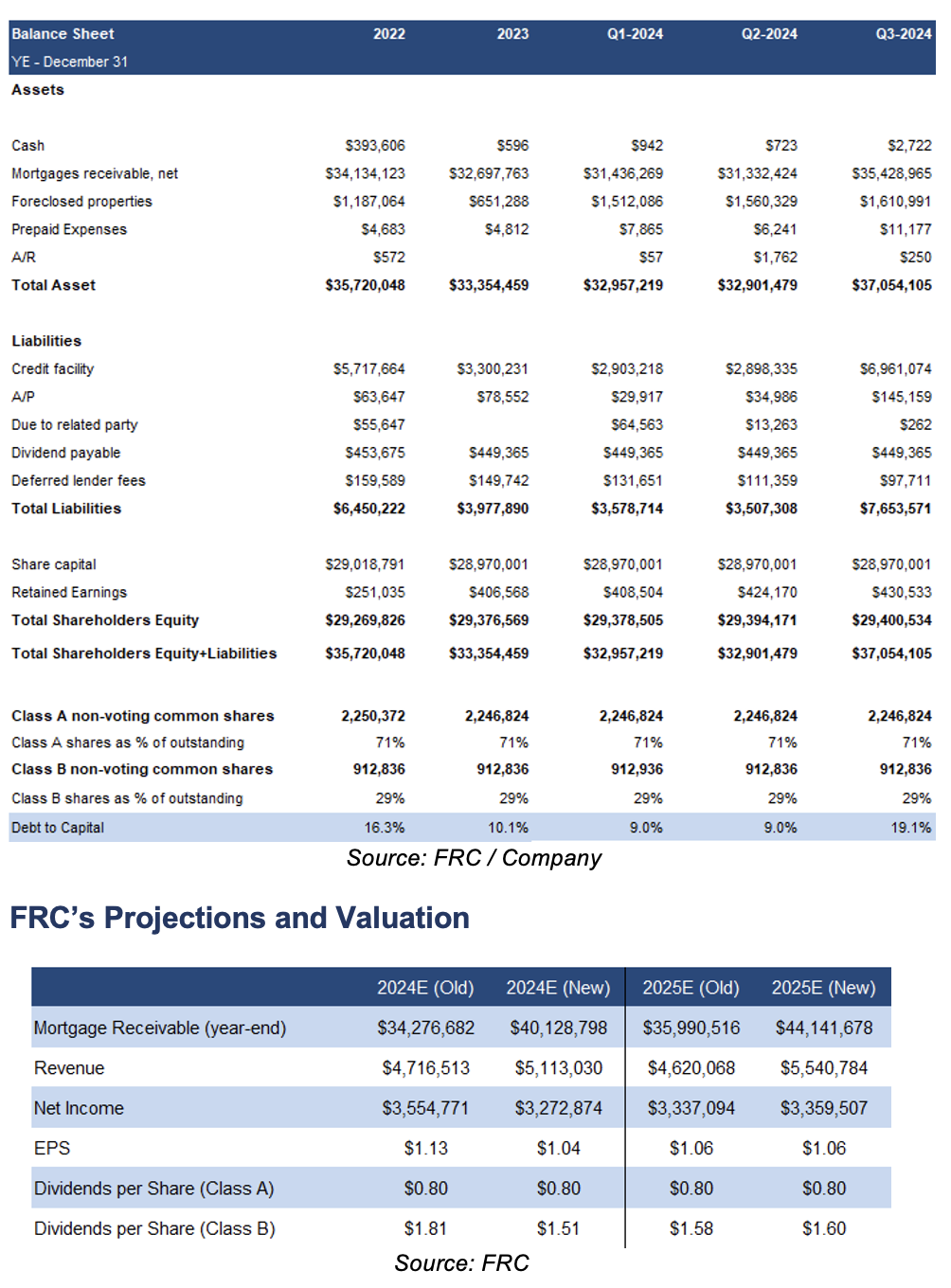

- Stage three mortgages (impaired) increased QoQ, from 1.7% to 5.7% of mortgages, driven by a builder with two mortgages facing liquidity challenges. However, management is optimistic about resolving these mortgages by year-end.

- Although management raised loan loss allowances by 0.23 pp QoQ to 2.96% of mortgages, we are cautiously projecting a sharp rise in provisions for Q4, adversely affecting full-year EPS.

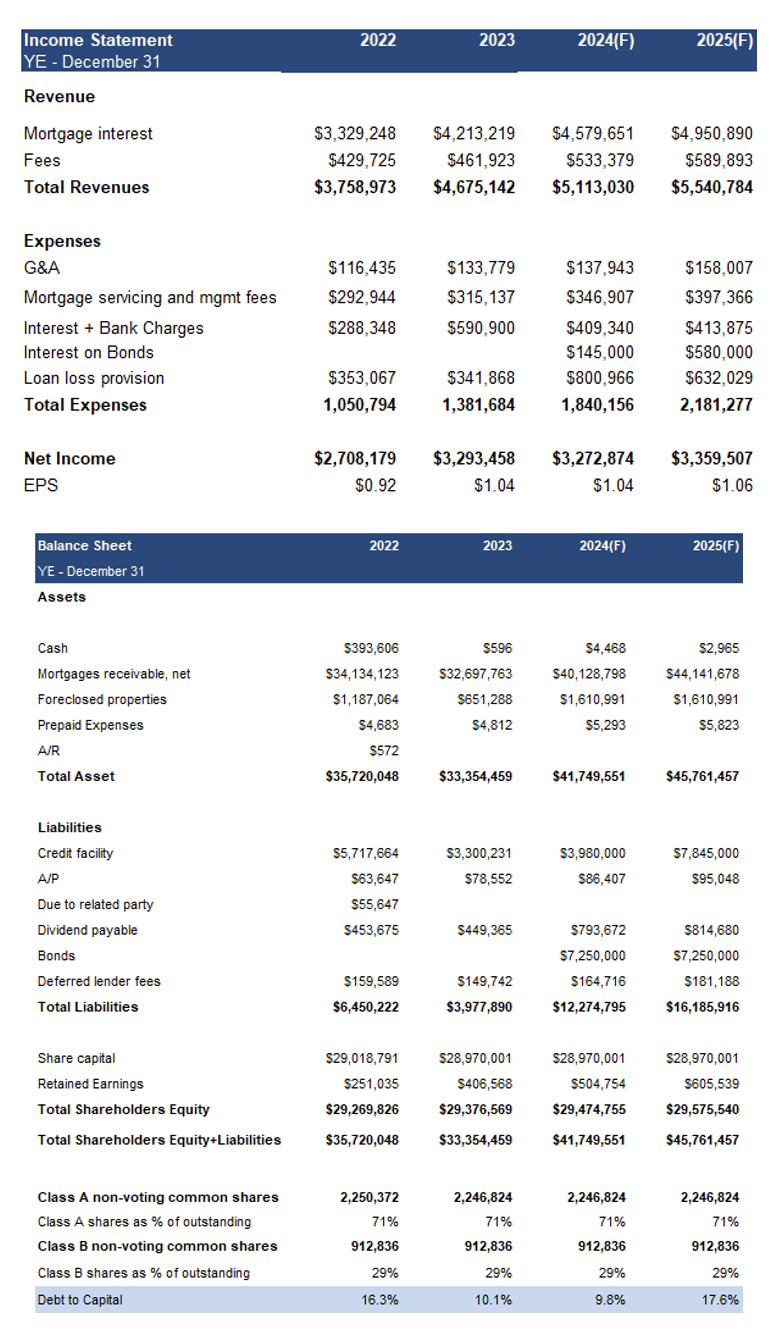

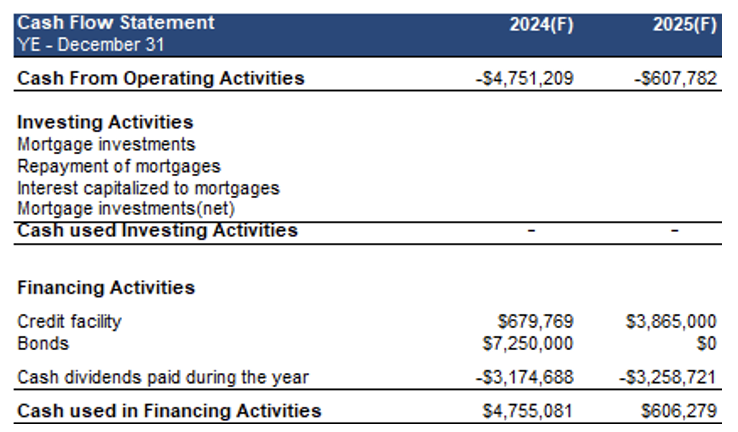

- Subsequent to Q3, the company raised $7.25M, and closed the first tranche of an ongoing $50M bond financing. Bondholders will participate on a pari passu (equal) basis with shareholders.

