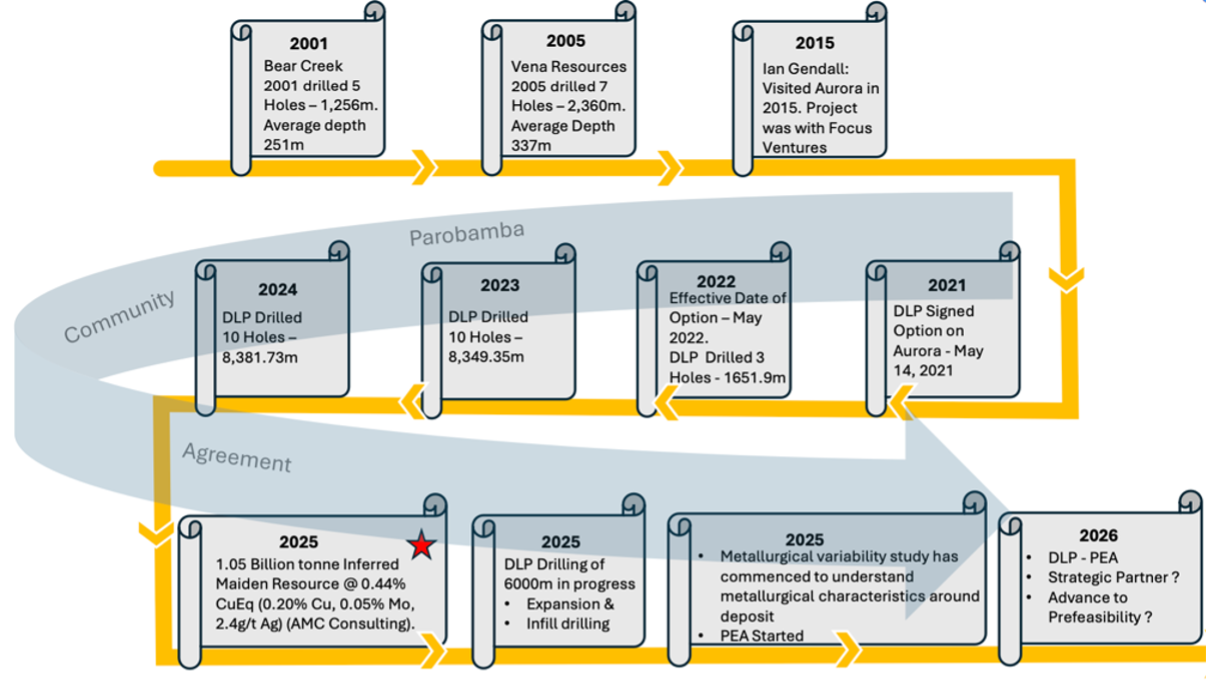

- DLP plans to complete a resource update, and a Preliminary Economic Assessment (PEA), in Q1-2026. While large projects are capital-intensive, we expect the PEA to reflect robust economics, supported by the substantial inferred resource, and recent drill results.

- Copper prices are up 19% YoY to US$5.06/lb. We maintain a positive outlook, anticipating continued US$ weakness, slow production growth, and recent supply disruptions. Per consensus, the market is expected to shift from a surplus in 2025, to a deficit in 2026.

