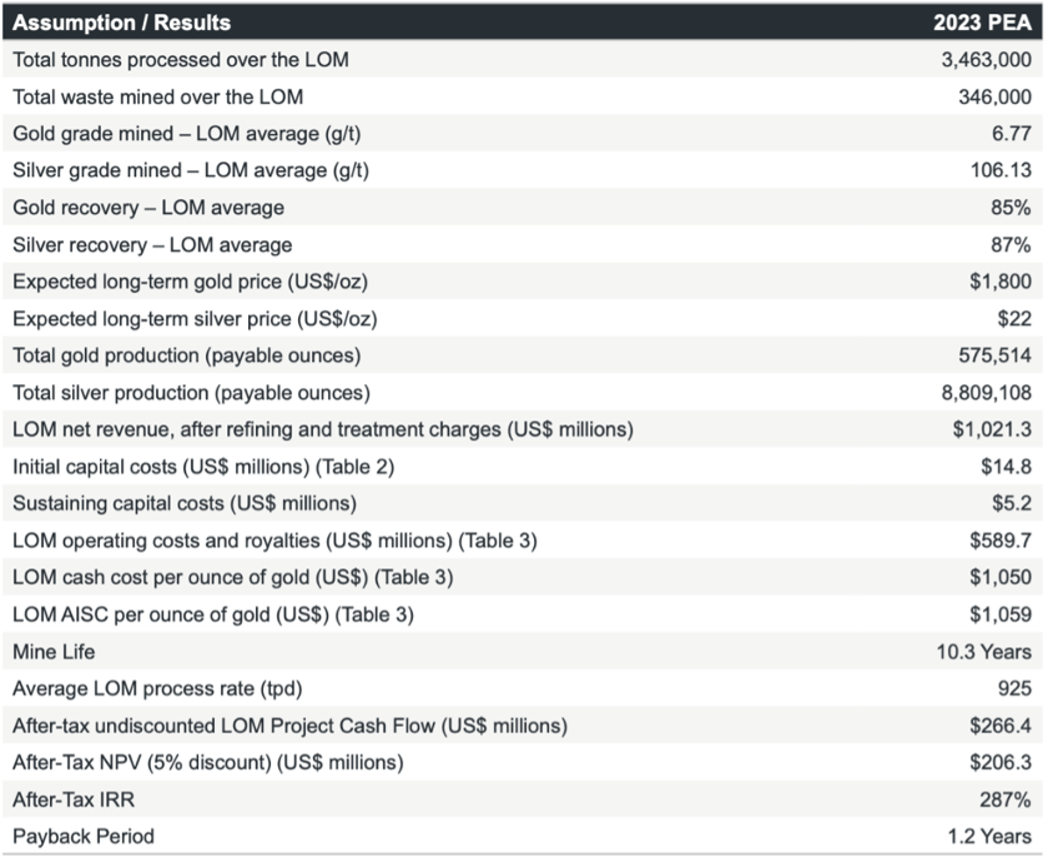

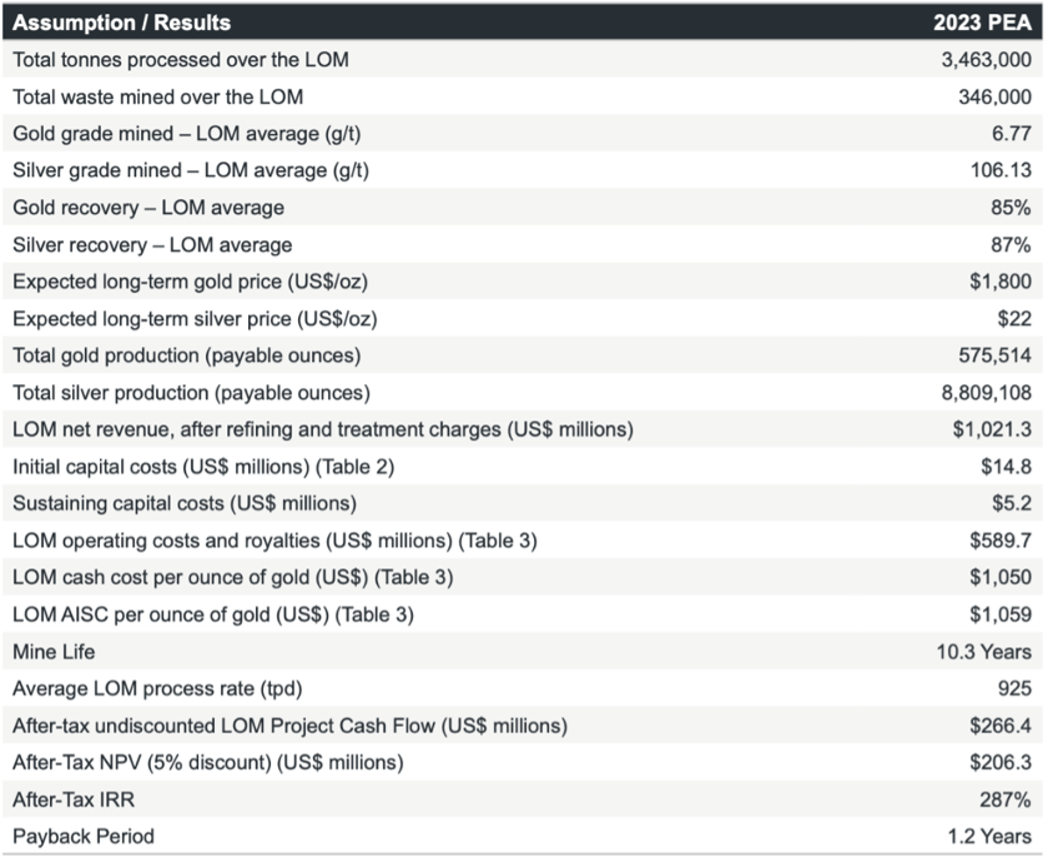

- Management aims to release an updated PEA by Q4 2025. The previous 2023 PEA reported an AT-NPV5% of $206M, and a very high AT-IRR of 287%, based on $1,800/oz gold vs the current spot price of $3,980/oz.