- We anticipate further rate cuts by the BoC (due to slower GDP growth, high unemployment, and cooling inflation), and a rise in BCF’s transaction volumes in 2025.

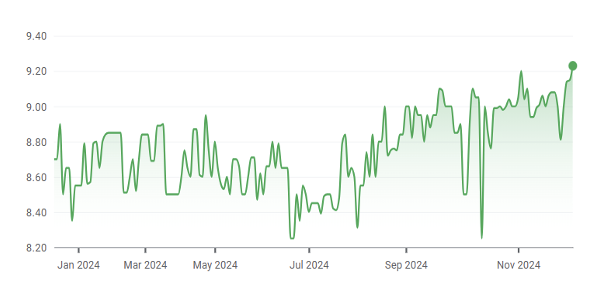

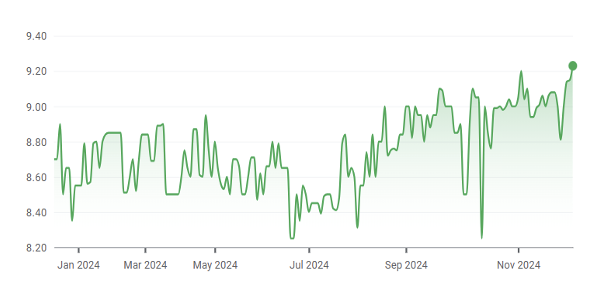

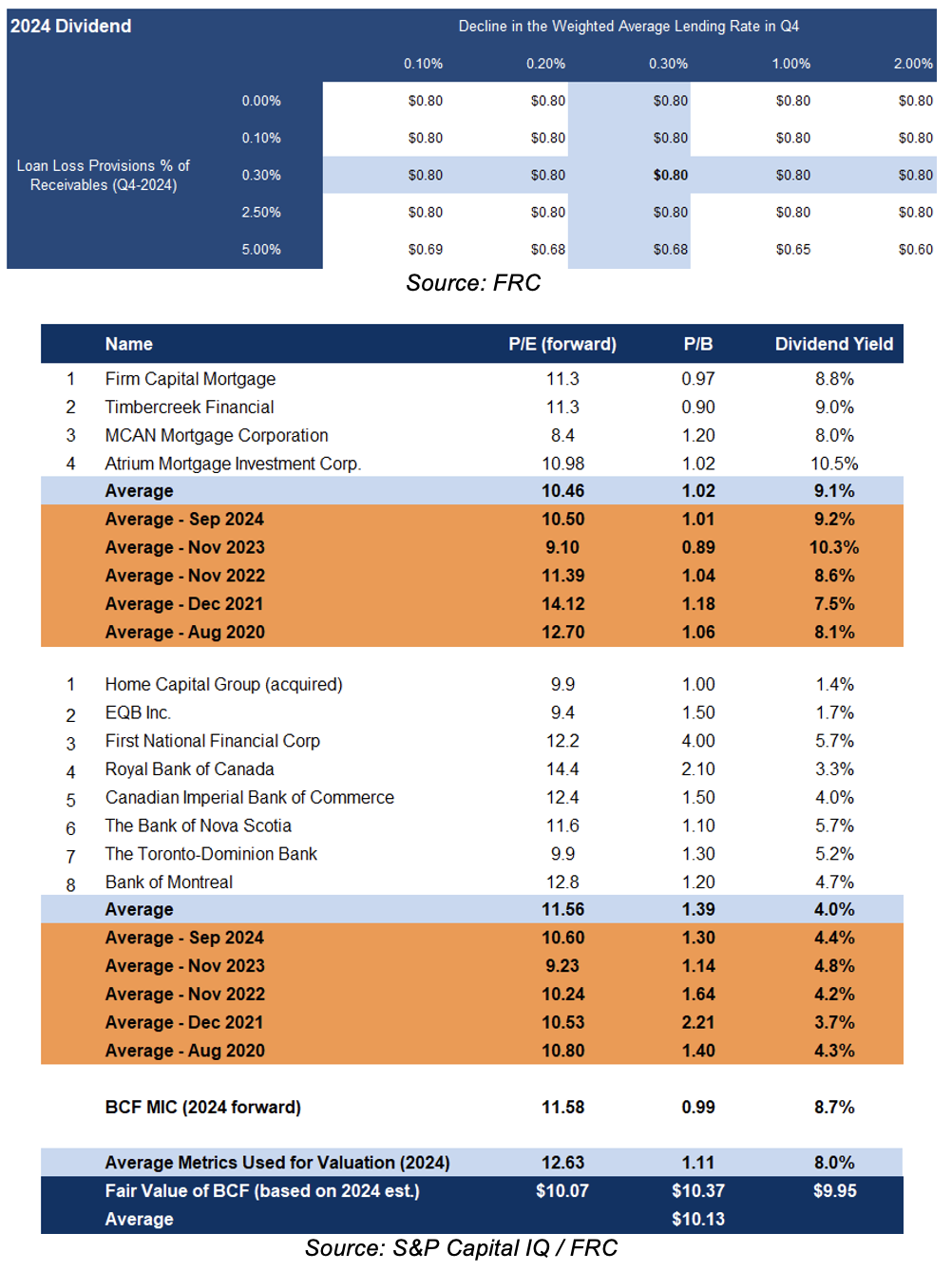

- In our September 2024 report, we predicted a rally in MIC/financial stocks driven by lower rates; sector multiples have since risen by 5%. We remain bullish on the sector, and anticipate additional rallies in the coming months as further rate cuts take effect.

