- The Turnagain project, which hosts one of the largest undeveloped nickel-cobalt deposits in the world, with open-pittable resources totaling 13 Blbs Ni, and 0.8 Blbs Co, is owned by GIGA (85%) and Mitsubishi Corporation (TSE: 8058/15%). A 2023 Preliminary Feasibility Study (PFS) returned an AT-NPV7% of US$574M, and an AT-IRR of 11.4%, using US$9.8/lb nickel. GIGA is trading at 1.5% of the AT-NPV.

- The project’s break-even nickel price is US$8.2/lb, compared to the current spot price of US$6.9/lb. Prices are down 4% YoY amid a higher supply surplus, and a stronger US$. With the supply surplus expected to increase in 2025, we anticipate nickel prices remaining soft in the near term. However, we expect long-term prices to range between US$8-US$10/lb, as most large undeveloped nickel projects cannot generate attractive economics if prices fall below US$8/lb.

- Despite the weakness in EV metal prices amid the recent slowdown in EV sales growth, the long-term outlook for EVs remains strong. Battery and EV manufacturers, along with miners, are actively seeking stable and long-term supply sources of EV metals.

- Over the next 12 months, Giga plans to explore high-grade copper and nickel targets, which will require an equity financing. Notably, Power Nickel (TSXV: PNPN), a nickel junior under coverage, recently discovered high-grade nickel-copper-PGM-gold-silver mineralization at its nickel project in Quebec, driving its MCAP from $35M to $195M within a year.

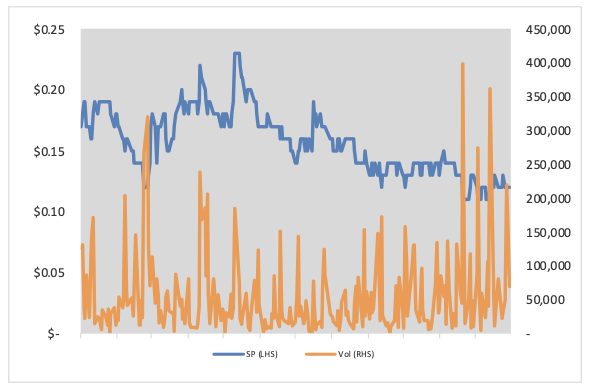

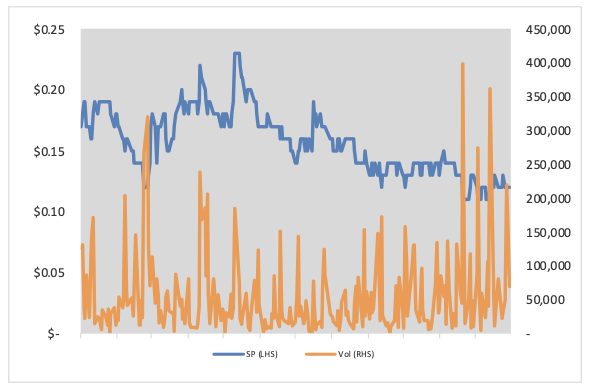

Price Performance (1-year)

