M&A Frenzy in Mining / ChatGpt’s Valuation Surge

Published: 10/7/2024

Author: FRC Analysts

Key Highlight

- Escalating tensions in the Middle East will likely dominate headlines and influence trading in the coming days.

- Coeur Mining’s (NYSE: CDE) acquisition of SilverCrest Metals (TSX: SIL), a junior gold-silver miner, at twice the sector average EBITDA multiple, underscores the strong appetite larger miners have for growing their portfolios through acquisitions.

- IsoEnergy Ltd’s (TSX: ISO) acquisition of Anfield Energy Inc. (TSXV: AEC) is consistent with our earlier prediction that major miners would pursue M&A to secure long-term uranium supply.

- A recent report by Ernst & Young supports our view that lack of capital is currently the primary risk for mining companies.

- OpenAI, the creator of ChatGPT, recently raised US$6.6B in funding, valuing the company at US$157B, or 14x revenue.

Commentary on Resource Companies Under Coverage

Power Metallic Mines Inc. (PNPN.V)

PR Title: Additional results of an ongoing drill program from its polymetallic Lion zone discovery (Quebec)

Analyst Opinion: Positive – Results from the first eight holes of a 30,000 m follow-up drill program at its high-grade polymetallic Lion zone returned promising values, including the best intersection to date: 32 m of 6.97% CuEq. Other noteworthy intercepts included 17 m of 4.15%, 5 m of 5.93%, and 12 m of 2.97%. Seven of the eight holes yielded noteworthy results, while results for four holes are pending. Overall, we believe the latest results have expanded the mineralized area, though at a slightly lower weighted average grade. We continue to value the project based on its potential to host up to 1 Blbs of high-grade CuEq. Note that the Lion zone is one of the two primary zones of mineralization identified on the Nisk project. The other zone is the nickel-rich Nisk Main deposit, which hosts a medium-sized, high-grade resource totaling 178 Mlbs of NiEq.

Grid Metals Corp. (GRDM.V, MSMGF)

PR Title: Outlines a 4 km long copper corridor at the MM copper-nickel project (Manitoba)

Analyst Opinion: Positive – Surface sampling has confirmed copper/nickel mineralization over a 4 km long trend (Eagle Gabbro) at its advanced stage MM project. Management is planning a maiden drill program. The MM property hosts two open-pittable nickel-copper-PGM deposits, with indicated resources totaling 263 Mlbs nickel, 317 Mlbs copper, and 450+ Koz of precious metals. GRDM also owns a 75% interest in the Donner lithium project (Manitoba), which hosts a relatively high-grade hard-rock (pegmatite) lithium resource (6.8 Mt at 1.39% Li2O).

Argentina Lithium & Energy Corp. (LIT.V, PNXLF)

PR Title: Positive results from the 13th lithium exploration well at the Rincon West project (Argentina)

Analyst Opinion: Positive – Drilling continues to return attractive lithium grades over long intervals (327 m ranging from 269 to 340 mg/L lithium), expanding mineralization to the northeast of the Rinconcita II property. We believe these results will positively contribute to a maiden resource estimate, expected next year.

Equity Metals Corporation (EQMEF, EQTY.V)

PR Title: Additional drill results from the Silver Queen gold-silver project (B.C.)

Analyst Opinion: Positive – Drilling returned bonanza grades of up to 1,372 AgEq at the Camp deposit. Additionally, a new discovery located 300 m to the north returned grades of up to 1,102 g/t. Drilling is underway at the No. 3 vein North. The Silver Queen property features high-grade epithermal veins, with four of the 20 known veins hosting 85 Moz at 6.2 AgEq.

Enertopia Corp. (ENRT)

PR Title: Announces metallurgical test results for its West Tonopah (WT) lithium clay project (Nevada)

Analyst Opinion: Positive – Initial third-party metallurgical tests yielded promising extraction rates of up to 97%. The project hosts a relatively small lithium resource, with attractive grades.

Skyharbour Resources Ltd. (SYH.V, SYHBF)

PR Title: Options South Dufferin and Bolt uranium projects

Analyst Opinion: Positive – SYH has optioned two of its early-stage uranium properties in the Athabasca Basin, Saskatchewan, to a private company. The optioner can acquire a 100% interest for $9.8M in cash and share payments, along with exploration spending commitments spread over five years. SYH owns 29 properties covering 580k hectares. The company is actively exploring its flagship, high-grade Russell and Moore Lake projects. In addition, nine are held under JV and option agreements. SYH is looking to find partners for the remaining. Partners could commit over $38M for exploration, and over $50M in cash/share payments to SYH vs SYH's current MCAP of just $82M.

CMC Metals Ltd. (CMB.V, CMCXF)

PR Title: Identifies drill targets at Amy, and encouraging results from Silverknife (B.C.)

Analyst Opinion: Positive – CMB is preparing to drill a geochemical anomaly (4 km long x 0.5-1.3 km wide) at its Amy silver-zinc-lead project. The property is prospective for high-grade silver-lead-zinc carbon replacement deposit (CRD) mineralization. Additionally, mapping on the Silverknife property identified alteration zones that are prospective for CRD mineralization. Silverknife is just 1.1 km from Coeur Mining’s Silvertip mine; one of the highest-grade silver-zinc-lead mines in the world.