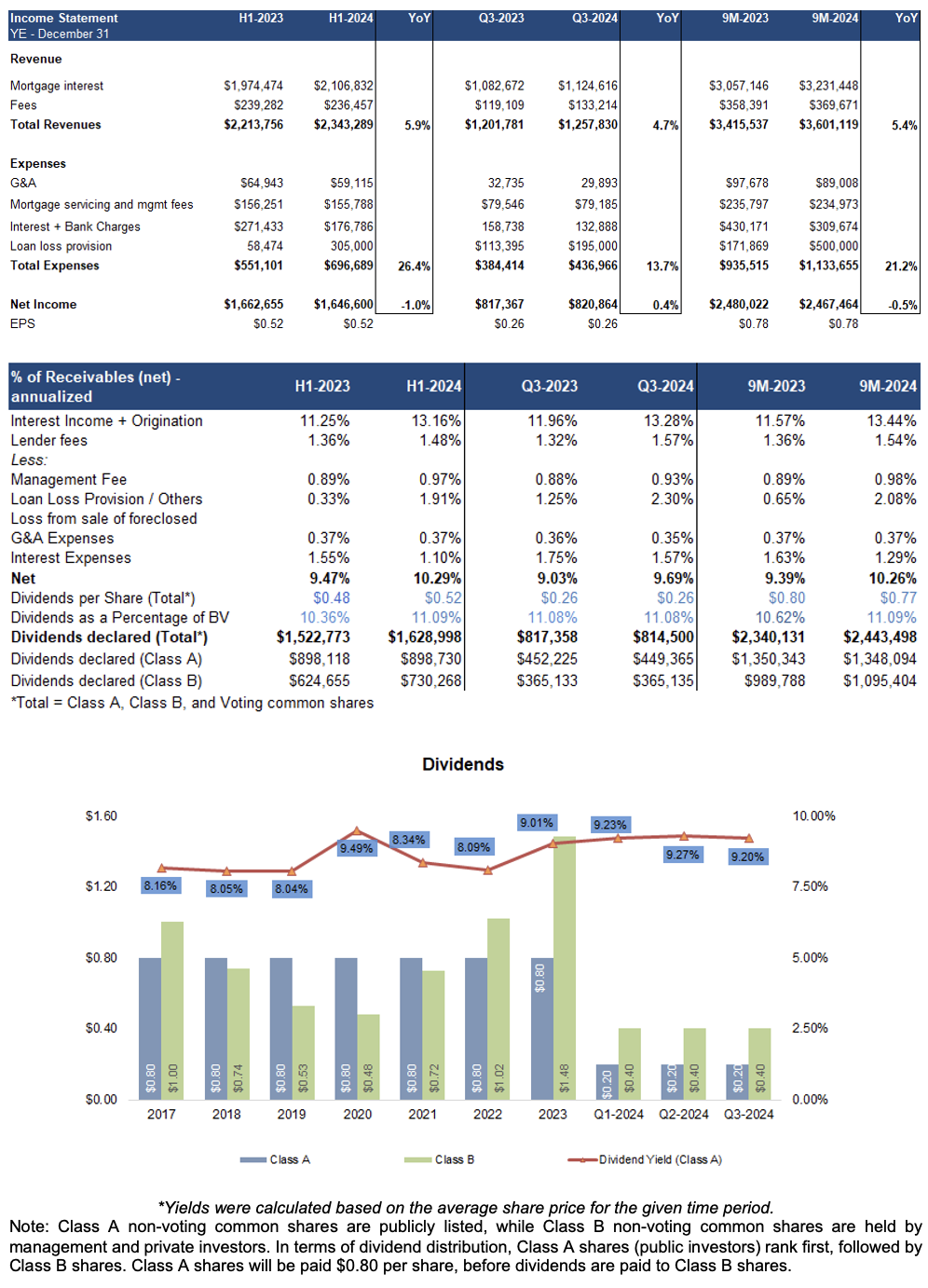

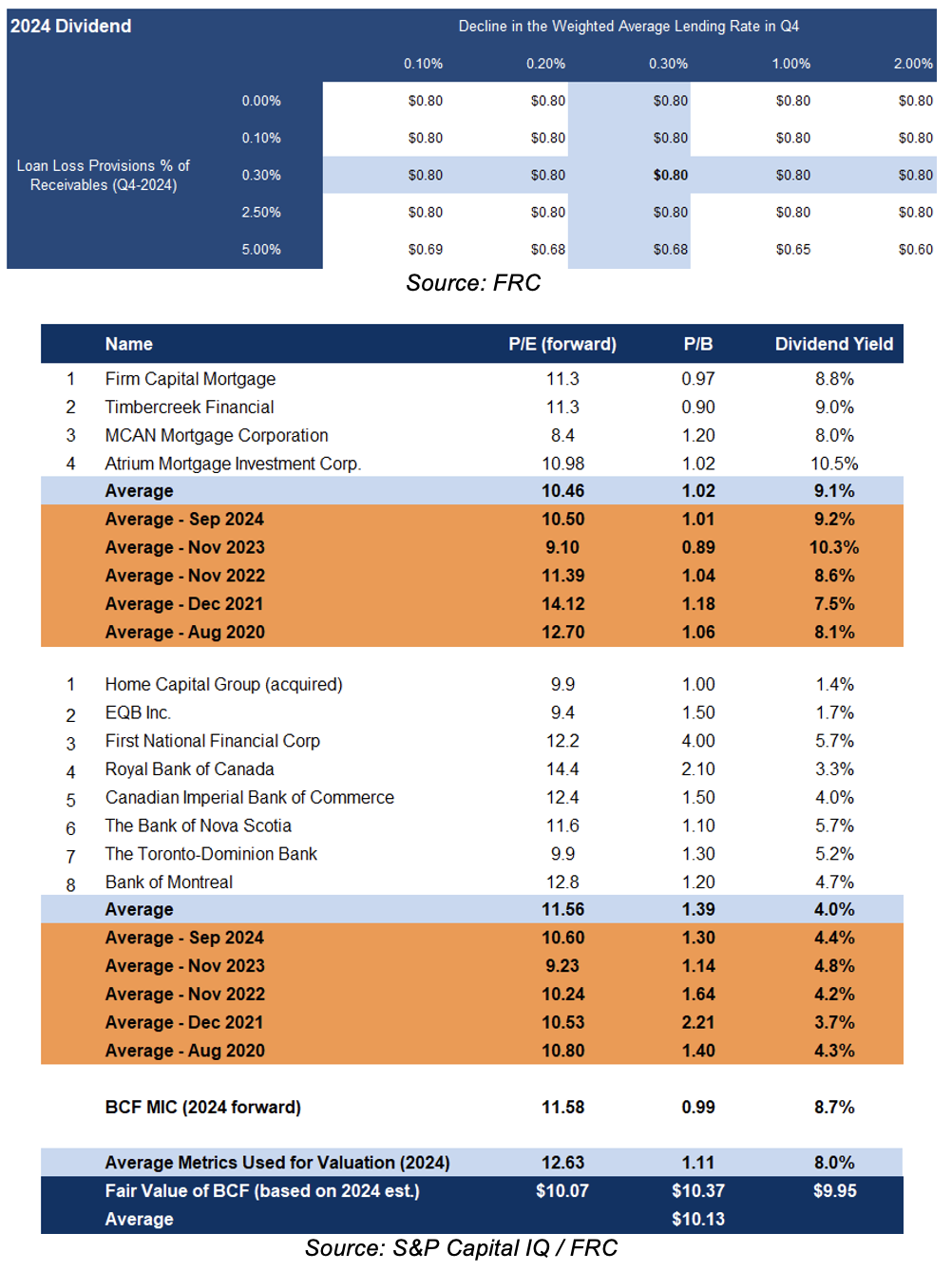

- Although we have lowered our 2024 EPS estimate, we believe BCF can comfortably distribute its committed $0.80/share annual dividend, even if lending rates decline by 2%, and loan loss provisions are increased 10x. This feature highlights BCF’s resilience, and its relatively low-risk profile.

Price and Volume (1-year)