| |

YTD |

12M |

| GIGA |

-8% |

-36% |

| TSXV |

2% |

11% |

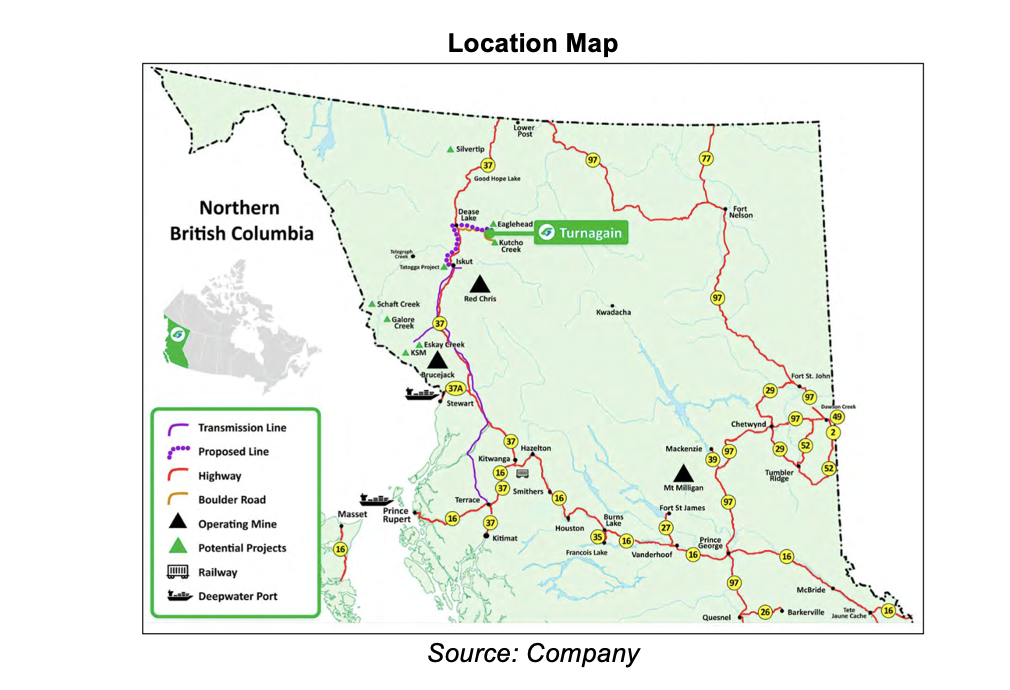

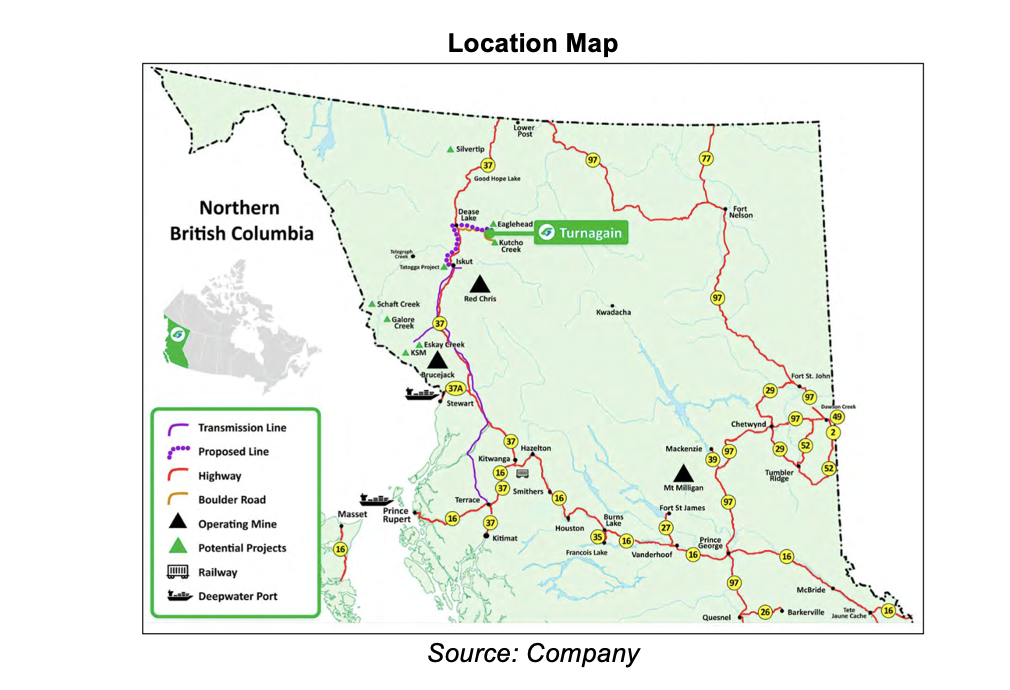

Turnagain Nickel Project, B.C.

This advanced-stage project, covering 40,069 hectares, is located in northern B.C.

A JV between GIGA (85%) and Mitsubishi Corporation (15%). Located 1,100 km north of Vancouver. Access to deep-water ports

Electricity can be obtained from an existing power grid. Potential for low carbon operations

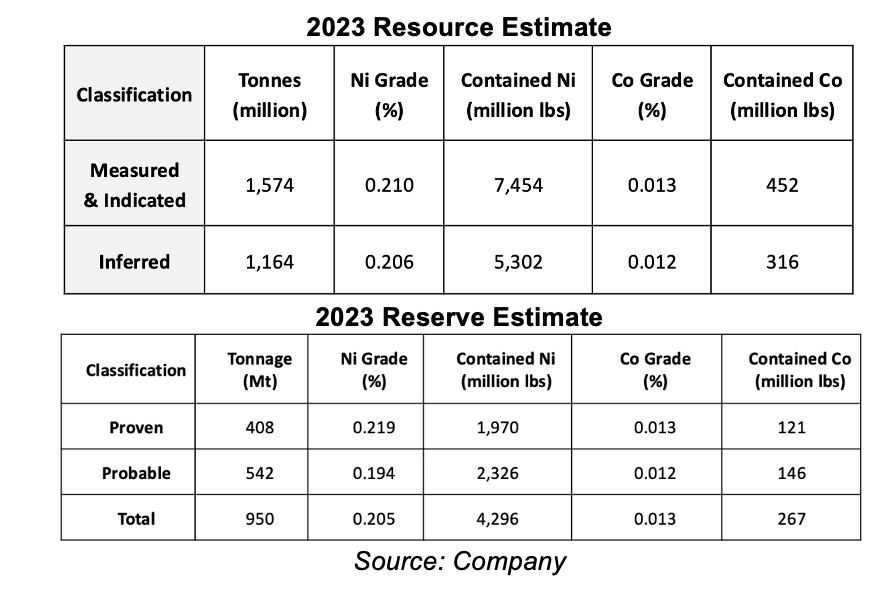

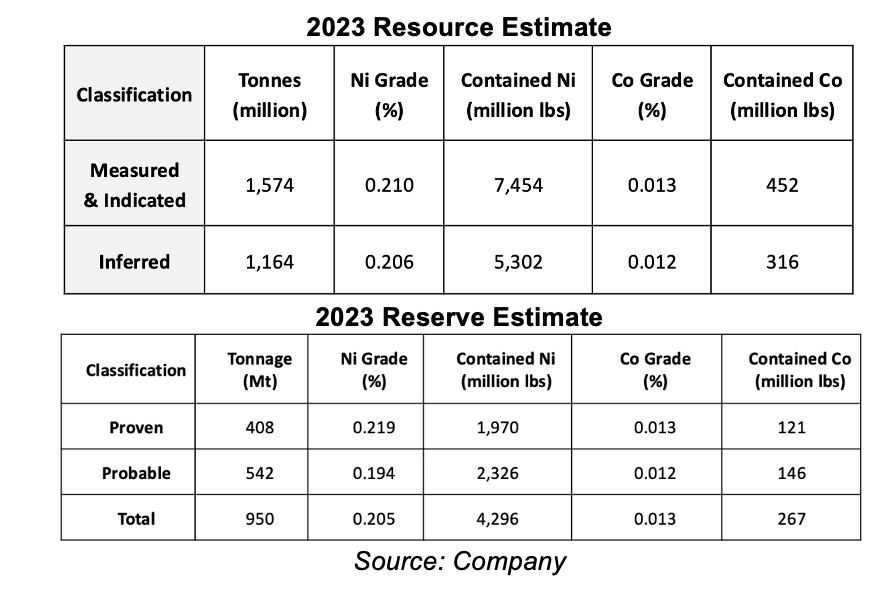

Mineralization, Resources, and PFS

The project hosts a large, low-grade nickel sulfide deposit.

