Two Juniors Announce Significant Financings Following Promising Developments

Published: 2/18/2025

Author: FRC Analysts

Highlights:

We analyze the performance of our top picks, including a copper junior, whose shares rose 22% last week. We also discuss promising developments and financings from other companies we cover.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Disclaimer: This article and research coverage is paid for and commissioned by issuers. See the bottom of this article for other important disclosures, rating, and risk definitions.

Power Metallic Mines Inc. (PNPN.V)

PR Title: Announces a $50M private placement

Analyst Opinion: Positive – This significant financing follows a series of encouraging drill results from the polymetallic Lion zone (Quebec). Proceeds from the current raise will fund aggressive follow-up drill programs. The property contains two primary zones of mineralization: the nickel-rich Nisk Main deposit, which hosts a mid-sized, high-grade resource of 178 Mlbs NiEq, and the recently discovered high-grade Lion zone. Shares are up 626% YoY, largely driven by the excitement surrounding the recent discovery.

Denarius Metals Corp. (DMET.NE, DNRSF)

PR Title: Announces a $4.5M private placement

Analyst Opinion: Positive – Proceeds will primarily be directed toward the Lomero, Toral, and Aguablanca projects in Spain. Certain insiders will likely commit $1M, sending a positive signal to the market. As mentioned in our note last week, Trafigura Pte. Ltd., a leading global commodity supplier, has offered a US$9M prepayment financing to fully fund construction activities at DMET’s Zancudo gold-silver project in Colombia. Production is expected to begin in the coming weeks.

Churchill Resources Inc. (CRI.V, CRICF)

PR Title: Identifies nickel and cobalt mineralization at its Florence Lake project in Labrador

Analyst Opinion: Positive – Sampling has delineated a 7.5 km x 1 km nickel-cobalt zone. The Florence Lake property is prospective for nickel sulphide deposits, a key source of class 1 nickel used in lithium-ion batteries.

FRC's Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, World Copper Ltd. (TSXV: WCU), was up 22%. WCU is advancing two large copper projects in the Americas.

* Past performance is not indicative of future performance (as of Feb 18, 2025)

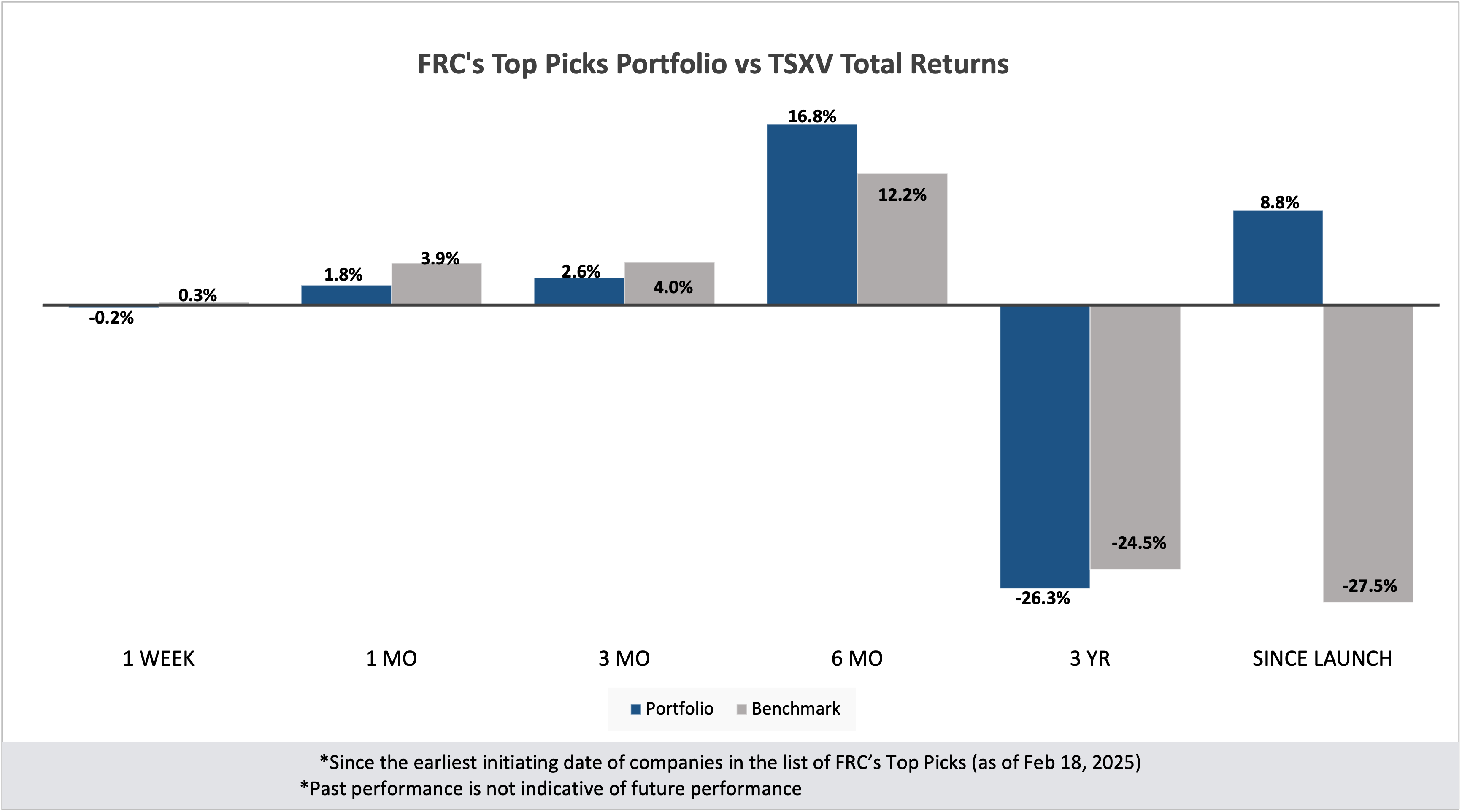

FRC's Top Picks Portfolio vs TSXV Total Returns

Performance by Sector

1. Since the earliest initiating date of companies in the list of Top Picks (as of Feb 18, 2025)

2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark.

3. Past performance is not indicative of future performance.