Skyharbour Resources Ltd.

Growing M&A Prospects in the Junior Uranium Space

Published: 12/8/2023

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | US $0.53 |

| Fair Value | US $1.16 |

| Risk | 5 |

| 52 Week Range | US $0.32-0.64 |

| Shares O/S (M) | 170 |

| Market Cap. (M) | US $90 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | 3.3x |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- SYH has expanded its portfolio by staking three uranium properties. Currently, SYH's land package spans 518k hectares across 24 properties, representing one of the largest portfolios among uranium juniors in the Athabasca basin.

- The company has completed a maiden drill program (9,565 m/19 holes) at the Russell Lake project, optioned from Rio Tinto/NYSE: RIO. Despite the program yielding low grades, mineralization has been confirmed over a strike length exceeding 1 km at one of the targets. A follow-up drill program is expected to commence in Q1-2024.

- Management is also planning a follow-up drill program at its flagship Moore Lake project, before completing a maiden resource estimate.

- Option partners are actively advancing their projects. SYH anticipates receiving payments totaling $2M in cash/shares from its partners in the upcoming months.

- Uranium prices are up 20% to US$81/lb (up 68% YoY) since the Israel-Hamas war broke two months ago. The Sprott Physical Uranium Trust (TSX: U-UN), the world’s largest physical uranium investment fund, has increased its holdings by 1% in the past two months to 62.9 Mbls (up 6% YoY). Given that Russia contributes to 35% of global enriched uranium production, we believe the uranium supply chain remains highly vulnerable. According to the World Nuclear Association, uranium demand for nuclear reactors is projected to rise by 28% by 2030, and nearly double by 2040. Consequently, we believe majors will likely pursue M&A to secure long-term supply.

- We foresee several catalysts from both the ongoing and planned exploration programs by SYH, and its partners.

