Power Metallic Mines Inc.

Transforms into a Polymetallic Play, Attracting Robert Friedland & Rob McEwen

Published: 9/5/2024

Author: FRC Analysts

Sector: Basic Materials | Industry: Other Industrial Metals & Mining

| Metrics | Value |

|---|---|

| Current Price | CAD $0 |

| Fair Value | CAD $1.17 |

| Risk | 5 |

| 52 Week Range | CAD $0.19-0.92 |

| Shares O/S (M) | 191 |

| Market Cap. (M) | CAD $222 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 6.3 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Since our previous report in January 2024, PNPN is up 170% driven by the discovery of a new high-grade polymetallic zone (“Lion”) on its high-grade nickel-copper-PGM-gold-silver Nisk project in Quebec.

- Strengthened balance sheet through a $20M equity financing from industry titans such as Robert Friedland, Rob McEwen, and institutional investors.

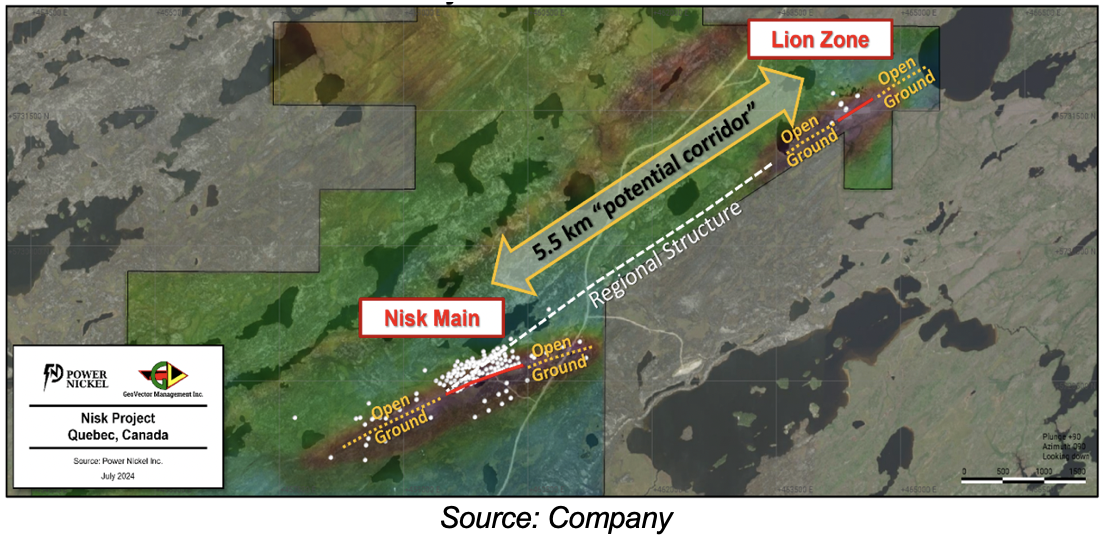

- Two primary zones of mineralization have been confirmed to date – the nickel-rich Nisk Main deposit, and the polymetallic/PGE-rich Lion zone (5.5 km apart).

- The Lion zone was discovered earlier this year through a drill program designed to follow up on a discovery hole. Fifteen out of 16 holes intersected Cu-Ni-PGM-Au-Ag rich mineralization, with weighted average grades of 3.11% Cu, 5.07 g/t Pd, 4.27 g/t Pt, 0.55 g/t Au, 23.53 g/t Ag, and 0.25% Ni (6.04% CuEq). This compares to 0.2-2% Cu, 0-10 g/t Au/PGEs, and 0.5-3% Ni for typical Ni-Cu-PGM deposits.