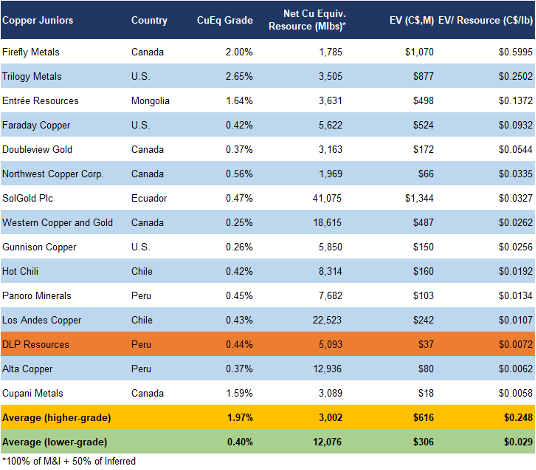

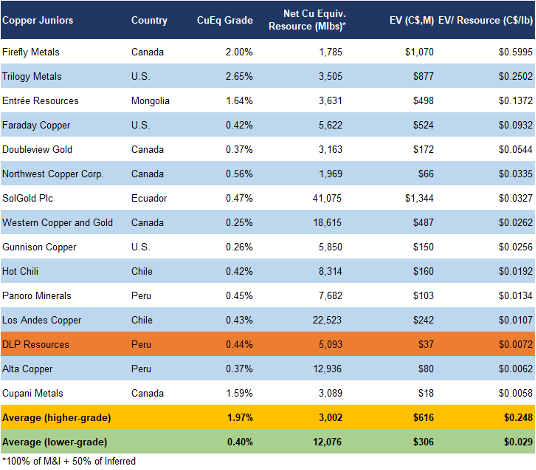

- DLP remains one of the most undervalued copper juniors, trading at $0.007/lb vs the sector average of $0.029/lb, a 75% discount.

- Upcoming catalysts include drill results, a resource update, and a PEA.

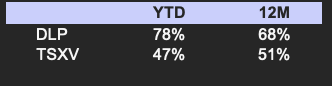

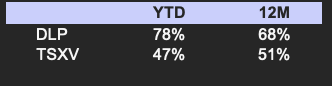

Price and Volume (1-year)

* Qualified Person: David L. Pighin, Consulting Geologist and Co-Founder of DLP Resources, and Ian Gendall, CEO & President of DLP Resources

* DLP Resources Inc. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions.