Portfolio Summary

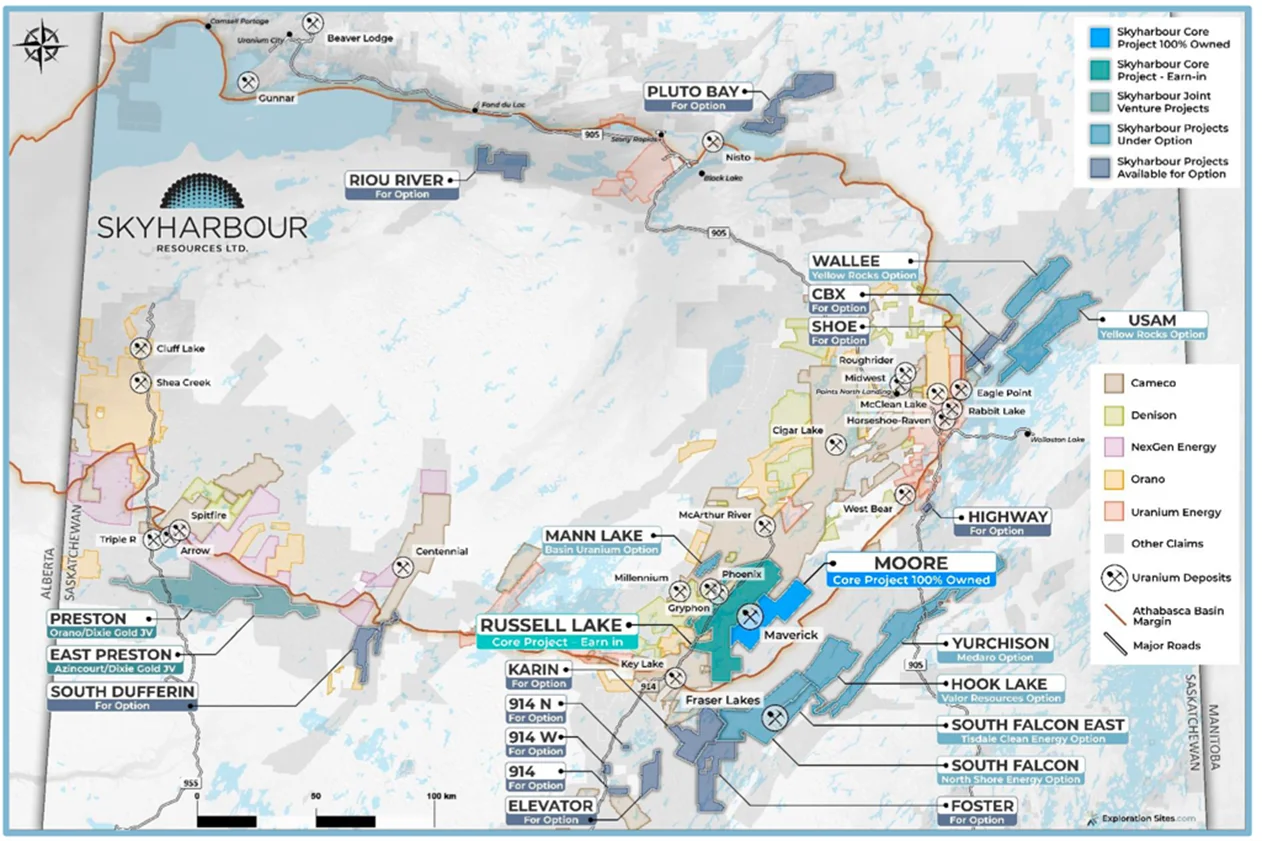

SYH’s Portfolio

24 properties, covering 518k hectares, in the Athabasca basin

The Athabasca basin hosts some of the world’s richest uranium projects

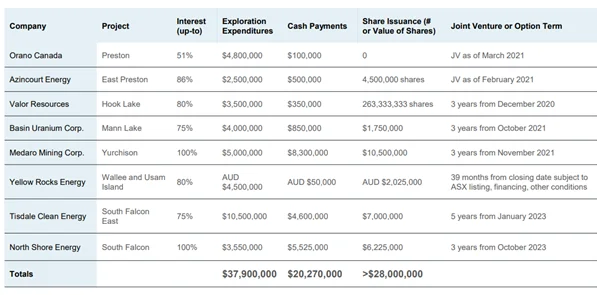

JV/Option Agreements

Source: Company

Nine projects with JV/ option agreements

Partners have committed $38M for exploration, and $48M in cash/share payments to SYH

Russell Lake Uranium Project

SYH has completed a maiden drill program totaling 9,595 m/19 holes, including 15 holes at the Grayling zone, and four holes at the Fox Lake Trail target.

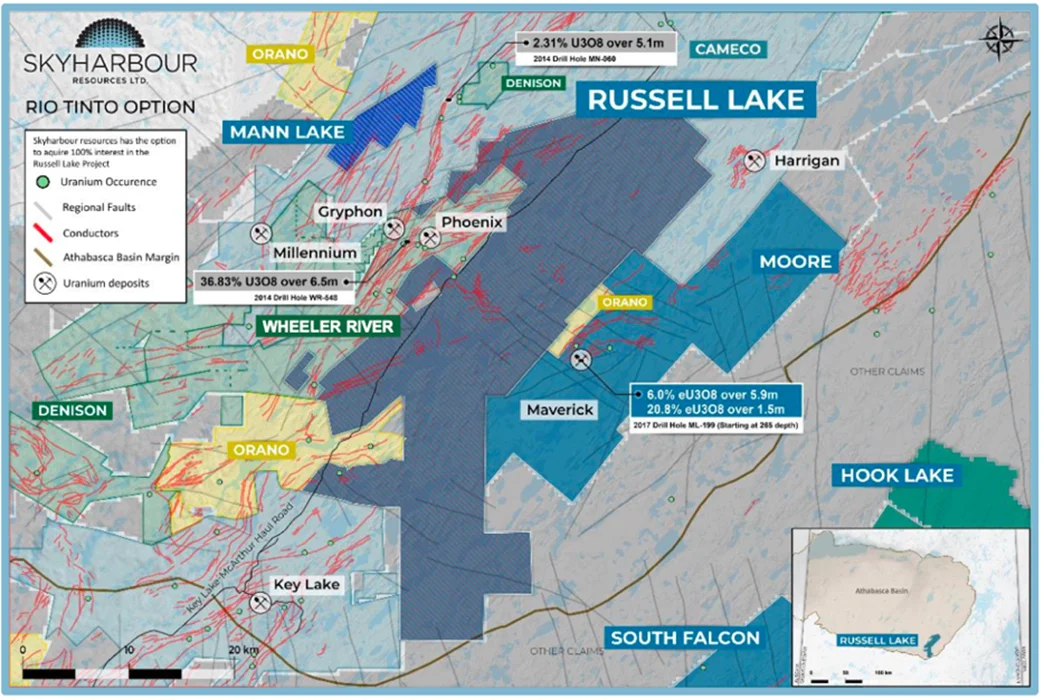

Location Map

Source: Company

Russell Lake is strategically located between SYH’s Moore uranium project, and Denison’s (TSX: DML) Wheeler River project, and close to Cameco’s (TSX: CCO) Key Lake mill, and MacArthur River mines