- DMET has commenced activities to restart operations at its Aguablanca project in Spain, the country’s only nickel mine, and an EU-recognized strategic project. Management is targeting production by mid-2026, with potential annual output of 70 kt of nickel-copper concentrates. Concurrently, a PEA on the Lomero project is planned for completion in early 2026.

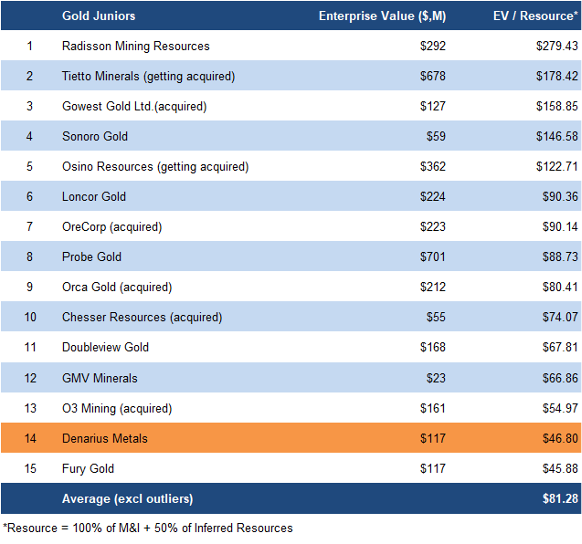

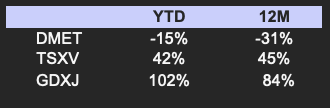

- With gold near record highs, we anticipate robust M&A activity over the next 12 months as larger companies target juniors. We remain positive on gold prices, supported by US$ weakness, strong safe-haven demand amid economic and geopolitical uncertainty, and potential global GDP pressures.

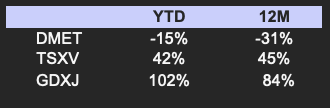

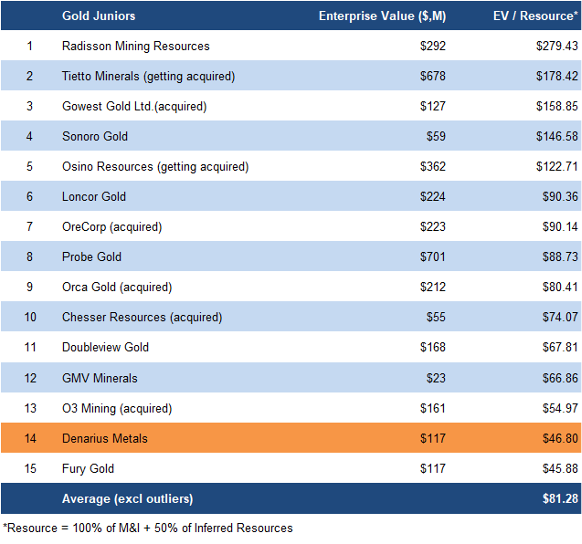

- DMET is trading at C$47/oz vs the sector average of C$81/oz gold equivalent. Upcoming catalysts include drilling, an updated PEA, and construction of the Zancudo processing plant, restart of Aguablanca operations, and a PEA on Lomero.

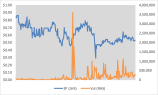

Price and Volume (1-year)

* Qualified Person: Dr. Stewart D. Redwood, PhD, FIMMM, QMR, FGS, Consulting Geologist to DMET

* Denarius Metals Corp. has paid FRC a fee for research coverage and distribution of reports. See last page for other important disclosures, rating, and risk definitions. All figures in US$ unless otherwise specified.

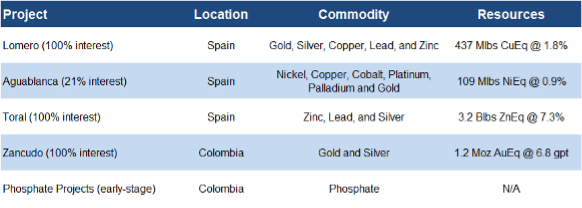

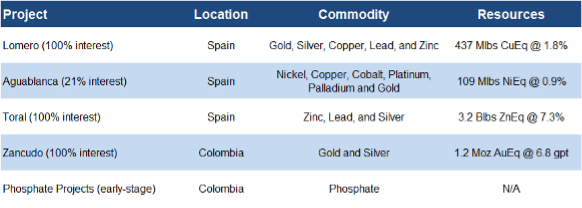

Portfolio Summary

Portfolio of four polymetallic projects, with Zancudo in pre-production, and Aguablanca positioned for near-term production

Source: Company

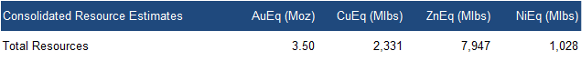

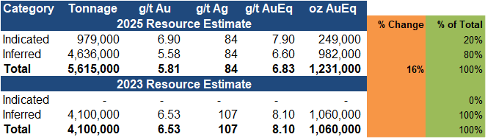

Combined resources of 3.50 Moz AuEq or 2.33 Blbs CuEq across four projects

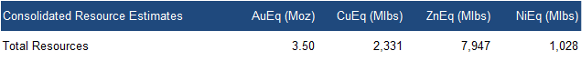

Zancudo Gold-Silver Project, Colombia (100% interest)

DMET has received final approval to build a 1,000 tpd processing plant, with concentrate production targeted for Q2-2026. The project commenced pre-production in Q2-2025. To date, DMET has shipped material containing 207 oz of gold, and 5 koz of silver.

