minerals List

Source: National Resources of Canada

North America has only one primary magnesium-producing mine and imports most of its consumption, highlighting the need for additional domestic producers

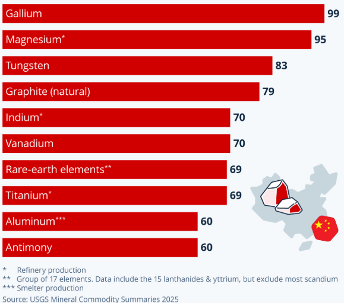

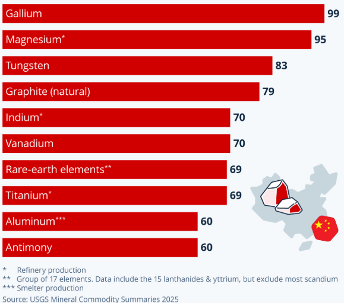

China’s Dominance in Critical Minerals (% of Global Production)

Source: Statista

Russia and China account for 70% of global reserves

China accounts for 95% of global magnesium production, highlighting the strategic importance of developing new North American sources, such as WHY’s Record Ridge project

Magnesium Ingot (99.9%) Prices – China (CNY/T)

Source: Trading Economics

Prices have fallen from their late-2021 peaks and have remained relatively flat over the past few years

Although we are not expecting a global deficit in magnesium supply (as global production capacity is higher than demand), we believe North American projects, such as Record Ridge, have significant upside potential, as magnesium commands a premium in North America due to limited domestic production and import costs from China. Also, we believe Western users will favor Western suppliers over Chinese ones.

Record Ridge Magnesium Project, B.C.

The project hosts a large, high-grade magnesium deposit in B.C.

Located 5 km north of the U.S.- Canada border

Location Map

Source: Company

Excellent infrastructure in place, including rail access, power, water, and natural gas

We see WHY’s projected OPEX as lower than peers, supported by its open-pit deposit, and B.C.’s inexpensive energy

2013 Resource Estimate

A large, high-grade open-pit resource

The current resource estimate accounts for just 8% of identified mineralization

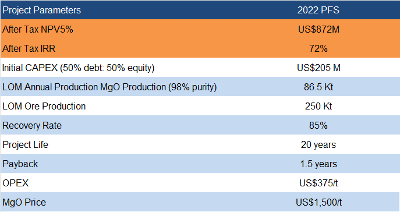

2022 PFS

The PFS returned robust economics, including an AT-NPV5% of US$872M, a very high AT-IRR of 72%, and a quick payback period of 1.5 years, using US$1,500/t MgO (in line with spot prices

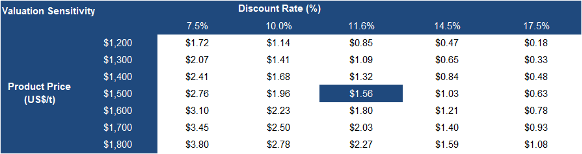

Sensitivity Analysis

(QP: Rick Walker B.Sc., M.Sc., P.Geo, Geologist of WHY Resources)

Source: Company / Technical Reports

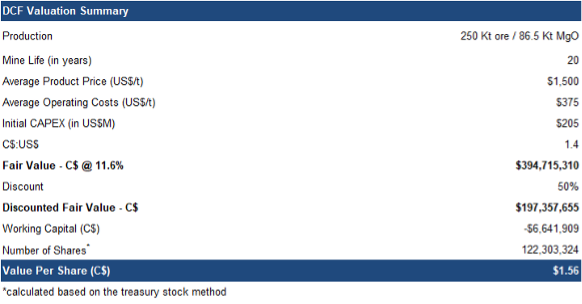

The PFS was based on a 20-year mine life, but we believe the mine could operate for over 170 years if 100% of M&I resources are utilized

Relatively low initial CAPEX of US$205M, and OPEX of US$375/t

AT-NPV5% decreases to US$445M, if MgO prices are lowered by 30%, and increases to US$1.3B, if MgO prices are increased by 30%

Proprietary Hydrometallurgical Process

Source: Company

WHY’s proprietary technology (developed in 2019) has the potential to produce premium (>99%) magnesium products, with nickel and silica as by-products

A closed-loop process with zero CO2 emissions, and low energy consumption

In October 2025, West High Yield received approval from the B.C. Ministry of Mines and Critical Minerals to develop and operate an open-pit mine, allowing extraction of up to 63,500 tonnes per year. The permit approval follows rigorous provincial and Indigenous review, and reflects strong support from the Osoyoos Indian Band, which has signed a cooperation agreement covering construction, operations, and environmental monitoring. We note that a positive relationship with local Indigenous communities is critical to the success of a mining project. Management plans to commence site preparation, small-scale mining, and preliminary ore sales, potentially generating early cash flow in 2026.