35+ km of untested targets

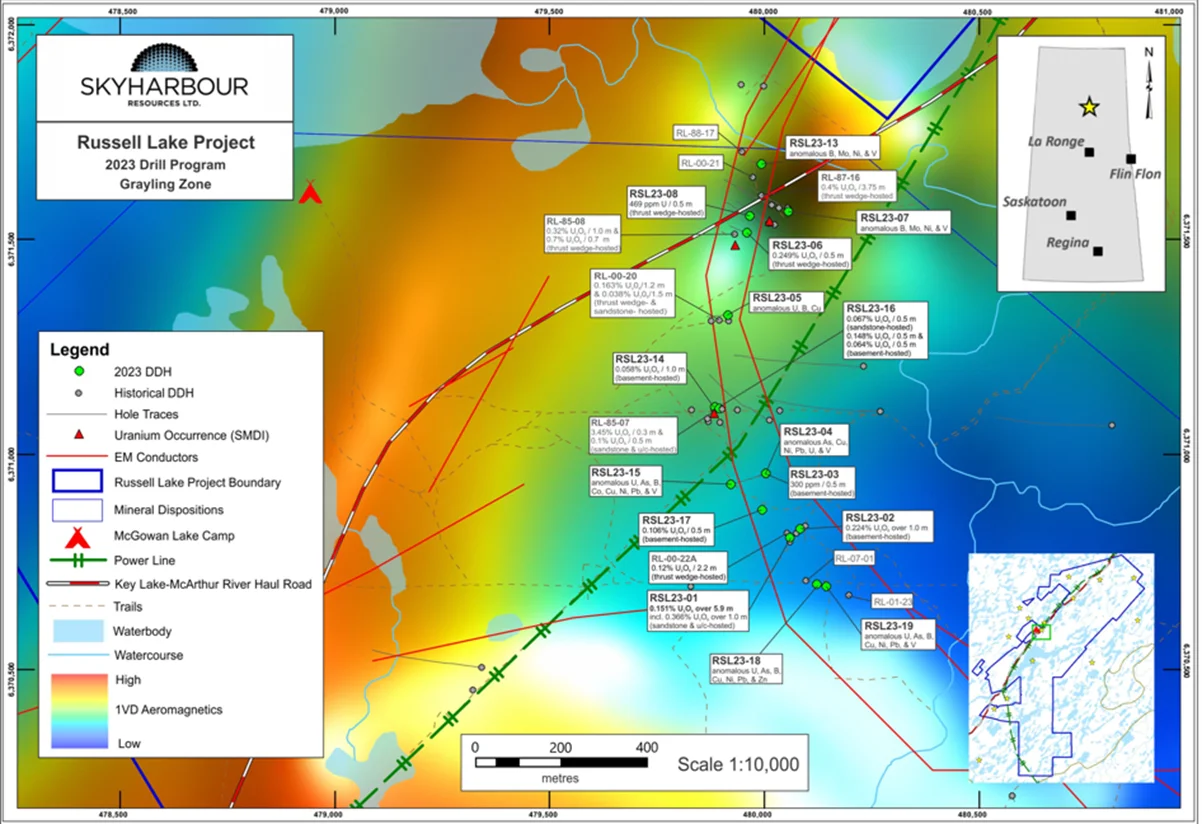

Mineralization was encountered in most of the drill holes at the Grayling zone, with notable results such as 5.9m of 0.15% U3O8 starting at 338 m, including 1.0m of 0.37%. Despite the program yielding low grades, it is noteworthy that mineralization has been confirmed over a strike length exceeding 1 km at Grayling.

2023 Drill Map (Grayling Zone)

Source: Company

Management is planning a follow-up drill program (4,000 to 5,000 m) in Q1-2024.

Drilling has confirmed mineralization over a strike length exceeding 1 km at Grayling

Updates on Other Projects

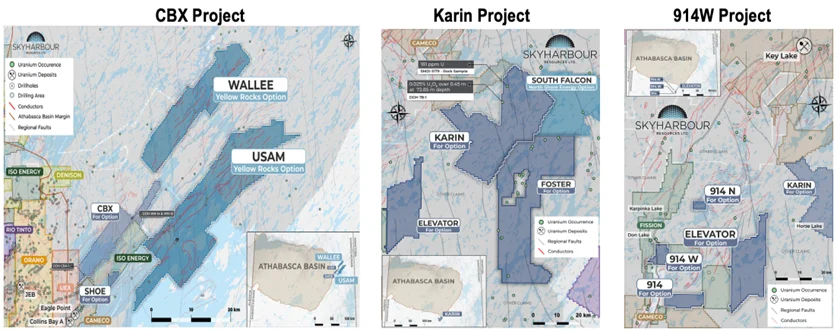

In August 2023, SYH staked three early-stage uranium prospects (CBX, Karin, and 914W) in northern Saskatchewan. Management is seeking JV partners to advance these projects.