Resources totaling 13 Blbs Ni, and 0.8 Blbs Co, making it one of the largest undeveloped nickel-cobalt deposits in the world

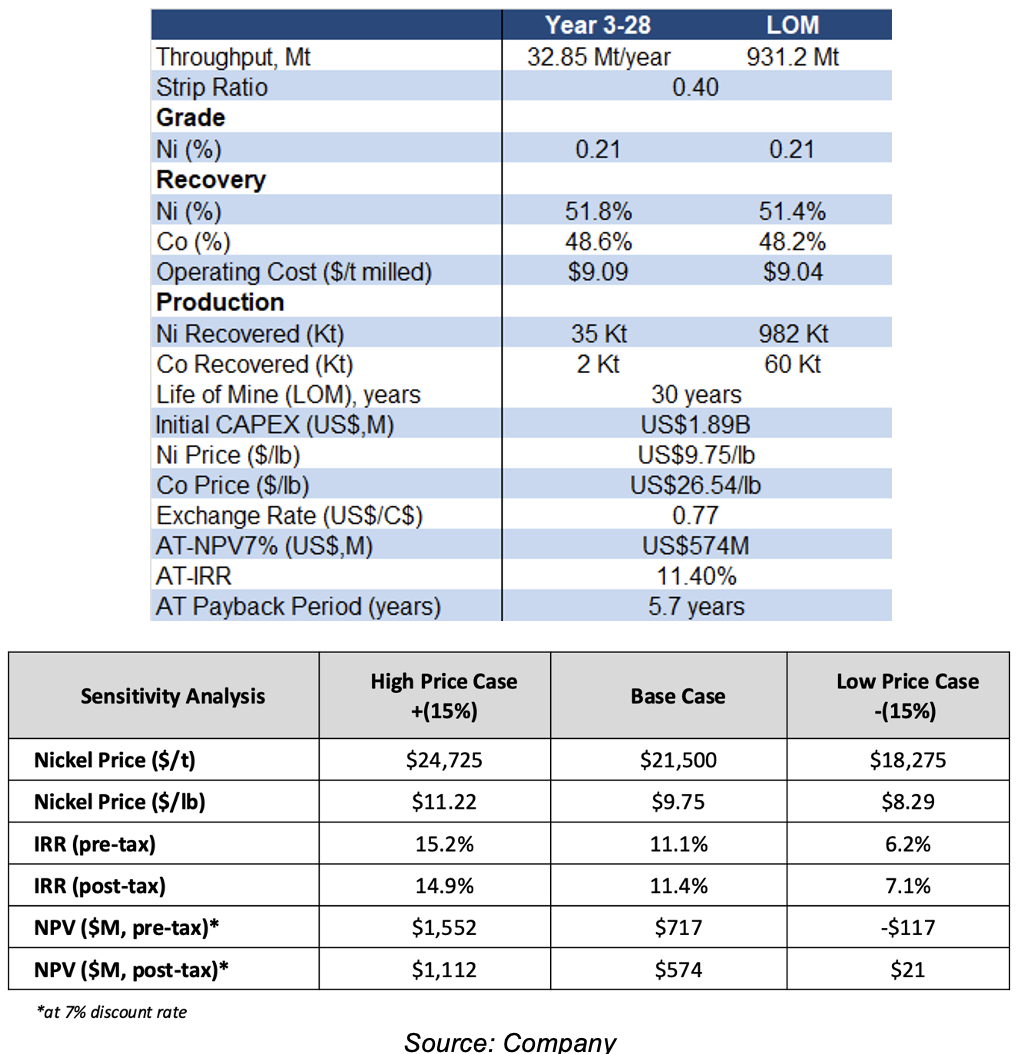

The 2023 PFS was based on open-pit operations spanning 30 years.