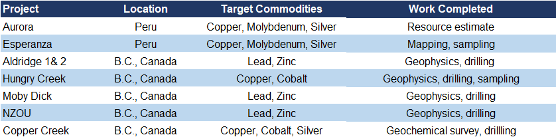

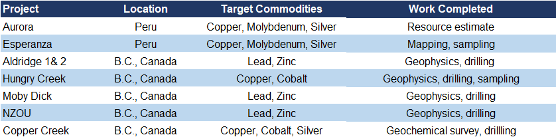

Portfolio Summary

Seven polymetallic projects in Peru and Canada

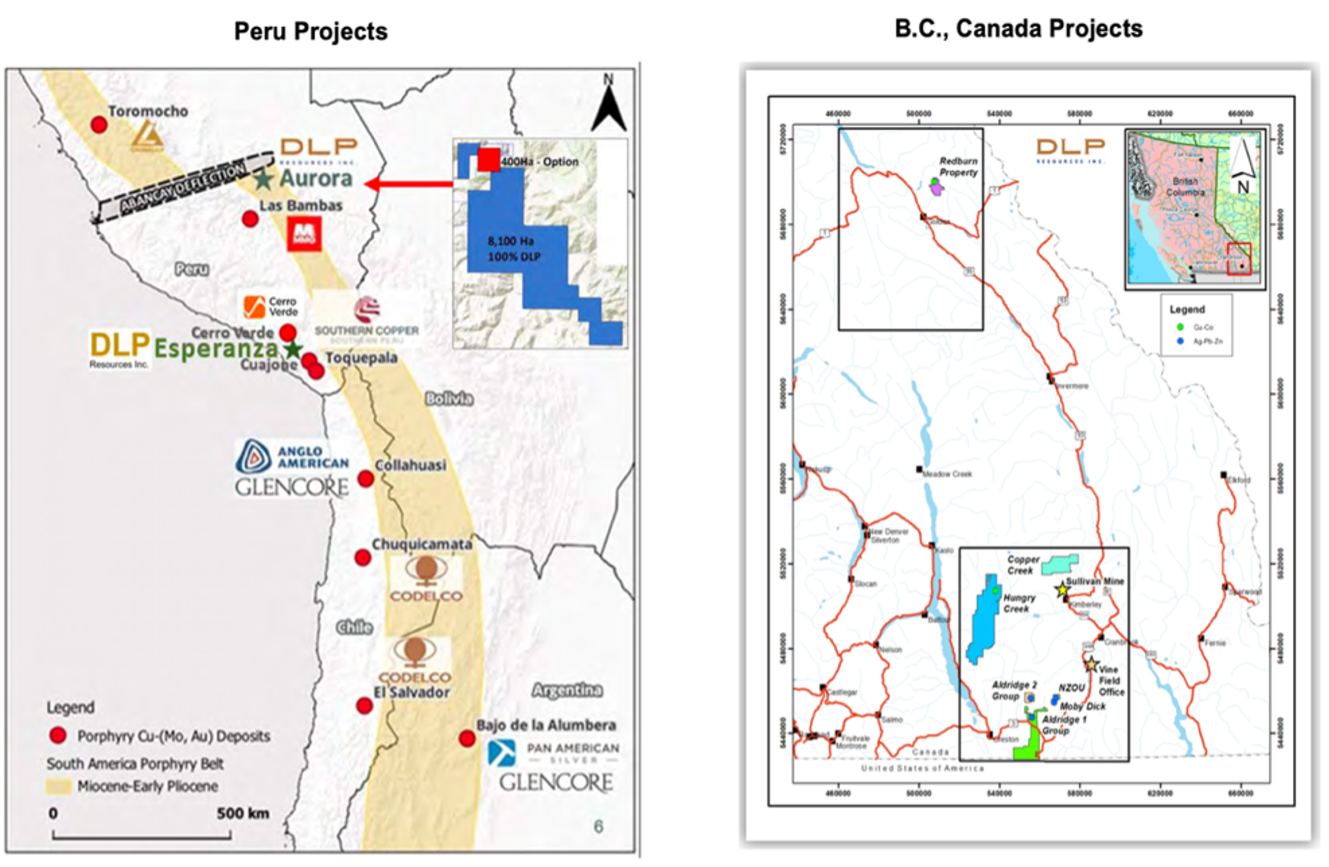

Project Locations

Two projects in Peru, and five projects in B.C.

