Market Intel Weekly

Teck Deal Boosts Junior's Valuation

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

Highlights

Highlights

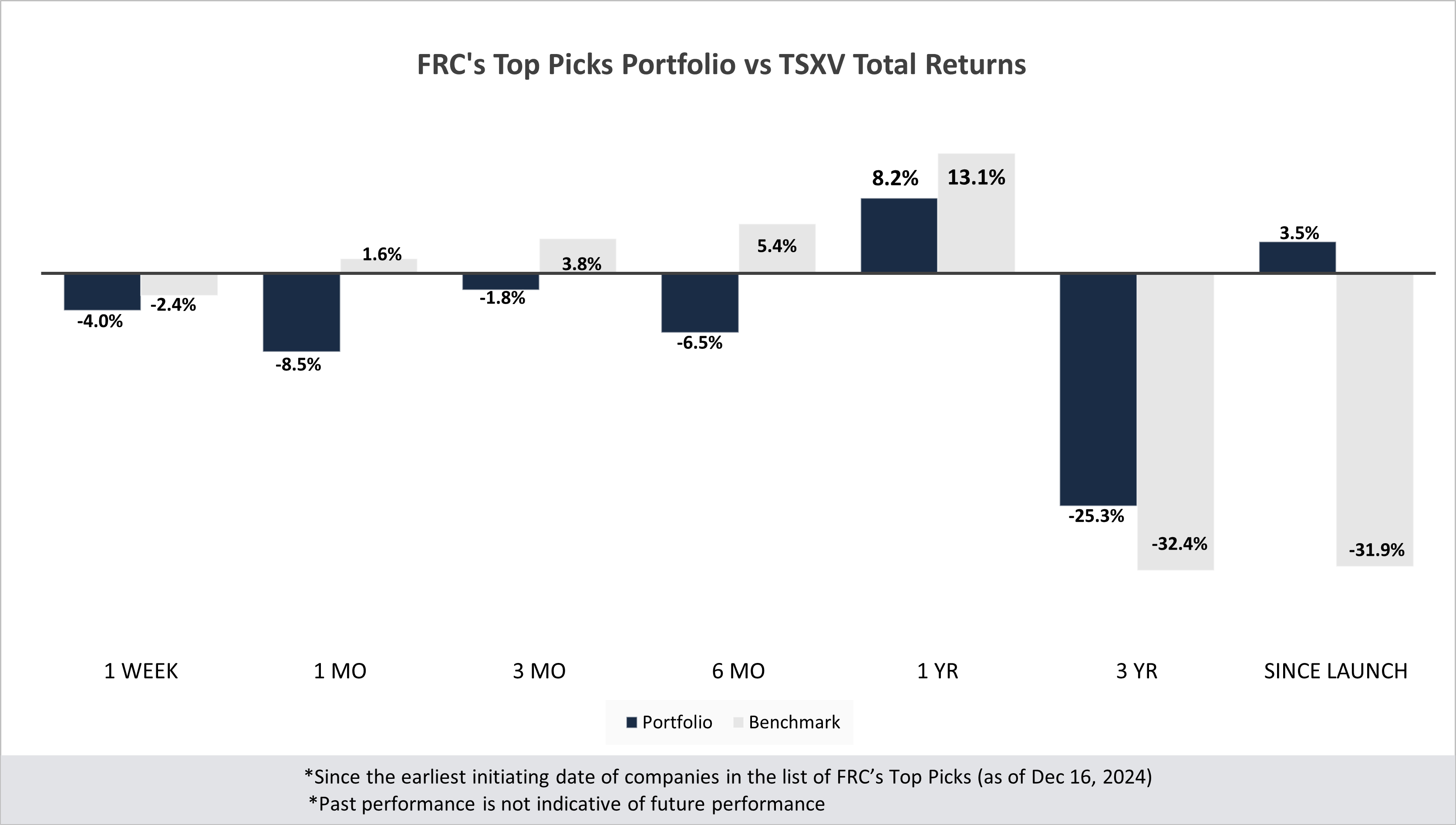

In this edition, we analyze the performance of our top picks, including a junior gold miner under coverage, whose shares rose 17% last week. We also highlight a junior that secured Teck’s (NYSE: TECK) partnership to advance one of its projects, unlocking significant value. Teck’s buy-in terms reveal that the junior’s stock is trading well below its potential.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Commentary on Resource Companies Under Coverage

Grid Metals Corp.

PR Title: Announces an option agreement with Teck Resources (NYSE: TECK) to develop the Makwa nickel project (Manitoba)

Analyst Opinion: Positive – TECK can acquire a 70% interest in the Makwa nickel project for $17.3M, including exploration spending ($15.7M) and cash payments ($1.6M). The deal implies a valuation of $25M for 100% of the Makwa project, which GRDM currently owns. With GRDM’s MCAP at just $9M, and an enterprise value of $8M, it appears the market is significantly undervaluing Makwa, while also overlooking the value of the Mayville deposit, and the flagship Donner lithium project. The deal with Teck is for the Makwa nickel project only, which is part of the advanced-stage MM project. MM hosts two open-pittable nickel-copper-PGM deposits: the nickel dominant Makwa deposit (220 Mlbs NiEq), and the copper dominant Mayville deposit (660 Mlbs CuEq/290 Mlbs NiEq). In our previous update in July 2024, we valued MM at $35M, with Makwa and Mayville each accounting for approximately 50%, or $17.5M each. With the deal valuing Makwa at $25M, we believe it represents excellent value for GRDM. In addition, the company can focus all of its resources on advancing its lithium assets, while Teck advances the Makwa project.