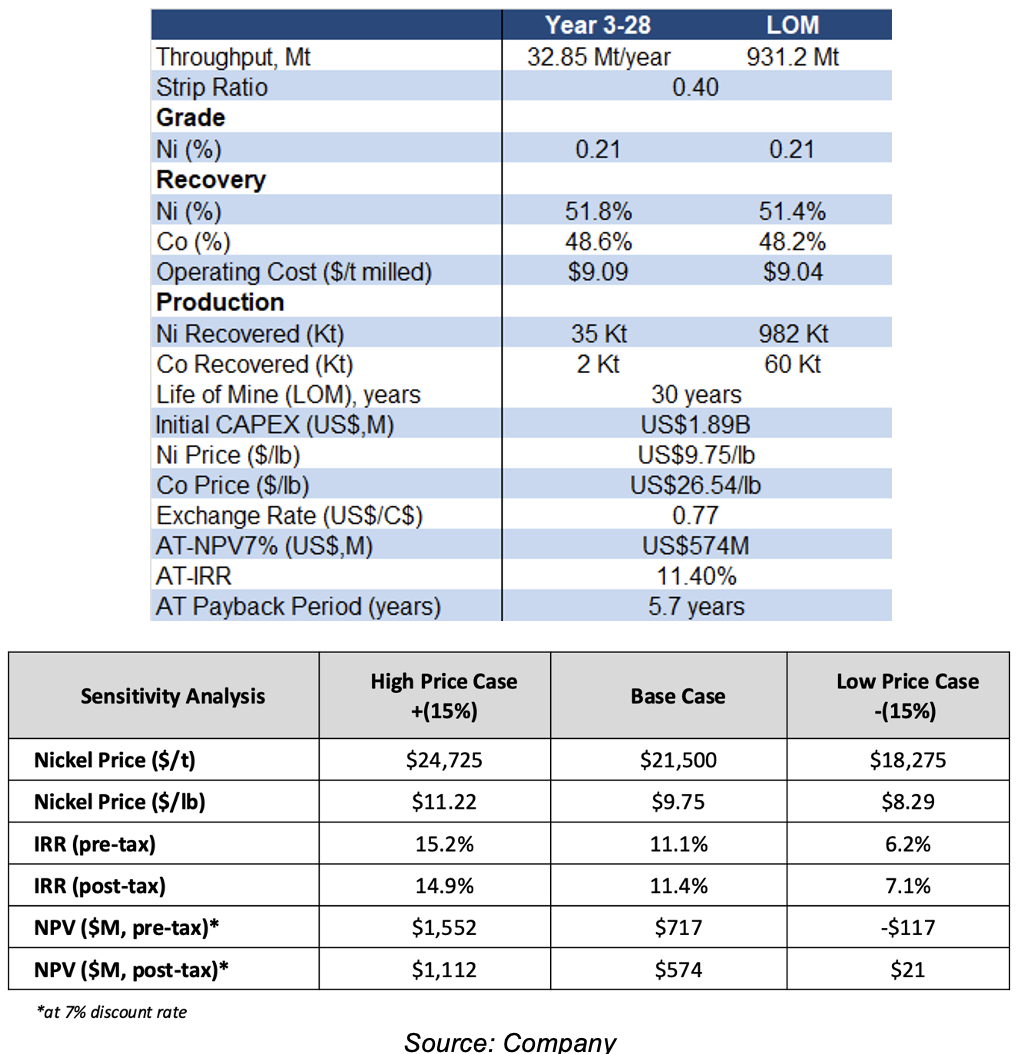

PFS Highlights

Metallurgical tests have shown that froth flotation can produce high-grade Ni and Co concentrates. The PFS returned an AT-NPV7% of US$574M, and an AT-IRR of 11.4%, using US$9.75/lb nickel, US$4.65/lb in cash costs, and US$1.9B in initial CAPEX

The project’s break-even nickel price is US$8.23/lb. We believe the PFS was conservative as it was based on only 34% of resources. Even a small increase in grades can have a substantial positive effect on the NPV and IRR of large nickel projects