New Claims Map

Source: Company

Three prospects covering 13,945 hectares

CBX is located 25 km northeast of the Eagle Point uranium mine owned by Cameco

914W is 48 km southwest of Cameco’s Key Lake operations

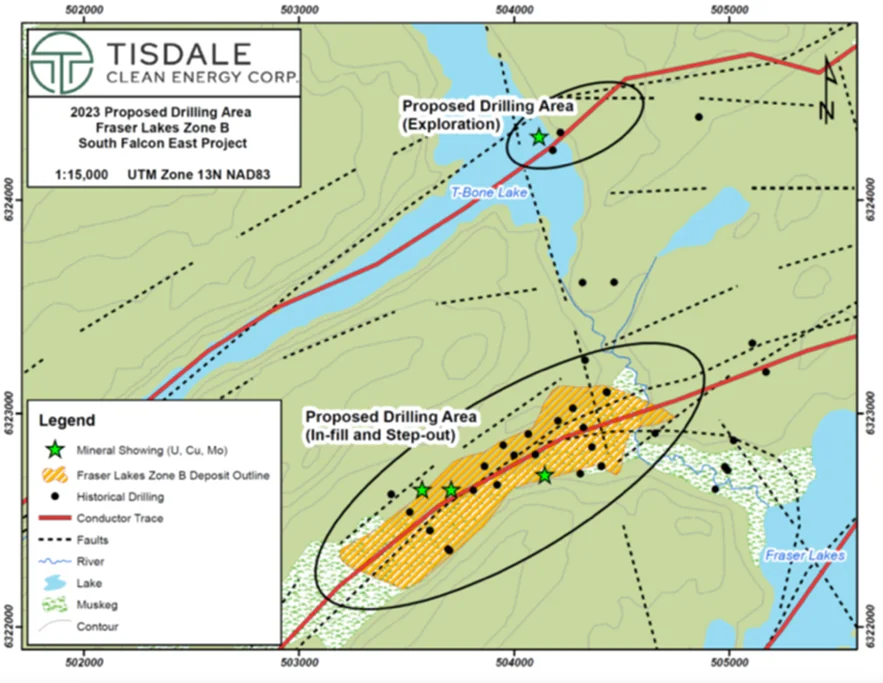

Partner Tisdale Clean Energy Corp. (TSXV: TCEC/MCAP: $3M) is initiating a 2,000 m step-out/in-fill drill program at the South Falcon East uranium project, prior to completing an updated resource estimate. In 2015, a maiden resource study had returned 7 Mlbs at 0.03% U3O8 of inferred resources.

2023 Proposed Drill Holes

Source: TCEC / Company

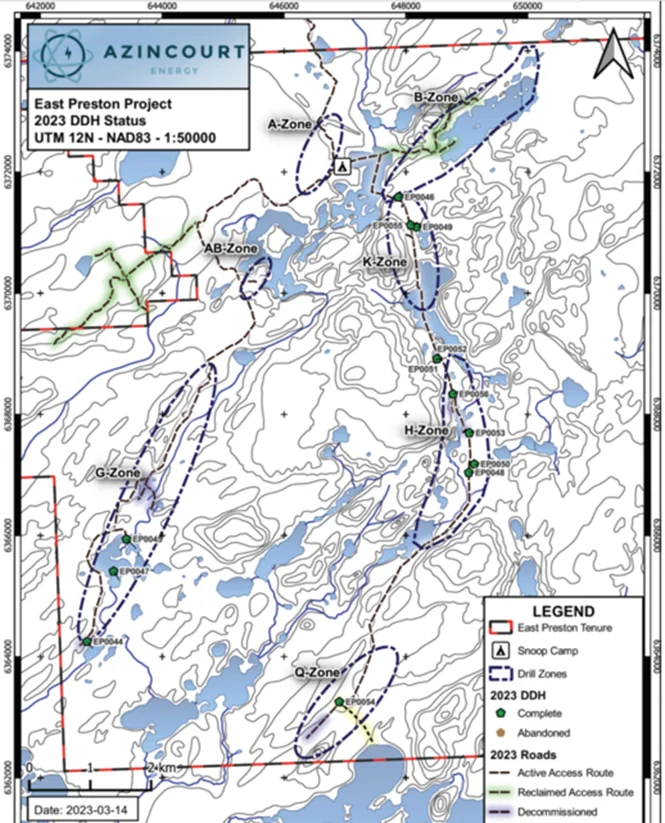

Azincourt (TSXV: AAZ/MCAP: $7M) is planning a winter drill program at the East Preston project, focusing on further testing the K- and H-zones indicated in the map below. A drill program conducted this year (3,066 m/13 holes) identified clay content, typically associated with uranium deposits, but did not yield any notable intercepts.

