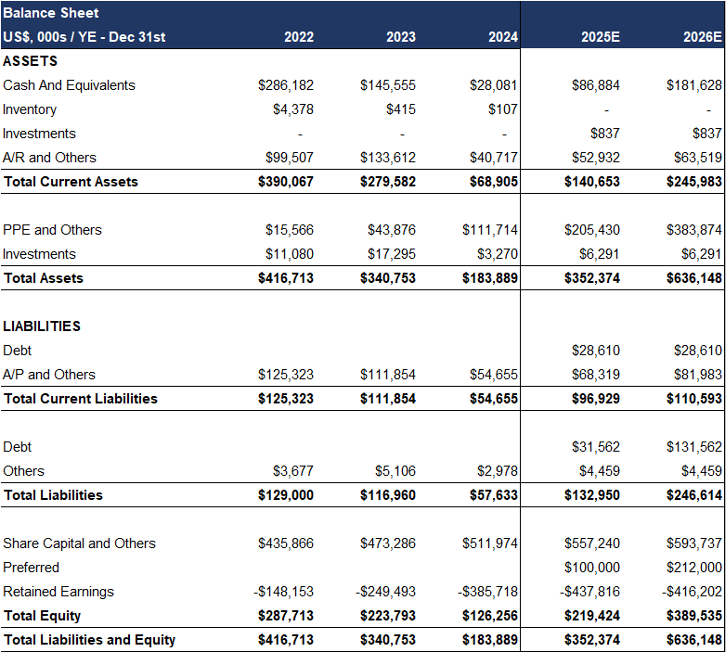

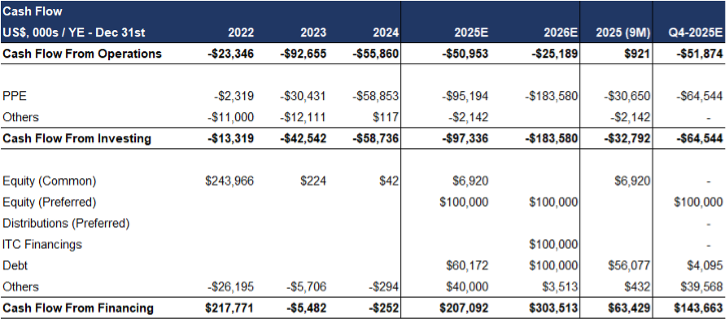

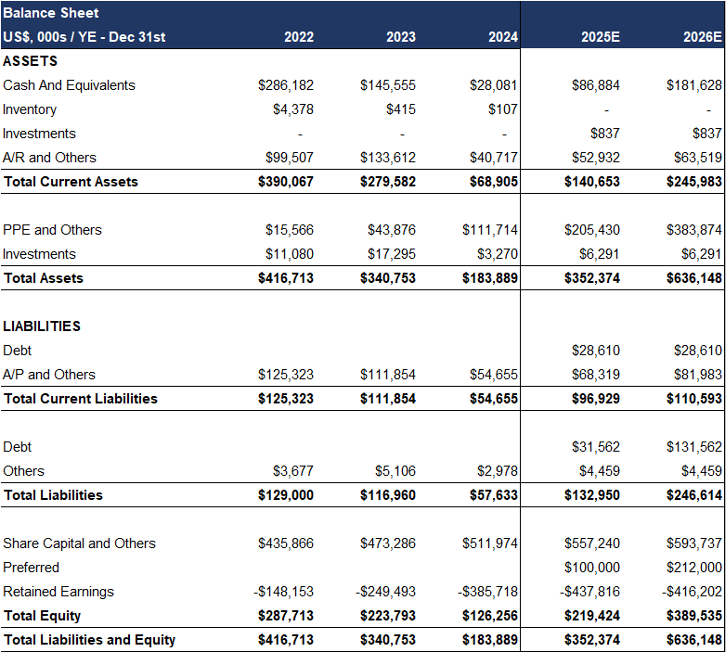

- Cash & Funding: The company had $62M in cash, and $60M in debt, at the end of Q3, and is well funded following a recent $300M financing from Orion Infrastructure Capital (OIC) to support the launch and growth of its Asset Vault division.

