Sekur Private Data Ltd.

Gaining Traction Amid Rising Cyber Threats and Stringent Data Privacy Regulations

Published: 7/15/2024

Author: FRC Analysts

Sector: Technology | Industry: Software Application

| Metrics | Value |

|---|---|

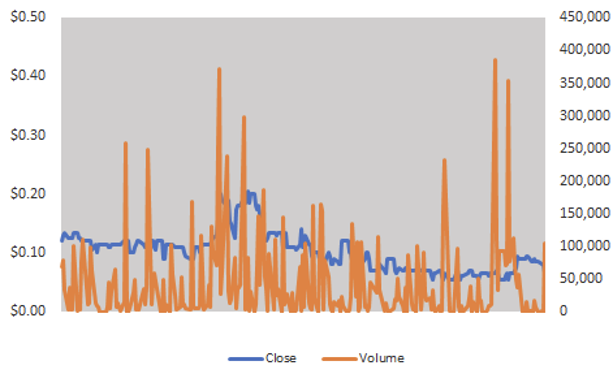

| Current Price | CAD $0.05 |

| Fair Value | CAD $0.47 |

| Risk | 4 |

| 52 Week Range | CAD $0.05-0.21 |

| Shares O/S (M) | 120 |

| Market Cap. (M) | CAD $6 |

| Current Yield (%) | N/A |

| P/E (forward) | N/A |

| P/B | 5.9 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

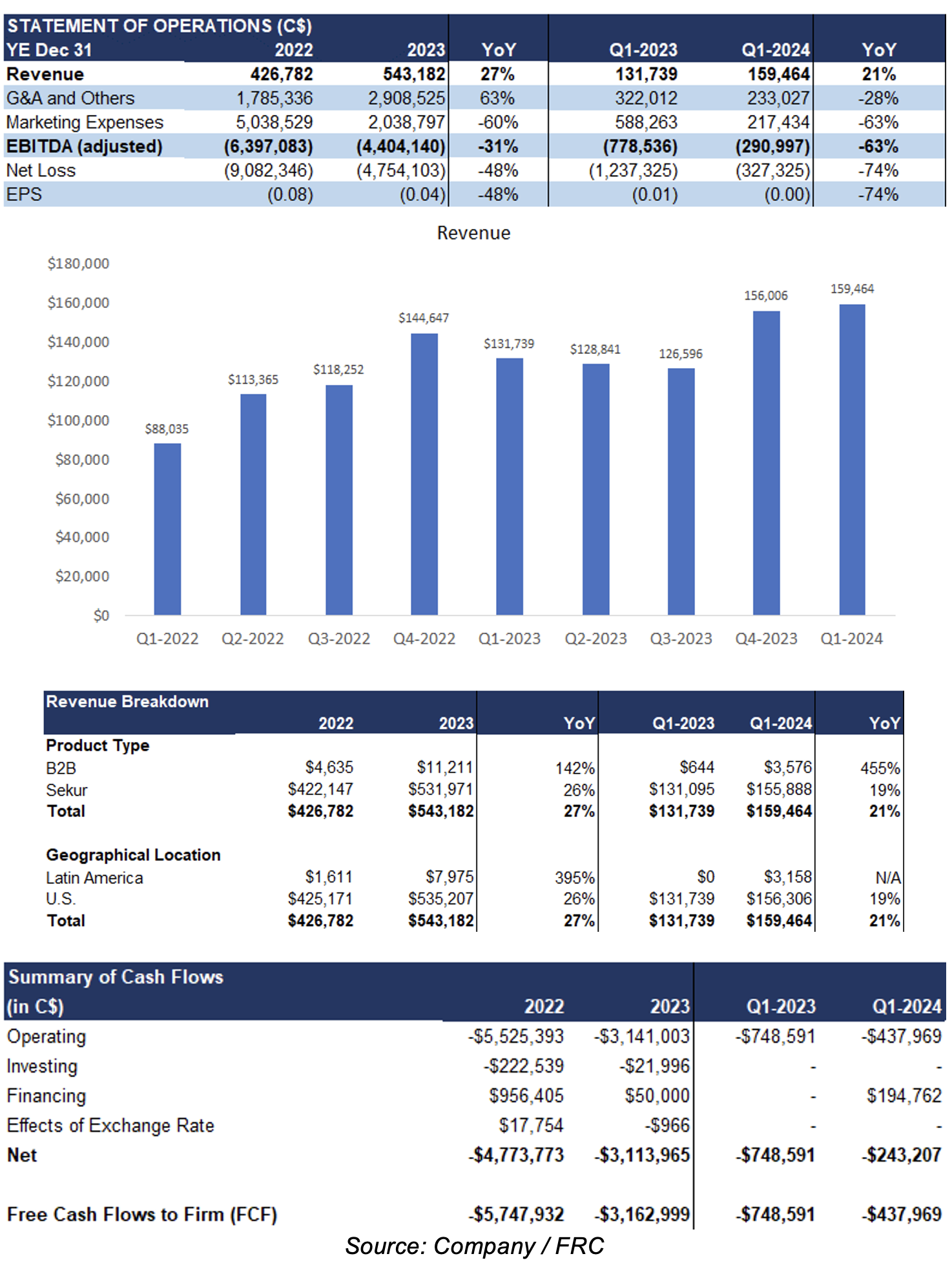

- 2023 revenue was up 27% YoY, beating our estimate by 9%. Q1-2024 revenue grew 2% QoQ and 21% YoY, but fell short of our estimate by 10%, attributed to reduced marketing initiatives.

- EBITDA and EPS remained negative, but improved YoY, aligning with our estimates.

- Although revenue growth continues to be driven by individual users in the U.S., Sekur has been gradually adding small and medium-sized businesses (SMBs).

- We believe businesses handling sensitive and confidential information, such as those in the medical, financial, and real estate sectors, are ideal targets for Sekur. In H2-2024, the company will introduce services tailored for large enterprises, and launch an affiliate and referral program, while aggressively targeting SMBs and corporate/enterprise clients.