Plant commissioning targeted for H1-2026

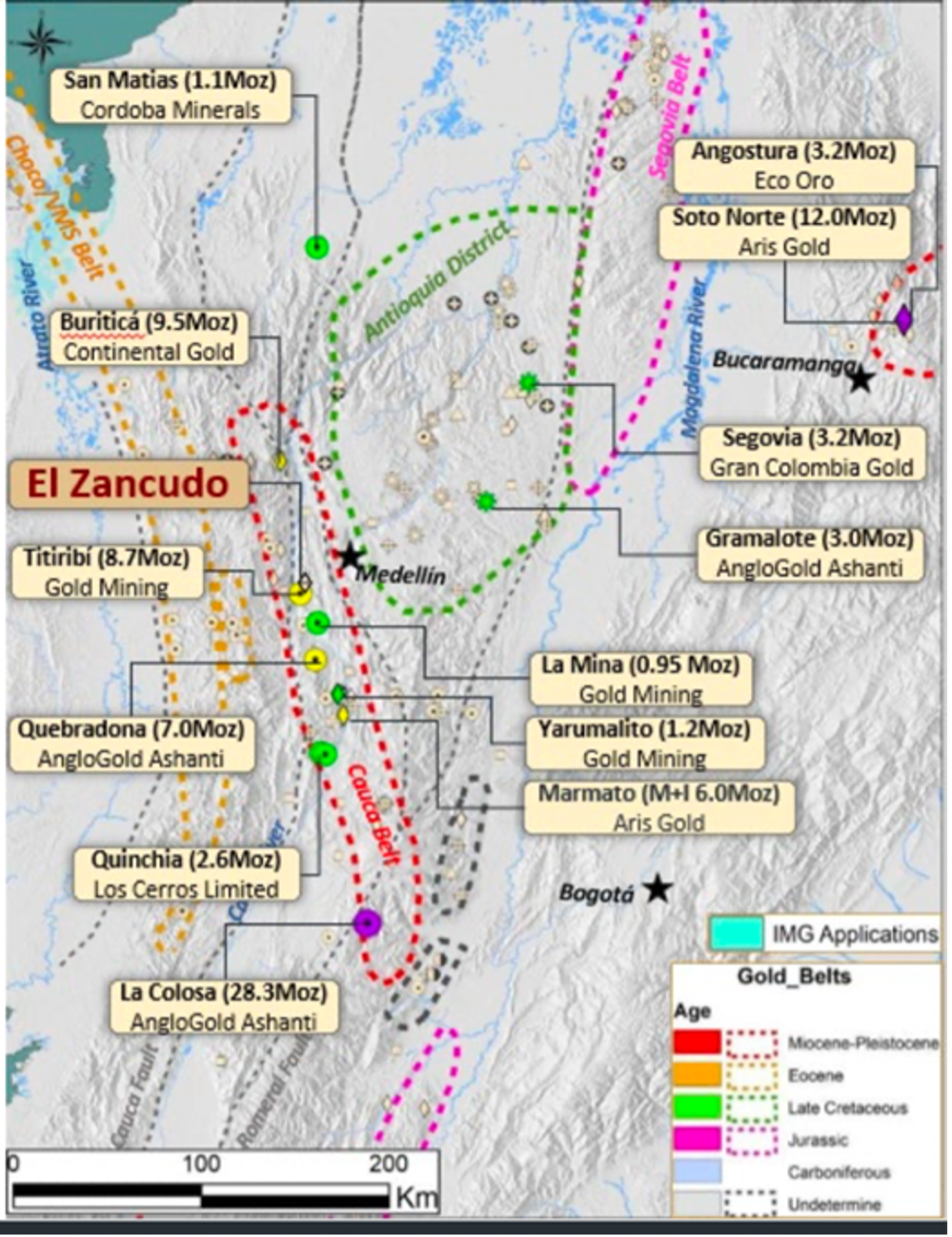

Project Location

The Zancudo district has produced 1.4-2.0 Moz AuEq

30 km southwest of Medellin

The project hosts a high-grade gold-silver-quartz vein system (3.5 km strike length x 0.4 km depth), and the historic Independencia gold mine

Excellent infrastructure, including underground mine access, connection to the national power grid, and water supply