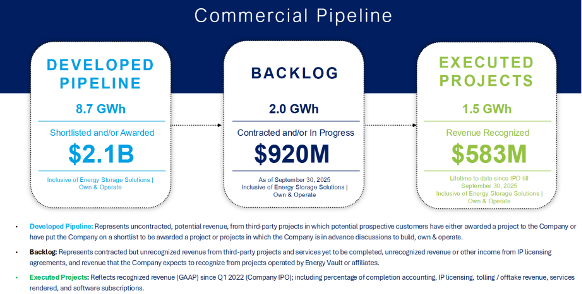

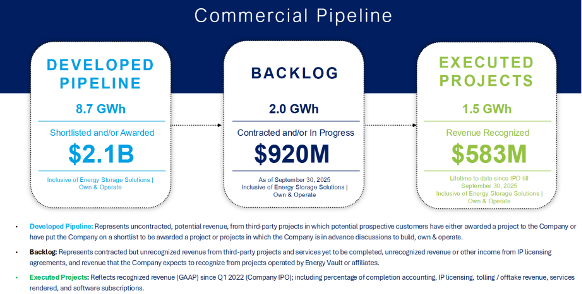

- Expands Project Pipeline: By the end of Q3, the company had 8.7 GWh in the pipeline (up from 5.9 GWh at the end of Q2), primarily driven by a recent agreement with EU Green Energy (a Balkan renewable energy developer) to deploy up to 1.8 GWh of storage systems in Europe over the next four years.

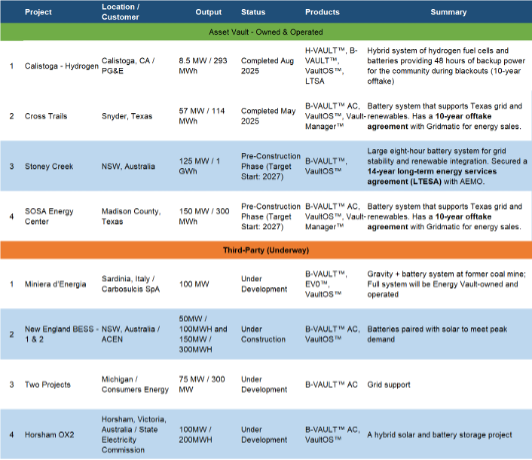

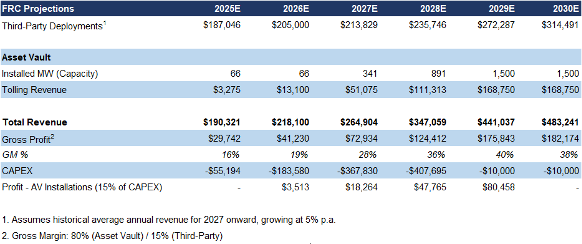

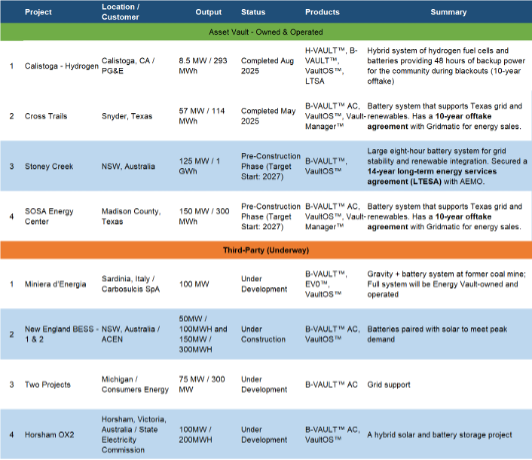

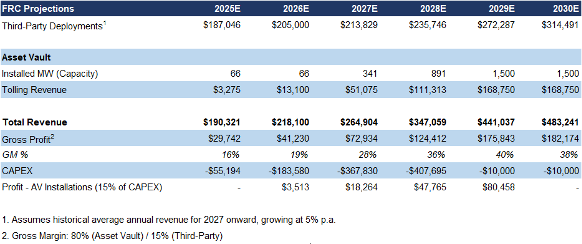

- The company’s primary focus remains on growing its Asset Vault division. The platform aims for $100–$150M in recurring EBITDA over four years across 1.5 GW of projects with $1B total CAPEX. The current portfolio consists of four projects (341 MW), including two operational and two in development, targeting $40M in annual EBITDA by 2027.