Obtains mining permit; small-scale test mining planned for next year

Source: Company

WHY’s long-term goal is to develop a MgO plant by 2030, which we believe is a realistic timeline

Gold Projects

WHY also owns two 100% gold projects in B.C.: the Gold Mine Rejects project (hosting non-compliant resources of 30 Koz gold in stockpiles), and the past-producing Midnight project, located in the historic Rossland gold camp. Drilling at Midnight has returned several bonanza-grade gold intercepts, highlighting strong exploration potential. With gold trading at record highs, we anticipate robust M&A activity over the next 12 months, as larger companies target juniors to expand their portfolios. We remain positive on gold prices, supported by US$ weakness, strong safe-haven demand amid economic and geopolitical uncertainty, and potential global GDP pressures.

Owns two 100% gold projects in B.C.; seeking JV partner to advance development

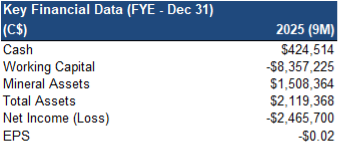

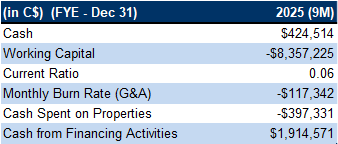

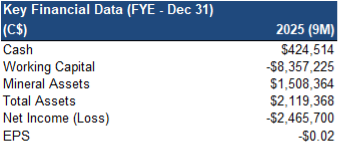

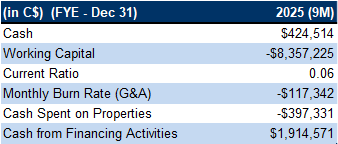

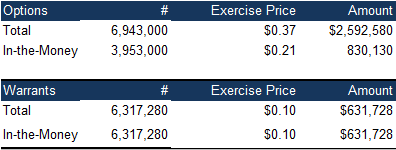

Financials

At the end of Q3- 2025, WHY had a working capital deficit of $8.36M, due to a $6.81M loan from the largest shareholder (the CEO’s family

Source: FRC / Company

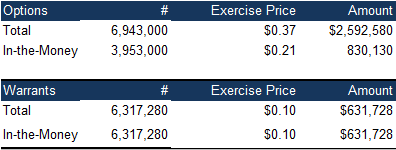

Subsequently, the company raised $1.90M through the exercise of warrants, and can potentially raise another $1.46M from in-the-money options and warrants

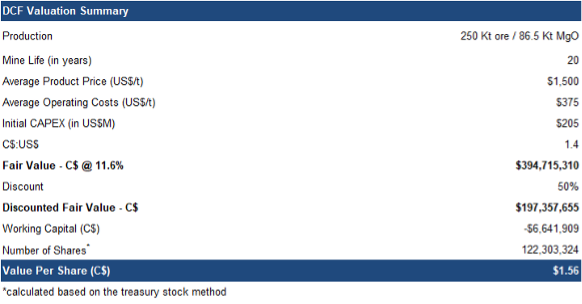

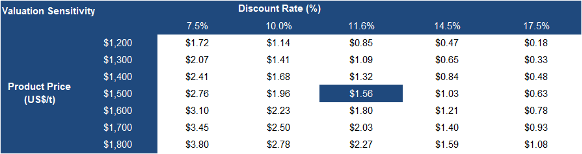

FRC Projections and Valuation

With the mining permit now granted, we have reduced our discount rate assumption from 15.0% to 11.6%, consistent with advanced-stage Canadian projects

Source: FRC

However, our valuation declined from $1.95 to $1.56/share due to share dilution since our previous report

We reiterate our BUY rating, and lower our fair value from $1.95 to $1.56/share. Despite improved fundamentals, the decline in valuation stems entirely from share dilution since 2023. With the mine permit in hand, Record Ridge is set to advance toward site preparation and test mining. Early shipments offer potential cash flow, and help establish long-term off-take agreements. With a large resource, strong project economics, and North America’s strategic need for magnesium, w believe the project remains well-positioned for development

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Commodity prices

- Project financing

- Potential for delays in development

- Potential for share dilution

We maintain our Highly Speculative risk rating (5), though regulatory and permitting risks have eased