Peru is the second largest copper producer in the world

Source: Company

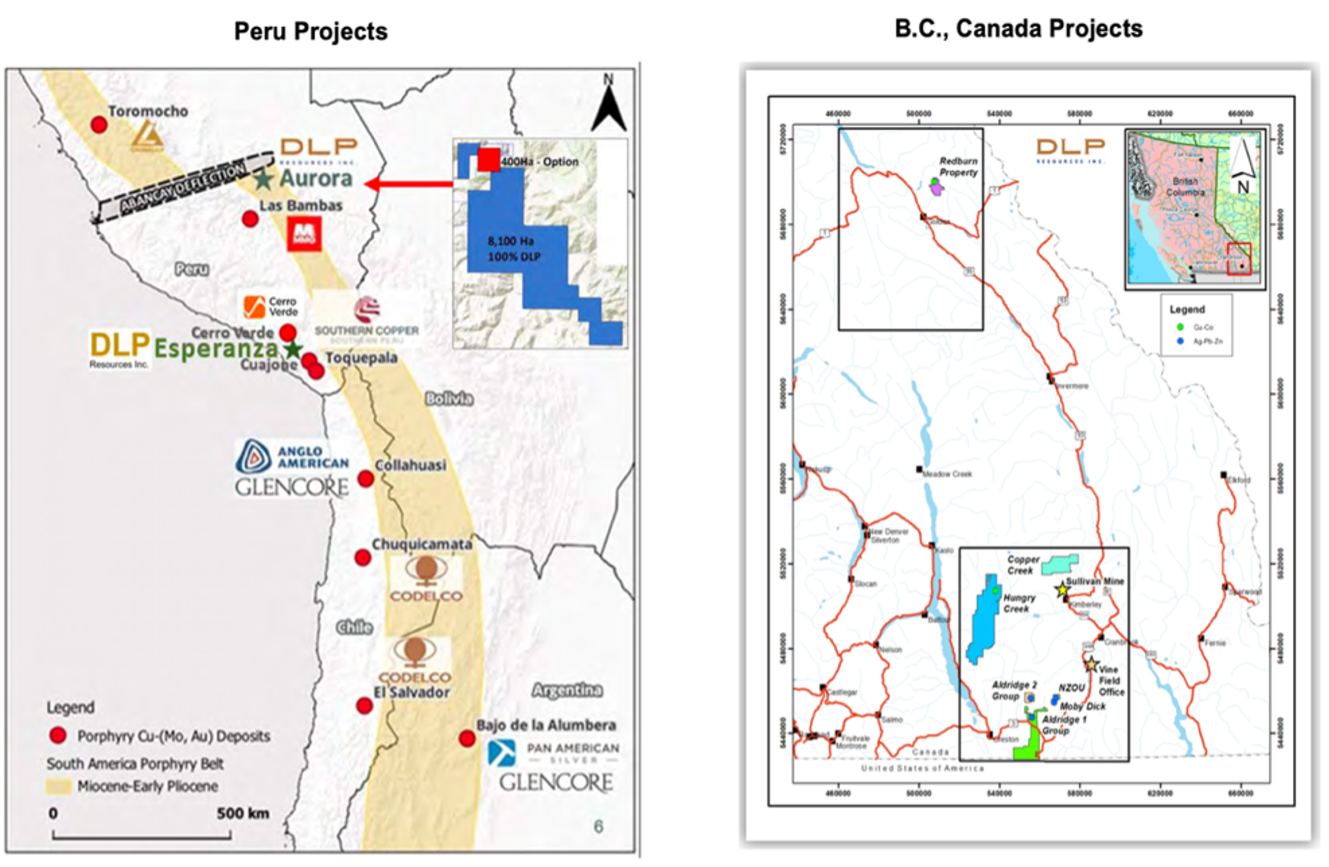

Aurora Cu-Mo-Ag Project, Peru (100% interest)

The flagship Aurora project hosts a large copper-molybdenum-silver porphyry deposit, suitable for open-pit mining.

Project Location

Located 65 km north of Cusco

Lies along the northern end of an underexplored porphyry belt

Access to paved and dirt roads, water, and power

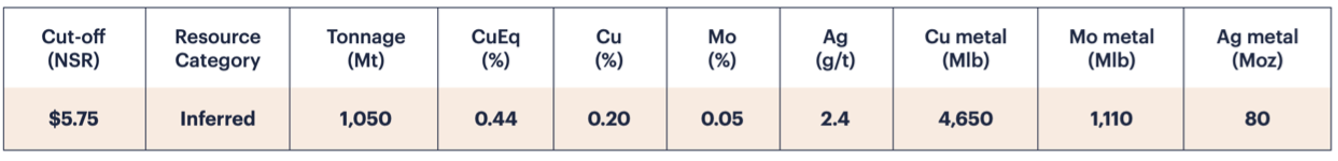

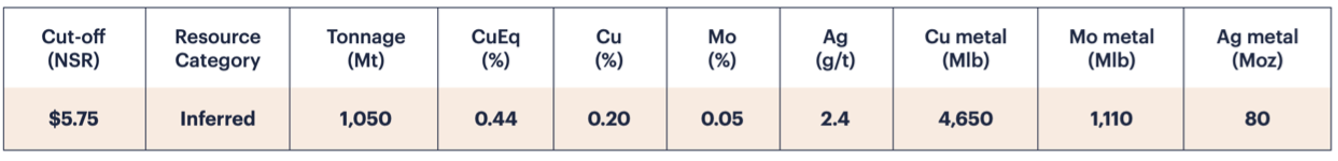

Open-pittable resources totaling 10.2 Blbs CuEq, representing significant tonnage, at a relatively low grade

2025 Resource Estimate

(QP: Chris Harman, MAIG, Principal Geologist of AMC Consultants Pty Ltd.)