- Market outlook remains robust given rising power demand, renewable adoption, and grid reliability needs. Key drivers include AI data centers, and renewable integration.

- The company has a project backlog of approximately $250M from third-party deployments, expected to be recognized as revenue in 2025–2026.

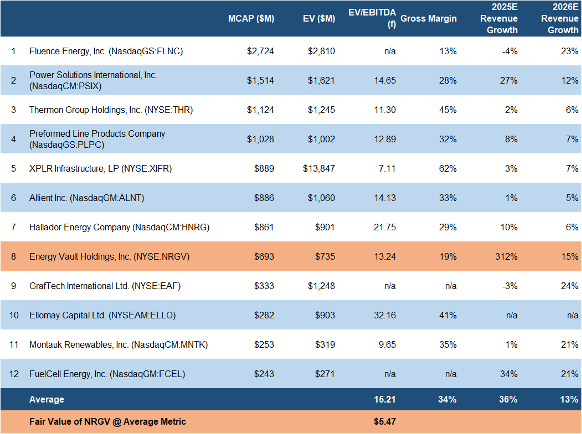

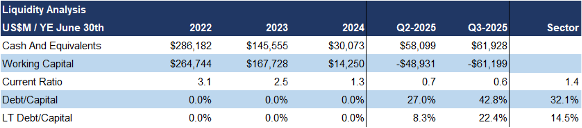

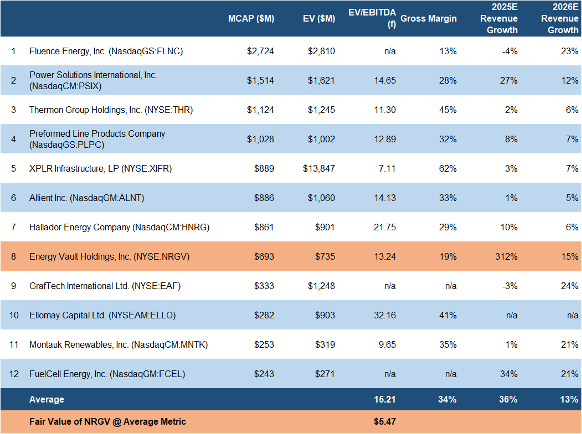

- NRGV is trading at 13x forward EBITDA vs the sector average of 15x, a 13% discount.

- Management reaffirmed 2025 full-year revenue guidance of $200–$250M, implying $150–$200M in Q4, up 350–500% sequentially.

Price and Volume (1-year)

* Energy Vault Holdings has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions. All figures in US$ unless otherwise specified.

Company Overview

Significantly expanded project pipeline: By the end of Q3, NRGV had deployed 1.5 GWh (Q2: 1.1 GWh), with 2.0 GWh in contracted backlog (Q2: 2.4 GWh), and 8.7 GWh in pipeline (Q2: 5.9 GWh)

Source: Company / FRC

Backlog projects total $920M in potential revenue, up 112% YTD, including about one-third from five third-party deployment projects (to be recognized in 2025–2026), and the remaining from tolling revenue tied to company-owned projects

Seven projects currently under development or construction, including two owned & operated and five third-party

