Analysts' Ideas of the Week

Uranium & Gold Financings, McEwen Copper News Boosts Streamer, and CEO Investment in Lender

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

Highlights

Highlights

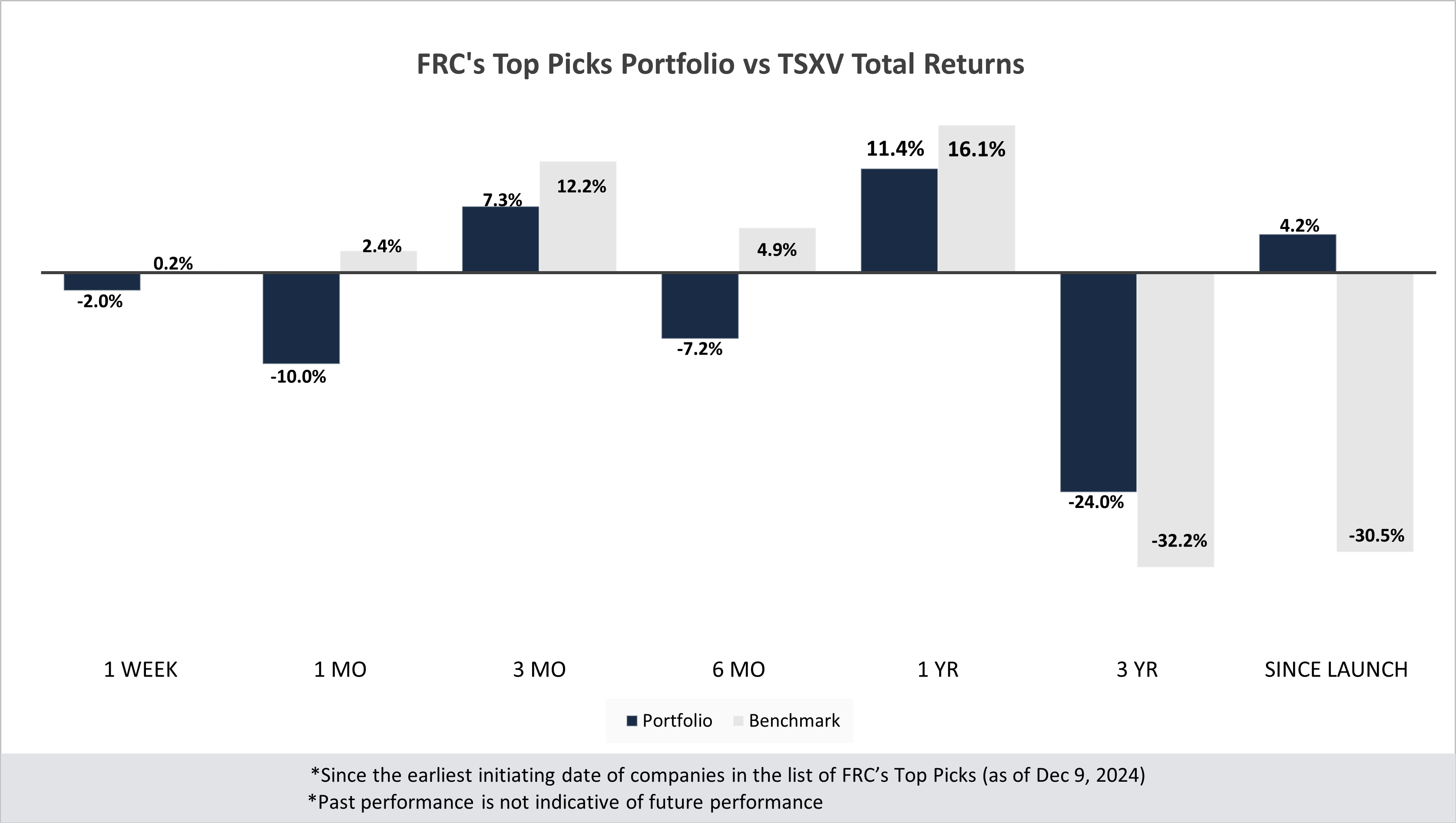

In this edition, we analyze the performance of our top picks, including a junior gold company under coverage, whose shares rose 10% last week. We also highlight key updates from other resource companies under coverage, including positive developments for a royalty company, financings, exploration successes, and a spin-out transaction. Additionally, the CEO of an alternative real estate lender investing personal funds into the deal signals strong confidence in the company’s growth prospects.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Commentary on Resource Companies Under Coverage

Power Metallic Mines Inc.