GMV Minerals Inc. (GMV.V, GMVMF)

PR Title: Completes initial drilling at the Daisy Creek project (Nevada)

Analyst Opinion: Positive – All five holes of a recently completed drill program at Daisy Creek intersected claystone with potential to host lithium clay mineralization. Management is awaiting assay results.

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks. The top performer, Millennial Potash, was up 26%. MLP is advancing a relatively low-CAPEX/OPEX potash project in Western Africa towards production.

| Top Five Weekly Performers | WoW Returns |

| Millennial Potash Corp. (MLP.V) | 26.1% |

| Panoro Minerals (PML.V) | 23.1% |

| Zepp Health Corporation (ZEPP) | 10.0% |

| World Copper Ltd. (WCU.V) | 8.3% |

| Noram Lithium Corp. (NRM.V) | 7.7% |

| * Past performance is not indicative of future performance (as of October 3, 2024) |

Source: FRC

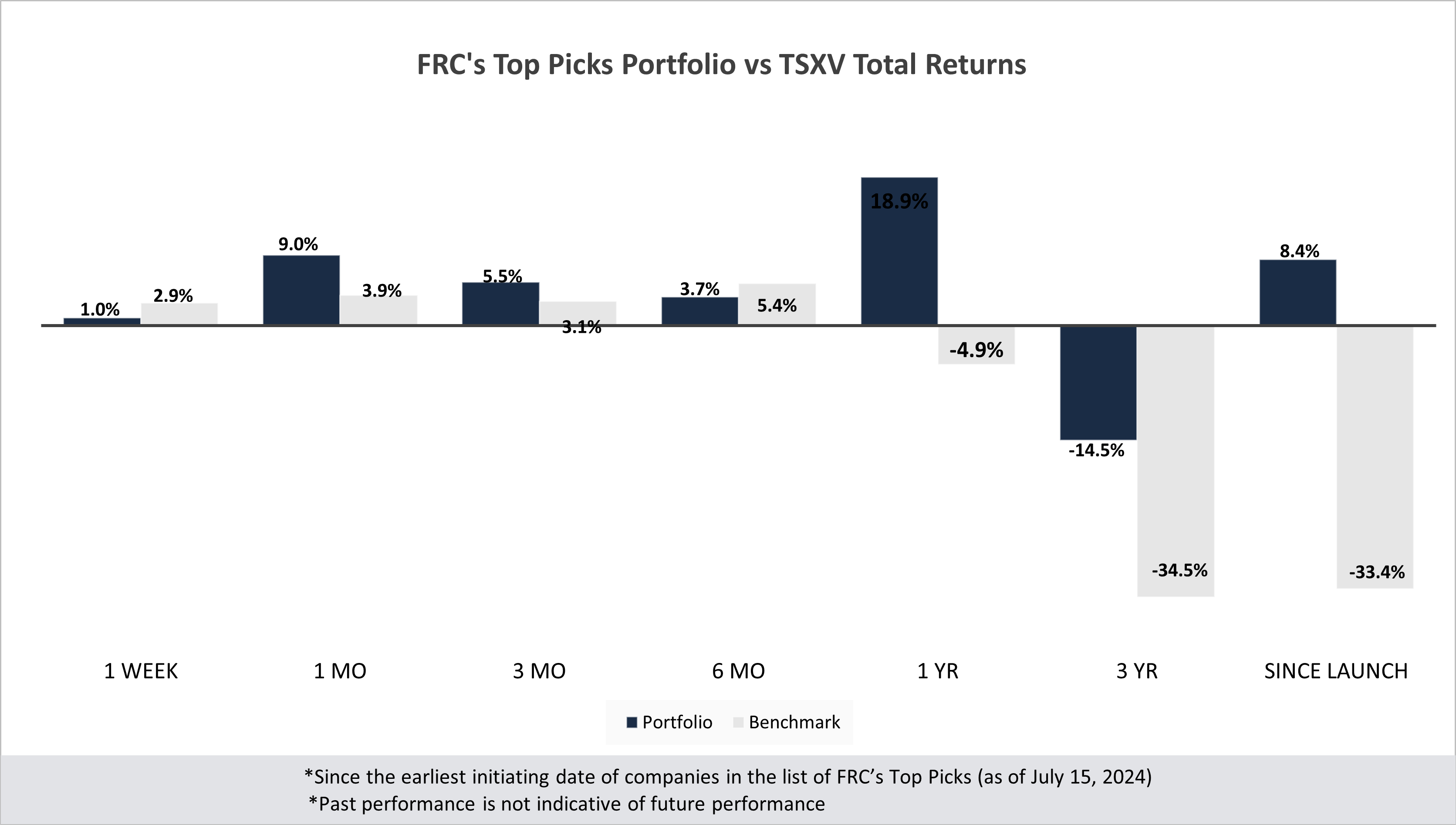

Our top picks have outperformed the benchmark (TSXV) in all seven time periods listed below.