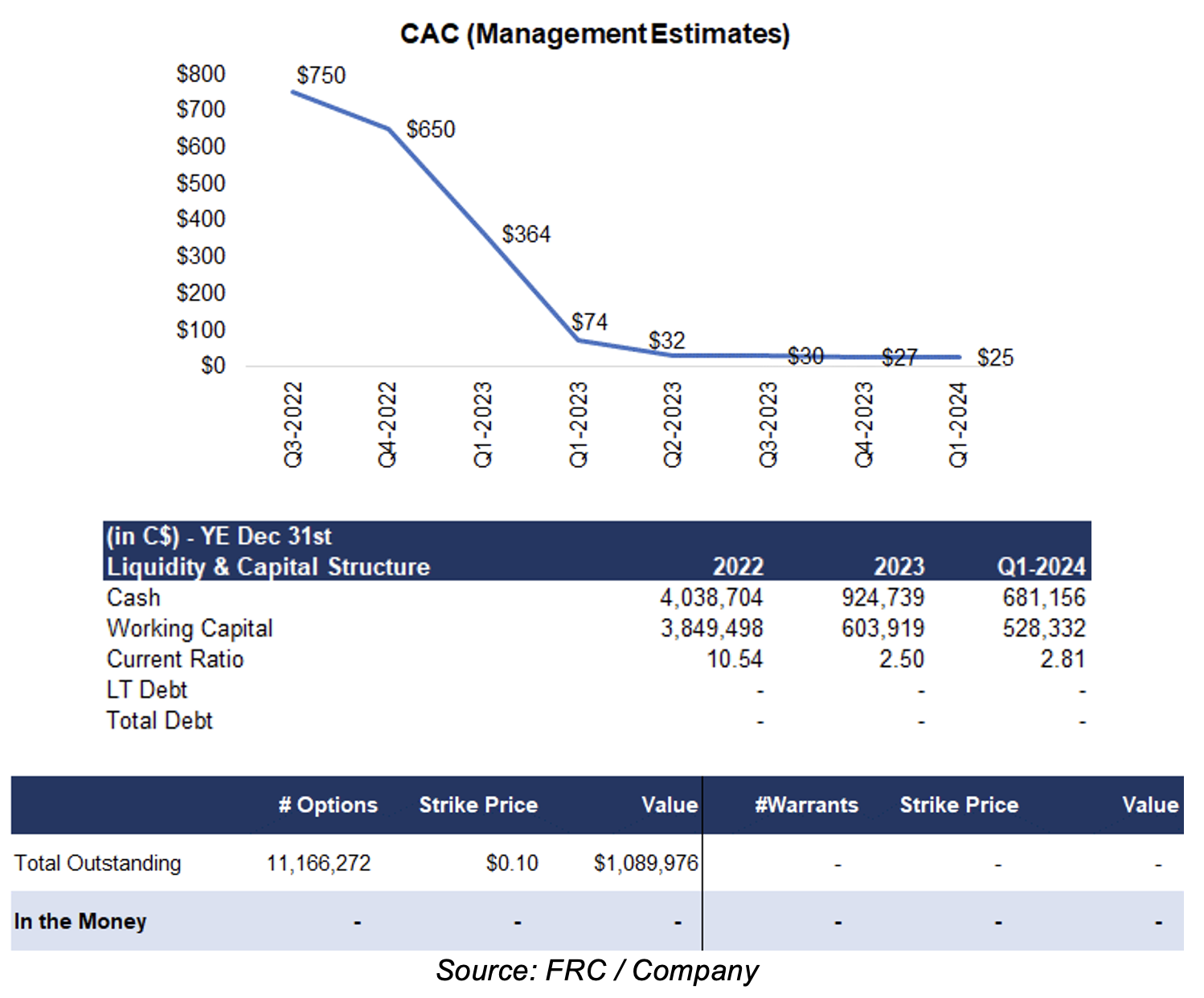

- Customer Acquisition Costs (CAC) have been decreasing for the past few quarters, dropping from US$85 in Q2-2023, to US$25 by Q1-2024. The significant decline in CAC was a result of the company’s shift towards in-house SEO marketing, and efforts to attract resellers and distributors, while cutting back on initiatives involving social media influencers.

- Although Sekur does not disclose revenue/user or user-count, we note that the annual pricing for its solutions/services ranges between US$77 and US$550 per user. As Sekur continues to onboard SMBs and enterprise clients, we believe the average revenue per user should rise.

- The recent AT&T (NYSE: T) data breach, which impacted millions of customers, along with the cyberattacks on a software company used by thousands of car dealers across North America, and Google's (NASDAQ: GOOGL) acquisition of Wiz, a major cybersecurity player, we believe highlight the critical importance of strong cybersecurity protocols.

- We anticipate the company will achieve profitability in 2026. Management is aiming for profitability by 2025, with plans to cut G&A and marketing expenses by more than 50% in both 2024 and 2025.

Price and Volume (1-year)