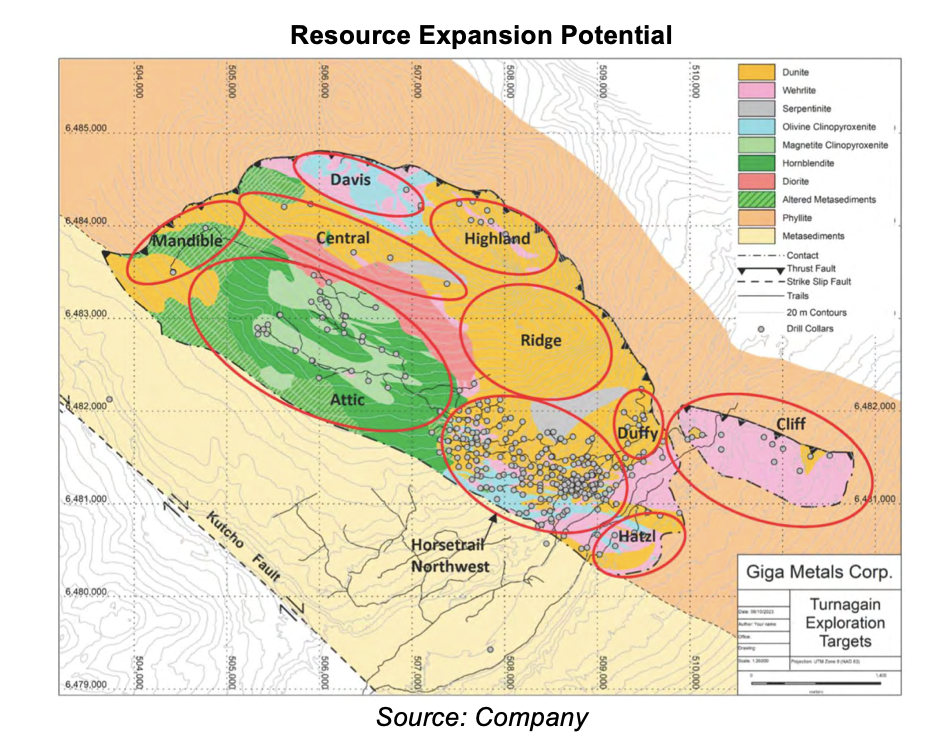

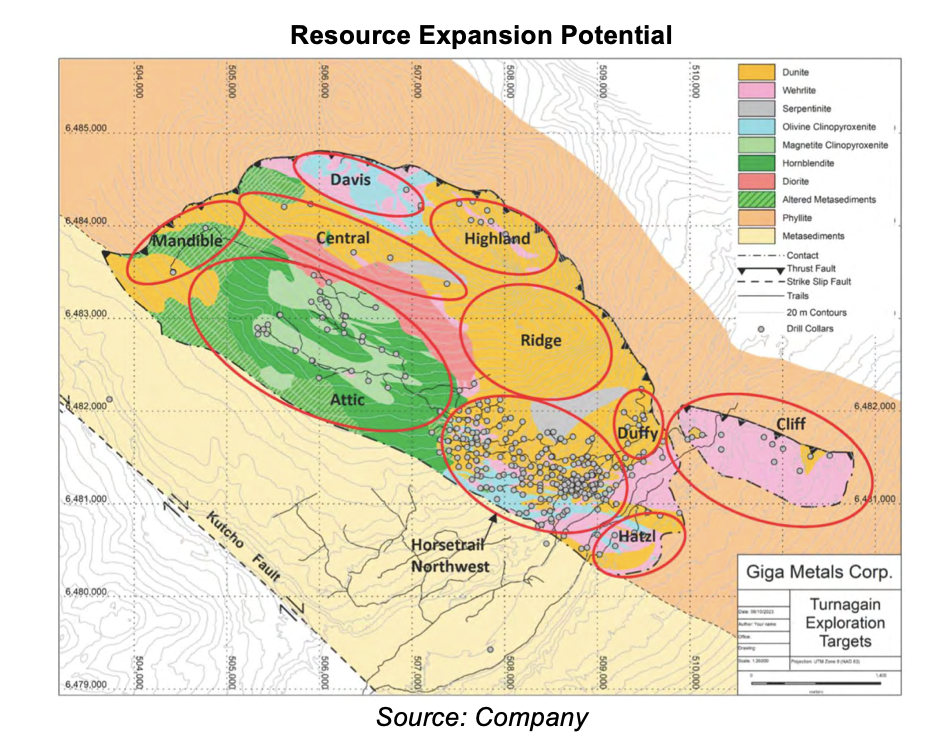

In December 2024, the company received a report from Dr. Stephen Beresford, a highly regarded nickel exploration geologist. Dr. Beresford was commissioned by Giga to assess the potential for high-grade mineral targets within the project, and recommend a suitable exploration program. His report identified several promising target types, including:

- A potential Volkovsky-type massive copper sulfide magnetite deposit within the Attic zone

- Semi-massive sulfide breccia pipes within the Attic and Bench zones, analogous to globally renowned deposits, such as the Giant Mascot in B.C., and the Aguablanca in Spain

The report concluded that a comprehensive exploration program incorporating gravity surveys, ground-based electromagnetic surveys, and drilling is necessary to effectively evaluate these targets.

Re-processing of historical magnetic survey data underway. Approximately 95% of M&I resources come from the Horsetail-Northwest-Duffy zones, located north of the Turnagain river

We believe there is potential for resource expansion as several targets have been identified, and more than 80% of the project area remains underexplored

The Turnagain project, with its focus on hydroelectricity, and carbon sequestration, aims for a significantly lower carbon footprint compared to many laterite nickel projects, which often rely on fossil fuels for energy and have higher processing energy demands. Approximately 60% of the world's known nickel resources are found in laterite deposits, while the remaining 40% are in sulfide deposits.

Over the next 12 months, the company plans to pursue an exploration program, targeting high-grade copper and nickel mineralization. To fund this initiative, Giga will need to undertake an equity financing.