Performance by Sector

| Total Return | 1 Week | 1 mo | 3 mo | 6 mo | 1 yr | 3 yr | Since launch |

| Mining | 1.6% | 9.1% | -2.1% | -0.1% | 10.2% | -30.5% | -6.1% |

| Cannabis | N/A | N/A | N/A | N/A | N/A | -39.2% | -23.6% |

| Tech | -3.8% | -7.4% | -21.9% | -47.9% | -35.9% | -36.6% | -4.7% |

| Special Situations (MIC) | -2.6% | 11.2% | 32.5% | 35.3% | 59.9% | -23.5% | 7.9% |

| Private Companies | N/A | N/A | N/A | N/A | 6.7% | 20.5% | 30.5% |

| Portfolio (Total) | 1.0% | 9.0% | 5.5% | 3.7% | 18.9% | -14.5% | 8.4% |

| Benchmark (Total) | 2.9% | 3.9% | 3.1% | 5.4% | -4.9% | -34.5% | -33.4% |

| Portfolio (Annualized) | - | - | - | - | 18.9% | -5.1% | 0.8% |

| Benchmark (Annualized) | - | - | - | - | -4.9% | -13.2% | -3.7% |

| 1. Since the earliest initiating date of companies in the list of Top Picks (as of October 3, 2024) | |||||||

| 2. Green (blue) indicates FRC's picks outperformed (underperformed) the benchmark. | |||||||

| 3. Past performance is not indicative of future performance. | |||||||

Market Updates and Insights: Mining

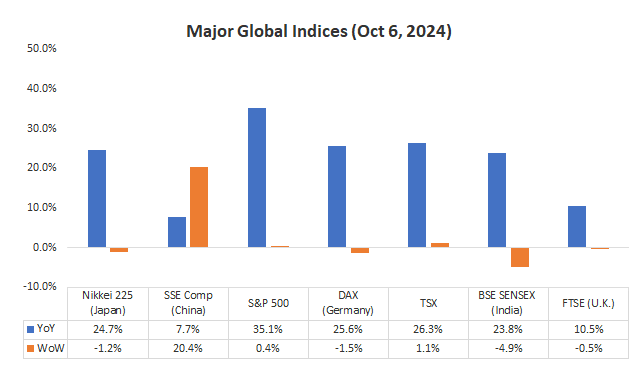

Last week, global equity markets were up 2.0% on average (up 3.7% in the previous week). Robust jobs data drove the US dollar and yields higher. We believe escalating tensions in the Middle East will likely dominate headlines and influence trading in the coming days. As mentioned last week, we anticipate heightened near-term volatility, and suggest that risk-averse investors refrain from active trading.