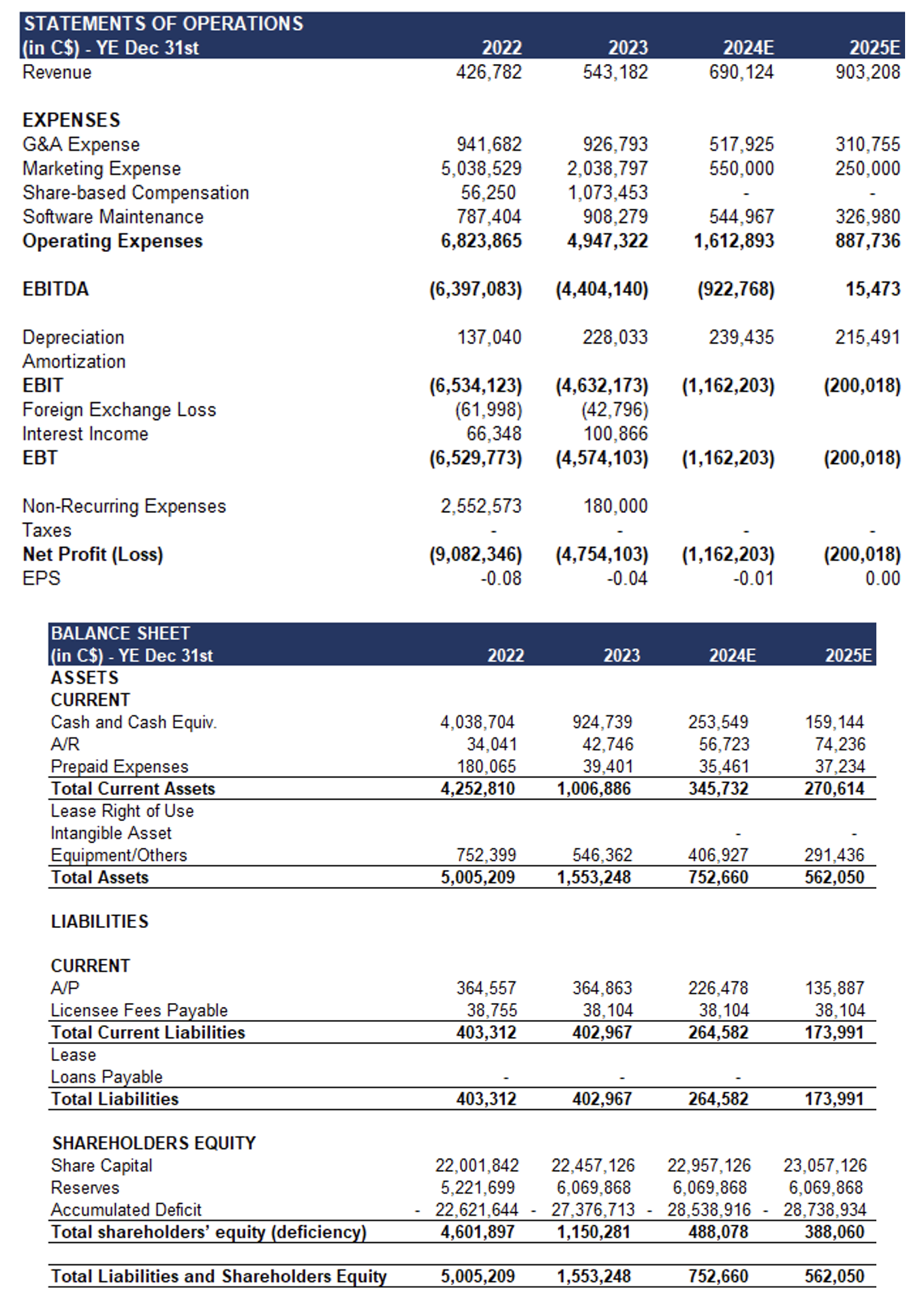

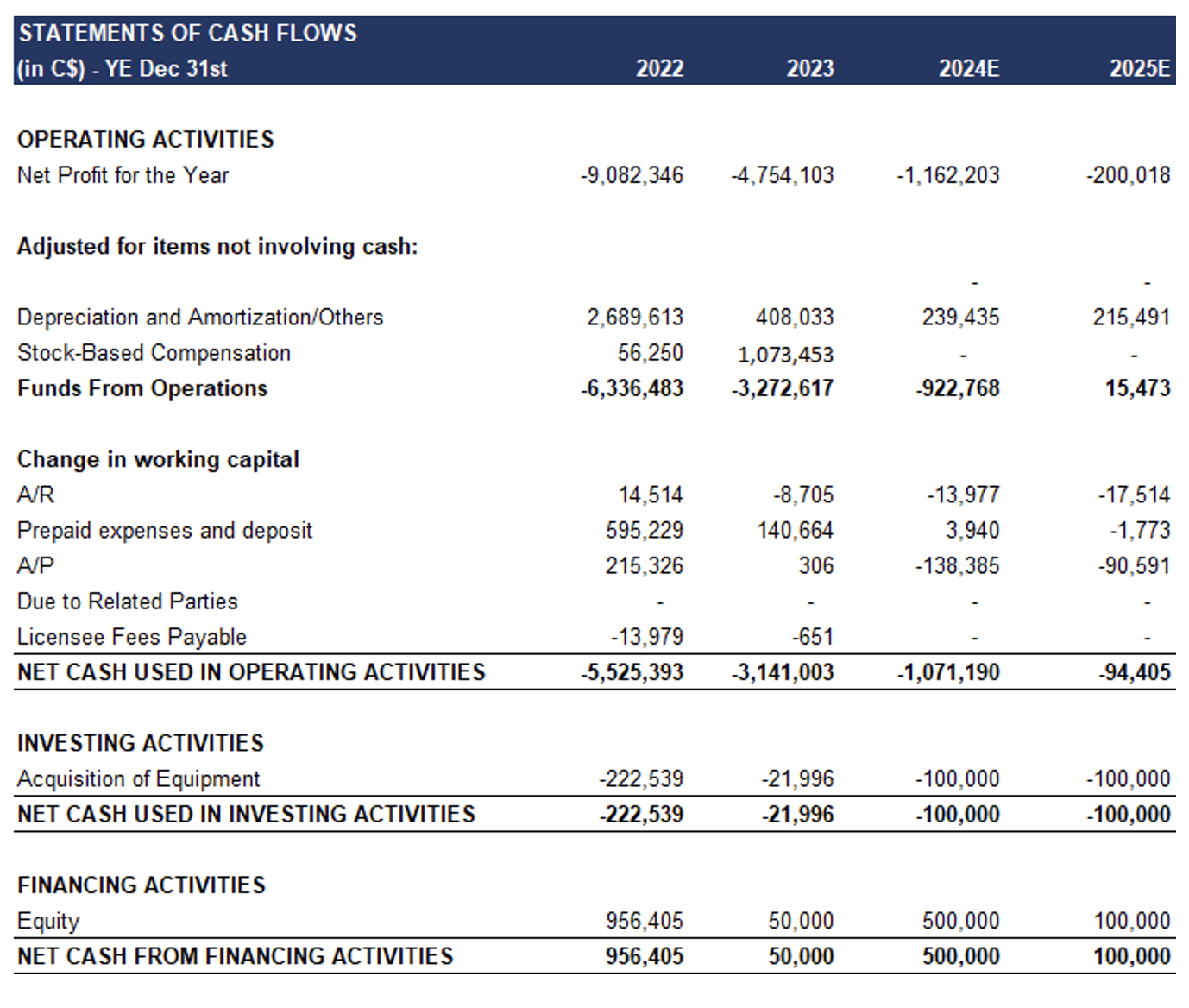

Financials

2023 revenue was up 27% YoY, beating our estimate by 9%. Q1-2024 revenue was up 2% QoQ, and 21% YoY, but missed our estimate by 10%, primarily due to reduced marketing initiatives

Revenue continues to be driven by individual users in the U.S. G&A and marketing expenses were lower than expected

EPS improved YoY in both 2023 and Q1-2024, meeting our estimates. Sekur has been able to reduce its CAC significantly.