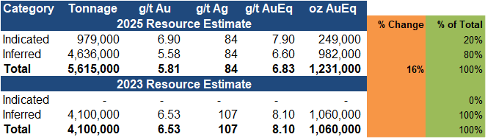

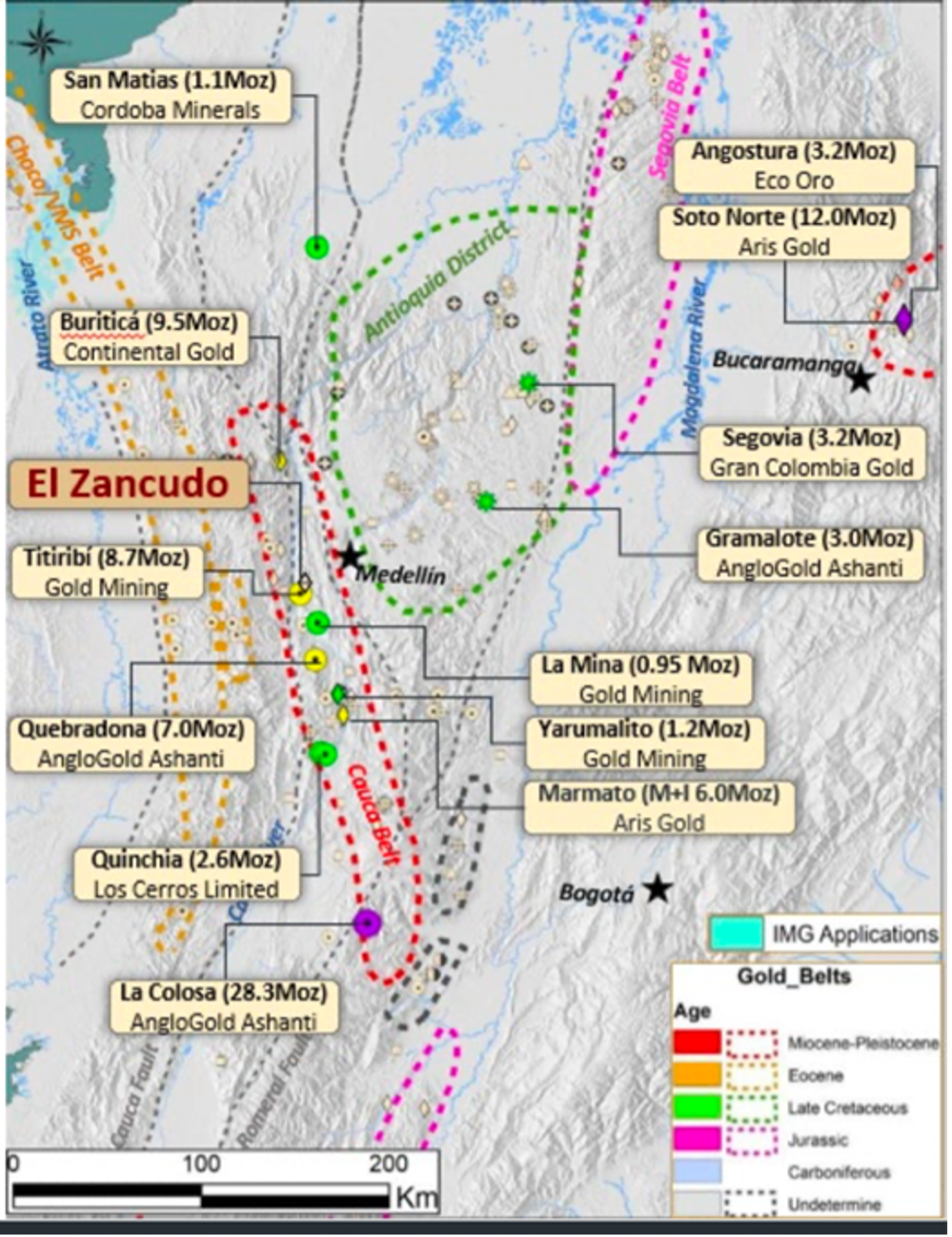

Earlier this week, DMET completed an updated resource estimate.

Zancudo Resource Estimate

(QP: Scott E. Wilson, CPG, President of Resource Development Associates Inc.)

Source: Company

Resources increased 16% to 1.23 Moz AuEq

Indicated resources now account for 20% of the total (previously nil), implying we now have greater confidence in the resource estimate

Source: Company

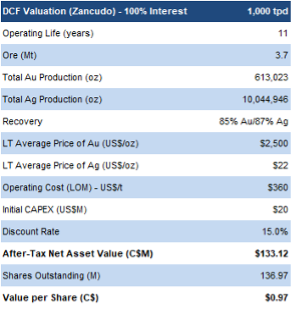

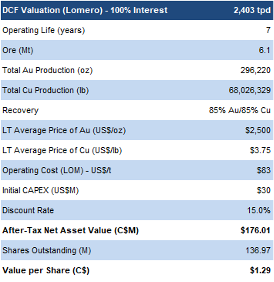

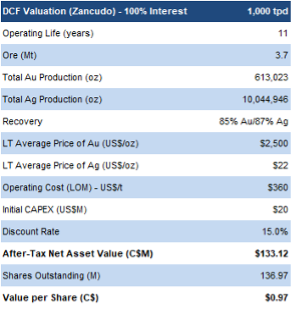

Low initial CAPEX

10-year underground operations

Management intends to complete an updated PEA by year-end

AT-NPV5% of $206M, and a very high AT-IRR of 287%, using $1,800/oz Au (spot: $3,980/oz); For context, we view IRRs above 50% as highly attractive for mining projects

Given the recent resource update, and the significant rise in gold prices since the last PEA, we anticipate stronger project economics