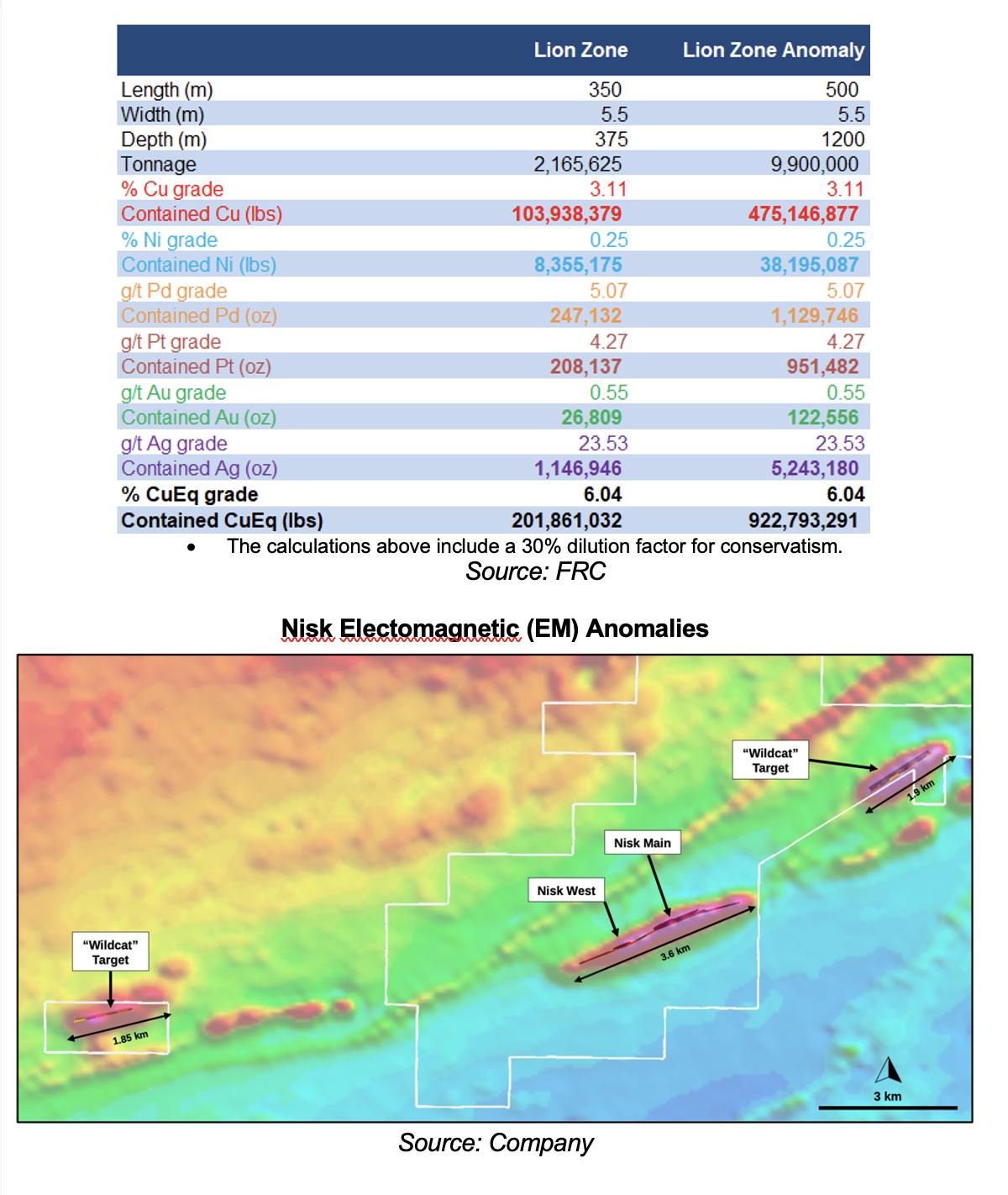

- Through this drill program, PNPN has transformed from a nickel junior to a polymetallic play. We believe initial results indicate potential for a high-grade, mid-sized deposit at the Lion zone, with high copper, gold, silver, and PGM grades akin to world-class Norilsk deposits in Russia. Based on our review of the drilling results, we believe the deposit could host up to 1 Blbs of high-grade CuEq.