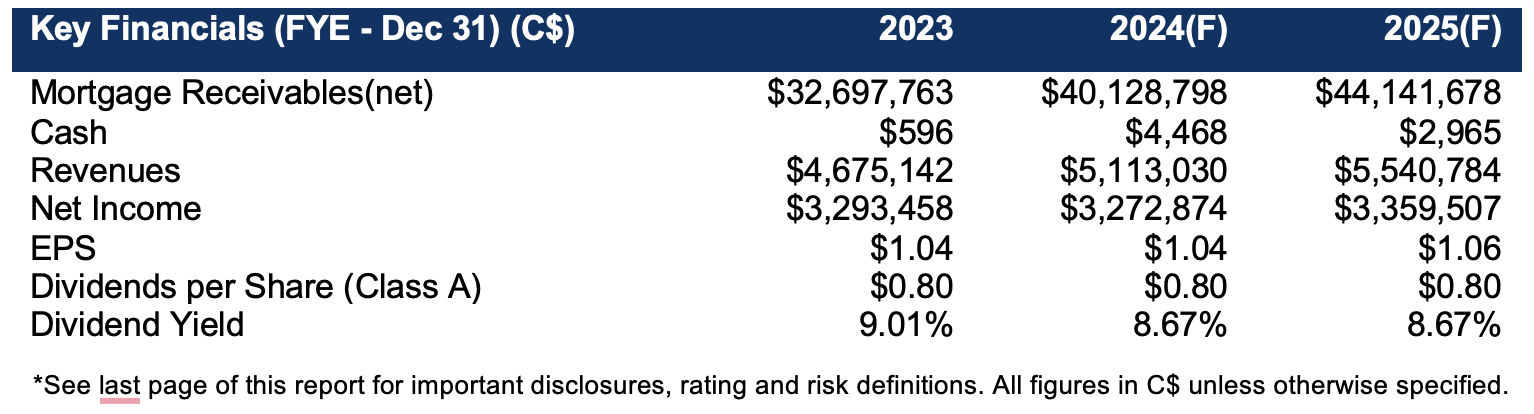

| |

YTD |

12M |

| BCF |

8% |

6% |

| TSXV |

12% |

14% |

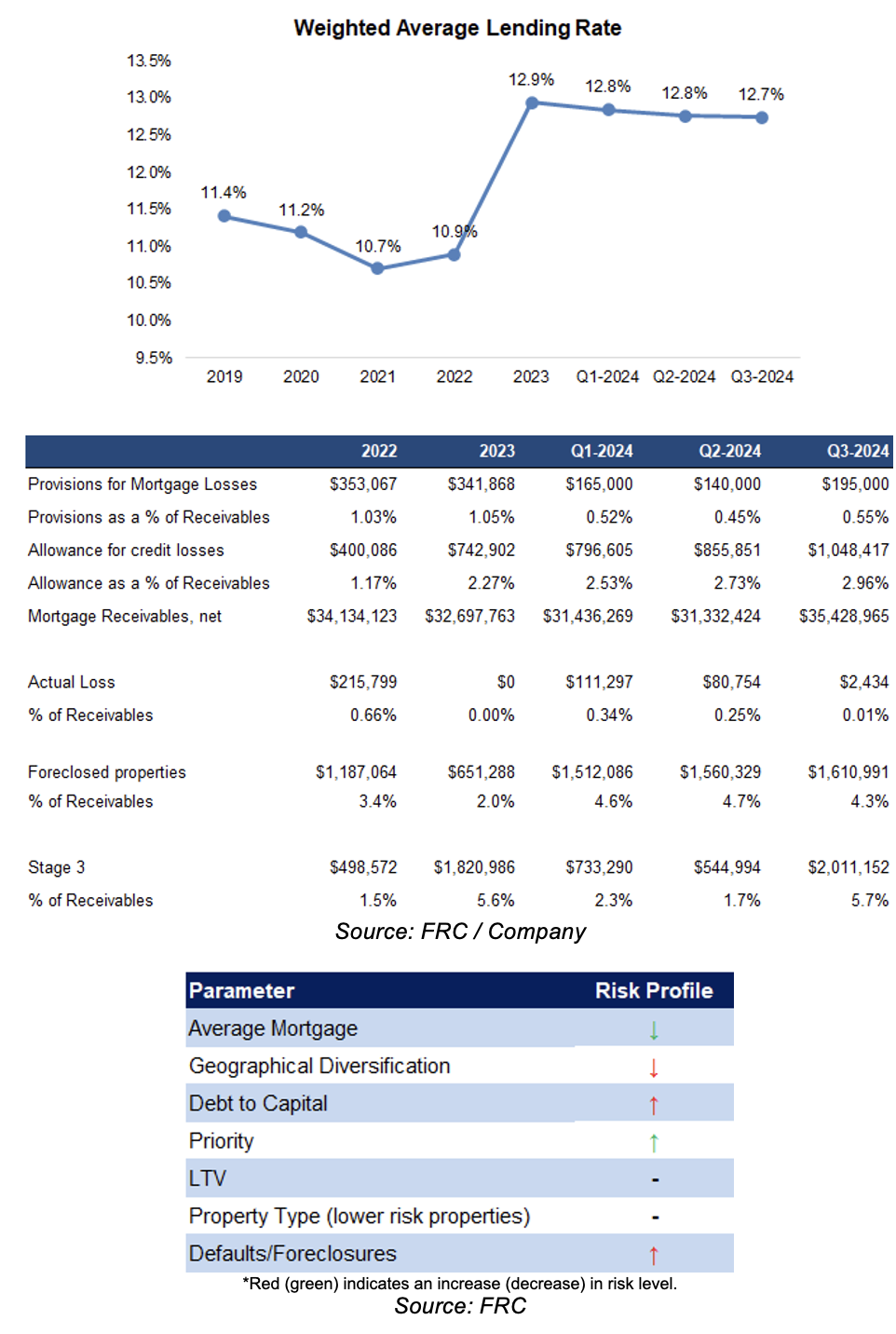

Portfolio Details

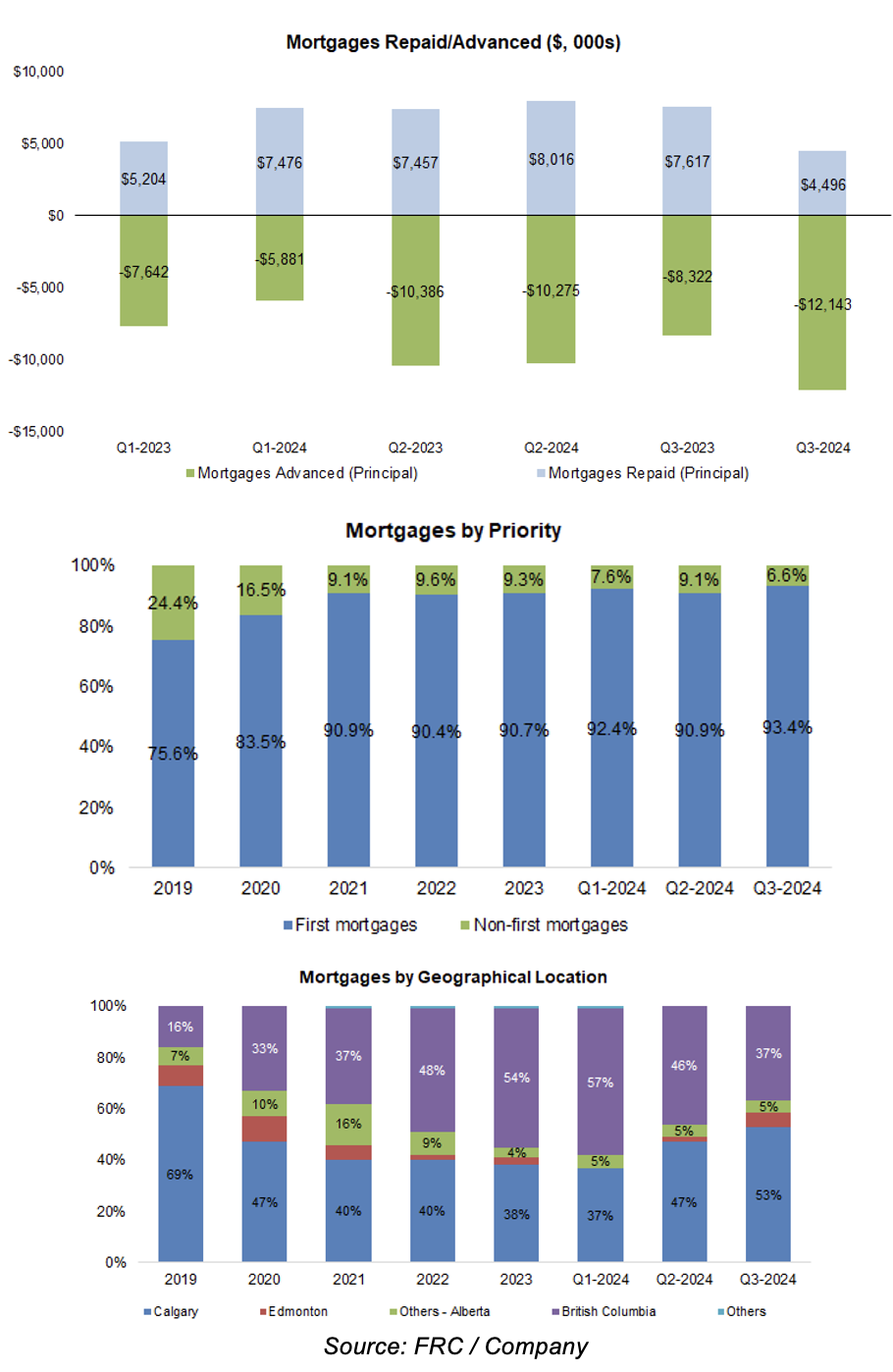

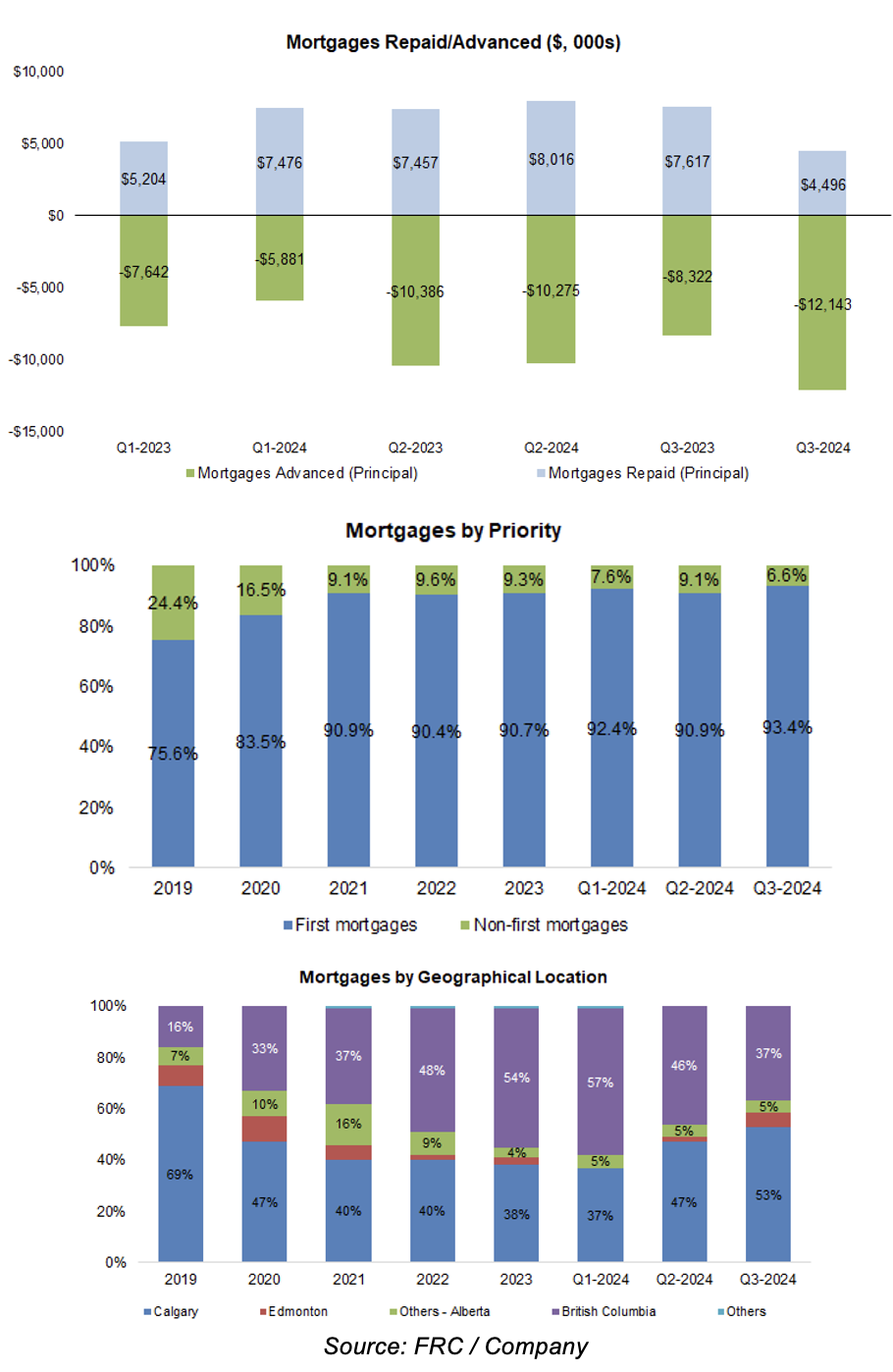

Mortgage advancements were up 46% YoY; repayments were down 41% YoY. As a result, mortgage receivables (net) were up 13% QoQ to $35M

Following the $7M raise post-Q3, we are raising our year-end receivables estimate by 17% to $40M

First mortgages increased, implying lower risk. Increased exposure to AB, and decreased exposure to B.C. as management is observing more attractive opportunities and fewer competitors in AB