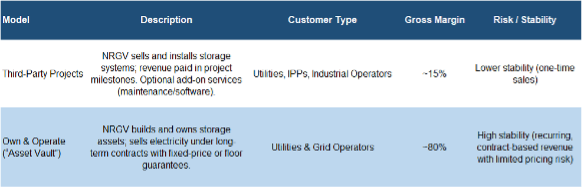

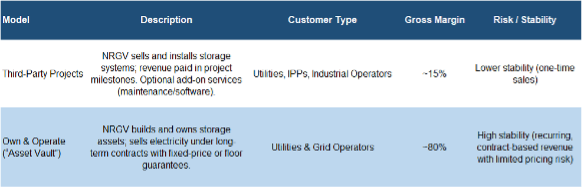

Business Model

NRGV is transitioning to an IPP, shifting primary revenue to long-term energy and power sales agreements (“tolling agreements”)

Low-margin third-party vs high-margin recurring Asset Vault revenue

Asset Vault Structure & Economics

*CAPEX to build a system is ~$0.30/Wh in the U.S. and ~$0.20/Wh outside the U.S., assuming a two-three hour duration

Source: Company / FRC

Asset Vault aims for $100-$150M annual recurring EBITDA within four years across 1.5 GW, or $0.07-$0.10/W; the four current projects (341 MW) target $40M EBITDA, or $0.12/W

Project economics depend on storage duration; longer-duration projects earn more EBITDA per MW (e.g., Sosa: two-hour → $0.07/W, Stoney Creek: eight-hour → $0.16/W)