Source: FRC / Various

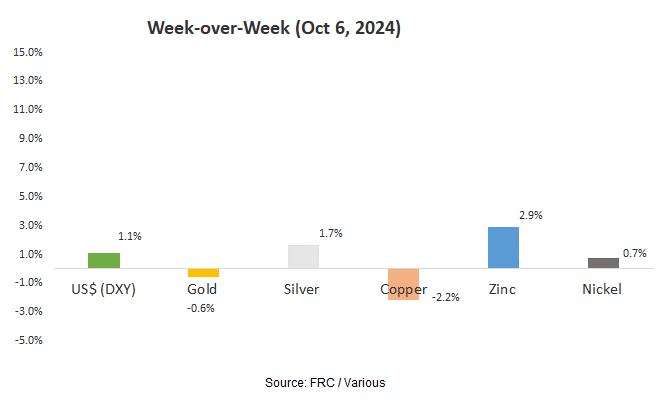

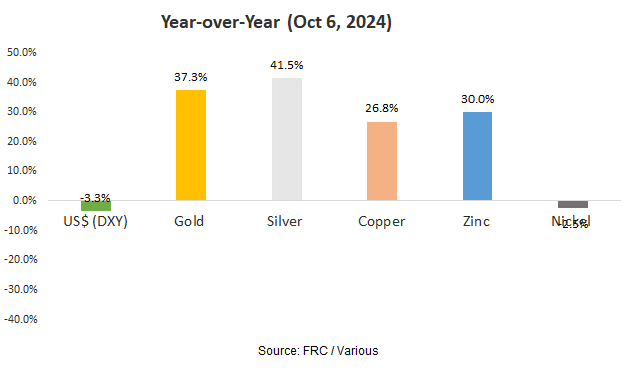

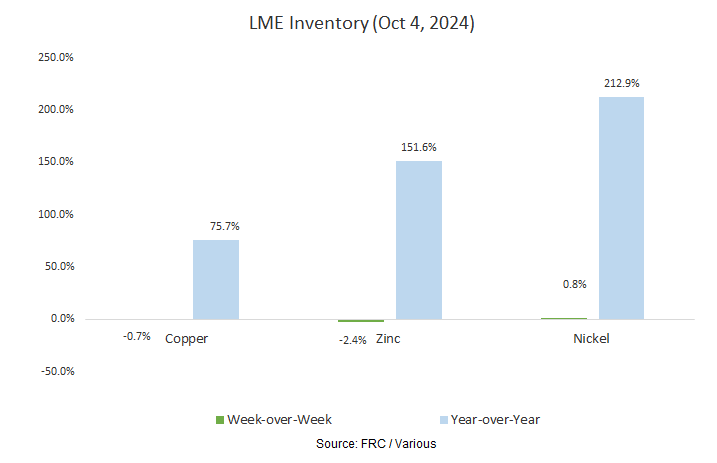

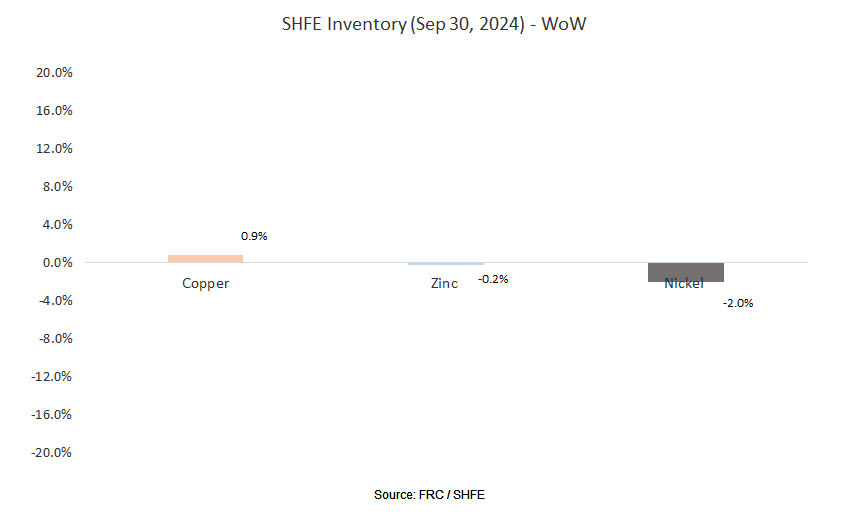

Last week, metal prices were up 0.5% on average (up 5.6% in the previous week).

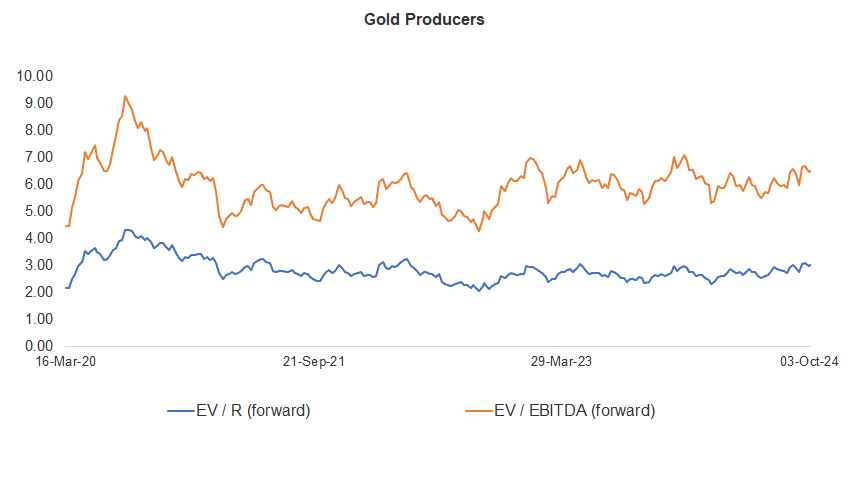

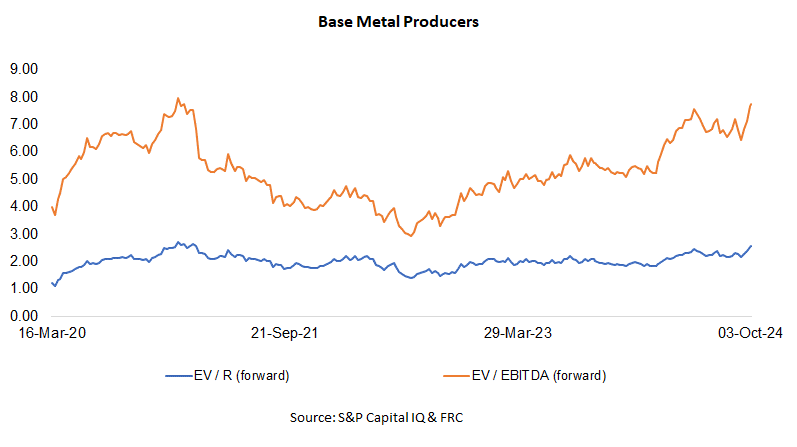

Gold producer valuations were up 1% last week (down 3% in the prior week); base metal producers were up 1% last week as well (up 7% in the prior week). On average, gold producer valuations are 9% lower (previously 10%) than the past three instances when gold surpassed US$2k/oz.