Metallurgical tests reported high recoveries of 95.8% Cu, 86.4% Mo, and 89.3% Ag

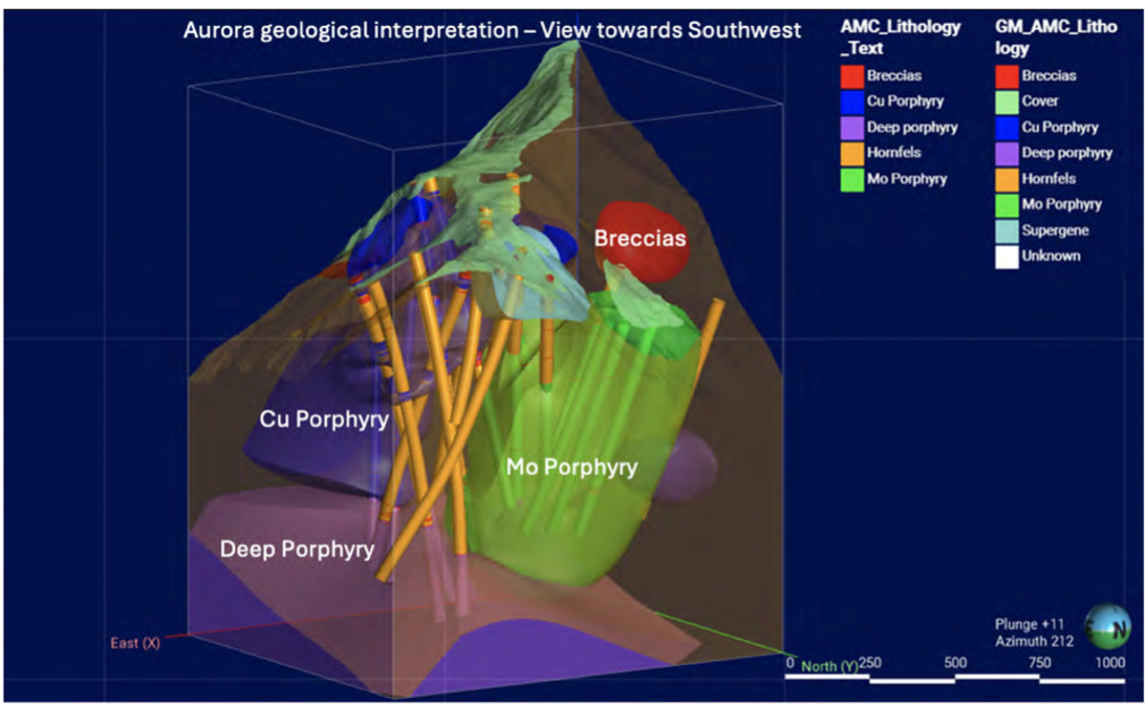

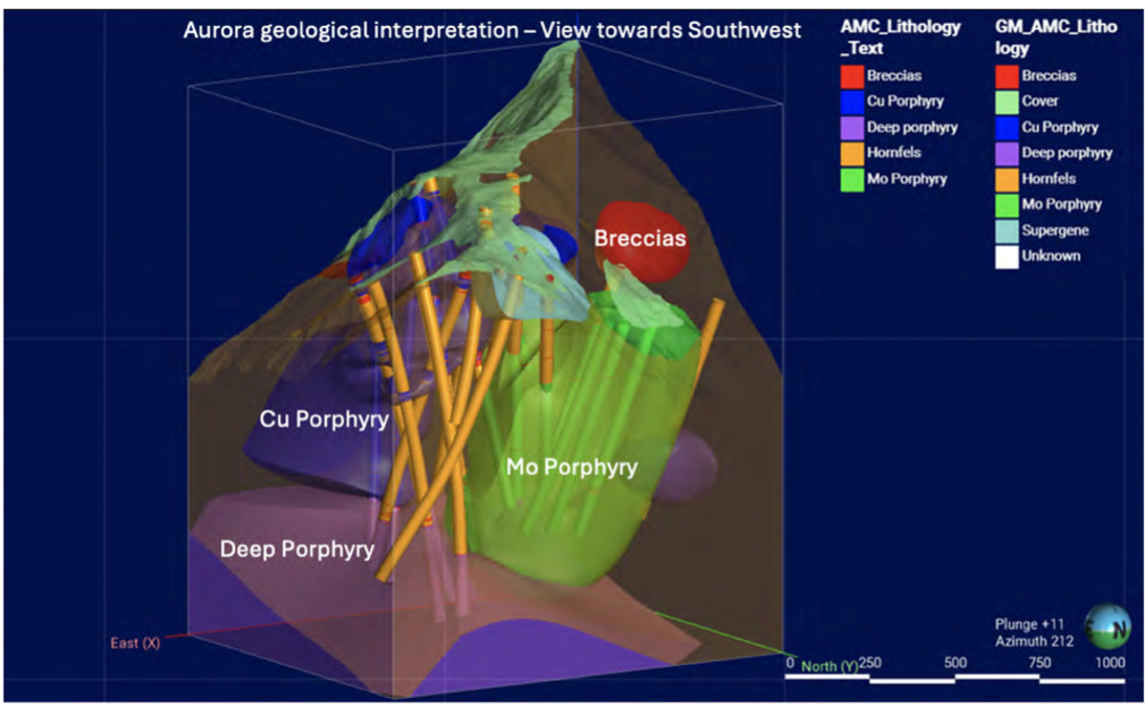

Aurora Geologic Model

Source: Company

Resources (1.1 km long x 0.95 km wide