Kidoz Inc.

EPS Surprise: Expected Profitability Ahead of Schedule

Published: 6/6/2024

Author: Sid Rajeev, B.Tech, CFA, MBA

Sector: AdTech | Industry: Advertising

| Metrics | Value |

|---|---|

| Current Price | CAD $0.26 |

| Fair Value | CAD $0.75 |

| Risk | 4 |

| 52 Week Range | CAD $0.10-0.36 |

| Shares O/S (M) | 131 |

| Market Cap. (M) | CAD $34 |

| Current Yield (%) | n/a |

| P/E (forward) | n/a |

| P/B | 5.2 |

Already a subscriber?

Want to know the fair value of the stock?

Subscribe for free to get exclusive insights and data.

Report Highlights

- Q1 revenue was up 7% YoY, but 11% below our estimate amid lower-than-expected ad spending. Major digital ad platforms, YouTube (NASDAQ: GOOGL), and Meta (NASDAQ: META), saw their ad revenue rise by 20% and 27% YoY, respectively.

- However, gross margins increased 13 pp YoY to 53%, primarily driven by higher direct vs reseller sales, beating our estimate by 11 pp. As a result, EBITDA and EPS improved YoY, and significantly surpassed our expectations.

- Since Q1 revenue typically represents only 10%-15% of the year's total, predicting the full-year revenue trend based on Q1 alone is challenging. Q1 could potentially be an anomaly, and we expect stronger revenue growth for the rest of the year given the anticipated growth in global digital ad spending.

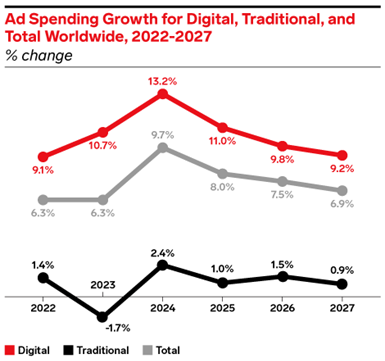

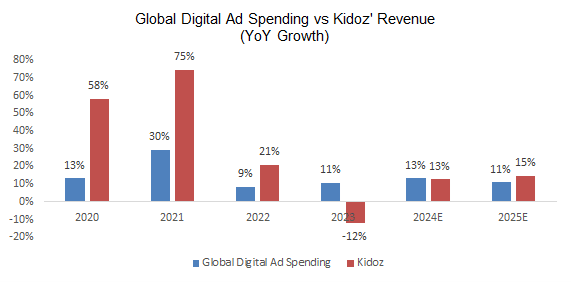

- Per eMarketer, global digital ad spending will grow by 13.2% this year, up from 10.7% in 2023, and 9.1% in 2022. From 2021 to 2023, KIDZ's revenue growth outpaced global digital ad spending growth by 1.3x on average.

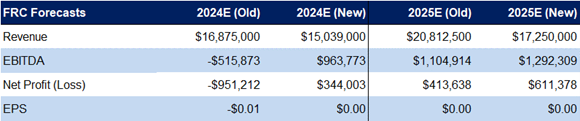

- While we have revised our 2024 revenue growth forecast downward (16% to 13%), we now anticipate EPS turning positive this year, instead of next year.

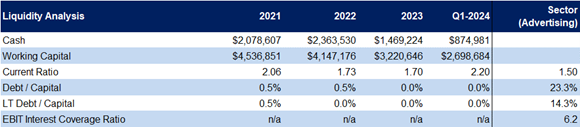

- KIDZ maintains a healthy balance sheet, with no debt.

- KIDZ’s forward EV/R is 1.6x vs the sector average of 3.3x, a 50% discount.

|

Key Financial Data (FYE - Dec 31) |

|

|

|

|

|

(US$) |

|

2023 |

2024E |

2025E |

|

Cash |

|

1,469,224 |

2,096,387 |

2,987,313 |

|

Working Capital |

3,220,646 |

4,023,712 |

5,108,130 |

|

|

Total Assets |

|

11,807,080 |

12,611,600 |

13,729,547 |

|

LT Debt to Capital |

0.0% |

0.0% |

0.0% |

|

|

Revenue |

|

13,326,824 |

15,039,000 |

17,250,000 |

|

Net Income |

|

(2,012,056) |

344,003 |

611,378 |

|

EPS |

|

-0.02 |

0.00 |

0.00 |

*See last page for important disclosures, rating, and risk definitions. All figures in US$ unless otherwise specified.