PR Title: Announces shareholder approval and court approval of spin-out of Golden Ivan property and Chilean assets

Analyst Opinion: Positive – Shareholders have approved a previously announced plan to spin out certain non-core assets into a newly formed company. Under this arrangement, shareholders will receive 0.05 of a common share in the new company for each PNPN share they own. Management has decided not to list the new company’s shares on any exchange in the near term. We believe this decision reflects their intention to carry out additional exploration, which could potentially lead to a higher valuation if initial results are favorable. Our fair value estimate for PNPN excludes these non-core assets, making the free shares an added reward for shareholders.

TNR Gold Corp.

PR Title: McEwen Copper secures environmental permit for construction and operation of the Los Azules copper-gold-silver project (Argentina)

Analyst Opinion: Positive – The advanced-stage Los Azules project hosts a large, open-pittable copper deposit (38 Blbs + 4.7 Moz gold +159 Moz silver). A definitive feasibility study (DFS) is expected in 2025. TNR owns a 0.36% net smelter return (NSR) royalty on the Los Azules project. We are projecting annual royalty revenue of $6M from this project for TNR, using conservative copper prices.

Skyharbour Resources Ltd.

PR Title: Announces a $9.5M private placement

Analyst Opinion: Positive – Proceeds will fund exploration and drilling at the company’s uranium projects in Saskatchewan, as well as working capital. SYH’s portfolio includes 29 properties, spanning over 1.4 million acres in the Athabasca Basin. We expect a surge in M&A activity in the uranium sector in 2025, driven by growing demand for sustainable energy for data centers and AI initiatives, coupled with a vulnerable supply chain.

N/A

PR Title: Announces a $3M private placement

Analyst Opinion: Positive – Shares are up 26% since we initiated coverage in October 2024. A significant advantage for LFLR is its ability to rapidly advance its Swanson gold project in Quebec into production with minimal CAPEX, thanks to the existing underground mine development, and its proximity to the 100% owned Beacon mill.

Grid Metals Corp.

PR Title: Initial results of a maiden drill program at the MM copper-nickel project (Manitoba)

Analyst Opinion: Positive – The first six holes from an ongoing drill program along the 4 km Eagle gabbro trend, within the MM copper-nickel project, intersected high-grade, copper-rich zones, including 44 m of 0.93% CuEq, with 25 m of 1.47%. GDRM is also conducting geophysical surveys to potentially identify additional mineralization. The advanced-stage MM project hosts two open-pittable nickel-copper-PGM deposits, with indicated resources totaling 263 Mlbs nickel, 317 Mlbs copper, and 450+ Koz of precious metals.

StrategX Elements Corp.

PR Title: Nagvaak project exploration update (Nunavut)

Analyst Opinion: Positive – Recent exploration identified additional targets within a 200 km by 100 km area at its flagship Nagvaak project. This property has potential for hosting nickel, vanadium, cobalt, silver, PGM, and graphite. Management is planning a drill program.

Churchill Resources Inc.

PR Title: Recent developments at the Taylor Brook nickel project (Newfoundland)

Analyst Opinion: Positive – Drilling at the TB-01 nickel target intersected both near-surface and deep nickel-copper-cobalt sulphide zones. Geophysical surveys are ongoing, and CRI plans follow-up exploration and drilling in H1-2025. Taylor Brook shows potential for hosting nickel sulphide deposits, a key source of class 1 nickel for lithium-ion batteries.