x 1.0 km deep) are spread across two primary zones: a copper-rich zone, and a molybdenum-rich zone

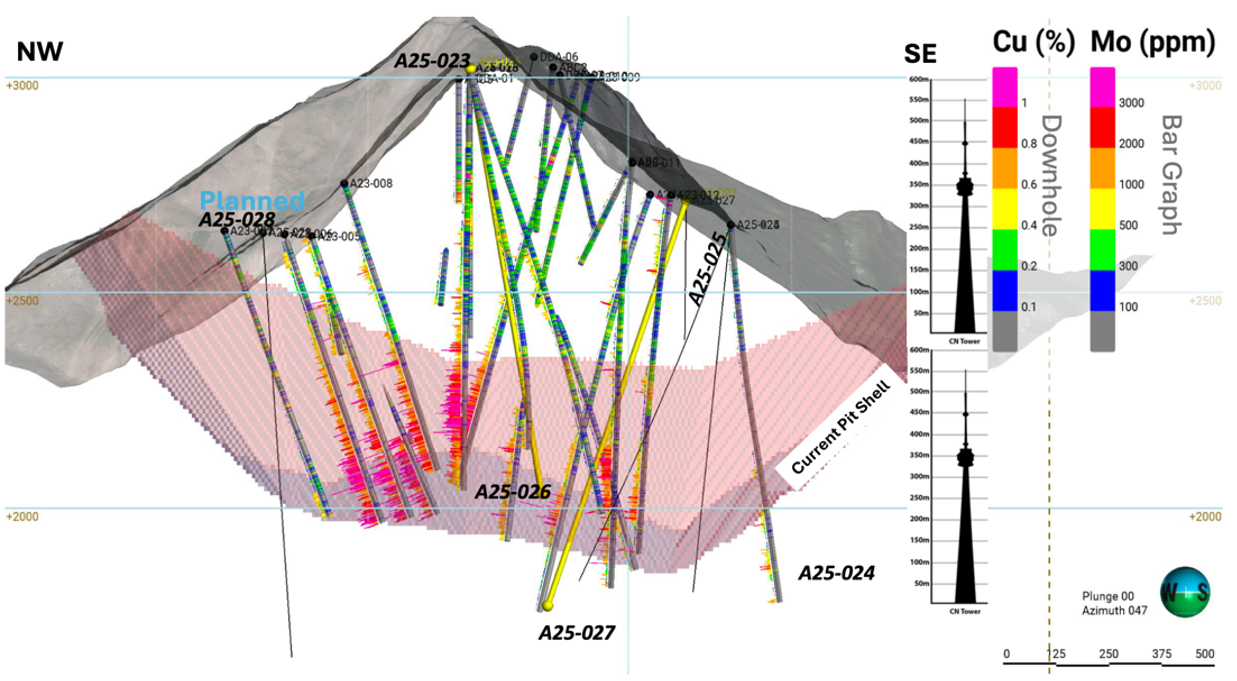

We believe there is resource expansion potential as the deposit remains open in multiple directions