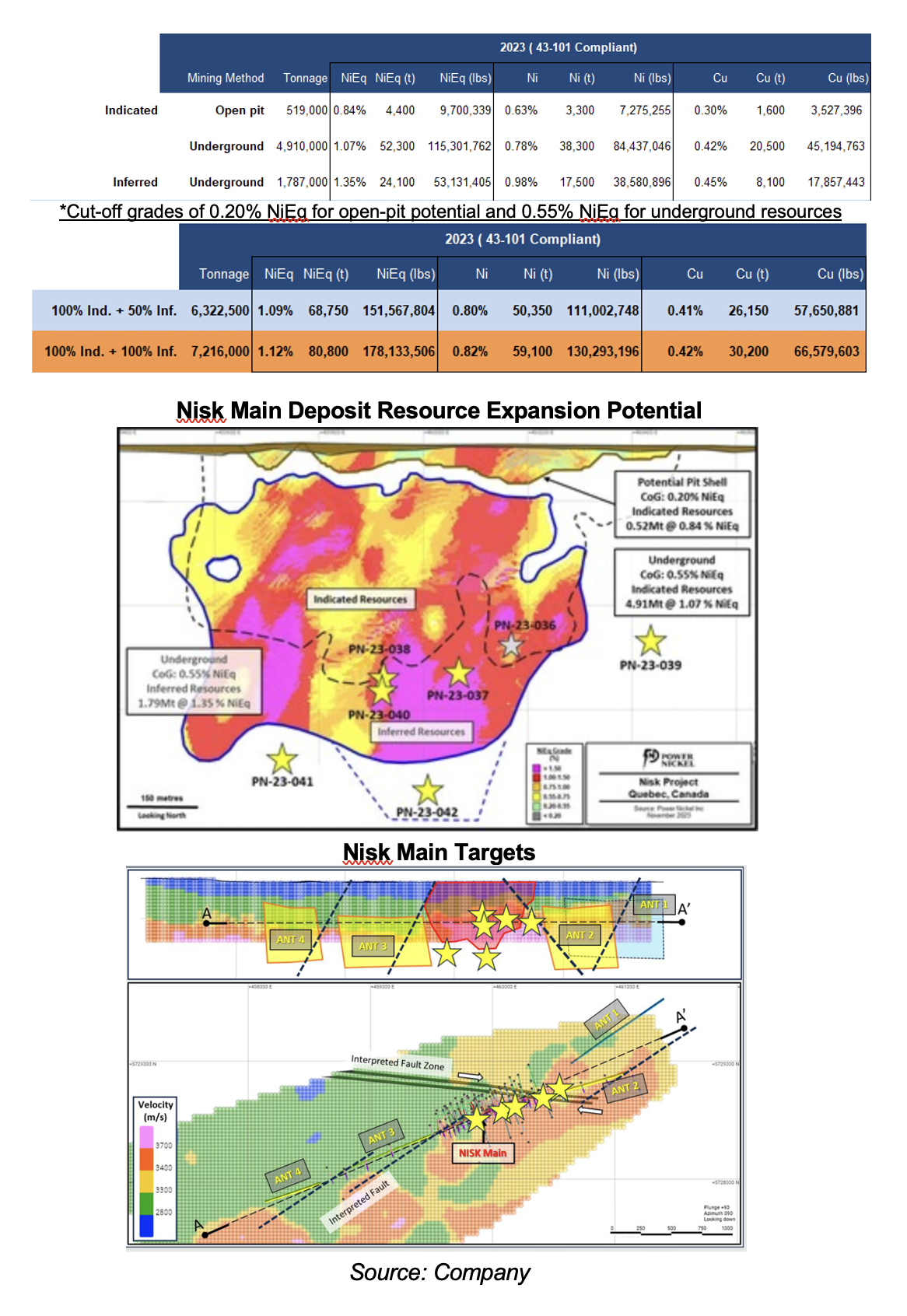

- The Nisk Main deposit hosts a medium-sized/high-grade resource totaling 178 Mlbs Nickel Equivalent (NiEq). This deposit hosts class 1 nickel; the type used in lithium-ion batteries powering electric vehicles/EVs. PNPN has partnered with a privately held metal refining technology company to conduct a feasibility study.

- We believe the project has significant resource upside potential, as mineralization at both Nisk Main and Lion remain open in multiple directions. In addition, several targets remain untested. An 8,000 m drill program is underway.

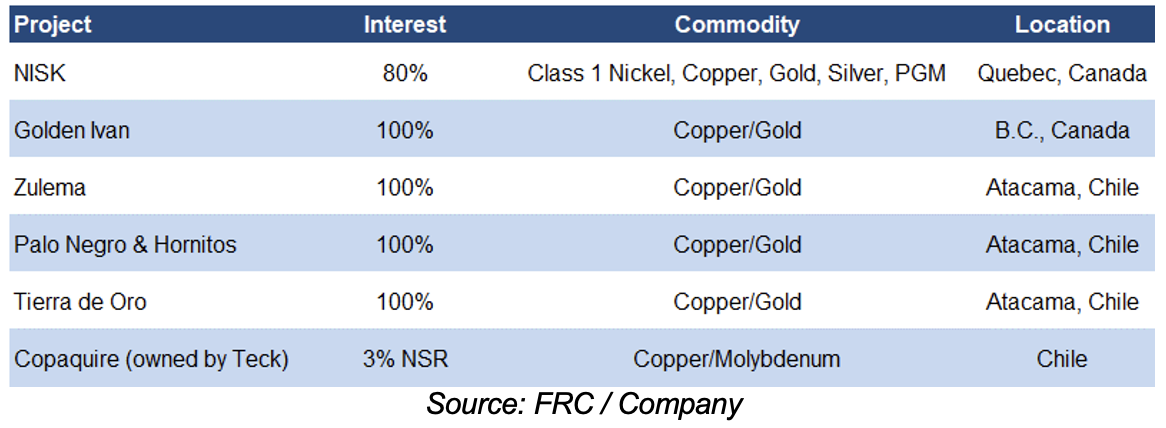

- PNPN plans to spin off its other projects, a move we support as it allows the company to monetize these assets and focus solely on the Nisk project.