| 01-Oct-24 | 04-Oct-24 | ||||

| Gold Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | Barrick | 3.35 | 6.87 | 3.38 | 6.92 |

| 2 | Newmont | 3.75 | 8.33 | 3.78 | 8.41 |

| 3 | Agnico Eagle | 5.07 | 9.20 | 5.13 | 9.32 |

| 4 | AngloGold | 2.24 | 5.12 | 2.27 | 5.17 |

| 5 | Kinross Gold | 2.70 | 5.69 | 2.79 | 5.87 |

| 6 | Gold Fields | 3.08 | 6.03 | 3.03 | 5.93 |

| 7 | Sibanye | 0.70 | 4.68 | 0.74 | 4.91 |

| 8 | Hecla Mining | 5.19 | 14.18 | 5.16 | 14.10 |

| 9 | B2Gold | 1.93 | 3.71 | 1.91 | 3.68 |

| 10 | Alamos | 6.01 | 11.08 | 6.04 | 11.13 |

| 11 | Harmony | 1.63 | 4.52 | 1.56 | 4.36 |

| 12 | Eldorado Gold | 2.73 | 5.31 | 2.76 | 5.37 |

| Average (excl outliers) | 2.98 | 6.47 | 3.00 | 6.51 | |

| Min | 0.70 | 3.71 | 0.74 | 3.68 | |

| Max | 6.01 | 14.18 | 6.04 | 14.10 | |

| Base Metal Producers | EV / R (forward) | EV / EBITDA (forward) | EV / R (forward) | EV / EBITDA (forward) | |

| 1 | BHP Group | 3.25 | 6.13 | 3.29 | 6.23 |

| 2 | Rio Tinto | 2.39 | 5.35 | 2.37 | 5.32 |

| 3 | South32 | 1.70 | 6.32 | 1.70 | 6.29 |

| 4 | Glencore | 0.41 | 6.00 | 0.40 | 5.94 |

| 5 | Anglo American | 2.01 | 6.12 | 1.98 | 6.01 |

| 6 | Teck Resources | 3.79 | 9.36 | 3.80 | 9.36 |

| 7 | First Quantum | 4.25 | 14.57 | 4.33 | 15.14 |

| Average (excl outliers) | 2.54 | 7.69 | 2.55 | 7.76 | |

| Min | 0.41 | 5.35 | 0.40 | 5.32 | |

| Max | 4.25 | 14.57 | 4.33 | 15.14 | |

Source: S&P Capital IQ & FRC

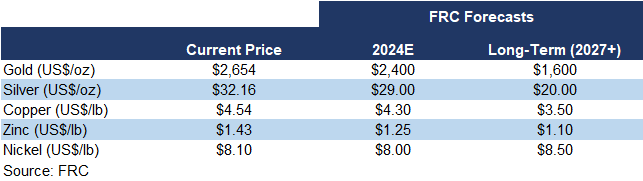

We are maintaining our metal price forecasts.

Key Developments:

- Coeur Mining. (MCAP: US$2.6B) is acquiring SilverCrest Metals for US$1.7B, reflecting a 22% premium over SIL's last closing price. SIL is a junior gold-silver producer in Mexico. We estimate that CDE is paying 8.8x EBITDA, which is twice the sector average. We believe this underscores the strong appetite larger miners have for growing their portfolios through acquisitions.

- IsoEnergy Ltd. (MCAP: $586M) is acquiring Anfield Energy for $127M, reflecting a 32% premium over AEC's last closing price. This acquisition will provide IsoEnergy with a permitted uranium mill in Utah, located adjacent to its Tony M Mine, as well as a portfolio of uranium and vanadium projects across Utah, Colorado, New Mexico, and Arizona. A recent PEA valued the mill at an AT-NPV12% of $178M, meaning IsoEnergy is acquiring it at 70% of the NPV. This acquisition is consistent with our earlier prediction that major miners would pursue M&A to secure long-term uranium supply. Given that Russia represents 35% of global enriched uranium production, we believe the uranium supply chain remains highly vulnerable.

- A recent report by Ernst & Young identifies capital as the primary risk for miners. We believe this as especially relevant for the lithium industry, which we view as having some of the strongest upside potential among mainstream and EV metals. The following video highlights our concerns - https://www.youtube.com/watch?v=CuWW4G62r_8&t

Market Updates and Insights: Cryptos

Prices of mainstream/popular cryptos were down 10% on average last week (down 5% in the previous week).

| October 4, 2024 | ||

| Cryptos | WoW | YoY |

| Bitcoin | -5% | 124% |

| Binance Coin | -7% | 160% |

| Cardano | -12% | 38% |

| Ethereum | -10% | 48% |

| Polkadot | -14% | 4% |

| XRP | -9% | 0.15% |

| Polygon | -11% | -31% |

| Solana | -9% | 527% |

| Average | -10% | 109% |

| Min | -14% | -31% |

| Max | -5% | 527% |

| Indices | ||

| Canadian | WoW | YoY |

| BTCC | -3% | 118% |

| BTCX | -2% | 121% |

| EBIT | -2% | 118% |

| FBTC | -3% | 33% |

| U.S. | WoW | YoY |

| BITO | -8% | 26% |

| BTF | -5% | 53% |

| IBLC | -2% | 88% |

Source: FRC/Yahoo Finance

The global MCAP of cryptos is US$2.26T, up 4% MoM, and 101%YoY.

