Analysts' Ideas of the Week

Phosphate Junior Secures Bid; Strong Results from Lithium, Gold, and Copper Explorers

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

Highlights

*Report and research coverage is paid for and commissioned by companies mentioned. See the bottom of this report for other important disclosures.

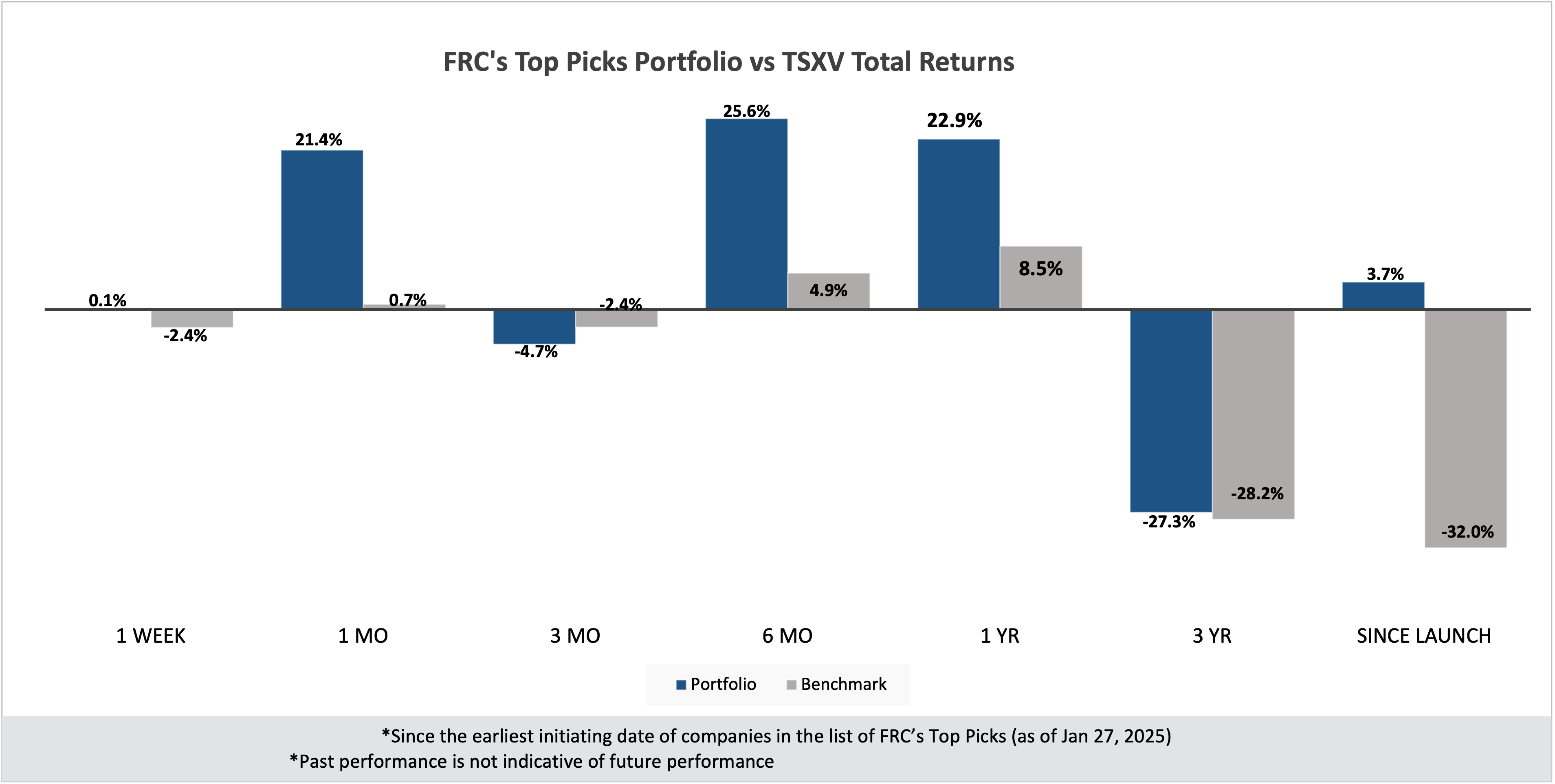

In this edition, we analyze the performance of our top picks, including a potash producer, whose shares rose 18% last week. We also highlight promising developments from gold, lithium, copper, and phosphate juniors.

Highlights

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Chatham Rock Phosphate Limited

PR Title: Proposed sale of Korella phosphate projects (Australia)

Analyst Opinion: Positive – Chatham has entered into an agreement to sell its Korella properties for C$3.7M in cash, along with future royalty payments of C$9/t for the first 0.19 Mt of production, and C$0.9/t thereafter. We estimate future royalties to range between C$2.7M and C$3.8M, bringing the total sale price to approximately C$6.4M–C$7.5M. In our previous update report in late 2023, we had valued this project at C$10.2M. While the deal is at a lower valuation, we view it positively as it provides an immediate cash infusion, enabling the company to advance its flagship assets, including Chatham Rise in New Zealand, and Makatea in French Polynesia, without near-term share dilution. We will publish a detailed update shortly.

Golden Arrow Resources Corporation

PR Title: Additional results from the Rincones target at San Pietro project (Chile)

Analyst Opinion: Positive – The pre-resource stage San Peitro project is prospective for IOCG deposits (typically high-grade/low OPEX). Recent drilling intersected mineralization over significant intervals, including 283 m grading 0.23% Cu, 0.04 g/t Au, 101 g/t Co, and 15.5% Fe. These results have extended the Rincones target by 250 m to the south (previously 2.6 km), and 135 m to the west (previously 1.6 km). GRG is awaiting assay results from two additional drill holes.

Grid Battery Metals Inc.

PR Title: Drill results from its Clayton Valley lithium project (Nevada)

Analyst Opinion: Positive – This property is located adjacent to Albemarle’s (NYSE: ALB) lithium mine, and Century Lithium’s (TSXV: LCE) advanced-stage lithium project. CELL recently completed a reverse circulation (RC) drill program consisting of five holes totaling 4,730 feet, with all holes intersecting mineralization. The best result was 170 feet grading 298 ppm Li, including grades of up to 741 ppm. Management is planning a follow-up program aimed at advancing toward a maiden resource estimate. Notably, the southern portion of the property, which remains untested, is of particular interest for its potential to host shallow but higher-grade lithium mineralization.

Power Metallic Mines Inc.

PR Title: Additional results from an ongoing drill program from its polymetallic Lion zone discovery (Quebec)

Analyst Opinion: Positive – Two out of three holes at the high-grade polymetallic Lion zone returned significant values, including 10.25 m of 6.26% CuEq, and 4.85 m of 1.85% CuEq. We continue to value the project based on its potential to host up to 1 Blbs of high-grade CuEq. Note that the Lion zone is one of the two primary zones of mineralization identified on the Nisk project. The other zone is the nickel-rich Nisk Main deposit, which hosts a medium-sized, high-grade resource totaling 178 Mlbs if NiEq.