- The company offers exposure to EV metals such as nickel and copper, and PGM. Despite the recent slowdown in EV sales growth, the long-term outlook for EVs remains robust. Battery and EV manufacturers, along with miners, are actively seeking stable and long-term supply sources of EV metals.

- Upcoming catalysts include resource delineation/expansion drilling, a feasibility study, and positive sentiment towards juniors focused on EV metals.

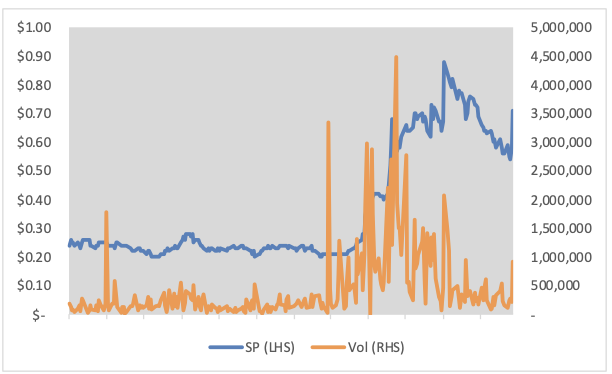

Price Performance (1-year)

Portfolio Summary

One polymetallic project, four copper-gold projects, and royalties in a development-stage copper project owned by Teck (TSX: TECK)

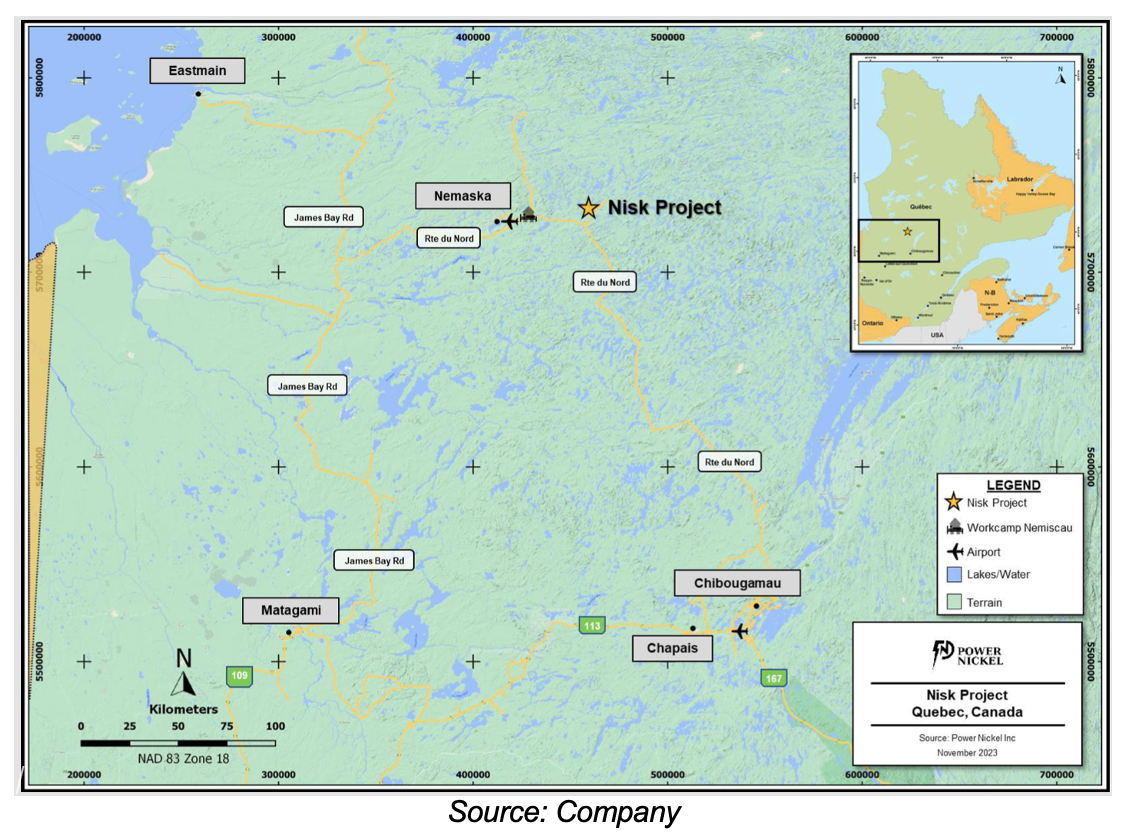

NISK is located in an active mining region, hosting several advanced stage lithium projects. Excellent infrastructure in place, including access to water, and low-cost hydro power

Nisk Polymetallic Project (Quebec)

The Nisk property, covering 45.9 km2, is located in an established mining region near James Bay, Quebec.