Total Crypto Market Cap Chart

Source: CoinGecko

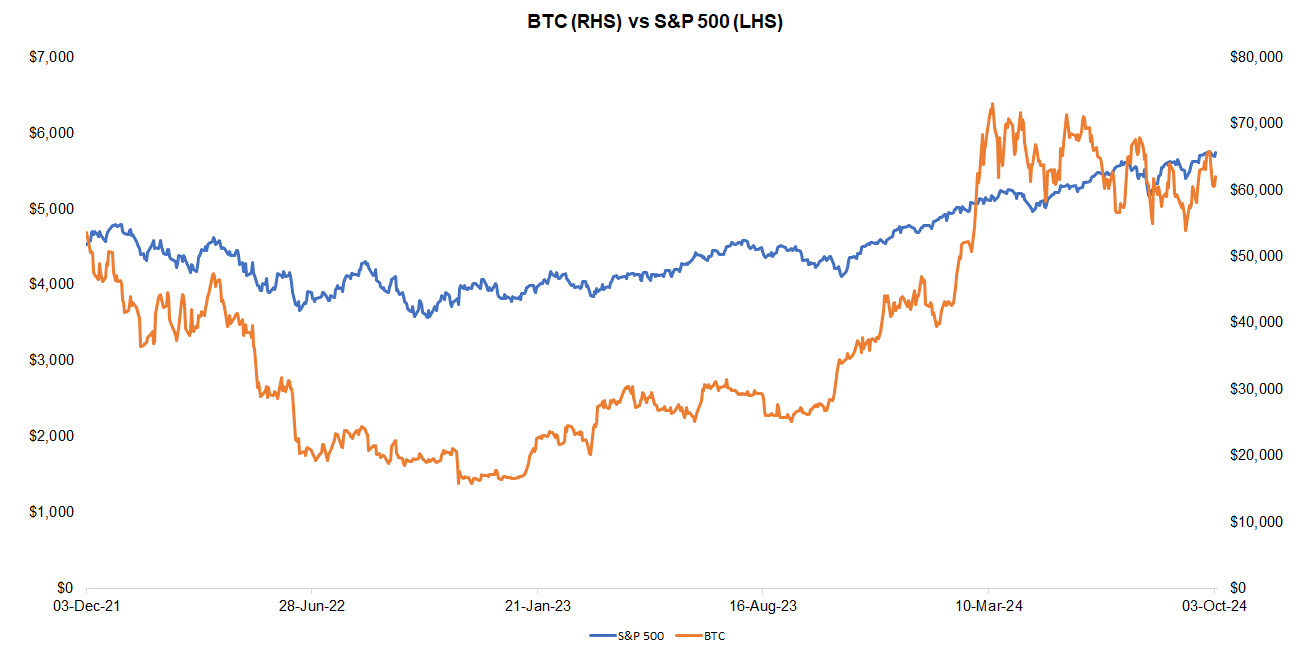

Last week, BTC was down 5.2%, while the S&P 500 was up 0.4%. The U.S. 10-year treasury yield was up 0.23 pp.

Source: FRC/ Yahoo Finance

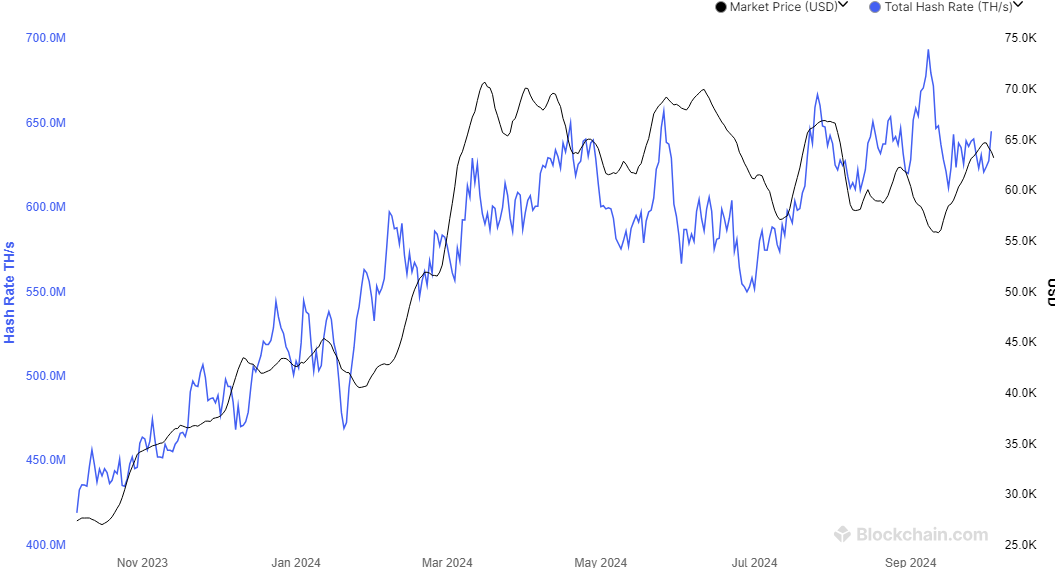

The global hash rate of BTC (defined as calculations performed per second/an indicator of network difficulty) is 645 exahashes per second (EH/s), up 2% WoW, but down 1% MoM. The increase in hash rates is negative for miners as their efficiency rates (BTC production per EH/s) are inversely linked to global hash rates.

