2025 Poised for a Surge in Mining M&A

Published: 1/20/2025

Author: FRC Analysts

Recent developments in the mining sector suggest that 2025 could mark a significant year for mergers and acquisitions (M&A). With commodity prices near record highs, miners are increasingly looking to expand their portfolios through strategic acquisitions rather than developing projects from scratch through exploration, which can be extremely costly, time-consuming, and risky. Below, we analyze three major recent developments that underscore this trend and examine their implications for the industry.

1. Glencore Signals Openness to New Deals

Glencore, one of the world’s largest mining companies, has indicated a renewed interest in M&A, signaling to investors that it is ready to pursue strategic acquisitions. With significant cash reserves and an appetite for growth, the company is well-positioned to capitalize on rising demand for critical metals like copper and nickel. Glencore’s openness to deals suggests heightened activity in the sector as other major players may follow suit to remain competitive.

Takeaway: Glencore’s potential acquisitions could set the stage for widespread consolidation in the mining industry, particularly in critical minerals, as companies aim to secure resources crucial for renewable energy and electrification. The company's interest in expanding copper output aligns with the global push for energy transition technologies.

2. Codelco and Saudi Arabia’s Copper Investments

Codelco, the Chilean state-owned mining giant, and Saudi Arabia are in discussions to jointly invest in copper projects. This partnership reflects a broader trend of nations seeking to diversify their critical mineral supply chains. Copper, essential for infrastructure and renewable energy projects, remains a high-demand commodity. Such joint ventures could pave the way for more cross-border collaborations, boosting global copper output and reshaping the competitive landscape.

Takeaway: Strategic alliances like this highlight the growing importance of securing copper supplies, as countries and companies position themselves to meet rising infrastructure and green energy demands. Codelco's expected production increase to approximately 1.4 million tons in 2025, up from 1.33 million tons in 2024, demonstrates a commitment to meeting global copper demand.

3. Positive Outlook on Lithium and the Need for Domestic Production

The U.S. Department of Energy’s recent increase in loan commitments for domestic lithium projects underscores a growing recognition of lithium’s critical role in the clean energy transition. With electric vehicle (EV) adoption accelerating globally, ensuring a reliable domestic supply of lithium is becoming a strategic priority. Current U.S. lithium production is insufficient to meet demand, leaving the country reliant on imports, particularly from China. Federal investments, such as the $996 million loan to ioneer Ltd’s project in Nevada, aim to address this gap and reduce vulnerabilities in the supply chain.

This support also signals confidence in a rebound for EV metals, despite recent price declines due to oversupply and slower EV growth. As market conditions stabilize, lithium demand is anticipated to rise, driven by EV battery needs and advancements in energy storage technologies.

Takeaway: Increased federal backing for domestic lithium production reflects a strategic shift to strengthen the U.S. supply chain and reduce import reliance. This move highlights a positive long-term outlook for lithium demand, with potential benefits for domestic miners as EV adoption and clean energy initiatives gain momentum.

Market Drivers: Commodity Prices and EV Metals

Gold, silver, and copper are trading near record highs, incentivizing miners to pursue acquisitions over the lengthy and expensive process of building resources from scratch. While electric vehicle (EV) metals like lithium and nickel are temporarily out of favor due to oversupply and slowing EV growth, this trend is expected to reverse, particularly for lithium, as market dynamics shift. These factors are likely to drive further consolidation in the sector, with miners leveraging M&A to secure high-value assets.