Nisk Location Map

The property hosts high-grade nickel-copper-PGM-gold-silver mineralization.

Primary Mineralized Zones

PNPN has identified two primary zones of mineralization – the Nisk Main zone, and the recently discovered Lion zone (5.5 km apart)

Lion Zone

Earlier this year, PNPN completed a 16-hole (7,832 m) drill program, leading to the discovery of the polymetallic-rich Lion zone. The drill program aimed to follow up on the discovery hole PN-23-031A, located 5.5 km northeast of the Nisk Main deposit, originally drilled to assess an airborne electromagnetic (EM) anomaly.

15 out of 16 holes intersected PGM-rich mineralization

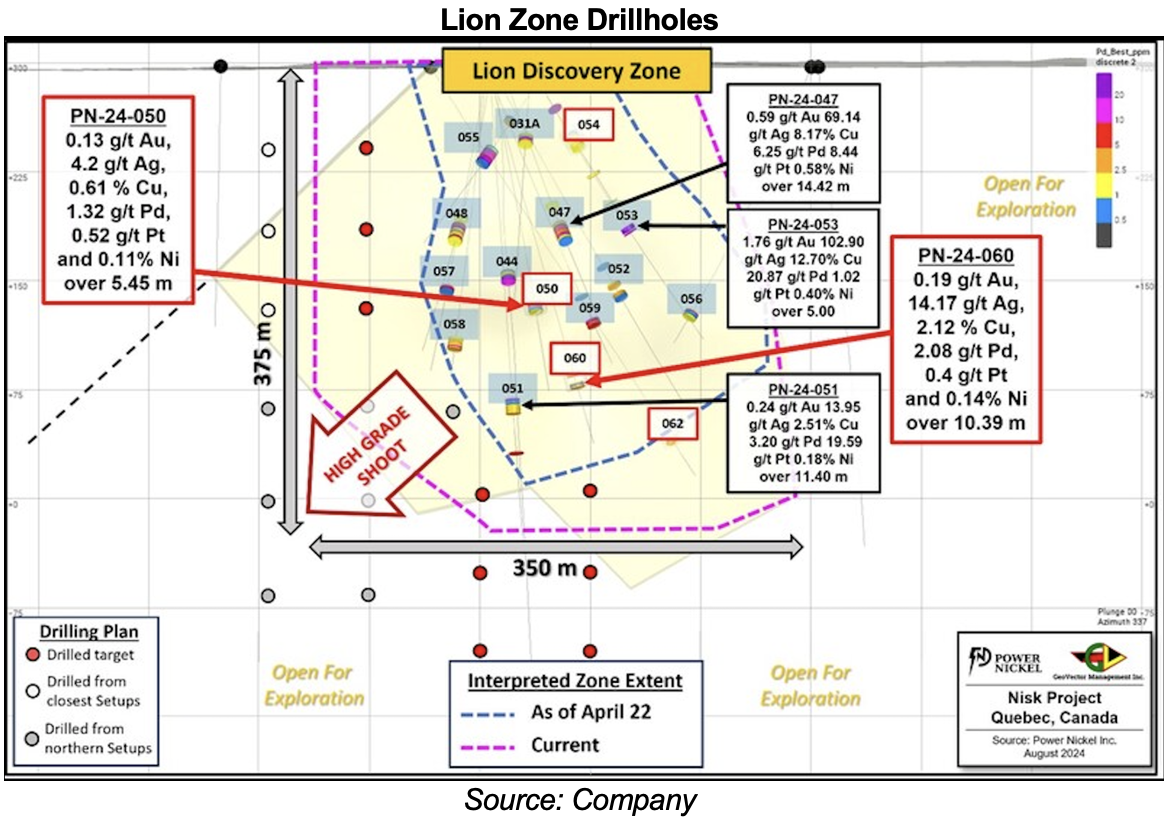

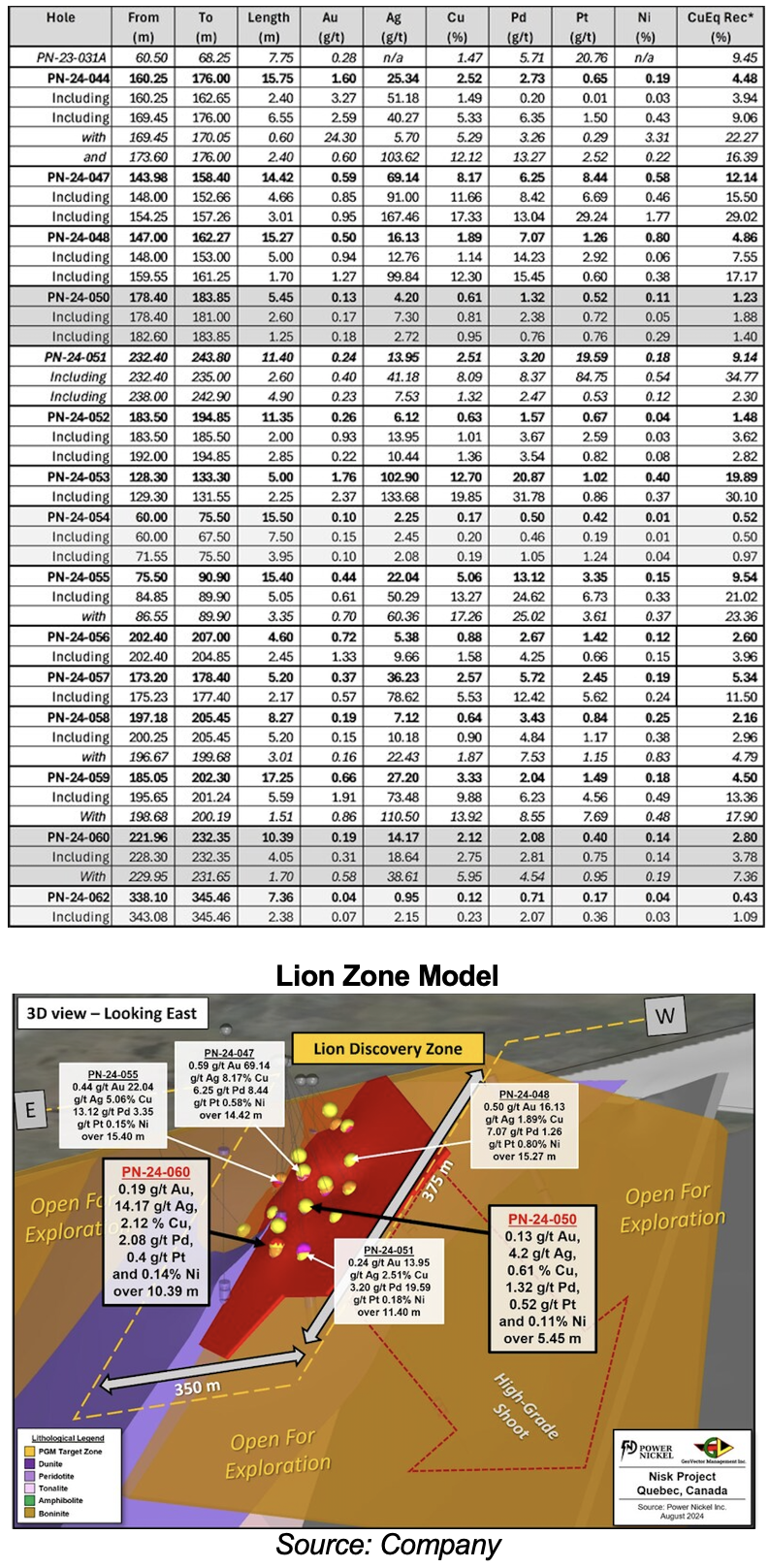

Drill results reported weighted average grades of 3.11% Cu, 5.07 g/t Pd, 4.27 g/t Pt, 0.55 g/t Au, 23.53 g/t Ag, and 0.25% Ni (6.04% CuEq) vs 0.2-2% Cu, 0-10 g/t Au and PGMs, and 0.5-3% Ni for typical Ni-Cu-PGE deposits

Drill Highlights

Multiple high-grade copper, gold, silver and PGM intercepts, including 5 m of 19.89% CuEq, 15.3 m of 9.54%, 17.3 m of 4.5%, and 15.8 m of 4.5%

The Lion zone measures 350 m long x 5-6 m wide x 375 m deep, and remains open in multiple directions

Preliminary Speculative Estimate (FRC Estimate)

Based on our review of the drilling results, projected dimensions, and the Lion Zone anomaly, we believe the deposit could host up to 1 Blbs of high-grade CuEq.