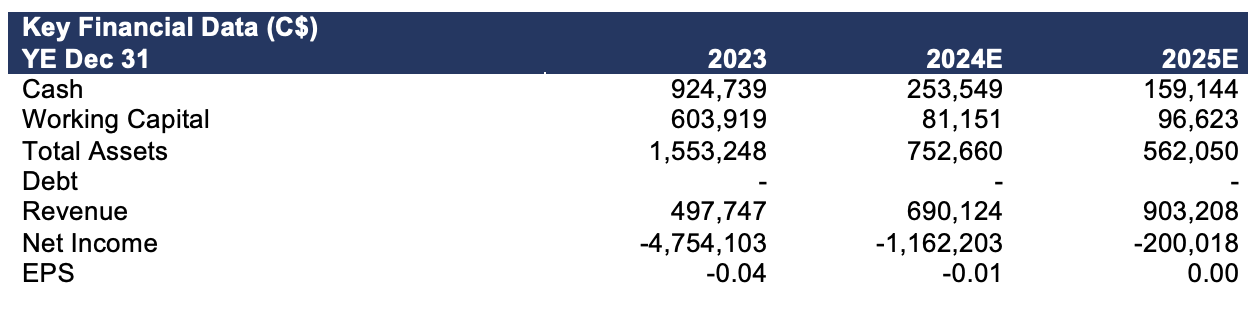

FRC Projections and Valuations

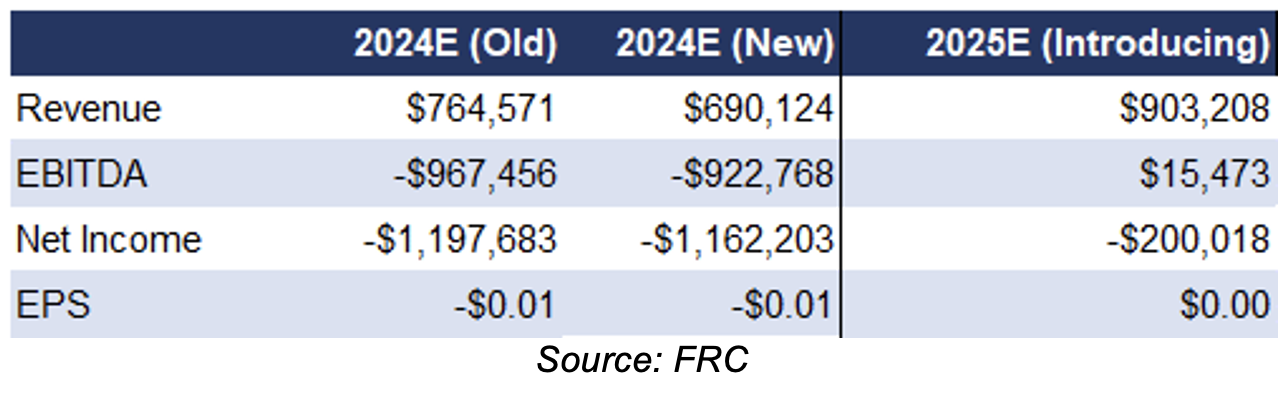

As Q1 revenue fell short of our estimate, we are lowering our near and long-term revenue forecasts

However, since Q1 EPS was in line, driven by reduced CAC and management’s cost-cutting initiatives, we are maintaining our 2024 EPS estimate

As a result of our lower long-term revenue forecasts, our DCF valuation decreased from $0.61 to $0.47/share.