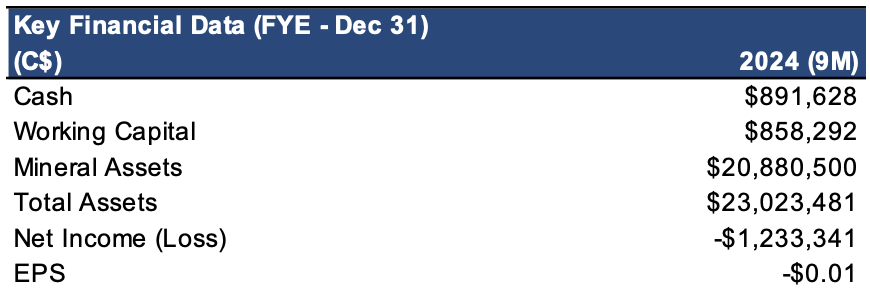

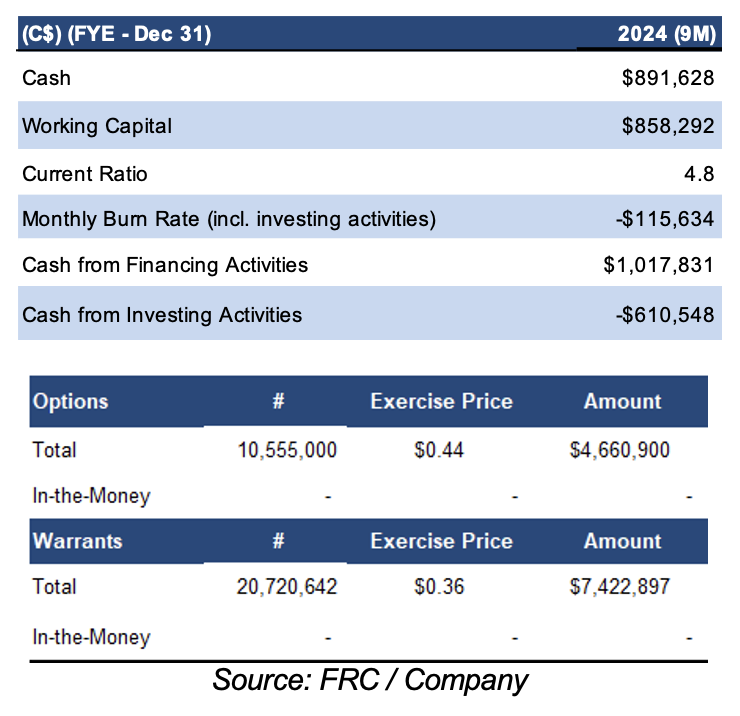

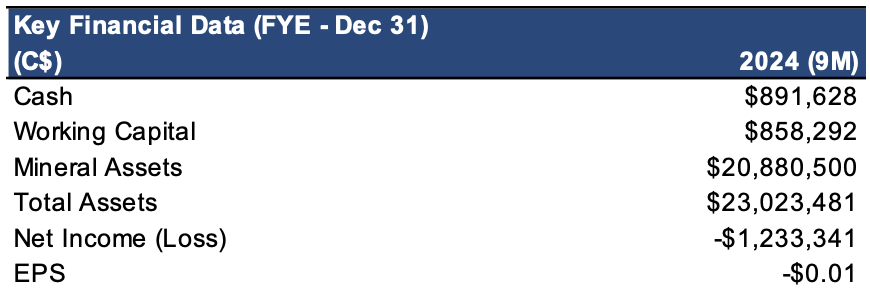

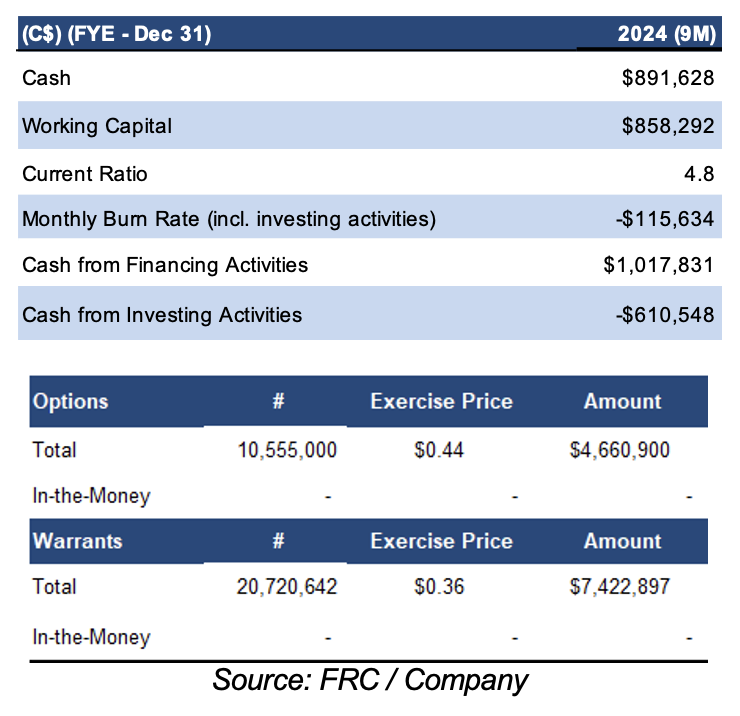

Financials

$0.9M in cash at the end of Q3-2024. None of the outstanding options/warrants are in-the-money