Potential for hosting a high-grade/medium-tonnage deposit

Nisk Main Zone

The Nisk Main zone hosts a high-grade nickel sulphide deposit encompassing open-pit, and underground resources. 70% of resources are in the indicated category, implying high confidence

2023 Resource Estimate (Nisk Main)

In addition to high-grade nickel, the deposit hosts low-medium grade copper, and low-grade gold, silver, PGM, and cobalt. We believe there is significant resource expansion potential as the deposit remains open at depth

In addition, several targets remain untested

Management has commenced a 20-hole/8,000 m drill program, and ground EM and gravimetry surveys, primarily focused on testing the lateral and depth continuity of the Lion and Nisk Main zones. Additionally, PNPN has partnered with a privately held metal refining technology provider (CVMR Corporation) to conduct a feasibility study.

Drilling and geophysics underway

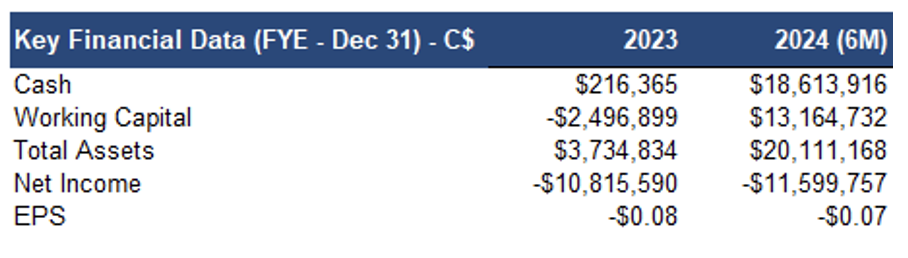

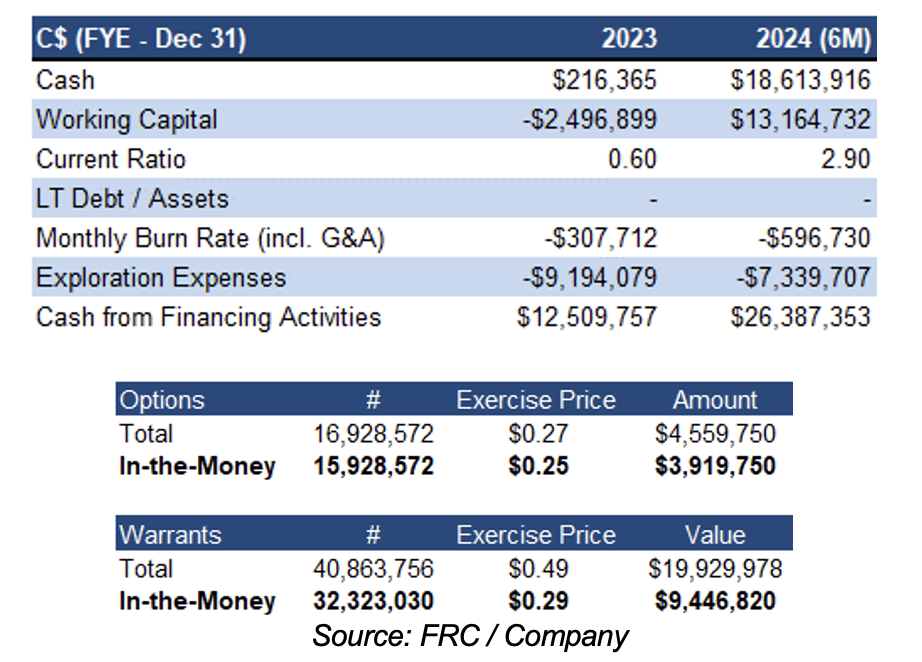

Financials

Strong balance sheet. Subsequent to Q1-2024, PNPN raised $22M through equity financings