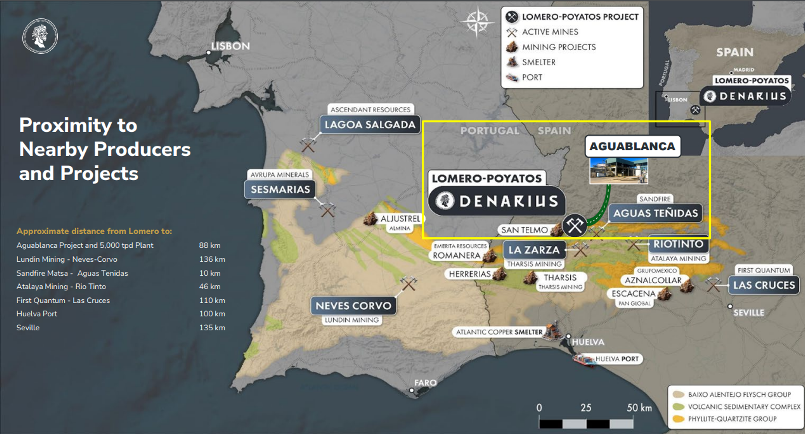

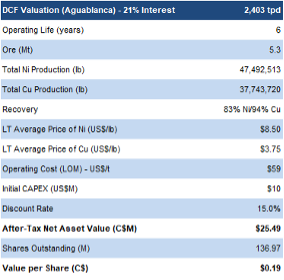

Aguablanca Polymetallic Project (21% interest, operator), Spain

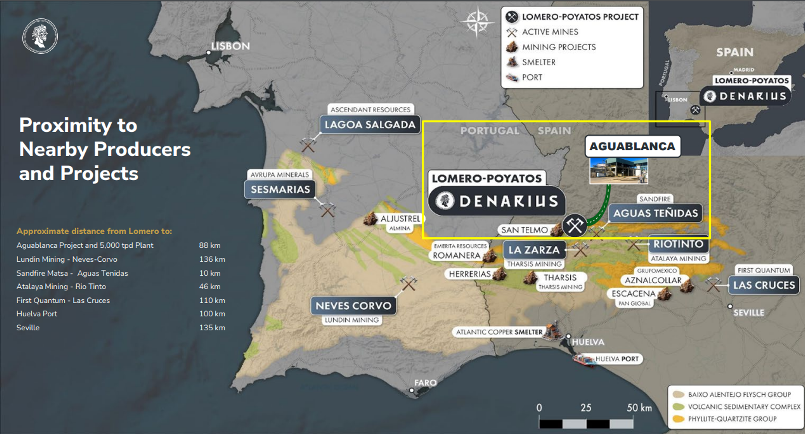

The Aguablanca project, which operated as an open-pit nickel-copper mine from 2005 to 2015, is planned to restart as an underground mine. It benefits from an existing 5,000 tpd processing plant, located 88 km from the company's Lomero project, with the capacity to process material from future Lomero operations.

Project Location

Source: Company

Recognized as a “Strategic project” by the European Commission

This project hosts the only known nickel-copper deposit in Spain

Fully permitted to re-start operations

The 2024 PFS assumed the project uses only 50% of the processing plant’s capacity, reserving the rest for Lomero to accelerate and reduce its production costs.