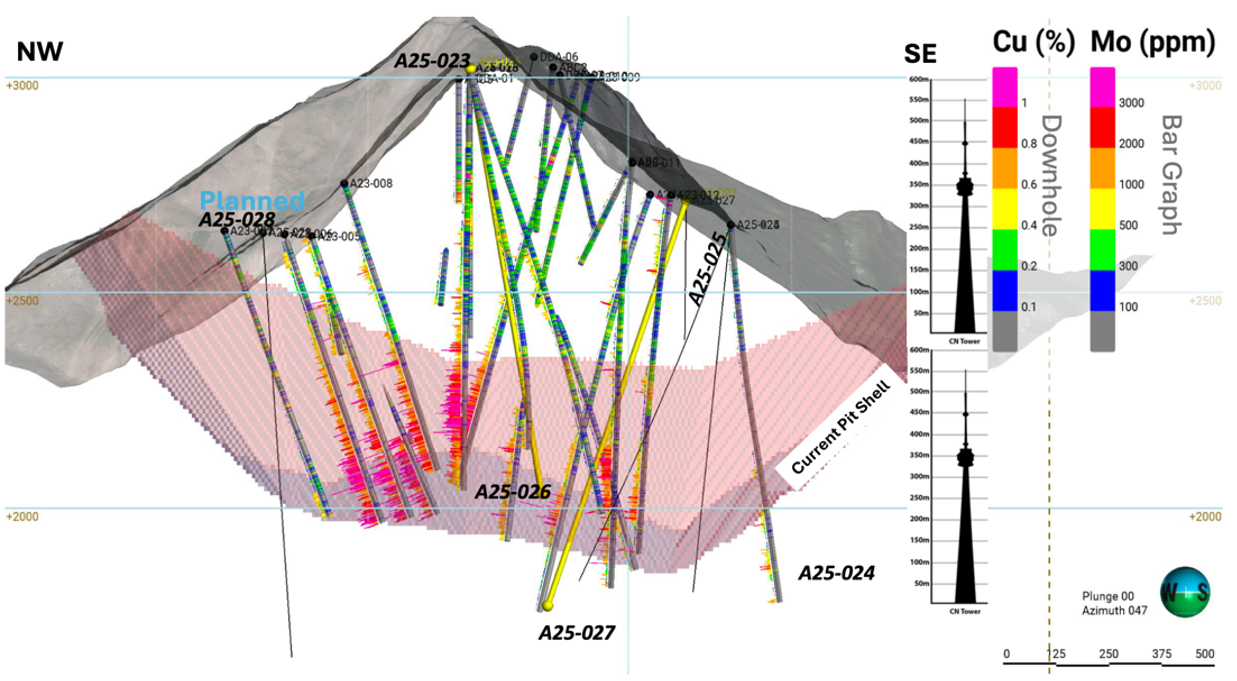

Initial results from the ongoing 6,000–7,000 m drill program returned strong copper, silver, and molybdenum grades, including 130 m at 0.50% CuEq, within a broader 927 m interval at 0.31% CuEq, suggesting potential to expand the resource envelope ~180 m to the southwest, and ~300 m to the southeast.