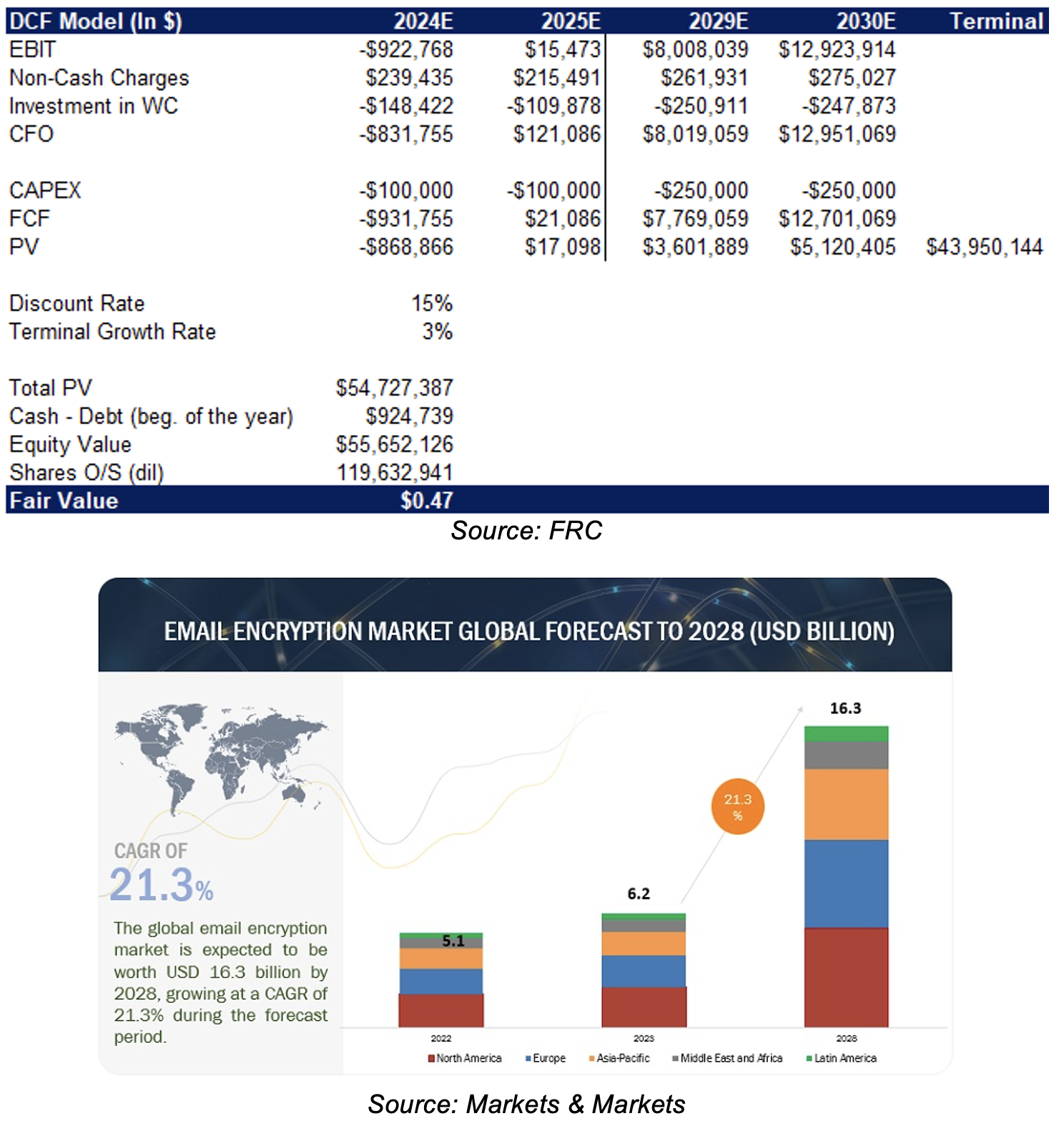

It is anticipated that the global email encryption market will grow by 21% p.a. over the next five years

As Sekur does not have any publicly traded comparables, we are continuing to not use a comparables valuation model. That said, we note that Sekur is trading at 3.5x revenue (based on our 2026 revenue forecast) vs the Application Software sector average of 6.7x (Source: S&P Capital IQ).

We are maintaining our BUY rating, and lowering our fair value estimate from $0.61/share to $0.47/share. We maintain a bullish outlook on the sector, driven by stringent data privacy regulations, and rising email data breaches, cyber threats, and security awareness.

Risks

We believe the company is exposed to the following risks:

- Yet to generate meaningful revenue

- Technological innovations are key for long-term sustainability

- Converting users from free to paid services can be challenging

- Rising competition among encrypted service providers

Appendix