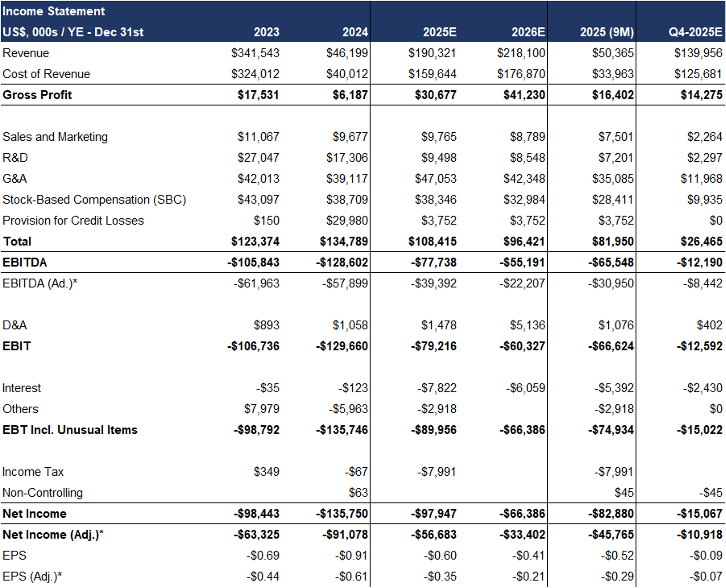

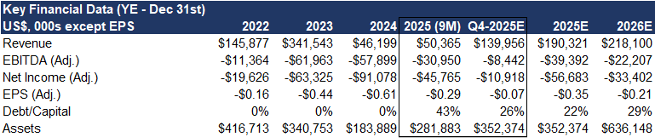

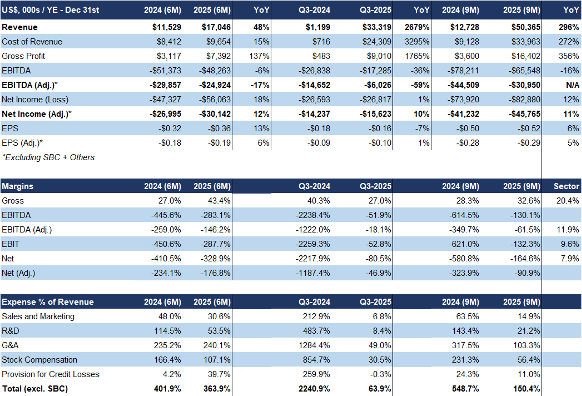

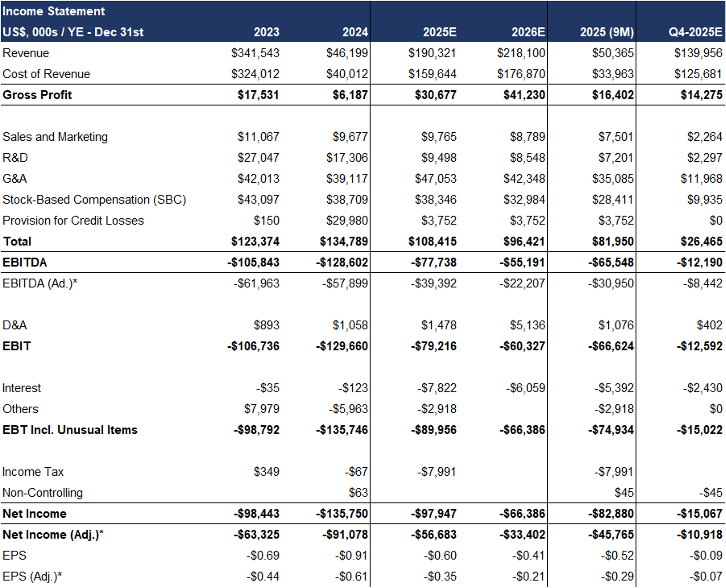

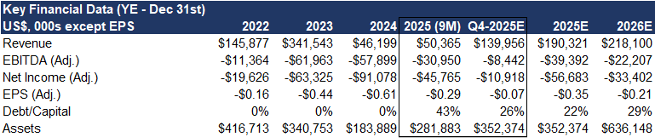

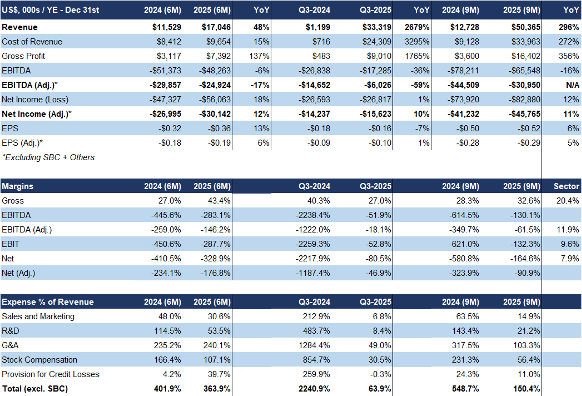

Financials

Q3 revenue, dominated by third-party deployment projects, was $33M, exactly in line with our estimate, compared to $1M in Q3-2024, and $17M in H1-2025

The higher mix of lower-margin project deployments led to gross margins declining 13 pp YoY to 27%

Operating expenses were up 7% YoY and came in 1% above our estimate

Adj. EBITDA improved significantly, from ($15M) to ($6M) on higher revenue vs our estimate of ($12M)

However, Adj. EPS fell to (-$0.10) from (-$0.09), driven by a higher income tax provision, missing our estimate of (-$0.08)