Located 88 km from DMET’s Lomero project

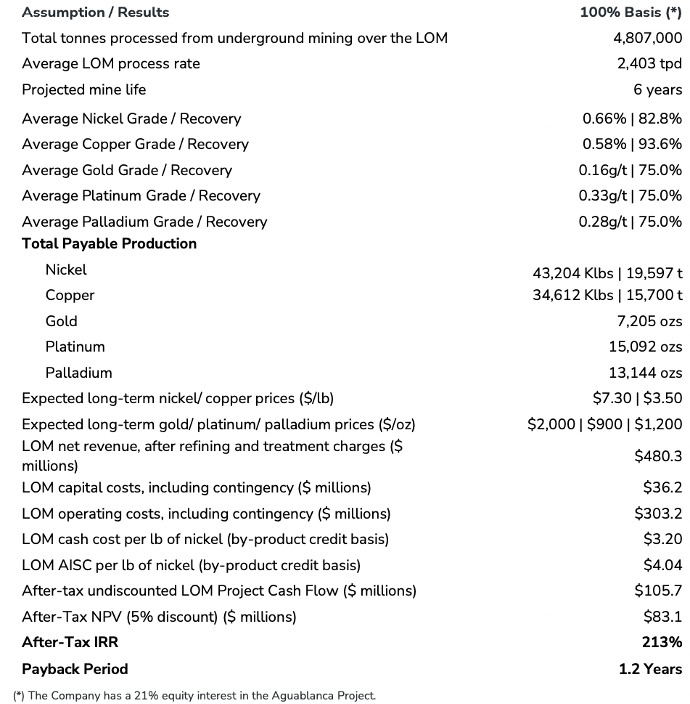

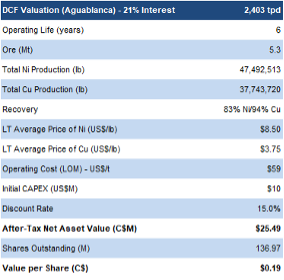

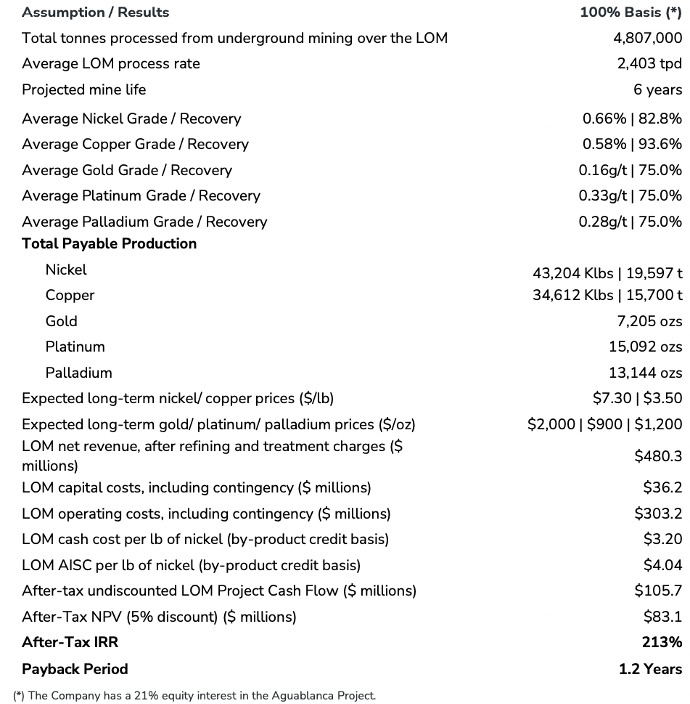

Aguablanca Polymetallic Project – Pre-Feasibility Study

With a well-maintained 5,000 tpd processing plant, the PFS estimated a low initial CAPEX of $6M

AT-NPV5% of $83M, and a very high AT-IRR of 213%, using $7.30/lb Ni (spot: $6.56/lb), and $3.50/lb Cu (spot: $4.98/lb Cu)

DMET has arranged an offtake agreement with Boliden AB (STO: BOL), a Swedish metals and mining company

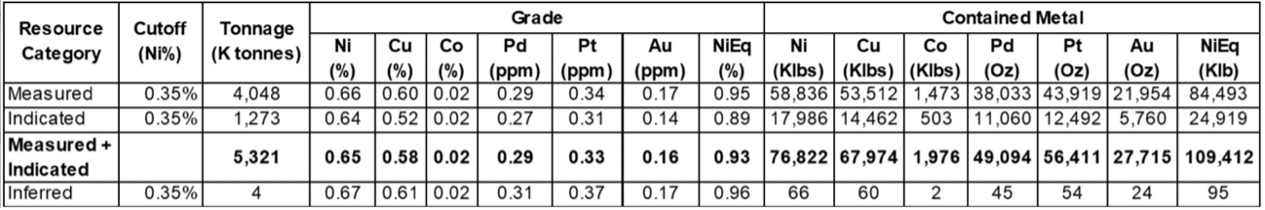

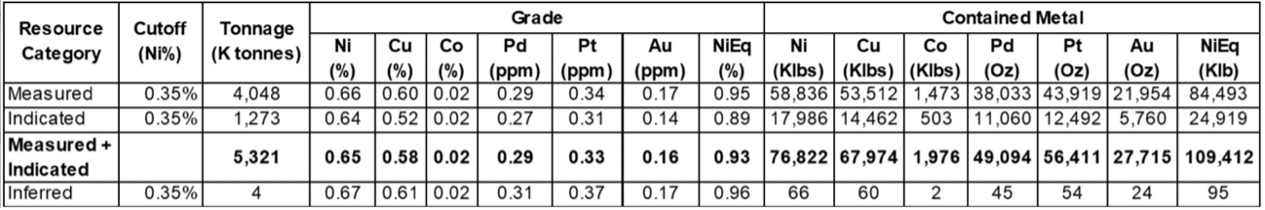

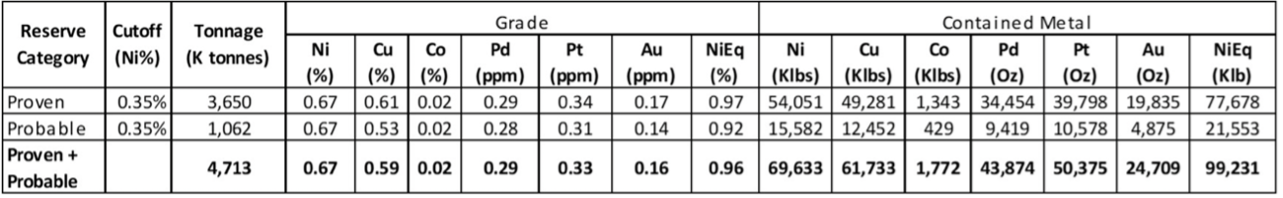

2024 Resource Estimate (inclusive of reserves)

Underground resources total 110 Mlbs NiEq

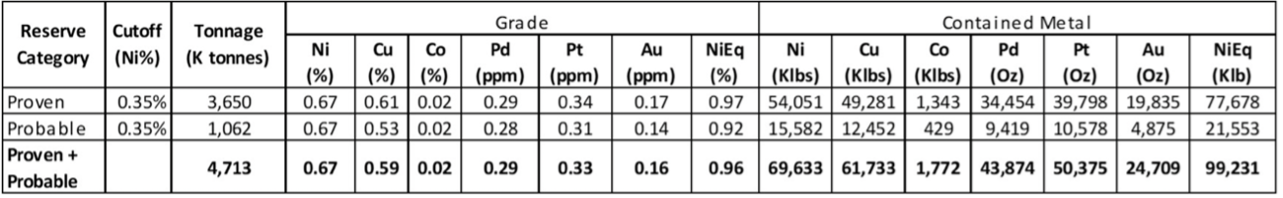

2024 Reserve Estimate

(QP: Scott E. Wilson, CPG, President of Resource Development Associates Inc.)