Total Hash Rate (BTC)

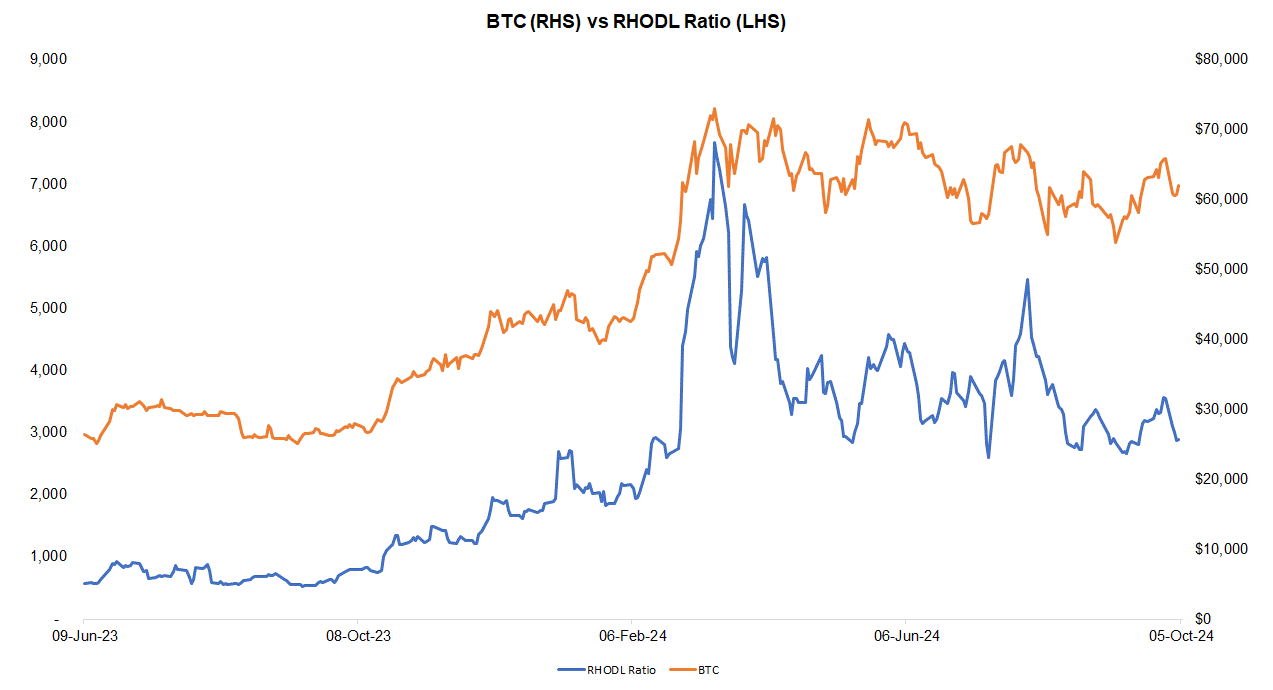

The Realized HODL ratio (RHODL), which gauges the activity of short-term holders relative to long-term holders, was down 19% WoW, but up 264% YoY. We interpret the decrease in RHODL as a sign of weakening demand.

Source: FRC/ Various

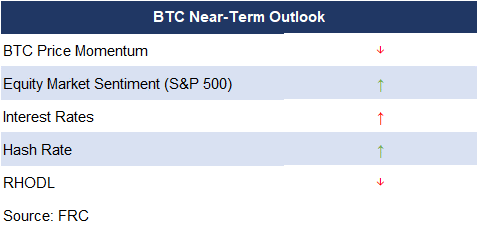

The table below summarizes the changes in key statistically significant factors influencing BTC prices, including the factors mentioned above. With two positive signals and three negative (unchanged), our outlook on near-term BTC prices remains bearish. Our model accurately predicted last week’s decline in prices.

* “↑” and “↓” indicate whether a parameter has increased or decreased

* Red (green) denotes a negative (positive) signal for BTC prices; black implies neutral.