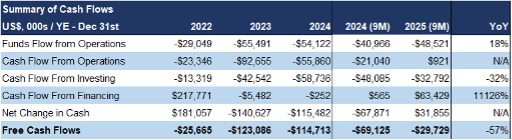

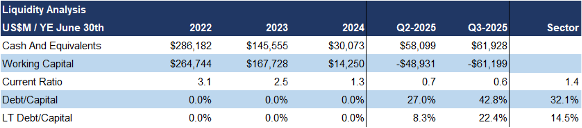

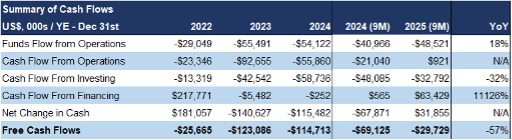

At the end of Q2, the company had $62M in cash, and $60M in debt

NRGV is well funded following the recent $300M financing deal with OIC

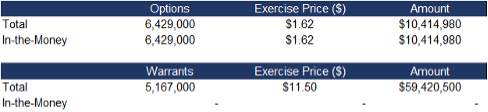

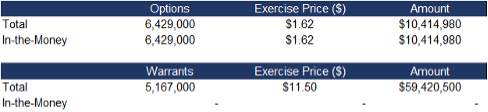

In-the-money options can bring in $10M

Source: FRC / Company

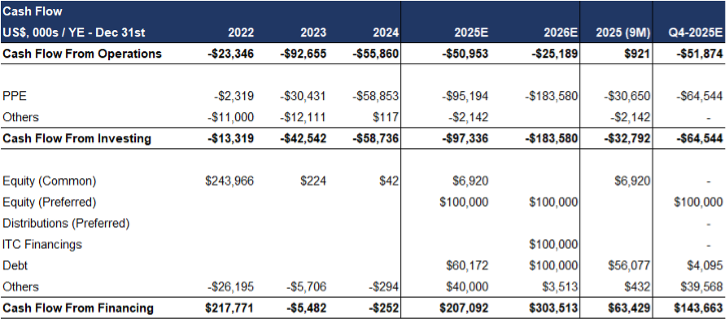

FRC Valuation and Rating

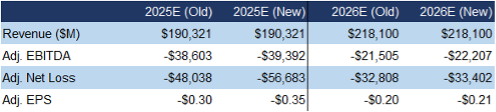

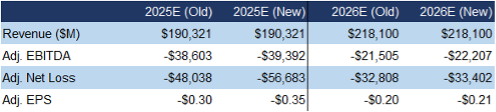

2025–2026 revenue forecasts unchanged; 2027+ raised on pipeline growth

We continue to expect ongoing project acquisitions for Asset Vault, scaling total capacity to 1.5 GW by 2029

Even though we are maintaining our 2025 revenue estimate, we are lowering our EPS forecast due to the higher income tax provision recorded in Q3

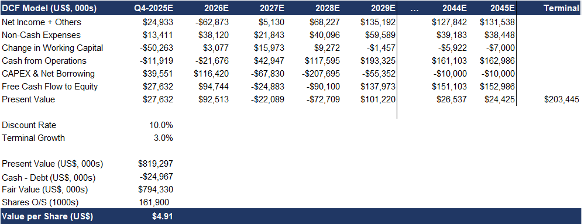

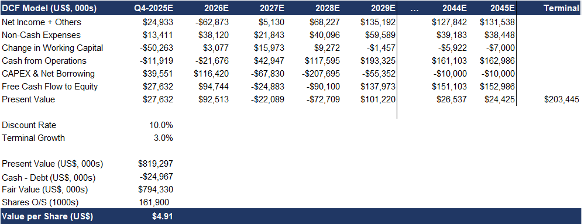

DCF valuation updated to $4.91/share, up from $4.21/share, due to stronger long-term revenue outlook

Source: FRC

*We use the present value of our 2029 EBITDA estimate for NRGV in this calculation.

Source: FRC / S&P Capital IQ

NRGV is trading at 13x forward EBITDA (previously 12x) vs the sector average of 15x (previously 16x); applying the sector multiple yields a comparables valuation of $5.47/share (previously $5.53/share)

We are reiterating our BUY rating, and adjusting our fair value estimate from $4.87 to $5.19/share (the average of our DCF and comparables valuations). We believe NRGV is well-positioned in the growing grid-scale energy storage market, supported by rising power demand, AI data centers, and renewable integration. Its Asset Vault platform provides visibility to recurring revenue and long-term EBITDA growth, backed by a strong project pipeline and solid funding.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- Tariffs: U.S. tariffs on Chinese lithium-ion imports may raise costs

- Policy: Changes in green energy incentives could reduce demand

- Credit: Customer or partner defaults may affect revenue

- Compliance: Projects must meet all regulations and permits

- Financing: High upfront costs require funding

- Sales Cycle: Long nine-to-18-month installation delays revenue

- FOREX

While the company operates in a relatively low-risk market with potential for long-term steady cash flow, we believe its early-stage deployment warrants a risk rating of 4 (Speculative)

APPENDIX