Source: Company

This is a medium-tonnage deposit with a moderate grade of 0.93% (for reference, low grades are <0.3%, and high grades are 1.5%+)

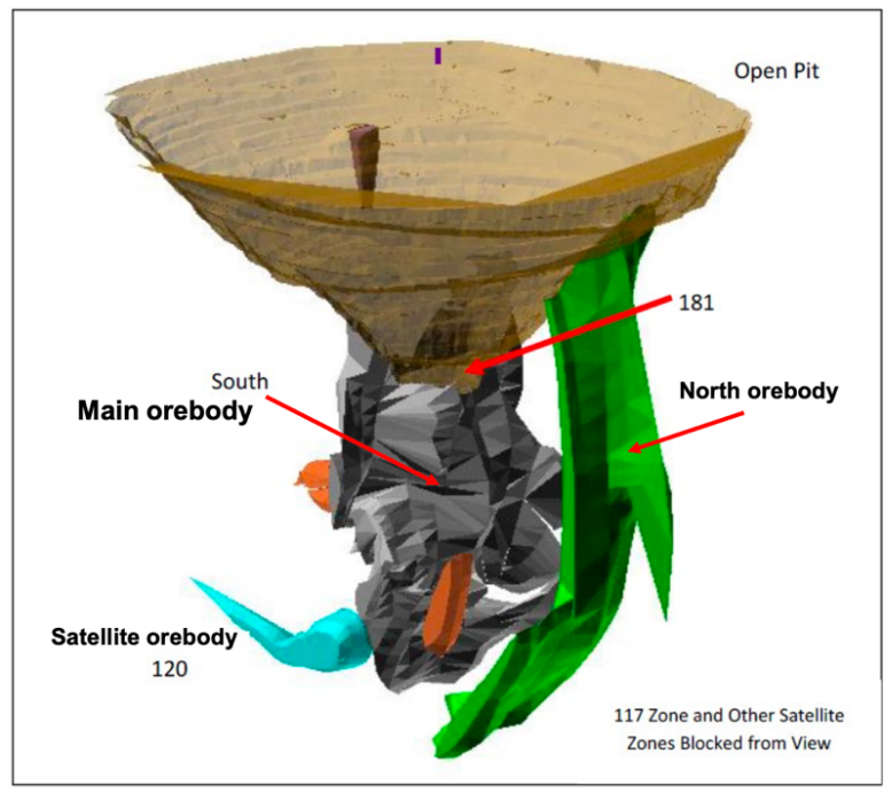

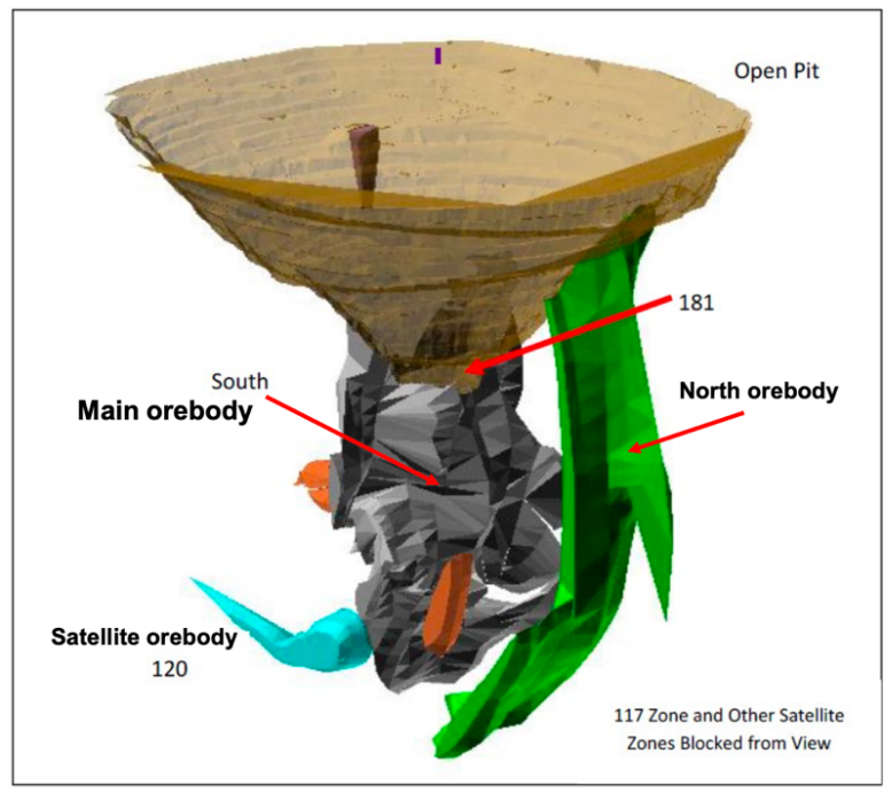

Exploration Upside

Source: Company

We note that there is significant resource expansion potential as the deposit remains open along the north, main, and satellite orebodies

Upcoming Catalysts

- Zancudo: Updated PEA expected in Q4 2025; 2026 drilling campaign in preparation. As previously mentioned, we anticipate improved economics in the updated PEA, given the recent increase in resources and higher metal prices.

- Aguablanca: Plant restart, dewatering, and underground mine prep underway for mid-2026 production.

- Lomero: PEA to be finalized soon, followed by 2026 resource expansion drilling.

- Toral: Updated resource estimate in 2026, followed by a PEA.