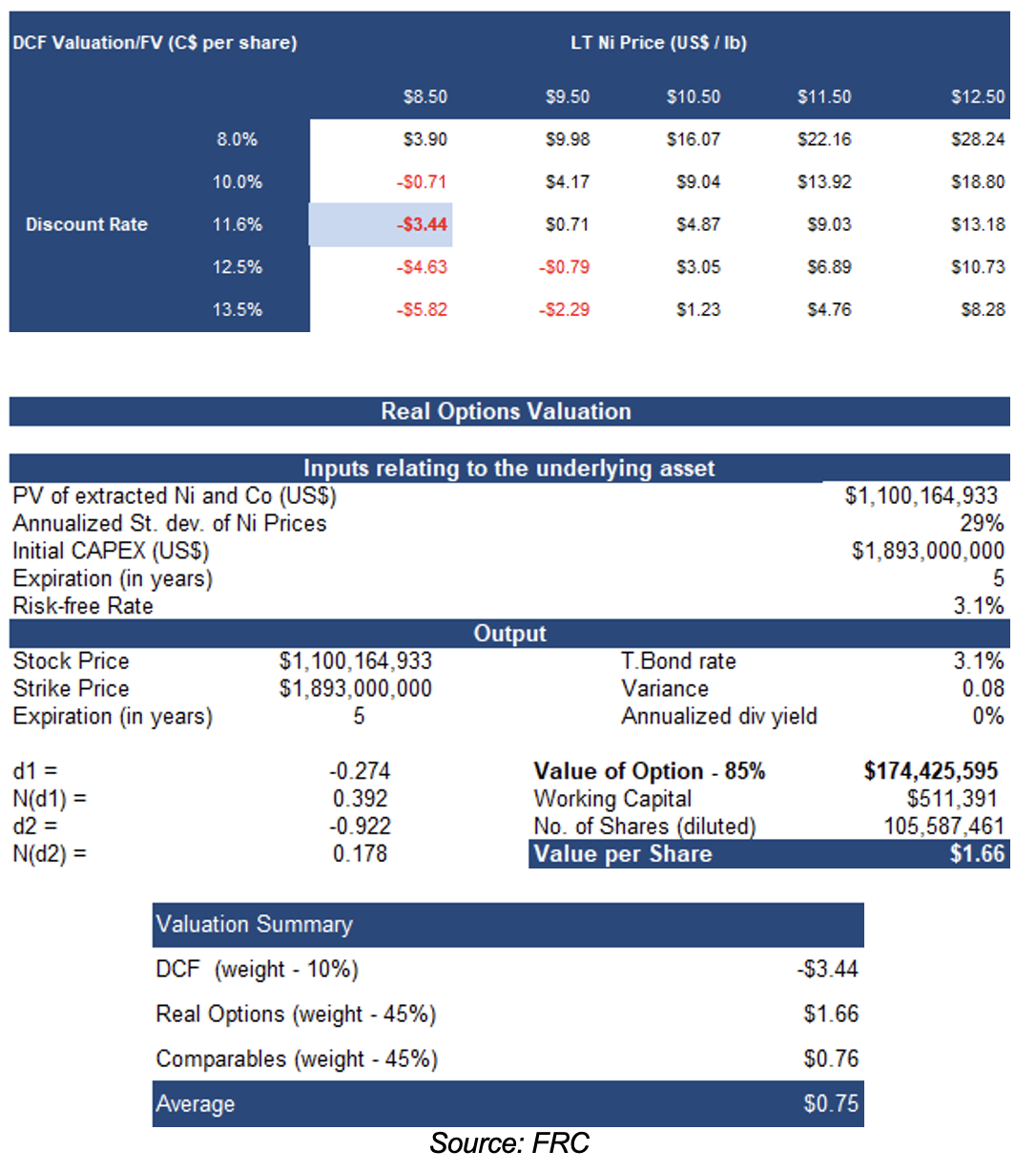

FRC Valuation and Rating

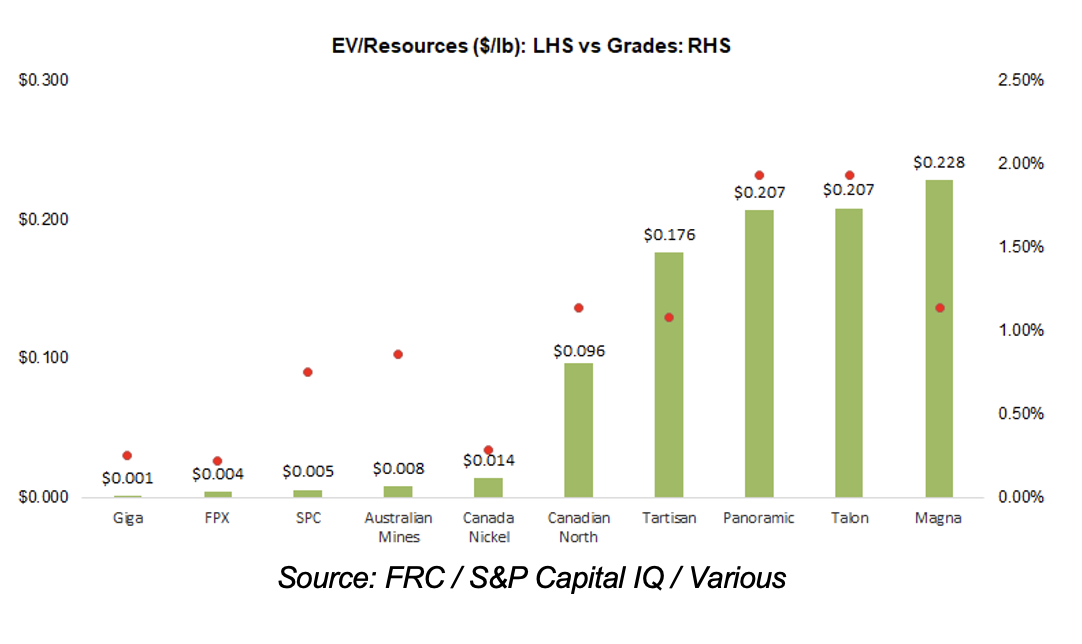

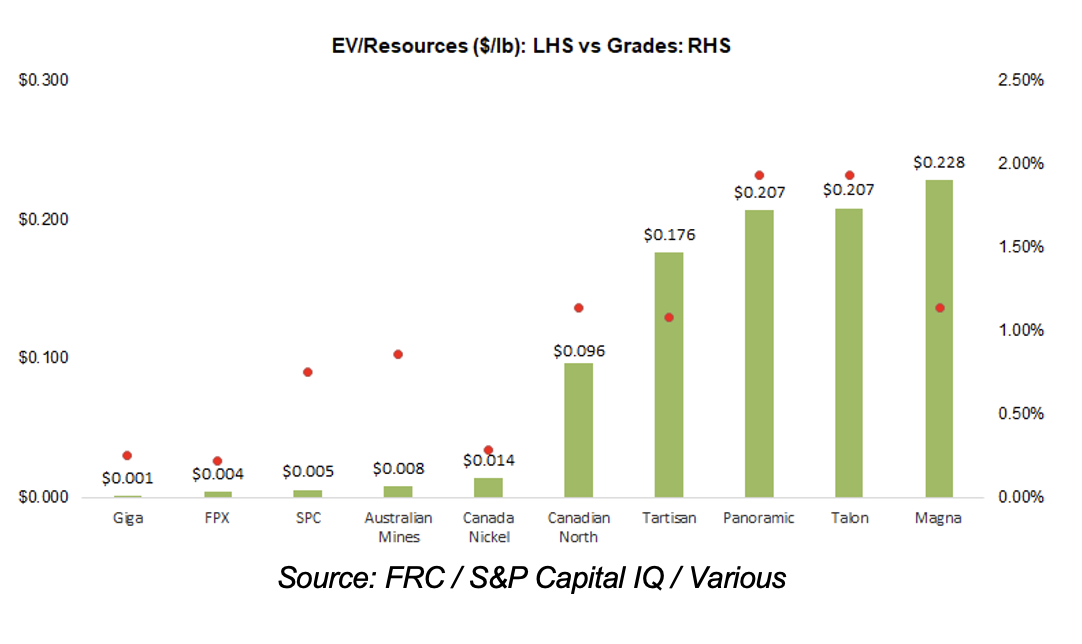

Giga is trading at just $0.001/lb (previously $0.002/lb) vs the comparables average of $0.008/lb (previously $0.011/lb), reflecting an 85% discount. Applying $0.008/lb to Giga’s resources, we arrived at a comparables valuation of $0.76/share (previously $1.19/share)

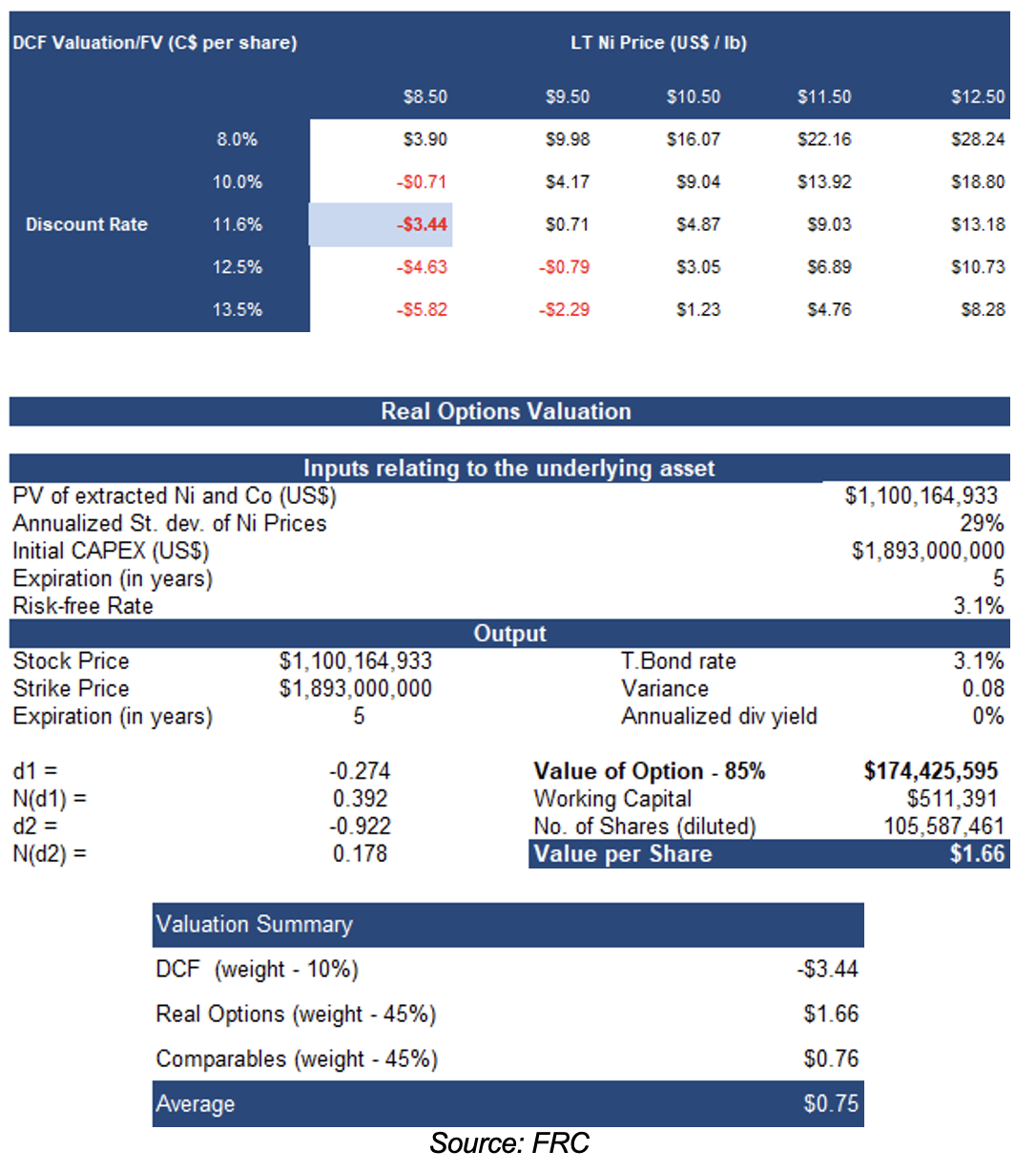

We are not making any material changes to our DCF or real options valuation models

Our weighted average valuation declined from $0.95 to $0.75/share, driven by a lower comparables valuation

We are reiterating our BUY rating, and adjusting our fair value estimate from $0.95 to $0.75/share. While near-term weakness in nickel prices presents a challenge, the long-term fundamentals for nickel remain strong, driven by the growing demand for EVs. We believe that successful exploration, and a potential increase in grades could significantly enhance the project's value.

Risks

Maintaining our risk rating of 5 (Highly Speculative)

We believe the company is exposed to the following key risks (not exhaustive):

- Larger projects tend to have high CAPEX

- Highly sensitive to nickel prices

- Project financing may take longer than expected

- Development, EIA, and permitting