Analysts' Ideas of the Week

This Smartwatch Gets Stellar Reviews; Solid Updates from Potash, Gas, Copper, and Gold Juniors

ByFRC Analysts

Disclosure: Articles and research coverage are paid for and commissioned by issuers. See the bottom for other important disclosures, rating, and risk definitions, and specific information.

Highlights

Highlights

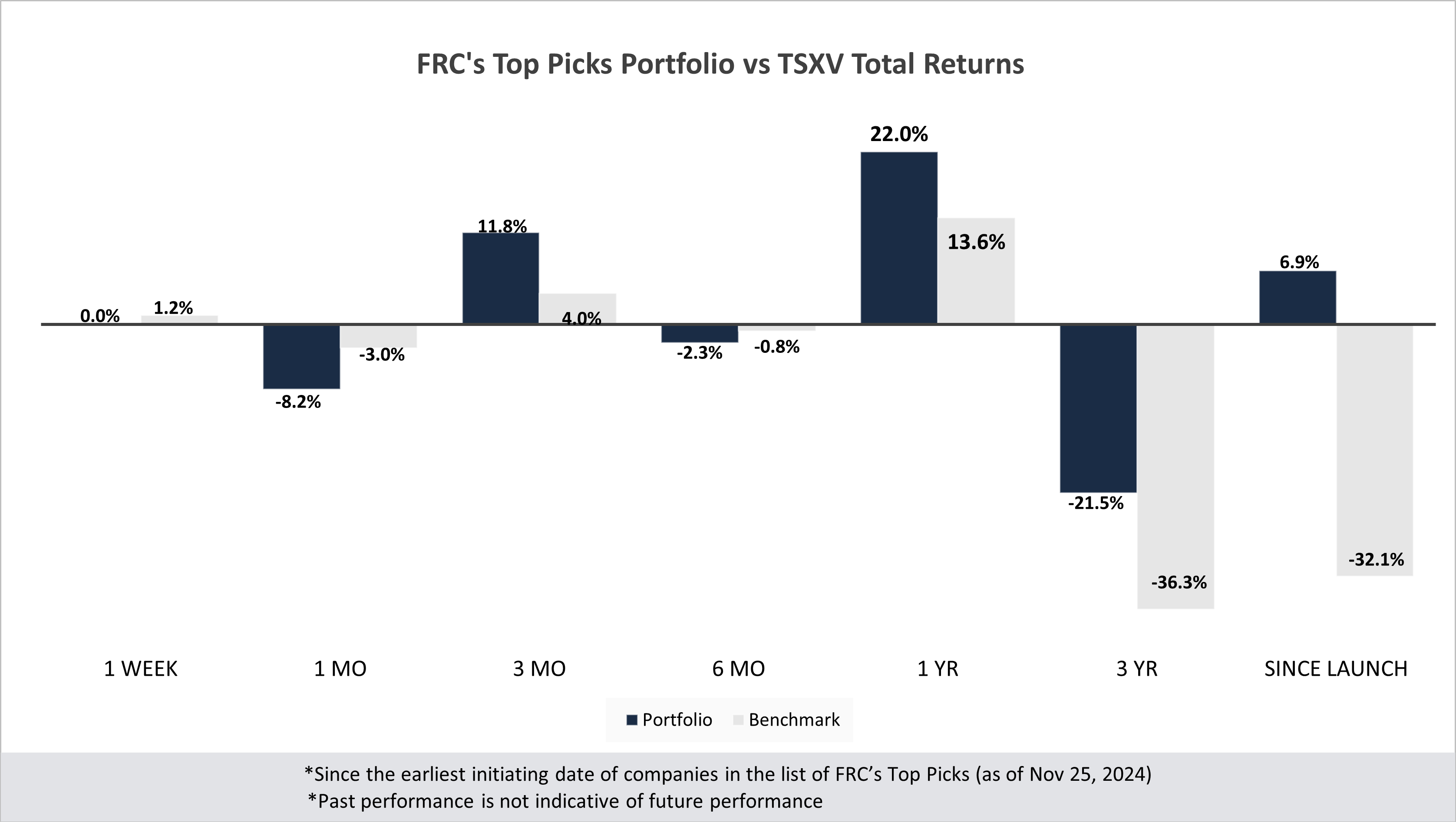

In this edition, we analyze the performance of our top picks, including a potash junior under coverage, whose shares rose 17% last week. We also highlight important updates from a leading global smartwatch maker, an international gas producer, and copper/gold juniors.

- Gain insights into companies under coverage that experienced significant developments last week, along with our analysts' commentary and actionable takeaways.

- FRC top picks and standout performers from the past week

Commentary on Resource Companies Under Coverage

DLP Resources Inc.

PR Title: Additional drill results from the Aurora copper-molybdenum-silver project (Peru)

Analyst Opinion: Positive – New drill holes from the Aurora project returned significant mineralization over long intervals, including 303 m of 0.49% CuEq, within a broader 1,190 m interval averaging 0.32%. We believe the project has the potential to host a large tonnage deposit, with molybdenum grades higher than those typically found in porphyry deposits. As detailed in our initiating report earlier this month, we believe the project has the potential to host over 5 Blbs CuEq. Management is aiming to complete a maiden resource estimate in Q1-2025.

Contango Ore, Inc.

PR Title: Drill results from the Johnson Tract (JT) project in Alaska, U.S.

Analyst Opinion: Positive – All 21 holes of a recent infill drill campaign returned thick, high-grade intercepts, including 5 m of 11.5 g/t AuEq, and 93 m of 9.1 g/t. The ultra high-grade JT project hosts 1.1 Moz AuEq at 9 gpt. CTGO plans to accelerate production at JT through a Direct Shipping Ore (DSO) model, similar to the strategy used at its flagship Manh Choh mine.

CMC Metals Ltd.

PR Title: Options the Silverknife property; high-grade surface sampling results from the Amy project (B.C.)

Analyst Opinion: Positive – CMB has optioned its Silverknife property to Coeur Mining (NYSE: CDE). Coeur can acquire a 100% interest in the property for $6.3M in cash and exploration expenditures. Given CMC’s 100% ownership of the project, and its $3M MCAP, it appears the market is not only undervaluing Silverknife, but also completely disregarding the value of CMC’s other assets. Note that Silverknife is just 1.1 km from Coeur’s Silvertip mine; one of the highest-grade silver-zinc-lead mines in the world. Surface sampling at the Amy property yielded impressive results, revealing high-grade mineralization with up to 643 g/t silver, 18.76% lead, 8.3% zinc, and 9.7% manganese. These mineralized zones, extending over 2.6 km, indicate potential for high-grade silver-lead-zinc carbon replacement (CRD) mineralization. Management is planning a drill program in 2025.

Millennial Potash Corp.

PR Title: Announces a $3.4M equity financing

Analyst Opinion: Positive – Proceeds will fund exploration and development of the Banio potash project in Gabon, Western Africa. A recent Preliminary Economic Assessment returned an AT-NPV10% of US$1.1B, and a high AT-IRR of 33%, using a 25-year average price of US$387/t of granular Muriate of Potash (gMOP) vs the spot price of US$300/t. MLP is trading at <3% of its AT-NPV.