2025 Drill Highlights

Initial results suggest potential for resource growth

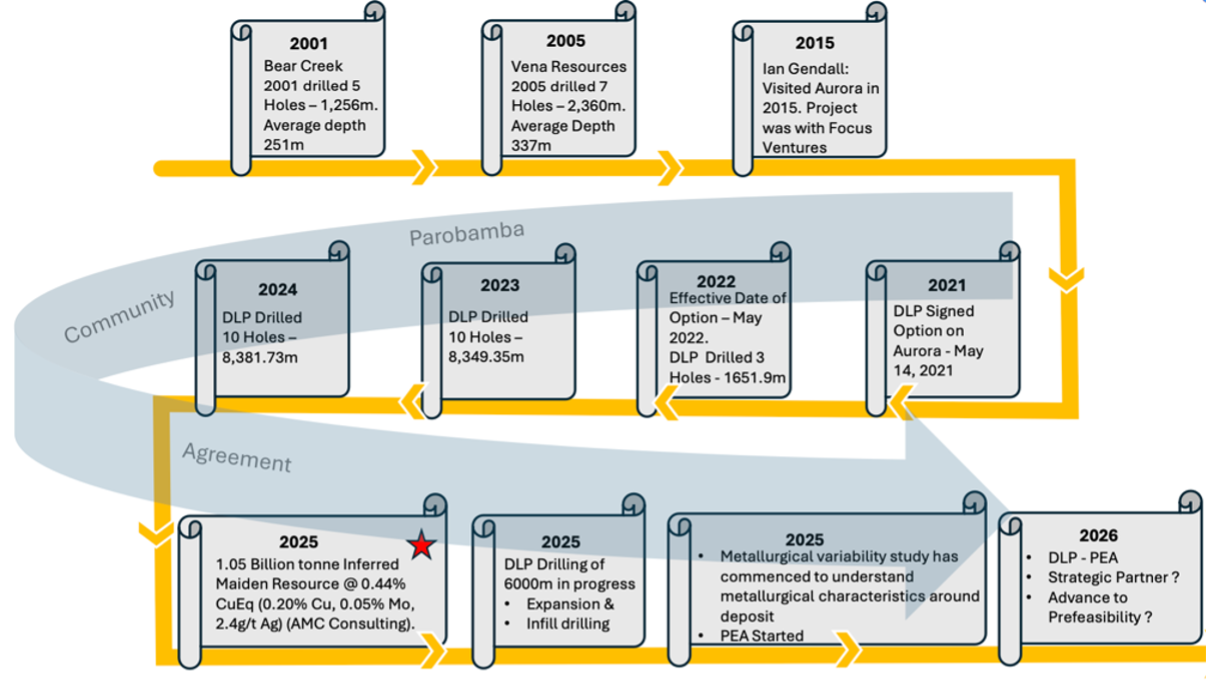

Project Development Timeline

Source: Company

Management is aiming to complete a resource update, and a PEA, by Q1-2026

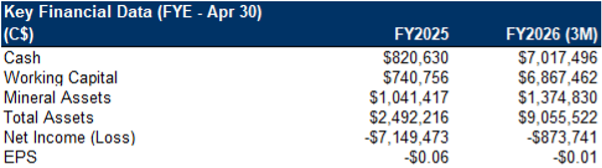

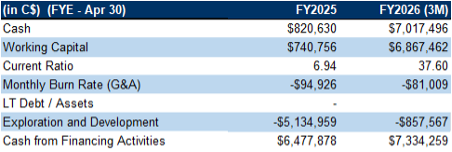

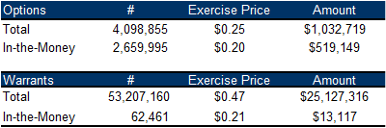

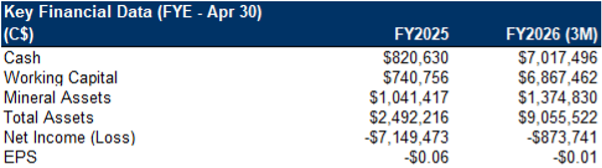

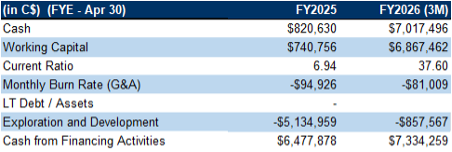

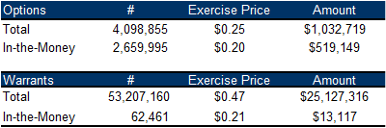

Financials

Strong balance sheet

Source: FRC / Company

Can raise up to $0.53M from in-the-money options and warrants

FRC Projections and Valuation

Source: FRC / S&P Capital IQ / Various

DLP remains one of the most undervalued juniors, trading at $0.007/lb (up from $0.006/lb) versus the sector average of $0.029/lb (previously $0.016/lb)

Driven by the stronger sector multiple, our comparables valuation rose to $1.00/share (previously $0.66/share)

We are reiterating our BUY rating, and raising our fair value estimate from $0.66 to $1.00/share. DLP’s Aurora project hosts a substantial inferred resource with significant expansion potential, supported by highly encouraging drill results. Upcoming catalysts, including further drilling, a resource update, and a PEA, could unlock meaningful value.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Commodity prices

- FOREX, permitting, and exploration

- Access to capital and potential for share dilution

- No guarantee that the company will be able to advance all of its projects simultaneously

We are maintaining our risk rating of 5 (Highly Speculative)