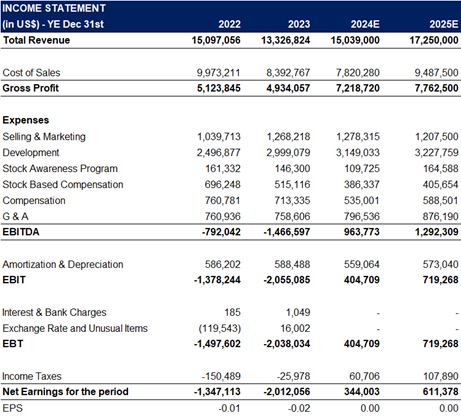

Financials

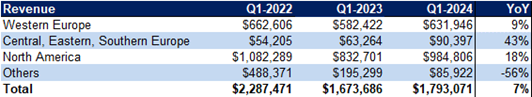

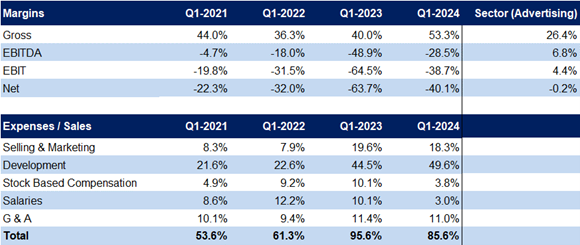

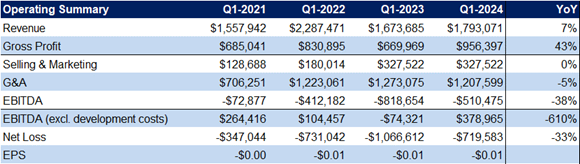

Q1 revenue was up 7% YoY, missing our forecast by 11%

However, gross margins increased 13 pp YoY to 53%, beating our estimate by 11 pp

G&A expenses were down 5% YoY, falling 8% below our estimate, primarily from slashing consultant fees

EBITDA and EPS remained negative

However, as a result of higher gross margins, and lower G&A expenses, EBITDA and EPS improved significantly, surpassing our estimates

Source: FRC/Company

Source: FRC/Company

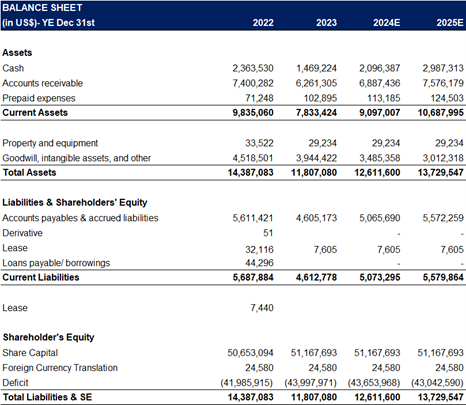

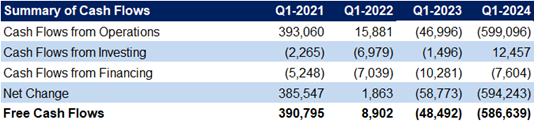

Healthy balance sheet, with no debt

Source: FRC/Company

Source: FRC/Company

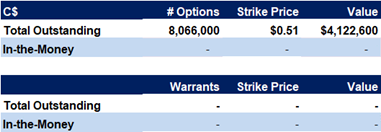

No outstanding options are in-the-money

Sector Outlook

Source: eMarketer

It is estimated that global digital ad spending will grow 13.2% this year, up from 10.7% in 2023, and 9.1% in 2022

Source: FRC/Various

From 2021 to 2023, KIDZ's revenue growth outpaced global digital ad spending growth by 1.3x on average

For conservatism, we anticipate KIDZ’s revenue will grow by 13% in 2024, and 15% in 2025, outpacing global digital ad spending growth forecasts by 1.2x

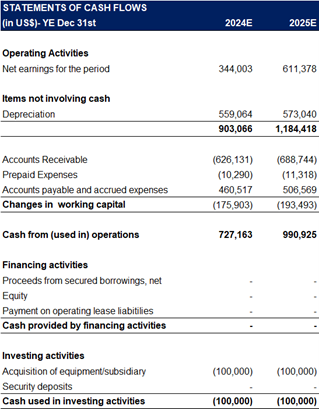

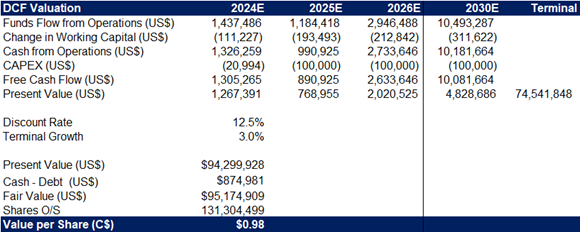

FRC Projections and Valuation

As Q1 gross margins were higher than expected, we are raising our 2024 and 2025 EPS forecasts

Source: FRC

We now expect EPS to turn positive this year instead of next year

As a result, our DCF valuation increased from C$0.94 to C$0.98/share

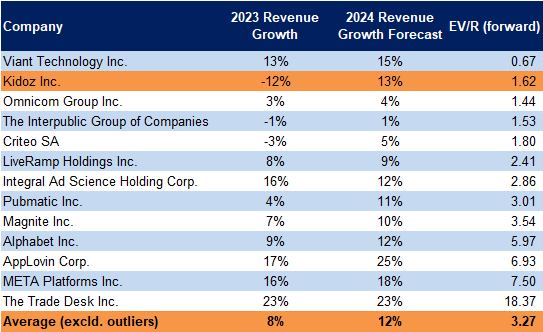

Digital AdTech Companies

Source: S&P Capital IQ/FRC

KIDZ’s forward EV/R of 1.6x (previously 1.2x) is significantly lower than the sector average of 3.3x (previously 3.0x)

Our comparables valuation decreased from C$0.54 to C$0.52/share, driven by our lower revenue estimate, partially offset by the higher average sector EV/R

Risks

We believe the company is exposed to the following key risks:

• Operates in a highly competitive space

• Unfavorable changes in regulations

• Ability to attract publishers and brands will be key to long-term growth

• FOREX