Source: FRC

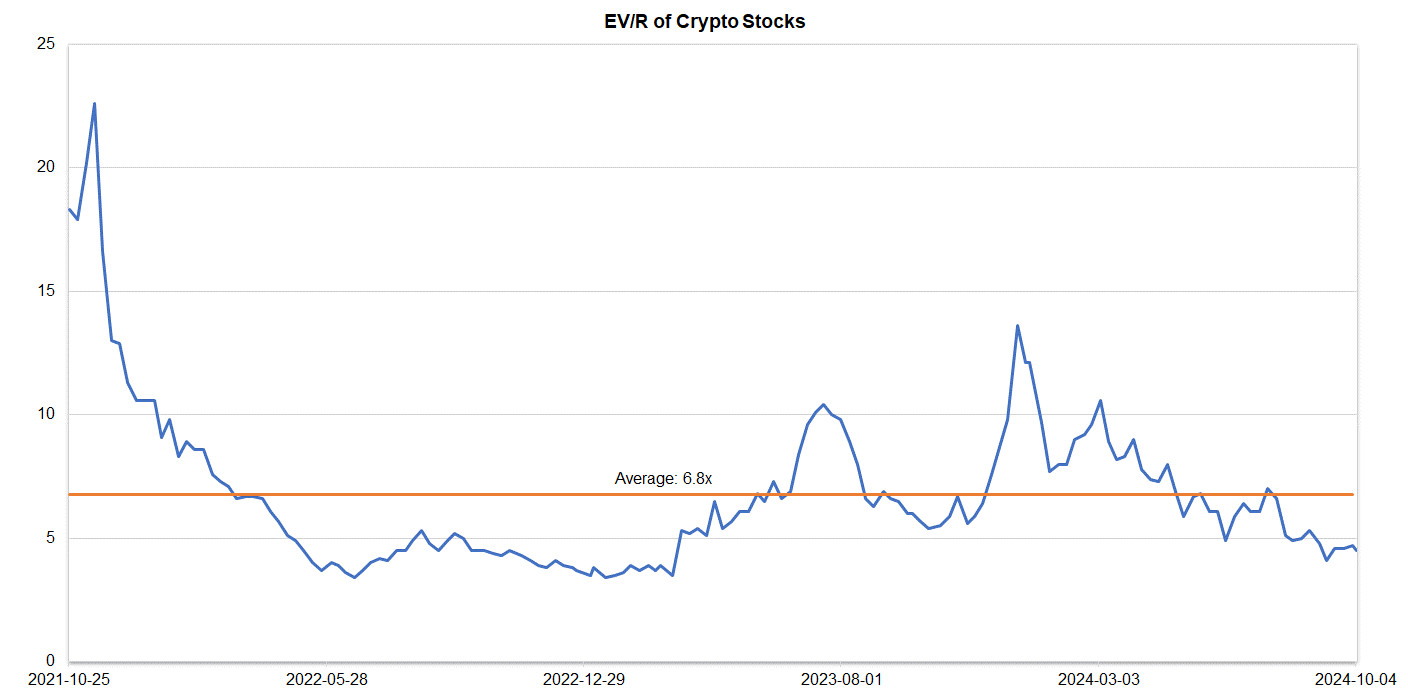

Companies operating in the crypto space are trading at an average EV/R of 4.5x (previously 4.7x).

Source: S&P Capital IQ/FRC

| October 4, 2024 | |

| Crypto Stocks | EV/Revenue |

| Argo Blockchain | 2.0 |

| BIGG Digital | 5.0 |

| Bitcoin Well | 0.6 |

| Canaan Inc. | 1.3 |

| CleanSpark Inc. | 6.1 |

| Coinbase Global | 8.4 |

| Galaxy Digital Holdings | N/A |

| HIVE Digital | 2.9 |

| Hut 8 Mining Corp. | 8.2 |

| Marathon Digital Holdings | 8.2 |

| Riot Platforms | 5.9 |

| SATO Technologies | 1.4 |

| Average | 4.5 |

| Median | 5.0 |

| Min | 0.6 |

| Max | 8.4 |

Source: S&P Capital IQ/FRC

Market Updates and Insights: Artificial Intelligence/AI

Major AI indices are up 0.7% WoW on average (up 0.6% in the previous week), and 24% YoY.

| October 4, 2024 | ||

| AI Indices | WoW | YoY |

| First Trust Nasdaq AI and Robotics ETF | -0.6% | 11% |

| Global X Robotics & AI ETF | -0.2% | 31% |

| Global X AI & Technology ETF | 0.5% | 41% |

| iShares Robotics and AI Multisector ETF | 1.3% | -3% |

| Roundhill Generative AI & Technology ETF | 2.4% | 42% |

| Average | 0.7% | 24% |

| Min | -0.6% | -3% |

| Max | 2.4% | 42% |

Source: FRC/Various

The following table highlights some of the most popular large-cap AI stocks. Shares of these companies are down 2% WoW on average (down 11% in the previous week), but up 78% YoY. Their average P/E is 34x (previously 33x) vs the NASDAQ-100 Index’s average of 32x (unchanged).

| AI Stocks | WoW | YoY | P/E |

| Arista Networks | -4% | 111% | 50.6 |

| Dell Technologies | -1% | 78% | 21.3 |

| Microsoft Corporation | -2% | 31% | 35.3 |

| NVIDIA Corp | 5% | 183% | 57.6 |

| Micron Technology | -4% | 49% | n/a |

| Palantir Technologies | -9% | 153% | n/a |

| Qualcomm | -2% | 53% | 21.6 |

| Super Micro Computer (SMCI) | -0.27% | 47% | 20.7 |

| Taiwan Semiconductor Manufacturing | -3% | 85% | 27.3 |

| Average | -2% | 88% | 33.5 |

| Median | -2% | 78% | 27.3 |

| Min | -9% | 31% | 20.7 |

| Max | 5% | 183% | 57.6 |

Source: FRC/Various

Key Developments:

- OpenAI, the creator of ChatGPT, recently raised US$6.6B in funding, valuing the company at US$157B, or 14x revenue. This is a significant increase from its previous valuation of US$80B earlier this year. Microsoft (NASDAQ: MSFT) and NVIDIA (NASDAQ: NVDA) were among the participants in this funding round.

- A recent report by Future Market Insights indicates that AI in the packaging market is set for significant growth, rising from US$1.8B in 2024, to US$23B by 2034, representing a CAGR of 29%. We foresee strong opportunities in industries that are heavily dependent on packaging, such as food and beverages, e-commerce, and pharmaceuticals.