East Preston Targets

Source: Azincourt Energy / Company

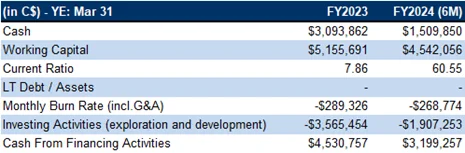

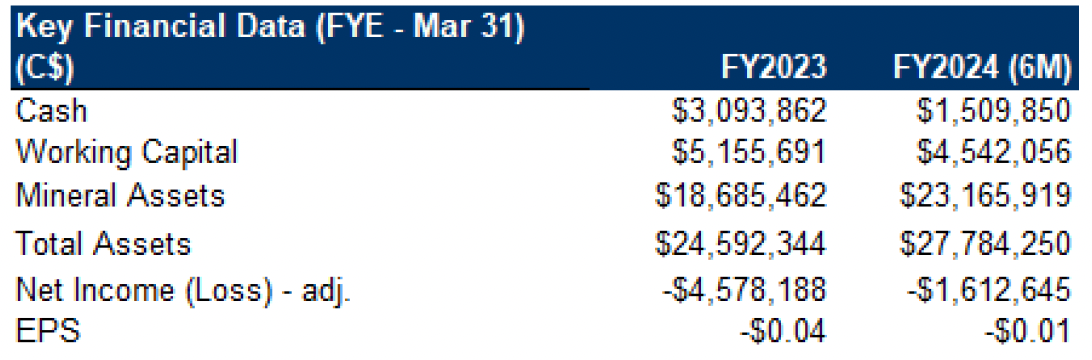

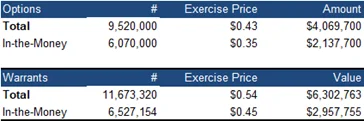

Financials

Strong balance sheet

In-the-money warrants, and options, can bring in $5M

FRC Valuations

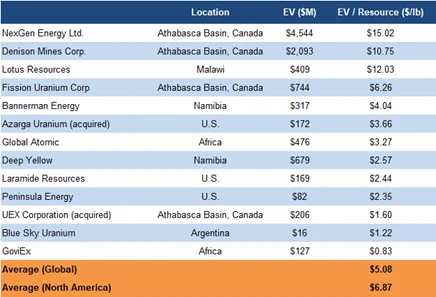

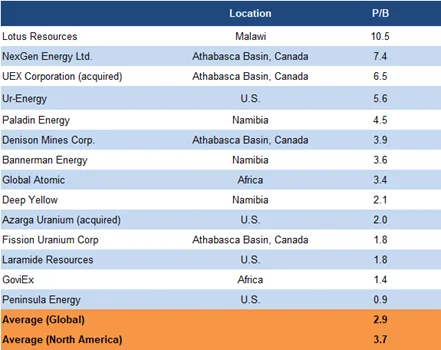

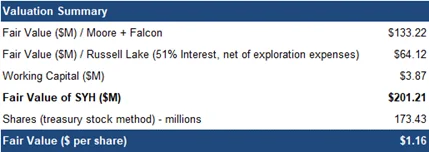

Uranium juniors in North America are trading at $6.9/lb (previously $5.3/lb), and 3.7x book value (previously 3.1x)

Source: FRC/S&P Capital IQ/Various

Applying sector multiples to SYH’s flagship assets, we arrived at a revised fair value estimate of $1.16/share vs our previous estimate of $0.97/share

We are reiterating our BUY rating, and adjusting our fair value estimate from $0.97 to $1.16/share. We believe the uranium sector is primed for consolidation, given the highly vulnerable supply chain. We anticipate that the ongoing and planned exploration programs by SYH, and its partners, should act as catalysts for the stock.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is dependent on uranium prices

- Exploration and development

- Flagship projects do not have a NI 43-101 compliant resource estimate

- Access to capital and share dilution

- No guarantee that option partners will follow through with their proposed programs