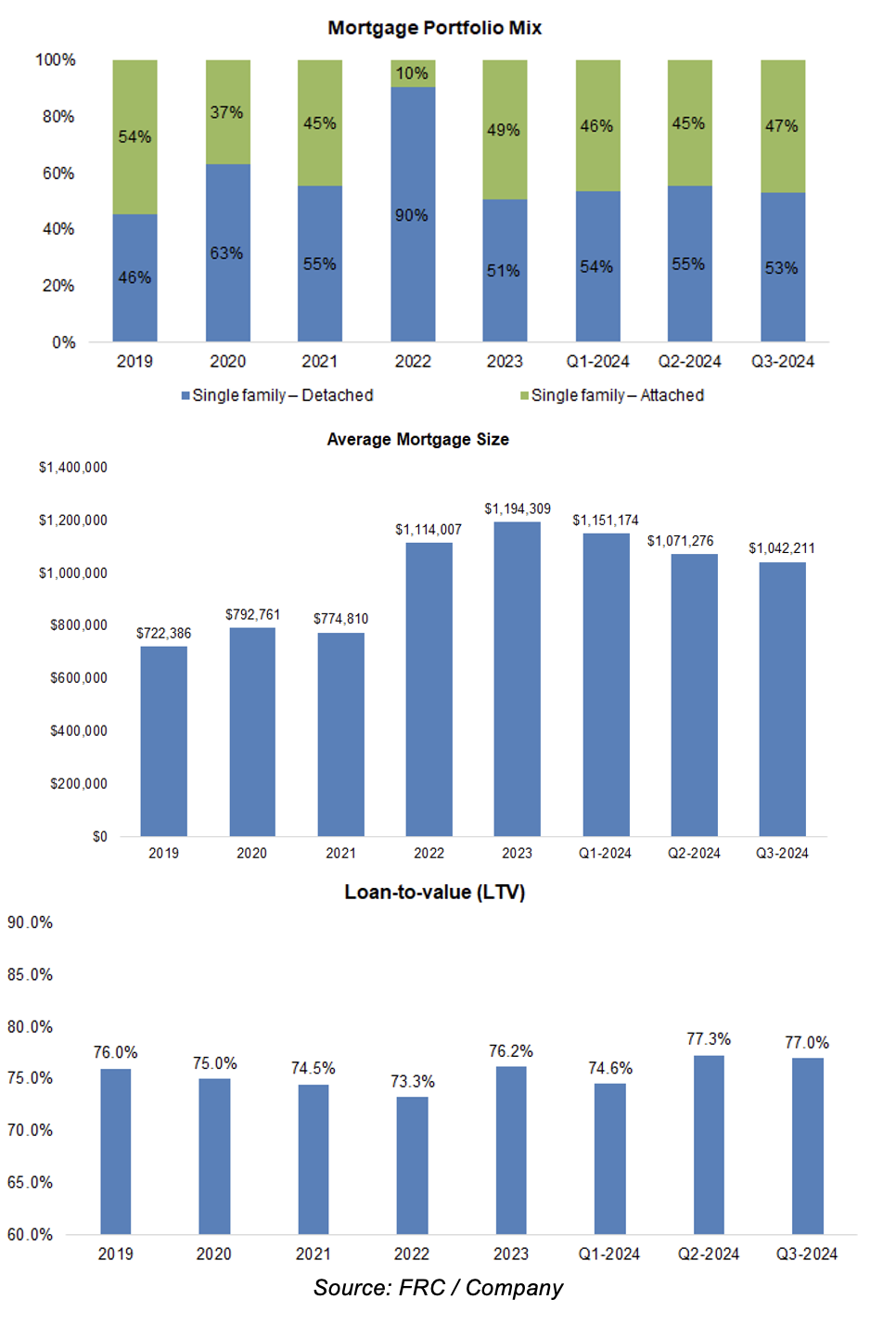

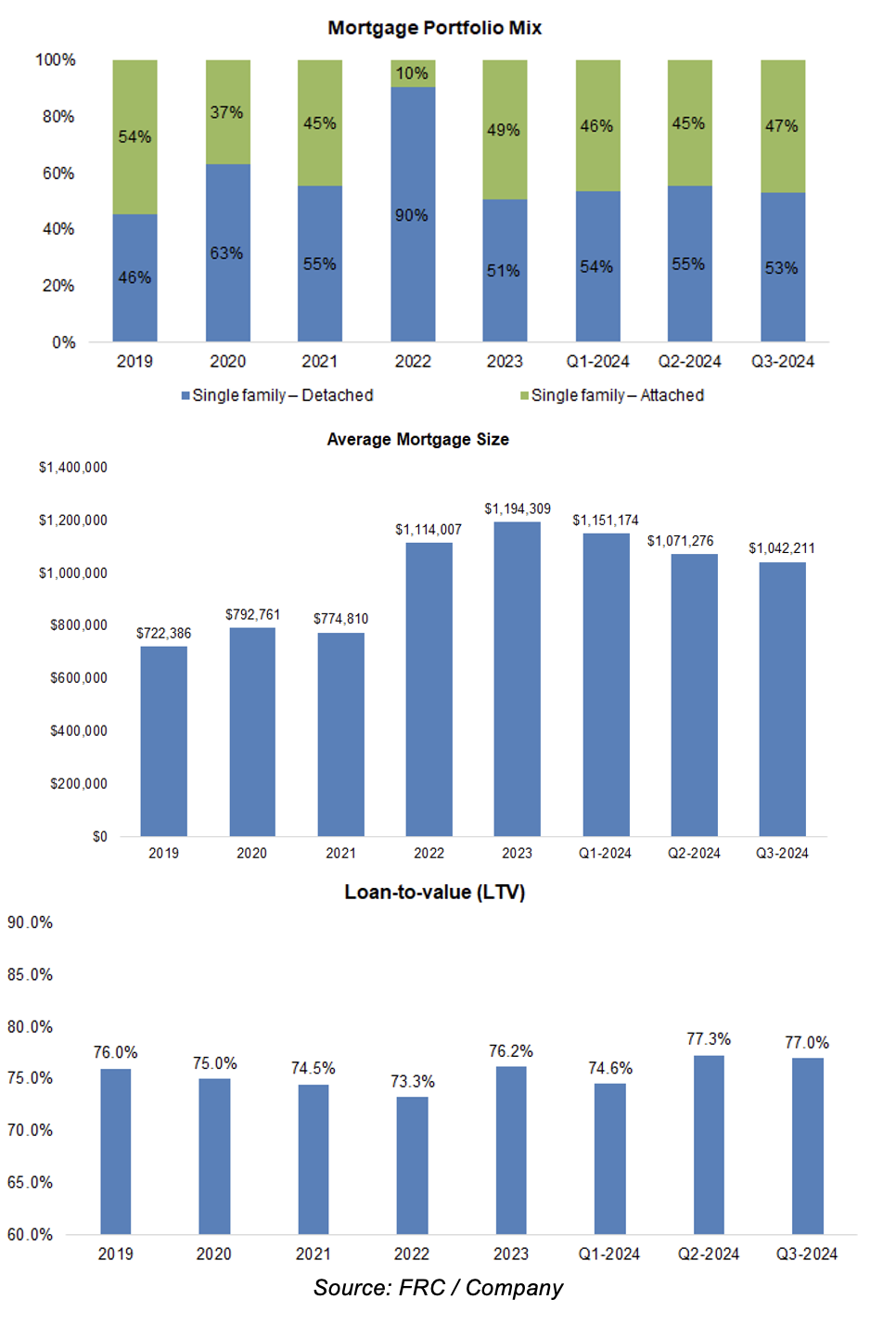

Remains focused on single-family units (construction). The average mortgage size was down 3% QoQ, implying lower risk. LTV remained unchanged

The average lending rate declined slightly, primarily due to the BoC’s rate cuts. Stage three mortgages (impaired) increased 269% QoQ, and 10% YTD, to 5.7% of mortgages

Management raised loan loss allowances by 0.2 pp QoQ to 2.96% of mortgages. BCF expects to reduce stage three mortgages before the year ends

For conservatism, we are raising our loan loss provision estimates. In summary, we believe the portfolio’s risk profile increased (three red vs two green signals)