Advancing all four projects simultaneously

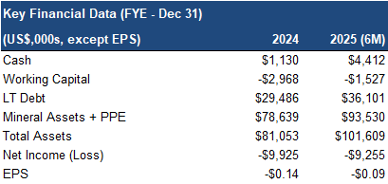

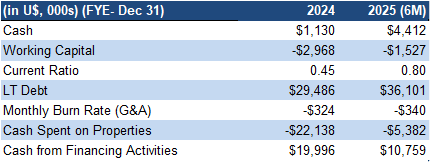

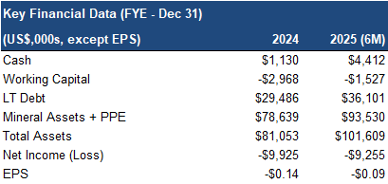

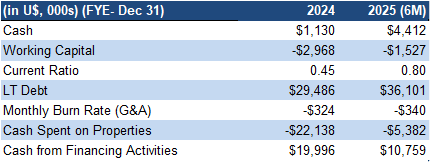

Financials

At the end of June 2025, the company had $4M in cash, and $36M in debt

Source: FRC / Company

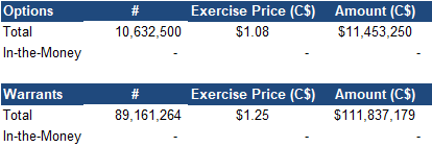

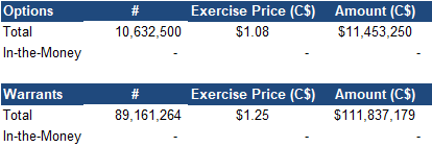

All options and warrants are out of the money

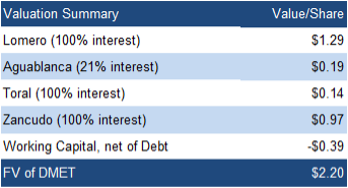

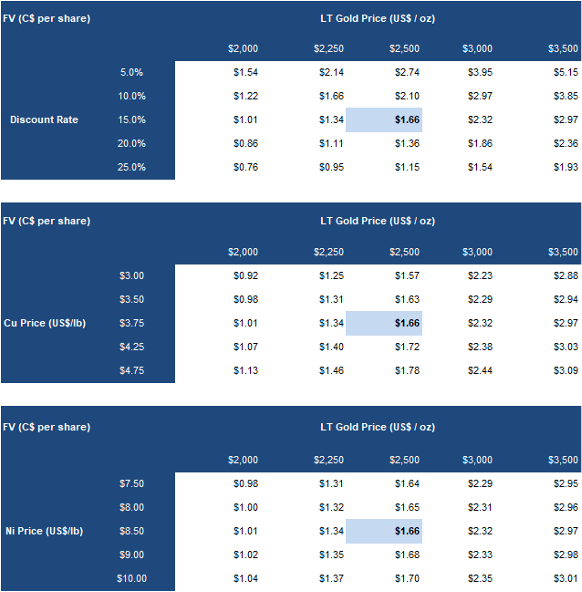

FRC Projections and Valuation

Source: FRC/S&P Capital IQ/Various

DMET is trading at C$47/oz (unchanged) vs the sector average of C$81/oz (previously C$62/oz

Our comparables valuation rose from C$1.06 to C$1.13/share, driven by higher sector valuations, partly offset by share dilution from equity financings

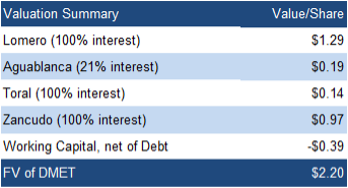

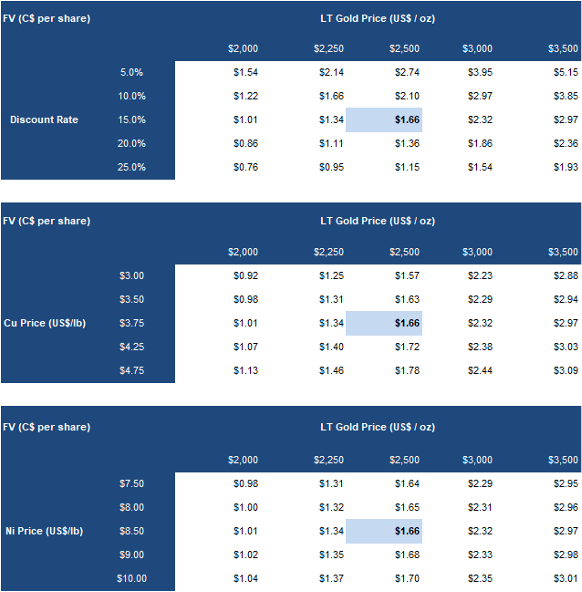

Our DCF (NAV) valuation fell from C$2.55/share to C$2.20/share, mainly due to share dilution, partly offset by higher metal price forecasts

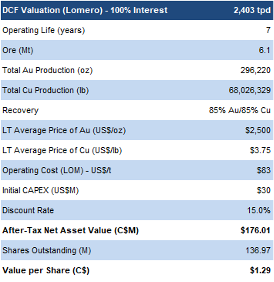

These tables summarize our valuation on each project

Source: FRC

The average of our DCF and comparables valuations is C$1.66/share (previously C$1.81/share)

Our valuation remains highly sensitive to metal prices

We are reiterating our BUY rating, and adjusting our fair value estimate from C$1.81/share to C$1.66/share (the average of our DCF and comparables valuations). DMET is progressing high-potential projects, with Zancudo and Aguablanca targeting production in 2026. Trading below the sector average, the company offers diversified exposure to precious and base metals, with upcoming PEAs providing potential near-term catalysts for the share price.

Risks

- Commodity prices

- Exploration, development, and permitting

- FOREX

- No guarantee that the company will be able to advance all of its projects simultaneously

- Access to capital and potential for share dilution

We are maintaining our risk rating of 5 (Highly Speculative)