In-the-money options and warrants can bring in $13M

FRC Valuation and Rating

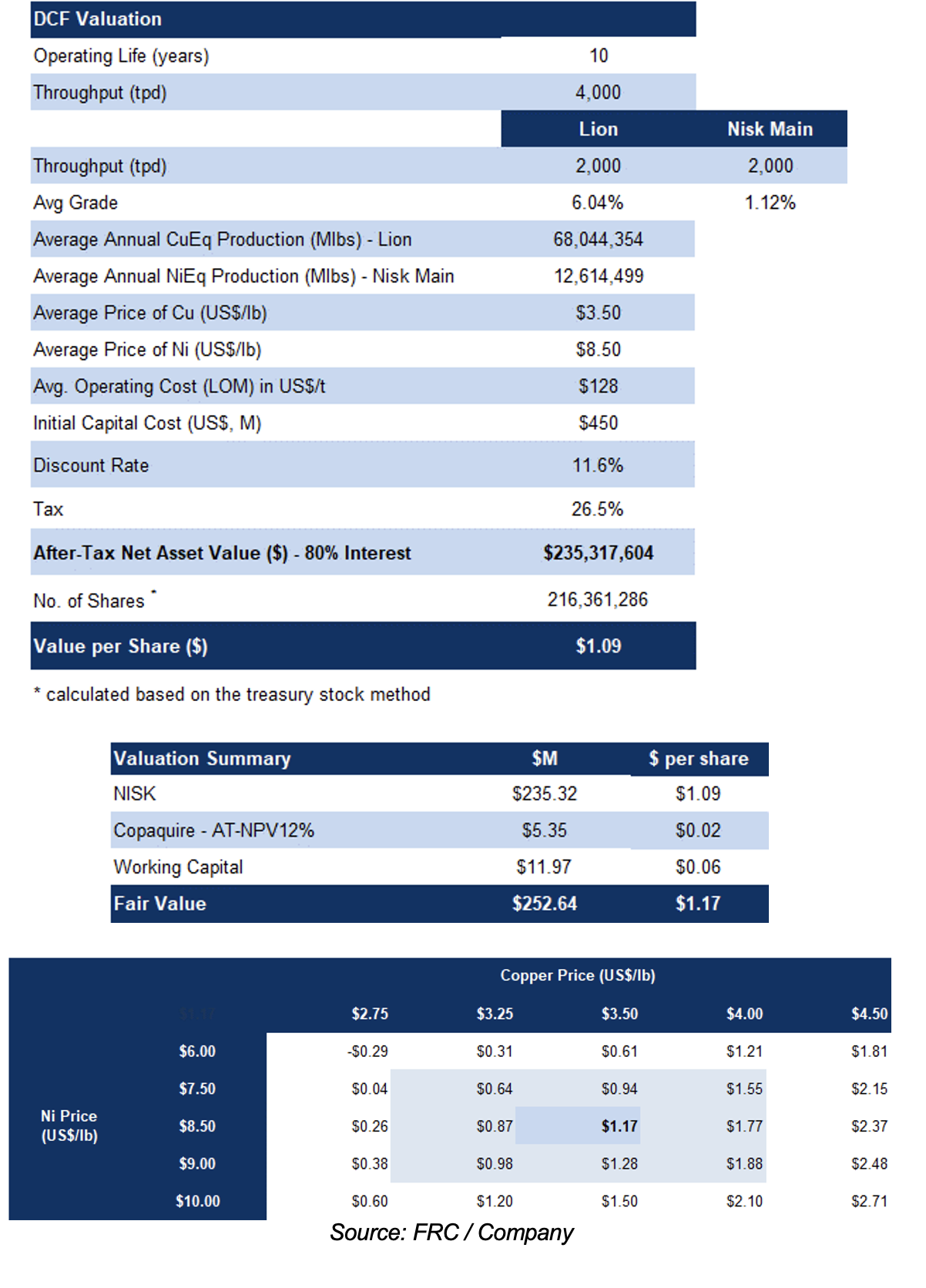

With the company’s shift from a nickel-focused junior to a broader polymetallic play, we are moving away from valuing it solely through comparisons with nickel juniors. Instead, we are introducing a preliminary Discounted Cash Flow (DCF) valuation model. This model assumes a 4,000 tonnes-per-day (tpd) operation, with 50% dedicated to processing copper sulfides, and the other 50% for nickel sulfides.

Our DCF valuation on Nisk is $1.09/share, and our fair value estimate on PNPN is $1.17/share

Our previous valuation, based exclusively on the Nisk Main zone and using a comparable valuation model, was just $0.41/share

Our valuation is highly sensitive to copper and nickel prices

We are reiterating our BUY rating, and raising our fair value estimate from $0.41 to $1.17/share. Upcoming catalysts include resource delineation/expansion drilling, and a feasibility study. We believe our preliminary/speculative estimate will offer insights to the market ahead of Lion's maiden resource estimate. We anticipate the stock will gradually align with our fair value as investors become more aware of the Lion zone’s potential.

Risks

We believe the company is exposed to the following key risks (not exhaustive):

- The value of the company is primarily dependent on commodity prices

- Exploration and development

- Permitting

- Access to capital and potential for share dilution

- No assurance that the company will be able to advance all of its projects simultaneously

Maintaining our risk rating of 5 (Highly Speculative)