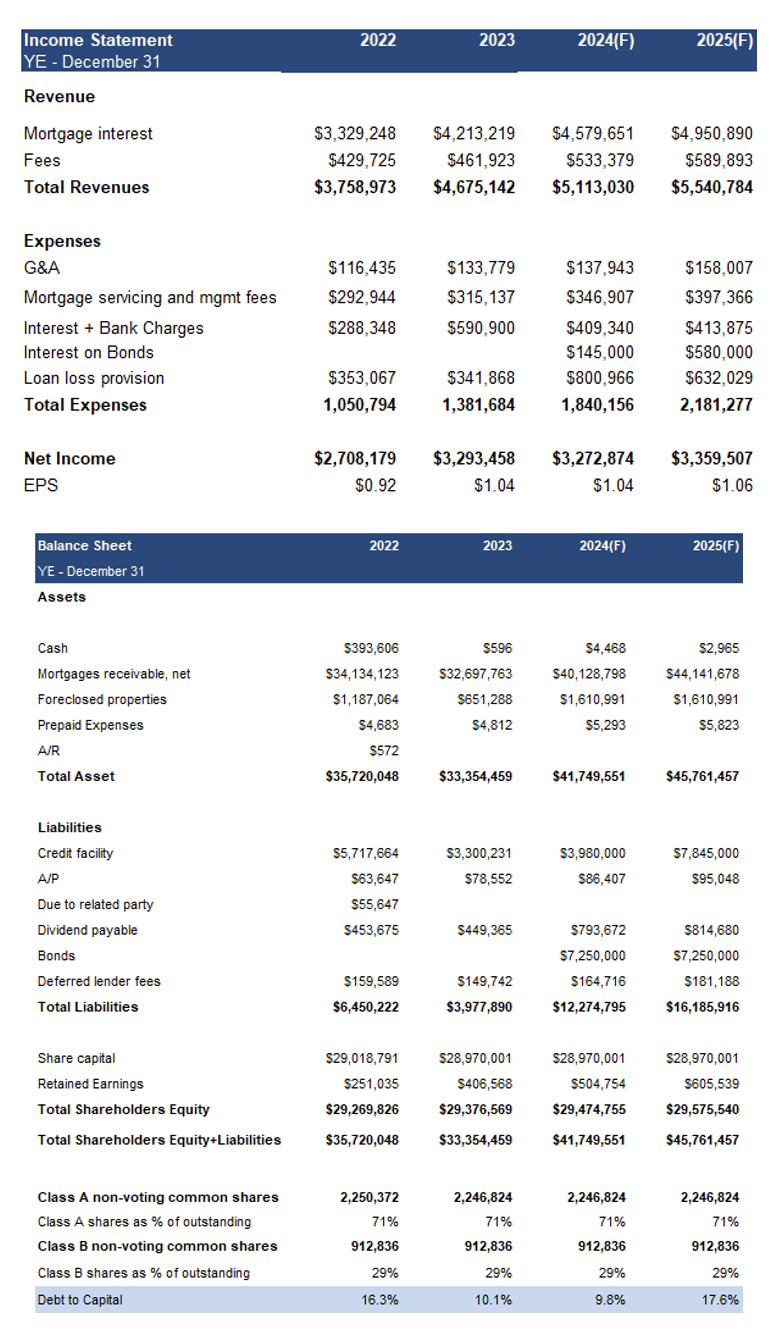

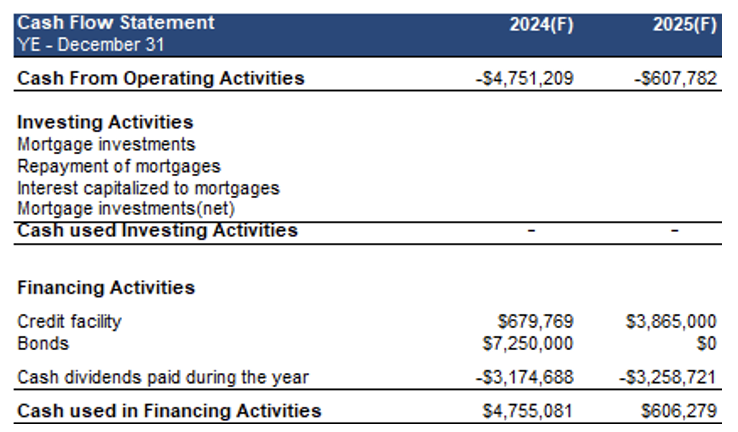

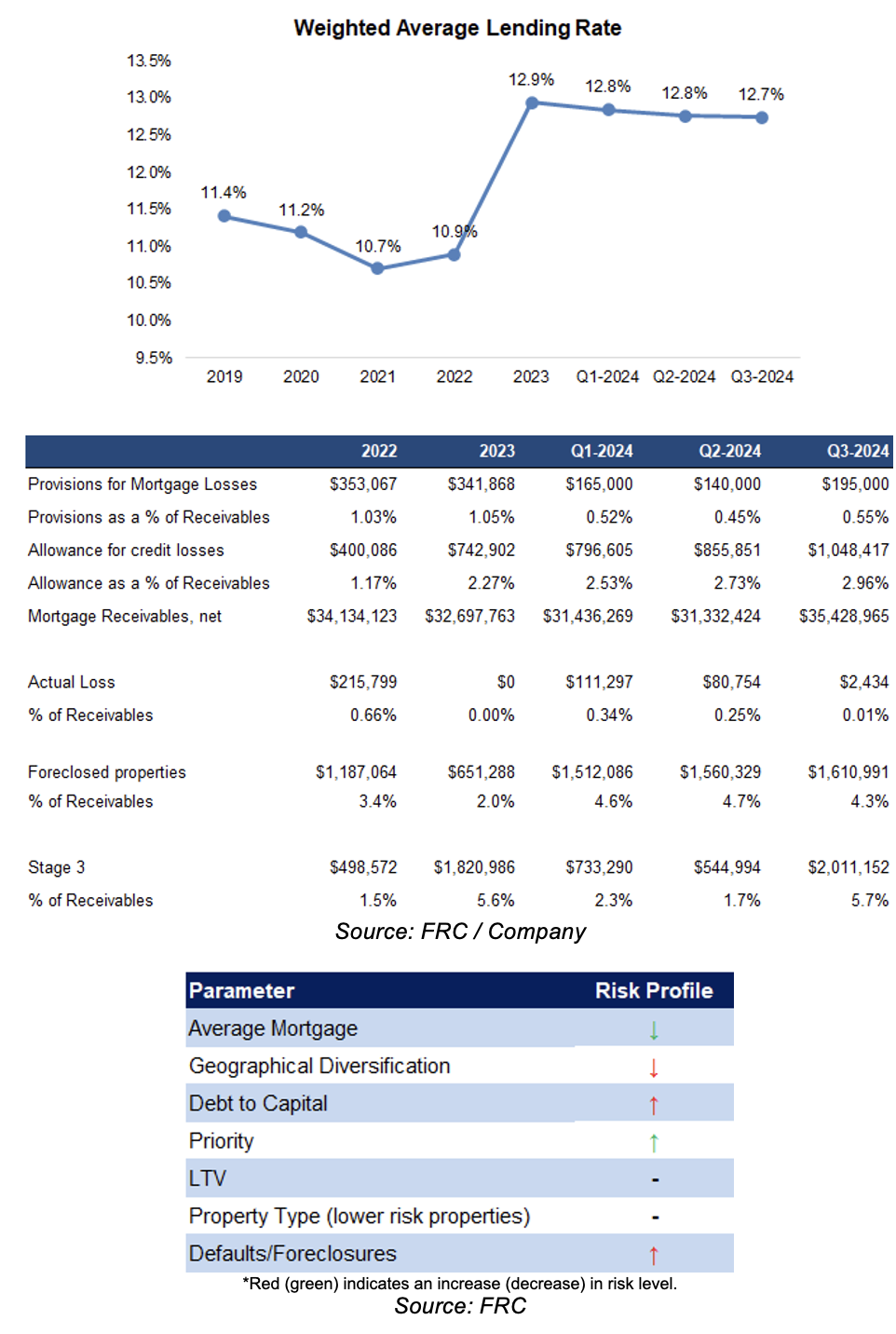

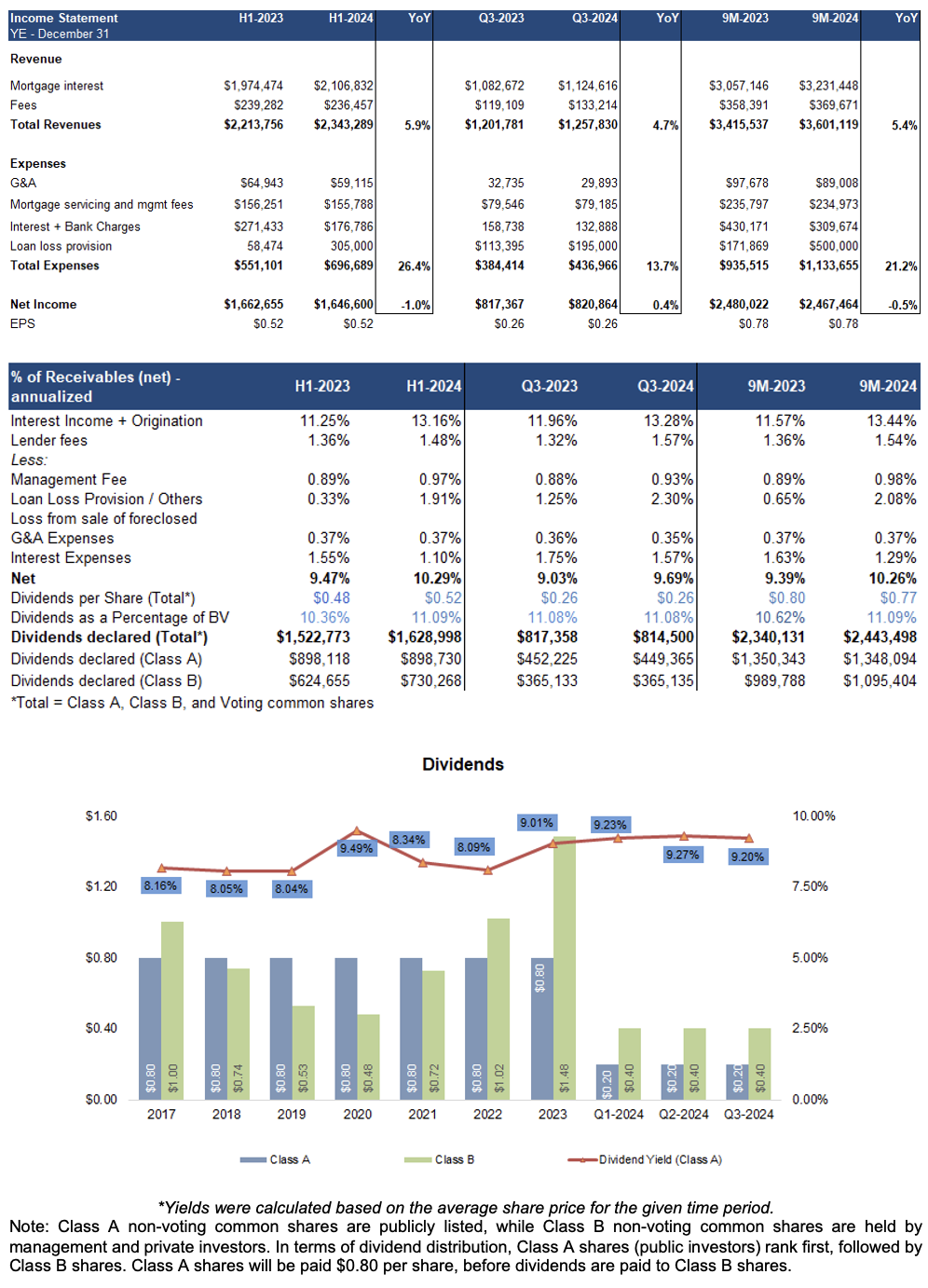

Financials

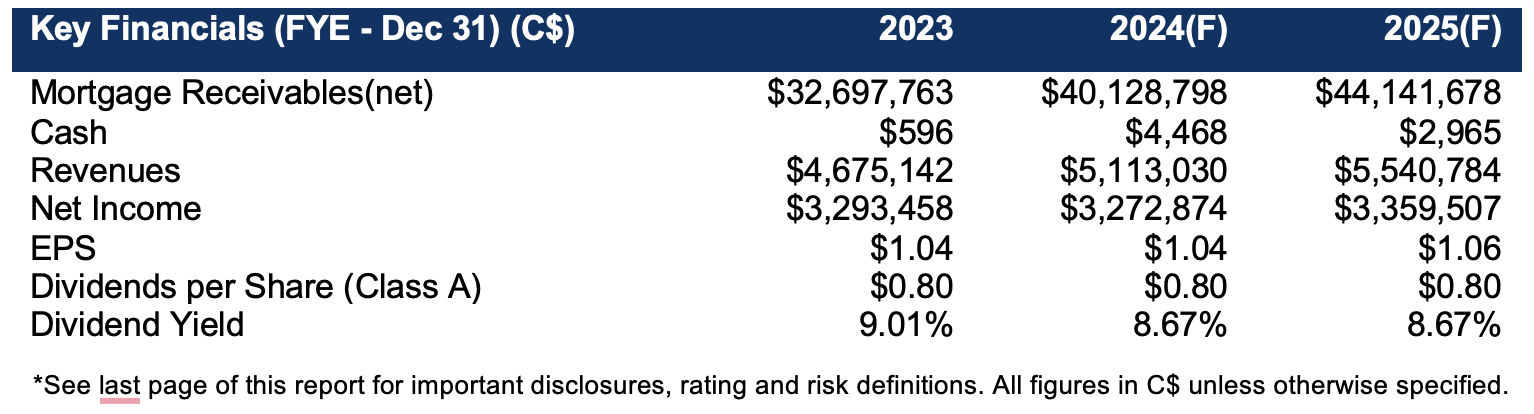

Revenue was up 5% YoY, beating our estimate by 3%, due to higher than anticipated lending rates. However, EPS was flat YoY due to higher loan loss provisions, missing our estimate by 7%

Source: FRC / Company

Net income increased 66 bp to 9.69% of mortgage receivables, due to higher lending rates. Dividends for Class A investors remained unchanged at $0.80/share, implying a yield of 8.7%

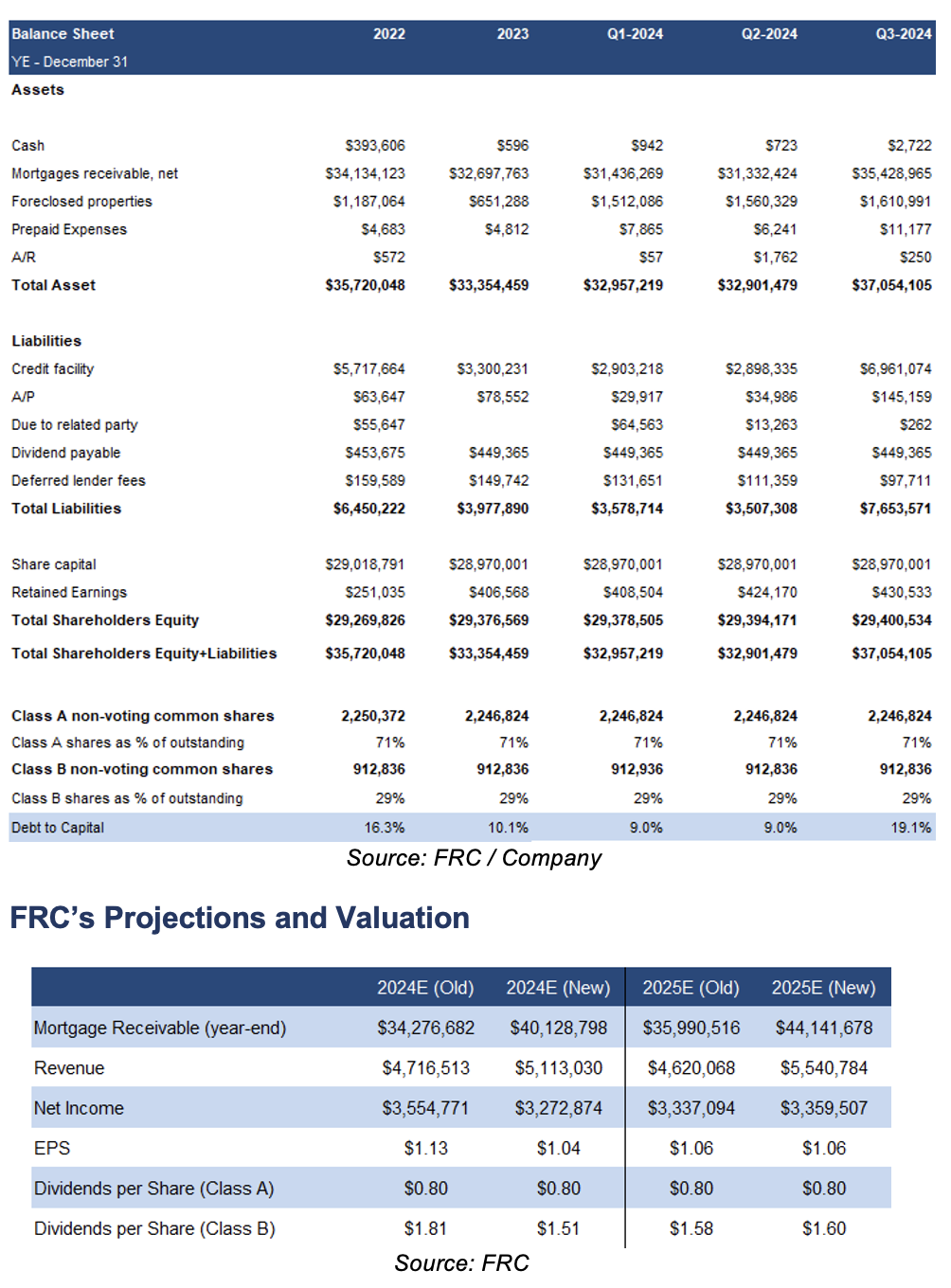

Debt/capital increased 10 pp QoQ to 19%, due to higher lending activity. We are lowering our 2024 EPS estimate due to higher loan loss provisions

However, we believe the company can comfortably distribute its committed $0.80/share annual dividend

We note that BCF should be able to distribute $0.80/share even if lending rates decline by 2%, and loan loss provisions are increased by 10x. Sector multiples are up 5% since our previous report in September 2024

Our fair value estimate increased from $10.09 to $10.13/share, driven by higher sector multiples, partially offset by our lower 2024 EPS estimate

We are reiterating our BUY rating, and adjusting our fair value estimate from $10.09 to $10.13/share, implying an expected return of 18% (including dividends) in the next 12 months. Historically, a declining rate environment has proven beneficial for financial/MIC stocks. With the BoC expected to continue lowering rates, yields are set to decline. However, we believe the risk of higher default rates is easing, and the mortgage origination market is likely to gain momentum in 2025.

Risks

The following, we believe, are the key risks of the company:

- Market concentration: BCF’s primary market is residential construction

- Allows borrowers to defer interest payments till maturity

- Credit and collateral

- Timely deployment of capital is critical

- Distributions are not guaranteed

- Investments in mortgages are typically affected by macroeconomic conditions, and local real estate markets

- The company uses leverage, increasing the fund’s exposure to negative events

- Default rates can rise during recessions

Maintaining our risk rating of 3

APPENDIX