Source: Bloomberg, BMI

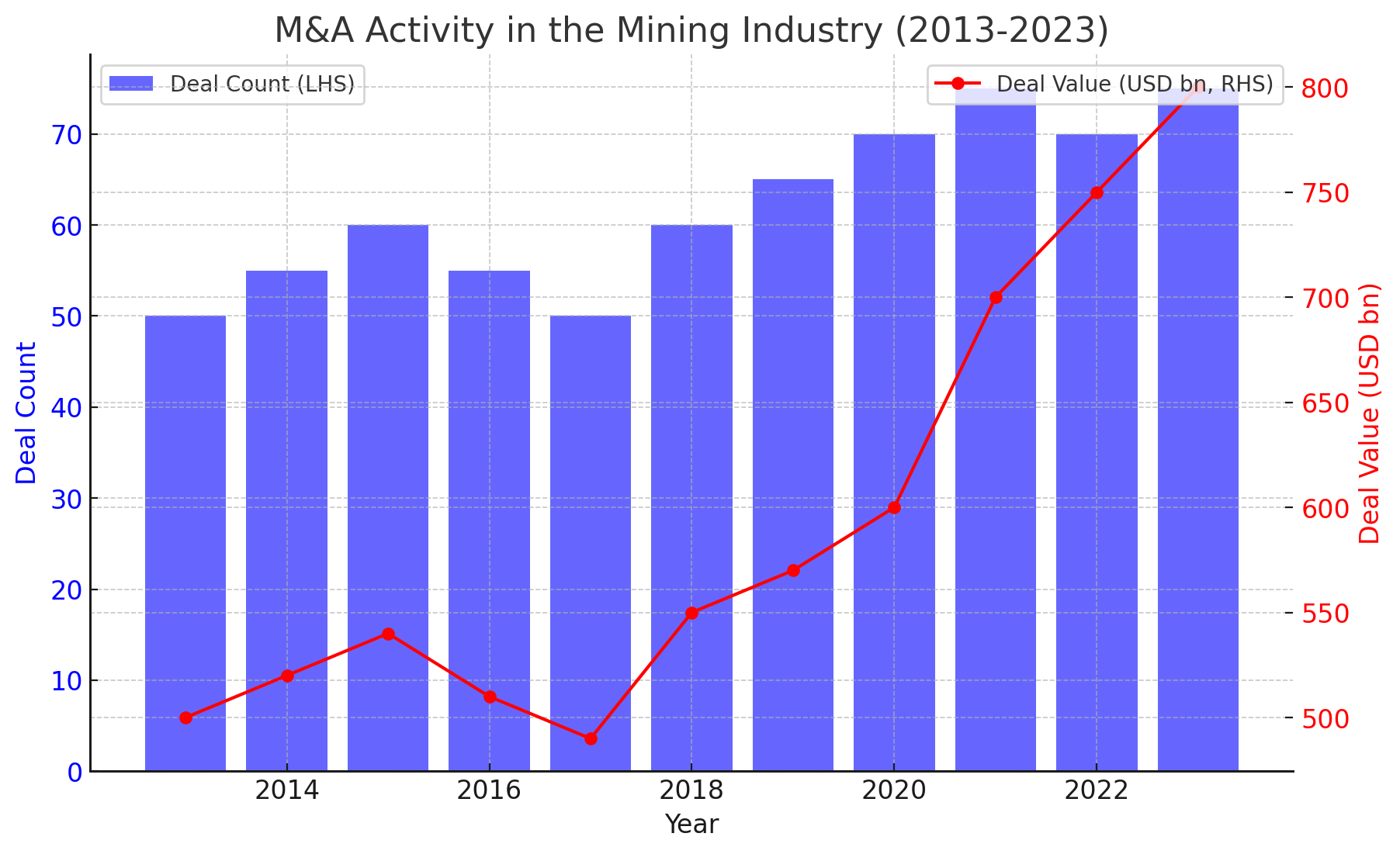

Historically, elevated commodity prices have strongly correlated with increased mergers and acquisitions (M&A) activity in the mining sector. During the 2004–2007 commodity price boom, the value of M&A transactions surged by 227%, as miners leveraged high cash flows to secure valuable assets amid favorable market conditions. This trend resurfaced in 2023, driven by the global energy transition and record-high prices for metals like copper, gold, and lithium. The mining industry saw a substantial rise in M&A activity, with the total value of deals approaching decade highs. This reflects the growing demand for critical minerals and miners' strategic shift toward acquisitions as a faster, more efficient way to expand portfolios and meet the surging demand for resources vital to green technologies.

Forecast: With strong commodity prices and a recovering outlook for EV metals, the mining sector is poised for a wave of strategic acquisitions in 2025. Investors should monitor companies with undervalued assets or strong balance sheets, as they are likely candidates for M&A activity. Check out our list of TOP PICKS to see our favorite stocks in the junior resource space.